20 September, 2021

Welcome to this week’s JMP Report.

I would like to thank our readers for the great feedback we are receiving on our report and I hope the report continues to add value to your reading.

If you would like more info on your Superannuation tax rates, contribution levels, options and general retirement planning, please do give me a call

On the equity front this week, CCP was the star of the weeks trading 208,882 shares, closing down 2 toea or -1.18% to K1.68 on Friday followed by BSP with 50,000 shares traded unchanged at K12.30 per share. KAM saw 4,800 shares closing unchanged at K1.00. The week was a short week due to the Public Holiday on Thursday 16th to celebrate 46th PNG’s independence.

A technical look at our stocks

|

WEEKLY MARKET REPORT 13.09.21 – 17.09.21 |

|||||||||||

|

STOCK |

QTY |

CLOSING |

CHANGE |

% CHANGE | 2020 Final Div | 2021 Interim | Yield % | Ex Date | Record Date | Payment Date | DRP |

|

BSP |

50,000 |

12.30 |

– |

0.00 | K1.0500 | K0.39000 | 11.61% | Frid 24 Sept | Mon 27 Sept | Mon 18 Sept | No |

|

KSL |

– |

3.25 |

– | 0.00 | K0.1690 | K0.08250 | 7.74% | Wed 01 Sept | Thurs 02 Sept | Fri 01 Oct | |

|

OSH |

– |

10.61 |

– | 0.00 | K0.0000 | – | 0.00% | Mon 30 Aug | Mon 20 Sept | Thur 20 Oct | |

|

KAM |

4,800 |

1.00 |

– | 0.00 | K0.0400 | K0.06000 | 10.00% | Wed 15 Sept | Mon 20 Sept | Thurs 20 Oct | Yes |

|

NCM |

– |

75.00 |

– |

0.00 | K0.0000 | – | 0.00% | Thu 26 Aug | Fri 24 Sept | Mon 01 Nov | |

| NGP | – | 0.70 | – | 0.00 | K0.0000 | – | 0.00% | Fri 17 Sept | Fri 24 Sept | Mon 01 Nov | |

|

CCP |

208,882 |

1.68 |

-0.02 | -1.18 | K0.0000 | – | 0.00% | ||||

|

CPL |

– |

1.00 |

– |

0.00 | K0.0000 | K0.0000 | 0.00% | ||||

On the Interest Rate front, interest rates remain stable with 364 TBill auction averaging 7.20%. As advised last week, BPNG have recommenced their Tap Bill issuance facility. This give the nonprofessional investor access to the bond market. If you would like information on how you can access the Bonds, please do contact us.

In the long end, the market is looking for more supply to assist with excess liquidity, an ongoing problem at the moment. Our book has buyers along the yield curve. Finance Company money remains in the 5.50% range.

What we have been reading this week

Weathering disruption: From cost management to cost excellence

Lance Mortlock C-Suite Advisory

We live in a time of unparalleled disruption: Supply chains are being knocked sideways, consumer markets altered, and public institutions are stretched to their limits. The world over, organizations are spending significant amounts of time, talent and treasury navigating our increasingly complex business system, the challenges of which are exacerbated by the COVID-19 pandemic. As measured by the Economic Policy Uncertainty Index, uncertainty has been elevated to record levels in the last 18 months. The pandemic’s long-term impact on industries and governments remains unclear, but uncertainty is here to stay.

While the influence of the pandemic is still persistent, leaders face other sources of change and turbulence. For example, climate change has become a top-of-mind issue, driven by demand for climate action from investors such as BlackRock, institutions, activists and the general public. Rapid advancements in digital, such as artificial intelligence and blockchain, are reshaping industries across the globe and renewing the need for companies to anticipate their competitors’ investments in technology. Financial markets are seeing unprecedented volatility driven by cryptocurrency, and social media users’ coalescence and a widespread desire to disrupt established systems. Perhaps most significantly, geopolitical events have been shaping the landscape of global economies as trade agreements are revised, and tariffs are invoked.

These events bring on greater levels of volatility, uncertainty, complexity and ambiguity (VUCA). Economists, however, argue that there are many reasons to remain optimistic. Many experts, including The World Bank forecast strong, but uneven economic growth in 2021 fuelled by solid consumption, renewed export potential and further government stimulus packages.

The pursuit of cost excellence has never been more important

Organizations that have weathered the pandemic storm and are poised to take advantage of a recovering economy exhibit a high degree of resourcefulness, the ability to streamline operations in pursuit of efficiencies and a laser focus on cost excellence.

Achieving cost excellence requires a disciplined, objective and pragmatic approach that targets inefficiencies and waste at the functional and enterprise levels. Gartner’s 2021 study on cost reduction mistakes indicates it also requires a deep-rooted cultural change in the organization to sustain success.

However, no one-size-fits-all method can act as a panacea for all organizations’ cost management needs. Organizations need to determine the right tools and techniques to deploy as part of their cost programs to move from simple cost management to more advanced cost excellence. Regardless of the chosen approach, time and time again, companies that effectively maintain cost excellence are more resilient to changes in the economy and marketplace, something more important today than ever before.

High-performing organizations focus on a solid foundation of data and analytics

When organizations think about strategic cost management and cost reduction, many overlook the need to adopt activities that comprehensively understand their “true” costs. Companies often rush into setting cost reduction targets and taking action without conducting a robust analysis of the actual costs associated with a product, service or business segment. As a result, hidden costs may not be fully accounted for in the reporting used by management to guide decision-making.

This can result in savings targets that miss the mark and cost excellence programs that fail to live up to expectations. To set the foundation for cost excellence, organizations must adopt the proper cost accounting and allocation methodology. Furthermore, firms need to understand the actual cost of their services, build transparency, improve cost reporting and use technology to drive more profound insights. For example, ride-hailing company Uber used prescriptive analytics, including Machine Learning and Natural Language Processing, to improve speed and accuracy when responding to customer support tickets saving the company millions of dollars.

Six step approach to addressing costs

- Understand– Get clear on the organization’s shortcomings and performance gaps. It’s also essential to adopt a suitable methodology, gather good foundational data and leverage technology and advanced analytical capabilities to get deeper insights.

- Strategize– Set goals and define success. It’s crucial to set goals and targets and determine what the organization is trying to achieve. The scope of the cost excellence program needs to be clearly defined, including whether it is genuinely enterprise-wide or focused on a specific function.

- Diagnose– Consider all sources and develop a portfolio of ideas. Develop an initial view of cost excellence ideas, including quick wins and longer-term, more impactful items. Use internal and external sources to get all ideas on the table.

- Prioritize & Refine– Pressure test idea options through modelling, analysis and projections. Develop criteria to prioritize ideas based on benefit/impact and effort and host various screening sessions with key stakeholders to align focus areas. Further, assess the ideas and develop more detailed business cases to confirm the benefits.

- Sequence– Develop a roadmap and formalize the approach. Sequence the business cases and map out an implementation timeline that ensures the appropriate pace, including required dependencies. Ensure you have leadership buy-in and clearly communicate timelines to critical stakeholders.

- Execute & evaluate– Implement ideas, monitor, and adjust as needed. Execute implementation plan, monitor and control progress, manage risk and enable benefit tracking. Work towards embedding cost excellence into the culture of the organization.

Cost excellence builds organizational resilience

Pursuing cost excellence through these 6 steps requires a clear strategy, leadership and organizational alignment, and a willingness and ability to make difficult decisions that challenge the organization. Organizations must strike the right balance between value, pace and sustainability.

Over the past 50 years, disruptive world-changing events have happened with significant pace and frequency. While COVID-19 is reshaping our world today, there will be another significant shift in the future, followed by others. When disruption is the norm, it becomes more and more challenging to accurately forecast economic and market impacts. Business leaders must be vigilant to changes happening in the market, and at the same time, ensure the organization can withstand these impacts. Building the suitable shock absorbers into an organization, including a culture of cost excellence, will help an organization build long-term resilience to weather the next eventual post-pandemic storm.

Authored by Lance Mortlock (Senior EY Strategy Partner & Haskayne School of Business Visiting Professor) with input from Chris Palmer (EY Senior Manager).

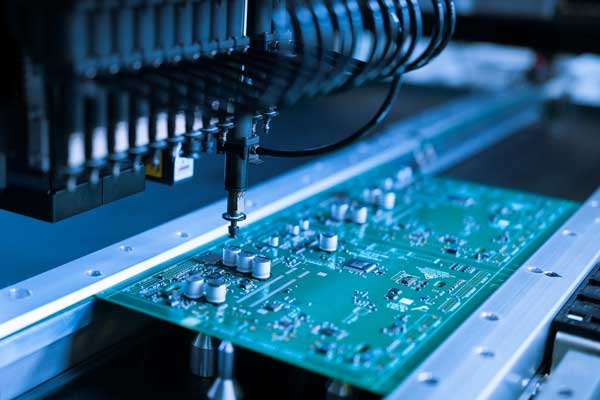

Rare earth metal prices explode, may lead to increased prices for electronics

Adding to a tsunami of bad news about the global supply chain

By Adrian Potoroaca September 14, 2021, 5:44 PM 59 comments

Why it matters: Prices for rare earth metals have surged over the past twelve months. This development will likely impact the prices of electronics for end-users in the coming months. Meanwhile, the US and China have been pointing fingers at each other, with no diplomatic solution in sight.

Over the past year, we’ve seen a string of news about supply shortages for everything from capacitors, $1 display driver chips to the advanced silicon found in phones, tablets, PC components, and car infotainment and driver assistance systems. Even if the tech industry were somehow able to crank more of these components, they’d still have to deal with a shortage of shipping containers.

Nikkei Asia reports, the crisis is far from over. Manufacturers of electronic components are now facing a new challenge as prices for rare-earth metals have surged over the past year and are expected to rise even further in the coming months.

The primary reason for the price hike is the smouldering trade war between China and the US, which never seems to end. Now that’s affecting shipments of some of the crucial ingredients needed to make all manner of electronic products.

The lithium used in batteries, nuclear energy, and spacecraft equipment has seen the most significant price increase—150 percent compared to September 2020. The second-largest increase was observed for holmium, which has more than doubled over the past twelve months.

Holmium is used to make magnets and special alloys for sensors and actuators. Neodymium and praseodymium are also used to make strong magnets found in speakers, motors, wind turbines, and more. These two metals have also seen an increase in price of over 73 percent year-over-year.

Prices of copper, tin, aluminum, cobalt, copper, and terbium oxide have also seen increased costs from anywhere between 37 to 82 percent. Manufacturers use these in chip packaging, mounting, and connecting electronic components on printed circuit boards, mechanical parts, metal casings, and more.

For most people, the behind-the-scenes process of sourcing these materials and transforming them into electronic devices, electric cars, and other products has been invisible and uninteresting. Now that it threatens to increase the prices we’ll pay for various electronic goods, the ugly complexities of the global supply chain are bubbling to the surface.

It certainly doesn’t help that governments have decided to electrify everything and set aggressive green goals at a time when the electronics and automotive industries can barely keep up. Demand for everything is at an all-time high, and experts have conflicting views on when supply will catch up with it.

|

Year |

US production (metric tons) |

China production (metric tons) |

Rest of the World (metric tons) |

US share of global output |

China share of global output |

|

1985 |

13,428 |

8,500 |

17,157 |

34% |

21% |

|

1990 |

22,713 |

16,480 |

20,917 |

38% |

27% |

|

1995 |

22,200 |

48,000 |

9,700 |

28% |

60% |

|

2000 |

5,000 |

73,000 |

5,500 |

6% |

87% |

|

2005 |

0 |

119,000 |

3,000 |

0% |

98% |

|

2010 |

0 |

120,000 |

11,000 |

0% |

92% |

|

2015 |

5,900 |

105,000 |

19,100 |

5% |

81% |

|

2020 |

38,000 |

140,000 |

62,000 |

16% |

58% |

Some believe that China is the culprit, as the country controls 55 percent of global production capacity and no less than 85 percent of the refining output for rare earth metals. In June, the Biden administration decried tighter export controls imposed by the Beijing government, calling them a “capricious enforcement of Chinese customs.”

One of the proposed solutions to this problem is to build more US rare earth capacity and reduce the reliance on China for critical raw materials. Perhaps ironically, Chinese rare earth mining giant Shenghe Resources owns a minority stake in MP Minerals. This US company operates the recently re-opened Mountain Pass mine in California—the supposed buffer against fluctuating prices for rare earth materials coming out of China.

Image credit: Reuters

In trying to build more rare earth capacity, the US government has offered millions in grants for mining companies to expand their operations. However, most of the concentrates obtained through mining in the US—some 50,000 tonnes per year—still have to be sent to China for final processing.

Meanwhile, several Chinese suppliers that have contracts with Apple, Amazon, Dell, Facebook, Logitech, and Sennheiser have seen their gross margins shrink below the industry average of 20 percent. So far, they’ve been able to absorb the shock, but soon enough, they’ll have to pass the costs to their customers, which will translate into higher prices for everything with electronics and batteries in it.

As of writing, there is only one consumer-facing company that adjusted its prices. During an earnings call, Sonos said it would raise prices between $10 to $100 depending on the product starting this month. Whether or not this will turn into a trend, only time will tell.

Masthead credit: Peggy Greb

The World Bank says climate change could displace more than 200 million people

REUTERS/MOHAMED ABD EL GHANY

Cairo is among the cities that could see a large influx of climate migrants, according to a new World Bank report

Climate change impacts are projected to displace 216 million people in developing regions by 2050, according to a new report from the World Bank.

Driven primarily by sea level rise and water scarcity, people will relocate within their own countries to cities and towns with more reliable access to natural resources and economic opportunity, the report finds.

What are the climate immigration hotspots?

As early as 2030, cities like Cairo, Hanoi, Dhaka, Tashkent could become climate immigration hotspots. The latest report, which focuses primarily on North Africa, East Asia, and Central Asia, builds on a document from 2018 that focused on sub-Saharan Africa, Latin America, and South Asia.

Of the six regions studied, sub-Saharan Africa is projected to see the greatest total number of internal migrants, with up to 85.7 million. North Africa, a region that is already chronically short of water, is projected to see the greatest share of its population affected, with up to 9% of people displaced by 2050.

Migration as a climate adaptation strategy

The report finds that migration risk is highly responsive to greenhouse gas reduction measures; in other words, as the Intergovernmental Panel on Climate Change report in August made clear, every fraction of a degree of warming that can be prevented will make an enormous difference in how global societies and economies experience climate change. In the most ambitious climate action scenario, the migration projection in 2050 is 80% lower, with just 44 million people across the six regions displaced.

In any case, internal migration need not be a bad thing per se, if it helps people to avoid harmful climate impacts. People move around anyway, and urbanization has been growing for decades. The challenge, highlighted by the report, is to ensure that destination locations are ready, with safe, affordable housing, employment opportunities, and sufficient public services for a growing population.

We hope you have enjoyed the read this week, if you would like any information on investing in PNG, please feel free to call.

Regards,

Chris Hagan,

Head, Fixed Interest and Superannuation

JMP Securities

Level 1, Harbourside West, Stanley Esplanade

Port Moresby, Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814