03 Nov – 07 Nov, 2025

Welcome to this week’s JMP Report,

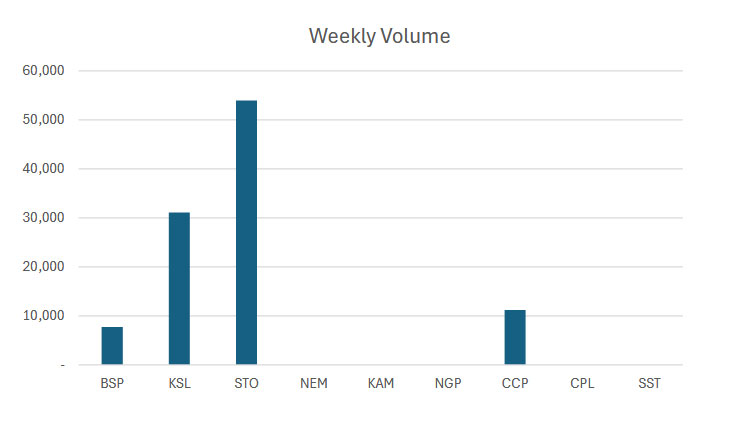

- Last week saw 4 stocks traded on the local market with a total trading value of K1,453.352.60.

- BSP traded 7,738 shares, closing steady at K24.00.

- KSL traded 31,072 shares. Closing lower form the previous week at K3.80.

- STO managed to trade 53,905 shares but closed 50t lower at K20.00.

- Lastly, CCP traded 11,217 shares lower by 2t at K4.63.

WEEKLY MARKET REPORT | 03 November, 2025 – 07 November, 2025

| STOCK | WEEKLY VOLUME |

CLOSING PRICE | VALUE | BID | OFFER | CHANGE | % CHANGE |

| BSP | 7,738 | 24.00 | 170,232 | 24.00 | 24.00 | 0.40 | 0.02 |

| KSL | 31,072 | 3.80 | 118,079 | 3.80 | 3.85 | (0.01) | (0.26%) |

| STO | 53,905 | 20.00 | 1,113,107 | – | 20.50 | (0.50) | (2.44%) |

| NEM | – | 181.00 | – | – | – | – | – |

| KAM | – | 1.90 | – | 1.90 | – | – | 1.06% |

| NGP | – | 1.35 | – | 1.35 | – | – | – |

| CCP | 11,217 | 4.65 | 51,935 | – | 4.64 | (0.02) | (0.43%) |

| CPL | – | 0.45 | – | 0.40 | 0.50 | (0.15) | (25.00%) |

| SST | – | 50.00 | – | – | 50.00 | – | – |

| 103,932 | TOTAL | 1,453,353 | (1.74%) |

Key takeaways:

- Market Announcement: KSL – Strategic Investment and Partnership with NiuPay Download >>

- Market Announcement: NEM Filing

Form 144 Filed Bruce Brook Download >>

Form 144 Filed Tom Palmer Download >>

Form 4 Filed Natascha Viljoen Download >>

Form 4 Filed Tom Palmer Download >>

Form 4 Filed Bruce Brook Download >>

Form 4 Filed Brian Tabolt Download >> - Market Announcement: CPL – Appendix-10B-Notice-of-Change-In-Directors-or-CEOs-Interests Download >>

- CPL – Insider Trading Policy – Oct 2025 Download >>

- Market Announcement: STO – Santos prices US$1 billion 10-year US 144A-Reg S bond Download >>

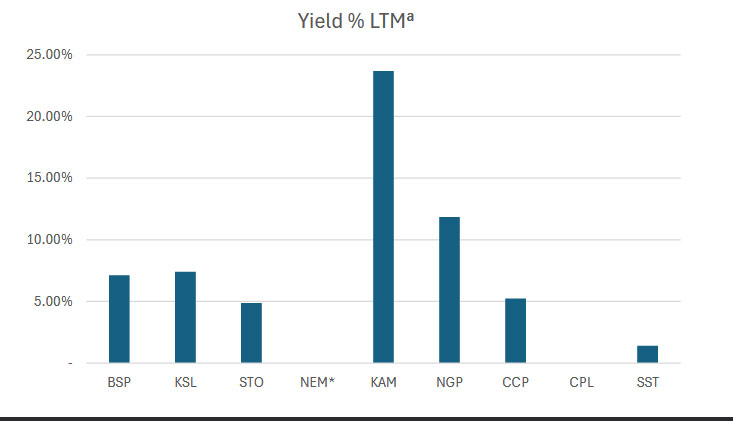

WEEKLY YIELD CHART | 03 November, 2025 – 07 November, 2025

| STOCK | NUMBER ISSUED OF SHARES |

MARKET CAP |

2023 INTERIM DIV | 2023 FINAL DIV | 2024 INTERIM DIV | 2024 FINAL DIV | 2025 INTERIM DIV | YIELD % LTM |

| BSP | 467,219,979 | 11,213,279,496 | K0.370 | K1.060 | K1.210 | K1.210 | K0.500 | 7.13% |

| KSL | 287,949,279 | 1,097,207,260 | K0.100 | K0.160 | K0.106 | K1.155 | K0.126 | 7.39% |

| STO | 3,247,772,961 | 64,955,459,220 | K0.310 | K0.660 | k0.506 | K0.414 | K0.559 | 4.87% |

| NEM* | – | – | – | – | – | – | – | – |

| KAM | 50,693,986 | 96,318,573 | K0.120 | – | – | – | K0.250 | 23.68% |

| NGP | 45,890,700 | 61,952,445 | K0.030 | – | K0.120 | K0.120 | K0.040 | 11.85% |

| CCP | 307,931,332 | 1,431,880,694 | K0.110 | K0.130 | K0.121 | K0.121 | K0.121 | 5.20% |

| CPL | 206,277,911 | 92,825,060 | K0.050 | – | – | – | – | – |

| SST | 31,008,237 | 1,550,411,850 | K0.350 | K0.600 | K0.300 | K0.300 | K0.400 | 1.40% |

| TOTAL | 80,496,334,598 | 5.18% |

a LTM = Last Twelve Months. We have calculated yields based on most recently declared

interim and final dividends.

* NEM pays quarterly dividends. We have added last 4 payments at current FX rates.

Dividend yield – is calculated by dividing a company’s annual dividends per share by its current share price and expressing the result as a percentage.

Domestic Markets Department – Money Markets Operations Unit

Auction Number: 05 NOV-25 / GOI / Government Treasury Bill

Settlement Date: 07-Oct-25

Amount on Offer: K267.780 million

|

TERMS |

ISSUE ID |

ISSUE ID |

ISSUE ID |

ISSUE ID |

ISSUE ID |

TOTAL |

|

Weighted Average Yield |

0.000 |

0.00% |

7.23% |

0.00% |

7.21% |

|

|

Amount on offer Kina Million |

0.000 |

0.000 |

20.000 |

50.000 |

306.780 |

376.780 |

|

Bids Received Kina Million |

0.00 |

0.000 |

48.300 |

65.120 |

479.100 |

592.520 |

|

Successful Bids Kina Million |

0.00 |

0.000 |

38.300 |

0.000 |

396.300 |

434.600 |

|

Overall Auction OVER-SUBSCRIBED by |

0.00 |

0.000 |

28.300 |

15.120 |

172.320 |

215.740 |

What we have been reading

AUSTRALIAN EQUITY STRATEGY- HOLD NOW, BUY ON WEAKNESS

By: Bell Potter – Monthly Bell Nov 2025 – Paul Basha, Strategist

+ AI story), and credit cockroaches (small spread moves spark outsized equity selling, signaling tight positioning and thin buffers).

Any of these could trigger a fast, multiple-led sell-off that Australia would participate strongly in. We highlight two high quality stocks our analysts rate HOLD on valuation. In an air-pocket we’d expect multiples to compress while earnings stay comparatively resilient versus sector peers, creating buy-on-weakness set-ups like April this year and August 2024. Assuming no change to the underlying thesis, the price reset is the opportunity.

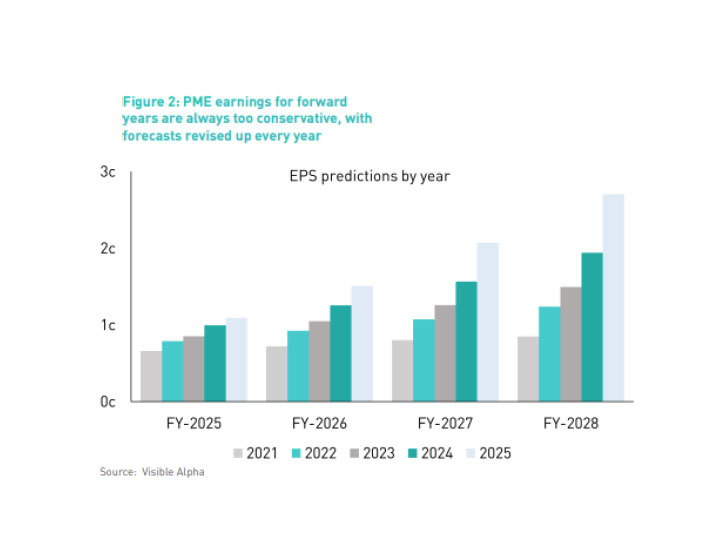

Pro Medicus (PME) – Best in class

Bell Potter view: this is one of the highest-quality names on the market.

We expect that PME’s revenue growth re-accelerates above 30%+ with margins expanding off an already high base as full-stack/cloud deployments and renewal pricing flow through. The P/E steps down each year as earnings compound, though from a very high starting point, with the stock remaining sensitive to multiple compression in a risk-off. HOLD now, Buy on weakness.

TechnologyOne (TNE) – PLUS one

Bell Potter view:

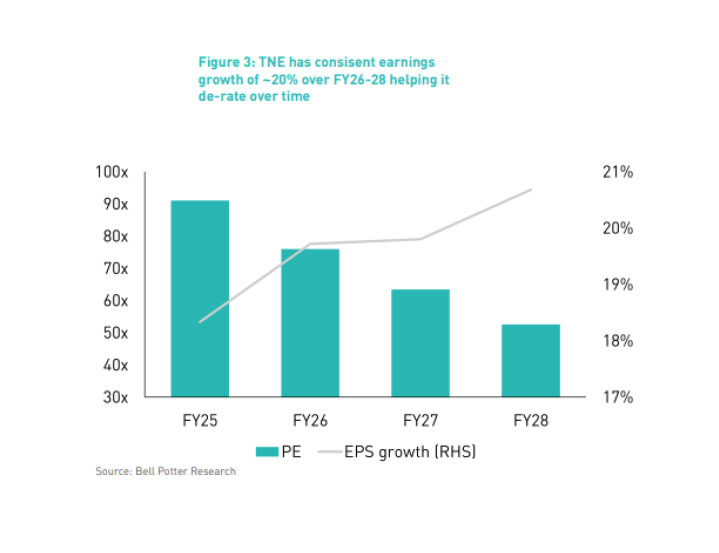

Execution has been consistent. EPS has compounded at ~17% over five years, with ~20% growth expected for FY25 and ~21% for FY26. R&D investment of roughly 20–25% of revenue funds a steady cadence of product launches, now with AI in the foreground.

Management’s FY30 ambitions (including $1bn+ ARR) look high but achievable. Our analyst is currently more bullish than management on the out-years (revenue and

margin trajectory), yet even on those numbers the valuation remains full. The stock can grow into its multiple, but at today’s settings the PEG sits above 4, which we view as too rich for fresh money. The business quality is not in question: long-dated contracts, high NRR, clear AI monetization paths, and growing both domestically and globally. HOLD now, Buy on weakness.

Regards,

JMP Securities Team

a. Level 3, ADF Haus, Musgrave St., Port Moresby NCD Papua New Guinea

p. PO Box 2064, Port Moresby NCD Papua New Guinea

Email: lars.mortensen@jmpmarkets.com

Ph: +675 7200 2233

Mobile: +675 7056 5124

Email: nathan.chang@jmpmarkets.com

Ph: +675 7167 3223

Mobile: +61 422 113 630