7 March, 2022

Welcome to this week’s JMP Weekly Report

The local bouse saw quite a number of trades pass through the PNGX last week. KSL traded the highest Trading last week saw BSP, KSL, CCP, CPL and STO take up the volume. BSP saw 969,297 shares trade at K12.50, KSL traded 2,666 shares at K3.00, CCP saw 101,124 shares trade at K1.60, CPL had a big week with 277,495 shares traded at K0.95 while STO had 2,896 shares trade at K18.50. Refer details below;

WEEKLY MARKET REPORT | 28 Febraury, 2022 – 4 March, 2022

| STOCK | QUANTITY | CLOSING PRICE | CHANGE | % CHANGE | 2021 FINAL DIV | 2021 INTERIM | YIELD % | EX-DATE | RECORD DATE | PAYMENT DATE | DRP | MARKET CAP |

| BSP | 969.297 | 12.50 | 0.25 | 2.08 | k1.3400 | – | 11.61 | THU 10 MAR | FRI 11 MAR | FRI 22 APR | NO | 5,356,538,075 |

| KSL | 2,666 | 3.00 | 0.10 | 3.33 | K0.1850 | – | 7.74 | THU 3 MAR | FRI 4 MAR | FRI 8 APR | NO | 67,052,337 |

| STO | – | 18.50 | – | – | K0.2993 | – | – | MON 21 FEB | TUE 22 FEB | THU 24 MAR | – | – |

| KAM | – | 1.00 | – | – | – | – | 10.00 | – | – | – | YES | 49,891,306 |

| NCM | – | 75.00 | – | – | USD$0.075 | – | – | FRI 25 FEB | MON 28 FEB | MON 28 FEB | – | 33,774,150 |

| NGP | – | 0.70 | – | – | – | – | – | – | – | – | – | 32,123,490 |

| CCP | 101,124 | 1.60 | – | – | – | – | 6.19 | – | – | – | YES | 492,690,131 |

| CPL | 277,495 | 0.95 | – | – | – | – |

– | – | – | – | – | 195,964,015 |

Dual Listed ASX Stocks

BFL – $5.92 flat

KSL – $0.85 flat

NCM – $27.135 +$1.475

STO – $8.175 +0.925

On the interest rate front, TBill were flat with the 365 day bills averaging 5.16%. Of note was that BPNG did not issue additional stock to meet the 244mill oversubscription unlike the two previous weeks which could place a little downward pressure on this week’s auction but I believe the trend is relatively flat for the short term.

There were no announcements from Treasury regarding GIS and the auction date appears to be still in the approval stages. I expect we will see some good volume and possibly a second auction soon after.

What we’ve been reading this week

5 big implication of the war in Ukraine of relevance for investors and why are Australian shares holding up better

Dr. Shane Oliver, Head of Investment Strategy and Economics and Chief Economist, AMP

The situation regarding Ukraine is at high risk of getting worse before it gets better for investment markets.

The key is how much Russian energy exports are disrupted & whether NATO forces avoid the conflict.

Five big picture implications are likely to be: increased geopolitical tensions; reduced globalisation; higher commodity prices; higher inflation; and higher interest rates over the medium term.

Australian shares have so far been more resilient thanks to higher commodity prices & strong dividends.

Introduction

Humans do horrible things to each other, and war is the worst example of that. What was first announced by Russia earlier last week as a “peacekeeping” force moving into part of eastern Ukraine controlled by Russian separatists quickly morphed into a full-blown attack. This in turn has seen a progressive ramping up in western sanctions on Russia. All of which has contributed to high levels of financial market volatility. This note looks at the current situation, five big picture implications of relevance to investors and the performance of Australian shares.

The current situation

The falls and volatility in global share markets in response to the war reflects a fear of the unknown about how far the conflict will extend and how severe the economic impact will be. The main economic threat is through higher energy prices as Russia supplies around 30% of Europe’s gas and oil imports and accounts for around 11% of world oil production. In short, investors are worried about a stagflationary shock.

If the conflict is limited to Ukraine with Russian gas still flowing to Europe and NATO not getting directly involved (Scenario 1), then the economic fallout will be limited, and further share market falls may be minor or we may have seen the low. But if Russian energy is cut off and NATO military forces get directly involved (Scenario 2) then share markets could have a lot more downside (like another 15% or so). And given the uncertainty investors may fear the latter scenario even if its ultimately avoided. There are several points to make regarding all of this.

- First, Russia is aiming to prevent Ukraine joining NATO but it has no interest in war with NATO as Russian military capability is weaker. President Biden has continued to stress that the US will not engage in military conflict with Russia – just as it managed to avoid it through the Cold War. The presence of nuclear weapons on both sides remains a huge deterrent – as President Putin reminded us. This along with western sanctions excluding Russian energy exports should help limit the war to Ukraine and minimise the global economic impact. This would favour Scenario 1.

- But trying to get geopolitical moves right is never easy. And there is a high risk the situation gets worse before it gets better. Things may not be going as well as Putin first assumed. Ukrainians seem to be fighting back hard. The West seems to be a lot more united and strident in its response to Russia including via severe sanctions (which will drive deep recession in Russia) & the supply of military equipment to Ukraine. Even China failed to support Russia at the UN & has expressed concern about harm to civilians.

- While a backdown by Putin is possible, to avoid a humiliating outcome he may go in harder. But with images being beamed around the world a more forceful Russian attempt to gain control with huge loss of life could further harden global resolve against Russia.

- European exports to Russia are just 0.7% of its GDP and US exports to Russia and Ukraine are less than 0.2% of its GDP so the direct impact on them from a collapse in the Russian economy would be small. The main threat comes via a hit to energy supply and so far the US and Europe have sought to minimise this threat by excluding the Russian energy sector from the sanctions.

- The US economy is far less vulnerable on the energy front than Europe as it produces and exports more energy than it consumes and imports. Russia needs the revenue from its energy exports to Europe and it’s not possible for it to quickly replace exports to Europe with exports to China (as the gas pipeline is already at capacity). But the more the sanctions on Russia escalate and the conflict goes on the greater the risk that Russia will curtail energy supplies. This is why the oil price has surged to around $US115/barrel.

- Even if there is no direct disruption, energy prices are likely to be higher than otherwise reflecting a risk premium as long as uncertainty remains high around supply. The same will apply to other commodity prices including foodstuffs where Russia and Ukraine are significant producers – eg, they account for about 25% of global wheat production.

No one knows for sure how this will unfold. But as we pointed out last week there is a long history of various crisis impacting share markets and the pattern is the same – an initial sharp fall followed by a rebound. Dark as it may seem at present the same is likely to apply this time as well, but trying to time it will be hard, so the best approach is for investors to stick to an appropriate long-term investment strategy. There are some things that will help drive a rebound once some dust settles:

- Just as in the Cold War (when the ideological divide was wide) Russia & the West will likely find a way to co-exist.

- The crisis is more inflationary than deflationary, but for the next few months its likely to be a constraint on more rapid central bank rate hikes.

- Additional defence spending will provide a boost to growth.

- While European growth will take a bit of a dent, global growth this year is still likely to be strong at around 4%.

- As a result, company profit growth is likely to remain solid this year, albeit down from last year.

Five big picture implications of the Ukraine crisis

On a medium-term basis though, the war in Ukraine will have some lasting implications of relevance to investors.

#1 A new “cold war” & reversal of the peace dividend

Geopolitical tensions were on the rise prior to the pandemic with the relative decline of the US & faith in liberal democracies waning from the time of the GFC. This has seen various regional powers flex their muscles – China, Russia, Iran and Saudi Arabia. The pandemic inflamed US/China tensions. And now Russia, under President Putin, is seeking to stop the eastward drift of NATO using force and to restore Russia to some of its former status, against the background of a Russia-China partnership. All of which is leading to fears (or maybe the reality) of a new cold war which the Ukraine war has given a push along. This in turn means a return to ramping up defence spending (with even Germany now planning to increase military spending to 2% of GDP) – reversing the peace dividend that saw countries reduce defence spending and allocate public spending to more productive uses in the post-Cold War era.

Implications: it may be good news for defence stocks but heightened geopolitical risks adds to investment market volatility and may require higher risk premiums (ie, lower price to earnings multiples) on growth assets. But its not all negative as the competition between nations can boost technological innovation as it did in the post WW2 Cold War.

#2 Reduced globalisation

A backlash against globalisation became evident last decade in the rise of Trump, Brexit & populist leaders. Coronavirus added to this with pressure to onshore supply chains. A reversal in globalisation has been evident in recent years in a peak in global exports and imports as a share of global GDP. Short of a quick negotiated solution or Putin being replaced there is a high-risk Russia will be excluded from much trade with the West for years, driving a further reversal of globalisation. Higher war risks also add to pressure for onshoring.

Implications: reduced globalisation risks leading to reduced growth potential for the emerging world generally, reduced global competition and reduced productivity if supply chains are managed on other than economic grounds. It threatens to add to inflationary pressure in the global economy. It will also reduce the breadth of global share and bond indices with Russia likely to be removed from global equity and bond indices – albeit its only 0.3% of the global share index.

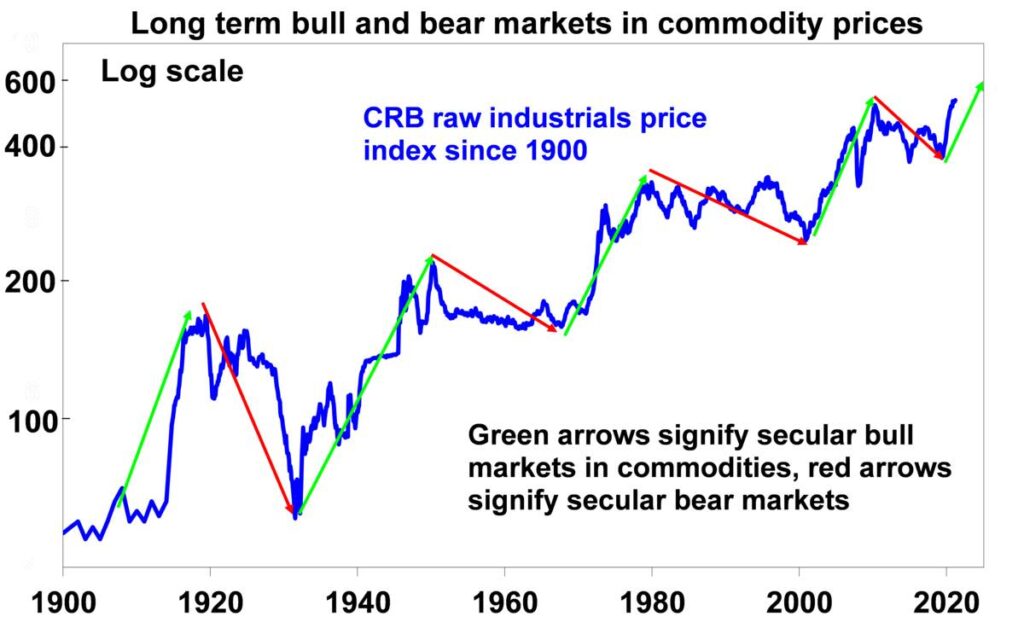

#3 Higher commodity prices

The Ukraine conflict, thanks to the disruption and threats to the supply of energy, industrial and agricultural commodities and increased demand for metal intensive defence goods is providing a further boost to commodity prices and adds to the case that we have entered a new commodity super cycle. This is also underpinned by low levels of resource investment in recent years and decarbonisation.

Source: CRB, Bloomberg, AMP

Implications: this is good news for commodity producers like Australia, but bad news for commodity importers like most industrial countries. It may see Australian shares and the $A outperform like during the commodity boom of the 2000s.

#4 Higher inflation

The boost to commodity prices – notably for energy and food – from the Ukraine war and longer-term from increased defence spending and a reversal in globalisation will further add to global inflation pressures. While the boost to energy and food prices may be temporary, the danger is that coming on the top of already high inflation rates it will add to inflation expectations and become more entrenched.

#5 Higher interest rates

The near-term uncertainty caused by the Ukraine crisis may take the edge of central bank monetary tightening in the short-term. But ultimately the hit to economic activity globally and in Australia is likely to be limited and the upwards pressure it adds to commodity prices and the risk of higher inflation for longer will reinforce the case for monetary tightening, and see higher interest rates and bond yields over the medium-term.

Implications: higher inflation, interest rates and bond yields will constrain longer-term returns from shares and property compared to what we have seen over the last 30 years.

Why are Australian shares holding up a bit better?

From their bull market highs global shares are down 8%, but Australian shares are only down 6% and have so far held above their January low. Australia will suffer from any hit to global growth from the crisis and Australian consumers will be hit with record petrol prices which could easily spike another 15-20 cents a litre in the next few weeks reflecting the rise in global oil prices to around $US115 a barrel. Against this though, Australia is relatively well protected: our trade links with Russia are trivial – with exports to Russia accounting for less than 0.1% of GDP; many of our energy and agricultural products can help fill the global gap left by disruption of Russian and Ukraine exports; and national income will receive a boost from higher energy and commodity prices. And finally, the just ended profit reporting season was positive and (based on calculations by The Coppo Report) will see $36bn in dividends paid to investors over the next two months, which is nearly 40% up on a year ago & only just down on the record payments six months ago. All of which should help the relative performance of Australian shares.

CONTAINER PREMIUMS: Market continues to dwindle amid increased sailing space – S&P Platts

Author: David Lademan, Greg Holt, Parisha Tyagi and Sam Eckett

Rates slightly above FAK as ex-China demand remains hampered

Southeast Asia-US rates rangebound at elevated levels

All-inclusive container shipping rates from North Asia to North America fell sharply in the week ending March 3 amid pushback from shippers as bearish macroeconomic factors began to weigh on sentiment.

Premium service fees for shipments from North Asia to both the East Coast and West Coast of North America were pegged at $1,000/forty-foot-equivalent unit above FAK rates for the routes, which S&P Global Commodity Insights assessed March 4 at $11,000/FEU to the East Coast and $9,300/FEU to the West Coast.

Some third-party booking agents were still offering as much as $15,000/FEU to the West Coast, but uptake has dwindled as better rates have become available directly from carriers as space on ships departing China comes open from shipment cancellations, a Canadian freight forwarder said.

“The driver of lower premiums is that is Chinese manufacturers are still having a hard time getting their cargoes out,” the freight forwarder said. “It’s indicative of clogs in the supply chain within China. One case of [coronavirus] can close an entire city, which could have kept workers from returning to their jobs promptly after Chinese New Year.”

A surge of US retail inventories in January indicated that retailers are overstocked with goods meant for the holiday season, while non-auto retail sales dropped 22% in January from December, indicating that rising inflation rates were already hitting consumer spending earlier this year, according to a report by New York-based freight-forwarding platform Shifl.

“A particularly strong increase in consumer price inflation over 2021 and the termination of stimulus checks and higher spend on travel and restaurants can be alarmist to the retail consumer base,” Shifl CEO said Shabsie Levy said. “This could push consumers to tighten their spending and further exacerbate the fall in retail sales.”

Shippers were also less convinced that congestion at US ports — and its depleting impact on carrying capacity — was sufficient justification for premium surcharges. The queue of ships waiting to berth at the Los Angeles/Long Beach port complex dropped Feb. 28 to 58 ships, its lowest level since October, while the worst congestion on the US East Coast, at Charleston port, had 24 ships at anchor waiting to berth March 3, down from more than 30 a week earlier.

“There seem to be a lot of differences of opinion on the outlook for rates this year,” a US-based freight forwarder said. “I wonder a lot about how order books are looking in China, and with oil shooting up now, inflation is top of the mind of consumers. A lot of companies thought the strong fundamentals of 2021 would carry into 2022, but they may be proven wrong.”

Southeast Asian rates rangebound

All-inclusive premium rates remained rangebound, with Southeast Asia to East Coast North America priced at $15,000-$18,000/FEU and West Coast at $13,000-$16,000/FEU.

The demand from US retailers has been weak as most of them stocked their inventories before the Lunar New Year, sources said, but market participants remained cautious amid cancellations to Russia.

“There has been a slowdown in cargo volumes to the US, but we expect a pickup in April,” a Singapore-based source said. Meanwhile, equipment availability remains tight and the growing conflict between Russia and Ukraine has spurred worries of supply chain blockages, the source said.

Major shipping lines, like Ocean Network Express, Hapag-Lloyd, and Maersk have halted operations in Russia and Ukraine, giving rise to concerns of added blank sailings into Europe.

“With more and more container lines halting business in Russia, supply chains will get tighter, freight rates are likely to go up, especially for [the] UK, as alternatives via rail or air are also crippled by sanctions,” a Singapore-based cargo owner said.

The delays of cargo at various transshipment hubs are also likely to add to the disruptions and hurt operational capacity, the cargo owner added.

Meanwhile, FAK rates on the route were also stable.

Platts Container Rate 25 — Southeast Asia-to-East Coast North America — was assessed at $10,500/FEU and PCR23 — Southeast Asia-to-West Coast North America — was assessed at $9,500/FEU, both unchanged from a week ago, according to S&P Global data.

Rates on the West Coast India to Middle East route were also unchanged amid stable supply-demand fundamentals.

PCR33 — West Coast India to the Middle East — was assessed at $2,100/FEU March 4, and TCR33 —West Coast India to the Middle East — at $1,000/TEU.

Elsewhere in the European markets, premium rates were still reported as operating to the Mediterranean, with one carrier source quoting rates as high as $15,626/FEU. Sources cited capacity issues, marine fuel prices, and an ongoing lack of containers as driving factors for the higher-quoted rates.

Lack of early warning systems ‘leave millions at risk’

USAID workers support a mangrove planting activity as part of a climate change adaptation strategy in the Philippines in 2011. Climate scientists have called for urgent investment in adaptation, such as early warning systems. Copyright: Jessie F. Delos Reyes, Public Domain.

- Damning climate report shows billions in global South highly vulnerable

- Authors call for urgent investment in adaptation, such as early warning systems

- Window for global action to address crisis ‘rapidly closing’

By: Fiona Broom

A lack of extreme weather early warning systems means millions of lives are at risk in climate-vulnerable communities in the global South, climate scientists warn in a landmark report.

Billions of people are living in hotspots of high climate vulnerability in Africa, South Asia, Central and South America, and small island developing states, warns the latest adaptation assessment report from the Intergovernmental Panel on Climate Change (IPCC).

Petteri Taalas, secretary-general of the World Meteorological Organization (WMO), said during the launch of the report’s summary for policymakers that it was critical to increase attention on adaptation, as extreme weather events continue to get worse in the coming decades.

“Any further delay in concerted global action will miss a brief and rapidly closing window to secure a liveable future.”

Hans-Otto Pörtner, co-chair, IPCC Working Group II

“One of the powerful ways to adapt is to invest in early warning services. But the basic weather and climate observing networks have severe gaps in Africa and island states,” Taalas said. Only half of the 193 members of the WMO had these services, resulting in higher human and economic losses, he added.

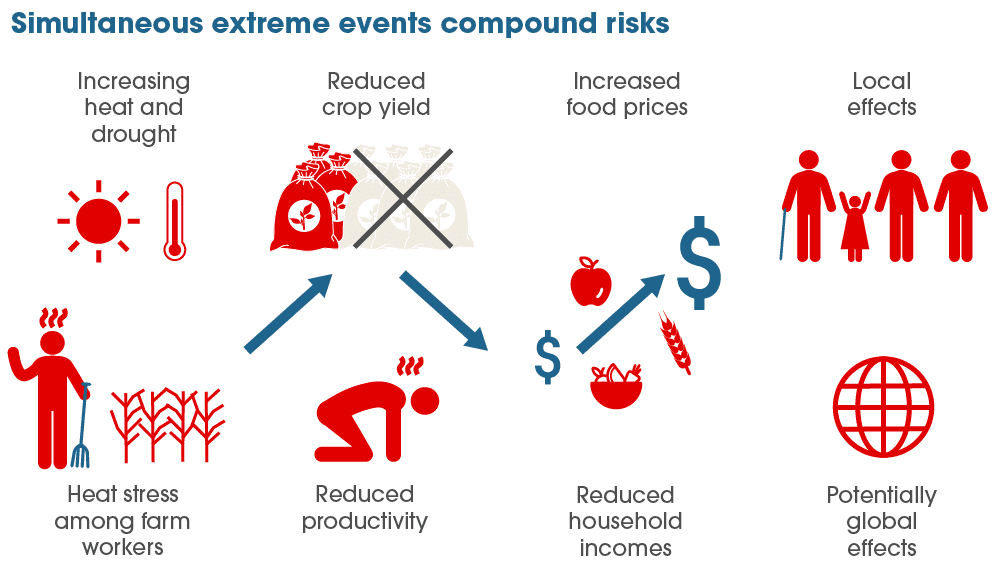

Increasingly frequent and intense global weather events have reduced food and water security and hindered efforts to meet the Sustainable Development Goals, the report found.

“The scientific evidence is unequivocal: climate change is a threat to human wellbeing and the health of the planet. Any further delay in concerted global action will miss a brief and rapidly closing window to secure a liveable future,” said Hans-Otto Pörtner, co-chair of the IPCC’s Working Group II that produced the report.

UN secretary-general Antonio Guterres said that the assessment report was like no other scientific report he had ever seen, calling it an “atlas of human suffering and a damning indictment of failed climate leadership”.

The document examines the risks posed by global warming, while offering ways that communities in different regions can adapt to the impacts of climate change.

Urgent adaptation

Small islands present the most urgent need for investment in capacity building and adaptation strategies, the report found, while Asia is facing increasingly severe heatwaves, monsoons and glacier melting.

Impacts on rural livelihoods and food security, particularly for small and medium-sized farmers and indigenous peoples in the mountains, are projected to worsen in Central and South America.

Working Group II co-chair Debra Roberts said that current global finance for adaptation was insufficient, especially for developing countries.

The “overwhelming majority” of global climate finance was targeted at emissions reductions, said Roberts, head of the sustainable and resilient city initiatives unit at South Africa’s eThekwini municipality, which includes the city of Durban.

Environment leader Wanjira Mathai tells SciDev.Net podcast Africa Science Focus what’s at stake at this year’s COP27 international climate summit.

Climate finance for adaptation in Africa is billions of dollars short of what it needs to be to reach even the lowest adaptation cost estimates, according to the report.

Analysis released last week (25 February) by Power Shift Africa, a think tank led by founding director Mohamed Adow, found that governments in Africa are spending up to US$90 million a year on climate adaptation, despite contributing the least to global greenhouse gas emissions.

Meanwhile, small island developing states lack access to data for climate modelling, the report says, which impedes their abilities to plan for and adapt to future extreme weather.

“This report shows that the rich world needs to radically increase adaptation support to those on the front lines of this emergency,” said Adow. “With 2022 seeing the UN climate summit COP27 taking place in Africa, this is the perfect year to address the adaptation crisis.”

Adapted from IPCC Working Group II, 2022.

Mami Mizutori, special representative of the UN secretary-general for disaster risk reduction, said: “The IPCC report points to many solutions on improving regional and local information, providing sound data and knowledge for decision-makers. This does work. Countries have succeeded in saving many lives through improved early warning systems and preparedness.”

Mizutori said that more investment in disaster prevention and risk reduction was needed for the world’s most vulnerable countries.

The report identified 127 risks covering a wide range of sectors, including agriculture, economies, infrastructure, and ecosystems. However, it suggests there are adaption measures that are feasible and effective and can reduce risks to people and nature.

Ecosystem restoration is a powerful tool for improving adaptation, the report says, while flood risks can be met by enhancing natural water retention by restoring wetlands and rivers, or upstream forest management.

Effective adaptation strategies and supportive public policies can enhance food availability and stability, and reduce climate risk for food systems while increasing their sustainability, the report says.

This piece was produced by SciDev.Net’s Global desk.

I hope you have enjoyed the read this week, if you would like more information on trading or setting up a trading account, please feel free to give me a call

Have an awesome week,

Chris Hagan,

Head, Fixed Interest and Superannuation

JMP Securities

Level 1, Harbourside West, Stanley Esplanade

Port Moresby, Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814