29-03 Sept-Oct, 2025

Welcome to this week’s JMP Report,

Weekly Trade Commentary

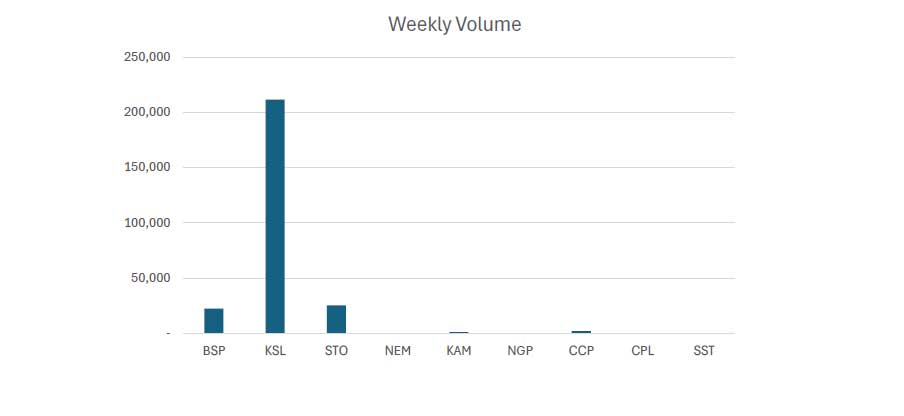

- Last week saw only 5 stocks traded on PNGX with a total trading value of K1,875,528.71.

- BSP traded good volumes 22,341 shares steady at K23.55.

- KSL traded the largest volumes of the week, 211,552 shares closing 5t higher at K3.85.

- STO traded good volumes also, 25,202 shares closing steady at K21.00.

- KAM traded the least number of volumes during the week, 1,038 shares closing higher by 1t at K1.88.

- Lastly, CCP traded only 2,044 shares changing hands steady at K4.65.

WEEKLY MARKET REPORT | 29 September, 2025 – 03 October, 2025

| STOCK | WEEKLY VOLUME |

CLOSING PRICE | VALUE | BID | OFFER | CHANGE | % CHANGE |

| BSP | 22,341 | 23.55 | 526,131 | – | 23.55 | – | – |

| KSL | 211,552 | 3.85 | 808,700 | 3.80 | 3.85 | 0.05 | 1.32% |

| STO | 25,202 | 21.00 | 529,242 | – | 22.00 | – | – |

| NEM | – | 181.00 | – | – | – | 0.01 | 0.53% |

| KAM | 1,038 | 1.88 | 1,951 | 1.88 | – | – | – |

| NGP | – | 1.35 | – | 1.35 | – | – | – |

| CCP | 2,044 | 4.65 | 9,505 | 3.20 | 4.65 | – | – |

| CPL | – | 0.40 | – | 0.45 | 0.65 | – | – |

| SST | – | 50.00 | – | – | 50.00 | – | – |

| 262,177 | TOTAL | 1,875,529 | 0.02% |

Key takeaways:

- KSL leads the way with trading for the week, while BSP and STO provide good liquidity to support total trading volume for the week. The 3 stocks combine to give 93.39% of last weeks total trade value.

- Kina Securities Limited (ASX:KSL / PNGX:KSL) (Kina or the Company) announces the appointment of Rayna Heckenberg as the Company’s new Chief Risk Officer (CRO), commencing 10 November 2025. Download >>

- NGIP Agmark Limited announces an interim dividend of 4 toea per share for the 2025 financial year. Download >>

- Market announcement: NGP – Update of Dividend Ex-date 2025 Interim Dividend Download >>

- Market Announcement: NEM – Newmont Announces CEO Transition Download >>

- Market Announcement BSP – Change of Company Secretary Download >>

- Market Announcement: KSL – Appendix 10B Notice of change in Directors Interest (Ivan Vidovich) Download >>

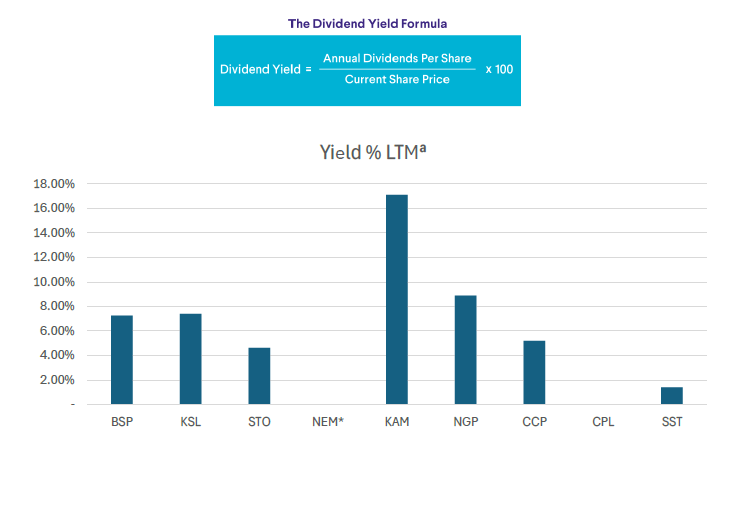

WEEKLY YIELD CHART | 29 September, 2025 – 03 October, 2025

| STOCK | NUMBER ISSUED OF SHARES |

MARKET CAP |

2023 INTERIM DIV | 2023 FINAL DIV | 2024 INTERIM DIV | 2024 FINAL DIV | 2025 INTERIM DIV | YIELD % LTM |

| BSP | 467,219,979 | 11,003,030,505 | K0.370 | K1.060 | K1.210 | K1.210 | K0.500 | 7.26% |

| KSL | 287,949,279 | 1,108,604,724 | K0.100 | K0.160 | K0.106 | K1.155 | K0.126 | 7.30% |

| STO | 3,247,772,961 | 68,203,232,181 | K0.310 | K0.660 | k0.506 | K0.414 | K0.559 | 4.63% |

| NEM* | – | – | – | – | – | – | – | – |

| KAM | 50,693,986 | 95,304,694 | K0.120 | – | – | – | – | 17.02% |

| NGP | 45,890,700 | 61,952,445 | K0.030 | – | K0.120 | K0.120 | K0.040 | 11.85% |

| CCP | 307,931,332 | 1,431,880,694 | K0.110 | K0.130 | K0.121 | K0.121 | K0.121 | 5.20% |

| CPL | 206,277,911 | 82,511,164 | K0.050 | – | – | – | – | – |

| SST | 31,008,237 | 1,550,411,850 | K0.350 | K0.600 | K0.300 | K0.300 | K0.400 | 1.40% |

| TOTAL | 83,536,928,257 | 5.14% |

a LTM = Last Twelve Months. We have calculated yields based on most recently declared

interim and final dividends.

* NEM pays quarterly dividends. We have added last 4 payments at current FX rates.

Dividend yield – is calculated by dividing a company’s annual dividends per share by its current share price and expressing the result as a percentage.

What we have been reading

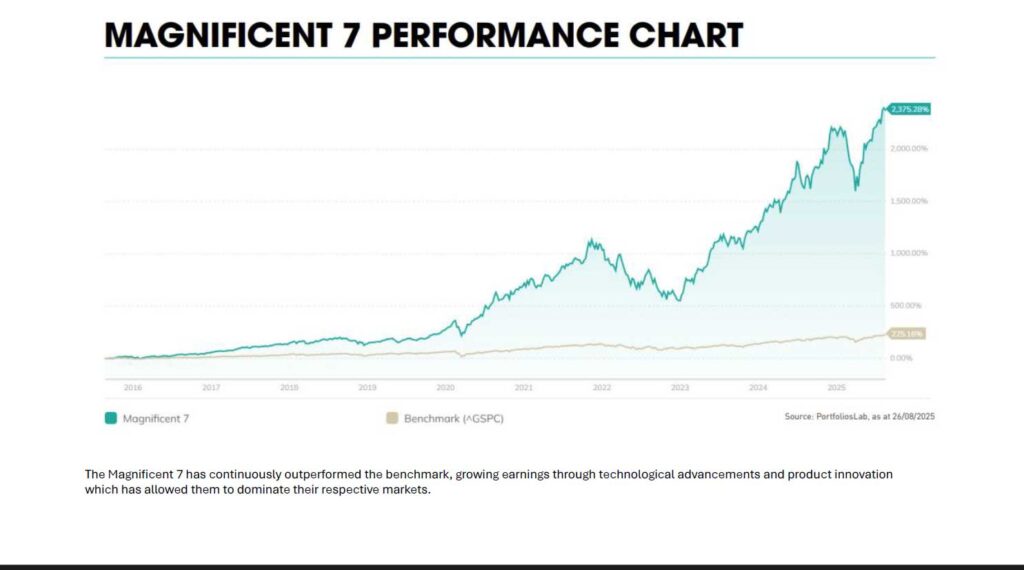

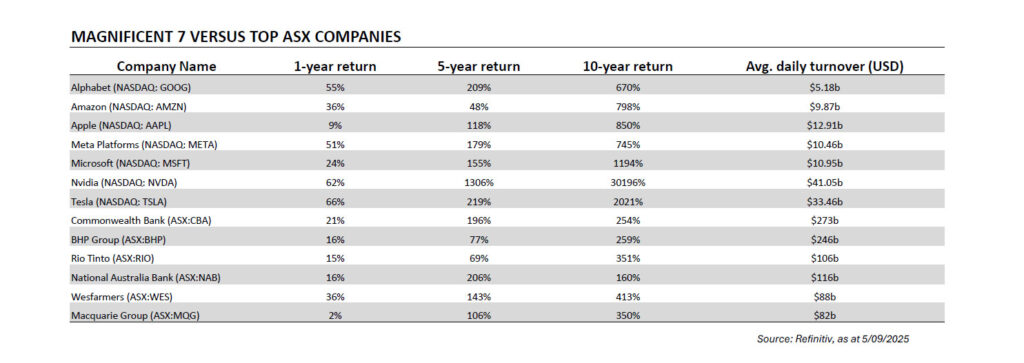

LOSE THE HOME BIAS. Need a compelling reason to diversify your portfolio away from the traditional Australian bias? The Magnificent 7 have outperformed the broader market and driven growth in the stock market for several years.

By: Bell Potter Securities Limited

Regards,

JMP Securities Team

JMP Securities

a. Level 3, ADF Haus, Musgrave St., Port Moresby NCD Papua New Guinea

p. PO Box 2064, Port Moresby NCD Papua New Guinea

Email: lars.mortensen@jmpmarkets.com

Ph: +675 7200 2233

Mobile: +675 7056 5124

Email: nathan.chang@jmpmarkets.com

Ph: +675 7167 3223

Mobile: +61 422 113 630