27 Oct – 31 Oct, 2025

Welcome to this week’s JMP Report,

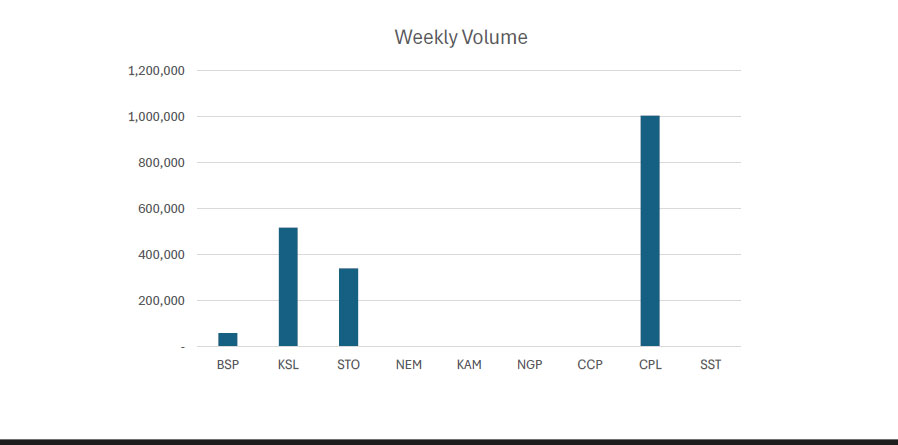

- Last week saw 4 stocks traded on the local market with a total trading value of K10,823,155.89.

- BSP traded 59,713 shares, closing 40t higher at K24.00. A new record high for BSP.

- KSL traded 518,211 shares, closing 1t higher from its previous price at K3.81.

- STO managed to trade good volumes, 340,410 shares at K20.50. Closing 50t higher from its previous close.

- CPL continues its volatile run of price movements. Trading 1,005,108 shares at K0.45, closing 15t lower form its previous close.

WEEKLY MARKET REPORT | 27 October, 2025 – 31 October, 2025

| STOCK | WEEKLY VOLUME |

CLOSING PRICE | VALUE | BID | OFFER | CHANGE | % CHANGE |

| BSP | 59,713 | 24.00 | 1,414,766 | 24.00 | 24.20 | 0.40 | 0.000 |

| KSL | 518,211 | 3.81 | 1,992,131 | 3.80 | 3.85 | 0.01 | (1.30%) |

| STO | 340,410 | 20.50 | 6,963,959 | – | – | 0.50 | – |

| NEM | – | 181.00 | – | – | – | – | – |

| KAM | – | 1.90 | – | 1.90 | – | – | 1.06% |

| NGP | – | 1.35 | – | 1.35 | – | – | – |

| CCP | – | 4.65 | – | – | 4.64 | – | – |

| CPL | 1,005,108 | 0.45 | 452,299 | – | 0.50 | (0.15) | (25.00%) |

| SST | – | 50.00 | – | – | – | – | – |

| 1,923,442 | TOTAL | 10,823,156 | 2.23% |

Key takeaways:

- Market Announcement: NEM – Commercial Production at Ahafo North, Ghana

Newmont Corporation – Newmont Announces Commercial Production at Ahafo North in Ghana Download >> - BSP Third Quarter 2025 Trading Update Download >>

- The JMP equities team recently provided some analysis in relation to our views on BSP Financial Group Limited (PNGX:BSP, ASX:BFL).

The release of the bank’s Q3 financial results this week has not radically changed our view of its prospects in the medium to long term. If anything, the short-term prospects look pretty strong. We are happy to share our views with the wider group of PNG capital market participants as part of growing and developing the industry in PNG. Download >>

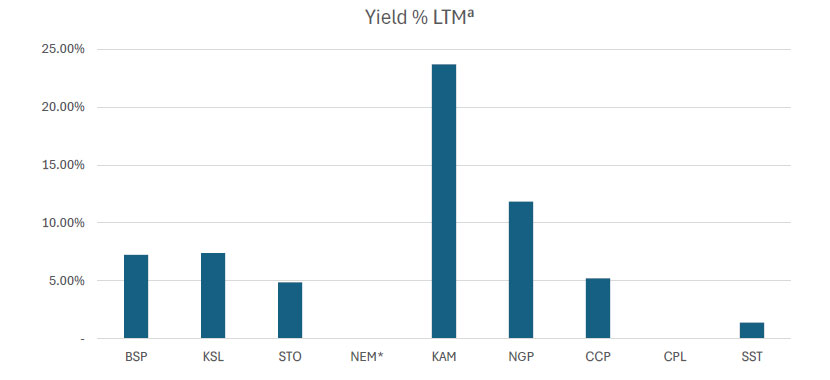

WEEKLY YIELD CHART | 27 October, 2025 – 31 October, 2025

| STOCK | NUMBER ISSUED OF SHARES |

MARKET CAP |

2023 INTERIM DIV | 2023 FINAL DIV | 2024 INTERIM DIV | 2024 FINAL DIV | 2025 INTERIM DIV | YIELD % LTM |

| BSP | 467,219,979 | 11,213,279,496 | K0.370 | K1.060 | K1.210 | K1.210 | K0.500 | 7.13% |

| KSL | 287,949,279 | 1,097,086,753 | K0.100 | K0.160 | K0.106 | K1.155 | K0.126 | 7.38% |

| STO | 3,247,772,961 | 66,579,345,701 | K0.310 | K0.660 | k0.506 | K0.414 | K0.559 | 4.75% |

| NEM* | – | – | – | – | – | – | – | – |

| KAM | 50,693,986 | 96,318,573 | K0.120 | – | – | – | K0.250 | 23.68% |

| NGP | 45,890,700 | 61,952,445 | K0.030 | – | K0.120 | K0.120 | K0.040 | 11.85% |

| CCP | 307,931,332 | 1,431,880,694 | K0.110 | K0.130 | K0.121 | K0.121 | K0.121 | 5.20% |

| CPL | 206,277,911 | 92,825,060 | K0.050 | – | – | – | – | – |

| SST | 31,008,237 | 1,550,411,850 | K0.350 | K0.600 | K0.300 | K0.300 | K0.400 | 1.40% |

| TOTAL | 82,123,100,572 | 5.07% |

a LTM = Last Twelve Months. We have calculated yields based on most recently declared

interim and final dividends.

* NEM pays quarterly dividends. We have added last 4 payments at current FX rates.

Dividend yield – is calculated by dividing a company’s annual dividends per share by its current share price and expressing the result as a percentage.

Domestic Markets Department – Money Markets Operations Unit

Auction Number: 29-oct-25 / GOI / Government Treasury Bill

Settlement Date: 31-Oct-25

Amount on Offer: K267.4000 million

|

TERMS |

ISSUE ID |

ISSUE ID |

ISSUE ID |

ISSUE ID |

ISSUE ID |

TOTAL |

|

Weighted Average Yield |

0.000 |

0.00% |

7.35% |

7.43% |

7.40% |

|

|

Amount on offer Kina Million |

0.000 |

0.000 |

10.000 |

20.000 |

237.400 |

267.400 |

|

Bids Received Kina Million |

0.00 |

0.000 |

26.000 |

39.000 |

339.300 |

404.300 |

|

Successful Bids Kina Million |

0.00 |

0.000 |

10.000 |

32.000 |

238.720 |

300.700 |

|

Overall Auction OVER-SUBSCRIBED by |

0.00 |

0.000 |

16.000 |

19.000 |

101.900 |

136.900 |

What we have been reading

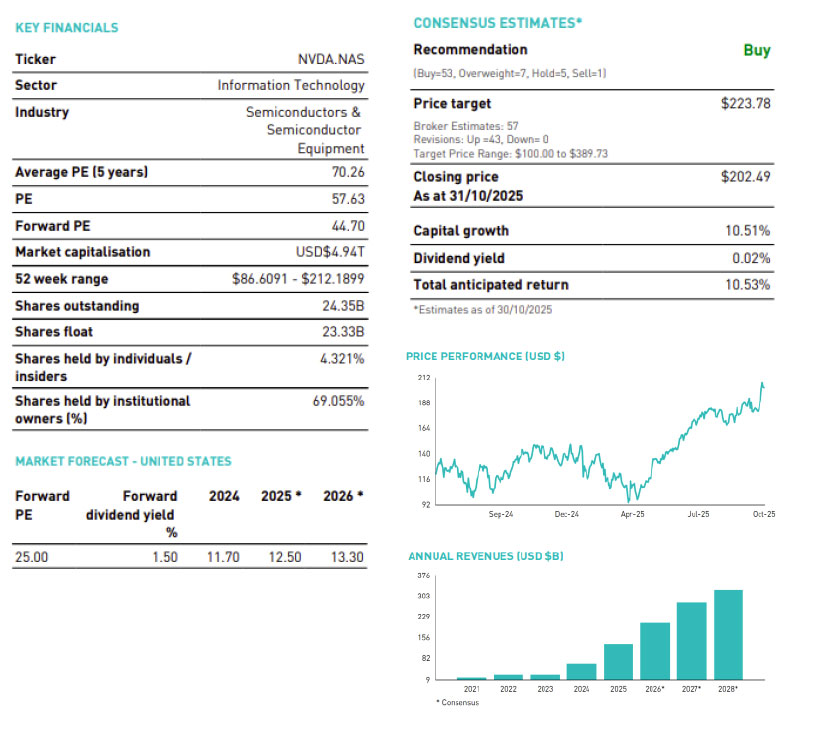

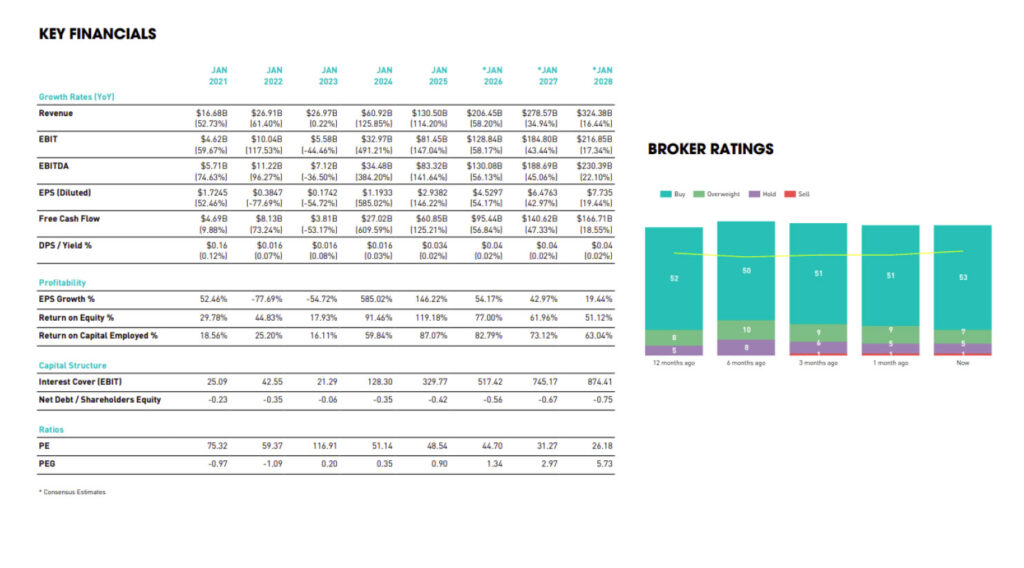

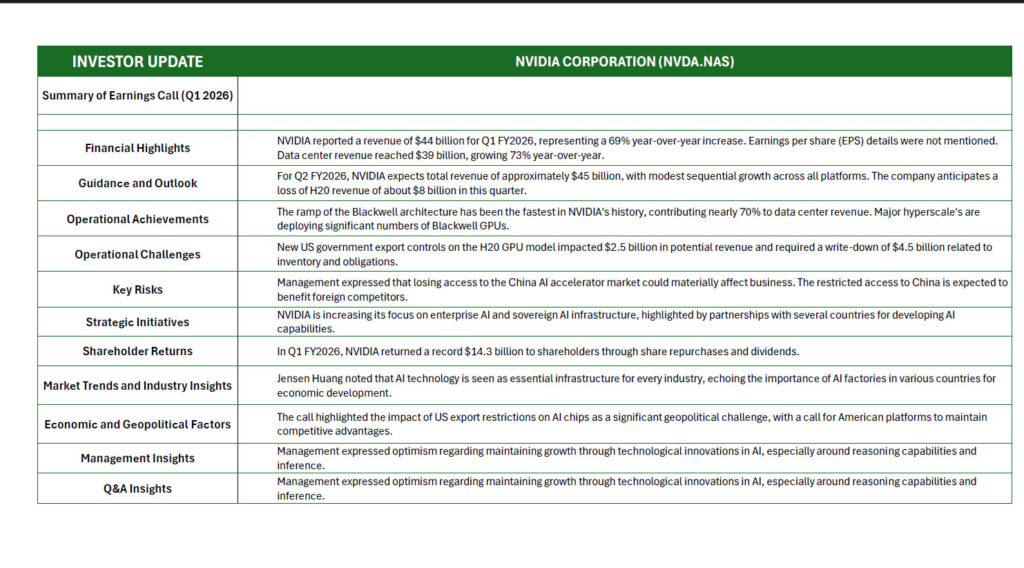

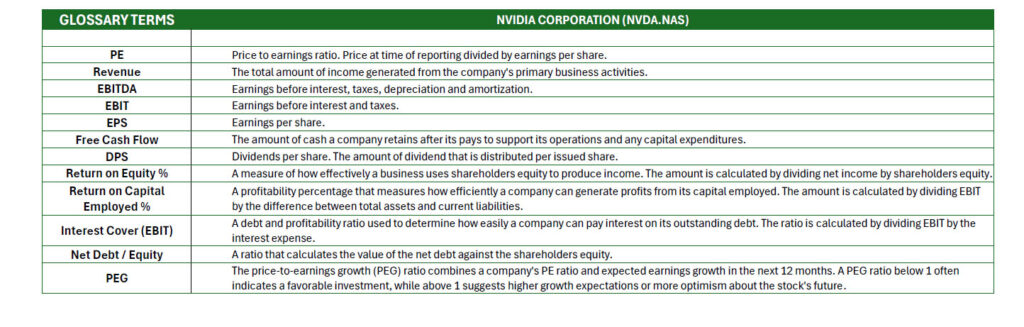

NVIDIA CORPORATION (NVDA.NAS)

By: Bell Potter – Consensus Report

The Graphics segment includes GeForce GPUs for gaming and PCs, the GeForce NOW game streaming service and related infrastructure, Quadro and NVIDIA RTX GPUs for enterprise workstation graphics, virtual GPU, or vGPU, software for cloud-based visual and virtual computing, automotive platforms for infotainment systems, and Omniverse Enterprise software for building and operating metaverse and 3D internet applications.

The Compute & Networking segment consists of Data Center accelerated computing platforms and end-to-end networking platforms including Quantum for InfiniBand and Spectrum for Ethernet, NVIDIA DRIVE automated-driving platform and automotive development agreements, Jetson robotics and other embedded platforms, NVIDIA AI Enterprise and other software, and DGX Cloud software and services.

The company was founded by Jen Hsun Huang, Chris A. Malachowsky, and Curtis R. Priem in April 1993 and is headquartered in Santa Clara, CA.

Regards,

JMP Securities Team

a. Level 3, ADF Haus, Musgrave St., Port Moresby NCD Papua New Guinea

p. PO Box 2064, Port Moresby NCD Papua New Guinea

Email: lars.mortensen@jmpmarkets.com

Ph: +675 7200 2233

Mobile: +675 7056 5124

Email: nathan.chang@jmpmarkets.com

Ph: +675 7167 3223

Mobile: +61 422 113 630