22 April, 2024

Hello and welcome to this week’s JMP Report,

On the equity front we saw 4 stocks trade on the local market last week. BSP traded 1,629 shares, closing 5t higher at K16.20, KSL traded 118,823 shares, closing 2t higher at K2.92, KAM traded 800 shares, closing 5t higher at K1.20 and CCP traded 150,070 shares, closing 1t higher at K2.13.

WEEKLY MARKET REPORT | 14 April, 2024 – 18 April, 2024

| STOCK | QUANTITY | CLOSING PRICE | BID | OFFER | CHANGE | % CHANGE | 2023 INTERIM | 2023 FINAL DIV | YIELD % | EX-DATE | RECORD DATE | PAYMENT DATE | DRP |

| BSP | 3,812 | 16.20 | 16.20 | 16.30 | 0.05 | 0.31 | K0.370 | K1.060 | 8.87 | TUE 27 FEB 2024 | WED 28 FEB 2024 | FRI 22 MAR 2024 | NO |

| KSL | 118,823 | 2.92 | 2.92 | 2.99 | 0.02 | 0.68 | K0.097 | K0.159 | 8.82 | TUE 4 MAR 2024 | WED 6 MAR 2024 | MON 15 APR 2024 | PA |

| STO | – | 19.36 | 19.36 | – | – | 0.00 | K0.314 | K0.660 | 5.04 | MON 26 FEB 2024 | TUE 27 FEB 2024 | TUE 26 MAR 2024 | – |

| NEM | – | 145.00 | 145.00 | – | – | 0.00 | – | USD 0.250 | 0.63 | MON 4 MAR 2024 | TUE 5 MAR 2024 | WED 27 MAR 2024 | – |

| KAM | 800 | 1.20 | 1.20 | – | 0.05 | 4.17 | K0.12 | – | – | – | – | – | YES |

| NGP | – | 0.69 | 0.69 | – | – | 0.00 | K0.03 | – | – | – | – | – | – |

| CCP | 150,070 | 2.13 | 2.13 | – | 0.01 | 0.47 | K0.110 | K0.131 | 6.21 | FRI 22 MAR 2024 | WED 27 MAR 2024 | FRI 19 APR 2024 | NO |

| CPL | – | – | – | – | – | – | – |

– | – |

– | – | – | – |

| SST | – | 45.00 | 45.00 | 50.00 | – | 0.00 | K0.35 | K0.60* | 1.33 | – | – | – | NO |

Dual Listed PNGX/ASX Stocks

BFL – 5.77 -2c

KSL – 92c – 3c

NEM – 60.27 -18c

STO – 7.83 +2c

On the interest rate front we saw BPNG announce the next GIS auction which is scheduled for April 23. Maturities are from 2yr to 10yr. May be some value in the 2yr around the 4.3% area. I will provide the results in next week’s report.

There was a little more liquidity taken out of the market this week, increasing from 1.9bn to last week to 2.02bn this week. But the big surprise was the 364 day TBill results with rates blowing out 13bpts to 3.60% and the market was significantly undersubscribed by 146mill, almost 50% less than what was on offer. Lets see if the lack of liquidity flows through to the GIS auction this week

Other Assets we monitor

Gold – 2,390

Palladium – 1,030

Platinum – 934

Silver – 28

Coffee – 2.41

Bitcoin – 64,626 +1.45%

Ethereum – 3,153 +2.83%

What we have been reading

Oliver’s insights

Israel/Iran fears and rate cut uncertainty – shares are vulnerable to a bout of volatility but here’s five reasons why the trend will likely remain up

Dr Shane Oliver – Head of Investment Strategy and Economics and Chief Economist, AMP Investments

Key points

– After strong gains, shares are vulnerable to a pull back or more volatile/constrained returns than seen so far this year.

– The key threats at present are Iran’s attack on Israel which risks escalating the war in the Middle East, threatening oil supplies, and higher inflation delaying rate cuts.

– Ultimately, we see the trend remaining up for shares.

– The key for investors is to stick to an appropriate long term investment strategy. Trying to time markets is hard.

Introduction

From their lows last October, it has been relatively smooth sailing for shares – with US shares up 28%, global shares up 25% & Australian shares up 17% to recent highs. But the last few weeks have seen a rough patch with renewed concerns about interest rates and fears of an escalation in the war around Israel to include Iran (after Iran fired missiles & launched drones at Israel in retaliation for an attack on its consulate in Syria). The obvious issue is how vulnerable are shares? Could the bull market that got under way from the inflation and interest rate lows of 2022 (that has seen global shares rise 42% and Australian shares rise 23%) be over?

The worry list for shares

The bull market since the 2022 lows has been driven by optimism that inflation is falling enabling central banks to lower interest rates at the same time that economic growth has held up better than feared resulting in a sort of Goldilocks – not too hot and not too cold – scenario. But after such strong gains there is now a significant worry list for shares.

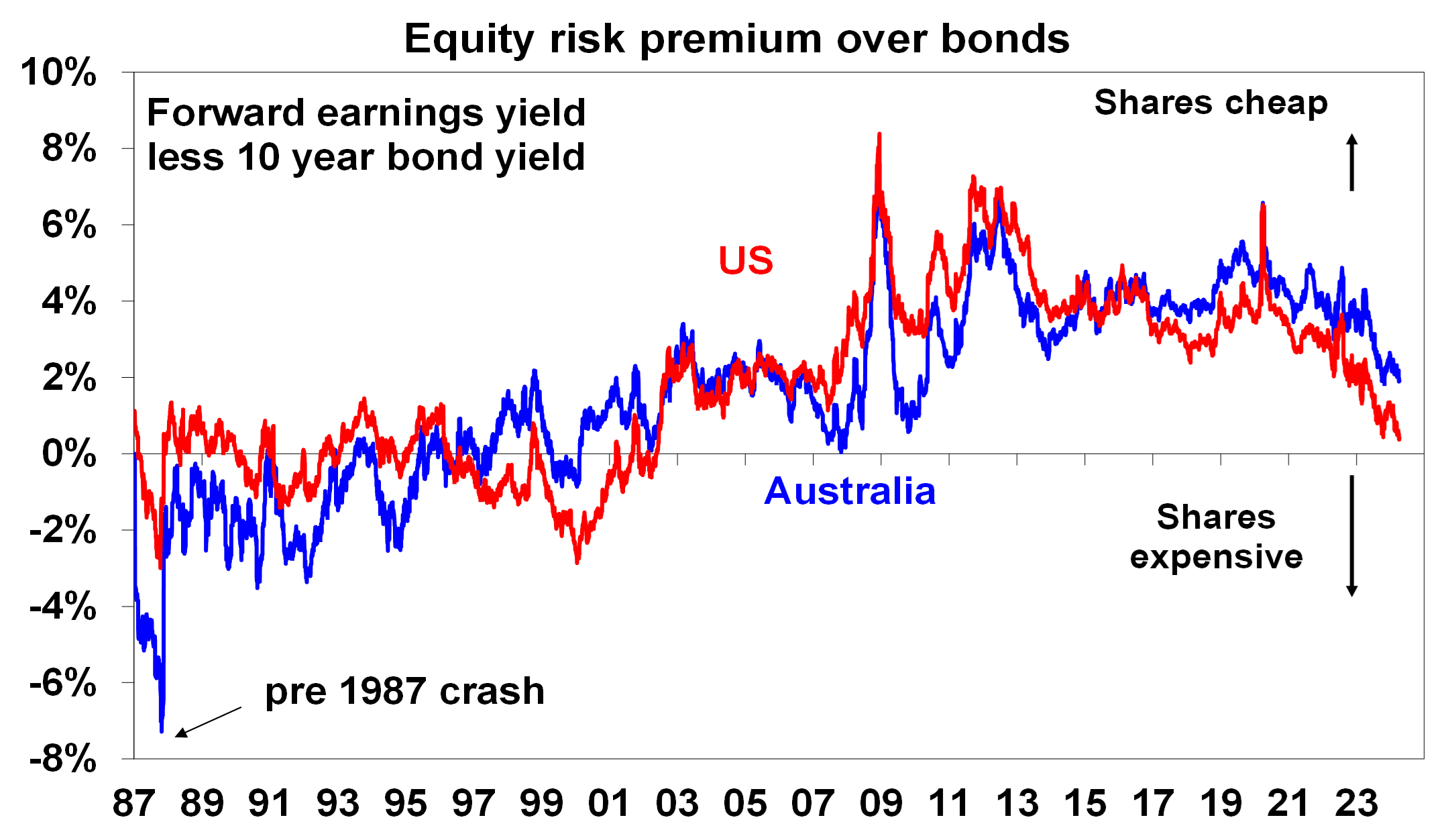

- First, share market valuations are stretched. The next chart shows that the risk premium offered by shares over bonds – proxied by the gap between forward earnings yields and 10-year bond yields – has fallen to its lowest since the early 2000s in the US. Australia is a bit more attractive, but the premium is still near the lowest since 2010.

Source: Bloomberg, AMP

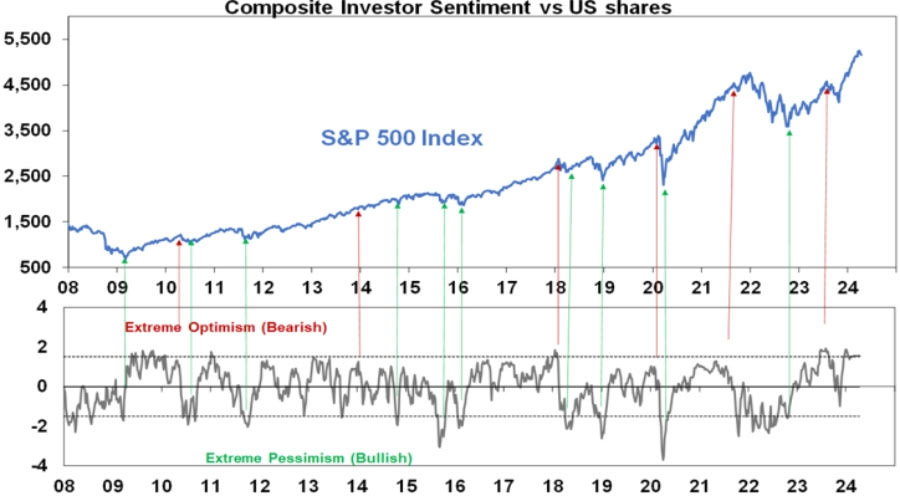

- Second, US investor sentiment is at levels that can warn of corrections (red arrows). It’s not a super reliable timing indicator but it is back to levels seen last July prior to the 10% fall in shares into October.

Sentiment index based on a composite of surveys of investors and investment advisers and options positioning.

Source: Bloomberg, AMP

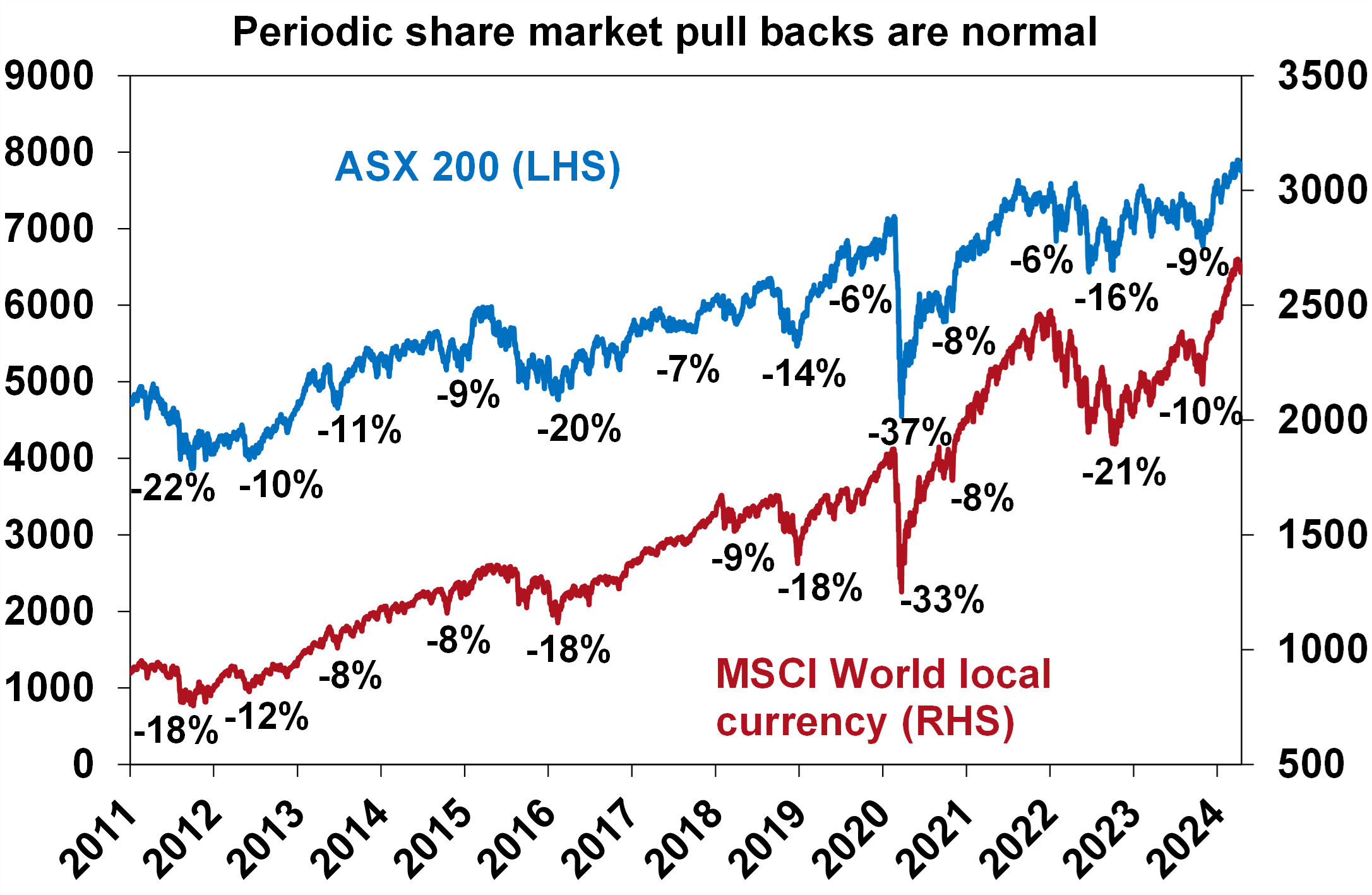

- Thirdly, after strong gains shares have become technically overbought, but it’s normal to have 5% plus pullbacks every so often.

Source: Bloomberg, AMP

Source: Bloomberg, AMP

- Fourth, uncertainty over when the Fed will start to cut rates has been increased by three worse than expected monthly CPI inflation results in a row as a result of sticky services inflation. This has seen money market expectations for 0.25% rate cuts this year scaled back from 7 starting in March this year to now less than two starting in September. And in Australia they have been scaled back from nearly three starting in June to no rate cut until late this year/early next.

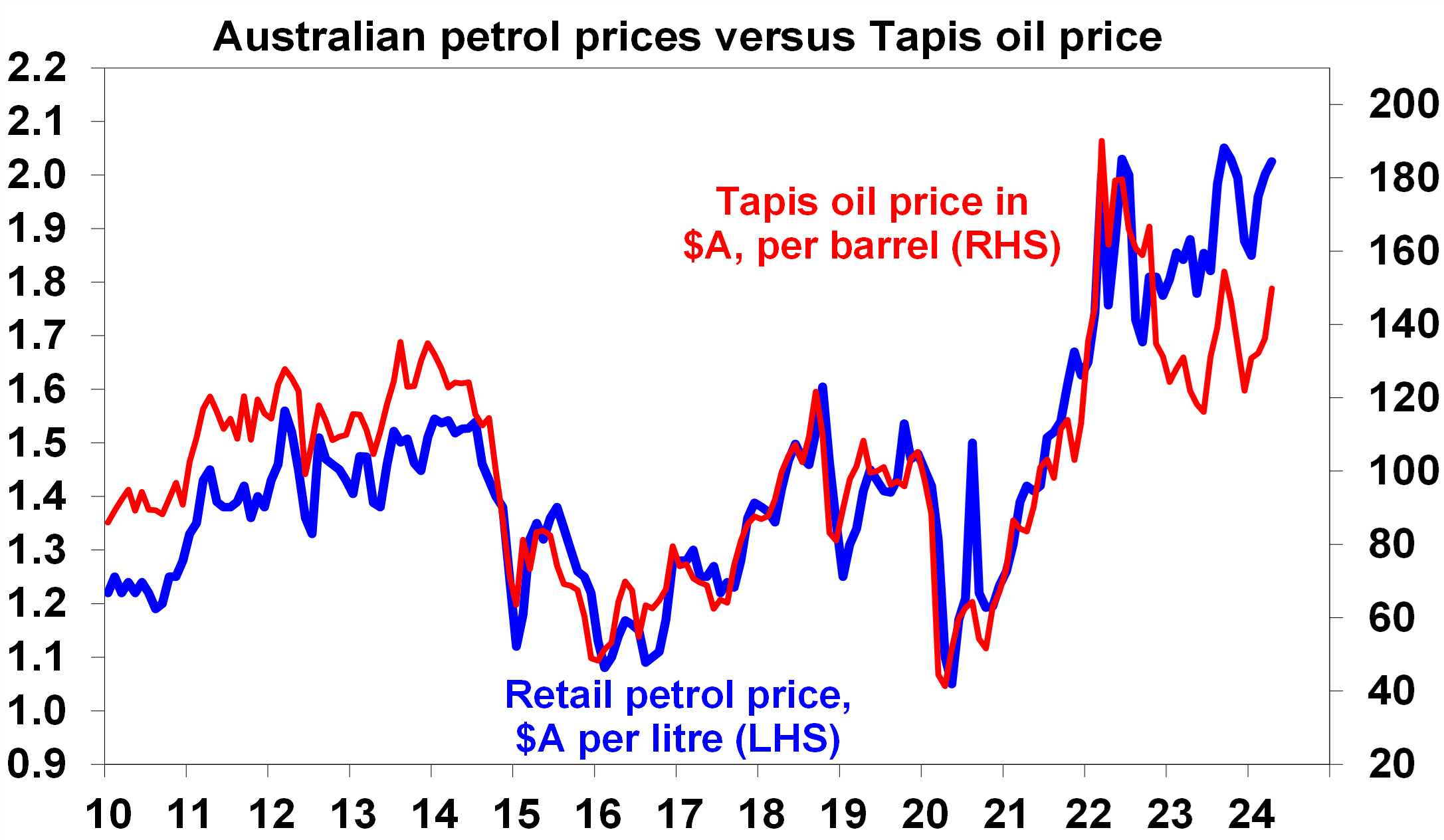

- Fifth, Iran’s retaliatory attack on Israel risks an escalation depending on how Israel responds. This would threaten Iran’s 3% of world oil production and the flow of oil through the Strait of Hormuz (through which roughly 20 million barrels a day or 20% of world oil production flows mainly enroute to Asia). Another sharp spike in oil prices would be a threat to the economic outlook as it could boost inflation again and risk adding to inflation expectations potentially resulting in higher than otherwise interest rates and act as a tax hike on consumers leaving less to spend on other things. Australian petrol prices are already around record levels despite oil prices still being well below their 2022 highs because of the rise in oil prices this year and wider refinery margins. A spike in world oil prices from around $US85/barrel for West Texas to around $US100/barrel would add around $15cents/litre to average Australian petrol prices and push the weekly household petrol bill in Australia to a record $76 up $10 a week from where it was a year ago. This would mean more than $500 less a year for the average family available to spend on other things.

Source: Bloomberg, AMP

Source: Bloomberg, AMP

- Sixth, the US presidential election threatens to cause volatility particularly if it looks like former President Trump will be returned. His policies to lower taxes would be taken positively by the US share market as they were in 2017, but his talk of raising tariffs (10% on all imports and 60% or more on Chinese imports) threatening higher inflation and an all out trade war would be negative. In his first term he went with tax cuts first (shares surged in 2017) then tariffs (shares slumped in 2018), but he may go with tariffs first if he wins this time.

- Finally, while the global economy has held up well, the risk of recession remains high as the full impact of the monetary tightening since 2022 continues to feed through as things like savings buffers built up through the pandemic are run down. Chinese growth also remains at risk given the ongoing weakness in its property sector.

In short, the combination of stretched valuations, high levels of investor optimism and technically overbought conditions leave shares potentially vulnerable to a further pull back. Geopolitical risks including events in the Middle East, delays to rate cuts and recession risks could provide a trigger.

Five reasons for optimism

However, while shares may be vulnerable a pull back and a period of increased volatility, several considerations suggest that the bull market will remain intact and the trend in shares will remain up.

First, US, global shares and Australian shares are still tracing out a pattern of rising lows and highs from 2022, which is still consistent with a bull market. Similarly, we have yet to see the sort of churning and a declining trend in the proportion of stocks making new highs that normally comes at major share market tops. And while many worry about a new tech bubble (and have done for years) the tech and AI centric stocks of today make real profits so Nasdaq’s PE is around 35 times, not the 100 times plus it was at the tech bubble high in 2000.

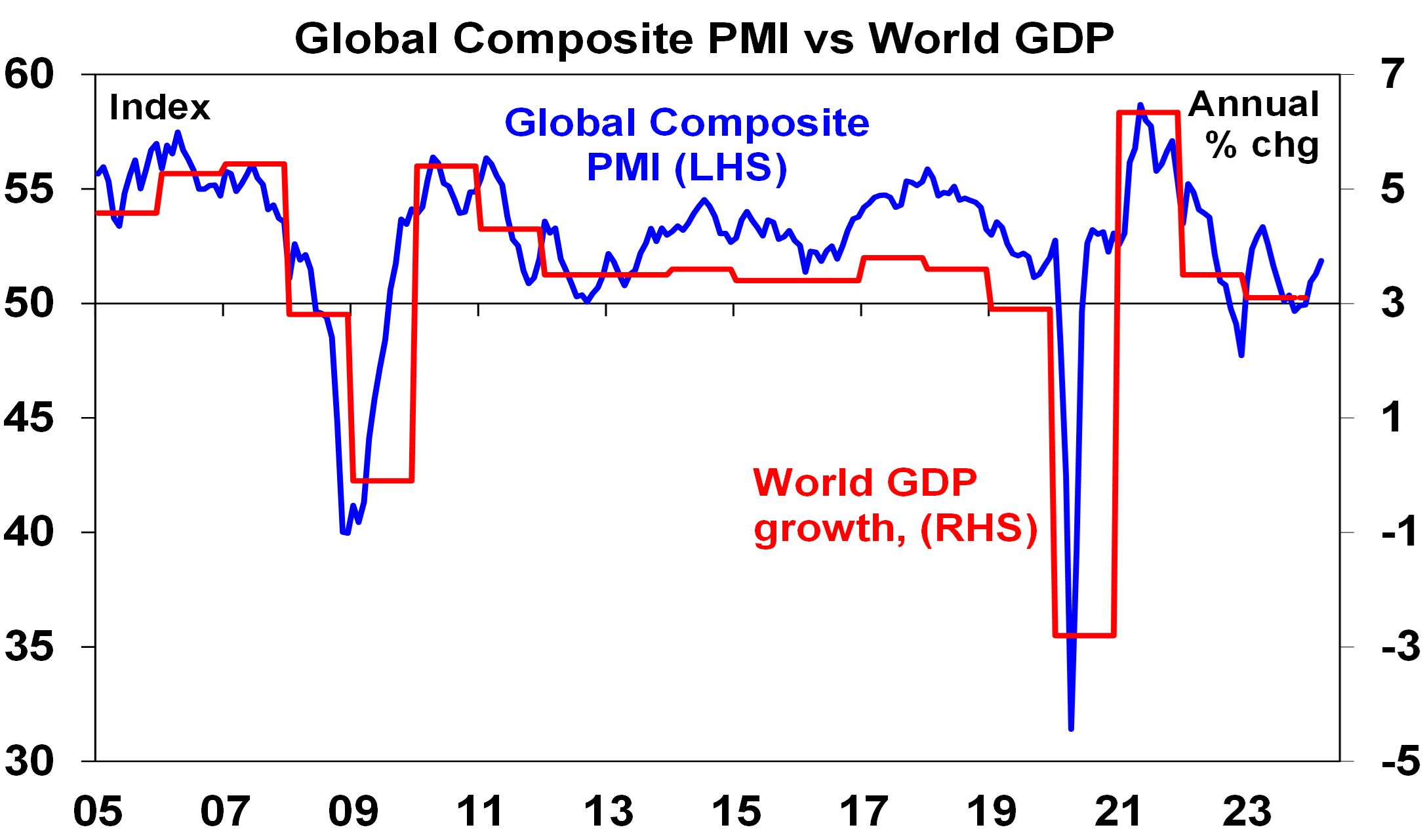

Second, while there are areas of weakness, global and Australian economic conditions generally continue to hold up far better than feared. In fact, business conditions according to purchasing manager surveys (PMIs) have improved recently. Consistent with this, profits have generally held up better than expected – while down slightly in Australia they have increased more than expected in the US and March quarter earnings results are likely to show a continuation of this.

Source: Bloomberg, AMP

Third, despite the relative resilience of economic activity inflation has fallen sharply globally (from highs around 8% to 11% to around 3%) and will likely keep falling allowing rate cuts. Although the US has proven a bit stickier in the last three months reflecting its stronger economy, inflation has continued to fall in other countries. And even in the US, cooling measures of labour market tightness are continuing to point to lower services inflation ahead. It’s a similar picture in Australia. So, while rate cuts have been delayed, they are still likely.

Fourth, while Chinese economic growth is not as strong as it used to be it seems to be hanging in there around 5% despite its property slump. While the iron ore price has recently fallen it remains in the same range it’s been in for the last two and a half years and well above many assumptions. Furthermore, the copper price appears to be breaking higher which is normally a sign of strength.

Finally, while geopolitical risks are high, they may not turn out the be as bad as feared – much as was the case last year:

- While the risk of an escalation between Israel and Iran is high – Iran’s retaliation to the attack on its Syrian consulate was similar to its response when General Soleimani was killed by the US in in 2020. It was well flagged, measured and there was minimal damage and designed not to provoke a bigger Israeli counter-retaliation. The US is also pressuring Israel to hold back and of course is motivated by trying to keep oil prices down in an election year. So far so good so markets have not gone into free fall and the oil price has not surged. Hopefully that remains the case, but there is a way to go yet.

- There is still a long way to go in the US election.

- It’s worth bearing in mind the response of shares to past geopolitical events. An analysis by Ned Davis Research on a range of crisis events back to WW2 shows an initial average 6% fall in US shares, but with shares up an average 6%, 9% and 15% over the subsequent 3, 6 and 12 months. Of course, there is a huge range around that!

Implications for investors

We remain of the view that shares will do okay this year as central banks ease. But given the long worry list, global and Australian shares are vulnerable to a correction or at least a more volatile and constrained ride than seen so far this year. For most investors though the key is to recognise that share market pullbacks are healthy and normal, it is very hard to time market moves and the best way to grow wealth is to adopt an appropriate long term investment strategy and stick to it.

Singapore Invests S$35 Million in Sustainable Finance Upskilling of Financial Sector

Mark Segal April 17, 2024

The Monetary Authority of Singapore (MAS), the central bank and financial regulator of Singapore, announced today that it will allocate S$35 million (USD$26 million) over the next three years to support upskilling and reskilling initiatives in order to develop sustainable finance specialists in the financial services sector.

The new investment announcement was made alongside the release by MAS and Institute of Banking and Finance (IBF) of the Sustainable Finance Jobs Transformation Map (JTM), a new study predicting that the sustainable finance market in the Association of Southeast Asian Nations (ASEAN) over the next decade will amount to S$4 to 5 trillion, spurring a major need to upskill the financial services workforce in order to seize these opportunities.

Mr Chia Der Jiun, Managing Director, MAS, said:

“ASEAN’s sizeable sustainable financing needs over the next decade present significant opportunities for Singapore’s financial centre to support the region’s transition to net zero. MAS is strongly supportive of efforts across financial institutions and the training providers to upskill the financial services sector workforce in a timely fashion. I encourage professionals to tap on the available support and deepen their sustainable finance capabilities to capture these opportunities.”

The new JTM study, conducted by KPMG in Singapore, and supported by Workforce Singapore (WSG), predicted that more than 50,000 financial services professionals are expected to see new sustainable finance-related tasks added to their jobs to a moderate to high degree, across a broad set of career tracks ranging from risk, compliance and product solutioning to sales, distribution and relationship management. New tasks for professionals could include the incorporation of sustainability risks into enterprise management systems, and structuring products to meet sustainable finance needs.

The study also highlighted 20 key job roles as high priority areas for upskilling, such as corporate banking relationship managers who will need knowledge of sectoral decarbonization pathways and sustainable finance instruments to identify and explain service offerings to clients, and portfolio managers, who will need sustainable investment management skills to construct investment portfolios meeting investors’ sustainability strategies and preferences. The study also predicted the emergence of entirely new roles, in areas including sustainability risk and strategy.

The new investment announcement follows the launch by MAS last year of the Finance for Net Zero (FiNZ) Action Plan, its series of strategies to mobilize financing aimed at catalyzing the net zero transition in Asia, and decarbonization activities in Singapore, which included targeted areas of action ranging from improving access to climate data to advancing disclosure by financial institutions, as well as building a workforce with sustainable finance skills and expertise as a key enabler.

MAS highlighted some of the key initiatives it will focus on through its investment to upskill and reskill the finance workforce, including expanding the suite of sustainable finance courses, with the development of two new undergraduate programmes focusing on sustainable finance, and plans to launch more than 65 new executive courses and a new executive masters in sustainable finance this year by institutes of higher learning, as well as the implementation of an IBF Skills Badge for industry professionals to recognize the acquisition of sustainable finance skills, and supporting skills-based hiring by employers.

Mr Alvin Tan, Minister of State, Ministry of Trade and Industry and Ministry of Culture, Community and Youth, and Board Member of MAS, said:

“If Singapore is to be Asia’s leading sustainable finance hub, we must equip our workforce to be ahead of complex and fast-evolving sustainable-finance related issues and opportunities.”

Do You Have a Traumatic Gold Injury?

Article by Martin Katusa | Chairman, Katusa Research

I’ll let you in on a market secret…

A few years ago, there was an entire generation of investors who placed their trust in precious metals stocks—and got decimated.

But the greatest toll it took wasn’t financial. It was the foundational trauma to their investing psyche.

The unfulfilled promises and brutal bear market they endured left a lasting scar. It’s not unlike childhood trauma, where the investors are unaware of its effect on their decision-making—and they couldn’t “fix” it even if they were.

So as gold starts to take off again, they’re running the opposite direction; freezing in fear; or fighting the investment thesis altogether.

“A gold breakout to all-time highs? That’ll never lead to anything good.”

“A gold breakout to all-time highs? Only a matter of time before it goes sideways and everyone loses money.”

No matter what data they see, or what they know to be true about gold, they won’t budge.

Here’s why. Profits were easy in 2020-2021—and Katusa Research subscribers were among the many who had several double – and triple-digit gains.

And they faithfully adhered to the rules and followed the wisdom passed down for centuries.

Then the gold market betrayed them.

When the storm hit—a bear market that ravaged portfolios and obliterated fortunes—precious metals investors’ faith was shattered. They were forsaken by the very asset that was supposed to be their safe haven.

And the severity of that negative experience severed the connection between ration and action.

So now, as gold reaches unprecedented heights, these once-bitten, forever-shy investors are staying on the sidelines.

Their anxiety of missing out is overpowered by permanent memory of the traumatic experience.

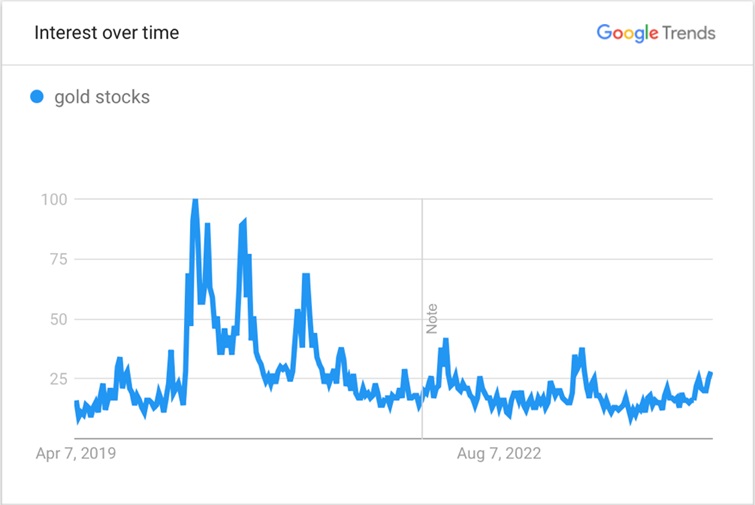

And it could cost them a fortune from missing out on the coming bull run in gold stocks.

You might ask: How do we know that’s what’s happening?

We have a front row seat data that others don’t have…

Katusa Research knows the number of research letters people subscribe to, as well as how they fluctuate based on what’s popular.

We see the sentiment levels in forums and are in contact with customer service teams. And we now how much money is raised every month in the private and public sectors.

As a rule, subscriptions, financings, and raises all go to all-time highs when a market is at its peak.

But the current market is breaking that rule. Here’s firsthand information you won’t find on Bloomberg or in the Wall Street Journal…

We are nowhere near the levels earlier this decade in the previous commodities bull market.

Traumatized investors no longer see new highs in gold as a strong indicator that gold stocks are ready to run. Instead, they see it as another prelude to a painful letdown.

Here’s more evidence, from the grandaddy of data itself:

As you can see, gold stocks aren’t anywhere close to the interest levels they held in 2020-2021—the last bull market.

Meanwhile gold itself has broken through – decisively – through its mid-2020 high.

But gold (and silver) stocks have yet to turn around—which means the runway this time is long.

For further information regarding this article, you can research Katusa Research

I hope you have enjoyed this weeks read, have a profitable week.

Regards,

Head, Fixed Interest and Superannuation

JMP Securities

a. Level 3, ADF Haus, Musgrave St., Port Moresby NCD Papua New Guinea

p. PO Box 2064, Port Moresby NCD Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814