28 August, 2023

Hello and welcome to this week’s JMP Report

Last week saw 6 stocks trade on the local market. BSP traded 11,922 shares, closing 2t higher at K13.12, KSL traded 26,527 shares, closing steady at K2.40, STO traded 439 shares, closing steady at K19.11, KAM traded 2,609 shares closing steady at K0.90, CCP traded 18,000 shares, closing steady at K2.00 and, CPL traded 7,181 shares also closing steady at K0.79.

Dual Listed Stocks PNGX/ASX

BFL – 5.35 -25c

KSL – 79c – -002c

NCM – 25.46 +47c

STO – 7.72 -7c

Our Order Book starts this week as nett buyers of STO, BSP and KSL

Interest Rates

Interesting looking at the Central Bank Bill market this week with 1.7b in bids received but the market was left with 859 oversubscribed. Overall the market was left 905mill across the short end. So there appears to be no desire from BPNG to soak up the short end liquidity at this stage.

There has been no GIS announcements.

A look at other Assets (7days)

Silver – 24.23 +$1.5

Natural Gas 2.66 -9c

Bitcoin – 26108 -.22%

PAX Gold – 1900 +1.49%

What we’ve been reading this week

More US Banks Downgraded: Is Another Banking Collapse on the Horizon?

Posted 23/08/2023 Article care of Ainslie News and Pricing

Two weeks after Moody’s lowered the ratings of a large suite of US regional banks, S&P Global Ratings has now followed suit with its own round of concerning downgrades.

In a recent Bloomberg report, S&P Global delivered a pessimistic outlook for more lenders as a result of higher interest rates and the withdrawal of deposits.

In the research note, S&P clarified that challenging conditions in lending have led them to lower the ratings of five banks by a single level each: KeyCorp, Comerica Inc., Valley National Bancorp, UMB Financial Corp., and Associated Banc-Corp. Additionally, they’ve assigned negative outlooks to River City Bank and S&T Bank.

More specifically, that depositors have “shifted their funds into higher-interest-bearing accounts, increasing banks’ funding costs,” S&P said, adding, “The decline in deposits has squeezed liquidity for many banks while the value of their securities – which make up a large part of their liquidity – has fallen.”

In Moody’s report two weeks ago, they attributed their series of bank downgrades to three main pillars, rising funding expenses, potential vulnerabilities in regulatory capital, and growing risks tied to loans connected with commercial real estate.

“US banks continue to contend with interest rate and asset-liability management risks with implications for liquidity and capital, as the wind-down of unconventional monetary policy drains system-wide deposits and higher interest rates depress the value of fixed-rate assets,” Moody’s analysts Jill Cetina and Ana Arsov said in the accompanying research note.

The Moody analysts went on to forecast a rather dire prediction for 2024.

“We continue to expect a mild recession in early 2024, and given the funding strains on the US banking sector, there will likely be a tightening of credit conditions and rising loan losses for US banks.”

These challenges in the banking sector align with the Federal Reserve’s series of substantial interest rate hikes, reaching levels not seen in over two decades. While the full ramifications of this tightening cycle might not have fully materialized, S&P has cautioned that elevated rates are placing stress on borrowers.

This scenario mirrors Fitch Ratings’ recent decision to downgrade the highest credit rating of the U.S. government. Fitch analyst Chris Wolfe even suggested the potential for another round of upheaval in the banking industry, with the prospect of widespread rating downgrades, even affecting major players such as JPMorgan Chase.

Now that would be a disaster of epic proportions.

Amidst all these developments, the KBW Bank Index, which tracks major U.S. banks, remains at levels similarly observed in March—a time when several regional banks encountered significant difficulties.

Clearly, the US banking system has been unstable for some time, as bank credit ratings are not merely downgraded overnight. However, the fact that traditional credit agencies have now at this point chosen to conform their ratings to the reality of the US banking sector, could mean there is a lot more damage to come, as the evidence for further banking collapses has become too great for these establishment agencies to ignore.

China’s slowdown and structural challenges and implications for Australia

Dr Shane Oliver – Head of Investment Strategy and Economics and Chief Economist, AMP Investments

Key points

– China’s economy is slowing not helped by a property collapse and longer-term structural constraints around poor demographics and threats to productivity growth.

– China needs to save less and spend more, and this requires significant fiscal stimulus. So far policy stimulus has been tepid, but a more forceful response is likely.

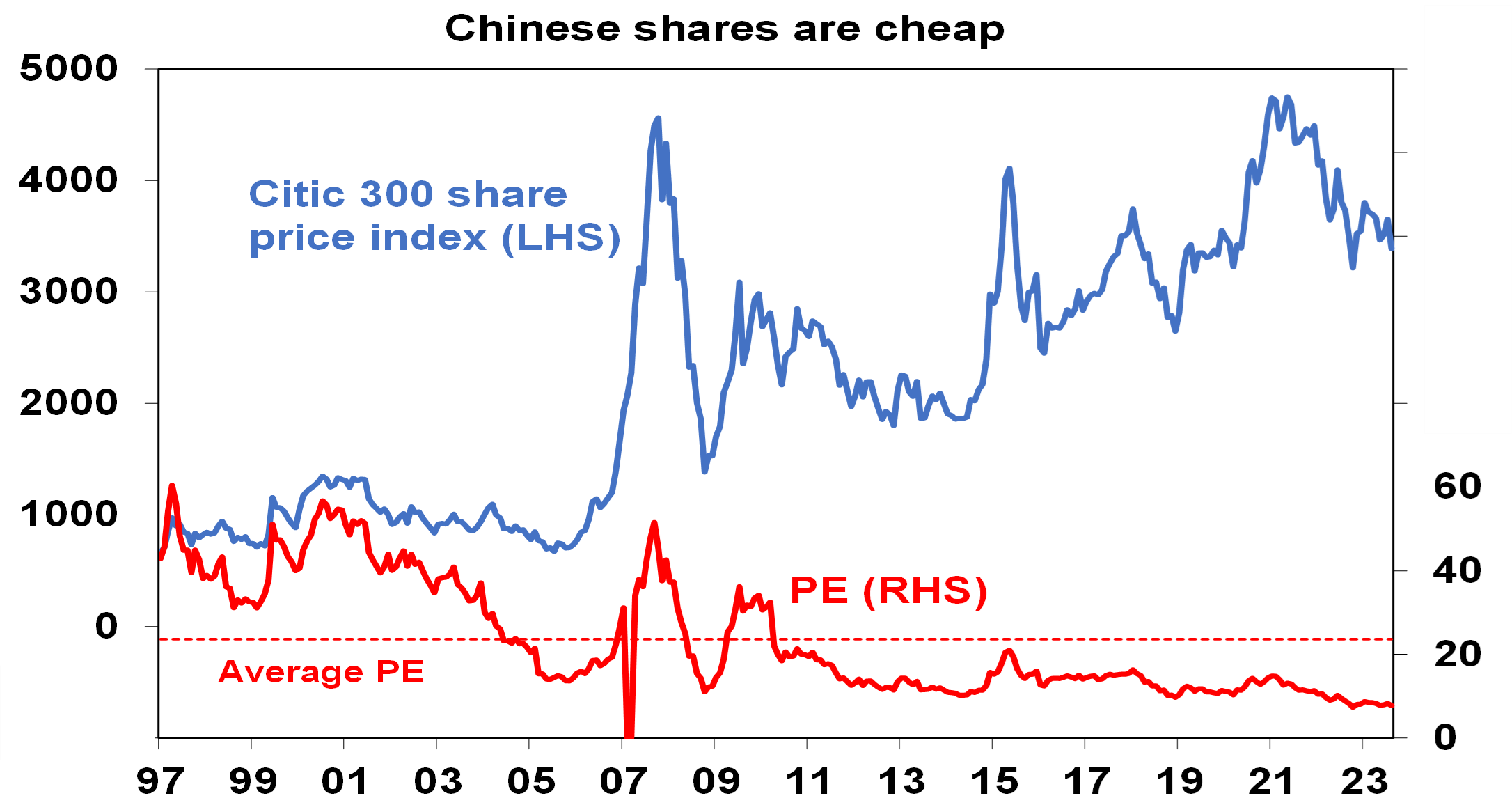

– Chinese shares are cheap but short-term risks are high.

– The risks around China’s outlook mean Australia can’t rely on the China/commodity boom indefinitely.

Introduction

Scepticism about China’s economic success has been an issue for years. But it’s intensified lately on the back of slowing growth, property problems, high debt and falling long term growth potential with talk that China is “teetering on the brink” and President Biden describing it as a “ticking time bomb”. After strong growth and a big run up in debt there is fear that it’s going down the same path as Japan which after a surge in asset prices and debt on the back of what was dubbed a miracle economy in the 1980s slipped into a long period of poor growth and deflation. As the world’s second largest economy what happens in China has significant ramifications globally and in Australia. This note looks at the main issues and what it means for Australia.

Slowing growth

After China’s Covid restrictions were finally eased late last year there was hope its economy would rebound. It did in the March quarter but since then its disappointed with GDP growth slowing to 0.8%qoq (from 2.2% in the March quarter) and July data showing a further slowing in growth in industrial production, retail sales (running at just 2.5%yoy) and investment.

Source: Bloomberg, AMP

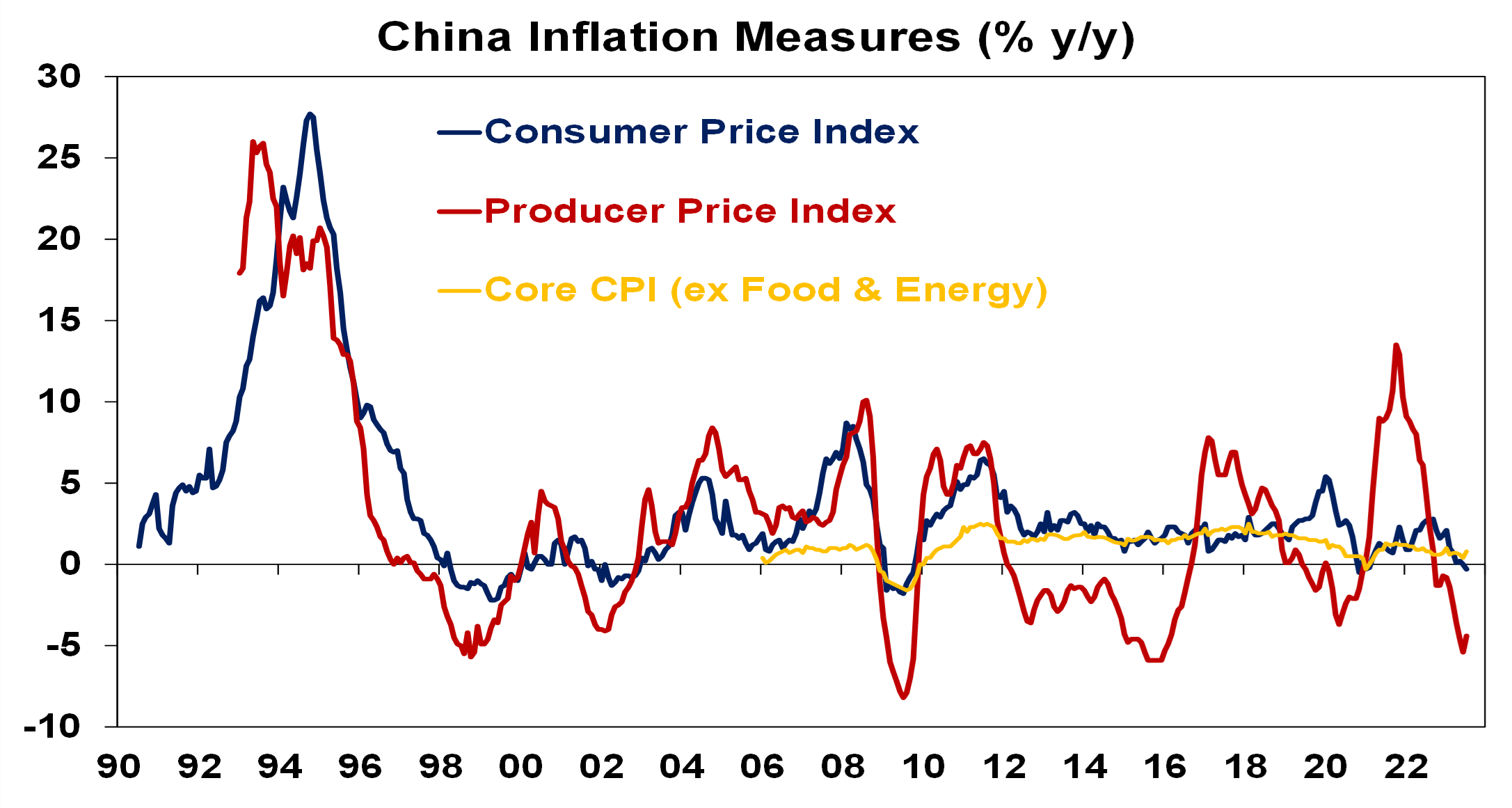

Exports and imports are down 14.5% you and 12.4% you respectively, bank lending and credit growth have slowed despite some monetary easing. Reflecting weaker conditions, business conditions PMIs have also fallen sharply. And youth unemployment has risen from around 12% to 21% over the last five years. Reflecting faltering growth, modest inflation has given way to deflation, although core CPI inflation is slightly positive.

Source: Bloomberg, AMP

The slowdown reflects a combination of factors but high on the list are:

- Many households seeking to rebuild savings which were depleted through the lockdowns – Chinese households did not have their incomes protected as in most western countries in the lockdowns so did not emerge with lots of excess savings compared to pre-Covid levels.

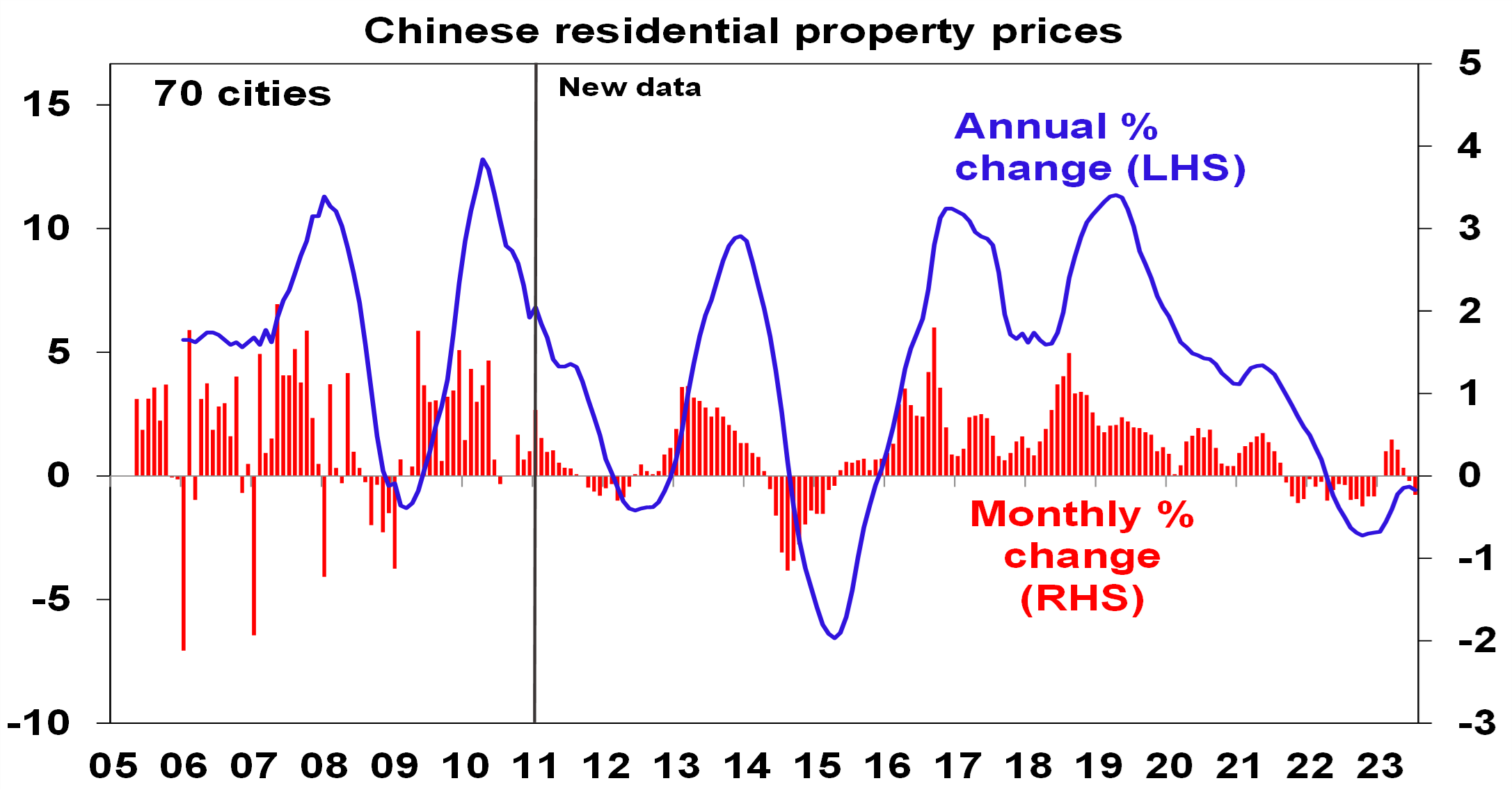

- A property collapse – after reaching record highs in 2021 new home sales are down sharply, property transactions are down 33%yoy and home prices have fallen reflecting tightening policies and oversupply. This has led to big problems at: developers (egg, Evergrande and Country Garden) that relied on high debt & a steady flow of new buyers; companies that issue investment products which helped finance developers; local governments that rely on land sales for revenue; & households who have seen property related investments sour.

Source: Bloomberg, AMP

Structural problems

However, the slowdown is also being impacted by structural problems:

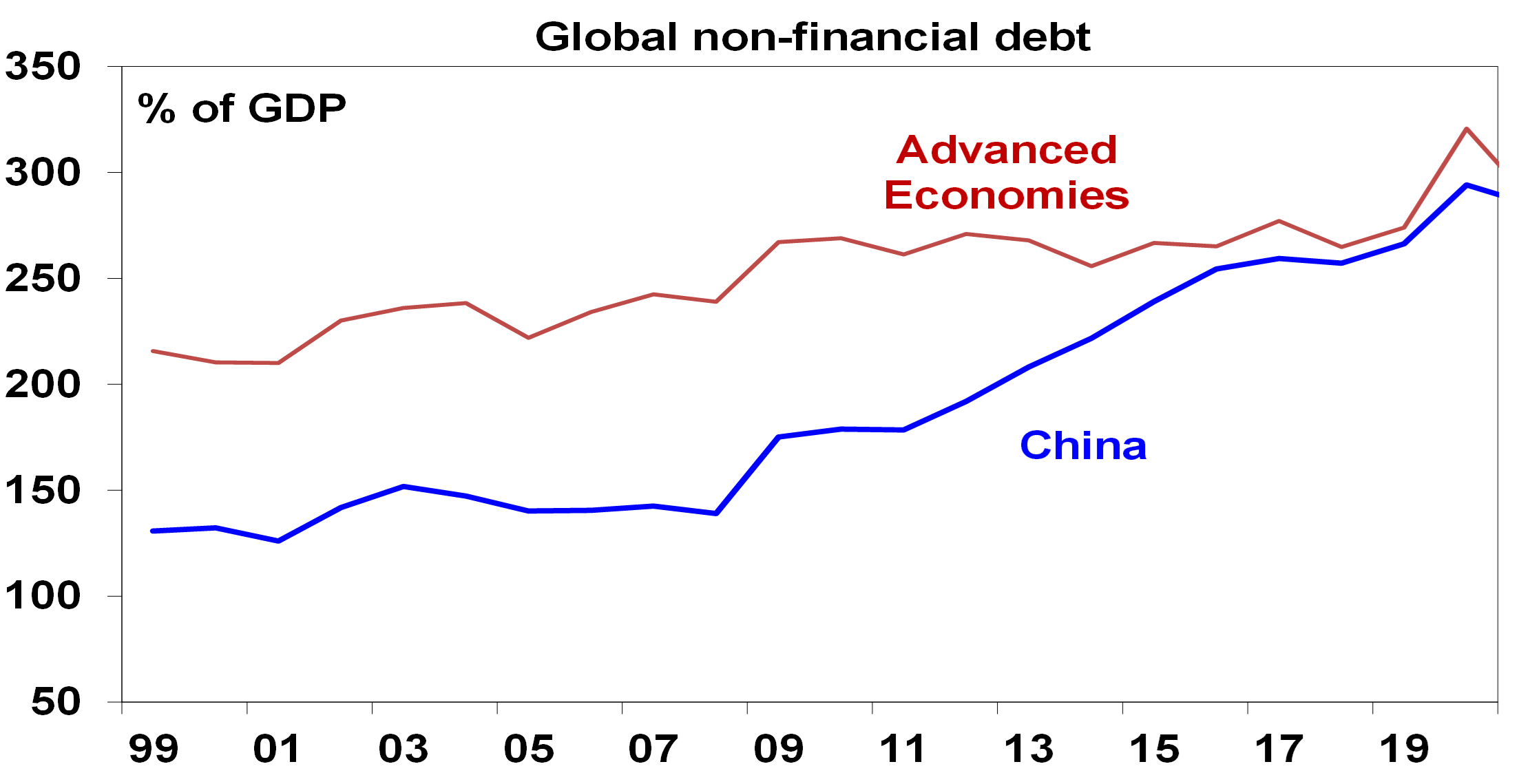

- The first thing to note is that China has a very high saving rate of around 45% of GDP, which is roughly double that of countries like Australia. This makes China’s debt problems very different to other countries as China has borrowed from itself (so there are no foreigners to cause a foreign exchange crisis). But it means the savings have to be recycled (usually via debt) into demand or else weak demand, high unemployment and chronic deflation can result. It did this initially through corporate debt into investment and then into property which has resulted in a rapid rise in China’s debt levels since 2008. But this is getting problematic.

Source: BIS, AMP

- Second, the easy opportunities for capital investment have been taken. China’s ratio of fresh capital to GDP and fresh debt to GDP have increased substantially indicating that ever more investment and debt is necessary to achieve the same increase in GDP as in the past.

- Third, this hasn’t been helped by geopolitical tensions which have slowed exports. It’s also added to a plunge in foreign direct investment (which is down 87%yoy) and restricted access to US technology.

- Fourth, while some cried wolf too early on China’s property market (recall the SBS Ghost Cities story from 2011!), using property to recycle high savings is souring. This was viable when urbanisation was rapid but analysis based on utility usage and light emissions at night suggest some areas may have 25% of apartments vacant.

- Fifth, China’s demographics are poor as its workforce is now shrinking and it has a rapidly aging population. This also weighs on property demand. But it also removes a key source of economic growth.

- Finally, despite a falling workforce China could still grow quickly because its GDP per capita and output per worker are around 20% of US levels – so it still has a lot of catching up to do. However, the easy gains of industrialisation by putting people in front of machines have been had and China runs the high risk of falling into the “middle income trap” (where countries fail to transition to being high income countries) as a result of increasing state intervention in the economy – with the resurgence of less efficient state owned enterprises (which now account for 60% of investment, up from 30% 10 years ago) and regulatory crackdowns on tech companies and other sectors acting as a disincentive to future entrepreneurs, state intervention on national security grounds and tighter access to foreign technology.

As a result of China’s falling workforce and slowing productivity growth, estimates of its potential real GDP growth have fallen from around 10% in 2006-10 to around 5% now and around 3% next decade.

The policy response and “Japanification”

The fear is that China continues to slow causing a spiral of bigger property sector problems with sharp falls in asset prices, more developers “failing”, increased consumer caution, weaker growth, and further falls in asset prices. Or that a major near crisis is averted but it slides into a decades long period of stagnation and deflation like Japan did after its 1980s boom years.

With opportunities to recycle China’s high saving rate into investment and property starting to diminish it should be saving less and spending more. To achieve this requires aggressive fiscal stimulus to rebalance the economy towards consumer spending. In particular this would involve improving social welfare (in terms of pensions, health and education) in order lower precautionary household saving and support spending.

Despite indications from Politburo meetings that stimulus would be forthcoming so far it’s been mild with only a few cuts to interest rates and relaxation of bank reserve requirements and measures to “promote” consumers to spend more and buy more homes without large scale measures to help them do so. This has led to concern the Government is more focussed on trying to avoid reflating credit and housing bubbles (much as Japan was in the early 1990s) and/or is not aware of the problem.

Our assessment though is that the Government is well aware of the need to support growth given the risk of social unrest and will ultimately do so – probably after the summer travel boom comes to an end soon. Furthermore the Chinese Government is unlikely to allow a GFC style collapse in property developers and is likely to continue to manage the problem.

So a collapse in the Chinese economy is unlikely but the risk that policy stimulus is too little or too late can’t be ignored and nor can the broader comparison with Japan at the end of the 1980s. A key difference with Japan 30 years ago is that China’s per capita GDP is still low so it still has lots of catch up potential, but its rapid private debt build up is similar to Japan’s, its demographic outlook is a bit worse and the threats to its productivity (with state intervention) and trade (with geopolitical tensions) are greater.

The Chinese share market

Chinese shares are down 36% from their record 2021 high and are cheap when compared to earnings (trading on a PE of just 7.7 times), book value and sales. This suggests significant potential for a bounce if significant stimulus is announced. However, the risks are on the downside.

Source: Thomson Reuters, AMP Capital

Implications for Australia

Uncertainty around China’s outlook is a key risk for global growth at present and could be a contributor to a further correction in share markets.

The collapse in the share of Australian goods exports going to China in 2021 and 2022 from around 42% to less than 30% (partly due to trade restrictions) without a major hit to our economy highlights that maybe Australia is not as dependent on China as many think. Nevertheless, a sharp downturn in China would be a double whammy for the Australian economy coming at the same time the lagged impact of big interest rate hikes on household spending comes through. But while it’s a risk it’s not our base case as ultimately we expect a ramp up in Chinese stimulus measures enabling Chinese growth to settle around 5% this year and 4.5% next year (not great compared to the past experience for China but not a disaster). However, the risks around the Chinese outlook and its longer-term growth mean Australia cannot rely on the China/commodity boom indefinitely driving national income and hence masking our poor productivity performance. This is another reason why Australia needs structural reform to boost our longer-term growth potential.

‘Higher Longer’ – The New ‘Transitory Inflation’

Posted 22/08/2023

As the world enters the 28th month of ‘transitory inflation’, it seems timely the new catch phrase from worldwide central banks is introduced – ‘Higher Longer’ – the new Central Bank Rhetoric. So as transitory is now referred to as sticky (ironically – their dictionary meanings are opposite), lets translate Higher Longer to what may end up being the exact opposite as Central Banks models continue to fail in their economic predictions with reactions creating more chaos.

In November 2021 Fed Chair Powel ditched the transitory inflation rhetoric (first seen in Central Bank notes in April 2021) ditching this tagline and opening the Fed to faster bond buying taper (QT) and 12 rate increases…. Here we are today with higher interest rates, higher house prices, higher government debt and a precarious world economy – where inflation in the US is being called sticky, disinflation in China is a recession and no one knows what the hell is going on in Japan because after 30 years of disinflation they now have 6% inflation and a Central Bank continuing yield curve control.

So let’s investigate why Higher Longer doesn’t make sense

Will oil prices continue to rise?

Oil is being touted as the reason inflation will continue to rise – and it certainly seems that way with current bowser prices in Australia becoming a current dinner table topic. Looking back with the beginning of the Ukraine War energy prices spiked as the US sanctioned Russia, spiking oil and gas prices in Europe, with the world energy companies gouging and paralysing the rest of the world including energy producer countries like Australia creating a huge inflationary shock. The US responded by pumping the US economy with cheap oil from its Strategic Petroleum Reserve, and lifting their internal production, Australia responded by sending (cheaper than Australian) gas overseas and 6 months later the world energy market was back in some sort of lower priced equilibrium that has only recently started to cause ructions of possible price inflation with continuous OPEC cuts. So why inflation in oil after a period of disinflation? Well, the SPR is emptying and OPEC just keeps cutting, in fact so low that current oil output is around that of 2009.

But the US is now producing record amounts of crude at 12 million barrels a day, China’s disinflation is putting downward pressure on oil demand, greater usage of public transport (as covid fear dissipates and oil pushes people back onto public transport), the potential for the end of the Ukraine war and finally renewables and nuclear maybe getting some ‘time in the sun’. So is it reasonable to see these prices rising much past the possible current fear of rising?

Article thanks to Ainslie News and Pricing

Sharjah Waste-to-Energy Plant is big sustainability success story

Sharjah Waste to Energy plant achieves major milestones towards zero-waste, net-zero emissions in first year of operations. Image Courtesy: Beah

Sharjah has reaffirmed its commitment and support to the UAE’s strategic vision to divert waste away from landfills

Tariq Al Faham/ Hazem Hussein, WAM (Emirates News Agency)

SHARJAH: Sharjah has stepped up its environmental efforts to achieve its goal of “zero” waste through the Sharjah Waste-to-Energy Plant, the region’s first commercial project of its kind, to reduce greenhouse gas emissions and minimise the effects of climate change to save the environment.

In launching the groundbreaking plant and turning solid waste into energy, Sharjah has reaffirmed its commitment and support to the UAE’s strategic vision to divert waste away from landfills, cut emissions and achieve climate neutrality by 2050 by adopting a sustainable energy mix that helps reduce carbon emissions to counter climate change.

The plant was launched in July last year to become the first commercial project of its kind in the Middle East, developed by the Emirates Waste to Energy Company, a joint venture between Bekah, the region’s leading sustainability group and Masdar, one of the world’s leading companies in renewable energy.

The plant feeds 2,000 homes in the emirate by connecting them to the Sharjah Electricity, Water and Gas Authority’s network while eliminating 150,000 tonnes of harmful carbon emissions.

The station treats a whopping 300,000 tonnes of solid waste annually. When the plant reaches its maximum operational capacity, it will generate 30 megawatts of energy annually, enough to provide electricity to more than 28,000 homes in the emirate.

While 90 per cent of the waste is treated by Bekah, the plant helps eliminate 450,000 tonnes of harmful carbon emissions, contributing to a sustainable quality of life in the emirate and the environment in the region at large.

The station, one of the innovative climate solutions, converts non-recyclable waste into electrical energy to provide clean, low-carbon energy that supports the sustainable development process in the country.

According to the station’s data, its operating mechanisms depend on treating non-recyclable waste in a thermal boiler to generate steam, which in turn contributes to the operation of a steam turbine that generates electricity. These components and mineral materials may be used in construction and road works.

The operating mechanism involves collecting fly ash resulting from the incineration process to treat it separately in a safe, scientific manner while treating the gas resulting from the waste incineration process before releasing it into the atmosphere in line with the environmental standards of the European Union.

The heat generated during the process is recovered and used in a steam boiler, which in turn is used to drive electric turbines and produce electricity. The plant’s boiler and thermal efficiency rates are among the highest in the industry.

The plant, covering an area of 80,000 square metres, is located near the materials sorting facility of Bekah. It collects, separates and recycles the Emirate’s waste, and sends the rest to landfills when necessary.

I hope you have enjoyed this week’s read, have a great week.

Regards,

Head, Fixed Interest and Superannuation

JMP Securities

Level 1, Harbourside West, Stanley Esplanade

Port Moresby, Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814