05 – 09 January 2026

Weekly Trade Commentary

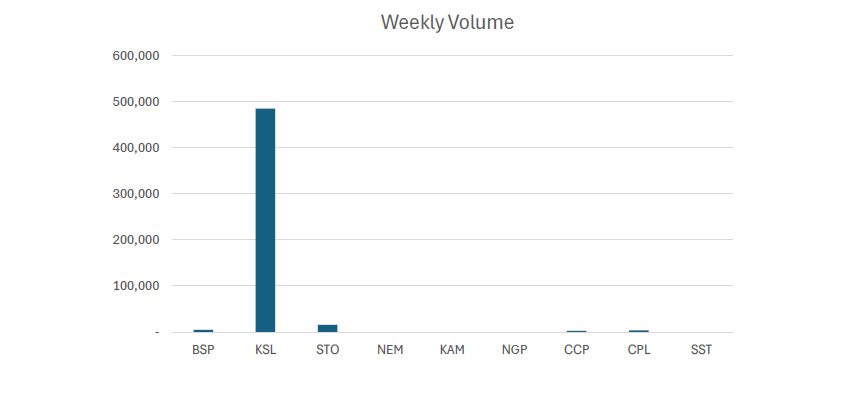

- Last week saw 5 stocks traded on the local market with a total trading value of K2,271,672.83.

- BSP traded 4,593 shares, steady at K24.55.

- KSL traded 484,848 shares, also steady at K3.81.

- STO traded 15,442 shares but closed 50t lower at K18.50.

- CCP closed 3t lower at K4.60. Trading only 2,666 shares.

- Lastly , CPL managed to trade 3,560 shares changing hands steady at K0.65.

WEEKLY MARKET REPORT | 17 November, 2025 – 21 November, 2025

| STOCK | WEEKLY VOLUME |

CLOSING PRICE | VALUE | BID | OFFER | CHANGE | % CHANGE |

| BSP | 4,593 | 24.55 | 112,758.15 | 24.00 | – | – | – |

| KSL | 484,848 | 3.81 | 1,858,660.08 | 3.81 | 3.85 | – | – |

| STO | 15,442 | 18.50 | 285,677.00 | 18.50 | 19.50 | (0.50) | (2.63%) |

| NEM | – | 181.00 | – | – | – | – | – |

| KAM | – | 1.92 | – | 1.95 | – | – | – |

| NGP | – | 1.35 | – | – | – | – | – |

| CCP | 2,666 | 4.60 | 5,798.10 | – | 4.60 | (0.03) | (0.65%) |

| CPL | 3,560 | 0.65 | 248,395.60 | – | 0.60 | – | – |

| SST | – | 50.00 | – | – | 50.00 | – | – |

| 511,109 | TOTAL | 2,271,672.83 | (2.09%) |

Key takeaways:

- NEM –Form 4 as filed -Tom Palmer – Download >>

- NEM -Form 4 as filed -Jenniffer Cmil – Download >>

- STO – Change of Director’s Interest Notice – Download >>

- NEM – Boddington December and January Bushfires – Download >>

- KAM – Appendix 2B Notification of change to the number of securities on issue – Download >>

- 2026 Trading Holidays-PNGX – Download >>

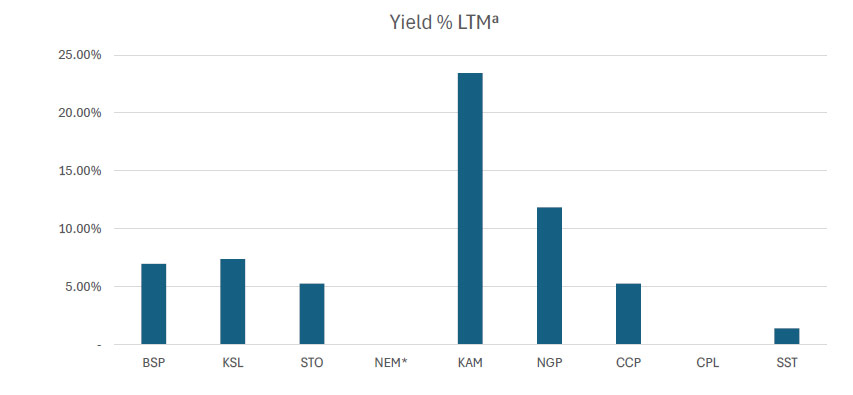

WEEKLY YIELD CHART | 5 January, 2026 – 9 January, 2026

| STOCK | NUMBER ISSUED OF SHARES |

MARKET CAP |

2023 INTERIM DIV | 2023 FINAL DIV | 2024 INTERIM DIV | 2024 FINAL DIV | 2025 INTERIM DIV | YIELD % LTM |

| BSP | 467,219,979 | 11,470,250,484 | K0.370 | K1.060 | K1.210 | K1.210 | K0.500 | 6.97% |

| KSL | 287,949,279 | 1,097,086,753 | K0.100 | K0.160 | K0.106 | K1.155 | K0.126 | 7.38% |

| STO | 3,247,772,961 | 60,083,799,779 | K0.310 | K0.660 | k0.506 | K0.414 | K0.559 | 5.26% |

| NEM* | – | – | – | – | – | – | – | – |

| KAM | 50,693,986 | 97,332,453 | K0.120 | – | – | – | K0.250 | 23.44% |

| NGP | 45,890,700 | 61,952,445 | K0.030 | – | K0.120 | K0.120 | K0.040 | 11.85% |

| CCP | 307,931,332 | 1,416,484,127 | K0.110 | K0.130 | K0.121 | K0.121 | K0.121 | 5.26% |

| CPL | 206,277,911 | 134,080,642 | K0.050 | – | – | – | – | – |

| SST | 31,008,237 | 1,550,411,850 | K0.350 | K0.600 | K0.300 | K0.300 | K0.400 | 1.40% |

| TOTAL | 75,911,398,533 | 5.49% |

a LTM = Last Twelve Months. We have calculated yields based on most recently declared

interim and final dividends.

* NEM pays quarterly dividends. We have added last 4 payments at current FX rates.

Dividend yield – is calculated by dividing a company’s annual dividends per share by its current share price and expressing the result as a percentage.

Domestic Markets Department – Money Markets Operations Unit

Auction Number: 07 JAN-26 / GOI / Government Treasury Bill

Settlement Date: 09-JAN-26

Amount on Offer: K350.000 million

|

TERMS |

ISSUE ID |

ISSUE ID |

ISSUE ID |

ISSUE ID |

ISSUE ID |

TOTAL |

|

Weighted Average Yield |

0.000 |

0.00% |

4.56% |

4.74% |

5.33% |

|

|

Amount on offer Kina Million |

0.000 |

0.000 |

30.000 |

70.000 |

250.000 |

350.000 |

|

Bids Received Kina Million |

0.00 |

0.000 |

11.00 |

5.00 |

4441.09 |

457.09 |

|

Successful Bids Kina Million |

0.00 |

0.000 |

11.00 |

5.00 |

201.09 |

217.09 |

|

Overall Auction OVER-SUBSCRIBED by |

0.00 |

0.000 |

-19.00 |

-65.00 |

191.09 |

107.09 |

What we have been reading

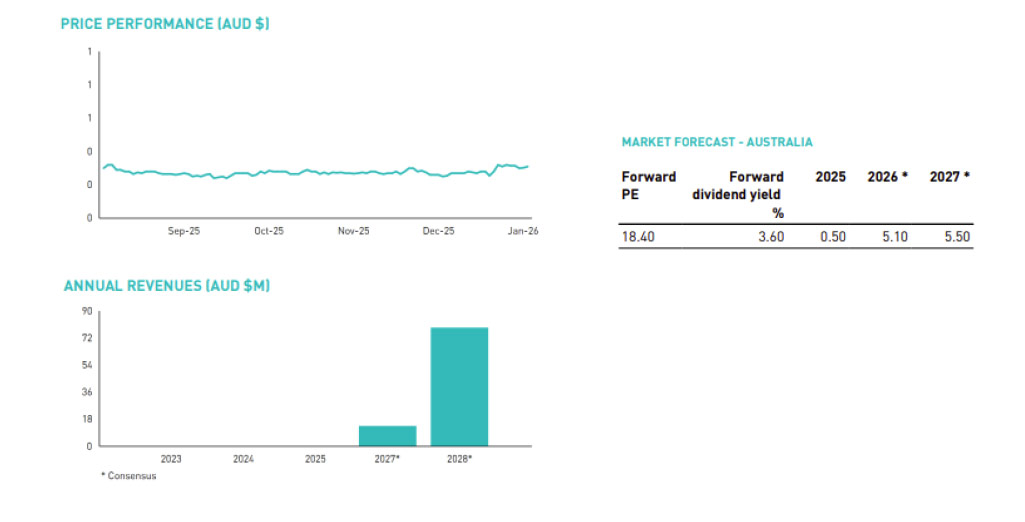

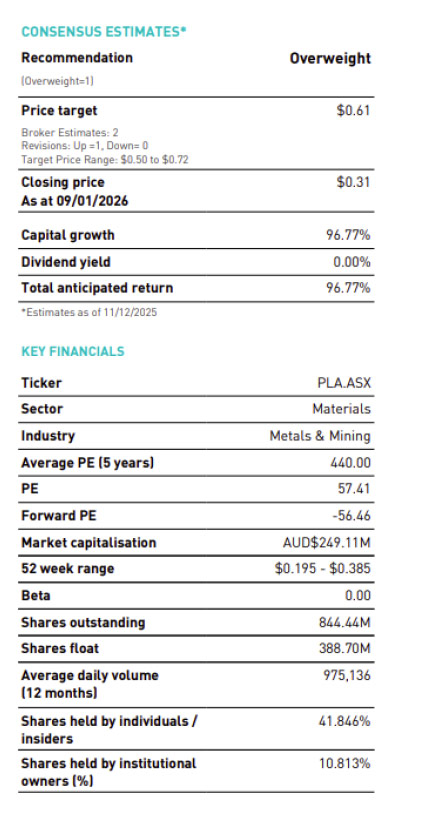

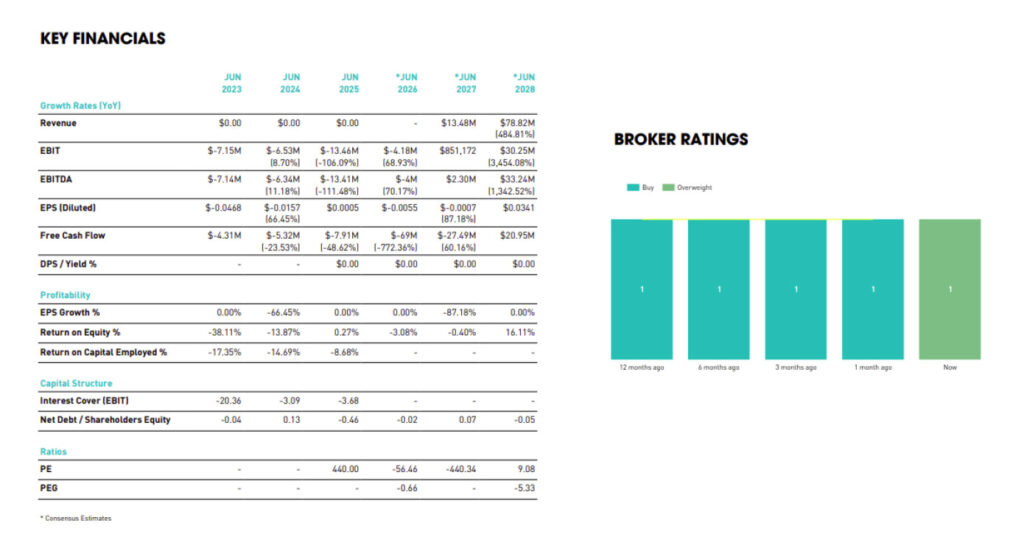

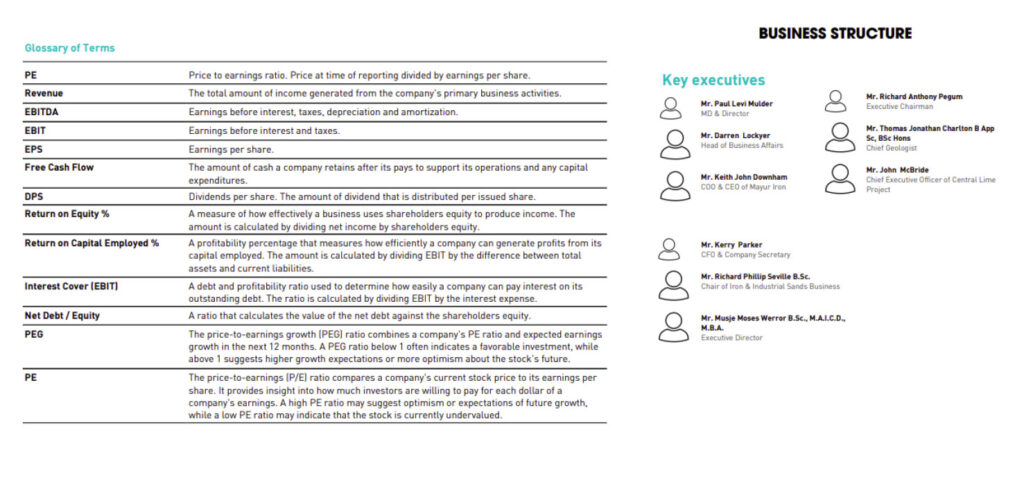

PACIFIC LIME AND CEMENT LIMITED (PLA.ASX)

By: Bell Potter – Consensus Report 2025

Regards,

JMP Securities Team

a. Level 3, ADF Haus, Musgrave St., Port Moresby NCD Papua New Guinea

p. PO Box 2064, Port Moresby NCD Papua New Guinea

Email: lars.mortensen@jmpmarkets.com

Ph: +675 7200 2233

Mobile: +675 7056 5124

Email: nathan.chang@jmpmarkets.com

Ph: +675 7167 3223

Mobile: +61 422 113 630