May 24, 2021

Good morning and welcome to this week’s JMP Report.

It was a busy week with several important market releases from our PNG Listed Companies –

- CCP Annual Report

- CPL Annual Report

- BSP Admitted to the ASX

- BSP announces K1.05 per share as the final dividend for 2020. With a 25 toea per share interim dividend having been paid in October 2020, the total dividend payment for the 2020 financial year is K1.30 per share, generating a yield of 10.83% on the current share price of K12.00 (as at 11th May 2021).

On the share market trading scene last week we saw BSP, KSL, CCP, OSH, NCM, KAM and CPL. BSP traded 173,087 shares unchanged at K12.00, KSL traded 60, 104 shares at K3.25, CCP saw 3,482 shares trade at K1.69, OSH traded 334 shares at K10.50, NCM traded 61 shares at K75.00, KAM traded 15,916 shares at K0.99 while CPL traded 10,000 shares at K0.70. Refer below details.

|

WEEKLY MARKET REPORT 17.05.21 – 21.05.21 |

||||

|

STOCK |

QUANTITY |

CLOSING |

CHANGE |

% CHANGE |

|

BSP |

173,087 |

12.00 |

– |

|

|

KSL |

60,104 |

3.25 |

– | |

|

OSH |

334 |

10.50 |

– | |

|

KAM |

15,916 |

0.99 |

– |

|

|

NCM |

61 |

75.00 |

– |

|

|

CCP |

3,482 |

1.69 |

– |

|

|

CPL |

10,000 |

0.70 |

– |

|

On the interest rate front, there has been no change to the weekly TBill issue with the 364 day TBills averaging 7.20% and 12 month finance company money offering around 5.5% a

Last week we saw the 2nd treasury bond issue for 2021 with the results as follows

Series Average yield

- 15022023 8.50%

- S15022024 8.98%

- 15082026 9.90%

- 15082027 10.30%

- 150022029 11.0%

- 15112030 11.25%

- 15022031 11.49%

What we have been reading this week

The return of geopolitical risk – What to watch over the remainder of 2021

Dr Shane Oliver

Head of Investment Strategy and Economics and Chief Economist, AMP Capital Sydney, Australia

Key points

Geopolitical issues generate much interest but don’t necessarily have a significant impact on markets.

But geopolitical risks are higher than prior to the GFC reflecting three big themes: a populist backlash against economic rationalist policies; the falling relative power of the US; and the polarising impact of social media.

After a lull following the transition to President Biden, key geopolitical issues to watch this year are: US and Australian tensions with China; Iran/Israel tensions; Russia and Ukraine; the German election; US tax hikes and a possible early Australian election.

Introduction

Over the last decade or so it seems geopolitical risk has become of greater significance for investors – particularly with the 2016 Brexit vote and Donald Trump’s election, and tensions with China from 2018. However, beyond lots of noise around President Trump and the US election, geopolitical risk took a back seat for most of the last year in terms of relevance for global investment markets as coronavirus dominated. But, after a period of relative calm following the handover to President Biden, there is a growing risk that it may make a bit of a comeback with tensions building in a number of areas.

Big picture geopolitical trends

Although significant geopolitical events impacted investment markets in the 1980s, 1990s and 2000s (with notably two Gulf Wars and 9/11), the broad trend in terms of geopolitical influence was reasonably positive for investment markets with the embrace of free market/economic rationalism (after the perceived failure of widespread government intervention in the 1970s), the collapse of communism and associated surge in global trade, the peace dividend and the dominance of the US as the global cop. However, over the last decade geopolitical developments have arguably started to move in a direction which is less favourable for investment markets. There are three big geopolitical developments contributing to this:

The political pendulum is swinging back to the left – the slow post-global financial crisis recovery, rising inequality, a dimming in memories of the malaise associated with interventionist economic policies and high inflation in the 1970s, and stress around immigration in various developed countries has contributed to a backlash against establishment politics and economic rationalist policies. This has been showing up in support for re-regulation, nationalisation, increased taxes and protectionism and other populist responses. While aspirational politics ruled in the 1980s & 1990s it’s since been replaced with scepticism about trickle-down economics. The trend towards bigger government has been pushed along by the pandemic, which has seen last decade’s fiscal austerity ditched in favour of big government spending and big budget deficits made possible by very low interest rates.

The swing of the political pendulum to the left is most acute in Anglo Saxon countries as it was here that the pendulum swung most towards free markets in the 1980s and 1990s. This swing is clearly evident under President Biden who is ushering in a greater focus on public spending to fix economic and social problems, partly financed by increased taxes and with bigger budget deficits. It’s also evident in Australia with the budget repair focus of last decade now on the backburner and the Government focussed on pushing unemployment below 5%. But the swing to the left is also evident in German politics. And scepticism about western capitalist democracy has also become more evident in some countries, notably China which has backed away from becoming more like the West.

In the short term, big government spending could boost growth and productivity and may be seen as necessary to “save capitalism from itself” (as FDR’s New Deal did). Longer term, big government could act as a dampener on productivity growth and boost inflation – but if the post-WW2 experience is anything go by that could take a while to be a major issue.

The relative decline of US power – this is shifting us away from the unipolar world that dominated after the Cold War when the US was the global cop, and most countries were moving to become free market democracies. Now we are seeing the rise of China at the same time that it’s strengthening the role of the Communist Party, Russia revisiting its Soviet past and efforts by other countries to fill the gap left by the US in parts of the world, resulting in a multi-polar world and increased tensions – all of which has the potential to upset investment markets at times.

Third, social media is allowing us to make our own reality resulting in entrenched division and less scope for cooperation amongst socio-political groups to achieve common goals. As politicians pander to this, the danger is that economic policy making will be less rational and more populist.

Global geopolitical issues to keep an eye on in 2021

The main geopolitical risks to key an eye on this year are:

US/China tensions, particularly regarding Taiwan – this is probably the biggest risk. Trump’s tariffs have not been reduced and Biden has maintained a hard line on China reflecting US public opinion. Tensions are heating up again as the US is preparing to sell weapons to Taiwan with military exercises in the Taiwan Strait and South China Sea, and some in China threatening to reunify Taiwan by force. The issue is arguably being accentuated by US restrictions on semiconductor sales to China and, of course, Taiwan has a state-of-the-art semiconductor industry. It’s hard to see China reunifying Taiwan by force given the economic costs that would flow from trade sanctions and it all sounds like a lot of posturing, but the risks have gone up and markets may start to focus on it more, particularly if there are accidental military clashes in the area. And there are reportedly signs Europe may be moving towards the US’s side on the broader US-China issue. Key to watch will be the Biden Admin’s review of US policy on China in coming months and Biden’s first bilateral meeting with President Xi.

Australia/China tensions – these have been building since Australia banned Huawei from participating in its 5G rollout and intensified last year after Australia called for an independent inquiry into the source of coronavirus, and China put bans and tariffs on various imports from Australia. The tensions may be escalating again with the Federal Government cancelling Victoria’s Belt and Road Initiative with China which could result in a further escalation in bans and tariffs on Australian exports to China. So far these have not had a major macroeconomic impact because the value of the products affected is small (less than 1% of GDP) and the impact has been swamped by the strength in iron ore exports and prices. And with Australia accounting for 50% of iron ore exports globally, there is insufficient iron ore supply from other countries for China to move to other sources. It could become more of an issue over the longer term if the tensions continue to worsen and ultimately impact iron ore, and this may already be showing up as a risk premium in Australian assets with the $A trading lower against the $US than might be suggested by the level of commodity prices and the trade surplus, and this may also be constraining the relative performance of the Australian share market. So any easing of tensions could boost the $A and Australian shares, but it could also go the other way if tensions escalate.

Iran/Israel tensions – the US is looking to return to the 2015 nuclear deal with Iran in order to continue its “pivot to Asia” and given its energy independence making it less reliant on Middle East oil. Iran wants a return to the deal to take pressure of its economy. But Israel is not keen, is strongly opposed to Iran’s nuclear ambitions and has allegedly sabotaged some Iranian facilities with Iran vowing retaliation. Ideally Biden needs to get a deal done before August when a more hawkish Iranian president may take over. Reports indicate US/Iran talks are making progress, but there is a long way go and tensions between Iran & Israel and Saudi Arabia & Iran could flare up in the interim with potential to impact oil prices – although beyond short term spikes the impact here is not what it used to be.

Russia tensions – Biden has taken a hard line against Russia. It could insist that Germany cancel the Nord Stream 2 (Russian/German gas) pipeline which would risk Russian retaliation possibly with another incursion into Ukraine. A full-scale Russian invasion of Ukraine is unlikely as it would unite Europe & the US against Russia and be costly economically, but another incursion is a risk. Tensions have faded in the last few weeks but could flare up again ahead of Russian elections in September with Putin looking for something to rally political support. Note though that the Russian invasion of Crimea and the shooting down of MH17 only saw brief 2% and 1% dips respectively in US shares in 2014 in what was a solid year.

German election – with Angela Merkel stepping down after nearly 16 years as Chancellor in Germany, polls indicate there is a good chance that the Greens will win control of government in the 26th September elections or if not then be a part of it. However, while this will likely need to be in coalition with the Christian Democrats which would limit the Greens more extreme left-wing policies, it’s likely to see German policy tilt to the left with more fiscal stimulus (a direction the Christian Democrats are leaning in anyway) which will boost recovery in Europe and be a further force for European integration. So, a Green win could actually be a positive risk for European shares.

Terrorism – The risks here have subsided, but new attacks can’t be ruled out. However, economies and markets seem to have become desensitised to them to a degree.

North Korea – Biden appears to be set on taking a more incremental approach to resolving issues with North Korea than Trump did, but more North Korean provocations could occur before progress is made. Note though that North Korean provocations had little lasting impact on markets in 2017.

US tax hikes – so far, the US share market has not been too concerned much about the Biden Administration’s proposed tax hikes on the assumption the negative impact will be offset by extra spending and congress will scale them back – which they probably will. This could change if they are not scaled back.

Australia – the main risk is an early election but differences between the Government and Labour are minor compared to the 2019 election. The Coalition is now eschewing fiscal austerity in favour of boosting growth to deliver a tight jobs market and higher wages. And Labour Leader Anthony Albanese has dropped most of the “big end of town” taxes it proposed in 2019. A Labor Government would take a tougher stance on climate and a more interventionist approach, however, a significant impact on the economy from a change of government is low compared to the 2019 election. To avoid separate House and Senate elections, the latest the next election can be is 21 May 2022. Recent controversies have reduced the chance of an early election.

Implications for investors

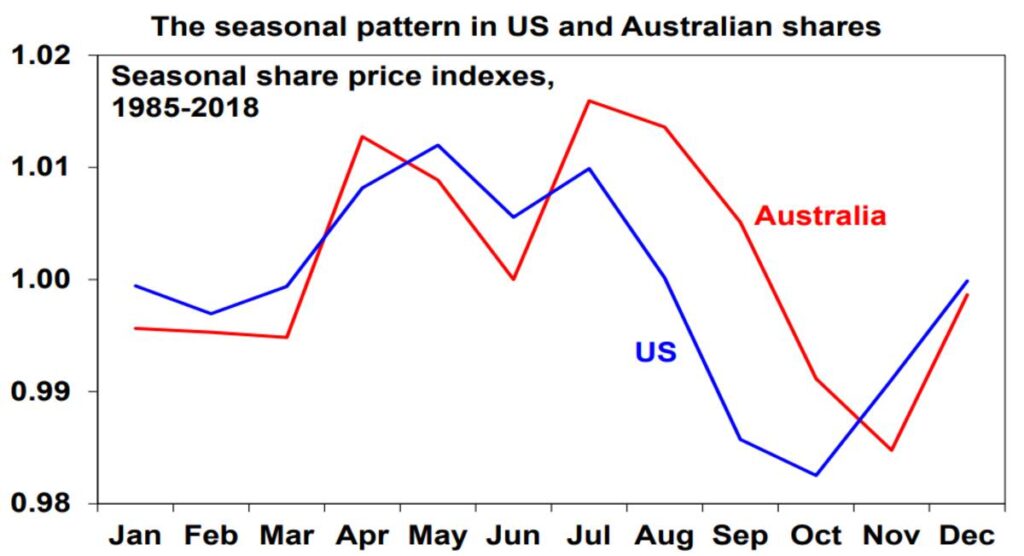

Our view is that share markets will head higher this year as recovery continues and this boosts earnings. However, investor sentiment is very bullish which is negative from a contrarian perspective and we are coming into a seasonally softer period of the year for shares, as the old saying “sell in May and go away..” reminds us and the next chart illustrates (although Australian shares can push higher into July). Geopolitical risks as noted above – along with a resumption of the bond market tantrum as inflation rises further and maybe a new coronavirus scare – could provide a trigger for a short-term correction.

Source: Bloomberg, AMP Capital

That said, there are several points for investors to bear in mind. First, geopolitical issues create much interest, but as we seen with, eg, Brexit, North Korea and trade wars, they rarely have lasting negative impacts on markets. Second, it’s hard to quantify geopolitical risks as you have to understand each issue separately. Finally, trying to time negative geopolitical shocks & pick their impact is not easy and it often makes more sense for investors to respond once they are factored into markets as the worst usually doesn’t happen, rather than permanently sheltering from them in low returning cash.

G7 agrees to stop financing coal projects by the end of 2021

The G7 nations and the EU said investments in unabated coal “must stop now”.

The world’s seven largest advanced economies have agreed to stop international financing of coal projects that emit carbon by the end of this year, and phase out such support for all fossil fuels, to meet globally agreed climate change targets.

Key points:

Getting Japan on board to end international financing of coal projects in such a short timeframe means countries such as China that still back coal are increasingly isolated and could face more pressure to stop.

In a communique, the Group of Seven nations — the United States, Britain, Canada, France, Germany, Italy and Japan — plus the European Union said “international investments in unabated coal must stop now”.

- “(We) commit to take concrete steps towards an absolute end to new direct government support for unabated international thermal coal power generation by the end of 2021, including through Official Development Assistance, export finance, The G7 and European Union vowed to end international investment in coal

- They agreed to help boost deployment of zero emission vehicles

- The Group of Seven nations affirmed their commitment to the 2015 Paris Agreement

Stopping fossil fuel funding is seen as a major step the world can make to limit the rise in global temperatures to 1.5 degrees Celsius above pre-industrial times, which scientists say would avoid the most devastating impacts of climate change.

investment, and financial and trade promotion support.”

Coal is considered unabated when it is burned for power or heat without using technology to capture the resulting emissions, a system not yet widely used in power generation.

Alok Sharma, president of the COP26 climate summit, has made halting international coal financing a “personal priority” to help end the world’s reliance on the fossil fuel, calling for the UN summit in November to be the one “that consigns coal to history”.

The Group of Seven nations also agreed to increase the rollout of electric vehicles.(

ABC News: Hugh Sando

The G7 nations also agreed to “work with other global partners to accelerate the deployment of zero emission vehicles”, “overwhelmingly” decarbonising the power sector in the 2030s and moving away from international fossil fuel financing, although no specific date was given for that goal.

They reiterated their commitment to the 2015 Paris Agreement aim to cap the rise in temperatures to as close as possible to 1.5 degrees Celsius above pre-industrial times and their targets for net zero greenhouse gas emissions.

In a report earlier this week, the International Energy Agency (IEA) made its starkest warning yet, saying investors should not fund new oil, gas and coal supply projects if the world wants to reach net zero emissions by mid-century.

The number of countries that have pledged to reach net zero has grown, but even if their commitments are fully achieved, there will still be 22 billion tonnes of carbon dioxide worldwide in 2050 which would lead to temperature rise of around 2.1C by 2100, the IEA said in its “Net Zero by 2050” report.

Reuters

Will The World’s Largest Oil Region Become A Hydrogen Hub?

The biggest oil-exporting region in the world, the Middle East, has set its sights on becoming a major clean energy exporter of green hydrogen. The largest oil producers in the Arab Gulf have jumped on the hydrogen bandwagon — especially its so-called green variety produced from water electrolysis using electricity from solar or wind — as it gains momentum with governments and the world’s largest international oil companies.

Hydrogen is expected to play a prominent role in lowering carbon emissions from energy-intensive industries. And the Middle East doesn’t want to miss out on this opportunity.

On the one hand, it wants to show the world it can export clean energy—not only crude oil—as the global energy transition accelerates. On the other hand, the oil-dependent economies of some of OPEC’s largest producers are determined to diversify into green energy exports and away from oil.

This past week, two announcements of green hydrogen projects in the Middle East made headlines: Dubai launched the first industrial-scale green hydrogen project in the region, while Oman announced plans to build one of the largest green hydrogen plants in the world.

Dubai, one of the emirates of the United Arab Emirates (UAE), which is currently OPEC’s third-largest oil producer, launched the first industrial-scale, solar-powered green hydrogen facility in the Middle East and North Africa in collaboration with Siemens Energy, Dubai Electricity and Water Authority (DEWA), and Expo 2020 Dubai.

Related: Gasoline Shortages Still Lingering Post-Colonial Pipeline Hack

During the day, the plant uses some of the photovoltaic electricity from the Mohammed bin Rashid Al Maktoum Solar Park to produce green hydrogen via electrolysis. At night, the green hydrogen is converted into electricity to power the city with sustainable energy, Siemens Energy says.

The Solar Park is expected to generate as much as 5 gigawatts (GW) of clean energy by 2030 as the largest single-site solar park in the world.

Companies in the region, international technology partners, and analysts believe that Dubai and the whole of the Middle East have a bright future in solar power generation, considering the abundant sunshine in the region.

“Against the background of low costs of electricity for solar PV and wind power in the region, hydrogen has the potential to be a key fuel in the energy mix of the future and could open up energy export opportunities for those areas with access to abundant renewable energies,” Siemens Energy said.

Start Trading On OPC Markets Today

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74-89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

The UAE could become an exporter of hydrogen, Siemens Energy CEO Christian Bruch told CNBC’s Dan Murphy in an interview this week.

“I do believe it must be, it will be, it should be, one of the key future commercial models in the UAE and the wider region, to be also, in future, an energy exporter for the world,” Bruch told CNBC.

Another oil producer in the Middle East, Oman—not an OPEC member but part of the OPEC+ alliance—also made a major announcement involving green hydrogen this week.

Related: UAE: Oil Demand Has Already Increased To 95 Million Bpd

Oman’s state-held energy company OQ, Hong-Kong-based green fuels developer InterContinental Energy, and Kuwait’s government-backed clean energy investor and developer, EnerTech, announced a plan for one of the biggest facilities of green hydrogen in the world. The plant will be powered by 25 GW of renewable energy and could cost as much as US$30 billion.

“Given the site’s strategic location between Europe and Asia, as well as excellent solar irradiance and wind resource facing the Arabian Sea, the development is well-positioned to offer a secure and reliable supply of green fuels globally at a highly competitive price,” InterContinental Energy said.

“Alternative energy is a key driver for OQ’s long-term growth and a cornerstone of its strategy. It is also in line with the country’s ambitious Oman Vision 2040 that aims to diversify the nation’s resources and maximize the financial value derived,” said Salim Al Huthaili, CEO Alternative Energy at OQ.

The region’s top oil producer and the world’s largest oil exporter, Saudi Arabia, is also eyeing green hydrogen projects and a share of the emerging clean hydrogen market.

NEOM, the future sustainable city promoted by Saudi Crown Prince Mohammed bin Salman, signed last year a deal with Air Products and Saudi ACWA Power for a $5 billion green hydrogen-based ammonia production project, which will export the product.

All these plans suggest that the oil powerhouse Middle East is not immune to the energy transition and growing global demand for clean energy products.

By Tsvetana Paraskova for Oilprice.com

Fortescue in talks to export green ammonia from Tasmania to Japan

Fortescue Future Industries, the green energy arm of Andrew Forrest’s Fortescue Metals, has signed a memorandum of understanding with Japanese engineering firm IHI Corporation to explore the potential to export green ammonia to Japan from Tasmania.

The ammonia would be produced at Fortescue’s planned 250 megawatt green hydrogen and ammonia project at Bell Bay on the north coast of Tasmania. Fortescue says the project, which is part-funded by the Tasmanian Government and would be powered by Tasmanian hydropower, could produce 250,000 tonnes of green ammonia per year.

The MoU commits to exploring “green ammonia supply chains between Australia and Japan”. Ammonia, a gas used in fertiliser, explosives, cleaning products and other industrial processes, is made from hydrogen and nitrogen.

Unlike pure hydrogen, it is relatively easy to liquify and transport, meaning there is the potential for it to be used as a means of storing and transporting green hydrogen – though this would be an energy intensive and expensive process.

Ammonia can also be used as a combustible fuel in itself, or converted back into hydrogen for use in hydrogen fuel cells.

Japan has shown significant interest in importing hydrogen, making it the most promising early market for the vast number of Australian green hydrogen projects that have been announced in recent months.

Japan’s interest is not just in green hydrogen. Kawasaki Heavy Industries, J-Power and Shell Japan and AGL Energy are in the process of exploring the potential to make “brown” or “blue” hydrogen out of Latrobe Valley brown coal and ship it to Japan.

In the “brown hydrogen” process, hydrogen is extracted from brown coal (lignite) and the CO2 that is produced as a byproduct is allowed to escape into the atmosphere. “Grey” and “black” hydrogen refer to use of natural gas or black coal instead of lignite. “Blue hydrogen” uses any fossil fuel as a feedstock, but theoretically captures and sequesters the CO2.

Green hydrogen is made in a completely different way, using renewably powered electrolysis to split water molecules into their component hydrogen and oxygen molecules.

In a low carbon world, Fortescue’s renewably-made hydrogen and ammonia would have a clear edge over hydrogen that uses fossil fuels as a feedstock. The company has plans to become a green hydrogen and ammonia colossus, with plans for up to 1,000 gigawatts of renewable capacity around the world, including 40 GW in the Pilbara in Western Australia. The idea is that much of that green electricity would run electrolysers that make hydrogen from desalinated seawater.

Fortescue Future Industries chief executive officer Julie Shuttleworth said Japan was a “priority market for green ammonia exports”.

“The world’s transition to a clean energy future represents a major growth opportunity and this MoU with IHI and IEA will help position FFI, IHI and IEA at the forefront of the global green industry,” she said.

“By leveraging our value chain and market access as well as the skills and capability of our people to rapidly develop complex projects, FFI is well placed to meet the future demand of green ammonia.”

IHI chief executive Hiroshi Ide said, “Australia, with an abundance of renewable energy, is a very promising location for large scale ammonia production. IHI will contribute to realising a carbon-free society by merging our ammonia combustion and production technology together with green ammonia.”

For more on ammonia exports, please listen to the latest episode of the Energy Insiders podcast, and the interview with Andrew Dickson from CWP, which is a partner is the 26GW Asia Renewable Energy Hub.

I do hope you enjoy the read, if you would like to discuss the impact of this week’s market announcements, the results of the Bond Auction and their impact on prices, please feel free to give me a call

Have an awesome week,Chris Hagan,

Head, Fixed Interest and Superannuation

JMP Securities

Level 1, Harbourside West, Stanley Esplanade

Port Moresby, Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814