August 02, 2021

Welcome to this week’s JMP Report.

Dear Investors, welcome to this week’s JMP Report

Last week on the local bourse, five stocks saw trading activities. BSP traded 216,964 closing unchanged at K12.30, followed by KSL with 133,665 shares trading also closing unchanged at K3.25. CCP traded 24,704 shares and closed unchanged at K1.70 along with KAM which saw 10,341 shares trading, closing unchanged at K1.00 per share. OSH saw 305 shares trade and closed down 0.09 toea or -0.85% to K10.51.

Refer details below;

|

WEEKLY MARKET REPORT 26.07.21 – 30.07.21 |

||||

|

STOCK |

QUANTITY |

CLOSING |

CHANGE |

% CHANGE |

|

BSP |

216.964 |

12.30 |

– |

0.00 |

|

KSL |

133,665 |

3.25 |

– | 0.00 |

|

OSH |

305 |

10.51 |

-0.09 | -0.85 |

|

KAM |

10,341 |

1.00 |

– | 0.00 |

|

NCM |

– |

75.00 |

– |

0.00 |

|

CCP |

24,704 |

1.70 |

– | 0.00 |

|

CPL |

– |

0.80 |

– |

0.00 |

On the interest rate front the TBill remains at 7.20% with the market still very liquid.

The Bank of Papua New Guinea conducted a Treasury Bond Tender and this was oversubscribed (results attached). The Bank accepted all bids up to the amounts on offer and there were no changes to yields from the previous tender. We are unaware of any further Treasury Bond auctions for the remainder of 2021.

Treasury has been successful in driving down the long end yields for the 2021 series tenders. There is still very good value to be had in the shorter end.

GIS Auction ResultsWhat we have been reading this week

WGC – GOLD DEMAND TRENDS Q2 2021

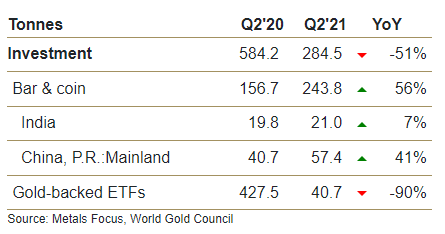

The World Gold Council released their latest quarterly Gold Demand Trends for Q2 2021 which saw a continuation of rampant bar and coin investment demand and a return to inflows into ETF’s. The quarter saw 955 tonne of gold consumed. As usual, we summarise across all uses and look at supply too.

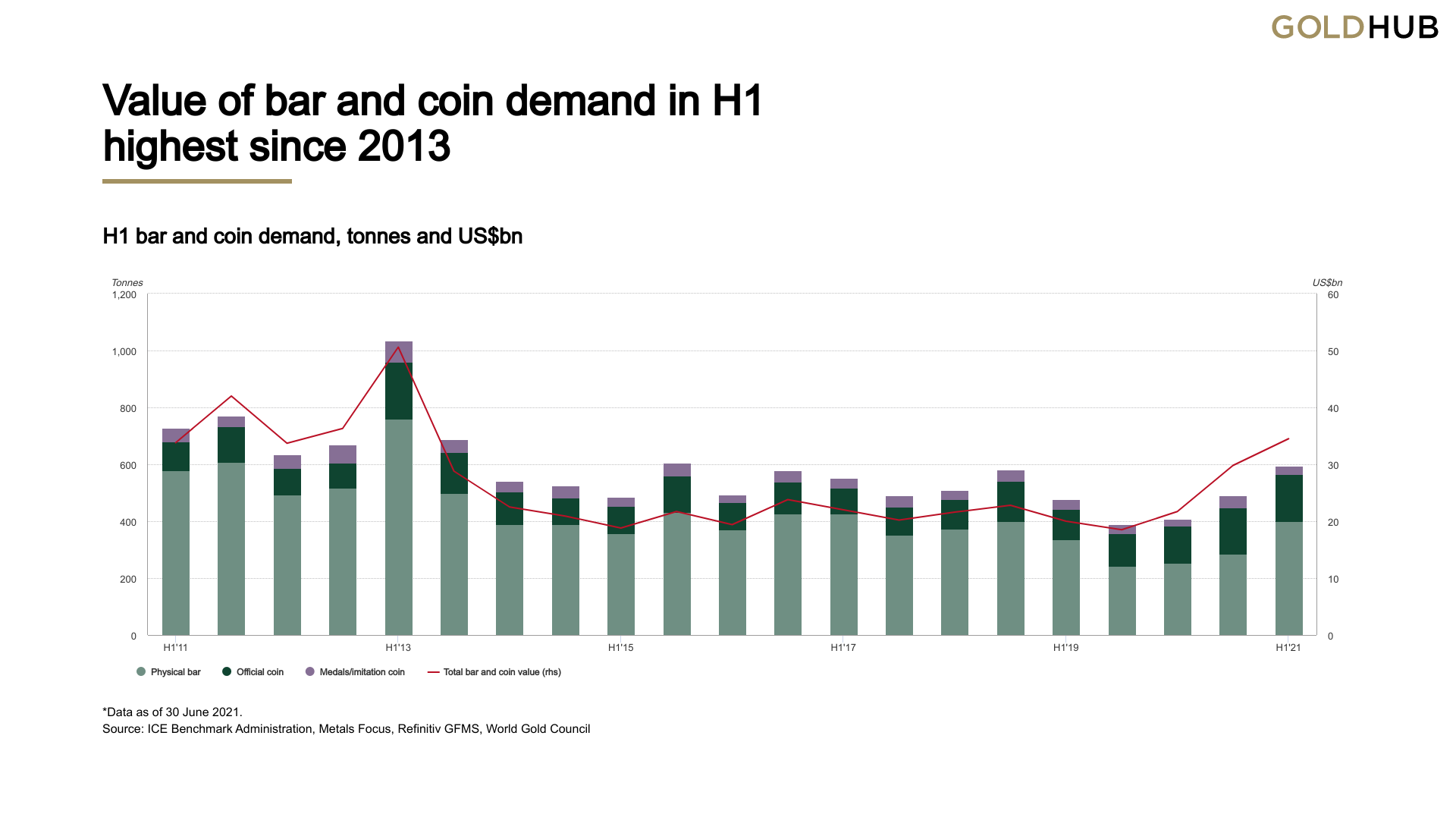

Bar & Coin Investment Demand

Bar and coin investment saw a fourth consecutive quarter of strong year-on-year gains with Q2 demand of 243.8 tonne resulting in a H1 total of 594.t, the strongest half year since 2013. Of that 244 tonne, China accounted for nearly a quarter at 57.3 tonne.

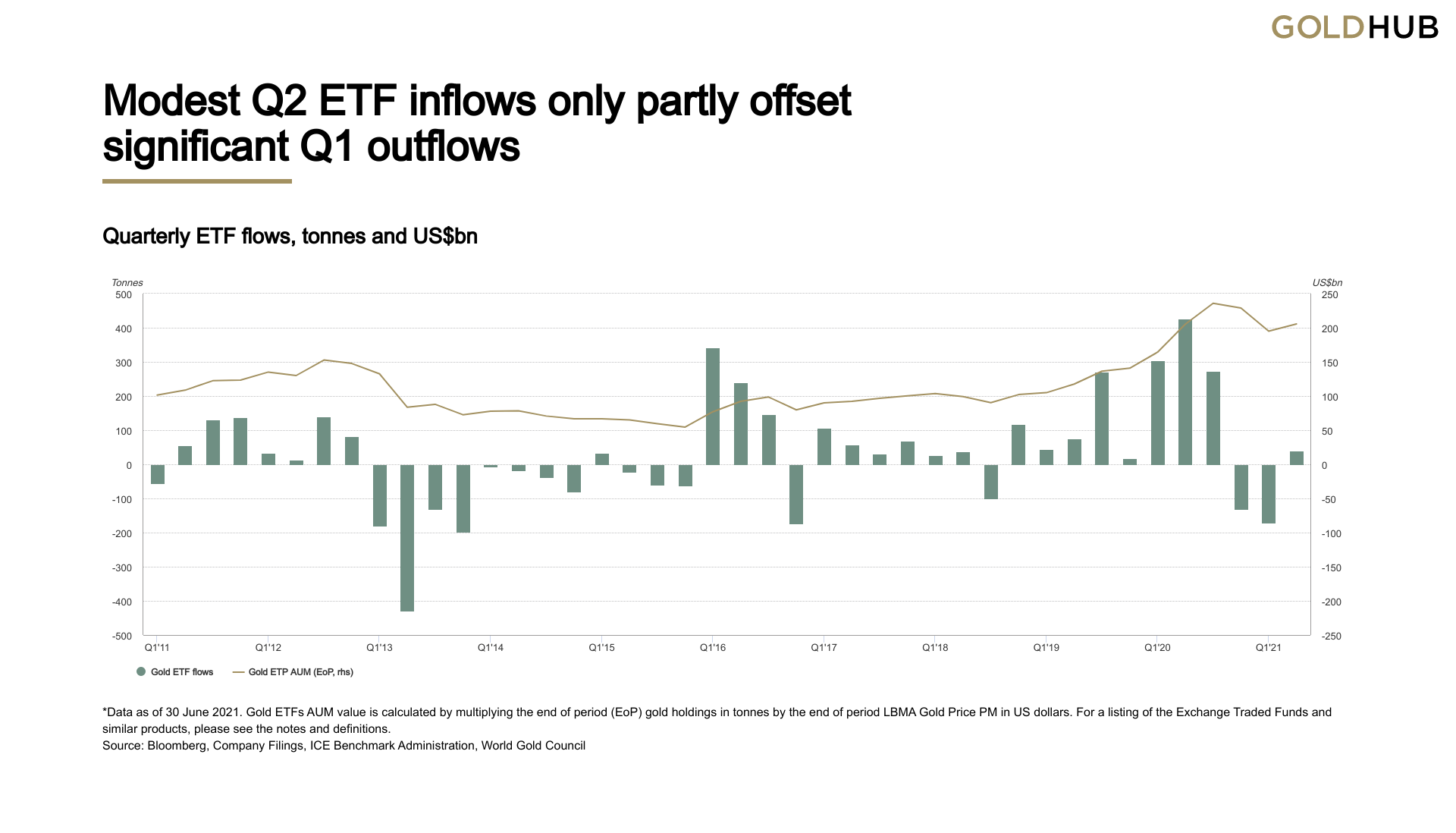

- ETF Investment Demand

- Modest Q2 inflows into gold-backed ETFs of 40.7 tonne only partly offset the heavy outflows from Q1; consequently, ETFs saw H1 net outflows (of 129.3t) for the first time since 2014.

ETF outflows slowed sharply in April, before reversing in May and resulting in the net inflows of 40.7t for the second quarter. These inflows were less than 10% of the huge 427.5t inflows we saw in Q2 2020 and help explain the sharp y-o-y drop in overall investment. The net result for H1 was for outflows of 129.3t, in comparison with record H1 2020 inflows of 731.2t.

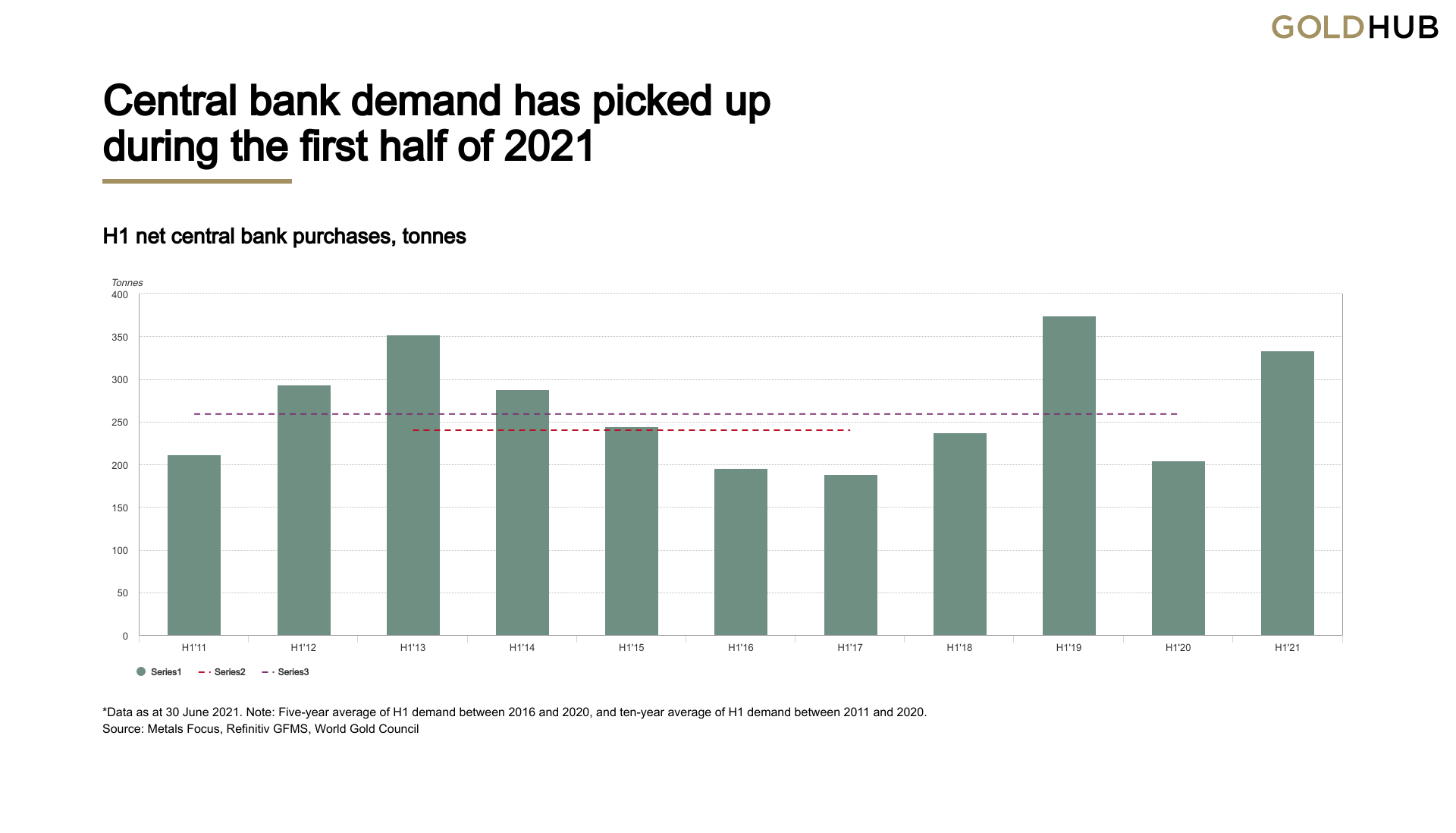

Central Bank Demand

In a third consecutive quarter of net central bank buying, global gold reserves grew by 199.9t in Q2, the highest level of quarterly net purchases since Q2 2019 (227.8t) and 73% above the five-year quarterly average. This brings net buying for H1 to 333.2t, 63% higher than H1 2020, 39% higher than the five-year H1 average, and 29% above the ten-year H1 average.

Having been relatively subdued in the second half of 2020, demand picked up in the first half of 2021, with almost two-thirds concentrated in Q2. Reported gross purchases by the IMF totalled 287.7t over the first six months, with nine central banks accounting for the vast majority of this…

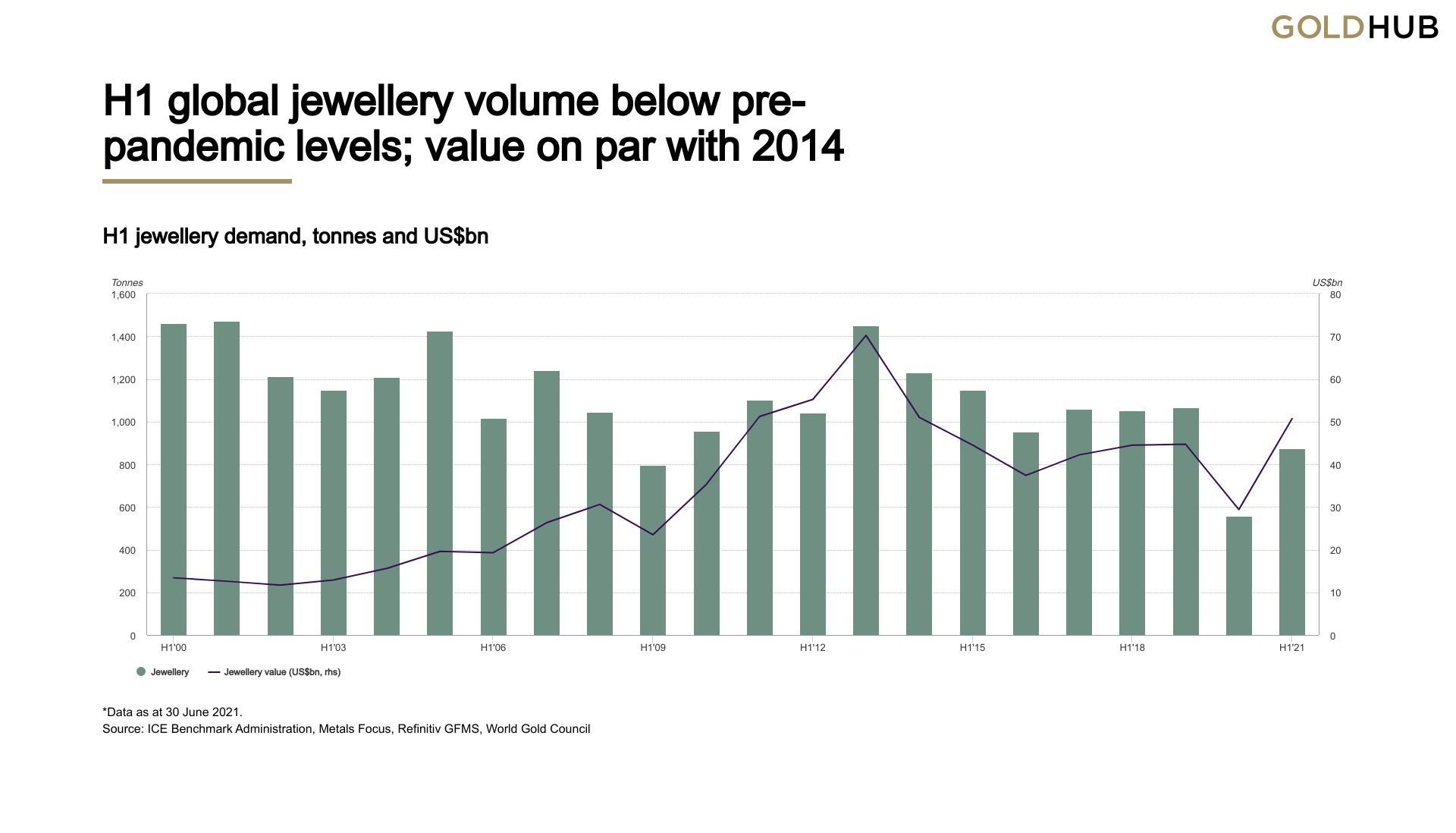

Jewellery Demand

Q2 jewellery demand (390.7t) continued to rebound from 2020’s COVID-hit weakness, although remained well below typical pre-pandemic levels, partly due to weaker Indian demand growth. Demand for H1, at 873.7t, was 17% below the 2015-2019

average

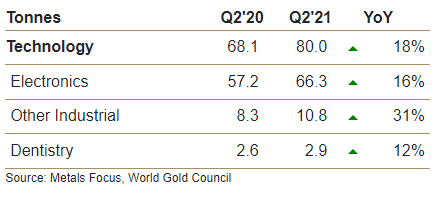

Technology Demand

Gold used in technology continued to recover from the 2020 lows with Q2 demand 18% higher y-o-y at 80t – in line with average Q2 demand from 2015-2019 of 81.8t. H1 demand (161t) was fractionally above that of H1 2019 (160.6t). Electronics rose 16%, memory 3%, LED 15%, wireless 7% and printed circuit boards 8%.

Supply

Gold supply bounced back in H1, up 4% y-o-y to 2,308t as the mining industry experienced much fewer pandemic production stoppages and some underlying production growth was recorded. Mine production increased 9% y-o-y in the first six months of the year. Recycled gold supply fell by 5% y-o-y in H1, despite a higher average gold price – up about 10% y-o-y – as the economic recovery reduced the incentive to recycle gold.

Despite a surplus of Covid-19 vaccines, only about half of Americans are fully vaccinated.

Bloomberg, July 28 2021

Some of those who chose not to get a shot are now paying a high price. The victims are younger and getting sicker at a much faster pace than in previous waves. Said one Missouri doctor: “I don’t remember anyone declining within 24 hours, until now.” Another clear sign of America’s fifth infection wave? Internet searches for “loss of taste” and “loss of smell,” common symptoms of Covid-19, are on the rise again. Though it seems some may have finally gotten the memo.

One of the worst hit states is Florida, whose Republican Governor Ron DeSantis has been a vocal opponent of most coronavirus precautions. Hospital admissions records just broke records for the entire pandemic. Norway now leads a pack of European nations that have leaped ahead in Bloomberg’s Covid Resilience Ranking, leaving America behind. Some 406 people in the U.S. were confirmed to have died Tuesday from Covid-19, though the actual number is likely higher. Here is the latest on the pandemic.

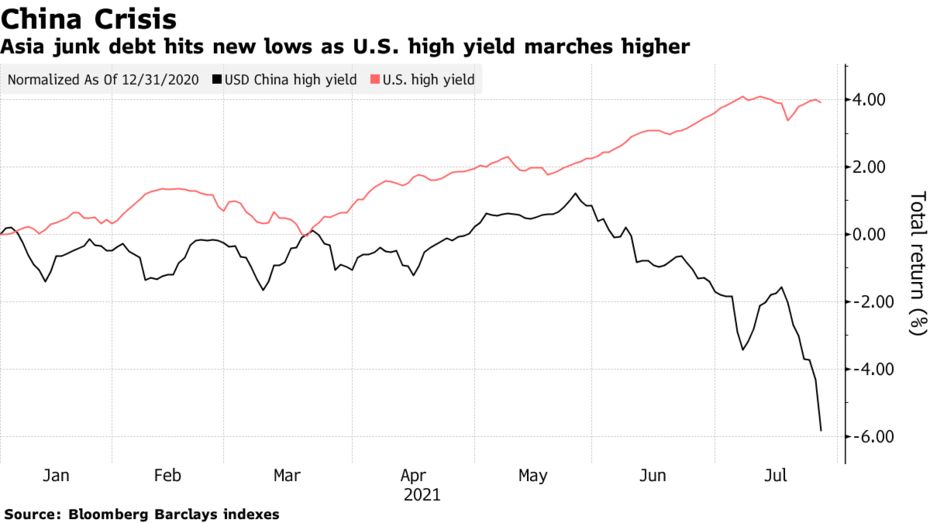

Credit Market Pain Seen Potentially Spreading From China to U.S.

By David Caleb Mutua, July 29, 2021, 1:53 AM GMT+10 Updated on July 29, 2021, 1:39 PM GMT+10

China is most significant risk to global credit markets: BofA

Any potential knock-on is likely to hurt U.S. high-yield: UBS

Increasing credit stress in China stemming from a government crackdown on a range of industries could spread to U.S. investors’ credit portfolios.

Global high-yield fund managers suffering losses in their Asia credit portfolios could look to lower risk across their holdings, or to sell more liquid, high-performing bonds such as U.S. speculative-grade notes to meet redemptions, according to UBS Group AG head of credit strategy Matthew Mish. That selling pressure could weigh on valuations for the securities that are at record highs.

“Managers may choose to reduce risk pre-emptively or if there’s less liquidity in Asia credit,” Mish said in a phone interview Tuesday. “They may also sell in part because regional valuation differences are extreme.”

Credit distress in China is the most significant risk to global credit markets now, according to Bank of America Corp. That’s because China is the second-largest U.S. dollar corporate bond market in the world with $425 billion in bonds outstanding and the second-largest domicile of dollar high-yield debt at $103 billion, strategists Oleg Melentyev and Eric Yu wrote in a note earlier this month.

“And so when 15% of it is trading at distressed levels, we pay attention,” wrote Melentyev and Yu, referring to the percentage of Chinese U.S. dollar high-grade and high-yield bonds that were trading at spreads above 10 percentage points as of the July 9 research note.

The risk is high enough that T. Rowe Price’s emerging markets debt team has been cutting the size of its exposure to Chinese high-yield debt since the first quarter, and has been switching into higher-quality junk-rated securities there as well.

Generally, the government has been telegraphing that it intends to allow more companies to fail, which is ultimately good for the financial system there even if it translates to near-term price declines, said Ben Robins, global fixed income portfolios specialist.

Recent growing fears in financial markets have stemmed from China’s escalating crackdown on industries from technology to education and property.

Much of the outcome in China hinges on what the government does next. The nation’s securities regulator convened a virtual meeting with executives of major investment banks on Wednesday, attempting to ease market fears about the clampdown on the private education industry. State-run media published articles after a rout in risk assets suggesting the selloff was overdone. Asian credit and equities rebounded Thursday following those moves.

But the extent of the recent slump has struck a nerve. Yields on Chinese junk dollar bonds reached a 15-month high just on Wednesday, according to a Bloomberg Barclays index.

“If there is a restructuring or default event in that market with a large issuer and you start to see spillover, that is a cascade of defaults more broadly and a sense this is becoming more of a systemic event, that would change the picture,” said UBS’s Mish. “It’s certainly one possible outcome, but it’s not our base case and a lot of this is heavily dependent on the government.”

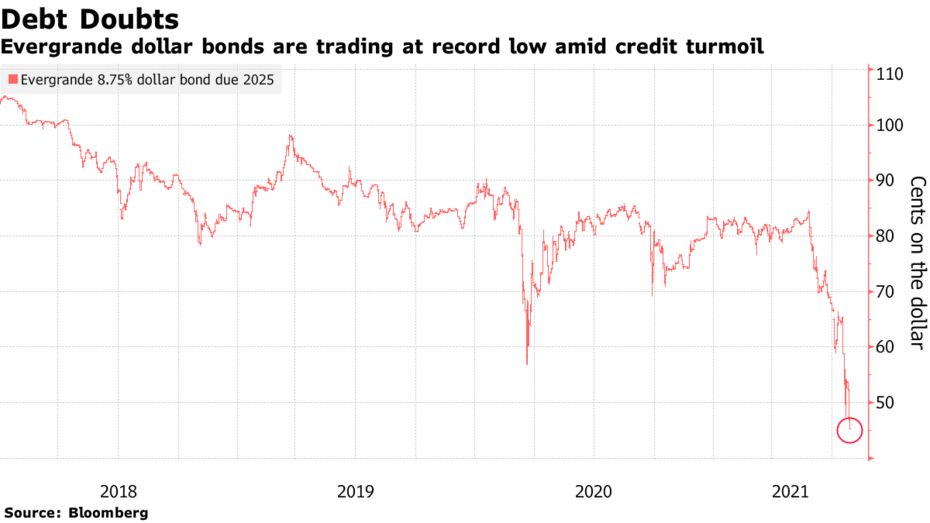

One of the biggest concerns in China’s credit markets now is property company China Evergrande Group. The world’s most indebted developer –and Asia’s biggest issuer of high-yield dollar bonds — has struggled to reassure the market that it has ample ammunition to make good on its borrowings while also countering short-sellers.

Now Evergrande’s main onshore unit is being sued by a mining company for unpaid bills. S&P Global Ratings cut the company’s credit rating deeper into junk late Monday, making it the third downgrade by a global firm in about a month. While Evergrande has repaid all its public bonds due this year, refinancing notes due next year would be challenging if the developer’s access to the capital market doesn’t recover in time, S&P said.

Read More: Spiraling Debt Crisis Confronts Evergrande Billionaire — and Xi

The developer’s dollar bonds due 2025 extended declines for a fourth day on Thursday, falling to about 44.5 cents, set for a record low, Bloomberg-compiled prices show.

While the fallout from Evergrande and the China regulatory risks has so far been largely contained to Asia, one source of vulnerability for U.S. junk bonds is that their valuations are relatively high. The Bloomberg Barclays U.S. Corporate High Yield total return index reached a record on July 12, and has been hovering close to that level recently. As of Tuesday, the index was just 0.2 percent below its peak.

Asia

Many Asian dollar bonds rallied Thursday on dip buying after the recent selloff.

- Credit-default swaps tightened, with the Markit iTraxx Asia ex-Japan CDS index contracting about 1 basis point Thursday, traders said. That leaves the gauge set for a second straight day of declines, the longest such streak in two weeks, according to data from CMA

- Still, the earlier slump this month in riskier securities from the region has left dollar bonds from Chinese issuers the worst performers in Asia this year

Worst Performer

China’s crackdown on firms makes its dollar bonds worst Asia performer

Source: Bloomberg Barclays index, as of July 28

Note: China makes up about half of the index with weighting of 48%

U.S.

Triton International Ltd was the sole issuer selling bonds in the U.S. investment-grade market on Wednesday, pricing $600 million of notes, upsized from $500 million.

- In high-yield, Allen Media is wrapping up its bond sale Wednesday and is expected to price the $340 million transaction while financial services company Jefferson Capital Holdings is expected to sell $300 million of five-year bonds

- ATI Physical Therapy Inc.’s leveraged loan extended its fall in the secondary market on Wednesday after the physical therapy provider cut its forecasts, surprising investors weeks after its public listing via a SPAC

- The billionaire owners behind Standard Industries Holdings Inc. are no strangers to debt-funded takeovers. But their latest acquisition is taking that playbook to a whole new level

- Jefferson Energy Companies is slated to sell $425 million of municipal bonds through two conduit borrowers, according to preliminary documents posted on MuniOS

- For deal updates, click here for the New Issue Monitor

- For more, click here for the Credit Daybook Americas

- Steve Liberatore, veteran ESG debt investor at Nuveen, takes your questions on Aug. 3 at 10:00 a.m. New York time in a live Q&A moderated by Bloomberg’s Caleb Mutua. Click here for more.

Europe

Earnings season is well underway, with Deutsche Bank AG raising its revenue guidance for next year even as it scrapped a cost target after a series of unexpected expenses

- The lender’s DWS Group raked in record client cash in the second quarter that also far exceeded analyst estimates

- Meanwhile, Barclays Plc’s investment bankers brought in a record haul in fees as the booming deals market extended through the second quarter, offsetting muted earnings in the trading unit

- The European Central Bank should consider keeping some of the flexibility of its emergency bond-buying program when it transitions to other asset purchases after the Covid crisis, said Pablo Hernandez de Cos, Governing Council member

— With assistance by Rebecca Choong Wilkins, James Crombie, Tasos Vossos, Priscila Azevedo Rocha, and Rahul Satija

Coronavirus continues to create havoc, globally and in Australia, but there are 5 reasons for optimism,

Shane Oliver, Head of Investment Strategy & Chief Economist

Key points

The news on coronavirus has been bleak again lately – with rising cases globally & the ongoing NSW lockdown.

However, there are five reasons for optimism: lockdowns still work against Delta (eg, in SA & Victoria); vaccines are working; once lockdowns end economic activity rebounds quickly; the threat posed by Delta will keep fiscal & monetary policy easier for longer; and vaccinations are ramping up in Australia.

Introduction

It seems the bad news on coronavirus doesn’t let up. The lockdown in NSW looks like going longer. There is endless debate about whether governments are doing the right thing, whether the vaccines will work and when we can reopen. And coronavirus cases are on the rise again, globally posing risks to the economic recovery. But there remains light at the end of the tunnel. This note looks at five reasons for optimism.

But first, the bad news

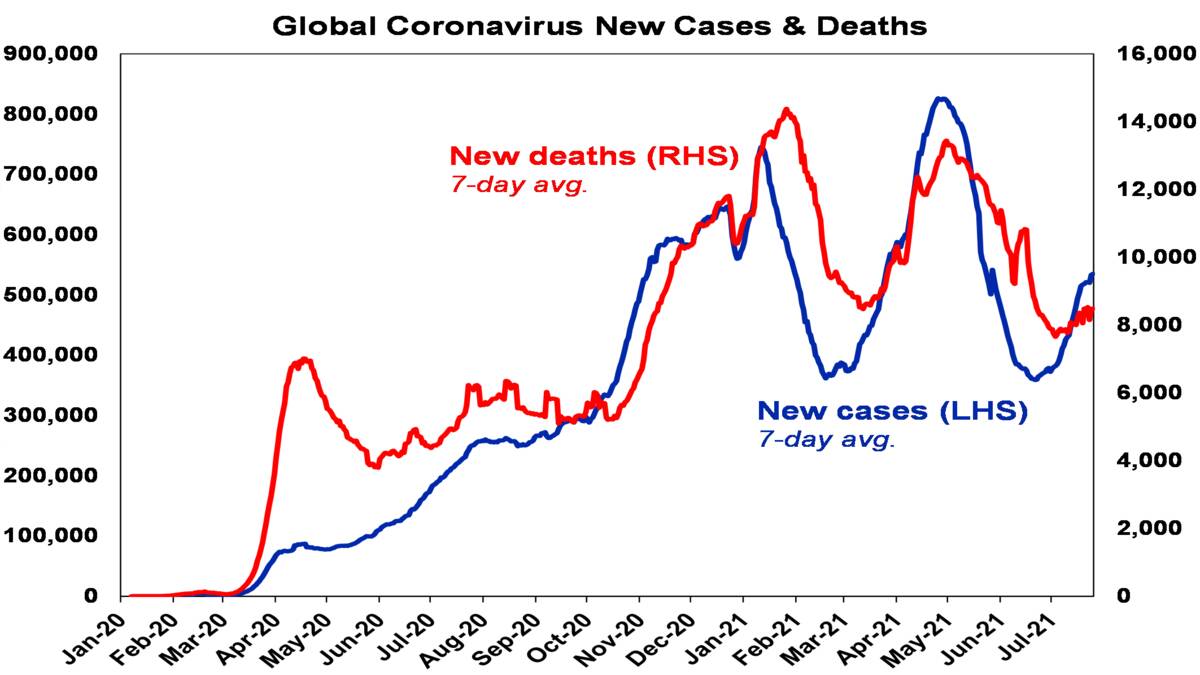

- First, global daily new coronavirus cases are rising again.

Source: ourworldindata.org, AMP Capital

- This has left impacted lowly vaccinated countries little choice but to tighten restrictions & enter lockdowns (to avoid overwhelming healthcare systems). This includes Asian countries that managed coronavirus well last year.

- Much of the latest upswing is occurring in relatively highly vaccinated developed countries – notably in the UK, Europe and the US – where it’s particularly affecting unvaccinated younger people, but also some vaccinated people. With only 50% or so of the population fully vaccinated that still leaves these countries vulnerable should new cases rise rapidly, causing a surge in hospitalisations. Some lowly vaccinated US states are at high risk, eg, Texas is running out of ICU beds. This in turn is seeing debate about a return to some restrictions, with some doing so – eg Singapore and the return of mask mandates in some US states.

- The Delta variant of coronavirus responsible for much of the recent surge in cases is 2-3 times more transmissible than the original version with a shorter incubation period.

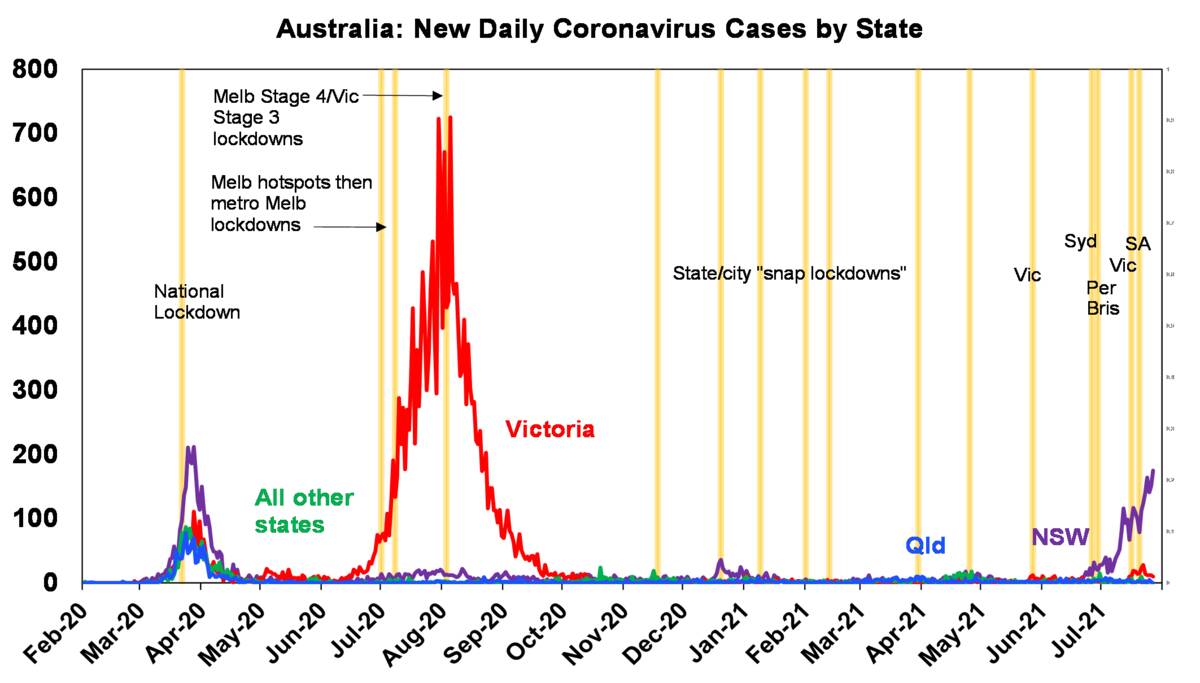

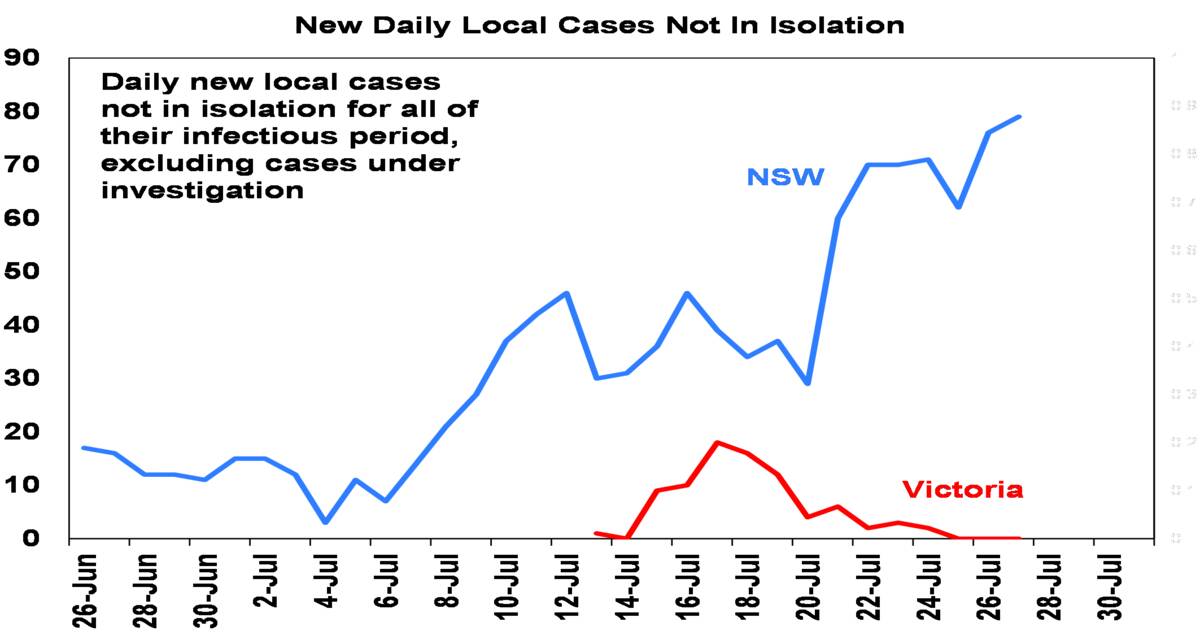

- Partly reflecting this, after more than four weeks in lockdown the number of new cases in NSW has continued to trend up, albeit being very low by global standards.

Source: Covid19data.com.au, AMP Capital

- The lockdowns seen since May and in NSW (assuming the NSW lockdown goes into August) are estimated to cost $12bn, resulting in a contraction in Australian September quarter GDP of around -0.7%, and risking a return to recession. Our Australian Economic Activity Tracker which combines weekly data has fallen sharply this month.

![]()

Source: AMP Capital

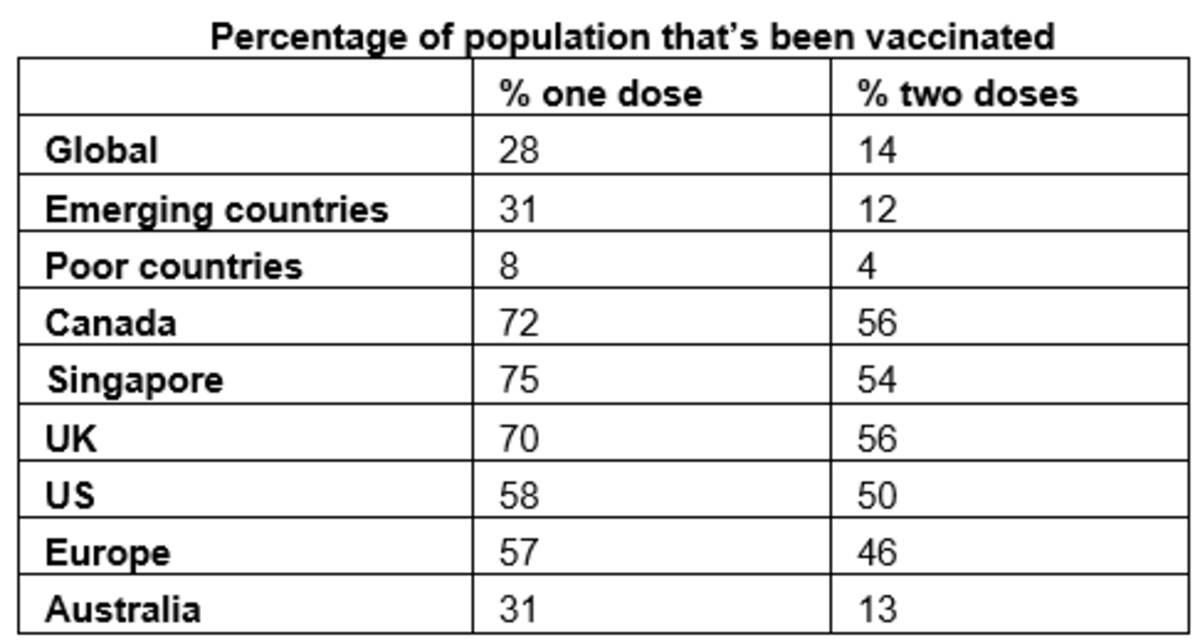

- Only 14% of the global population has been vaccinated with two doses, & in Australia its only 13%. Which means there is a long way to go to reach herd immunity – which may require 80% to be fully vaccinated given the Delta variant.

Source: ourworldindata.org, AMP Capital

Five reasons for optimism

First, lockdowns still work against the Delta variant. This is being seen in various Asian countries and in Australia, with Victoria, Queensland, WA & SA all managing Delta outbreaks with short lockdowns and able to reopen again without getting everyone vaccinated. The key difference versus NSW was that they started earlier in terms of the new daily case load (1-10 a day v nearly 30 in NSW) & went harder up front. SA has ended its snap lockdown & Victoria has announced the end of its.

Source: Covid19data.com.au, AMP Capital

And while it may take longer in NSW because it started later, new cases are not exploding despite the Delta variant. In fact, the rate of increase is slower than seen in the Victorian wave from mid-last year. This suggests the NSW lockdown is helping – it started earlier than Victoria’s did last year. And having had 3.5 million vaccines already administer in NSW may also be helping. So, while the lockdown is taking longer than expected and may have to be tightened – it does appear to be helping & the experience of other states tells us they still work. They just need to start earlier and harder if we want them to be short.

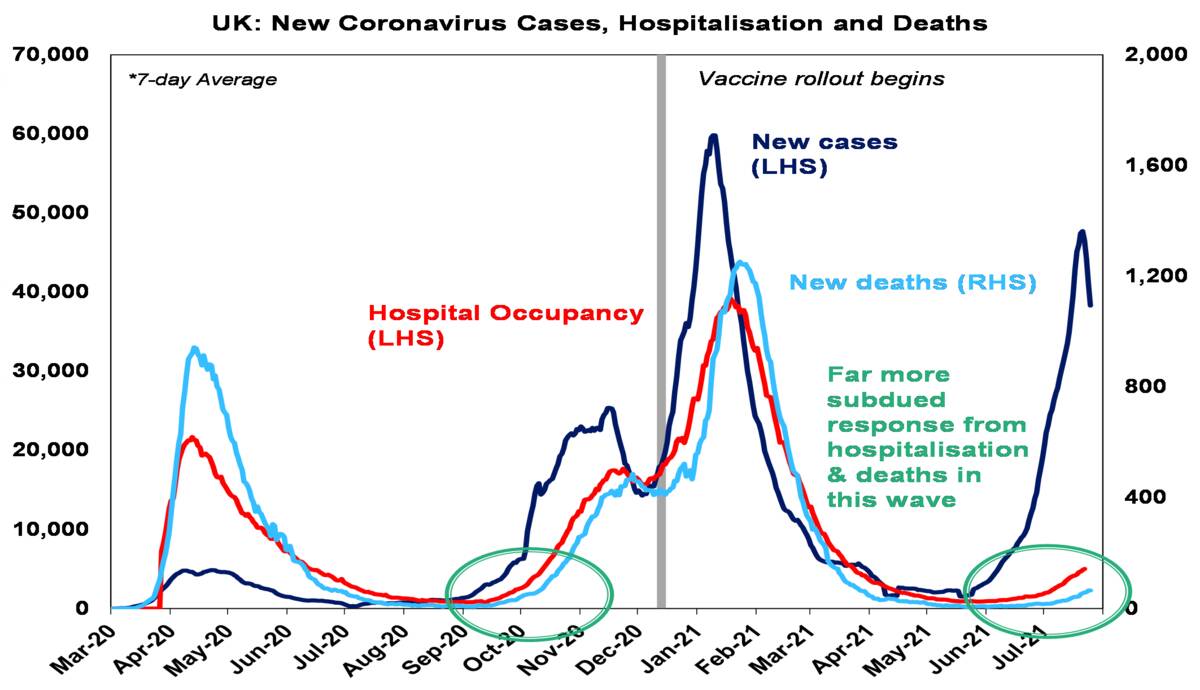

Second, vaccines are working. While the UK, US and Europe have seen a rise in new cases, hospitalisations and new deaths are more subdued this time around. This is clear in the UK – which has also seen new cases fall in the last week (vaccines helping slow the spread or it could just be an aberration?)

Source: ourworldindata.org, AMP Capital

This is all consistent with vaccines being 90% plus effective in preventing the need for hospitalisation and deaths, even though they’re less effective in preventing infection (61% for AstraZeneca and 82% for Pfizer/Moderna with respect to Delta) & only 47% effective in preventing onwards transmission based on UK data. The success of the vaccines can also be seen in the US with per capita new cases and hospitalisations in the top quartile of vaccinated states up to 25% below that in the bottom quartile of unvaccinated states. Ideally, these countries should be waiting till they reach 80% or so vaccinated before fully reopening (as Singapore is) to reduce the risk of problems with overwhelmed hospitals. But with older and more at-risk people close to being fully vaccinated this should be manageable with restrictions (like masks & distancing) rather than hard lockdowns. And so, the recovery should be able to continue.

Third, the experience of the last year has demonstrated repeatedly that once lockdowns end economic activity rebounds rapidly propelled in part by pent up demand. We are starting to see this in Europe where confidence and business conditions have rebounded above that in Australia and the US thanks to its reopening (after a double dip recession in the December and March quarters). It has been seen repeatedly in Australia after the numerous lockdowns (including the 3-4 month Victorian lockdown last year). Ramped up Government support points to the same happening again in NSW through the December quarter serving to get the recovery back on track.

Fourth, the threat posed by Delta will add to pressure for more fiscal stimulus and easier for longer monetary policy. It will increase pressure in the US to pass President Biden’s $4 trillion eight-year American Jobs and Families Plans and will help keep the Fed dovish. Pressure for more stimulus (back to JobKeeper) is also ramping up in Australia and it will likely see the RBA delay its decision to reduce bond buying.

Finally, the pace of vaccination in Australia is ramping up rapidly. Last week was the first with over 1 million vaccinations. At the rate of 1 million vaccines a week Australia will hit 60% vaccinated by around year end and 80% by mid-March. If we ramp it up to 1.5 million doses a week as global vaccine production ramps up, it will be 60% by mid-November and 80% by early January. Beyond around 80% fully vaccinated we should (new mutations aside) be able to start to live with coronavirus in the community without overwhelming the health care system and keeping deaths down. This is the only way to end the snap lockdowns in a way that does not risk Australians’ health and the economy. Because as we saw last year, countries that were lax in controlling coronavirus and allowed deaths to surge saw a bigger hit to their economies.

Implications for investors

The renewed surge in coronavirus cases poses a short-term risk to share markets and other cyclical trades like the Australian dollar. However, there is a danger in over emphasising this as we remain of the view that the economic recovery globally and in Australia will continue as lockdowns end in the short term and increased vaccination allows a more sustained reopening over the next 12 months. Share markets have proven relatively resilient so far because there is now more evidence of the ability of science & medicine to control the virus, the Delta variant is seen as driving easier for longer fiscal and monetary policy and US June quarter earnings results are again coming in far stronger than expected.

Subscribe below to Oliver’s Insights to receive my latest articles

Shane Oliver, Head of Investment Strategy & Chief Economist

Investors Lose $1 Trillion in China’s Wild Week of Market Shocks

Fri, July 30, 2021,

(Bloomberg) — It began with a record crash in Chinese stocks on Wall Street and only got crazier from there.

The nearly $1 trillion selloff ignited by Beijing’s shock ban on profits at tutoring companies has triggered a new round of soul searching about the investment case for Chinese assets in the Xi Jinping era.

After a week of wild market swings and tense calls with clients, some investors have decided China just isn’t worth the trouble. Others spot buying opportunities after valuations sank to the lowest level in decades. As Xi’s Communist Party attempts one of its biggest economic policy shifts since the 1980s, almost everyone agrees the regulatory onslaught has further to run.

Friday, July 23

2 p.m. Hong Kong

Word begins spreading through chatrooms long before it becomes official: much of China’s booming tutoring industry will be forced to turn non-profit. Even after months of anticipation, it’s worse than investors feared. New Oriental Education & Technology Group Inc. loses half its value in an hour as short sellers pounce. Nirgunan Tiruchelvam, a research analyst at Tellimer, wonders which sectors will become targets next. High on his list: property, gaming and health care.

3:26 p.m. Beijing

China’s housing ministry issues a warning to the country’s real estate companies, saying it will “notably improve order” in the property market and crack down on violations. China Evergrande Group, the indebted developer that some investors fear is on the brink of default, sinks to session lows.

4:10 p.m. Hong Kong

The Hang Seng Index closes with a 1.5% loss. There are few signs of widespread contagion, for now.

5:30 a.m. Austin

Soren Aandahl, founder of short seller Blue Orca Capital LLC, sees the headlines on his phone. His first thought: “Buckle up.” The U.S.-listed shares of New Orient and TAL Education Group tumble more than 40% in pre-market trading. Less than six months ago, they were some of the highest-flying stocks on Wall Street.

4 p.m. New York

The Nasdaq Golden Dragon China Index closes with an 8.5% decline, after earlier falling by as much as 10.3%. All but two of the index’s 98 members retreat. Some investors wonder if the tutoring crackdown could presage broader changes in the tenuous VIE structure used by most big Chinese companies listed in New York.

Saturday, July 24

10:09 a.m. Beijing

China orders Tencent Holdings Ltd. to give up its exclusive music streaming rights, the latest salvo in a months-long assault on the nation’s tech giants. Pony Ma, the company’s billionaire founder, has so far weathered the clampdown better than his long-time rival Jack. But that hasn’t stopped Tencent shares from losing a third of their value since February.

7:22 p.m. Beijing

The government finally confirms its sweeping tutoring overhaul, saying the industry has been “severely hijacked by capital.”

Cliff Zhao, head of research at CCB International Securities Ltd. in Hong Kong, works through the weekend writing research reports. It was “just as busy as the U.S.-China friction in 2018 and the pandemic outbreak in March last year,” he says later. “These events have no precedent.”

8:30 p.m. Chicago

“That’s nuts,” says Paul Nolte, a portfolio manager who helps manage $4 billion at Kingsview Investment Management, as he watches Asian markets react to the weekend news. Nolte hasn’t owned Chinese shares directly since selling Tencent and Alibaba in 2019, but he’s beginning to worry about his exposure via holdings of global exchange-traded funds. The weighting for mainland- and Hong Kong-based stocks in the MSCI Emerging Markets Index has doubled in 10 years to about 35%.

Monday, July 26

9:20 a.m. Hong Kong

The open is ugly and Alvin Cheung’s clients are getting nervous. The associate director at Hong Kong-based Prudential Brokerage Ltd. says “no one knows,” when they ask him if the market is near a bottom.

10:54 a.m. Beijing

The selloff is most extreme in the tech sector, but it’s starting to spill over. The CSI 300 Index of shares in mainland China tumbles more than 3%. The rout is especially painful for Alice Wang, a 27-year-old who works in the education consulting business in Beijing. “We are in the front line for the hit,” she says later. “It’s a double whammy for me.”

3:49 p.m. Beijing

China issues new guidelines for online food platforms, saying they must ensure the welfare of delivery workers. Xi has made “common prosperity” a cornerstone of his economic agenda amid rising discontent in China over the country’s yawning wealth gap. Food delivery giant Meituan, already under investigation for suspected monopolistic practices, tumbles as much as 15%.

“The stock drops on Friday and Monday again took me back to my days in Indonesia” during the Asian financial crisis in the late 1990s, says Herald van der Linde, HSBC Holdings Plc’s head of Asia Pacific equity strategy. “There were moments where you just think — Oh my God!”

Tuesday, July 27

8 a.m. Hong Kong

Evergrande, the world’s most indebted developer, disappoints equity investors by deciding against a special dividend. S&P Global Ratings had cut its credit rating by two notches the previous night, the third downgrade by a global ratings company in about a month.

2:45 p.m. Hong Kong

Tencent says in a cryptic statement that it stopped accepting new users for WeChat while the popular social media platform undergoes a “security technical upgrade.” New registrations will resume around early August, the company says. Investors see it as another reason to sell. The stock, among the most widely held in Asia, tumbles 9%.

2:55 p.m. Shanghai

Trading desks are abuzz with unverified rumors that U.S. funds are offloading China and Hong Kong assets. The selloff in shares spreads to the yuan and S&P 500 Index futures. Treasuries rally as investors rush into havens. Prudential Brokerage’s Cheung doesn’t think the speculation has any merit, but it shows how fragile sentiment has become.

“China has a PR problem,” says Jason Hsu, founder and chief investment officer of Rayliant Global Advisors. “The market is saying ‘I don’t know what’s going on, so I am going to sell and then ask questions.’”

At Shenzhen JM Capital Co., fund manager Zhuang Jiapeng spends three hours on a call to convince one investor not to liquidate his China holdings. “Clients get freaked out when there are steep losses,” he says later. “It’s human nature.”

4 p.m. New York

The Golden Dragon China index has now lost 19% in the span of three trading days. Patrick Springer, managing director of institutional securities at Huatai Securities USA, has been busy fielding calls from clients since Friday. Some are wondering whether MSCI Inc. and its peers will rethink their push in recent years to boost China’s weighting in benchmark indexes. Others are nervous about what Chinese authorities might do to address the “three big mountains” of unaffordable education, health care and housing. “Investors think that the way the Chinese government tries to improve income inequality over the last few days is not good for future capital formation,” Springer says.

Wednesday, July 28

9:45 a.m. Shanghai

It’s another down open for the CSI 300, but some funds are snapping up shares of big banks and brokerages in bulk. Talk of the National Team’s arrival grows louder. Adding fuel to the rally: A flurry of articles in state media suggesting the rout was overdone.

6 p.m. Beijing

China’s securities regulator does its part to shore up confidence, convening a hastily arranged virtual meeting with executives of major investment banks including Goldman Sachs Group Inc. and UBS Group AG. Some bankers come away with the message that the education policies were targeted and not intended to hurt companies in other industries.

11:01 p.m. Beijing

China’s official Xinhua News Agency adds to the chorus, saying recent policies targeting internet platforms and after-school tutoring are aimed at protecting online data security and social welfare rather than “outright curtailing” of those industries. The securities regulator is supportive of companies that seek foreign listings, Xinhua says.

Thursday, July 29

9:30 a.m. Shanghai

The first positive open in five days gives bulls some breathing room, but reminders of the market chaos endure. Goldman Sachs Group Inc. analysts Kinger Lau and Timothy Moe write in a note that the regulatory crackdown has left some clients wondering whether China’s stock market has become too dangerous. “‘Uninvestable’ has featured in many of our recent conversations with clients,” they say. The bank’s prime brokerage desk issues a report showing that hedge fund clients focused on fundamental stock-picking for China are headed for their worst month on record.

5:31 p.m. Hong Kong

After a day of relative calm and a 3.3% gain in the Hang Seng Index, a Wall Street Journal report on Didi Global injects a fresh dose of volatility. The newspaper says Didi is considering going private to placate Chinese authorities and compensate investors for losses incurred since the company listed in the U.S. in late June. The ride-hailing giant had come under mounting scrutiny from Beijing after going through with its IPO despite objections from internet regulators, who have grown increasingly worried about the national security risks of Chinese tech giants that list overseas. Didi soars more than 40% after the WSJ report, but pares most of the gains after the company says speculation about its privatization is untrue.

Friday, July 30

9:30 a.m. Hong Kong

Evergrande is back in focus after a court freezes assets of its listed onshore subsidiary. More creditors are publicizing their disputes with the developer, fueling further investor concern about its financial health. The company’s shares plunge more than 9% to their lowest level since January 2017 and one of its offshore bonds sinks to 39 cents on the dollar.

4:45 p.m. Beijing

The CSI 300 finishes with an 0.8% loss on the day and a 5.5% decline on the week. After the close, there’s a flurry of action as authorities summon the country’s largest technology companies for a warning on data security, vow tighter oversight of overseas share listings and accuse ride-hailing companies of anti-competitive behavior.

A meeting of the Communist Party’s Politburo chaired by Xi offers investors little reassurance that the regulatory onslaught will slow in the second half. The 25-member Politburo pledges “improvement” in the system for approving overseas listings by companies, Xinhua reports, without giving details.

The clampdown “is something very hard to discount,” Tellimer’s Tiruchelvam says. “Investing in China is not for the faint-hearted.”

We would like to thank Bloomberg, AMP Capital and WGC for their articles we have shared this week.

Download - Low-Carbon BaseI hope that you have gained some valuable information from our report this week. Also if you would like more information in regards to shares, bonds, funds management or Superannuation Compliance and Education, please do not hesitate to contact us.

Regards,

Chris Hagan,

Head, Fixed Interest and Superannuation

JMP Securities

Level 1, Harbourside West, Stanley Esplanade

Port Moresby, Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814