23 May, 2023

Welcome to this week’s JMP Report

Last week’s activity on the PNGX saw 4 stocks trade. BSP traded 8,201 shares, closing 10t lower at K12.80, KSL traded 198,070 closing 9t higher at K2.29, STO traded 1,706 shares, closing steady at K19.10 and CCP traded 138,222 shares also steady, closing at K2.00.

Refer details below;

WEEKLY MARKET REPORT | 14 May, 2023 – 18 May, 2023

| STOCK | QUANTITY | CLOSING PRICE | CHANGE | % CHANGE | 2021 FINAL DIV | 2021 INTERIM | YIELD % | EX-DATE | RECORD DATE | PAYMENT DATE | DRP | MARKET CAP |

| BSP | 8,201 | 12.80 | –0.10 | -0.78 | K1.4000 | – | 13.53 | THUR 9 MAR 2023 | FRI 10 MAR 2023 | FRI 21 APR 2023 | NO | 5,317,971,001 |

| KSL | 198,070 | 2.20 | 0.09 | 4.09 | K0.1610 | – | 9.93 | FRI 3 MAR 2023 | MON 6 MAR 2023 | TUE 11 APR 2023 | NO | 64,817,259 |

| STO | 1,706 | 19.10 | – | 0.00 | K0.5310 | – | 2.96 | MON 27 FEB 2023 | TUE 28 FEB 2023 | WED 29 MAR 2023 | YES | – |

| KAM | 0 | 0.95 | – | 0.00 | – | – | – | – | – | – | YES | 49,891,306 |

| NCM | 0 | 75.00 | – | 0.00 | USD$1.23 | – | – | FRI 24 FEB 2023 | MON 27 FEB 23 | THU 30 MAR 23 | YES | 33,774,150 |

| NGP | 0 | 0.69 | – | 0.00 | – | – | – | – | – | – | – | 32,123,490 |

| CCP | 138,222 | 2.00 | – | 0.00 | K0.225 | – | 6.19 | FRI 24 MAR 2023 | WED 29 MAR 2023 | FRI 5 MAY 2023 | YES | 569,672,964 |

| CPL | 0 | 0.80 | – | 0.00 | K0.05 | – |

4.20 |

WED 22 MAR 2023 | THUR 30 MAR 2023 | THU 30 JUL 2023 | – | 195,964,015 |

Dual Listed Stock – PNGX/ASX

BFL – 4.90 +10t

KSL – 77c +1c

NCM – 26.95 -$1.30

STO – 7.38 +12c

Our book has us nett buyers of BSP, STO and nett sellers of CCP and KSL.

In the interest rate market, the TBill auction this week was again limited to the 364 day paper with 200mill on offer and the Bank received K617mill in bids. The average was 3.05% and the market was left oversubscribed by 417mill.

In the Gentleman’s Market, the GIS auction was held during the week and I have attached the results for your information. So a quick analysis of the yield curve, Central Bank Bills 91days at 2.83% (banks only), 364 day TBill at 3.05%, 2yr at 4.32%, 6yr at 5.42, and 10yr at 6.05. So, we have 2% between 1yr and 10yr. We have seen some weakening in the longs and this is understandable, 10yr debt at 2% over 1yr?

Download - GIS Auction Results

Commodity and Coin Markets

Gold – 1973 – {June 21, 2022 1841.80}

Oil – WTC 72.12 {June 21, 2022 104.30}

Silver 23.79 {June 21, 2022 21.40}

Bitcoin – 26,907 -1.64%

Ethereum 1,821 -.25%

PAXGold – 1,984 -1.71%

What we’ve been reading this week

Econosights – the rise of artificial intelligence… threat to jobs or productivity boost?

Diana Mousina, Deputy Chief Economist, AMP

Key points

– The release of ChatGPT shows that use of artificial intelligence in the way humans live and work is here to stay.

– Technology has replaced some routine manual and cognitive jobs. Now, AI threatens non-routine cognitive jobs because of its ability to replicate skilled human behaviour.

– Productivity growth has slumped across the major economies in recent years and history shows that technological improvements have long-term benefits on per capita GDP growth which lifts living standards. AI could be the productivity boost we all needed.

– However, it will take some time for widespread AI usage as it is still expensive to maintain and faces many regulatory issues before it is fully integrated into everyday life.

Introduction

The release of ChatGPT in late 2022 is renewing concerns around machines taking over human jobs. We look at the potential impact of Artificial Intelligence (AI) on the global economy in this Econosights.

Humanity is always advancing

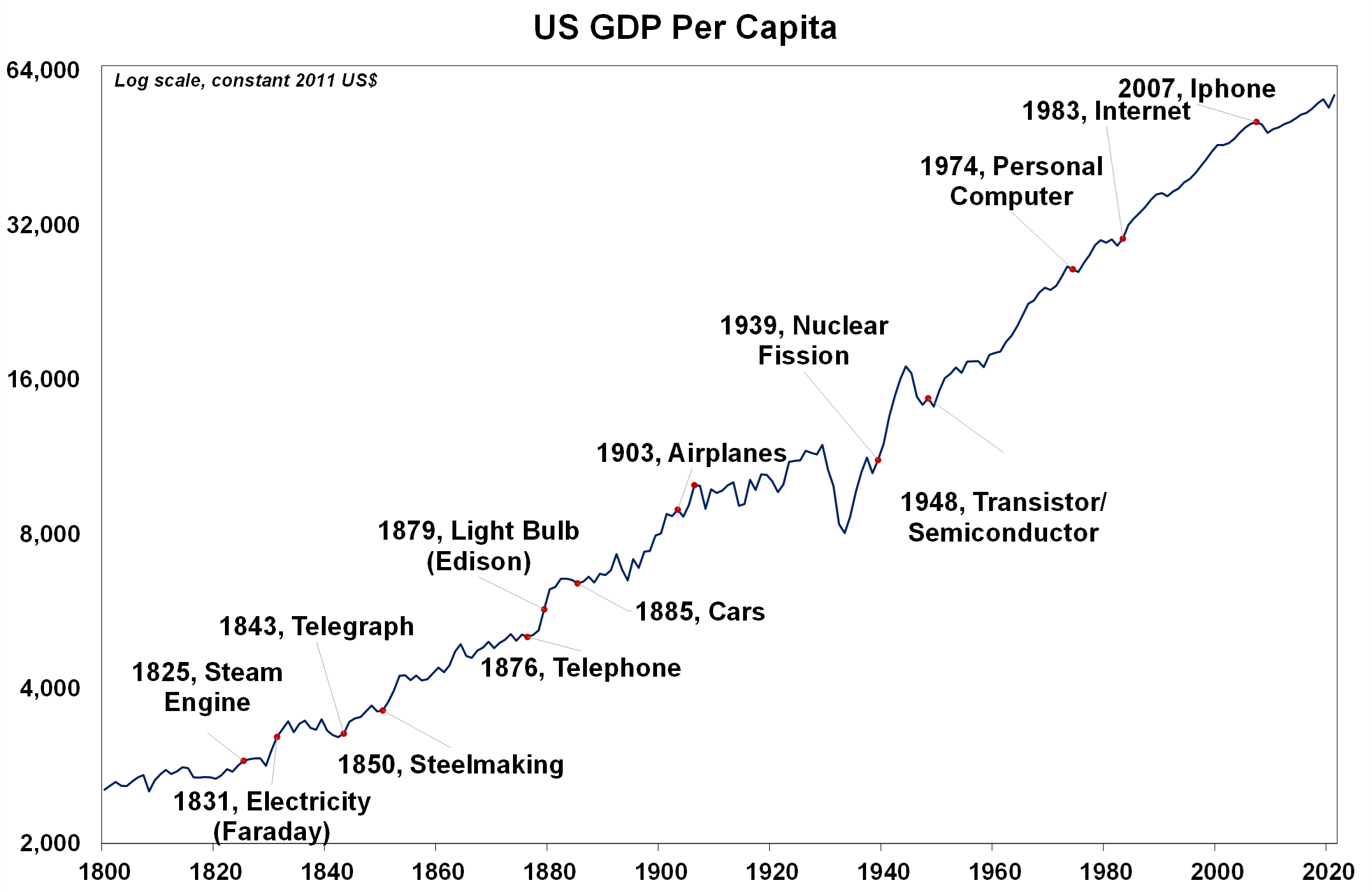

ChatGPT is a program developed by OpenAI which uses a large language model (LLM) in its programming. Ultimately, it is a super advanced chat bot. LLM is not new and other tech companies like Alphabet, Amazon and Nvidia have their own versions. However, ChatGPT is superior to many of its rivals and many are calling it a gamechanger. ChatGPT has the ability to process a large amount of data, create new content, replicate human behaviour closely and be applied broadly (it has uses beyond text conversations). Whether or not ChatGPT itself becomes as widely used as expected, artificial intelligence usage is here to stay and will have impacts on how humans live. But, technological advancements are nothing new. Humans have been through many transformative periods through history (see the chart below).

Source: Maddison Project Database 2020, World Bank, AMP

Although each event would have seemed like a big adjustment at the time, the ultimate result has been a rise in per capita GDP growth through time (albeit with bumps along the way!) which has lifted living standards.

Technology and the labour market

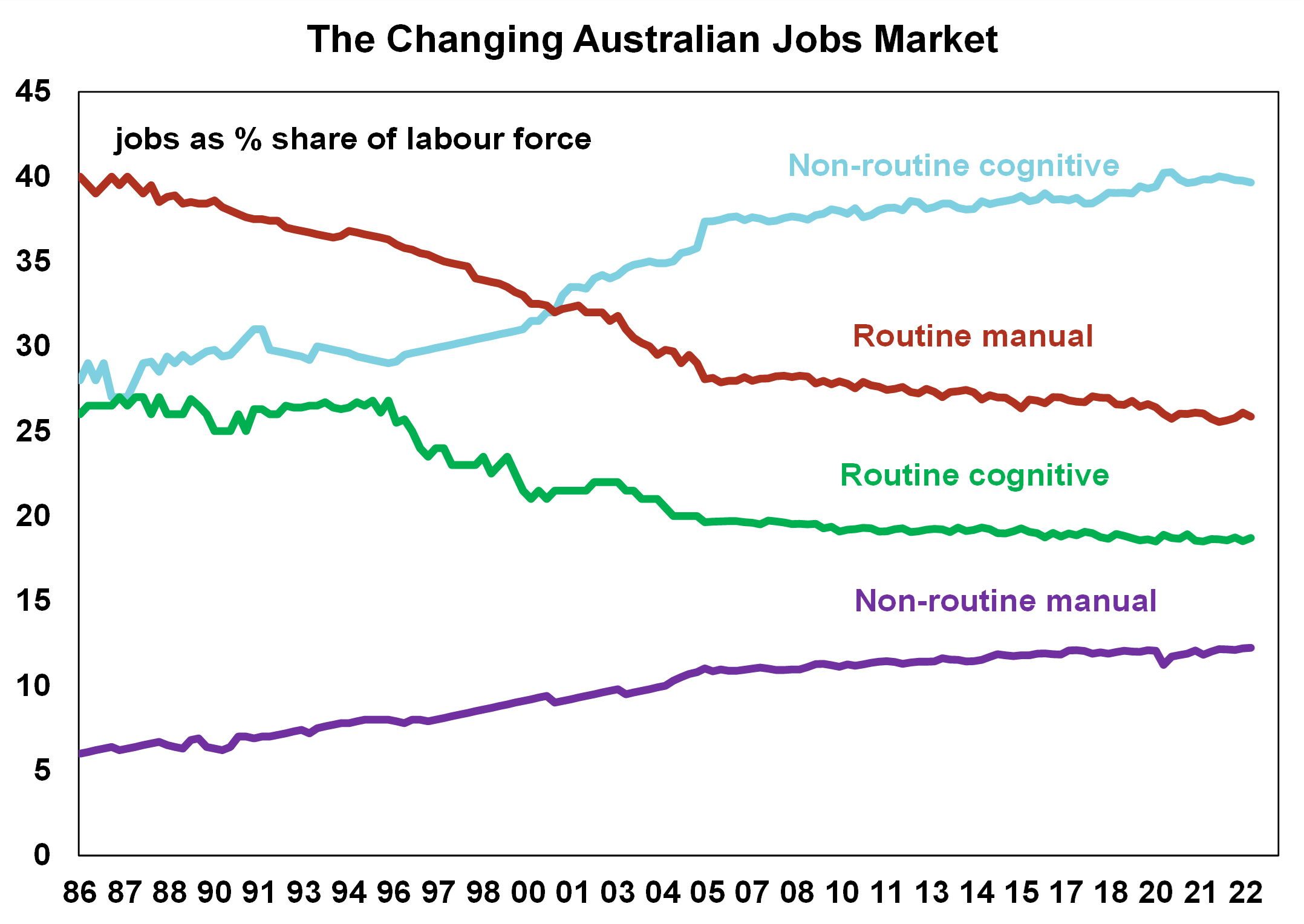

The threat of technology taking jobs traditionally done by humans has been around for many years. Initially, technology and automation was used to replace some routine manual jobs, for example, in the production process which saw a big fall in jobs employed in the traditional sectors of agriculture and manufacturing (in 1900 14% of Australian jobs were in manufacturing and 25% in agriculture versus 6% and 2% most recently). But more recently, tech enhancements through areas like machine learning have started to replace some routine cognitive jobs including, for example in customer service and office occupations. The chart below looks at the Australian labour market and shows that routine manual jobs have fallen as a share of the workforce over time, from 40% in the late 1980’s to 26% recently while routine cognitive jobs have declined from 26% to 19% over this time. Over the same period, non-routine cognitive jobs have risen from 29% to 40% of the workforce which tend to be the higher-skilled jobs that are harder to replace by machines like management and professional skills that require human judgement and expertise. However, the risk from AI is that it threatens this particular group of jobs because of AI’s ability to mimic human behaviour. The jobs least at risk from AI and other technological changes are the non-routine manual jobs which tend to be service-based roles that deal with assisting people and these have grown from 6% of the workforce in the late 1980’s to 12% of the workforce and will continue to be important due to the aging population in the advanced world.

Source: ABS, RBA, AMP

OpenAI estimates that around 80% of the US workforce could have at least 10% of their work tasks impacted by the introduction of tools like ChatGPT and 19% of the workforce will have 50% of their tasks impacted. This is significant. But as history has shown, new jobs be created will be created in this process, especially in areas like compliance, cybersecurity, legal and engineering. And this is occurring at a time when workforce growth is slowing in many countries as the ratio of consumers relative to workers increases (because of the aging of populations). So AI might help with labour shortages. There is also an important role for government to play in the technology transition to ensure that the right education and training are available for their populations.

Will AI boost productivity growth?

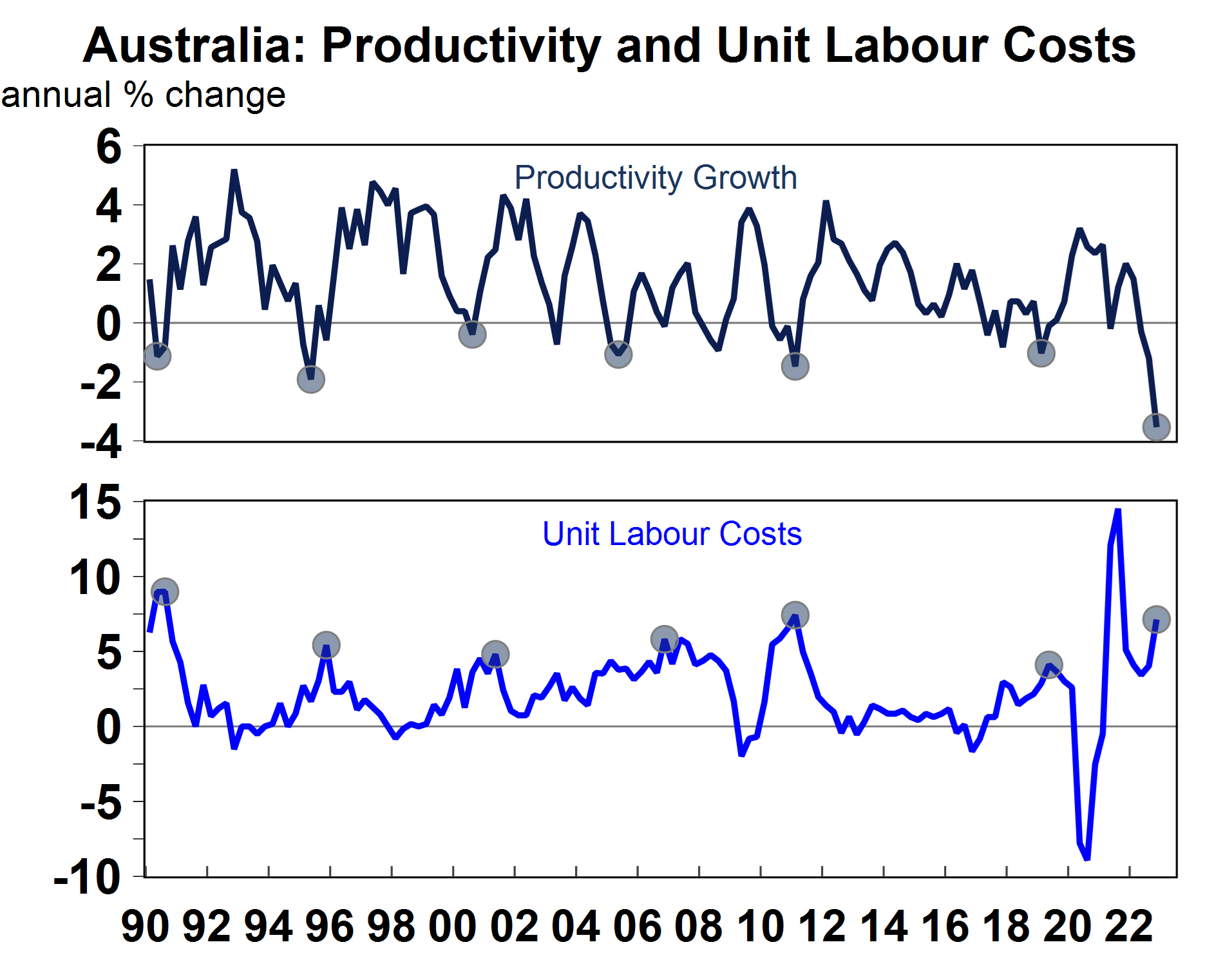

Productivity growth has been poor in major economies over recent years. In Australia, productivity is down by 3.5% over the year to March and -0.9% in the US. There are multiple reasons for this. As economies have moved towards being predominately services-based, productivity gains are arguably harder to achieve compared to industries like manufacturing and agriculture, there appear to be measurement issues of productivity in services industries and Covid-19 disruptions have resulted in a large bounce back in services jobs which have low productivity which is impacting the data. The Reserve Bank of Australia mentioned the need to lift productivity growth as a requirement to lower unit wages growth in Australia. Declines in productivity growth result in a rise in unit labour costs (the chart below shows that at points when productivity growth declines, unit labour costs tend to rise and vice versa) which is inflationary and negative for living standards in the long-run.

Source: Macrobond, AMP

AI could prove to be needed boost to the services industry. Some analysts have tried to measure the potential impact of AI on the economy (Goldman Sachs see a 7% increase in annual GDP growth over a 10-year period and some academics see a 3ppt rise in annual productivity growth) but in reality, it is very difficult and imprecise to predict. And some would say that we have been hearing about the IT revolution driving higher productivity and growth for 20 years now and despite lots of innovations along the way we are still waiting to see the massive productivity boom.

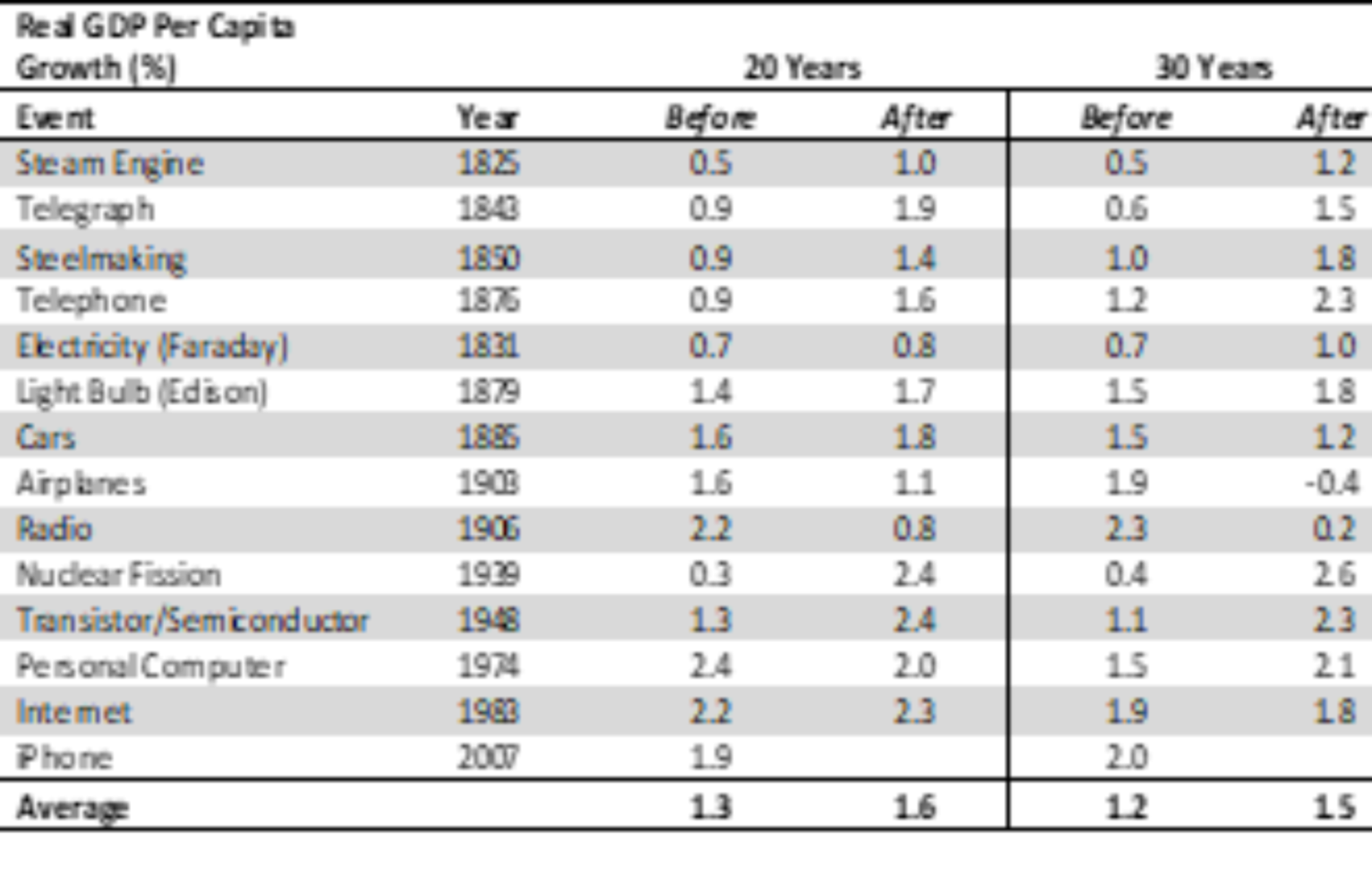

We have looked at major historical technological events and the impact to US GDP growth 20 and 30 years after the event (to allow time for adoption and wide-spread use) – see the table below.

Source: Maddison Project Database 2020, World Bank, AMP

It shows that GDP growth per capita tended to be 0.3 percentage points higher in the 20 and 30 years after each major technological break-through.

So there does appear to be some long-term benefit to technological progress on GDP and living standards.

Implications for investors

From an investment point of view, the implications for sectors from the impacts of AI are not very clear right now. There is risk that the current big tech firms like Alphabet, Meta, Amazon and Microsoft could suffer long-term and loose relevance, if they do not innovate and are replaced by new AI firms. However, they could end up being a part of the transition and benefit as a result. It is also difficult to put a timeframe on how soon AI could be integrated completely into everyday life with most estimates suggesting that it is at least another 5-10 years away.

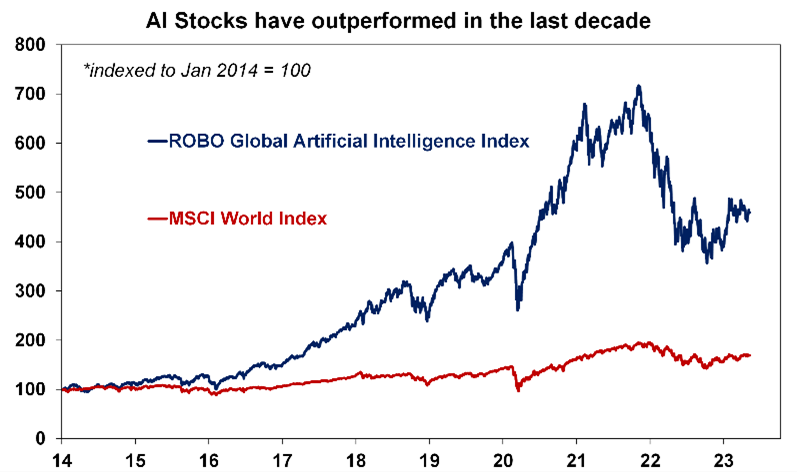

Out of interest, AI stocks have outperformed the MSCI world index significantly over recent years (see the chart below) and more AI-based private companies are likely to become public in coming years.

Source: Bloomberg, AMP

In terms of the impact to other asset classes, large-scale computing power will be necessary to power the programs behind AI which could benefit commodities over the long-term.

There are also significant geopolitical concerns from the adoption of AI. As we move into a multi-polar world and the US and China compete for global tech dominance, AI will feature strongly as an area to control and watch because of its potential usage in warfare. So geopolitical tensions will be an ongoing point of tension in global markets.

It is also important to be mindful of the many risks associated with AI and the numerous steps that are needed to occur before it is widely used in our everyday lives. Currently, AI technology is expensive to maintain, it might not give accurate results, privacy issues will have to be tightened and it has climate issues associated with it because of the large computing power necessary. So, it needs many improvements before it is accessible for widespread use. Recently, major players in the tech space in the “Future of Life Institute” published a letter signed by more than 1,000 experts in the field for a six-month pause in AI research given that the “out-of-control” race could have large negative consequences for humanity. Some countries like Italy have also temporarily blocked ChatGPT usage. So, it will be a while before it is deemed safe to use on a broad scale. This is not our “Terminator moment”…yet.

ExxonMobil on Linkedin

Almost two-thirds of the world’s population live in the Asia Pacific region. Standards of living are also rising, further increasing the demand for energy and modern products.

There is a pressing need for countries in this region to accelerate its decarbonization efficiently in order to meet the targets outlined in the Paris Agreement.

ExxonMobil’s Global LNG Marketing Vice President Andrew Barry sees lower carbon and affordable energy sources like natural gas, as an important solution for reducing CO2 emissions while still meeting power demand.

Natural gas has been touted as one of the key energy sources in accelerating this future.

Not only is this lower-emissions energy source bringing power to people across Asia Pacific, it is also helping to support the integration of variable renewable power sources, like wind and solar, while paving the way for alternative fuels like hydrogen, which can be created from natural gas and can use gas-related infrastructure.

A bridge to the future

Almost two-thirds of the world’s people live in Asia Pacific. That growing population is rapidly industrializing, and the standards of living are rising.

As this developing middle class expands, they’ll need more energy to power their lives. The region already accounts for more than half of global energy demand and 52% of global CO2 emissions, with 85% of that power coming from traditional fuels.

As such, the region needs to accelerate its decarbonization rapidly in order to meet the targets outlined in the Paris agreement. This requires an energy transition towards lower-carbon, affordable sources to reduce CO2 emissions while still meeting power demand in the region.

According to Andrew Barry, ExxonMobil Global LNG Marketing vice president, natural gas will be critical to this energy transition.

Barry sees natural gas as a bridging fuel, filling in during the downtimes renewables face when the sun isn’t shining and the wind isn’t blowing, making reliable, lower-emission energy more accessible and affordable.

“What’s been really encouraging over the past several years is the significant cost reduction that we’re seeing in renewables,” he said. “And when you combine renewable power generation with a source like natural gas, which is flexible, abundant and has a high energy intensity, you get power that has a lower emissions profile and lower cost.”

ExxonMobil’s Global LNG Marketing vice president Andrew Barry said the ability of natural gas to provide low-carbon back up energy may prove to be its greatest contribution to the energy transition

This was supported by research from Malaysia’s Universiti Tenaga Nasional, which found natural gas is key in helping Asia Pacific move towards using more renewables.

“Natural gas makes the best fit for a sustainable renewable energy transition in any country around the globe, due to its competitiveness towards other fossil fuels such as coal and its ability to aid the integration of renewables,” the study said.

A recent United Nations Economic Commission for Europe (UNECE) report also outlined the role of natural gas in supporting the uptake of renewable energy.

It added that the ability of natural gas to provide low-carbon backup energy during heavy demand “may prove to be its greatest contribution to the energy transition”.

Barry went on to explain that this is why ExxonMobil is investing in natural gas projects around the world – to support the expansion of affordable lower-emissions energy.

“We’re making big steps forward in Mozambique. This year we expect to be bringing on the first floating LNG facility in Mozambique,” Barry said.

“That’s going to be a significant game changer and a key enabler for growth in the country, and then we’re progressing the onshore LNG facilities.

“Also, in Papua New Guinea – in addition to the PNG LNG facilities, which are another key asset for us, we’re very excited about some recent expansion opportunities.”

He explained that these developments are part of a strategy to double ExxonMobil’s current energy position and its supply source from where it is today by 2030.

Helping hydrogen

Natural gas not only supports intermittent power generation sources like wind and solar, it also paves the way forward for the broader development of hydrogen.

Hydrogen and hydrogen-based fuels could meet 10% of global energy needs and reduce 6% of total cumulative emissions under the IEA’s Net Zero by 2050 scenario, according to the IEA.

About 75% of the world’s hydrogen is currently produced with natural gas, and using “blue” hydrogen, pairing the use of natural gas and carbon capture and storage technology to further reduce emissions, could be one of the most cost-effective ways for low-carbon hydrogen technology to develop between now and 2030.

“Green” hydrogen, another low-carbon hydrogen that is produced by using renewable generated electricity to separate hydrogen from water, is also likely to play an important role.

“Hydrogen is going to be an important and critical energy source as we move further into this energy transition,” Barry said.

“The real key to the energy transition is developing reliable energy with the lowest cost and lowest emissions, which could be achieved through production of hydrogen” he said. “Gas can play a key role in that by combining gas production with carbon capture and storage, to then produce ‘blue’ hydrogen, which could be the lowest-cost hydrogen source.”

Barry added that hydrogen can also leverage traditional natural gas infrastructure.

“We think that hydrogen has similar characteristics to natural gas, being able to be used in power generation, in pipelines and in transport,” Barry said.

A European Union study into hydrogen found utilizing existing gas pipelines and infrastructure reduced the need for new investment in hydrogen, helping to support its uptake.

As society moves towards a lower-emission energy future, natural gas will play an increasingly important role in helping to provide affordable, reliable, lower-emission energy to people around the world.

Amazon Deforestation Drops 64% in Brazil in April

By: Paige Bennett

Aerial view of an illegal mining camp during an operation by the Brazilian Institute of Environment and Renewable Natural Resources against Amazon deforestation at the Yanomami territory in Roraima State, Brazil, on Feb. 24, 2023. ALAN CHAVES / AFP via Getty Images

Preliminary data shows that deforestation in the Amazon rainforest within Brazil has seen a 64% decline compared to deforestation in April 2022. The findings represent a major shift under Brazil’s newly elected President Luiz Inácio “Lula” da Silva, who campaigned on promises to end deforestation in the country.

The data could signal hopes of reversing an alarming report from earlier this year, when the rainforest experienced record-high deforestation in February. In January 2023, Lula’s first month of presidency, Amazon deforestation declined 61% year over year, as reported by Reuters.

Now, despite a lack of staffing and funding brought about by former far-right President Jair Bolsonaro, Brazil is seeing less deforestation for April and for the year as a whole so far. April’s data, from INPE (National Institute for Space Research), shows deforestation down about 64% to 321 square kilometers compared to an average of 898 square kilometres. For the year, deforestation has declined 38%, World Wildlife Fund (WWF)-Brasil reported.

While the numbers are hopeful, experts are concerned about upcoming data for the summer months, when deforestation traditionally peaks.

“We received the April numbers as a positive sign, but unfortunately we still cannot speak of a downward trend in deforestation in the Amazon. The numbers are at a very high level and the dry season, which is favourable to deforestation, has not yet started,” Mariana Napolitano, conservation manager at WWF-Brasil, said in a statement. “Other initiatives such as incentives for the green economy, the creation of protected areas and the demarcation of Indigenous lands, such as those that took place recently, are necessary.”

Lula plans to end deforestation by the end of the decade and recently received more than $100 million from Britain for Amazon rainforest conservation efforts, Reuters reported. Earlier this month, Lula also established six Indigenous reserves, where mining is prohibited and logging and commercial agricultural practices are restricted. These reserves contain around 620,000 hectares (1.5 million acres) of Amazon rainforest for protection. Continued conservation efforts and enforcements could help continue a downward trend. According to WWF-Brasil, deforestation began climbing rapidly in 2012 and nearly tripled over 10 years. Deforestation surpassed 10,000 square kilometres from 2019 to 2021, when Bolsonaro was president.

Lula was previously president from 2004 to 2011. During this time, Brazil’s Amazon deforestation declined nearly 75%. The president has pledged to bring deforestation to zero by 2030; currently, Brazil’s annual Amazon deforestation rate remains high at around 11,594 square kilometres.

I hope you have enjoyed this week’s read. Please contact me if you would like to explore opening a Trading Account or you would like a review of your investment portfolio. Have a great week

Regards,

Head, Fixed Interest and Superannuation

JMP Securities

Level 1, Harbourside West, Stanley Esplanade

Port Moresby, Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814