6 Oct – 10 Oct, 2025

Welcome to this week’s JMP Report,

Weekly Trade Commentary

-

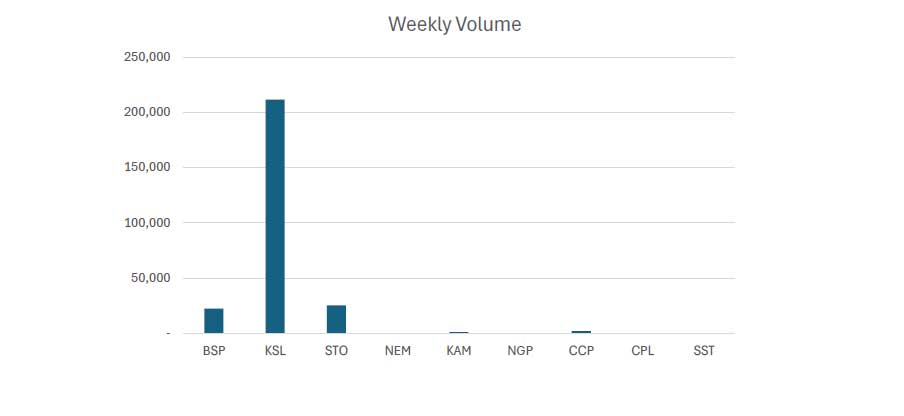

Last week saw 4 stocks actively traded on PNGX with a total trading value of K3,853,257.69.

-

BSP traded good volumes 22,571 shares steady at K23.55.

-

KSL traded 106,512 shares closing lower at by 1t at K3.84.

-

STO traded 95,688 shares closing steady at K21.00.

-

Lastly, CPL traded the largest volumes of the week, 2,248,750 shares closing at K0.65.

WEEKLY MARKET REPORT | 6 October, 2025 – 10 October, 2025

| STOCK | WEEKLY VOLUME |

CLOSING PRICE | VALUE | BID | OFFER | CHANGE | % CHANGE |

| BSP | 22,571 | 23.55 | 531,547 | – | 23.55 | – | – |

| KSL | 106,512 | 3.85 | 406,963 | 3.80 | 3.85 | (0.01) | (0.26%) |

| STO | 95,688 | 21.00 | 2,009,448 | – | 22.00 | – | – |

| NEM | – | 181.00 | – | – | – | – | – |

| KAM | – | 1.88 | – | 1.88 | – | – | – |

| NGP | – | 1.35 | – | 1.35 | – | – | – |

| CCP | – | 4.65 | – | 3.20 | 4.65 | – | – |

| CPL | 2,248,750 | 0.40 | 905,300 | 0.45 | 0.65 | 0.25 | 62.50% |

| SST | – | 50.00 | – | – | 50.00 | – | – |

| 2,473,521 | TOTAL | 3,853,258 | 0.10% |

Key takeaways:

- KSL leads the way with trading for the week, while BSP and STO provide good liquidity to support total trading volume for the week. The 3 stocks combine to give 93.39% of last weeks total trade value.

- Kina Securities Limited (ASX:KSL / PNGX:KSL) (Kina or the Company) announces the appointment of Rayna Heckenberg as the Company’s new Chief Risk Officer (CRO), commencing 10 November 2025. Download >>

- NGIP Agmark Limited announces an interim dividend of 4 toea per share for the 2025 financial year. Download >>

- Market announcement: NGP – Update of Dividend Ex-date 2025 Interim Dividend Download >>

- Market Announcement: NEM – Newmont Announces CEO Transition Download >>

- Market Announcement BSP – Change of Company Secretary Download >>

- Market Announcement: KSL – Appendix 10B Notice of change in Directors Interest (Ivan Vidovich) Download >>

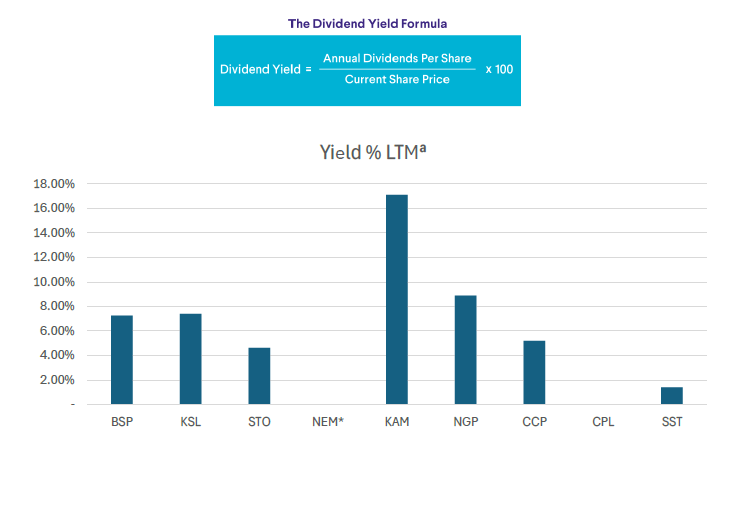

WEEKLY YIELD CHART | 29 September, 2025 – 03 October, 2025

| STOCK | NUMBER ISSUED OF SHARES |

MARKET CAP |

2023 INTERIM DIV | 2023 FINAL DIV | 2024 INTERIM DIV | 2024 FINAL DIV | 2025 INTERIM DIV | YIELD % LTM |

| BSP | 467,219,979 | 11,003,030,505 | K0.370 | K1.060 | K1.210 | K1.210 | K0.500 | 7.26% |

| KSL | 287,949,279 | 1,105,725,231 | K0.100 | K0.160 | K0.106 | K1.155 | K0.126 | 7.32% |

| STO | 3,247,772,961 | 68,203,232,181 | K0.310 | K0.660 | k0.506 | K0.414 | K0.559 | 4.63% |

| NEM* | – | – | – | – | – | – | – | – |

| KAM | 50,693,986 | 95,304,694 | K0.120 | – | – | – | – | 17.02% |

| NGP | 45,890,700 | 61,952,445 | K0.030 | – | K0.120 | K0.120 | K0.040 | 11.85% |

| CCP | 307,931,332 | 1,431,880,694 | K0.110 | K0.130 | K0.121 | K0.121 | K0.121 | 5.20% |

| CPL | 206,277,911 | 82,511,164 | K0.050 | – | – | – | – | – |

| SST | 31,008,237 | 1,550,411,850 | K0.350 | K0.600 | K0.300 | K0.300 | K0.400 | 1.40% |

| TOTAL | 83,534,048,765 | 54.98% |

a LTM = Last Twelve Months. We have calculated yields based on most recently declared

interim and final dividends.

* NEM pays quarterly dividends. We have added last 4 payments at current FX rates.

Dividend yield – is calculated by dividing a company’s annual dividends per share by its current share price and expressing the result as a percentage.

Domestic Markets Department – Money Markets Operations Unit

Auction Number: 08-oct-25 / GOI / Government Treasury Bill

Settlement Date: 10-Oct-25

Amount on Offer: K270.440 million

|

TERMS |

ISSUE ID |

ISSUE ID |

ISSUE ID |

ISSUE ID |

ISSUE ID |

TOTAL |

|

Weighted Average Yield |

0.000 |

0.00% |

7.70% |

7.80% |

7.83% |

|

|

Amount on offer Kina Million |

0.000 |

0.000 |

10.000 |

20.000 |

240.440 |

270.440 |

|

Bids Received Kina Million |

0.00 |

0.000 |

28.530 |

97.670 |

392.870 |

519.070 |

|

Successful Bids Kina Million |

0.00 |

0.000 |

3.530 |

60.000 |

302.200 |

365.730 |

|

Overall Auction OVER-SUBSCRIBED by |

0.00 |

0.000 |

18.530 |

77.670 |

152.430 |

248.630 |

What we have been reading

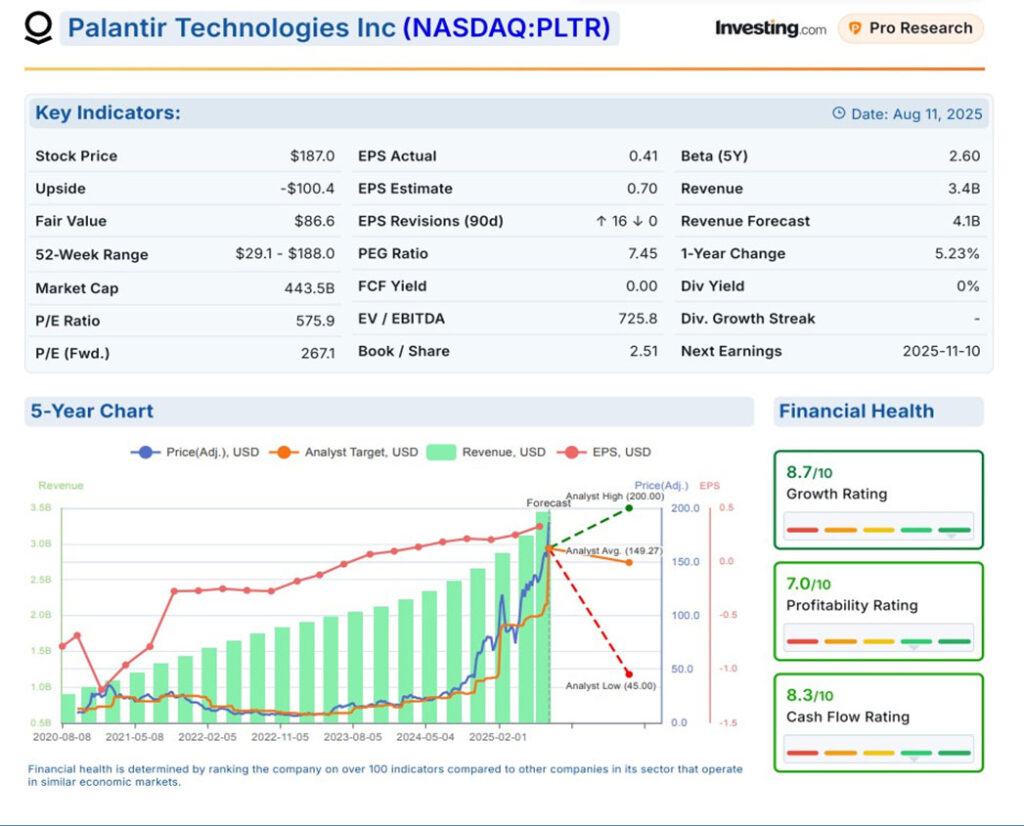

Palantir Executive Summary

By: Landing.Investing.com

Palantir Technologies is a leading AI and data analytics company that provides sophisticated software solutions to both government and commercial clients, with particularly strong operations in the United States market.

The company has demonstrated exceptional financial performance, with revenue growth accelerating to 39% year-over-year in Q1 2025 and reaching a milestone of $1 billion in quarterly revenue in Q2 2025. Palantir maintains impressive profitability metrics, including an 80.01% gross profit margin and projected free cash flow margins of 43% for 2025.

The company’s unique Ontology feature and robust AI technology capabilities have contributed to high customer retention rates and expanding market presence, particularly in the US commercial and government sectors. Growth prospects appear promising, with significant opportunities in Middle Eastern markets, including Saudi Arabia, UAE, and Qatar.

The company is successfully leveraging cross-selling opportunities between government and commercial sectors, while expanding its enterprise data transformation initiatives, as evidenced by recent contracts with major financial institutions. However, Palantir faces several challenges, including limited international commercial presence, particularly in European markets where AI adoption has been slower, and concerns about its reliance on stock-based compensation.

The company’s market position is supported by strong fundamentals, including a healthy current ratio of 6.49 and consistently expanding operating margins, which reached 44% in fiscal year 2025. Nevertheless, investors should consider risks such as intense competition in the AI market, potential changes in government spending priorities, and regulatory challenges in handling sensitive data across jurisdictions.

In a significant recent development, Palantir secured a potential $10 billion contract with the U.S. Army over ten years, consolidating 75 separate deals into a single enterprise framework, further solidifying its position in the government sector.

The company’s Q2 2025 results exceeded analyst expectations, leading multiple firms to raise their price targets, although valuation concerns persist among some analysts.

Regards,

JMP Securities Team

JMP Securities

a. Level 3, ADF Haus, Musgrave St., Port Moresby NCD Papua New Guinea

p. PO Box 2064, Port Moresby NCD Papua New Guinea

Email: lars.mortensen@jmpmarkets.com

Ph: +675 7200 2233

Mobile: +675 7056 5124

Email: nathan.chang@jmpmarkets.com

Ph: +675 7167 3223

Mobile: +61 422 113 630