4 September, 2023

Hello and welcome to this week’s JMP Report

With the market coming into the half yearly reporting season, the market was a little light on volume. BSP traded 1,504 shares, closing 2t higher at K13.14, KSL traded 102,292 shares, closing 15t higher at K2.05, CCP traded 78,558 shares closing 5t higher at K2.55 and CPL traded 10,123 shares, closing steady at K0.79.

WEEKLY MARKET REPORT | 28 August, 2023 – 1 September, 2023

| STOCK | QUANTITY | CLOSING PRICE | CHANGE | % CHANGE | 2021 FINAL DIV | 2021 INTERIM | YIELD % | EX-DATE | RECORD DATE | PAYMENT DATE | DRP | MARKET CAP |

| BSP | 1,504 | 13.14 | 0.02 | 0.15 | K1.4000 | – | 13.53 | FRI 22 SEPT 2023 | MON 25 SEPT 2023 | FRI 13 OCT 2023 | NO | 5,317,971,001 |

| KSL | 102,292 | 2.55 | 0.15 | 5.88 | K0.1610 | – | 9.93 | WED 6 SEPT 2023 | THU 7 SEPT 2023 | THU 5 OCT 2023 | NO | 64,817,259 |

| STO | 0 | 19.11 | – | 0.00 | K0.5310 | – | 2.96 | MON 28 AUG 2023 | TUE 29 AUG 2023 | THU 28 SEPT 2023 | NO | – |

| KAM | 0 | 0.90 | – | 0.00 | – | – | – | – | – | – | NO | 49,891,306 |

| NCM | 0 | 75.00 | – | 0.00 | USD$1.23 | – | – | FRI 18 AUG 2023 | MON 21 AUG 2023 | MON 18 SEPT 2023 | NO | 33,774,150 |

| NGP | 0 | 0.69 | – | 0.00 | – | – | – | – | – | – | NO | 32,123,490 |

| CCP | 78,558 | 2.05 | 0.05 | 2.44 | K0.225 | – | 6.19 | – | – | – | NO | 569,672,964 |

| CPL | 10,123 | 0.79 | – | 0.00 | K0.05 | – |

4.20 |

– | – | – | NO | 195,964,015 |

Dual Listed Stock PNGS/ASX

BFL – 5.46 +15c

KSL – .835 +4.5c

NCM – 25.77 +27c

STO – 7.81 +18c

JMP Order Book

Our Order Book starts the week with JMP a buyer of BSP, CCP, KSL, STO

Interest Rates

On the interest rate front, BPNG issued 1.163b, this was all taken up by the banks @ 2%. No alerts on the next GIS tender

Other trading Assets

Natural Gas – 2.69 +3c

Silver – 24.55 +32c

Bitcoin – 25,959 -0.37%

Ethereum – 1,636 -1.08%

PAX Gold – 1,919 +1%

What we’ve been reading this week

China in trouble

Martin Katusa

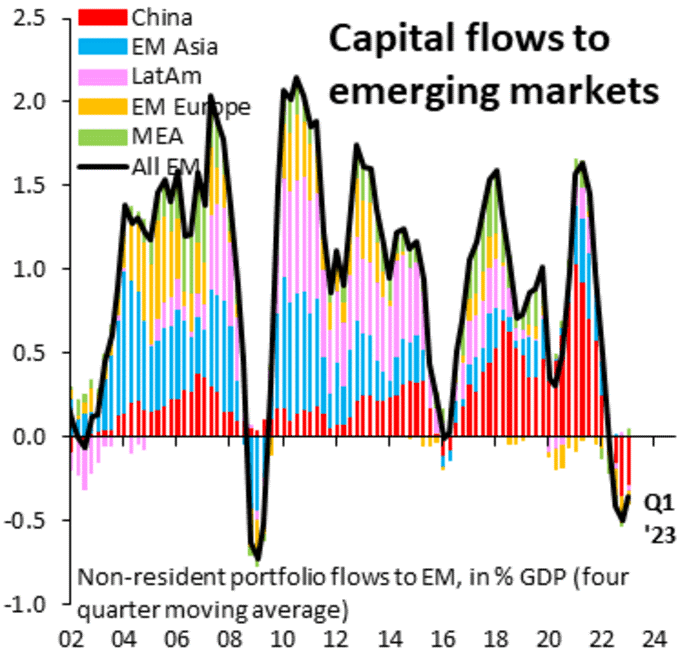

Lately, China has been seeing very large capital outflows out of its economy. Over the past several months, foreign investors have been leaving in droves:

As the chart reveals, China had been steadily increasing its share of foreign investment in emerging markets for the past decade.

Yet, the COVID-19 pandemic sharply reversed this trend, even causing capital to flow out of China for the first time in nearly 10 years—a total loss exceeding $10 billion.

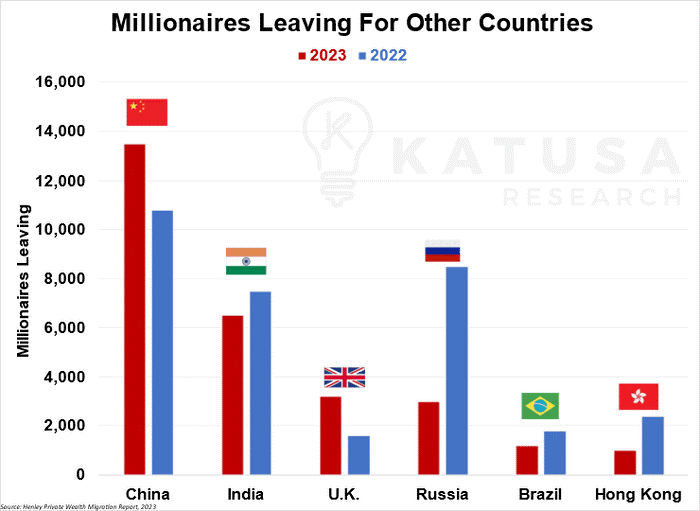

Meanwhile, within China’s borders, wealthy domestic investors are also packing their bags…

As an estimated 13,500 Chinese millionaires are projected to leave for greener pastures this year. This is the most of any country, more than even Russia.

This exodus marks an uptick from last year’s figure of 10,800 millionaires…

Anecdote: By the way, Canada has been one of the top destinations worldwide for high net-worth individuals looking to resettle, a fact that’s been evident in my hometown of Vancouver with skyrocketing housing prices. But I digress.

The Chinese economic recovery has been anything but, and the government is struggling to restore a semblance of confidence in its flagging markets.

Global macroeconomic conditions have been tough everywhere however, between high inflation and the war in Ukraine.

So, what sets China apart from the rest of the world?

It’s Not Easy Being Red

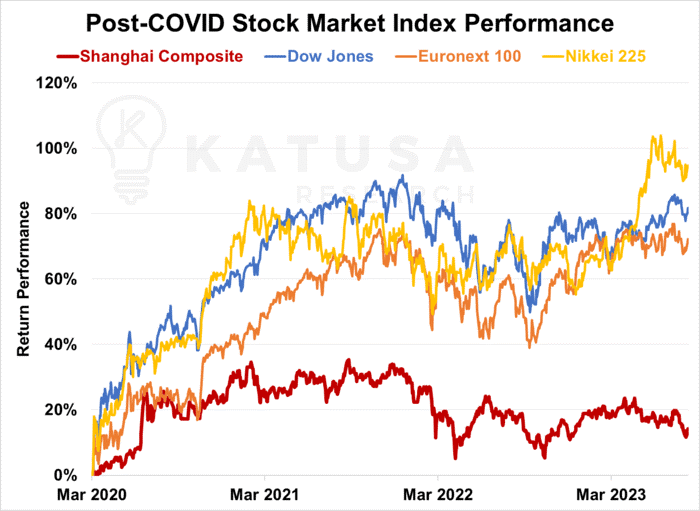

While global economies and stock markets have largely bounced back since the bleak days of late spring 2020—despite intermittent setbacks—the Chinese markets remain a notable outlier.

But China’s markets, like the Shanghai Composite, haven’t done as well as those in the U.S. and Europe.

As you can see, Chinese stock markets have lagged since the pandemic started, while markets in other countries have recovered more strongly.

Now, there have been extra obstacles since the worst parts of the pandemic ended.

The Ukraine war seriously affected food and energy prices, making them go higher. This added to existing problems in the supply chain caused by COVID-19.

Government actions to boost the economy during the pandemic, along with people buying more goods instead of services because of lockdowns, also played a part in rising prices during the second half of last year.

Building Blocked

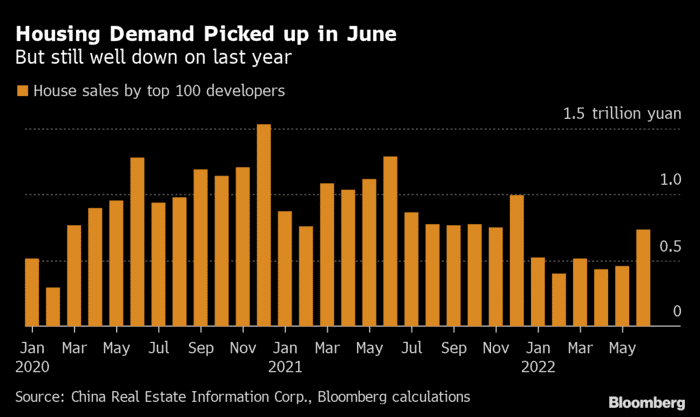

One major factor affecting the Chinese economy that hasn’t been seen in other countries is the slowdown in its real estate sector.

Demand and sales for new homes have plummeted, and major property developers such as Evergrande and Country Garden are in serious financial trouble – with the former having to file for bankruptcy earlier this month.

China’s High-Yield Real Estate Total Return Index is down 82% in the past two years.

The Chinese property market makes up about a quarter of China’s economy. So, when it slows down, the impact is felt worldwide. To fight this, China’s government has been spending more on things like roads and bridges.

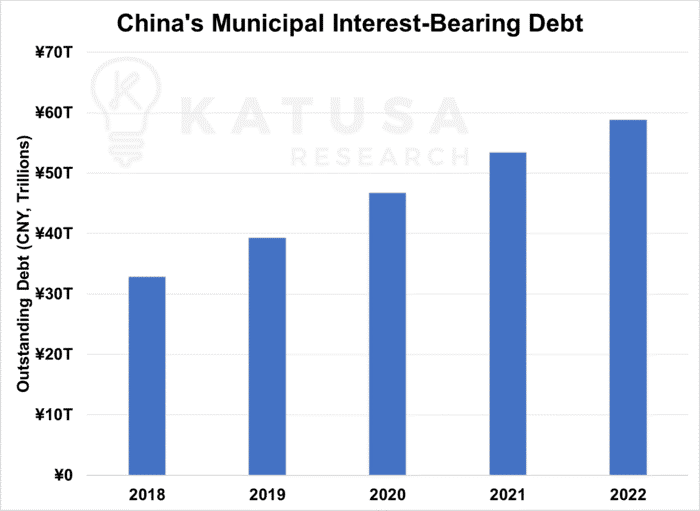

But now, city debt is at an all-time high.

So high that local governments can’t “amend, extend and pretend” anymore:

Put together, local governments in China alone hold roughly USD$8.1 trillion worth of debt – half of China’s GDP.

Contrast this with total U.S. municipal bond debt of $4.0 trillion versus domestic GDP of $26.8 trillion – just under 15% – and you see just how much this problem is getting out of hand in China.

Of over 200 Chinese cities with financial data available for the last calendar year, half of them saw interest payments account for 10% or more of their total cash flow.

Two major cities, Lanzhou and Guilin, had interest burdens last year exceeding 100% of all the fiscal resources available to them.

It’s Not Just Government Feeling the Pinch

Earlier in August…

A major Chinese financial services firm, Zhongzhi Enterprise Group Co. along with its affiliate, Zhongrong International Trust Co., missed payments on over 30 different high-yield products.

Keep in mind this isn’t some local credit union…

Zhongzhi manages about USD$137 billion in assets for Chinese citizens, and much of that money has gone towards a 33% stake in Zhongrong.

Zhongrong had to freeze withdrawals from its short-term investments, prompting Chinese regulators to get involved.

They’ve asked major state-affiliated banks, such as Citic Group and China Construction Bank, to scrutinize Zhongrong’s finances. This opens the door for a possible government bailout.

Adding to the mounting challenges, urban youth unemployment has surged to a record high. In fact, the rate hit 21.3% in June, leading the government to stop publishing these troubling statistics.

Meanwhile, both China’s manufacturing and consumer sectors are in a slump, as evidenced by falling industrial output and declining retail sales over the past few months.

Long story short, things aren’t looking great in China right now.

So, given where things stand, President Xi Jinping has had to reach into his bag of tricks for alternative options.

Chief among these was another surprise rate cut of 10 basis points to the Chinese central bank’s one-year loan prime rate, announced just last week, and the third one this year.

Following this there was also a reduction of the Chinese government’s 0.1% duty on stock trades down to 0.05%, to bolster market activity.

- In the same vein, Chinese stock exchanges have also lowered their margin financing requirements to do the same.

- In fact, Chinese regulators are even thinking about banning the shorting of stocks!

It’s not likely to happen, but that’s a major red flag if I’ve ever seen one.

Where China Goes, the Rest of the World Must Follow

According to the IMF, every 1% growth in the Chinese economy corresponds to about 0.3% growth globally.

Simply put, when the Chinese economy is hurting, so too is the rest of the world’s:

- Falling Chinese imports has hit its neighbours like Japan, South Korea and Thailand hard. Besides Asia, Africa has also been hit hard, with import values down over 14% year to date.

- Discretionary spending on things like luxury brands and overseas tourism have traditionally been a staple demand of the Chinese upper class, but spending here has also suffered as a result of the slowdown in the Chinese economy.

- Deflationary pressures from the Chinese economy have led to cheaper prices for Chinese goods in the U.S. While this is good for consumers dealing with inflation, it will present headwinds for domestic manufacturers in the months ahead.

For the moment, China’s problems are largely China’s problems.

If the Chinese government doesn’t find a way to improve the situation quickly, the world will start paying attention, whether China likes it or not.

This could force President Xi to take more extreme steps to stabilize the economy.

Depending on how things in China shake out, there may be more rough sailing ahead for the global markets.

Kia to Reuse Plastic from Record 55 Tons of Collected Ocean Trash

By Jennifer L

South Korean carmaker Kia will use recycled plastic from a record 55-ton reclaimed trash from the Pacific Ocean in its future EV models, marking the company’s efforts for a sustainable mobility solutions provider. The impressive amount of plastic trash is recovered by Kia’s partner, The Ocean Cleanup.

The Ocean Cleanup is an international non-profit organization seeking to rid the world’s oceans of plastic. The team’s record-breaking catch was from the Pacific Ocean and landed at Victoria, Vancouver, Canada.

Commenting on this significant effort, a Kia executive noted that it shows how technology can drive sustainable solutions at scale. The senior VP further remarked that:

“Initiatives such as this one perfectly align with Kia’s transition to a sustainable mobility solutions provider and our Plan S strategy… by acting as a responsible corporate citizen.”

Kia has set ambitious net zero goals and taken steps to slash its carbon emissions.

Kia’s Sustainable Mobility Toward Net Zero

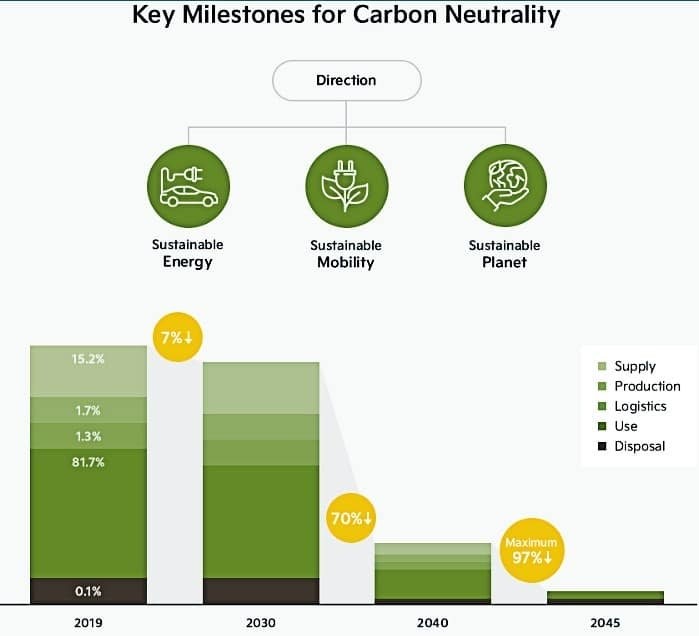

The Korean automaker has a strong focus on reducing its carbon emissions. In 2021, Kia declared to achieve carbon neutrality by 2045. To this end, the automaker aims to slash its carbon emissions by 97% compared to 2019 levels by 2045.

Kia will then look for ways to offset the remaining footprint to make its net emissions “zero” at all levels. The company plans to meet its net zero targets through its so-called 3Ss – Sustainable Energy, Sustainable Mobility, and Sustainable Planet.

A big part of reaching its net zero or carbon neutrality targets, apart from transitioning to full-electric models, is investing in recyclable and eco-friendly materials and technology to lower its emissions and environmental impacts.

Such strategy includes the brand’s support of The Ocean Cleanup as reflected in the project’s record haul. Recycling of the reclaimed plastic will start shortly with Kia using some of the plastic trash in future models. Recycled plastics will become interior components of Kia’s future fully electric cars.

This move aligns with Kia’s commitment to provide sustainable mobility solutions that have a measurable impact on the environment. It’s something that the carmaker has been doing with its fabrics and carpets from recycled PET and bio-based leather. For instance, in its EV9 model, the car has floor carpet made from fishing nets.

The Ocean Cleanup’s 7-year partnership will give Kia more resources to recycle and use in its interior car parts.

Plastic Credits from the World’s Largest Floating Waste

The 55-ton record trash was recovered using The Ocean Cleanup’s System 002 extraction technology following a long voyage through the Great Pacific Garbage Patch (GPGP). It’s the planet’s biggest accumulation of floating waste, with a surface area of around 1.6 million sq. kilometres. In other words, that’s equal to more than 4x the size of Germany.

Image source: Firstpost.com

The company’s floating systems are designed to capture plastics of all sizes, from microplastics to massive wastes. Their modeling estimates that the cleanup team needs around 10 full-size systems to clear the GPGP.

By deploying fleets of extraction systems, The Ocean Cleanup projects can remove 90% of floating ocean plastic by 2040.

Right after it brought its recovered trash to shore with System 002, the team revealed its new System 03 technology. This new system is about 3x bigger than its predecessor. So apparently, it can capture more plastic waste at lower costs (per kilo of trash removed).

The System 03 extraction also has a more sophisticated environmental monitoring and safety technology designed to protect marine life.

The Ocean Cleanup said it will offset all carbon emissions from its System 002 campaign. The team is also working with Maersk in experimenting with low-carbon fuels for their support vessels.

Announcing their future plans, Nisha Bakker, a director at The Ocean Cleanup, said that they’re aiming to remove 50% of the GPGP every 5 years, but they can’t do this huge task alone. With that, Bakker further noted that:

“Committed and valued partners, and particularly our global partner Kia, remain essential for The Ocean Cleanup to bring our shared ambitions of plastic-free oceans to reality.”

Their innovative and giant effort of recovering plastics from the oceans in partnership with Kia can make them eligible for earning plastic credits. Each credit is equal to a ton of plastic waste that would otherwise have not been collected or recycled.

They can then leverage plastic credits to address their sustainability concerns or as part of their net zero commitments.

Kia’s commitment to repurposing 55 tons of Pacific Ocean plastic recovered by The Ocean Cleanup into future EV models symbolizes a pivotal shift toward a more sustainable automotive industry. This initiative scores big both in protecting our oceans and eliminating plastic waste.

A Watershed Week for Crypto

Posted on 31/08/2023

The past week stands as a historic milestone in the landscape of cryptocurrencies. A courtroom victory for Grayscale Investments has reinvigorated the prospect of Bitcoin ETFs, while politicians are making crypto a talking point in the lead-up to the next U.S. presidential election. These watershed moments signal not just the maturation of digital assets, but also their impending entanglement with mainstream politics and finance. Read on to understand why this week could very well be a turning point for crypto.

The SEC’s Bitcoin ETF Dilemma

The crypto world is abuzz with anticipation as the U.S. Securities and Exchange Commission (SEC) gears up to make some crucial decisions on a slew of Bitcoin ETF proposals. Major financial institutions like BlackRock and Fidelity are at the forefront, alongside crypto-centric companies like Bitwise. The SEC published the fund proposal in the federal register on July 19, starting a 240-day clock for the commission to rule on the product.

However, the path is strewn with regulatory deadlines and expectations remain muted. James Seyffart, a Bloomberg Intelligence analyst, tweeted on Aug. 15: “A ruling in favourof Grayscale Investments in its suit against the SEC could spur a range of bitcoin ETF approvals sooner than that.” Seyffart’s quote underlines the ongoing litigation, emphasising how interconnected these financial tools are within the regulatory landscape.

Grayscale Triumphs Over SEC

In a remarkable win for the crypto industry, Grayscale Investments defeated the SEC in an appeals court, clearing a major hurdle towards the launch of a Bitcoin ETF. This event marks a monumental juncture for the industry, allowing for potentially massive capital inflow from retail investors. The ruling has catalysed enthusiasm across the market, sparking rallies in Grayscale’s Bitcoin Trust and the price of Bitcoin itself.

“The denial of Grayscale’s proposal was arbitrary and capricious,” wrote Judge Neomi Rao in the court’s opinion, illuminating the SEC’s inconsistent treatment of crypto financial products. The event accentuates the changing tides and growing momentum of the digital asset industry. Owen Lau, an analyst at Oppenheimer & Co, rightly mentioned, “There’s huge optimism baking into the market right now.”

The Bitcoin Election: Crypto Takes the Political Stage

With the U.S. presidential election drawing nearer, cryptocurrencies are being thrust into political dialogues. While certain Republican candidates have openly embraced cryptocurrencies, others have been more reserved in their approach. Vivek Ramaswamy, for example, is vocally pro-crypto, describing the upcoming election as a “referendum on fiat currency.”

On the flip side, Florida Governor Ron DeSantis has been ambivalent. Although he’s banned central bank digital currencies in Florida, he also promised to protect Bitcoin. “The Bitcoin Election,” as some are calling it, could signal a turning point for the crypto industry in the U.S., fostering a more amicable regulatory environment.

Conclusion

In summary, the past week has been a rollercoaster of events for the cryptocurrency industry. From the SEC’s pending decision on Bitcoin ETFs, which has major financial institutions and crypto-focused companies on the edge of their seats, to Grayscale Investments’ significant legal victory that could pave the way for more mainstream investment in cryptocurrencies—the times are a-changin’. On top of that, as the U.S. gears up for its presidential election, the political spotlight is beginning to shine on cryptocurrencies, adding yet another layer of complexity and potential opportunity for the industry.

The landscape is dynamic and the stakes are high, but one thing is clear: Cryptocurrency is no longer a fringe topic; it’s squarely in the realm of mainstream financial discourse and is rapidly moving into political dialogues. Whether you are an investor, a policymaker, or simply someone interested in the future of finance and technology, these developments are worth keeping an eye on.

Remember to subscribe to this newsletter and follow us on social for regular updates on the dynamic world of blockchain and cryptocurrency. If you’re interested in an easy and personal way to buy/sell/swap cryptocurrency, don’t hesitate to contact us – call 1800 AINSLIE. Our team of friendly consultants are ready to guide you, your company, or SMSF through the process, making your cryptocurrency buying journey effortless. We also offer industry-leading crypto custody with minute-by-minute internal audits to guarantee the safety of your assets.

I hope you have enjoyed this week’s read, if you would like more information on opening a trading account, please feel free to reach out.

Regards,

Head, Fixed Interest and Superannuation

JMP Securities

Level 1, Harbourside West, Stanley Esplanade

Port Moresby, Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814