8 May, 2023

Welcome to this week’s JMP Report

On the PNGX last week we saw 2 stocks trade, BSP and CPL. BSP traded 43,443 shares, trading 10t higher to close the week out at K12.90 and CPL traded 2,500 shares down 15t to close at 80t.

WEEKLY MARKET REPORT | 1 May, 2023 – 5 May, 2023

| STOCK | QUANTITY | CLOSING PRICE | CHANGE | % CHANGE | 2021 FINAL DIV | 2021 INTERIM | YIELD % | EX-DATE | RECORD DATE | PAYMENT DATE | DRP | MARKET CAP |

| BSP | 43,443 | 12.90 | 0.10 | 0.78 | K1.4000 | – | 13.53 | THUR 9 MAR 2023 | FRI 10 MAR 2023 | FRI 21 APR 2023 | NO | 5,317,971,001 |

| KSL | 0 | 2.48 | – | 0.00 | K0.1610 | – | 9.93 | FRI 3 MAR 2023 | MON 6 MAR 2023 | TUE 11 APR 2023 | NO | 64,817,259 |

| STO | 0 | 19.10 | – | 0.00 | K0.5310 | – | 2.96 | MON 27 FEB 2023 | TUE 28 FEB 2023 | WED 29 MAR 2023 | YES | – |

| KAM | 0 | 0.95 | – | 0.00 | – | – | – | – | – | – | YES | 49,891,306 |

| NCM | 0 | 75.00 | – | 0.00 | USD$1.23 | – | – | FRI 24 FEB 2023 | MON 27 FEB 23 | THU 30 MAR 23 | YES | 33,774,150 |

| NGP | 0 | 0.69 | – | 0.00 | – | – | – | – | – | – | – | 32,123,490 |

| CCP | 0 | 2.00 | – | 0.00 | K0.225 | – | 6.19 | FRI 24 MAR 2023 | WED 29 MAR 2023 | FRI 5 MAY 2023 | YES | 569,672,964 |

| CPL | 2,500 | 0.80 | –0.15 | -18.75 | K0.05 | – |

4.20 |

WED 22 MAR 2023 | THUR 30 MAR 2023 | THU 30 JUL 2023 | – | 195,964,015 |

Dual Listed Stocks PNGX/ASX

BFL -2c

KSL – 74c -1c

NCM – 29.80 +88c

STO – 7.16 +9c

Our Order Book starts the week with JMP Securities as a nett buyer of Credit Corp, BSP and nett seller of KSL.

And other markets

Gold – 2015 +26

Palladium – 1497 -109

Bitcoin – 28842 -1.99%

Ethereum – 1914 +1%

PAXGold – 2022 +1.04%

On the interest rate front

An interesting result last week, the auction results were steady at 3.06% but the Bank issued the original offer of 131mill which left the market oversubscribed by 208mill. My report last week included the GIS results which were bid quite aggressively, I expect to see another auction to be held next month.

What we’ve been reading this week

FINANCIAL TIME BOMB: SOARING DEBTS AND DEVALUATION

Article care of Ainslie Bullion – Posted | 04/05/2023

Raoul Pal, one of our favourite prominent finance experts, recently tweeted about the over-leveraged economy, and GDP growth being insufficient to cover interest payments on government and private sector debt. Raoul argues that, consequently, interest payments are shifted to the Federal Reserve’s balance sheet and seemingly never need to be paid back.

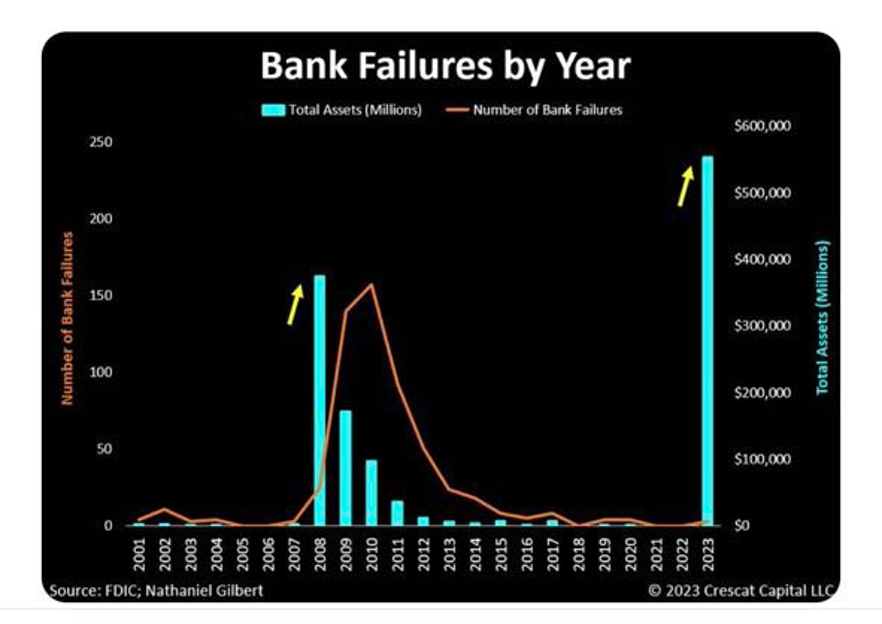

He notes that monetisation of interest payments is a trend seen in the United States, European Union, United Kingdom, Japan, and other regions. It contributes to the growth of central bank balance sheets. Occasionally, something “blows up” in the financial system, like the 2008 banking crisis, the 2012 EU crisis, the 2020 pandemic, and the current 2023 banking issues.

In normal circumstances, these events would lead to complete equity and debt wipe-outs. However, due to excessive financial interconnections and collateral chains, these losses are now socialised through QE. This process devalues fiat currencies (denominator), as the money printer conceals problems under the rug.

As governments cannot collect enough taxes to cover the debt burden, government debt interest payments are also shared among the population using the same mechanism. This results in debt compounding due to interest payments and non-payment of the actual principal debt.

The majority of the population (99%) bears the brunt of these debt payments and bailouts, while the top 1% of asset holders see their assets appreciate due to the falling denominator (fiat currency value). Incomes and revenues don’t keep up with this process, causing people who don’t invest to become poorer.

Only a few assets consistently outperform this debasement: gold and silver. These assets have the highest beta (sensitivity) to global central bank balance sheets. Traditional investments such as real estate, S&P 500, bond yields, emerging market equities, and credit either perform in line with or underperform compared to central bank balance sheets. Individuals can opt out of this insidious debt mutualisation by investing in gold and silver.

Sticking to old investment strategies or doing nothing makes you pay for the system’s losses. Since 2012, the G4 central bank balance sheet has grown at a rate of 10% per annum. If your chosen assets don’t earn at least 10% per annum over time, you are effectively becoming poorer every year.

The world’s financial system now, as we’ve argued, revolves around liquidity and the debasement of fiat currencies. To avoid paying for the system’s losses and becoming poorer, it’s essential to invest in assets like precious metals that consistently outperform this debasement. It’s important to remember that during the GFC, over 150 banks went out of business. In today’s context, just four bank failures account for nearly the same amount of assets that financial institutions held during the 2008-2009 crisis. If you’re wondering whether the Federal Reserve will permit a similar systemic issue to develop now, pay attention to gold prices, which are beginning to reflect the potential need for liquidity injections to maintain financial stability.

This morning, gold reached a new all-time high in AUD, with a spot rate of $3,095/oz at the time of writing. This surge coincides with growing concerns about a potential Fed default by the end of the month. Janet Yellen confirmed on Monday that, due to the current US debt ceiling, the government may be unable to service its debt as early as June 1st.

Raoul shared his perspective on this issue earlier today via Twitter, stating “Feels like the FDIC, the Treasury and the Fed are going to have a lot more work to do this weekend. I’ll be surprised if we don’t lose a few banks on the weekend and finally a larger policy response to try to stem the flow of failures.”

To provide a clear and concise overview of the current economic situation:

- Over-leveraged economy with insufficient GDP growth to cover interest payments on debt

- Growing central bank balance sheets due to monetisation of interest payments

- Devaluation of fiat currencies as losses are socialised through QE

- Majority of the population bearing the brunt of debt payments and bailouts

- Potential for more bank failures, exacerbating financial instability.

- Possibility of a Fed default due to the current US debt ceiling.

Do we have to repeat ourselves any further? Balance your wealth in an unbalanced world.

Schroders to Launch Fund Offering Investors Access to Energy Transition Infrastructure Opportunities

Mark Segal May 4, 2023

Global investment manager Schroders’ private markets investment division Schroders Capital announced today that it has received approval from the UK’s Financial Conduct Authority for the first-ever energy transition-focused Long-Term Asset Fund (LTAF), a new investment vehicle designed to give investors access to illiquid and private assets, such as renewable energy infrastructure.

The announcement follows the launch of the UK’s first LTAF by Schroders in March, targeting climate change and net zero-focused investments. The new LTAF will focus on renewable energy and energy transition aligned infrastructure investments, including wind and solar. According to Schroder, the fund will help unlock new capital flows for infrastructure projects, allowing investors, particularly Defined Contribution (DC) pension managers, to invest in renewable energy projects.

Tim Horne, Head of UK Institutional DC, Schroders, said:

“Broadening the opportunity set for savers needs to be a priority for the DC market, particularly in private assets which have the potential to help DC investors achieve their aims of a good outcome in retirement. Schroders continues to lead the market in DC innovation, having two of the three authorised LTAFs. The growth and investment into our LTAF platform is just one way we are helping to meet the needs of UK retirement savers.”

The new LTAF will be managed by renewable energy specialist Schroders Greencoat. Schroders acquired Greencoat last year, with a stated goal to become a global leader in the fast-growing renewable infrastructure sector.

Duncan Hale, Private Markets Group, Schroders Greencoat, said:

“For too long DC pension scheme members have had their noses pressed up against the glass, looking in at other types of investors enjoying the benefits that come from investing in illiquid assets. We are excited about the ability to offer access to renewable energy and energy transition related infrastructure assets to DC members widely, not only due to the attractive risk and return metrics they provide but also their ability to reflect members’ sustainability requirements.”

Poland and Japan deepen hydrogen cooperation

By Dominic Ellison May 05, 2023

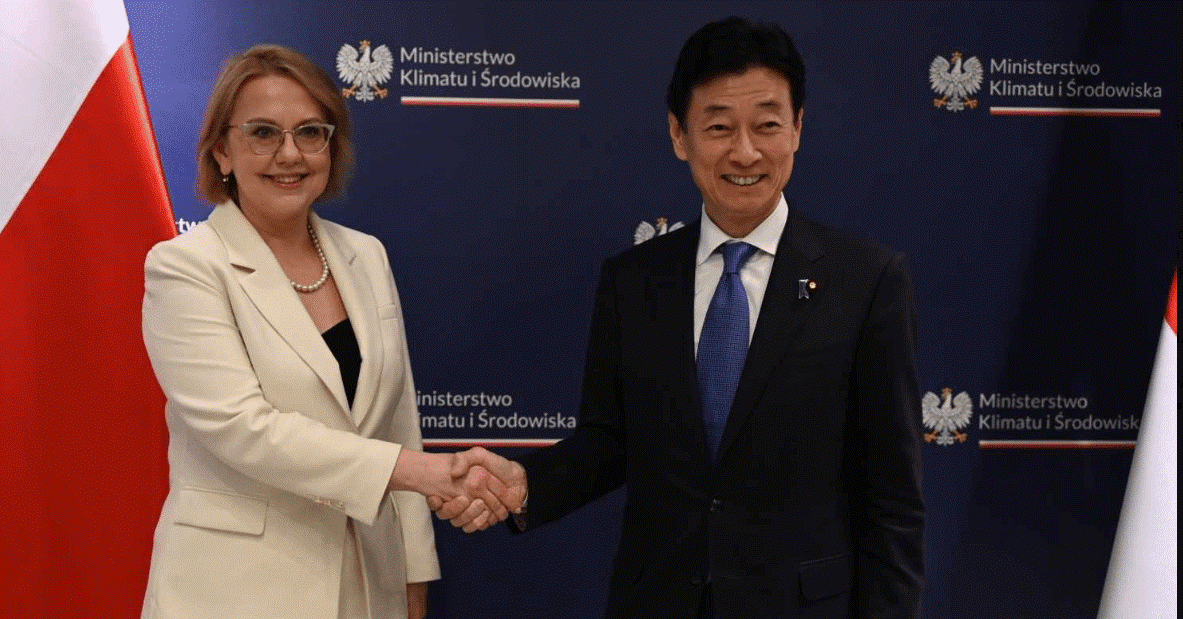

Poland and Japan have signed an MoU which will deepen hydrogen cooperation between the two countries.

In a tweet, Anna Moskwa, Minster of Climate and Environment, wrote, “Today, together with the Minister of Economy, Trade and Industry of Japan, Yasutoshi Nishimura, I signed a Memorandum of Understanding on cooperation between our countries in this field. This agreement will translate into increased interest in business in hydrogen investments in Poland hydrogen investments.

“Today we also outlined new areas of cooperation. In addition to hydrogen, it is CCS carbon capture and storage technology. This is another step towards energy sovereignty.”

Japan has been building closer links with Europe, signing a Memorandum of Cooperation on Hydrogen with the EU last December.

The Asian powerhouse plans to establish a full-scale international hydrogen supply chain to cut the cost of hydrogen by 2030 and to encourage the use of ammonia in thermal

power generation as a low-carbon transition fuel.

Recently it announced ambitions to increase its annual hydrogen supply to 12 million tonnes in 2040 from its current two million tonnes.

Under plans to revise its Basic Hydrogen Strategy in late May this year (2023), the Japanese Government also hopes that JPY 15 trillion ($112.86bn) of public and private investment will follow over the next 15 years to advance the use of hydrogen and renewable energy sources.

Prime Minister Fumio Kishida, said, “We will step up efforts for decarbonisation at home while responding to fierce international competition in the fields of renewable energy and hydrogen.”

Japan’s roadmap to tackle climate change comprises three milestones. Firstly, Japan is committed under the United Nations Climate Change Convention to reduce greenhouse gas (GHG) emissions by 26% from 2013 levels by 2030.

The second is to promote the development of innovative technologies by 2050 that enable Japan to contribute to the reduction in accumulated atmospheric CO2 globally to ‘Beyond Zero’.

The third and most ambitious milestone, unveiled by Prime Minister Suga Yoshihide on October 26, 2020, calls for Japan to achieve net zero GHG emissions by 2050, setting Japan on course to become carbon neutral in 30 years.

Poland is currently in third place among European hydrogen producers, behind Germany and the Netherlands, with an annual production of approx. 1.3 million tonnes, but only a marginal share of hydrogen comes from renewable sources.

The development of its hydrogen economy requires the creation of the entire value chain, in particular the construction of new RES power generation capacity, installations for the production of hydrogen and its derivatives from low-carbon sources, processes and technologies for the needs of the energy sector, heating, transport and other sectors of the economy.

Three public hydrogen refuelling stations are planned to be constructed in the Polish cities of Wałbrzych, Poznań and Katowice by PKN ORLEN.

H2 View reported last November that the Poznań and Katowice stations are due to be launched in the second half of 2023, while the development in Wałbrzych is expected to be in service by early 2025.

I hope you have enjoyed this week’s read. Please reach out to us if you wish to open a trading account or are an existing investor and would like to be more active with your investment portfolio.

Regards,

Head, Fixed Interest and Superannuation

JMP Securities

Level 1, Harbourside West, Stanley Esplanade

Port Moresby, Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814