23 October, 2023

Hello and welcome to this week’s JMP Report

On the equity front last week, we saw 4 stocks trade. BSP traded 2,433, closing 4t higher at K13.50, KSL traded 180,000 shares, closing 9 toea higher at K2.50, STO traded 452 shares closing steady at K19.22 and CPL traded 92,938 shares, closing 9t lower at K0.70.

WEEKLY MARKET REPORT | 16 October, 2023 – 20 October, 2023

| STOCK | QUANTITY | CLOSING PRICE | CHANGE | % CHANGE | 2022 FINAL DIV | 2023 INTERIM | YIELD % | EX-DATE | RECORD DATE | PAYMENT DATE | DRP | MARKET CAP |

| BSP | 2,433 | 13.50 | 0.04 | 0.30 | K1.4000 | K0.370 | 13.33 | FRI 22 SEPT 2023 | MON 25 SEPT 2023 | FRI 13 OCT 2023 | NO | 5,317,971,001 |

| KSL | 180,000 | 2.50 | 0.09 | 3.60 | K0.1610 | K0.097 | 10.75 | WED 6 SEPT 2023 | THU 7 SEPT 2023 | THU 5 OCT 2023 | NO | 64,817,259 |

| STO | 452 | 19.22 | – | 0.00 | K0.5310 | K0.314 | 4.42 | MON 28 AUG 2023 | TUE 29 AUG 2023 | THU 28 SEPT 2023 | – | – |

| KAM | 0 | 0.90 | – | 0.00 | – | K0.12 | 13.33 | TUE 19 SEP 2023 | WED 20 SEP 2023 | THU 19 SEP 2023 | YES | 49,891,306 |

| NCM | 0 | 75.00 | – | 0.00 | USD$1.23 | K0.719 | 2.60 | FRI 18 AUG 2023 | MON 21 AUG 2023 | MON 18 SEPT 2023 | – | 33,774,150 |

| NGP | 0 | 0.69 | – | 0.00 | – | K0.0.3 | 5.80 | FRI 6 OCT 2023 | WED 11 OCT 2023 | WED 1 NOV 2023 | – | 32,123,490 |

| CCP | 0 | 2.05 | – | 0.00 | K0.123 | K0.110 | 11.51 | FRI 24 MAR 2023 | WED 29 MAR 2023 | FRI 5 MAY 2023 | YES | 569,672,964 |

| CPL | 92,938 | 0.70 | -0.09 | -12.86 | – | – |

– |

WED 22 MAR 2023 | THU 30 MAR 2023 | THU 30 JUL 2023 | – | 195,964,015 |

Dual listed PNGX/ASX

BFL – 5.20 -5c

KSL – 0.765 -.05c

NCM – 24.81 -1.19

STO – 8.00 +36C

JMP Order Book

We start the week nett buyers BSP, KSL, STO

On the interest rate front

In the TBill market this week we saw some shorter paper issued, with 182day paper averaging 1.63%, 273day paper 2.28% and 364day paper averaging 3.27%, up from 3.20%. I would expect yields to weaken a little further this week.

There has been no GIS auction announcement this week.

Other assets we watch

Natural Gas – 2.90 +34c

Silver – 23.90 –1.00

Platinum – 903.60 – +116.60

Bitcoin – 29,831 +9.69%

Ethereum – 1637 +5%

PAX Gold – 1966 +2.3%

What we’ve been reading this week

The threat of higher oil and petrol prices flowing from the war in Israel

Dr Shane Oliver – Head of Investment Strategy and Economics and Chief Economist, AMP Investments

Key points

– The war in Israel has added to the upside risks to oil prices and downside risks to shares in the near term.

– If Iran stays out of the conflict & a major supply disruption is avoided the impact on shares should ultimately be minimal.

– If alternatively, oil prices do have a renewed surge it’s more likely to be deflationary as it will act as a “tax on spending”. So central banks, including the RBA, should look through it.

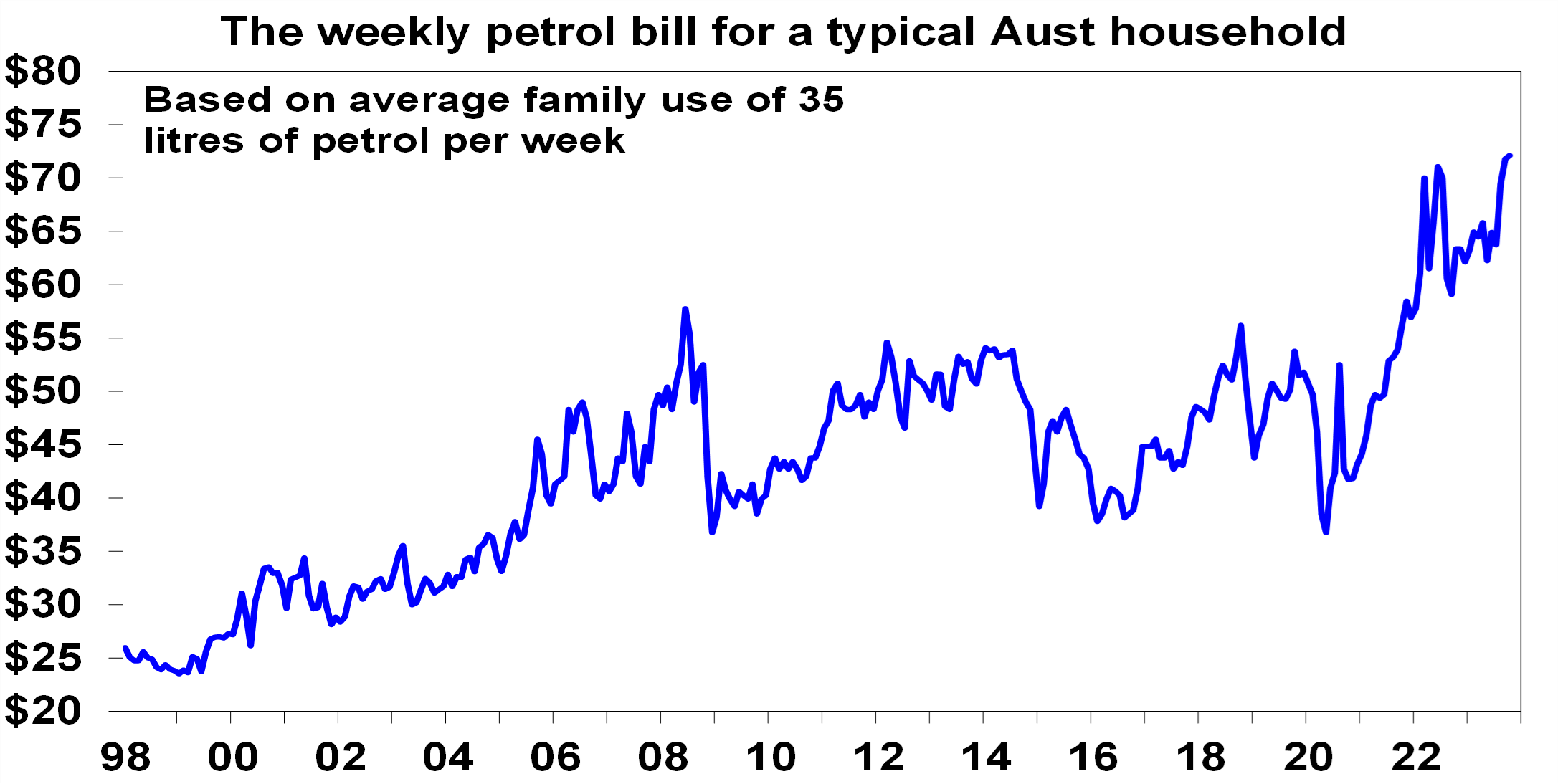

– The rise in petrol prices has already added $12 a week to the average household fuel bill in Australia since May.

Introduction

The war in Israel is terrible from a humanitarian perspective. From an economic and investment perspective the concern is that it will lead to a surge in oil prices that will add to inflation, keep interest rates higher for longer and add to the risk of recession. This note looks at the main issues.

Oil prices were already up

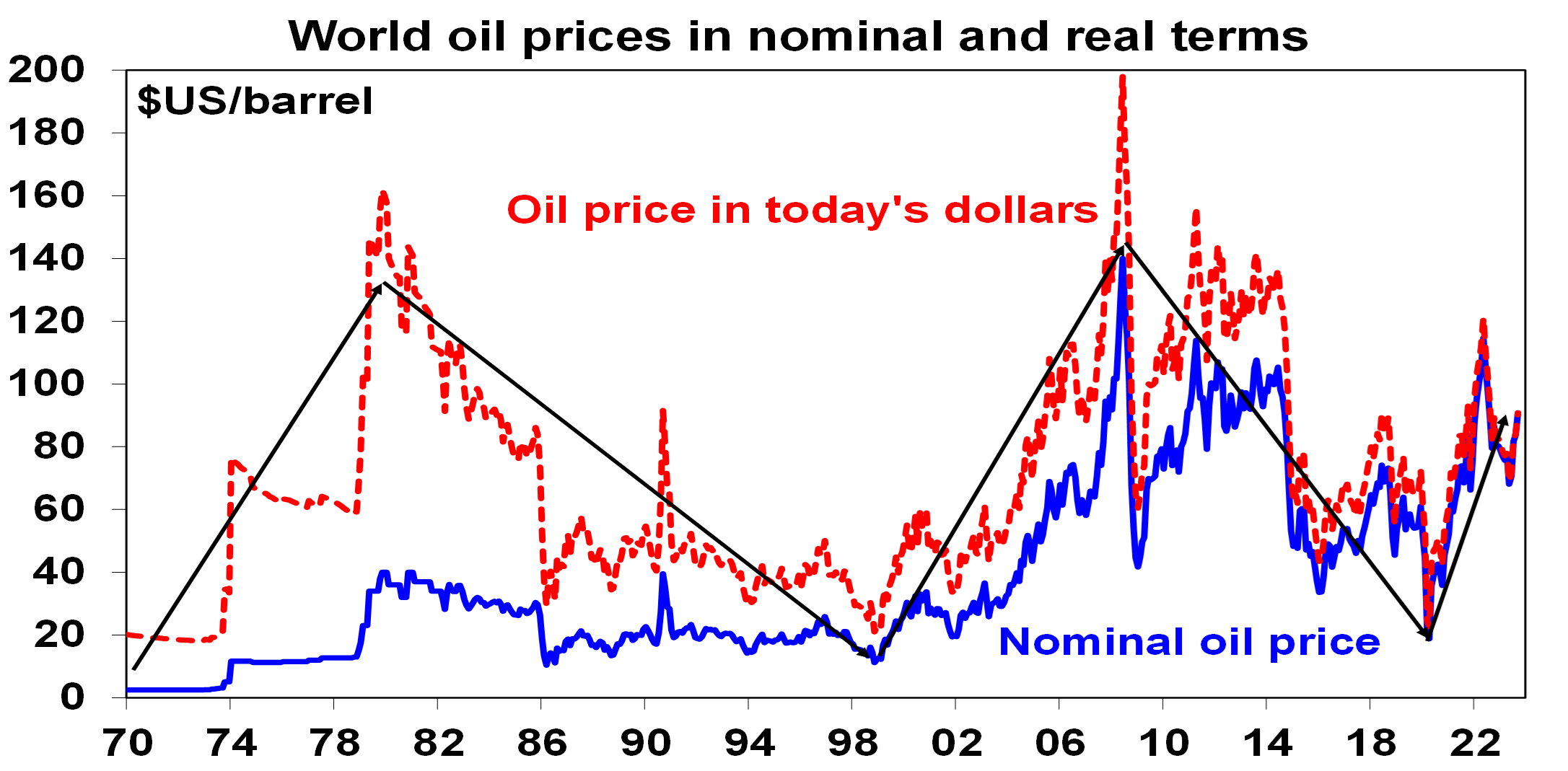

So far, the impact on oil prices has been modest with oil prices up about $US4 a barrel to around $US0.87 for West Texas Intermediate since Hamas’ attack on Israel. However, it comes at a time when oil prices had already reversed a large part of their fall into June to just below $US70 a barrel post their rise last year to a high of $US123.7 on the back of the invasion of Ukraine, which was their highest since 2008 when they peaked at $US145. For context, the next chart shows world oil prices since 1970 both in nominal terms (blue line) and after adjusting for inflation (red line). Oil prices are currently high in nominal terms, particularly compared to pandemic lows but in line with their range since the mid-2000s. In real terms they are below the highs reached in the second oil crisis in 1979.

Source: Bloomberg, AMP

The rebound in oil prices since mid-year reflected a combination of:

- production cutbacks by Saudi Arabia and Russia;

- the risk of more to come with Russia keen to punish the West;

- low inventory levels; and

- global oil demand holding up better than feared.

And the fear is that the latest conflict in Israel will send prices even higher.

Oil prices and conflicts in Israel & the Middle East

Since Hamas’ attacks share markets are little changed to up slightly and the $US4/barrel rise in the oil price is consistent with normal volatility. So why aren’t markets more concerned? Surely any conflict in the Middle East is bad via higher oil prices? Well, not necessarily – as it depends on whether global oil supplies are significantly impacted or not.

- The first global oil shock in 1973 came with the Arab/Israeli war that saw many Arab countries against Israel and saw OPEC boycott oil supplies to the US which drove a fourfold increase in world oil prices.

- The second oil shock in 1979 came as the Iranian revolution saw its oil production collapse and resulted in a threefold increase in oil prices.

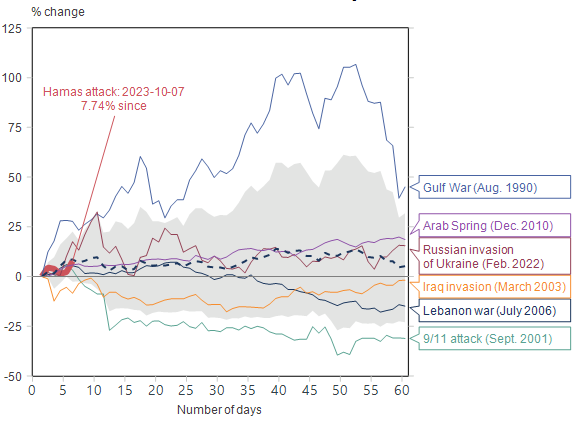

- Since then its been more mixed: the first Gulf War in 1990-91 (which saw Iraq invade Kuwait and a coalition led by the US dislodge it) saw a spike in oil prices but it was brief; the second Gulf War in 2003 (which saw the invasion of Iraq) had little impact; and the war in Lebanon (2006), Arab Spring (from December 2010), war in Syria & numerous flare ups in the Israeli/Palestinian conflict have had little impact.

Oil prices and various geopolitical events since 1990

Source: Macrobond, AMP

The key is whether oil supplies from major producers in the Middle East are impacted. Israel along with Lebanon & Syria are not big oil producers. And this is not a re-run of the 1973 conflict – now Arab countries are on the sidelines with many having better relations with Israel. In fact, the timing of Hamas’ actions looks motivated to prevent progress towards a Saudi/Israeli security pact which could have further isolated them & Iran.

The main risk is if Iran, which backs Hamas and Hezbollah in Lebanon, is drawn into the war which could threaten its oil production (2.5% of global consumption), the flow of oil through the Strait of Hormuz (through which 20% of world oil flows) or even Saudi production (as Iran did in 2019).

Scenarios

One can’t discount the possibility that Israel doesn’t take the bait and holds its fire to avoid giving Hamas the overreaction it’s hoping for – we will know pretty soon. But our base case (with 70% probability) is that the conflict is limited to Israel/Hamas in Gaza and with some expansion to include Hezbollah in Lebanon and maybe other groups in Syria (with Iran supporting its proxies but not getting directly involved). This would cause bouts of uncertainty in investment markets as the war escalates and expands but not enough to significantly threaten oil supplies.

- The US will likely want to avoid bringing Iran directly into the conflict until after next year’s election (in order to avoid a surge in oil prices) & Israel may not want to open another front or to put the US offside.

However, while it’s not our base case the risk of Iran becoming directly involved is significant and can’t be ignored. Iran’s backing of Hamas and its nuclear weapons breakout capability mean Israel has a strong incentive to attack Iran at some point (as does the US after the next election) resulting in a greater threat to world oil supplies. If this occurred, it could conceivably push oil prices above $US150. So, it’s something to keep a close eye on. And even if Iran does not directly become involved the risk of a further cut in Russian oil production (which accounts for about 10.5% of global oil production) is high given its desire to punish the West for supporting Ukraine. So, the risk of a further rise in oil prices is high.

Impact of higher oil prices on the global economy

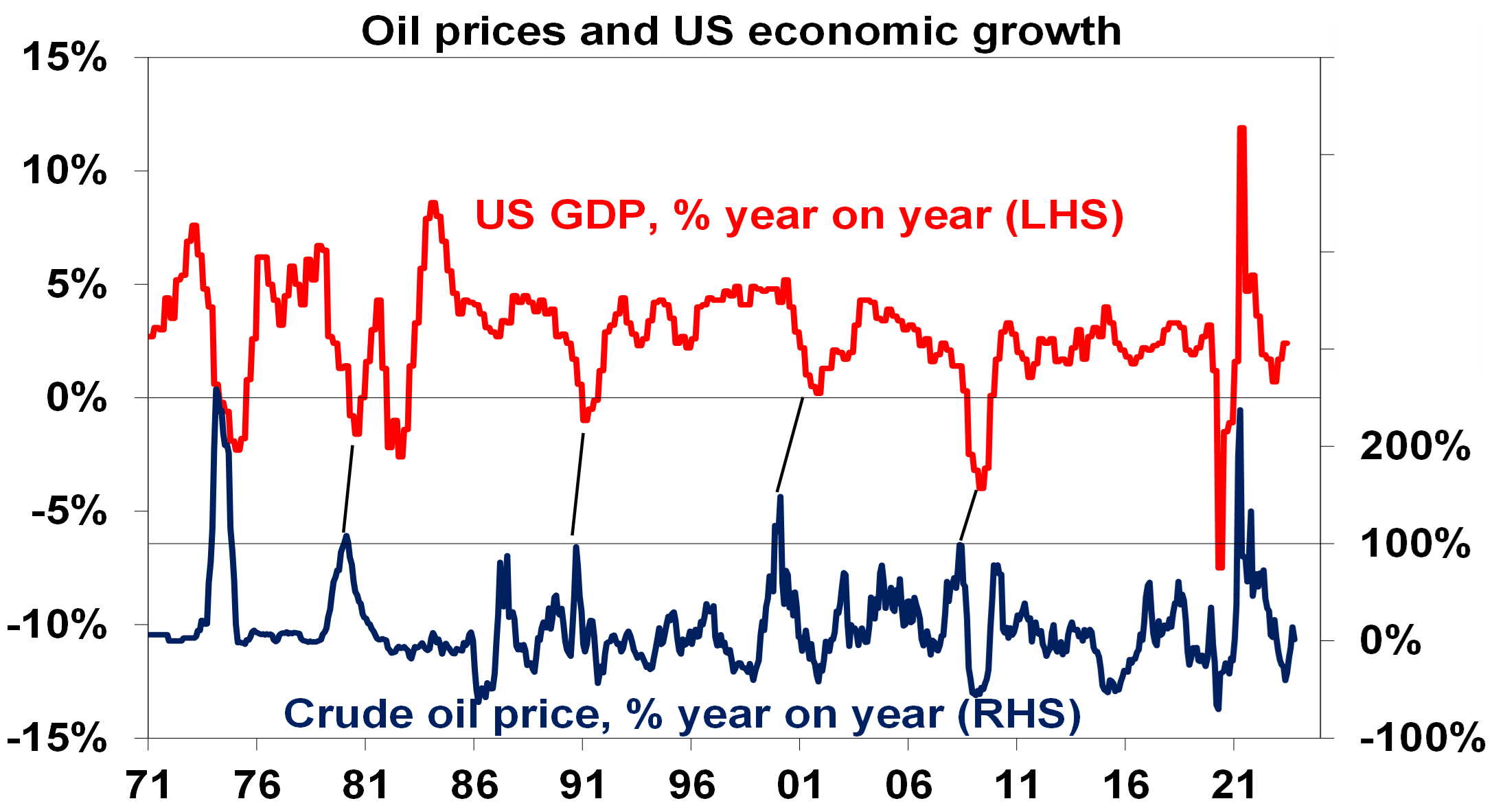

Given upside risks to oil prices its worth considering what this might mean for the global and Australian economies with many fearing it will add to inflation keeping interest rates higher for longer. But it’s not that simple. Past oil price surges have played a role in US & global downturns – in the mid-1970s, the early 1980s, the early 1990s, early 2000s and even the GFC. See the next chart. They weren’t necessarily the driver of these recessions as other factors (like tight monetary policy, the tech wreck of 2000 and the US housing downturn prior to the GFC) often played a much bigger role. But they made things worse because a rise in energy prices is a tax on consumer spending which leads to lower spending power.

Note: the relationship between oil prices & GDP looks messy over 2020 and 2021 as oil prices crashed with the pandemic & then rebounded into 2021 but were still low. Source: Reuters, AMP

It’s not so much the oil price level that counts as its rate of change, as businesses and consumers get used to higher prices over time. Trouble often ensues if the oil price doubles over 12 months, ie goes above the 100% line on the right hand side axis of the last chart.

18 months ago, when oil prices surged into the Ukraine war, the impact was mainly inflationary reinforcing the need for central banks including the RBA to raise interest rates. Back then household budgets were strong, households wanted to spend with reopening, everything was going up in price and monetary policy was easy. Now all of that is reversed so a further surge in oil & petrol prices is more likely to be a “tax on spending” than a further boost to inflation and hence be deflationary which will make it very hard for higher fuel and transport costs to be passed on to consumers beyond the direct impact of the increased price of petrol. This means it mainly will add to the risk of recession. However, while it will ultimately depend on how high oil and hence petrol prices go there are some positives suggesting it may not be quite as negative as feared:

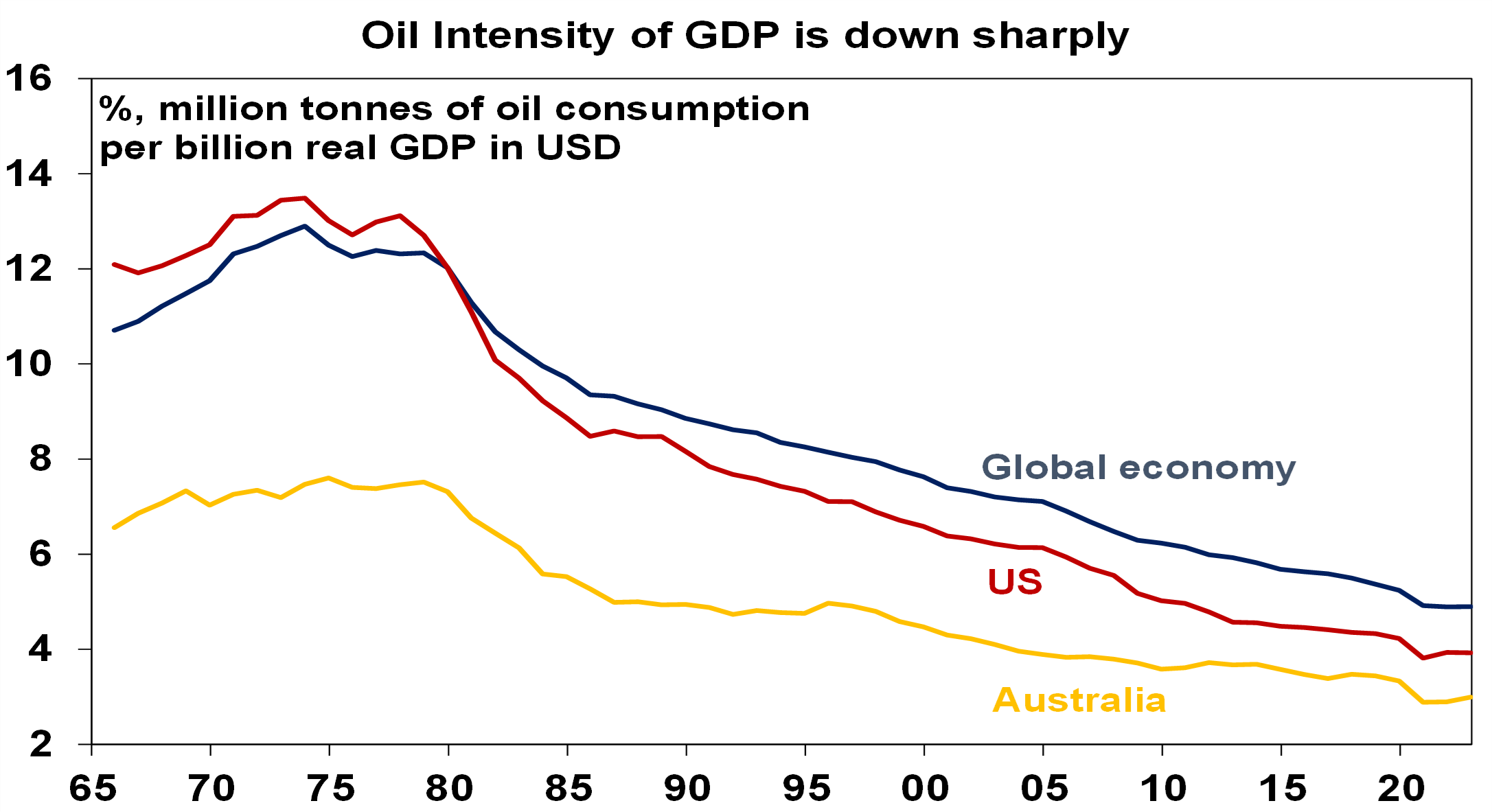

- First, the oil intensity of economic activity has been falling with energy efficiencies & the growth of the services sector. Compared to 1973 it’s down about 70% in the US & about 60% in Australia. So, the impact of an oil price surge today is less than it used to be. It will still hurt though.

Source: World Bank, Energy Institute, Bloomberg, AMP

- Secondly, we have not yet seen a doubling over 12 months in oil prices suggesting they have not yet at least gone up enough to cause a major hit to global growth. That said they are an additional negative.

Impact on Australia

Australian petrol prices track the Asian Tapis oil price in Australian dollars pretty closely. This is because our prices are largely set globally – to which is then added the GST, fuel excise, distribution costs and retailer margins. Current petrol prices already reflect current oil prices – although there is some scope of a fall if oil refinery margins fall. The rise in petrol prices will add around 0.3 percentage points directly to September quarter inflation and if sustained another 0.2 percentage points this quarter.

Source: Bloomberg, AMP

However, the rise in petrol prices since May has increased the typical Australian household’s weekly car fuel bill by about $12. With household budgets now stretched and the reopening boost behind us this likely means that $12 a week less is available for spending elsewhere, which in turn will likely reduce underlying inflation pressures and add to the risk of recession. And with other commodity prices being soft (unlike 18 months ago) there won’t be the additional boost to national income (and the Federal budget) that came with last year’s surge in oil prices.

So overall we would see any further surge in oil and petrol prices that may flow from events in the Middle East as being a further dampener on economic growth and underlying inflation. As such, the RBA should look through it rather than further increase interest rates.

Implications for investors

The war in Israel has added to the upside risks to oil prices and downside risks to shares in the near term. If Iran stays out of the conflict and a major supply disruption is avoided, the impact on shares on a 12-month view should be minimal.

10 tips to become a more resilient investor

Tony Featherstone

Consulting Editor of ASX Investor Update

Knowing how to handle occasional losses can help you stay in the market longer.

Key points

- Long-term investing is one of the keys to potential wealth creation.

- Investing for the long term requires navigating periods of high volatility.

- It also requires skills to understand and cope with some inevitable losses.

[Editor’s Note: This article provides general, educational information on investor resilience and dealing with occasional sharemarket losses. Every investor is different, so seek advice from a licensed financial adviser or do further research of your own before acting on themes in this article.]

The investment saying ‘time in the market is more important than timing the market’ is a beauty. It reinforces the power of long-term investing in shares.

Of course, long-term investing does not guarantee success. But more time in the market means more exposure to an asset class (Australian and global equities) that historically outperforms other major asset classes over time [1].

Time in the market requires resilience. That is, the fortitude to invest through occasional periods of stomach-churning volatility and portfolio losses.

Resilience is built on principles of sound investing, such as portfolio diversification, patience, conviction and a long-term focus. Investing resilience usually comes with experience and a few hard knocks along the way.

Resilience also depends on avoiding investment traps. Holding too few stocks, allocating too much capital to a stock position, overloading on debt to buy stocks, basing decisions on “hot tips”, and speculating can kill resilience. These traps usually mean less time in the market for an investor.

There’s also a personal side to investor resilience. How one views market volatility, deals with market noise and copes with occasional losses has a big say in how much time you spend in the market. It’s easy to give up after a few losses.

ASX Investor Update asked four professional investors for their view on resilience and investment losses. How do they learn from their mistakes and become stronger, more resilient investors over time?

The experts were Sebastian Evans of NAOS Asset Management; Will Riggall of Clime Investment Management; Hugh Dive of Atlas Funds Management; and Nathan Bell of Intelligent Investor.

We synthesised their views into 10 key insights:

- Know what a loss is

For many retail investors, losses are clearcut. You lose money when selling a share below its purchase price. But consider an investor who worries about a 10% fall in their portfolio in a year. Compared to the Australian sharemarket which fell 15% that year [2], the investor has outperformed the market, even though the absolute loss still hurts. In relative terms, they have won rather than lost.

When asked about losses, NAOS’ Sebastian Evans discusses missed opportunities – the stocks he considered buying but thought were too expensive, only to watch them increase many times in value. “When we look back on losses, it’s often about the stocks we didn’t buy because we underestimated how much that a quality, simple business can grow over time.”

Intelligent Investor’s Nathan Bell says “mistakes of omission” are the true portfolio killers. “The great stocks you don’t buy that go up 10 or 20 times outweigh the many poor decisions.”

The key is to measure your portfolio performance and compare it to an appropriate index, such as the S&P/ASX 200 Index for Australian shares. That way, you have more context to understand investment losses.

- Some losses are inevitable

Clime’s Will Riggall makes a telling point: “A fund manager who consistently gets 60% of their ideas right each year will have top-quartile performance. Put another way, even the best managers get many ideas wrong.” Atlas’ Hugh Dive says if 60% of stocks in your portfolio perform as expected, “you’re having a great year”.

Having realistic expectations about share investing helps build resilience. Every professional investor has at least a few “howlers” (stock ideas that crash) during their career. Sometimes, they research an idea from head to toe and still get it wrong. Having some losses during your “time in the market” is part of investing. Minimising and recovering from those losses is what matters.

Hugh Dive says every portfolio should have a few losers in it. “If every stock in there is a winner, it’s probably time to sell the portfolio. You need some stocks in there that are currently out-of-favour, undervalued and can recover.”

- Know your biases

Picture this: an investor buys a stock for $2, then watches it halve over the next few months after a profit downgrade. The investor resists selling, believing the stock will recover to $2. Their view is anchored to the past. Another investor refuses to sell because they have loss aversion. They avoid facts about the stock that contradict their opinion and seek facts that confirm it.

Will Riggall says too many investors base their investment strategy on hope after a stock falls. “They change their view on the stock and hope that it will recover, even though hope is not an investment strategy. The key is to understand your investing biases when a stock disappoints and know how to manage them.”

- Lose small, win big

An investor who has six winners and four losers in their portfolio in a year can still deliver attractive returns if the winners win more, and the losers lose less. In market parlance, this means “letting your winners run and cutting your losses early”. The trouble is, market volatility can leave some investors frozen with fear. When markets move quickly, their investing strategy is “hold and hope”.

Holding stocks through a period of losses (rather than crystallising losses by selling them) might be the right approach. So, too, could buying more of that stock if its valuation is more attractive after price falls. Another strategy might be to sell the stock early and minimise losses if something unexpected changes.

“The key is recognising when you’ve made a mistake on a stock and moving fast to cut it from your portfolio,” says Hugh Dive. “For me, investing is fundamentally about limiting losses and avoiding capital destruction. If you do that, you have more capital to allocate to good ideas and let those profits run.”

NAOS’s Sebastian Evans says investors often sell their winners too early, keeping losers in their portfolio in the hope that they will recover. “The result is a deteriorating portfolio performance because you’re holding stocks that others don’t want.”

- Do a pre-mortem

Some investors rarely consider what can go wrong with a stock upon buying it – only what can go right. Intelligent Investor’s Nathan Bell always does a “pre-mortem” before buying. “That way, you’ve considered all the risks and probabilities upfront, so they’re less of a surprise should they occur,” he says.

Doing a pre-mortem upfront can help investors imagine what could go wrong and how they would react. For example, an investor who buys a construction stock might decide the big risk could be a surprise earnings downgrade that is followed by another downgrade given that the business has high fixed costs. During the pre-mortem process, the investor knows how to react if that downgrade occurs.

- Know why a stock falls

Many investors view stocks in black-and-white terms. When the stock falls, they got it wrong. When it rises, they got it right. But as Clime’s Will Riggall notes, you can be right and wrong on a stock at the same time. “A stock might rally for reasons completely different to what you expected, which means your investment thesis was wrong. The same can be true when stocks fall.”

The key is understanding why the stock fell and comparing to why you bought it in the first place. For example, an investor buys a retail stock because they think it will grow by opening more stores. The retailer does just that, but its price falls 20% during a market sell-off. In this instance, the investor decides the loss is due to market volatility rather than changed company fundamentals, so buys more of the stock at a lower price.

Some investment losses can be due to market volatility, changing cyclical or structural industry conditions, deteriorating company fundamentals, large investors exiting the stock, or just plain bad luck. The loss might be more tolerable if you can pinpoint its source.

- Embrace volatility

Nobody likes watching the sharemarket tumble and their portfolio slump. Some retail investors panic and sell. Many retreat to the sidelines. Others take advantage of volatility to buy stocks at lower prices. They see the turbulence as akin to buying bargains in a department-store sale.

The key is understanding volatility and not confusing it with risk. Volatility denotes the size of changes in asset prices and is a measure of uncertainty. Risk is the chance of an investment’s return differing from an expected outcome. Volatility creates valuation anomalies when prices fall or rise too far due to sentiment.

Naos’ Sebastian Evans says some investors make bad decisions during market volatility. “They get extremely nervous and worry about their losses. But often during these times, you get to buy good companies at lower prices. If you invest for the long term, as we do, the volatility can create opportunity.”

- Commit to learning from mistakes

Atlas’ Hugh Dive says he learns far more from stock losers than the winners. “During their career, every fund manager gets some very hard lessons drummed into them, thanks to losing stocks. These can be really valuable insights that help you in the future, even though they are painful at the time.” Clime’s Will Riggall says learning from mistakes is the key to becoming a better investor. “You need to commit to learn from losses and embed those learnings into your process.”

This is not easy. Some investors want to forget about stocks that burn them. Others cannot rationally learn from the mistake because their judgment is clouded. They can’t extract value from losing ideas – the lifelong lessons that make them more resilient investors.

- Put emotion aside

Intelligent Investor’s Nathan Bell says the worst mistake is getting emotional about losses. “Research shows we feel losses twice as much as our wins, so it’s easy to lose confidence after a mistake and miss out on the next great opportunity.” Clime’s Will Riggall says the best way to “dust yourself off” after a loss is by looking at new opportunities. “Our team thinks about every dollar as a unit of capital we can allocate to any stock at any time. When you think about investing in terms of capital allocation, it frees up your thinking and reduces stress.”

Even great investors sometimes struggle to park their emotions when stock ideas turn sour. It’s natural to be elated when stocks rally and disappointed when they fall. The key is understanding your emotions and having portfolio processes, such as rules to allocate money to ideas (position sizing) or pre-determined points to minimise losses (stop-loss levels), that reduce the effect of emotions.

- Seek help if gets too bad

Investment maxims about “time in the market” and “cutting losses early” sound great on paper. But all the investment information in the world might not help someone who loses a significant amount of capital they cannot afford. For some people, intense market volatility and heavy stock losses can create ongoing financial stress that damages their physical and/or mental health.

If you are struggling with stress from investment losses, seek help from medical professionals or through national mental-health helplines and other support groups. The National Debt Helpline, for example, provides free and confidential financial counseling.

————–

[1] The 2023 Vanguard Index Chart report found US had the highest average return, followed by Australian shares, over FY1994 to FY2023, of all major asset classes.

[2] As measured by the S&P/ASX 200 Accumulation Index (which includes dividends)

ABOUT THE AUTHOR

Tony Featherstone, Consulting Editor of ASX Investor Update

Tony Featherstone is Consulting Editor of ASX Investor Update and a former managing editor of BRW, Shares, Personal Investor, CFO and Asset magazines. The views expressed in this article might not necessarily reflect those of ASX.

DISCLAIMER

The information in this article should not be considered financial-product advice or investment advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 30 September 2023.

Australia signs on to United Nations’ High Seas Treaty to give world’s oceans protection from pollution, environmental damage

By Brianna Morris-Grant

By Brianna Morris-Grant

The new treaty is landmark moment for marine conservation. (Supplied: Citizens of the Great Barrier Reef)

Australia has signed a landmark treaty to give two-thirds of the world’s oceans a “fighting chance” at surviving over-fishing and pollution.

Key points:

- The High Seas Treaty was agreed to in March after a 36-hour marathon final negotiation

- It applies to areas of the ocean outside the 200 nautical mile jurisdiction of each country

- UN Secretary-General Antonio Guterres says it gives the ocean “a fighting chance”

The United Nations’ High Seas Treaty is designed to extend environmental protections to oceans not officially owned by any country.

Foreign Affairs Minister Penny Wong announced Australia had signed on at the UN General Assembly in New York.

She said Australia was working to bring the treaty “into force as soon as possible”.

“We have worked alongside our Pacific partners to make this treaty a reality, safeguarding our Blue Pacific for future generations,” she said.

The agreement, officially the Conservation and Sustainable Use of Marine Biodiversity of Areas Beyond National Jurisdiction (BBNJ) Treaty, was reached in March after a 36-hour final negotiation.

It applies to areas of the ocean outside the 200 nautical miles (around 370km) economic zone surrounding each country.

The agreement was labelled a “historic breakthrough” when it was reached earlier this year.

What are the treaty’s man goals?

- Collection and sharing of marine genetic resources

- Area-based management tools, including establishing marine protected areas

- Environmental impact assessments to review potentially harmful projects outside national borders

- Capacity-building and technology transfer to support developing states

UN Secretary-General Antonio Guterres told UN members at the time: “The ocean is the lifeblood of our planet, and today, you have pumped new life and hope to give the ocean a fighting chance.”

Environment and Water Minister Tanya Plibersek said international cooperation to protect oceans was “crucial”.

“The high seas cover 60 per cent of the world’s surface and only about one per cent of these oceans is currently protected,” she said.

“This treaty will enable us to meet our global goal of protecting 30 per cent of our earth’s oceans.

“(It) allows us to establish marine parks in the high seas, leading to stronger protections for oceans around the world.”

I hope you have enjoyed this weeks read, if you would like to discuss your investment journey, please feel free to reach out.

Regards,

Head, Fixed Interest and Superannuation

JMP Securities

Level 1, Harbourside West, Stanley Esplanade

Port Moresby, Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814