June 16, 2021

Welcome to this week’s JMP Report.

On the equity front, it was a quiet week for announcements from our PNGX Listed Companies.

On the trading front, last week we saw BSP, OSH , NCM, KAM, CCP, KSL and CPL trade. BSP had 595,296 shares trade to finish the week off at K12.30, OSH traded 1,173 at K10.50, NCM saw 218 shares trade at K75.00, CCP traded 350 shares at K1.70, KSL saw 77,833 shares trade at K3.25, KAM traded 8,845 shares at K1.00 while CPL traded 10,757 shares at K0.70. Refer details below;

|

WEEKLY MARKET REPORT 07.06.21 – 11.06.21 |

||||

|

STOCK |

QUANTITY |

CLOSING |

CHANGE |

% CHANGE |

|

BSP |

595,296 |

12.30 |

. |

|

|

KSL |

77,833 |

3.25 |

– | |

|

OSH |

1,173 |

10.50 |

– | |

|

KAM |

8,845 |

1.00 |

-0.08 |

-8% |

|

NCM |

218 |

75.00 |

– |

|

|

CCP |

350 |

1.70 |

-0.2 |

-12% |

|

CPL |

10,757 |

0.70 |

– |

|

On the interest rate front, the TBill auction results where much the same at 7.20% for the 364 days. There is still a lot of interest in the longer end of the market particularly in the 4 to 10yr area of the curve. As noted previously, the system is very liquid. We are awaiting on an announcement from BPNG as to whether there will be a Government Inscribed Stock auction later this week.

The finance companies are still offering up reasonably good rates which are quite attractive for the retail market. BPNG Tap Bonds are still closed and no immediate recommencement date is available.

What we have been reading this week

City of Berlin plans to install solar on all new buildings

Any future urban building in the German capital will incorporate solar rooftops, making solar energy the norm. Older buildings will also be retrofitted with solar PV systems, and a new energy standard is foreseen, to be enshrined in federal law.

Last week, the Berlin Senate’s Economic and Energy committee held a vote, pending final approval by the house of representatives (Abgeordnetenhouse) at the end of June: as of 2023, any new buildings and significant rooftop renovations will include mandatory solar PV, both for residential and non-residential buildings. This program is expected to turn 30% of all Berlin roofs into solar roofs. According to the Fraunhofer ISE, within the first five years of the program, this ruling could save approximately 37 000 tonnes of CO2 every year. In total, solar power production in Berlin is expected to increase forty times over.

“Berlin is showing the right climate ambition by voting to ensure new and renovated building roofs include solar. Legislation to deploy solar PV on buildings are a powerful tool to drive building decarbonisation and we are seeing more and more examples of regional and local authorities opting for mandatory solar roofs to help reduce CO2 emissions. The upcoming revision of the Renewable Energy Directive II and the Energy Performance of Buildings will be key to ensure the same ambition is replicated across the EU, ensuring buildings can fully contribute to the objectives of the Energy System Integration and Renovation Wave strategies” said Miguel Herrero, Coordinator of the Solar Buildings Workstream at SolarPower Europe.

Berlin is well on its way for its “Solar City” plan. A set of measures is planned to accelerate the expansion of solar, with the goal of achieving 4.4 GW of solar PV, covering a quarter of Berlin’s electricity demand. Originally the goal was to achieve this figure by 2050, but currently the Senate is reconsidering to aim for success “as soon as possible”.

Is Gas So Scarce in Europe That Coal Is Making a Comeback

By Vanessa Dezem, Jesper Starn and Isis Almeida

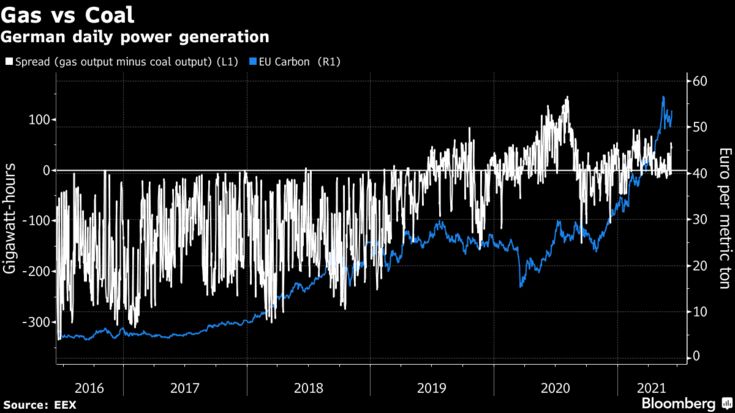

Europe is so short of natural gas that the continent — usually seen as the poster child for the global fight against emissions — is turning to coal to meet electricity demand that is now back to pre-pandemic levels.

Coal usage in the continent jumped 10% to 15% this year after a colder- and longer-than-usual winter left gas storage sites depleted, said Andy Sommer, team leader of fundamental analysis and modelling at Swiss trader Axpo Solutions AG. As economies reopen and people go back to the office, countries like Germany, the Netherlands and Poland turned to coal to keep the lights on.

Europe has long been at the forefront of the battle to reduce global warming. The continent has the world’s largest carbon market, charging the likes of utilities, steel producers and cement makers for polluting the environment. But even with record carbon prices this year, low gas reserves mean burning coal — the dirties of fossil fuels — has become more widespread again.

“Energy demand has been pretty strong in Europe and we have seen a recovery from the pandemic,” Sommer said in an interview. “Gas storage is so low now that Europe cannot afford to run extra power generation with the fuel.”

The return of coal is a setback for Europe ahead of the climate talks in Glasgow later this year. Leaders of the world’s biggest economies failed to set a firm date to end coal burning at the meeting of the Group of Seven at the weekend in Cornwall, U.K.

Europe faced freezing temperatures earlier this year, boosting demand for heating at a time liquefied natural gas cargoes were being sent to Asia instead. Russia sent less gas to the continent via Ukraine ahead of the start of the Nord Stream 2 link to Germany, expected later this year.

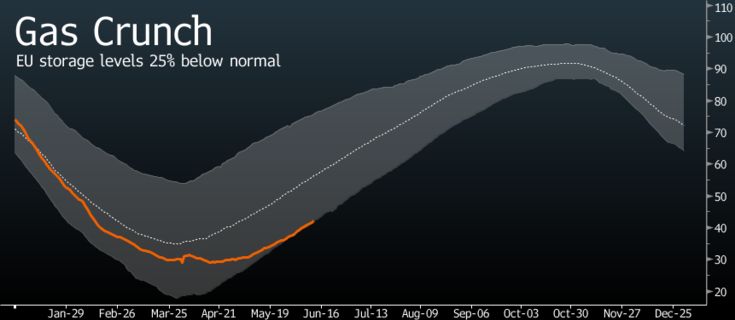

All of that mean that European storage is currently 25% below the five-year average and benchmark Dutch gas surged more than 50% this year. Futures are currently trading near their highest level for this time of the year since 2008.

“People thought Russia was going to book more capacity via Ukraine and that just hasn’t happened in a meaningful way,” said Trevor Sikorski, head of natural gas and energy transition at consultants Energy Aspects in London. “The market is super tight, it’s trying to get less gas into power.”

GIE European gas storage: percentage of full

Electricity demand, which crashed as the coronavirus locked down cities from Frankfurt to London, is now back. Usage in countries including Germany, Spain and the Czech Republic are above the five-year average, while demand is flat in Italy and France, Morgan Stanley said in a report Monday.

With gas supplies already tight amid heavy maintenance cutting flows from Norway, utilities have turned to coal to keep the lights on. While the price of carbon is trading near a record, many have hedged it years in advance. That means burning coal could still be profitable.

Generators with “highly efficient” new plants can probably manage to produce power from coal until 2023, even with high carbon prices, Axpo’s Sommer said.

The G-7 recognized that coal is the single biggest cause of greenhouse gas emissions in its final communique. But the group promised only to “rapidly scale-up technologies and policies that further accelerate the transition away from unabated coal capacity”.

“It’s not a great a message to be sending,” said Ursula Tonkin, portfolio manager of the Whitehelm Capital Low Carbon Core Infrastructure Fund, the Australia-based company that has $4.4 billion of assets under management in all of its funds.

While it would be “fantastic” if politicians came to a deal, coal is likely to be phased out anyway by 2030, 2035, said Tonkin. “Politics are important, but you also have the economics of the transition really kicking in within that timeframe,” she said.

Made in Australia: why is the Pentagon investing in Australian rare earths?

By Matthew Hall 14 Jun 2021

Efforts by the US to reduce its reliance on China for rare earths have taken a new turn, with the Department of Defense now bankrolling a rare earths refinery in Texas, to be built by Australia’s Lynas Rare Earths. We look into this new example of state-level investment in rare earths projects, and what it could mean for the future of an ever-escalating resource conflict.

The Texas facility is expected to produce around 5,000 tonnes per annum once it is operational, and will be able to receive rare earth carbonate directly from Lynas’ proposed Kalgoorlie facility in Western Australia. Source: Josh Withers on

You can buy a lot of things for $30m. If you’re Netflix, you can splash that cash on a documentary about rapper and fashion designer Kanye West. If you’re West himself, $30m covers about 50% of the mansion you live in with Kim Kardashian, whom you are currently in the process of divorcing.

If you are not Kanye West, but are in fact the United States Department of Defense (DoD), you’ve opted to spend about $30m on a rare earths refinery as part of attempts to reduce Chinese dominance of the metals. Each to their own.

The deal between the DoD and Lynas has been a while in the making; recognising a need for domestic production of rare earth metals, the US Government signed a contract with Lynas to begin initial work on a heavy rare earths separation facility in July 2020.

That collaboration has continued with the DoD providing approximately $30m in funding for Lynas to construct a commercial separation facility for light rare earths – the more common type of rare earth elements. The collaboration between state and business is sponsored by the Defense Production Act, the presidential authority used to expedite and expand the supply of materials from US industry for purposes of national defence.

An escalating rare earths conflict

The Defense Production Act, an invention of the Korean War, was invoked in the 1950s to establish domestic aluminium and titanium industries in the US – materials needed to counter growing Russian influence on the world stage.

That the Act has been invoked again to spur a rare earths capability in the US shows the gravity of the issue. China provides more than 85% of the world’s rare earths, and the country has reportedly been exploring whether it can hurt western defence contractors by limiting supplies to the US or Europe.

Rare earth elements are used in everything from iPhones to F-35 fighter jets; more than hurting wallets, China restricting access to rare earths could pose significant national security threats.

From the perspective of the US, China’s dominance of rare earths means it holds too many cards if tensions or conflicts escalate – rare earth elements have applications in nuclear energy in addition to their applications in military equipment and weaponry.

Even the sole operating rare earths mine in the US, Mountain Pass in California, ships over 50,000 tonnes of concentrated rare earths to China each year due to outdated processing facilities at the site. MP Materials, which operates the mine, received Pentagon funding last year to establish domestic processing facilities for light rare earths.

Rare earths from down under

The Texas facility is expected to produce around 5,000 tonnes per annum once it is operational, and will be able to receive rare earth carbonate directly from Lynas’ proposed Kalgoorlie facility in Western Australia.

Lynas owns and operates the Mt Weld rare earths mine in Western Australia. One of the biggest rare earths deposits in the world, the Mt Weld concentrator is a flotation plant designed to process 240,000tpa of ore, producing up to 66,000tpa of concentrate, containing 26,500tpa of rare earth oxides.

Australia has its own quarrels with China – exacerbated by the Australian Government calling for an investigation into China’s initial handling of the Covid-19 outbreak in Wuhan – that have seen China imposing taxes of up to 212% on Australian wine and Chinese investment in Australia plummeting 61% in 2020. China has been Australia’s biggest trade partner, meaning tensions are between the two are hardly ideal.

So closer collaboration between nations looking to reduce reliance on China for rare earths makes sense – the US and Canada have already committed to establishing a North American supply chain for critical minerals to reduce reliance on overseas imports.

Lynas’ Texas light rare earths processing facility, along with the heavy rare earths facility if that contract goes ahead, will serve the defence industrial base as well as the growing commercial market – including electric vehicles and green technologies. With President Biden’s administration committing to decarbonisation targets and investing in green technologies at home, Lynas could potentially have a lot to gain from establishing itself in the American supply chain.

In a statement announcing the contract with the DoD, Lynas CEO and managing director Amanda Lacaze said: “Rare earth materials are critical inputs to many industrial supply chains, including electric vehicles, electronics, and several defence applications. While demand for rare earth materials continues to grow, Covid-19 has exposed the risks within global supply chains of the single sourcing of critical materials.”

A future for state-backed rare earths projects?

China’s muscling over various commodities, and its dominance over those as critical as rare earths, naturally has governments around the world concerned.

Japan is reportedly set to increase funding for rare earths exploration, and is considering lifting the 50% ceiling on government funding for resource exploration work by the end of this year. It would mean that state-backed companies like Japan Oil, Gas, and Metals National Corporation can stump up more than half of the money required for exploration work – a move that may spur foreign involvement and a Japanese rare earths capability of its own.

The DoD’s involvement in funding domestic projects, like the contract with Lynas and working with MP Materials to establish domestic processing at Mountain Pass, marks a change from the American preference of letting the invisible hand of the market resolve things. Reuters last year reported that a Pentagon review determined that funding domestic rare earths projects was in the best interest of the US Government.

The collaboration with Lynas could even open the door to more work between the US and the Australian rare earths industry. Australia is believed to host a not insignificant amount of rare earth deposits that are yet to be exploited. The Australian government has been mulling the use of public money to get these projects off the ground, and an ever hungrier American market could further accelerate Australia’s rare earths development.

I hope you enjoyed this weeks read, if you would like more information on our report and would like to find out how you too can invest in the Equity and Bond markets, please feel free to give me a call.

Regards

Chris Hagan,

Head, Fixed Interest and Superannuation

JMP Securities

Level 1, Harbourside West, Stanley Esplanade

Port Moresby, Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814