29 April, 2024

Hello and welcome to this week’s JMP Report,

On the equity front last week we saw 4 stocks trade on the local market. BSP traded 293 shares, closing 10t higher at K16.30. KSL traded 21,407 shares, closing 3t higher at K2.95, STO traded 314 shares, closing 1t higher at K19.37 and CCP traded 15,000 shares, closing 2t higher K2.15.

WEEKLY MARKET REPORT | 22 April, 2024 – 26 April, 2024

| STOCK | QUANTITY | CLOSING PRICE | BID | OFFER | CHANGE | % CHANGE | 2023 INTERIM | 2023 FINAL DIV | YIELD % | EX-DATE | RECORD DATE | PAYMENT DATE | DRP |

| BSP | 293 | 16.30 | 16.30 | – | 0.10 | 0.61 | K0.370 | K1.060 | 8.87 | TUE 27 FEB 2024 | WED 28 FEB 2024 | FRI 22 MAR 2024 | NO |

| KSL | 21,407 | 2.95 | 2.92 | 2.95 | 0.03 | 1.02 | K0.097 | K0.159 | 8.82 | TUE 4 MAR 2024 | WED 6 MAR 2024 | MON 15 APR 2024 | YES |

| STO | 314 | 19.37 | 19.37 | – | 0.01 | 0.05 | K0.314 | K0.660 | 5.04 | MON 26 FEB 2024 | TUE 27 FEB 2024 | TUE 26 MAR 2024 | – |

| NEM | – | 145.00 | 145.00 | – | – | 0.00 | – | USD 0.250 | 0.63 | MON 4 MAR 2024 | TUE 5 MAR 2024 | WED 27 MAR 2024 | – |

| KAM | – | 1.20 | 1.20 | – | 0.05 | 4.17 | K0.12 | – | – | – | – | – | YES |

| NGP | – | 0.69 | – | – | – | 0.00 | K0.03 | – | – | – | – | – | – |

| CCP | 15,000 | 2.15 | 2.13 | – | 0.02 | 0.93 | K0.110 | K0.131 | 6.21 | FRI 22 MAR 2024 | WED 27 MAR 2024 | FRI 19 APR 2024 | NO |

| CPL | – | – | – | – | – | – | – |

– | – |

– | – | – | – |

| SST | – | 45.00 | – | 50.00 | – | 0.00 | K0.35 | K0.60* | 1.33 | WED 24 APR 2024 | FRI 26 APR 2024 | FRI 26 JULY 2024 | NO |

Dual Listed PNGX/ASX

BFL – 5.85 +8c

KSL – .925 +.5c

NEM – 65.7 +5.61

STO – 7.72 -11c

On the interest rate front we saw the 7 day Central Bank Bill auction volume drop to 1.7bn from 1.9bn, issuing at 2%.

In the 364 day TBill market we saw a further weakening of 10 bpts to average 3.7%. An interesting result, BPNG offered 243mill, they received 101mill in bids and issued 74mill, leaving the auction 141mill undersubscribed. This is indicating there was a fairly long tail in the bids which BPNG was not prepared to issue at but it has left the market considerably undersubscribed. I see further weakening in the yields this week, but we will need to see the Banks appetite to meet maturities and the need for new borrowing.

In the GIS auction we saw a mixed bag really, the auction was left undersubscribed by 200mill after 700mill was on offer. I noted last week that the only real value was in the 2yr and the result was an oversubscription in this maturity, averaging 4.30%. The yield curve has a 1.5% spread between the 2yr and the 10yr at 5.8%. Remember 364day TBills went through last week at 3.7%. The average for the results were within a close range of the coupon rates. I can see further weakening across the yield curve with the market easing their bids in the May auction.

Other Assets we like to monitor

Gold – 2,335 -$55

Palladium – 956 -$74

Platinum – 916 -$18

Silver – 27.18 -82c

Coffee – 2.33 -8c

Bitcoin – 62,890 -3.22%

Ethereum – 3,266 +3.70%

What we have been reading

FCA Proposes Anti-Greenwashing and Sustainability Disclosure Rules for Portfolio Managers

Mark Segal April 24, 2024

ESG REPORTING/ INVESTORS/ REGULATORS

The Financial Conduct Authority (FCA), the conduct regulator for financial services firms and financial markets in the UK, announced the launch of a consultation on a new proposal to extend its new Sustainability Disclosure Requirements (SDR), including rules aimed at helping investors assess the sustainability attributes of investment products, and to avoid greenwashing risk, to portfolio managers.

The proposal follows the release by the FCA of its SDR requirements for asset managers in November 2023, which included an anti-greenwashing rule for sustainability-related product claims, as well as rules for naming and marketing funds based on their sustainability characteristics, and for the use of a new sustainable investment product labelling regime.

While the initial SDR was developed primarily for retail investors, the new proposal would extend the requirements to firms that manage a group of investments for consumers, with a focus on wealth management services for individuals and model portfolios for retail investors, with the FCA noting that firms that offer portfolio management services to professional clients will not be subject to the naming and marketing requirements.

The initial SDR included an anti-greenwashing rule, ensuring claims about the environmental or social characteristics of financial products or services “are fair, clear, and not misleading, and consistent with the sustainability profile of the product or service,” as well as naming and marketing rules for investment products, requiring that sustainability-related terms can only be used in product names and marketing if a label is used, or if a label is not used, the product’s name accurately reflects the products characteristics, but without using terms such as ‘sustainable’, ‘sustainability’, or ‘impact.’

The labelling regime introduced four labels – including Sustainability Focus, Sustainability Improvers, Sustainability Impact, and Sustainability Mixed Goals – intended to help consumers to differentiate between the sustainability objectives and investment approaches of investment products, along with criteria for the use of each label.

Under the new proposal, portfolio managers would be subject to the new naming and marketing rule on December 2, 2024, the same date as asset managers, and would also be able to begin using the labels at the same time. Firms with assets under management greater than £50 billion would be required to begin providing product-level disclosures under the SDR from December 2025, and those with AUM greater than £5 billion from December 2026.

Alongside the new proposal, the FCA also released new guidance for firms to help meet the new rules. In its new finalized guidance, the FCA noted that it received feedback from stakeholders that was “broadly positive and supportive,” with the new document providing responses to the feedback, including clarifying the scope of the rule, adding examples of good practice, and confirming that the anti-greenwashing rule will come into effect at the end of May 2024.

Sacha Sadan, FCA’s Director of Environmental, Social and Governance, said:

“Confirming the new anti-greenwashing guidance and our proposals to extend the Sustainability Disclosure Requirements and investment labels regime are important milestones that maintain the UK’s place at the forefront of sustainable investment. Our good and poor practice anti-greenwashing examples will help firms market their products in the right way.”

EU Parliament Adopts Environmental, Human Rights Sustainability Due Diligence Law

ENVIRONMENT/ GOVERNMENT/ SOCIAL

Mark Segal April 24, 2024

Lawmakers in the European Parliament voted 374 to 235 to adopt the Corporate Sustainability Due Diligence Directive (CSDDD), a key piece of legislation setting mandatory obligations for companies to address their negative impacts on human rights and the environment, clearing a major hurdle towards the implementation of the new law, which came into significant doubt when an earlier version failed to gain approval by member states in the EU Council.

The revised CSDDD, which significantly scales back the number of companies covered by the law, and extends the timeline to full implementation, must now be formally approved by the Council before it can enter into force.

The adoption of the revised CSDDD by Parliament follows a four-year process to advance the regulation, beginning with studies by the European Commission in 2020 on directors’ duties and sustainable corporate governance and on due diligence requirements in the supply chain, leading to the Commission’s proposed CSDDD draft in February 2022, setting out obligations for companies to identify, assess, prevent, mitigate, address and remedy impacts on people and planet – ranging from child labor and slavery to pollution and emissions, deforestation and damage to ecosystems – in their upstream supply chain and some downstream activities such as distribution and recycling.

The law also requires companies to adopt transition plans to align their businesses with the Paris Agreement goal with limiting global warming to 1.5°C, and mandates member states to put in place supervisory authorities to investigate and impose penalties on non-complying firms.

After Parliament and Council had reached an agreement on the new legislation, sending the directive for final approval by each body, however, the approval vote in Council was postponed in January after Germany threatened to not support the regulation on concerns of the bureaucratic and potential legal impact it would have on companies, with its success then thrown into further doubt when Italy reportedly also subsequently pulled its support, ultimately failing to pass in late February after a last minute effort by France to significantly scale back the scope of the new rules to only the largest companies in the EU.

- Following some significant compromises on the legislation, member states in the Council finally approved the CSDDD last month. The revised CSDDD significantly scaled back the number of companies by raising the thresholds of those covered by the new legislation to 1,000 employees, up from 500, and to those with revenue greater than €450 million, up from €150 million. The new thresholds would cut back the number of companies in the scope of the CSDDD by roughly two thirds. Lower thresholds that had been in place for high-risk sectors were also removed, with the possibility to be reconsidered later.

Additional changes to the CSDDD included phasing in the legislation, beginning with companies with over 5,000 employees and revenue greater than €1.5 billion in 2027 followed by companies with more than 3,000 employees and €900 million revenues in 2028, and for all other companies in the scope of the law in 2029. The revised CSDDD also removed the requirement for companies to promote the implementation of climate transition plans through financial incentives.

Following the vote, lead MEP Lara Wolters said:

“Today’s vote is a milestone for responsible business conduct and a considerable step towards ending the exploitation of people and the planet by cowboy companies. This law is a hard-fought compromise and the result of many years of tough negotiations.”

Econosights: Does the Federal Reserve have to cut rates first?

Diana Mousina, Deputy Chief Economist, AMP

Key points

– The tightening in monetary policy in recent years has had a mixed impact on the major developed economies.

– Economic growth in Canada, New Zealand, the Eurozone and Australia (to a lesser extent) has slowed noticeably. In comparison, the US economy has held up better.

– Inflation has declined the most in Canada and the Eurozone and is at a level where central banks will start considering cutting interest rates over the next few months.

– The US economy is often seen as a leading indicator for the rest of the world, from impact to global economic growth and financial markets.

– But the Fed is unlikely to be the first major central bank to start cutting interest rates in this cycle, just as it wasn’t the first major bank to hike rates after the pandemic.

– Investors need to remember that domestic growth conditions are the primary factor behind a central bank’s decision on monetary policy.

Introduction

It is often thought that the US Federal Reserve Bank is the first to move interest rates in a tightening or loosening cycle. This perception is the result of a few reasons. The US is the largest economy in the world, so trends in the US economy are often seen as a leading indicator for the rest of the world. The large influence of the US economy through financial markets is also important, through the impact to all asset classes, particularly listed equities, bonds and currencies with the US dollar as the world’s principal reserve currency. In this Econosights we look at whether the US Federal Reserve will be the first major central bank to cut interest rates in this cycle.

Global central bank rate decisions

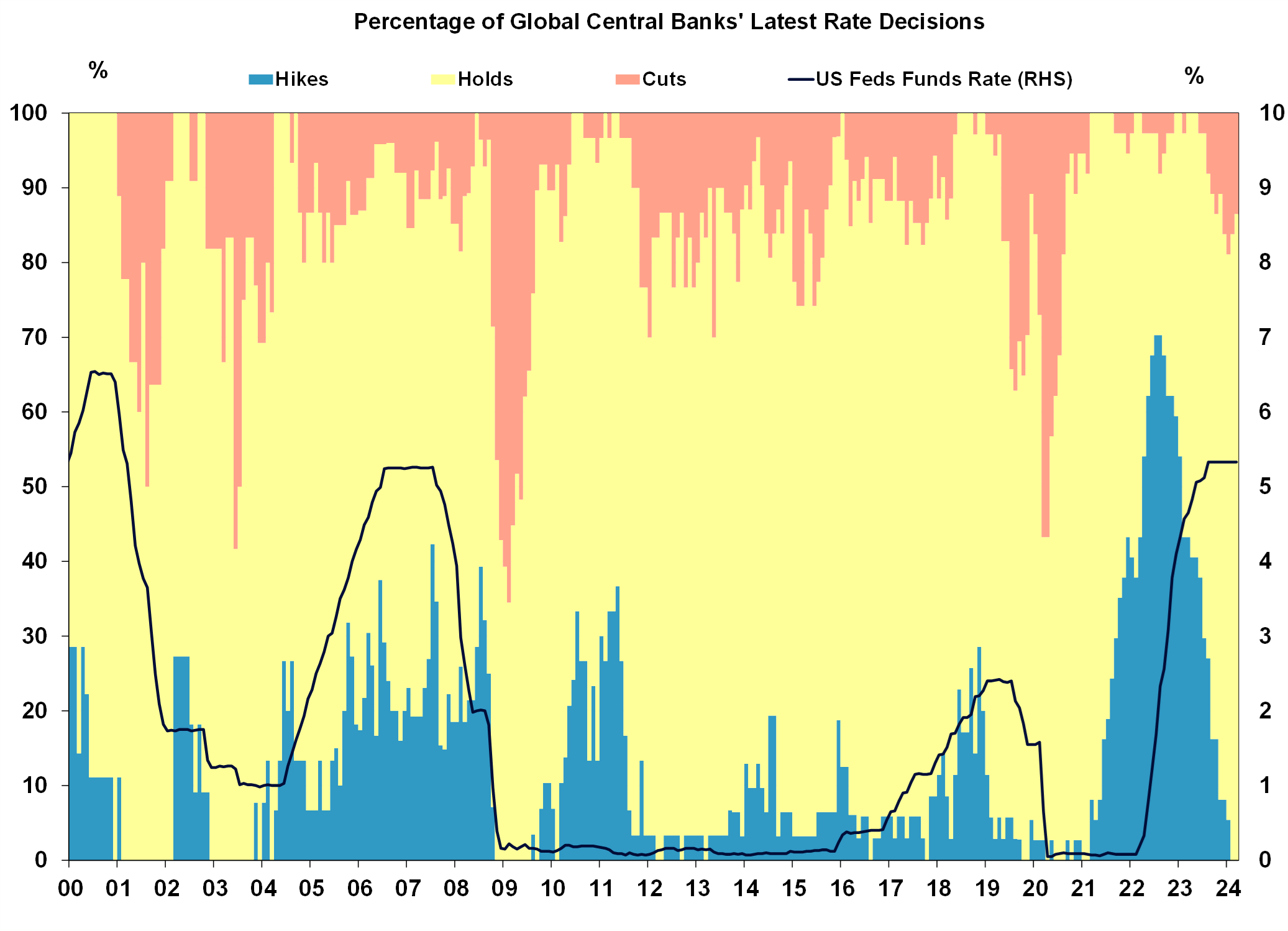

It’s important to remember that there are many central banks around the world apart from the 10 majors that most in the developed world focus on. Most major data agencies track the interest rate decisions for 37 central banks across the developed and emerging world. The next chart looks at the proportion of global central banks cutting and hiking interest rates and the movement in the US Fed Funds rate. It shows that in different cycles, the Fed hasn’t necessarily led the interest rate cycle. In the post-GFC period from 2011-2017 when a moderate chunk of central banks were hiking rates, the US was firmly on hold. In the post-COVID period of interest rate hikes, the Fed started hiking rates after the initial wave of hikes from other central banks had already started.

Source: Bloomberg, AMP

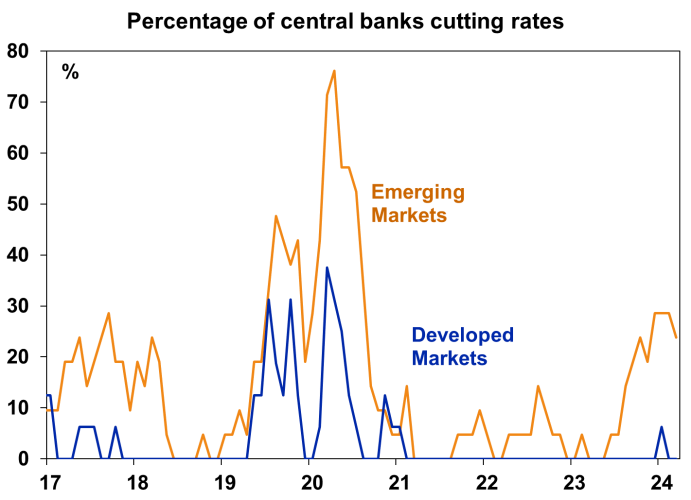

Often, emerging market central banks are the first to either hike or cut interest rates (and by larger amounts) because of higher volatility related to their currencies and to deal with capital inflow.

In the current cycle, most market commentators are talking about when interest rates will start to be reduced across the major developed economies. However, some emerging market central banks have already begun the process of loosening monetary policy (see the chart below).

Source: Bloomberg, AMP

The current cycle

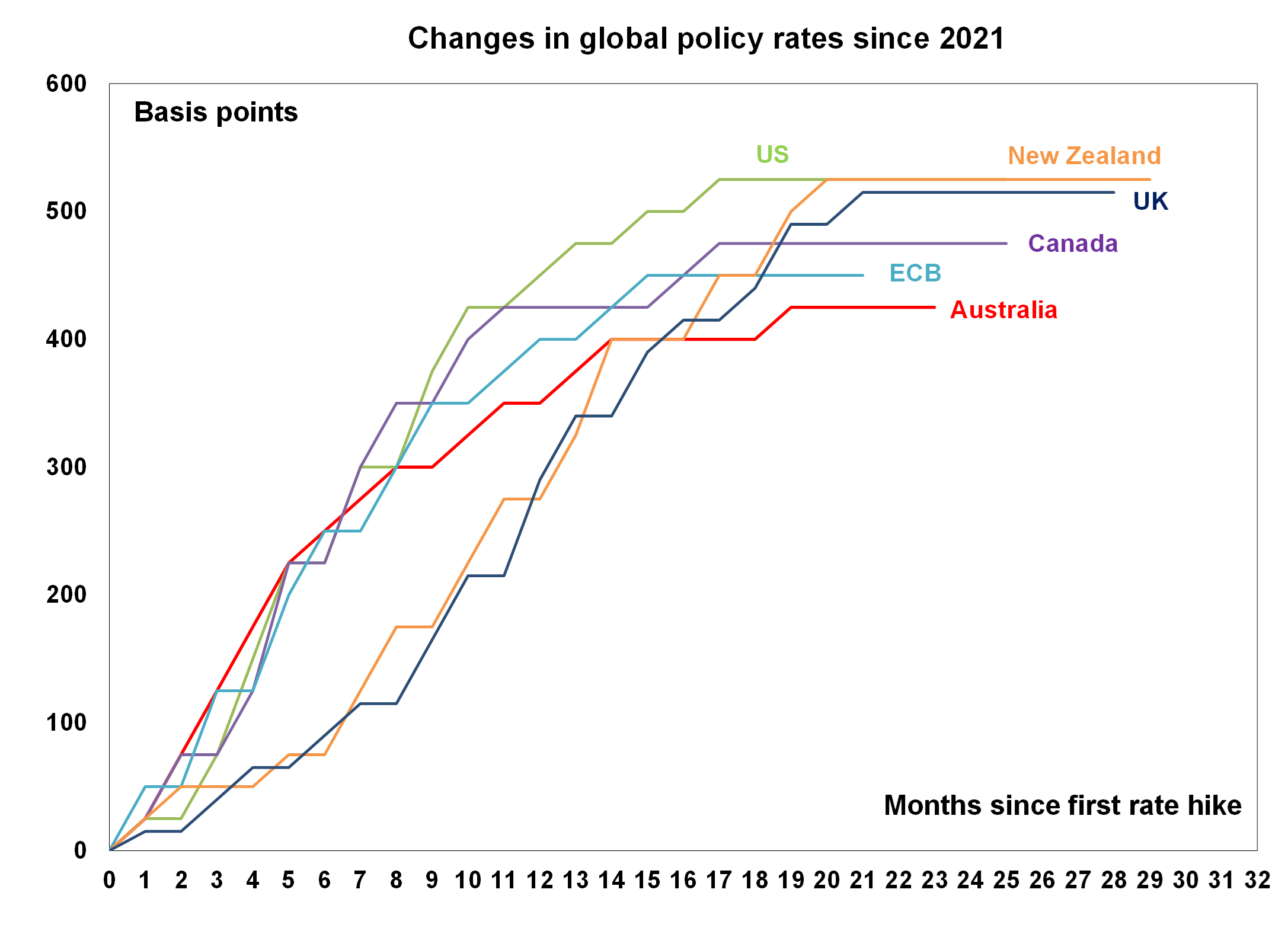

Since 2021, most major central banks that we track have increased their policy rates by 425 – 525 basis points (or 4.25-5.25% – see the next chart).

Source: Bloomberg, AMP

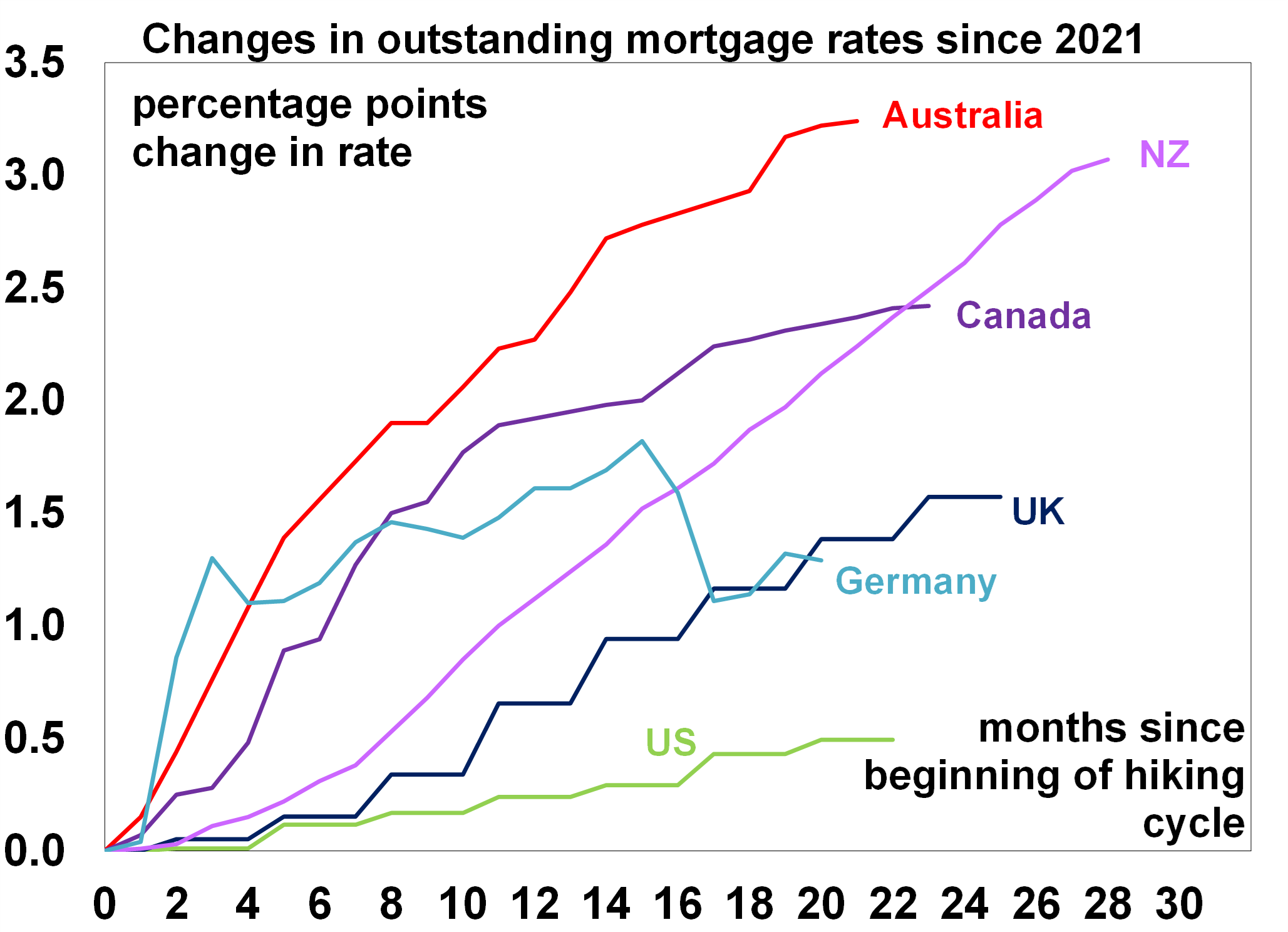

The impact on the economy from interest rate changes occurs through the pass-through to borrowing rates, both to businesses and households. In each economy, the pass-through of changes to borrowing rates has occurred at a different pace, depending on the structure of housing lending (including the length of fixed loans and share of fixed versus variable loans). The chart below looks at the changes in outstanding mortgage rates since 2021. Australia has had the largest increase in outstanding mortgage rates despite having the lowest increase in interest rates compared to its peers. In contrast, US outstanding mortgage rates have barely risen, despite having one of the largest increases in rates across the major central banks.

Source: Bloomberg, AMP

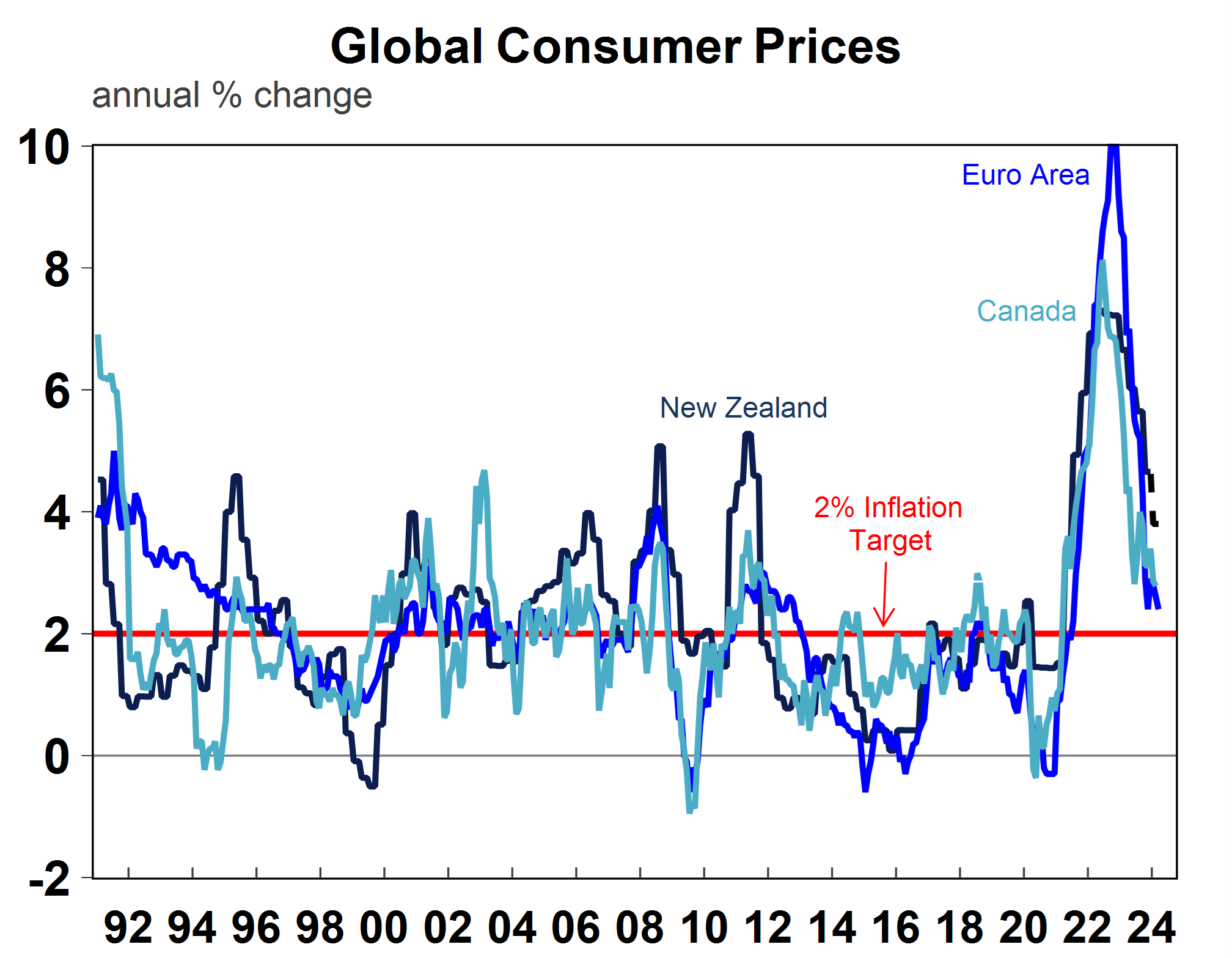

The three major economies that have seen the largest slowing in economic growth in the past year are Canada, New Zealand and the Eurozone. Canada and New Zealand have had some of the largest increases in outstanding mortgage rates across the major economies. And economic growth has clearly softened from the impact of higher rates. New Zealand GDP growth was negative in the second half of 2023 (a technical recession). Canada narrowly avoided a technical recession in the second half of 2023, but growth is low at under 1% per annum. While mortgage rates in the Eurozone have only increased moderately (using Germany as a proxy), Eurozone growth has been basically flat over 2022-23 from the impacts of high energy prices. Inflation has come down considerably in Canada and the Euro area, with headline consumer prices just above the 2% inflation target (see the next chart). Services inflation in New Zealand is still high, despite the slowing in economic growth.

Source: Macrobond, AMP

As a result, the Bank of Canada and the European Central Bank are likely to cut interest rates at their June meetings, ahead of the US Federal Reserve who are likely to delay the start of rate hikes until the second half of 2024 given the recent upside surprises to inflation. Lower inflation in New Zealand is needed before the Reserve Bank of New Zealand starts loosening monetary policy, which is likely by July or August. For Australia, we have been expecting the Reserve Bank of Australia (RBA) to start cutting rates in June but the risk is a later start to cuts (like in August) as the RBA appears reluctant to cut interest rates before further confirmation of a slowing in inflation.

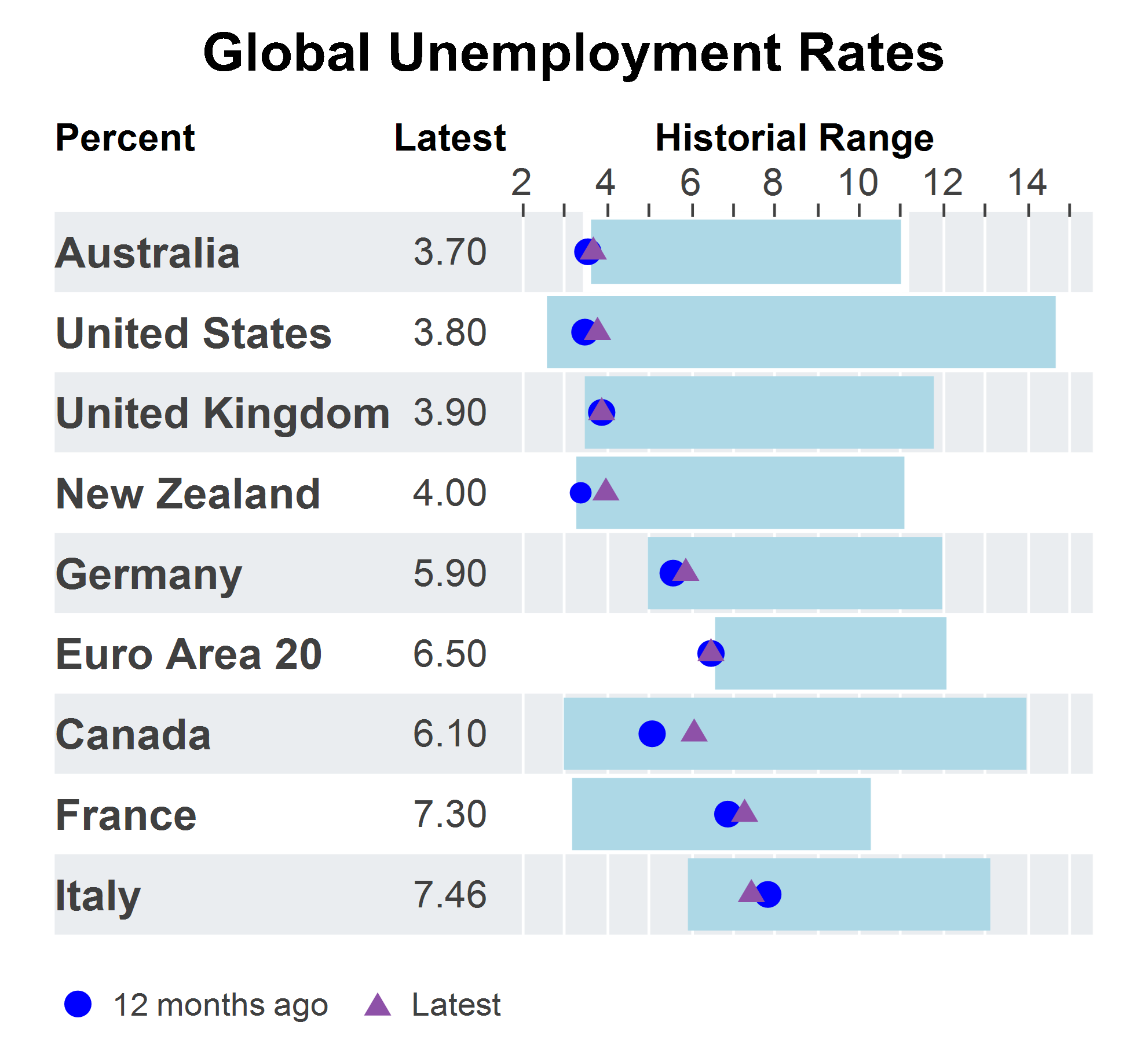

One factor which may delay potential rate cuts is the strength in labour markets which has kept wages growth elevated. Unemployment rates have generally remained low around the world (see the chart below), with unemployment rates around where they were a year ago. Canada and New Zealand have seen some of the larger increases in unemployment.

Source: Macrobond, AMP

Implications for investors

Expectations for US interest rates have an important bearing on financial market pricing for interest rates, which influences bond yields and equities. However, investors need to remember that domestic growth conditions are the primary factor behind a central bank’s decision on monetary policy and the Fed is unlikely to be the first major central bank to cut rates in this cycle.

II hope you have enjoyed this week’s read. If you would like to discuss your investment journey, please feel free to reach out to me.

Regards,

Head, Fixed Interest and Superannuation

JMP Securities

a. Level 3, ADF Haus, Musgrave St., Port Moresby NCD Papua New Guinea

p. PO Box 2064, Port Moresby NCD Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814