12 June, 2023

Welcome to this week’s JMP Report

Last week saw 4 stocks trade on PNGX. BSP traded 54,236 shares, down 5t to close at K12.80, KSL traded 685,432 shares, up 20t to close at K2.40, CCP traded 5,589 shares, closing steadily at K1.99 and CPL traded 5,842 shares, also closing steady at K0.80.

Please see further detail below,

WEEKLY MARKET REPORT | 8 June, 2023 – 12 June, 2023

| STOCK | QUANTITY | CLOSING PRICE | CHANGE | % CHANGE | 2021 FINAL DIV | 2021 INTERIM | YIELD % | EX-DATE | RECORD DATE | PAYMENT DATE | DRP | MARKET CAP |

| BSP | 54,236 | 12.80 | -0.05 | -0.39 | K1.4000 | – | 13.53 | THUR 9 MAR 2023 | FRI 10 MAR 2023 | FRI 21 APR 2023 | NO | 5,317,971,001 |

| KSL | 685,432 | 2.40 | 0.20 | 8.33 | K0.1610 | – | 9.93 | FRI 3 MAR 2023 | MON 6 MAR 2023 | TUE 11 APR 2023 | NO | 64,817,259 |

| STO | 0 | 19.10 | – | 0.00 | K0.5310 | – | 2.96 | MON 27 FEB 2023 | TUE 28 FEB 2023 | WED 29 MAR 2023 | YES | – |

| KAM | 0 | 0.95 | – | 0.00 | – | – | – | – | – | – | YES | 49,891,306 |

| NCM | 0 | 75.00 | – | 0.00 | USD$1.23 | – | – | FRI 24 FEB 2023 | MON 27 FEB 23 | THU 30 MAR 23 | YES | 33,774,150 |

| NGP | 0 | 0.69 | – | 0.00 | – | – | – | – | – | – | – | 32,123,490 |

| CCP | 5,589 | 1.99 | – | 0.00 | K0.225 | – | 6.19 | FRI 24 MAR 2023 | WED 29 MAR 2023 | FRI 5 MAY 2023 | YES | 569,672,964 |

| CPL | 5,842 | 0.80 | – | 0.00 | K0.05 | – |

4.20 |

WED 22 MAR 2023 | THUR 30 MAR 2023 | THU 30 JUL 2023 | – | 195,964,015 |

Dual Listed PNGX/ASX

BFL – 4.89 – flat

KSL – 76c +2c

NCM – 26.41-1.09

STO – 7.39 -5c

Our Order Book starts the week as nett buyers of BSP, KSL, STO and nett sellers of CCP and CPL – please email me for details

Interest Rates

In the short end, Central Bank Bills averaged 2.81% for 91days. The Bank offered 656mill leaving the market 162mill oversubscribed. In the TBill market, we saw 364 day rates remain steady at 2.99% with the Bank issuing 200mill, leaving the market 154mill oversubscribed. Finance Company money remains steady around 2.25% for 1yr.

There have been no further announcements regarding the next GIS auction. We do expect an announcement within the next two weeks.

Other Assets

Gold – 1,977

Gas – 2.25

Silver – 24.41

Bitcoin – 26,134 +.58 (7days)

Ethereum – 1,771 +10.01 (7 days)

PAX Gold – 1,915 –1.43 (7days)

What we’ve been reading this week

Super funds looking elsewhere as they outgrow shrinking ASX

Hannah Wootton and Alex Gluyas – Updated Jun 7, 2023

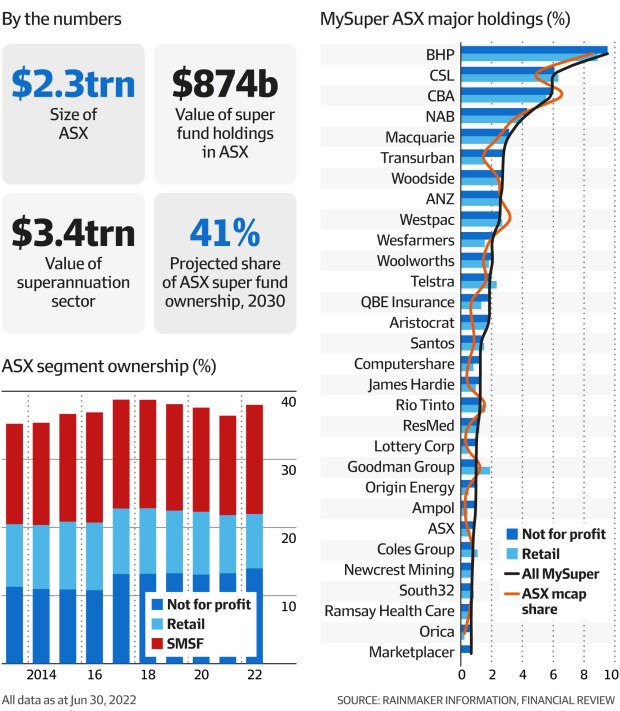

Super funds are being forced to buy fewer Australian shares as their asset pools grow faster than the shrinking ASX can accommodate, chief investment officers say, with their $3.5 trillion in retirement savings instead going overseas or into unlisted assets.

The value of Australia’s share market is on track to contract this year for the first time since 2005, to the tune of $43 billion, because of an uptick in takeovers and a two-year drought of new floats.

Colonial First State’s Jonathan Armitage reckons there’s more opportunity in global equities. Dominic Lorrimer

Super funds own 38 per cent, or $874 billion, of the bourse, up from 35 per cent a decade ago, according to data from financial services research house Rainmaker.

But this is only expected to grow to 41 per cent by 2030 despite the size of the sector increasing, falling short of dramatic earlier predictions that it would own more than 60 per cent by 2040.

AMP chief investment officer Anna Shelley said funds had to reduce their “home bias” of portfolios to meet their fiduciary obligations as they continued to grow.

“For example, it would be imprudent to own too much of a single stock or bond because the market impact of buying or selling would be too great,” she said.

The size of the funds has also made changing portfolio allocations or rebalancing assets to meet target weightings harder, she said, as they needed to use derivatives or spread trades out to limit their impact on the market.

Sonya Sawtell-Rickson favours inflation-linked bonds.

Funds are instead ramping up their investments in global equities and unlisted assets – with unlisted property a particular favourite of industry funds despite regulatory warnings about inflated valuations – to make up for their relative slowdown in exposure to the ASX.

Colonial First State CIO Jonathan Armitage said that while Australia had some companies that competed on the global stage such as BHP, CSL and Macquarie, the opportunities in overseas markets was generally much larger.

“There is a limitation in how large some Australian corporates who have a domestic-only focus can grow,” he said.

“There will [also] be a limit to how much some [super funds] can be invested in Australian shares once you get to a certain size.”

HESTA CIO Sonya Sawtell-Rickson added that offshore investments offered access to “certain thematics” such as climate change solutions that served the best long-term financial interest of members.

“We continue to like assets that provide inflation protection, including inflation-linked bonds and infrastructure, and we also like specific strategies that have market tailwinds such as in affordable housing and healthcare property here in Australia,” she said.

Ms Shelley said the ASX was also concentrated in “old economy” sectors and lacked the “meaningfully sized ‘new economy’ companies that had driven global growth over the past few decades.

Australia did not have as many large listed technology companies during the industry’s boom, for example, and sector darling Canva is still privately owned.

This trend looks set to continue, with assets in the energy transition, especially in battery metals, also disappearing from the ASX.

BHP’s takeover of OZ Minerals means there is no longer a high-quality, pure-play copper miner on the bourse, and the recent acquisition of lithium producer Allkem and the ongoing fight to own Liontown Resources will further shrink the ASX’s transition exposure.

Pull not push

But the CIOs said the rapid growth of super funds did not mean there was little value for them in the ASX any more, just that their size had opened up opportunities for investing offshore and in unlisted assets.

The ASX is valued about $2.3 trillion, while the superannuation sector is worth $3.4 trillion.

“While our exposure to the ASX as a percentage of assets has fallen slightly in recent years, this reflects our significant growth and the capacity that extra scale has provided to access new investment opportunities,” Aware Super CIO Damian Graham said, pointing to unlisted assets and global listed assets as new homes for the fund’s money.

The shift to unlisted assets comes as property valuers warn that prime CBD office towers could drop in value by as much as 20 per cent in coming months and after Rest Super pulled a Melbourne office building from sale after receiving bids 15 per cent below book value.

Brett Chatfield, the acting CIO of Cbus, which has the highest allocation to property of any super fund at 14 per cent of assets under management, said the fund “certainly has a decent runway ahead of [it] before scale would start to constrain our ability to invest in the ASX”.

He said the “relative concentration” of the local market posed diversification challenges, and he saw “a slight advantage to investing across the broader range of countries, economies, industries and stocks across the developed and emerging markets outside Australia”.

ADB Records $11.4 Billion in Cofinancing, Focused on Resilience Against Economic Shocks

News Release | 05 June 2023

MANILA, PHILIPPINES (5 June 2023) — The financing partners of the Asian Development Bank (ADB) committed $11.4 billion in cofinancing of ADB projects in 2022 to help build the resilience of developing member countries and enable them to withstand economic shocks, according to the Partnership Report 2022: Driving Growth, Boosting Resilience published today.

“Resilience is one of the four pillars of ADB’s Strategy 2030 and is integrated into all aspects of our development work,” said ADB Managing Director General Woochong Um. “Our region needs resilient infrastructure, cities, and communities. We want the environment and natural resources to be resilient. We want all economies in the region to be resilient. Our partnerships enable significant progress in promoting resilience.”

ADB and its partners helped countries and communities strengthen resilience across Asia and the Pacific. Actions included providing cash transfer support to Sri Lankans suffering through food inflation, helping Mongolia weather economic shocks from rapidly escalating food and fuel prices, and enabling Vanuatu to better target its COVID-19 response to the poor and marginalized.

ADB’s partnerships also strengthened women’s economic resilience. They helped the Bank of Georgia provide financing for women-owned or led small businesses; Indonesian women and other vulnerable groups increase financial inclusion; and Indian farmers, especially women farmers, link to markets and agricultural value chains.

Strengthening resilience also involves optimizing the use of digital technology. Under ADB’s Trade and Supply Chain Finance Program, the digital standards initiative was designed to drive digitalization of global trade. In South Asia, ADB and partners are helping water utilities improve their operational efficiency with smart water management technology. Several countries in the region are improving health care and reducing costs by digitizing national health information and finance systems.

Cofinancing for sovereign projects reached $4.3 billion in 2022. About 92% of the cofinancing commitments came from bilateral and multilateral partners. The rest was mobilized from global funds, ADB-administered trust funds, and philanthropic and private organizations.

Cofinancing for nonsovereign operations—comprising private sector projects and technical assistance; transaction advisory services; and programs for trade finance, supply chain finance, and microfinance—reached $7.1 billion in 2022.

Numerous private sector partners, 14 bilateral partners, 6 multilateral partners, and 4 global funds cofinanced 124 sovereign and 41 nonsovereign projects with ADB in 2022.

The fully digital 2022 Partnership Report features stories and videos on cofinanced projects, profiles of financing partners and their contributions, and updates on ADB-managed trust funds. It illustrates how financing partnerships are delivering concrete impact on the ground, how they are aligned with ADB operational priorities, and how partnerships amplify ADB’s operations.

ADB is committed to achieving a prosperous, inclusive, resilient, and sustainable Asia and the Pacific while sustaining its efforts to eradicate extreme poverty. Established in 1966, it is owned by 68 members—49 from the region.

EU Regulators Find Growing Greenwashing Risk for Banks, Asset Managers

INVESTORS/ REGULATORS/ SUSTAINABLE FINANCE

Mark Segal June 5, 2023

Greenwashing risks are growing for a wide range of financial services providers, including banks, investment firms and insurers, according to new reports released by Europe’s three primary financial regulatory agencies, the European Supervisory Authorities (ESAs), aimed at helping market participants better understand and identify the risks, and supporting regulators in responding to greenwashing.

The ESAs include The European Banking Authority (EBA), The European Insurance and Occupational Pensions Authority (EIOPA), and The European Securities and Markets Authority (ESMA).

Key sources of greenwashing risk identified by the regulators included claims about sustainability impact and company engagement made by asset managers, litigation risk related to misleading ESG claims made by banks, and misleading product claims by pension and insurance providers.

The new reports follow a request last year by the European Commission for input from the ESAs on several aspects related to greenwashing and its related risks, and on the supervisory actions taken and challenges faced to address those risks.

The Commission’s request highlighted the rapid growth in demand for and offerings of sustainable investment products, and noted that while it views this growth as a “very positive trend,” it also raised the risk of greenwashing, warning that such practices could undermine trust in sustainable finance, and “the capacity of the financial system as a whole to channel private capital to sustainable investments.”

Following the Commission’s request, the ESA’s issued a Call for Evidence on greenwashing aimed at gathering information on greenwashing risks and practices across the banking, insurance and financial markets sectors, which informed the reports.

Alongside the issuance of the reports, the ESAs established a working definition of greenwashing, describing it as:

“A practice where sustainability-related statements, declarations, actions, or communications do not clearly and fairly reflect the underlying sustainability profile of an entity, a financial product, or financial services. This practice may be misleading to consumers, investors, or other market participants.”

Markets regulator ESMA noted a “mismatch between growing demand for ESG products and the limited pool of assets that are deemed sustainable,” driving competition among market participants to boost their sustainability profiles and produce sustainable products, which may in some cases be misleading.

ESMA highlighted areas of high risk exposure for different types of market participants, with issuers most exposed through their pledges about future ESG performance and forward looking information, investment managers through claims about engagement with investee companies, or about their ESG strategy and governance or claims about impact, and investment service providers facing risk through claims about the extent to which their advice offered to retail investors takes sustainability into account.

ESMA also suggested that the establishment of a labelling scheme for sustainable financial products would be beneficial. In November 2022, ESMA proposed new rules for asset managers for the use of ESG or sustainability-related terms for funds, in order to ensure that investors aren’t misled about the investment products’ ESG characteristics.

Banking regulator EBA found a “clear increase in the total number of potential cases of greenwashing.” The regulator assessed greenwashing risk as “low or medium for banks,” “medium or high for investment firms” and “expected to increase in the future.”

The EBA report found that the key risk areas for banks were found most commonly at the entity level, based on reputational and operational factors, including litigation risk, with less often at the product level.

Some of the most common greenwashing risks for banks identified by the EBA included promoting sustainability initiatives while omitting information about non-sustainable activities, such as claiming to be fighting deforestation while investing in companies that may be linked to deforestation activities, or making claims about decarbonizing lending activities while continuing to invest in oil companies.

Insurance and pensions regulator EIOPA’s report found that “greenwashing has a substantial impact on insurance and pension consumers,” such as deceiving consumers into purchasing products not aligned with their preferences, and noted risks for insurers at the entity level, as well as in product manufacturing, delivery and management, and for pensions through scheme design, delivery and management.

Each of the regulators noted similar challenges in developing and managing supervisory frameworks to address and monitor greenwashing risks, particularly the need to develop accurate data and methodologies.

Following the publication of the reports, the ESAs said that they will publish final reports on their greenwashing study in May 2024, and consider recommendations including on possible regulatory framework changes.

I hope you have enjoyed this weeks report. If you would like to discuss your invest needs, please do not hesitate to reach out.

Regards,

Head, Fixed Interest and Superannuation

JMP Securities

Level 1, Harbourside West, Stanley Esplanade

Port Moresby, Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814