17 Nov – 21 Nov, 2025

Welcome to this week’s JMP Report,

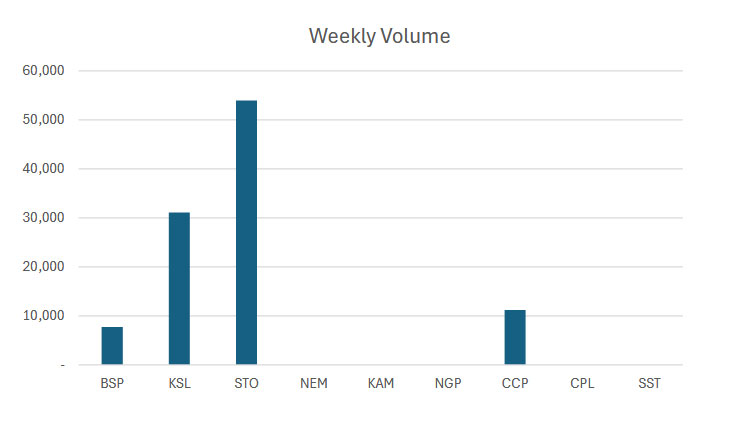

- Last week saw 4 stocks traded on the local market with a total trading value of K2,360,193.46.

- BSP traded 4,468 shares, closing 10t higher at K24.20.

- KSL traded 519,153 shares, closing 1t higher at K3.81.

- CCP managed to trade only 1,255 shares but closed 1t lower at K4.62.

- Lastly, CPL traded 551,988 shares steady again at K0.45.

WEEKLY MARKET REPORT | 17 November, 2025 – 21 November, 2025

| STOCK | WEEKLY VOLUME |

CLOSING PRICE | VALUE | BID | OFFER | CHANGE | % CHANGE |

| BSP | 4,468 | 24.20 | 108,074 | 24.10 | 24.20 | 0.10 | 0.00 |

| KSL | 519,153 | 3.81 | 1,976,321 | 3.80 | 3.81 | 0.01 | 0.26% |

| STO | – | 19.50 | – | – | 22.00 | – | – |

| NEM | – | 181.00 | – | – | – | – | – |

| KAM | – | 1.90 | – | 1.90 | – | – | 1.06% |

| NGP | – | 1.35 | – | 1.35 | – | – | – |

| CCP | 1,255 | 4.62 | 5,798 | – | 4.62 | (0.01) | (0.22%) |

| CPL | 551,988 | 0.45 | 248,395 | – | 0.65 | – | – |

| SST | – | 50.00 | – | – | 50.00 | – | – |

| 1,076,864 | TOTAL | 2,338,588 | (0.06%) |

Key takeaways:

- Market Announcement: CGA – PNG Air 2024 Full Annual Report Final Download >>

- Market Announcement: CPL – Special Dividend Announcement Download >>

- Market Announcement: CGA – PNG Air Capital Raise- Notice for Extension of Subscription period Download >>

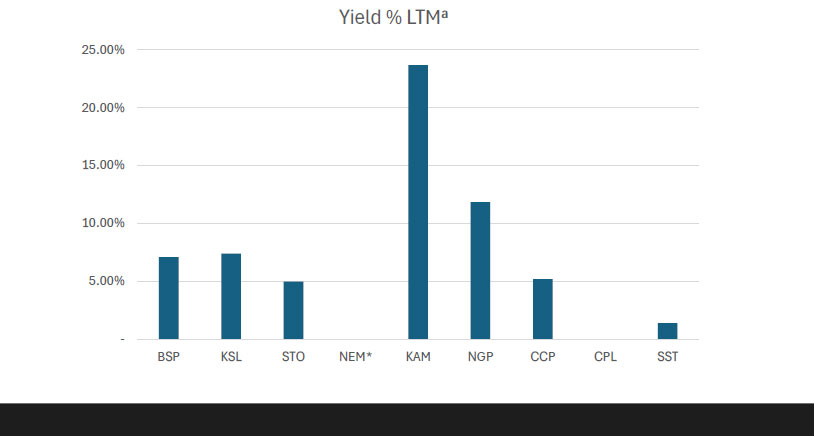

WEEKLY YIELD CHART | 17 November, 2025 – 21 November, 2025

| STOCK | NUMBER ISSUED OF SHARES |

MARKET CAP |

2023 INTERIM DIV | 2023 FINAL DIV | 2024 INTERIM DIV | 2024 FINAL DIV | 2025 INTERIM DIV | YIELD % LTM |

| BSP | 467,219,979 | 11,306,723,492 | K0.370 | K1.060 | K1.210 | K1.210 | K0.500 | 7.07% |

| KSL | 287,949,279 | 1,097,086,753 | K0.100 | K0.160 | K0.106 | K1.155 | K0.126 | 7.38% |

| STO | 3,247,772,961 | 63,331,572,740 | K0.310 | K0.660 | k0.506 | K0.414 | K0.559 | 4.99% |

| NEM* | – | – | – | – | – | – | – | – |

| KAM | 50,693,986 | 96,318,573 | K0.120 | – | – | – | K0.250 | 23.68% |

| NGP | 45,890,700 | 61,952,445 | K0.030 | – | K0.120 | K0.120 | K0.040 | 11.85% |

| CCP | 307,931,332 | 1,422,642,754 | K0.110 | K0.130 | K0.121 | K0.121 | K0.121 | 5.24% |

| CPL | 206,277,911 | 92,825,060 | K0.050 | – | – | – | – | – |

| SST | 31,008,237 | 1,550,411,850 | K0.350 | K0.600 | K0.300 | K0.300 | K0.400 | 1.40% |

| TOTAL | 78,959,533,666 | 5.28% |

a LTM = Last Twelve Months. We have calculated yields based on most recently declared

interim and final dividends.

* NEM pays quarterly dividends. We have added last 4 payments at current FX rates.

Dividend yield – is calculated by dividing a company’s annual dividends per share by its current share price and expressing the result as a percentage.

Domestic Markets Department – Money Markets Operations Unit

Auction Number: 09 NOV-25 / GOI / Government Treasury Bill

Settlement Date: 21-Nov-25

Amount on Offer: K308.150 million

|

TERMS |

ISSUE ID |

ISSUE ID |

ISSUE ID |

ISSUE ID |

ISSUE ID |

TOTAL |

|

Weighted Average Yield |

0.000 |

0.00% |

6.69% |

6.71% |

6.76% |

|

|

Amount on offer Kina Million |

0.000 |

0.000 |

20.000 |

50.000 |

238.15 |

308.15 |

|

Bids Received Kina Million |

0.00 |

0.000 |

105.50 |

158.90 |

633.71 |

898.11 |

|

Successful Bids Kina Million |

0.00 |

0.000 |

20.00 |

50.00 |

331.63 |

401.63 |

|

Overall Auction OVER-SUBSCRIBED by |

0.00 |

0.000 |

85.50 |

108.90 |

395.56 |

589.96 |

What we have been reading

FOOD FOR THOUGHT

By: Bell Potter – Monthly Bell Nov 2025 – John Snape, Strategist

Bega Cheese Limited (BGA) is engaged in: (1) the processing, manufacturing and distribution of dairy and associated products to both Australian and international markets; and (2) the processing and manufacturing of spreads and condiments for consumer markets.

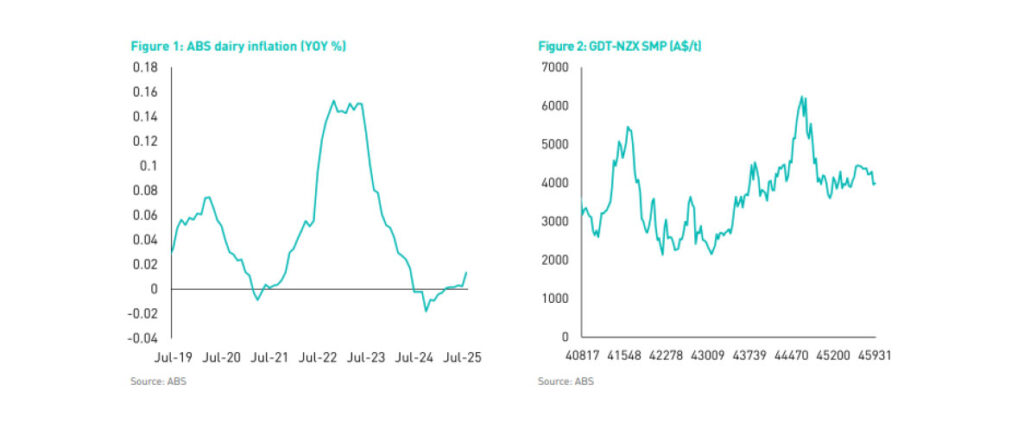

In August 2023 BGA announced the implementation of a 5-year strategic plan target EBITDA $250m (vs. FY23 EBITDA of $160m) and ROIC>10% (vs 5% at FY23). Since then, BGA has both re-established the profitability in its Bulk processing division (through cost out programs and an industry wide rebalance in farmgate prices with commodity returns) and delivered against the baseline acquisition targets for Lion Dairy and Drinks. FY25 EBITDA was $202m and FY26e EBITDA guidance established at $215-220m. BGA has also announced plans to consolidate processing over FY26-27e (Strathmerton and Kingaroy), delivering annual EBITDA savings of $35-40m. The benefits from these initiatives are drivers of growth in FY27-28e and imply that BGA now has a line of sight to achieving the 5-year strategic targets.

From a short-term perspective, the commodity BGA has the most exposure to is skim milk powder, where pricing has demonstrated weakening from the highs seen in 2H25. Against this the branded business has seen reasonably strong gains in core portfolio products, such as yoghurt (+8%) and white milk (+6%), which is well above industry growth rates. We expect the combination of these strong branded pricing gains and shift to Out-of-home consumption will be major drivers of FY26e outcomes and would see the Branded division as the primary driver of growth.

Following recent restructuring announcements with regard to the closure of Strathmerton and winding down of the PCA operations, there appears a clear pathway towards a $250- 270m EBITDA target. If successful in generating this return and having consideration for the cash costs to achieve this target (c$85-100m), it would imply a share price of $8.00-9.00ps (at BGA’s historical ~12x EBITDA multiple). In effect BGA now has a clearly articulated strategy to generating >20% p.a. EPS growth to FY28e, offering one of the more attractive GARP plays in the sector.

Elders Ltd (ELD)

Elders Ltd (ELD) is a leading supplier of fertilizer, agricultural chemicals and animal health products to rural and regional Australia, with strong agency positions in livestock, wool and real estate.

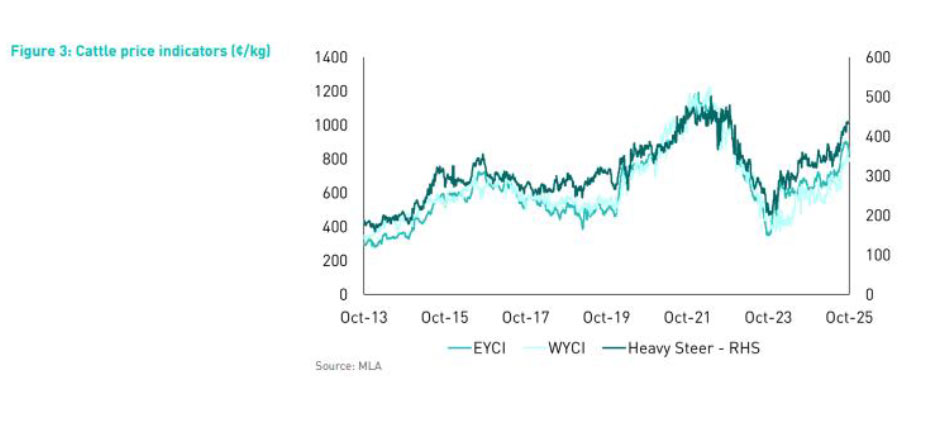

ELD, like BGA, is another stock that offers a compelling three-year growth at a reasonable valuation, with the growth story in our view centers on three key pillars:

ELD base business growth: FY25e EBIT guidance for the base ELD business is $142-146m. Executing on continued backward integration in ag-chem ($15m margin opportunity); delivering on SYSMOD ($11m margin opportunity); annualizing 1H25 acquisitions ($2m in FY26e); and non-recurrence of the Southern drought conditions (BPe $20-25m margin recovery), would provide a pathway to $190-200m EBIT by FY27e.

Consolidation of the Delta acquisition: ELD recently announced it had gained ACCC clearance for the proposed Delta transaction. In FY24 Delta generated $42m in EBIT (and ACCC required store disposal were a modest contributor) and ELD highlighted a 3-year synergy target of $12m, largely through backward integration in ag/vet chem and duplicate cost removal. Delta should make a partial year contribution in FY26e and provide growth through to FY28e as synergy targets are realized.

Livestock leverage: The largest earnings leverage from a commodity exposure is the livestock agency business of ELD, which is exposed to both livestock prices and volumes. Livestock prices and turnoff value enters FY26e demonstrating high double digit YOY gains and this is a favorable dynamic for ELD. Encouragingly, domestic cattle prices continue to trade at a historically high discount to export meat prices, implying good support for livestock prices for FY26e.

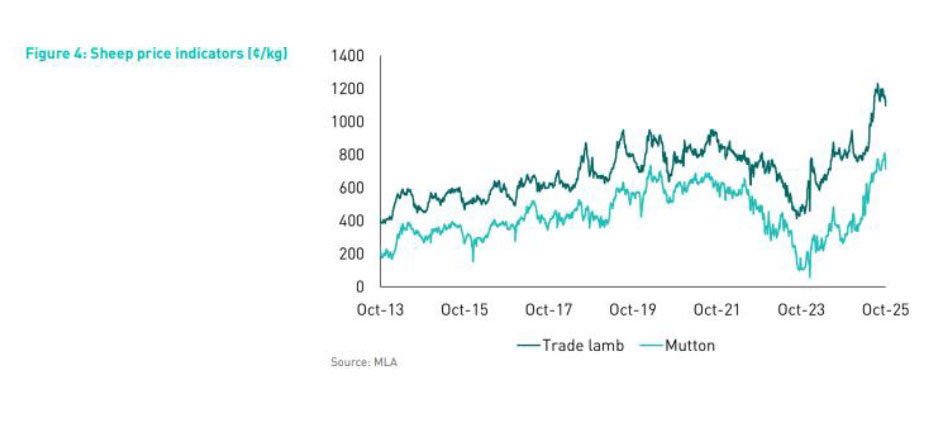

The recent closing of the Delta transaction is clearly a positive development, given the elongated acquisition timeline and in isolation is expected to be ~10% EPS accretive on a PF25e basis. In addition, we see encouraging indicators heading into FY26e, with crop input prices (fertilizer and glyphosate tech), livestock prices (cattle, lamb and mutton) and wool prices all demonstrating double digit YOY gains. A more normal selling pattern in FY26e, delivery on SYSMOD and backward integration initiatives, sector activity tailwinds and consolidation of Delta are expected to drive high double-digit EPS growth in FY26-27e. This view does not look reflected in the current share price, with ELD trading at ~12x FY26e EPS.

Regards,

JMP Securities Team

a. Level 3, ADF Haus, Musgrave St., Port Moresby NCD Papua New Guinea

p. PO Box 2064, Port Moresby NCD Papua New Guinea

Email: lars.mortensen@jmpmarkets.com

Ph: +675 7200 2233

Mobile: +675 7056 5124

Email: nathan.chang@jmpmarkets.com

Ph: +675 7167 3223

Mobile: +61 422 113 630