1 May, 2023

Welcome to this week’s JMP Report

On the equity front, the PNGX traded 4 stocks with BSP trading 345,713 shares, closing steady at K12.80, STO traded 503 shares, closing steady at K19.10, NCM traded 603 shares, closing K1.00 higher at

K75 and CCP traded 64,429 shares closing at K2.00.

Please see the full overview below,

WEEKLY MARKET REPORT | 24 April, 2023 – 28 April, 2023

| STOCK | QUANTITY | CLOSING PRICE | CHANGE | % CHANGE | 2021 FINAL DIV | 2021 INTERIM | YIELD % | EX-DATE | RECORD DATE | PAYMENT DATE | DRP | MARKET CAP |

| BSP | 347,713 | 12.60 | – | 0.00 | K1.4000 | – | 13.53 | THUR 9 MAR 2023 | FRI 10 MAR 2023 | FRI 21 APR 2023 | NO | 5,317,971,001 |

| KSL | 0 | 2.48 | – | 0.00 | K0.1610 | – | 9.93 | FRI 3 MAR 2023 | MON 6 MAR 2023 | TUE 11 APR 2023 | NO | 64,817,259 |

| STO | 503 | 19.10 | – | 0.00 | K0.5310 | – | 2.96 | MON 27 FEB 2023 | TUE 28 FEB 2023 | WED 29 MAR 2023 | YES | – |

| KAM | 0 | 0.95 | – | 0.00 | – | – | – | – | – | – | YES | 49,891,306 |

| NCM | 603 | 75.00 | 1.00 | 1.33 | USD$1.23 | – | – | FRI 24 FEB 2023 | MON 27 FEB 23 | THU 30 MAR 23 | YES | 33,774,150 |

| NGP | 0 | 0.69 | – | 0.00 | – | – | – | – | – | – | – | 32,123,490 |

| CCP | 64,429 | 2.00 | – | 0.00 | K0.225 | – | 6.19 | FRI 24 MAR 2023 | WED 29 MAR 2023 | FRI 5 MAY 2023 | YES | 569,672,964 |

| CPL | 0 | 0.95 | – | 0.00 | K0.05 | – |

4.20 |

WED 22 MAR 2023 | THUR 30 MAR 2023 | THU 30 JUL 2023 | – | 195,964,015 |

Dual listed Stocks PNGX/ASX

BFL – 4.90 +2c

KSL – 73c -2c

NCM – 28.90 +2c

STO – 7.07 -9c

On the interest rate front the TBill market remained steady with the 364day bills averaging 3.06%. The auction was well bid with the bank issuing 218 mill and leaving the market short and oversubscribed by 226million.

I have attached the results for the GIS auction with 504mill bids received and the bank issuing 429mill of the 400mill on offer. There was reasonable volume issued in the 10yr with a 1% tail between 5.3% and 6.3%.

Download GIS Auction Results

And for something a little different

Gold – 1989 + $7

Palladium 1606 -$106

Platinum – 1074 -$54

Bitcoin – 29,338 +6.68%

Ethereum 1891 +2.32%

PAXGold – 2000 +.84%

What we’ve been reading this week

Key principles for successful investing

Martin Dinh – ASX

Four issues to consider in the journey to long-term wealth creation.

Key points

- Having clear goals is the starting point for long-term investing.

- The next step is choosing an appropriate asset allocation and periodically rebalancing assets in your portfolio.

- Minimising transactions and costs and maintaining long-term perspective and discipline are other key factors in successful investing.

Investing can be a great way to build wealth but can often be unpredictable due to factors that we cannot control.

When constructing a portfolio, you can incorporate several key investment principles that focus on a number of factors that are within your control to give yourself the best chance of long-term investment success.

Here are four issues to consider:

- Create clear and appropriate investment goals

The first key investment principle when constructing a portfolio is to create clear and appropriate investment goals.

Investment goals can be broken down into return and risk objectives. The return objective involves determining how much your investments need to grow to meet your investment goals. The risk objective involves assessing your willingness to take on risk.

Your ability to take on risk can be influenced by a number of factors such as your time horizon, your current financial situation and the size of expenses relative to your portfolio.

When coming up with your investment goals, it is often helpful to incorporate this into an investment plan, such as the example below.

|

Example of a basic investment plan |

|

|

Investment objective |

|

|

Constraints |

|

|

Contributions |

|

|

Asset allocation target |

|

|

Rebalancing frequency |

|

|

Monitoring and evaluation |

|

Source: ASX

- Create an asset allocation that is consistent with your investment goals

The second key investment principle is to create an asset allocation that reflects your investment goals and risk tolerance.

Asset allocation refers to a process of dividing your investments across different asset classes, such as equities, property, fixed interest securities and cash, in a way that reflects your investment goals and risk tolerance.

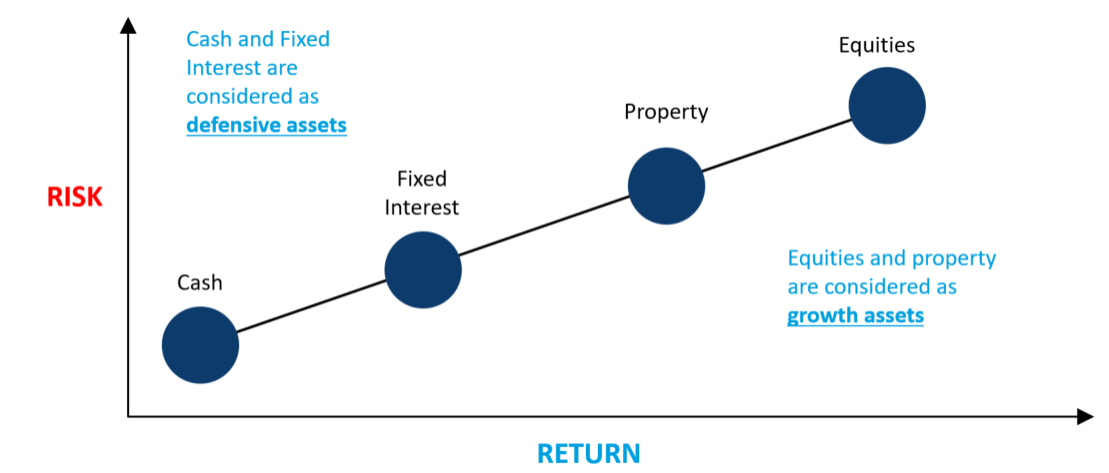

Each asset class will have its own risk and return profile and it is important to understand this relationship when constructing your asset allocation.

Source: ASX

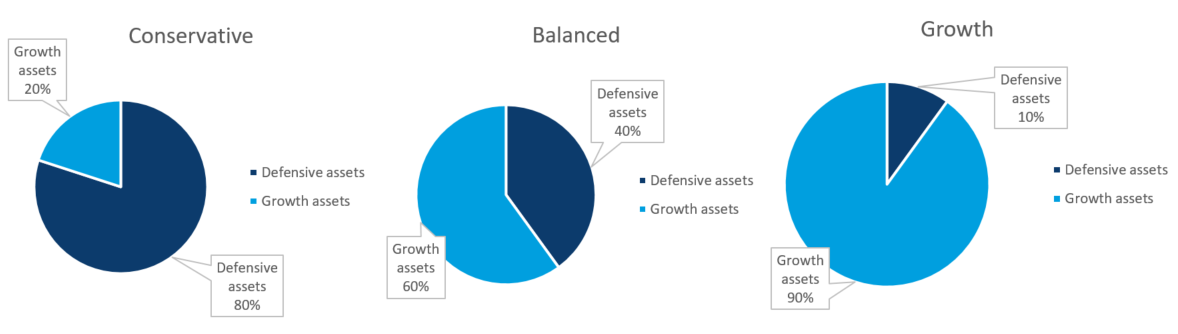

The right asset allocation will depend on your individual investment goals and risk tolerance.

Below are three broad asset allocations that may suit the needs of a range of investors along the risk spectrum from conservative to growth.

Source: ASX

|

Investor Profile |

Conservative |

Balanced |

Growth |

|

Time horizon |

Short |

Medium |

Long |

|

Risk tolerance |

Low |

Medium |

High |

|

Investment goal |

Capital protection |

Balance between capital protection and growth |

Capital growth |

Source: ASX

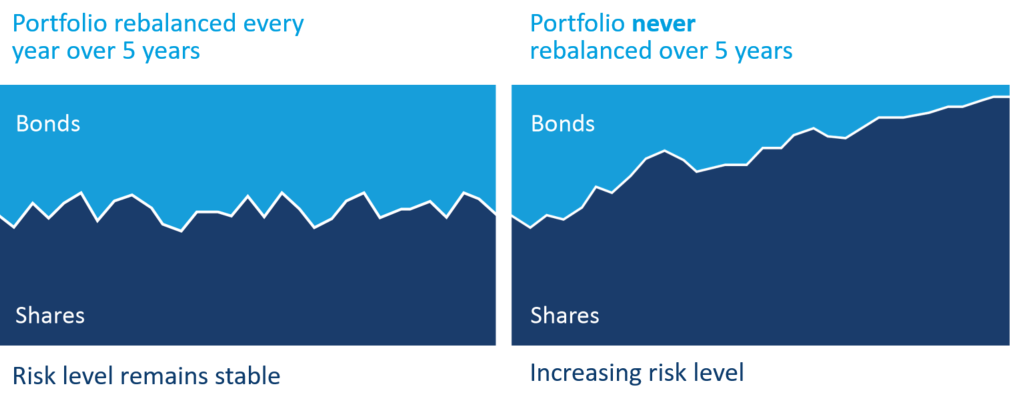

Asset allocation is not a set-and-forget strategy. You should regularly rebalance your portfolio, because the performance of assets will change over time which will cause you to move away from your target asset allocation.

Rebalancing a portfolio involves selling a proportion of your assets that have risen in value and using those proceeds to buy assets that have fallen in value.

Source: ASX

In the above diagram, the investor has determined that their target asset allocation comprises an even split between stocks and bonds.

Over time, the stock market has performed better than the bond market and the investor’s asset allocation now comprises a significantly higher allocation to stocks than bonds. As consequence, the investor’s portfolio now contains a higher level of risk than their target asset allocation.

To rebalance their portfolio, this investor would sell a proportion of their shares and use those proceeds to buy more bonds until they have a portfolio that comprises an even split between stocks and bonds.

By regularly rebalancing your portfolio, this ensures your asset allocation continually reflects your investment goals and risk tolerance.

- Minimise cost

It is important to minimise costs where you can because even small differences in terms of fees can have a substantial impact on the returns on your investments, in particular over the long-time horizon.

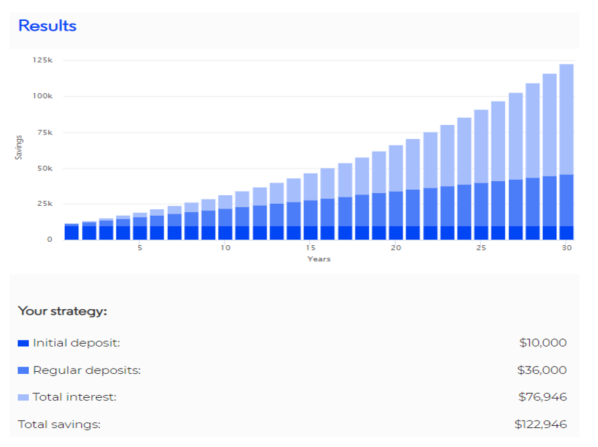

In the below example, you can see that the total annual cost of 2% on a $100,000 investment rather than 1%, assuming this investment grows by 5% per annum, would reduce your final return by more than $80,000 over a 30-year period.

Source: Managed funds fee calculator – Moneysmart.gov.au

- Maintain perspective and long-term discipline

Having investment perspective and discipline will provide you with the time for your investment to grow through a powerful investing concept called compounding.

Compounding is an investing concept that involves earning returns on both your original investment and on the return you previously received.

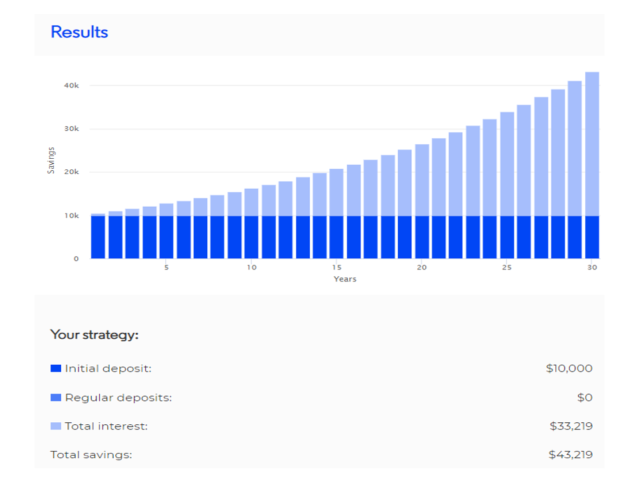

The impact of compounding can be illustrated by using basic maths. Assume you have $10,000 and it grows 5% in the first year. At the end of the first year, this investment will grow to $10,500. Assume in the second year, this same investment grows 5%. At end of the second year, this investment will grow to $11,525.

Instead of your investment growing by $500 like it did in the first year, your investment has grown $525 because you are earning a return on the $10,500 that you had at the end of the first year and not on the original investment. That is essentially what compounding is.

If you extrapolate this same example over a 30-year period, your $10,000 investment will have grown exponentially to more than $43,000.

Source: Compound Interest Calculator – Moneysmart.gov.au

Disclaimer: note the graph provided is not a prediction and does not represent any particular investment. The can examples are not intended to be your sole source of information when making financial decisions and you should consider getting advice from a licensed financial advicer if you need advice.

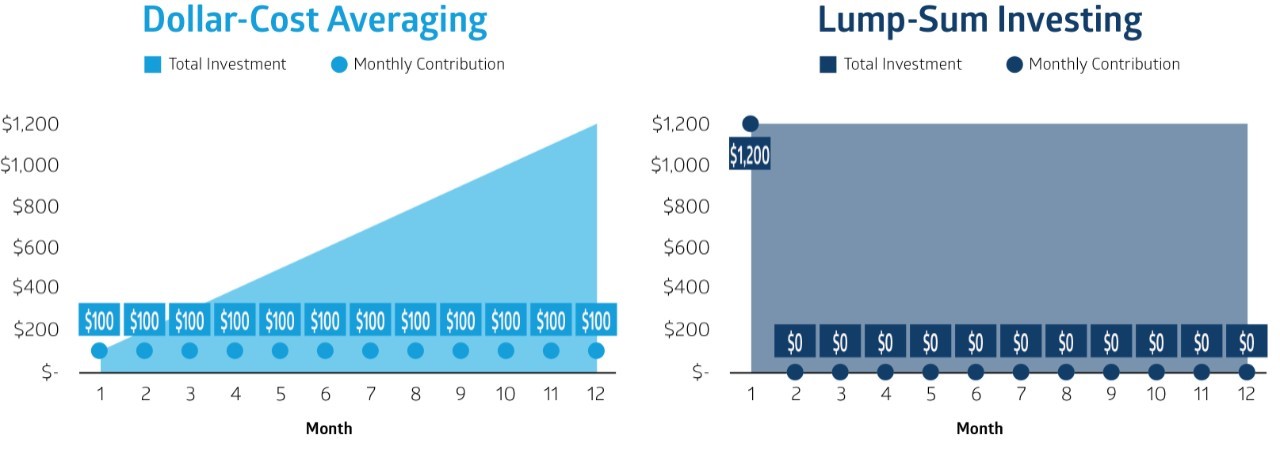

When maintaining perspective and long-term discipline, you could consider taking a “dollar-cost average” approach as opposed to a lump-sum approach.

A dollar-cost average approach refers to the process of making small regular contributions regardless of the share price whereas a lump-sum approach refers to investing all at once in an investment. The diagram below compares dollar-cost averaging to investing a lump sum.

Source: eToro

A dollar cost-average approach can help remove emotion from investing because you are buying shares on a regular basis regardless of market conditions. This will smooth out the purchase price because there will be times where you are buying the shares at a more expensive price but also other times where you will buying the shares at a cheaper price.

Making small regular contributions can also be a great way for you to reach your investment goals because the impacts of compounding are even more profound. This is because you are earning an annual compound return on both your original investment as well as all the contributions that you make over the entire period.

Using the same example that we provided above, let us now assume this investor now makes regular $100 contributions a month for the entire period.

You can see from the below graph that this $10,000 investment has now grown to over $122,000, which is more than three times higher than the investor’s portfolio that did not make any regular contributions.

Source: Compound Interest Calculator – Moneysmart.gov.au

Disclaimer: note the graph provided is not a prediction and does not represent any particular investment. The can examples are not intended to be your sole source of information when making financial decisions and you should consider getting advice from a licensed financial advisor if you need advice.

Investment goals and risks

Prior to investing, it is important to consider your investment goals and risk tolerance.

Important considerations

An investment can start with as little as $500 plus brokerage costs. Here are a few important considerations before you start.

Your investment goals, Investment advice, Investment strategy

The investment products available through the ASX can assist investors in achieving their investment goals when used correctly. The strategy that is right for you will depend on your own personal circumstances and it is important to seek professional advice before deciding to invest.

The following strategies can be useful tools to help investors achieve specific outcomes, and you should take time to learn more about these and other strategies before deciding what is right for you.

Strategic Asset Allocation

Strategic asset allocation sets the proportion to be invested in each asset class in order to achieve your investment objective. If you are investing for a short period of time (1 – 3 years), then you may be willing to accept low levels of risk of losing your capital while achieving a lower return. This may mean taking a conservative approach by choosing asset classes and products that provide a relatively predicatable rate of return and allow you to access your money quickly when you need it. If you have a long-term (7+ years) investment timeframe then you may be looking to create a high growth portfolio that invests in relatively riskier asset classes (such as Australian and international shares), has higher levels of volatility (periods where the capital value goes up and down) and provides higher expected rates of return versus other asset classes.

Core-Satellite

The core-satellite approach to portfolio construction uses index tracking investments, such as ETFs, as the stable ‘core’ of the portfolio with carefully selected lowly correlated active investments, such as managed funds (mFunds), as the ‘satellites.’ The advantages are that a sizeable portion of the portfolio is invested in the lower cost ETFs whilst the portfolio also benefits from the alpha that can be obtained from exposure to active, professionally-invested managed funds. This approach helps investors achieve diversification across asset classes and investment strategies while helping to reduce total investment management fees.

Dollar-Cost Averaging

Dollar-cost averaging involves investing the same amount of money into an investment product at regular intervals over a long time period – whether market prices are up or down. For example, if investing into shares, more shares are purchased if prices are lower and fewer are purchased when prices are higher. This helps average the purchase prices over the total period that an investor keeps investing. This investing discipline helps investors avoid emotional buying decisions when prices are higher or lower. Dollar cost averaging through a managed fund or ETF enables you to gain a broad investment exposure with each investment.

Reinvesting Distributions and Dividends

Most managed funds and ETFs allow you to reinvest distributions back into the fund. Reinvesting distributions allows you to purchase more units and increase your investment in the fund. Whether you choose to reinvest your distributions may depend on whether you bought the fund for capital growth or for income purposes. You may also choose to use your distributions to invest in a different fund or other assets in order to help diversify your portfolio.

Dividends or distributions reinvested are still treated as income and as such, are subject to tax.

Re balancing

In establishing a portfolio, investors often start with a strategic asset allocation (see above). After a period of investment, you may find that your initial asset allocation has changed, for example into a higher growth allocation. This is because some asset classes may grow more strongly than others and some asset classes may fall in value. Rebalancing your allocation can be done with new cash flows or by selling down and reallocating a portion of your portfolio. However if you are selling down assets, be aware of the tax consequences and seek tax advice.

Future Fund ready to embrace stock picking again

Jonathan Shapiro Senior reporter AFR – Apr 27, 2023

KEY POINTS

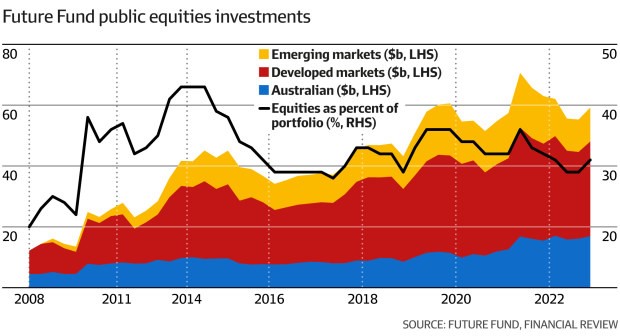

- The Future Fund currently has $65 billion invested in developed and emerging sharemarkets.

- It has commenced a new program to invest in domestic small-cap funds.

- The shift into active equities is part of a multi-year process to reposition the portfolio for what the Future Fund has described as a “new investment order.”

The head of the $200 billion Future Fund declared the easy gains fuelled by the era of cheap money is over, and the sovereign wealth giant is prepared to back stock pickers again.

Six years ago, the Future Fund transferred its entire sharemarket exposure to low-cost index tracking strategies, terminating its mandates with fund managers on the belief markets were so warped by central bank policy that it was too hard to justify paying for skill in such constrained conditions.

Its new stance, which also introduces a program to invest in domestic small caps for the first time, is a response to a changed world in which central bank policies no longer dominate equity market returns, and stock pickers can truly add value.

Future Fund CEO Raphael Arndt at the sovereign fund’s office in Melbourne on Wednesday. Elke Meitzel

“There’s a richer universe for active management,” the Future Fund’s chief executive Raphael Arndt told The Australian Financial Review.

The comments came ahead of Dr Arndt’s keynote address at The Financial Review Alpha Live Summit on Thursday in Sydney.

Advertisement

His comments – to be broadcast live – will articulate how the Future Fund is positioning for a tougher investing environment where only the best investors will succeed.

The fund, Dr Arndt says, will do “everything we can to search out skill wherever it exists”, and is prepared to pay high fees if required to access high performing funds.

Dr Arndt says investors have always faced a trade-off between paying fees to active managers, seeking low-cost alternatives such as passive exchange-traded funds, and creating internal teams to manage money.

But he says the calculus is shifting more towards seeking out skill when broader market returns are challenged in light of global monetary tightening and the US banking crisis.

The address will also outline how the sovereign fund is repositioning its portfolio for a far more challenging outlook, and explain its approach to environmental, social and governance frameworks.

The Future Fund has $65 billion invested in developed and emerging sharemarkets, including Australia.

After a review conducted in 2017, the Future Fund elected to replace active managers with passive and factor-based strategies that invest based on well-understood stock characteristics such as quality, growth, value and momentum.

Dr Arndt said that reflected the prevailing macroeconomic environment in which the performance of equity strategies was dominated by how these factors performed, and not based on actual stock selection ability.

“Equity market returns were largely responsive to central bank policies around either interest rate or quantitative easing or liquidity settings,” he said.

“We continue to think that strategy makes sense at some level, but it’s also true that markets have become more sophisticated around those decisions, so you need a more dynamic approach.”

Dr Arndt says changing market and economic conditions have prompted it to review awarding mandates to active equity managers again. He said as the fortunes of certain regions diverge, while companies with weak balance sheets are vulnerable to higher costs and rising interest rates, stock pickers can shine.

“As economic conditions change in the real world, then some companies will be in sweet spots where they can take advantage of that.

“Other ones won’t be or will come under margin pressure because of more populist politics and more aggressive regulation.”

But Dr Arndt says the Future Fund will rely heavily on technology to determine which fund managers are relying on skill, and which are relying on luck.

Dr Arndt is also set to reveal that the Future Fund has commenced a new program to invest in domestic small cap funds. The sector has always been deemed too difficult to access and to make a difference to the overall returns of a portfolio the size of the Future Fund’s.

But changes in domestic market conditions have led it to consider investing in small caps. This will be welcome news for some funds that are losing mandates from super funds as a result of the Your Future, Your Super regime, which is leading some institutions to more closely track the S&P/ASX 300 benchmark dominated by large companies.

The shift into active equities is part of a multi-year process to reposition the portfolio for what the Future Fund has described as a “new investment order”.

That will involve more volatility, higher inflation, challenges to corporate profits, deglobalisation, populism and greater co-ordination between fiscal and monetary policy.

The research prompted the Future Fund to declare the death of the so-called 60:40 portfolio in which a combination of equities and bonds work to smooth out returns through all market conditions, assuming that equities rally when bonds sell off and the inverse is also true.

While the Future Fund invests in a range of asset classes, including infrastructure, private equity, property and hedge funds, listed equities still represent a sizeable portion of its portfolio.

Over the last 10 years, equities has averaged about one-third of the total portfolio size and was as high as 45 per cent in 2015.

That is still well below the 51 per cent allocation to stocks of Australian superannuation funds, according to Willis Towers Watson figures, the highest among seven of the world’s largest pension fund markets.

The Future Fund has had a long-held disdain for investing in government bonds. That is shared to some extent by superannuation funds, which have a 13 per cent allocation to fixed income, the lowest of the seven major pension markets.

Dr Arndt says the Future Fund has increased its allocation to duration (meaning interest rate risk) via derivatives, and says that while bonds are a more attractive hedge against inflation in the medium term, over the long run, they are risky.

“We still are concerned about a stagflation. In fact, it looks more likely than not that we’ll have a stagflation.”

Dr Arndt says higher interest rates, which are still below the rate of inflation, aren’t sufficiently attractive either.

“Unfortunately, it’s still negative in a real sense. We felt like cash was expensive to hold because of inflation, so we have reduced that cash holding as a result of that.”

Jonathan Shapiro writes about banking and finance, specialising in hedge funds, corporate debt, private equity and investment banking. He is based in Sydney. Connect with Jonathan on Twitter. Email Jonathan at jonathan.shapiro@afr.com

I hope you have enjoyed this week’ read. I have been asked many times as to how you start your investment journey.

I hope the ASX articles assist you with your analysis and gives you something to refer back too. Have a great week and please reach out to me if you need assistance to open a trading account with JMP Securities.

Regards,

Head, Fixed Interest and Superannuation

JMP Securities

Level 1, Harbourside West, Stanley Esplanade

Port Moresby, Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814