22-26 September, 2025

Welcome to this week’s JMP Report,

Weekly Trade Commentary

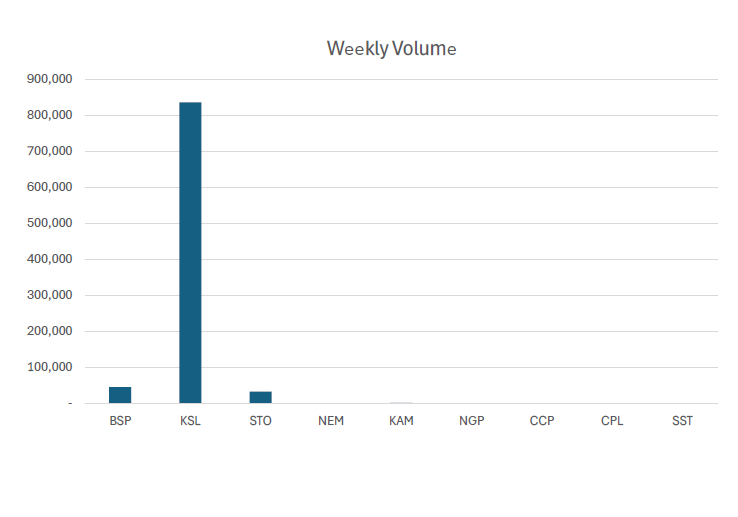

Last week saw only 4 stocks traded on PNGX with a total trading value of K4,889,991.80. BSP traded good volumes, 44,256 shares steady at K23.55. KSL traded the largest volumes of the week, 835,788 shares closing 7t lower at K3.80. STO traded good volumes also, 31,869 shares closing at K21.00. KAM traded the least number of volumes during the week, 1,080 shares changed hands higher by 1t at K1.87.

WEEKLY MARKET REPORT | 22 September, 2025 – 26 September, 2025

| STOCK | WEEKLY VOLUME |

CLOSING PRICE | VALUE | BID | OFFER | CHANGE | % CHANGE |

| BSP | 44,256 | 23.55 | 1,042,228.80 | 23.55 | – | (0.07) | (1.81%) |

| KSL | 835,788 | 3.80 | 3,175,994.40 | 3.70 | 3.93 | – | – |

| STO | 31,869 | 21.00 | 669,749 | – | 22.00 | 0.01 | 0.54% |

| NEM | – | 181.00 | – | – | – | – | – |

| KAM | 1,080 | 1.87 | 2,020 | 1.87 | 2.00 | – | – |

| NGP | – | 1.35 | – | 1.35 | – | – | – |

| CCP | – | 4.65 | – | 3.20 | 4.65 | – | – |

| CPL | – | 0.40 | – | 0.40 | 0.65 | – | – |

| SST | – | 50.00 | – | – | 50.00 | – | – |

| TOTAL | 4,889,991.80 | (0.02%) |

Key takeaways:

- BSP and KSL continue to dominate total trading values with over 86% combined between the 2 stocks.

- On the 19th of September (Last Friday), BSP paid their HY 2025 interim dividend, 50t/share.

- This week STO and KSL will be paying there HY 2025 interim dividends, on the 1st and 2nd of October respectively. STO will be paying K0.559/share and KSL K0.126/share.

- CGA – Results of PNG Air Special Meeting for Shareholders dated 22 September2025. Download >>

– This is based on CGA seeking up to K20 mil via equity raising at a price of 2t/share proposing up to one billion (1,000,000,000) new ordinary shares (New Shares).

– The issuance would give preference to existing minority shareholders. After that, any unsubscribed shares would be offered to new investors (“sophisticated investors”) with minimum investments of PGK 250,000.

– Appointment of Weathermen Capital Advisors Limited as agent and broker. - Market Announcement Newmont: NEM – First Gold Pour at the Ahafo North Project. Download >>

- Market Announcement: NEM – Update – Dividend/Distribution

Download >> Note: NEM dividends will be paid put today dated 29.09.25

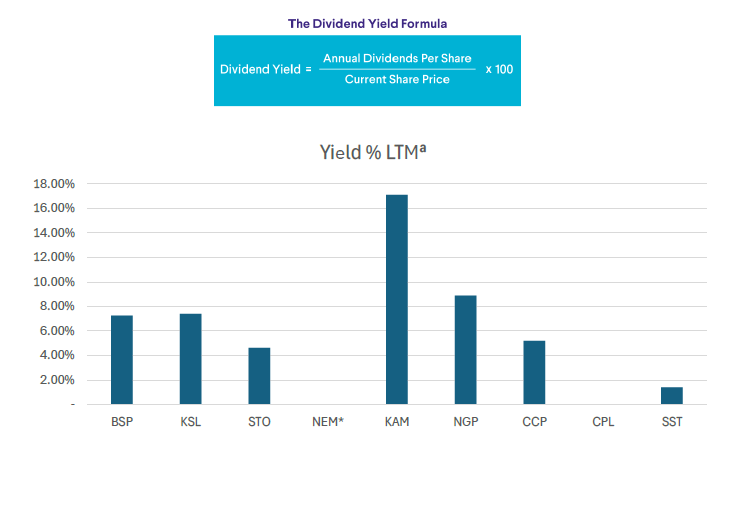

WEEKLY YIELD CHART | 22 September, 2025 – 26 September, 2025

| STOCK | NUMBER ISSUED OF SHARES |

MARKET CAP |

2023 INTERIM DIV | 2023 FINAL DIV | 2024 INTERIM DIV | 2024 FINAL DIV | 2025 INTERIM DIV | YIELD % LTM |

| BSP | 467,219,979 | 11,003,030,505 | K0.370 | K1.060 | K1.210 | K1.210 | K0.500 | 7.67% |

| KSL | 287,949,279 | 1,094,207,260 | K0.100 | K0.160 | K0.106 | K1.155 | K0.126 | 7.39% |

| STO | 3,247,772,961 | 68,203,232,181 | K0.310 | K0.660 | k0.506 | K0.414 | K0.600 | 4.83% |

| NEM* | – | – | – | – | – | – | – | – |

| KAM | 50,693,986 | 94,797,754 | K0.120 | – | – | – | – | 17.11% |

| NGP | 45,890,700 | 61,952,445 | K0.030 | – | K0.120 | K0.120 | – | 8.89% |

| CCP | 307,931,332 | 1,431,880,674 | K0.110 | K0.130 | K0.121 | K0.121 | K0.121 | 5.20% |

| CPL | 206,277,911 | 82,511,164 | K0.050 | – | – | – | – | – |

| SST | 31,008,237 | 1,550,411,850 | K0.350 | K0.600 | K0.300 | K0.300 | K0.400 | 1.40% |

| TOTAL | 83,522,023,854 | 5.14% |

a LTM = Last Twelve Months. We have calculated yields based on most recently declared

interim and final dividends.

* NEM pays quarterly dividends. We have added last 4 payments at current FX rates.

Dividend yield – is calculated by dividing a company’s annual dividends per share by its current share price and expressing the result as a percentage.

What we have been reading

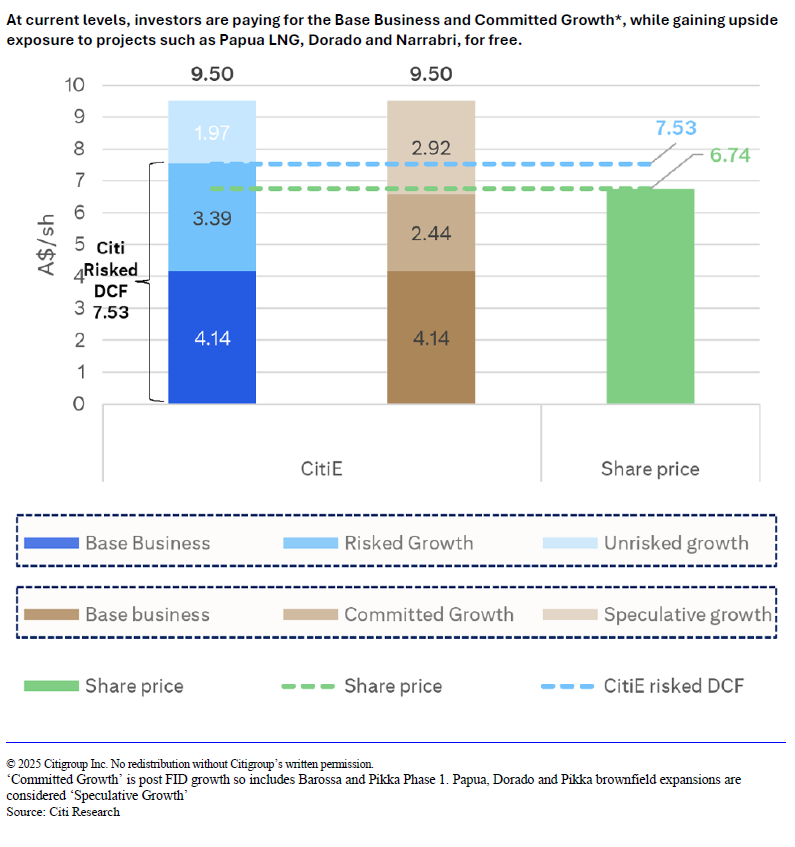

Santos Ltd (STO.AX) | Buy

XRG-STO retrospective; share price sugges ts value. Maintain Buy.

Regards,

JMP Securities Team

JMP Securities

a. Level 3, ADF Haus, Musgrave St., Port Moresby NCD Papua New Guinea

p. PO Box 2064, Port Moresby NCD Papua New Guinea

Email: lars.mortensen@jmpmarkets.com

Ph: +675 7200 2233

Mobile: +675 7056 5124

Email: nathan.chang@jmpmarkets.com

Ph: +675 7167 3223

Mobile: +61 422 113 630