14 November, 2022

Hello and welcome to this week’s JMP Report

Last week we saw three stocks trade on the local bourse, BSP, KSL and CCP. BSP traded 334,383 shares closing unchanged at K12.41, KSL saw 1,438 shares trade, closing 5t lower at K2.90 while CCP traded 100,000, closing up 5t to K1.95.

Refer details below

WEEKLY MARKET REPORT | 7 November, 2022 – 11 November, 2022

| STOCK | QUANTITY | CLOSING PRICE | CHANGE | % CHANGE | 2021 FINAL DIV | 2021 INTERIM | YIELD % | EX-DATE | RECORD DATE | PAYMENT DATE | DRP | MARKET CAP |

| BSP | 334,383 | 12.41 | – | – | K1.3400 | K0.34 | 11.61 | FRI 23 SEPT | MON 26 SEPT | FRI 14 OCT | NO | 5,317,971,001 |

| KSL | 1,438 | 2.90 | -0.05 | -1.72 | K0.1850 | K0.0103 | 7.74 | MON 5 SEPT | TUE 6 SEPT | TUE 4 OCT | NO | 64,817,259 |

| STO | 0 | 19.10 | – | – | K0.2993 | K0.26760 | – | MON 22 AUG | TUE 23 AUG | THU 22 SEPT | – | – |

| KAM | 0 | 0.95 | – | – | – | – | 10.00 | – | – | – | YES | 49,891,306 |

| NCM | 0 | 75.00 | – | – | USD$0.075 | K0.70422535 | – | FRI 26 AUG | MON 29 AUG FEB | MON 29 AUG | – | 33,774,150 |

| NGP | 0 | 0.70 | – | – | – | – | – | – | – | – | – | 32,123,490 |

| CCP | 100,000 | 1.90 | -0.05 | 2.63 | K0.134 | – | 6.19 | THU 16 JUN | FRI 24 JUN | THU 28 JUL | YES | 569,672,964 |

| CPL | 0 | 0.95 | – | – | K0.04 | – |

– |

THU 5 APR | THU 14 APR | FRI 29 APR | – | 195,964,015 |

Dual listed stocks PNGX/ASX

BFL- $4.75 -8c

KSL – 865c -1c

NCM – $19.83 +$2.43

STO – $7.59 -35c

The order book

We start the week as nett sellers of BSP and nett buyers of STO and CCP

Interest rates

On the interest rate front we saw a small increase in the 364 day auction rate with the average bids coming in at 4.26%, up slightly from 4.22% the week before. The market seems to be tightening a little with bids exceeding the offer by only 25mill yet the bank issued 50mill less than originally offered. This could indicate a long tail on the bids with a lack of strong demand to get the liquidity set. It could also indicate the markets anticipation of a GIS auction for later in the month which was confirmed on Friday evening, a little earlier than expected, with 169 mill offered from 4yr out to 10yr. Interesting to note 100 mill is offered between the 5 and 7yr.

Finance Company money continues as previous weeks levels with FIFL offering 1.85% in the 1yr.

And for something different

Gold – 1771

WTC Oil – 89

Silver – 21.71

Bitcoin – 16,419

Ethereum – 1,224

USD coin – 1.00

What we’ve been reading this week

BIG BREAKOUT ON GOLD & SILVER – MORE TO COME?

Article courtesy of Ainslie Bullion

Both gold and silver surged higher again last week amid a continued weakening USD and volatility returning to markets on mixed news around possible peace talks in Ukraine, the possibility of a full Republican congress and the ‘war’ between 2 of the biggest crypto exchanges breaking out and crypto falling accordingly. But there are more structural factors at play and we discuss that today.

As we wrote earlier this week, that surge in silver is often a precursor to strength in both gold and silver prices and last night added weight to that thesis. It was also an important night for seeing a substantive break out of gold’s falling channel this year.

Last week USD spot surged $37.10 (2.21%) for gold and $0.53 (2.55%) for silver with gold now firmly back above the $1700 mark at $1712 at the time of writing. Despite that USD weakness seeing a stronger AUD we were still up 1.84% and 2.17% respectively for gold and silver.

The chaos on crypto markets that looks like Binance will rescue FTX and FTX currently suspending withdrawals was a salient reminder of the beauty of physical precious metals that have no such counterpart risk and indeed Ainslie’s crypto wallets where again there is no counterparty risk to holding crypto. There is a lot of dust to settle on the Binance / FTX situation so we will give a full account on Monday and Tuesday next week with the benefit of some of the FUD settling and better hindsight.

This same appeal of lack of counterparty risk when owning physical gold and silver was evident too in the latest World Gold Council report we detailed on Monday. The last quarter was remarkable for the move from paper (ETF’s and futures) to physical gold globally, and in particular central banks covering themselves with the largest quarter of buying ever from them.

The sell off in ETF’s has been driven by the so called carry cost of owning gold (non yielding) amid high interest rates. The more astute look at the REAL interest rate but even that can be interpreted differently. Simply, it is the difference between the nominal interest rate and the inflation rate. So for the US that is 3.85% less 8% which puts it in negative territory and hence attractive to gold. Pure finance manages often use instead the breakeven inflation rate (subtracting the yield of an inflation-protected bond from the yield of a nominal bond) which is currently 2.4%, the highest real rate since the GFC. The former is based on current facts, the latter on expectations. Those whose who believe the spin are selling gold, those who don’t are buying, and often in physical form.

Last night Goldman Sach’s analyst in a note to paid clients made this observation:

“high inflation tends to be (extremely) bullish for gold when the market questions the central bank’s ability to fight it, such as during Burns’s tenure in the 1970s. In contrast, high inflation tends to be bearish for gold when the market gives the CB credit in its ability to reduce it, such as during Volcker’s fight on inflation in the early 1980s.”

We have questioned previously the true motivation of central banks to real inflation all the way back to 2%. It just simply isn’t in their interest to do so.

He takes cues then from the huge central bank demand for gold this year noting:

“EM CB demand appears to be a reflection of geopolitical trends that have been years in the making vs a one-off spike.”

“with CB demand rising by 233 tonnes over the past year, the gold price was boosted by 6.5%, all else equal. Going forward, if CB gold purchases were to continue at a 400 tonnes quarterly pace, that could boost equilibrium gold prices by 25%, all else equal. In a less extreme scenario where purchases moderate to 250 tonnes per quarter over the next year, we believe gold could increase by 12.5%, all else equal.”

“there is limited further downside in Spec positioning which is already close to historic lows. The bank also thinks that, while the drawdown in US ETFs can continue, European liquidations should slow after the ECB turned more dovish. Thus, structurally higher CB demand should help absorb further ETF selling which further enhances the gold price return asymmetry in our view.”

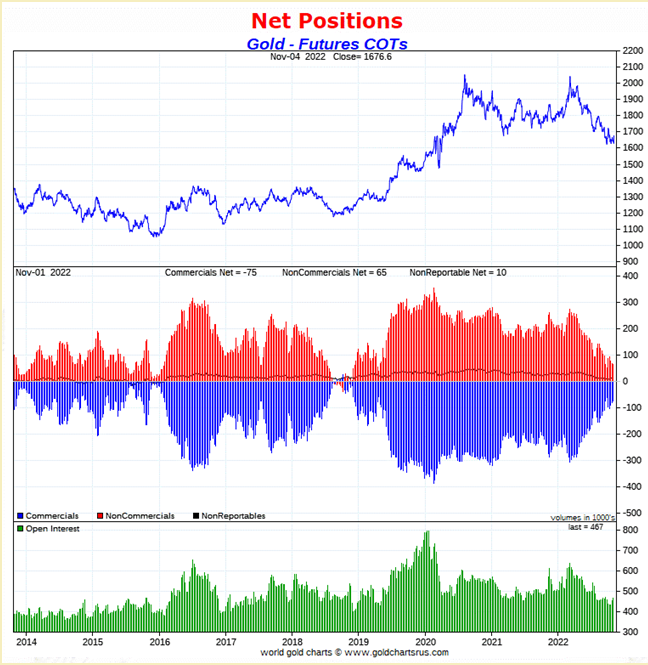

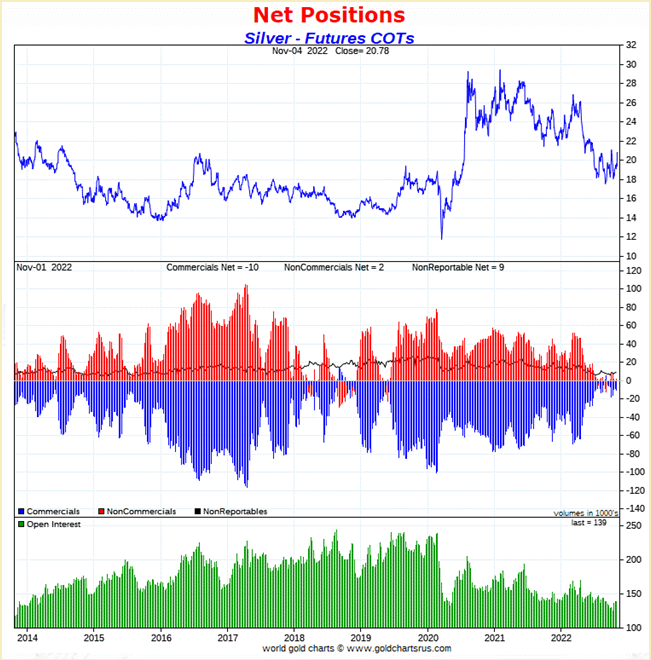

To that latter point on futures spec positioning, the latest Commitment of Traders report from COMEX paints an incredibly bullish picture for both gold and silver:

Oliver’ insights – seven reasons why Australia should be able to avoid a recession

Dr Shane Oliver – Head of Investment Strategy and Economics and Chief Economist, AMP Investments

Key points

– The combination of cost-of-living pressures, sharp interest rate hikes and a global downturn point to a sharp slowing in the Australian economy next year, with consumer confidence at recessionary levels.

– However, there are several reasons why Australia should be able to avoid a recession: the business investment outlook is solid; there is a large pipeline of homebuilding work; high energy prices boost national income; the $A will fall if the global economy gets too weak; immigration is rebounding; inflation may be less of a problem in Australia; and the RBA has moved into the more cautious lane on rate hikes.

Introduction

Economic and financial commentary has been particularly gloomy of late, with talk of a “dire”, “grim”, “bleak”, “perilous” and “confronting” outlook. The problems are well known: high inflation; particularly high and still rising energy prices; central banks aggressively raising interest rates; a high risk of recession globally; the war in Ukraine, along with other geopolitical risks; and the downturn in China. One could be forgiven for thinking that recession in Australia is inevitable in the next year.

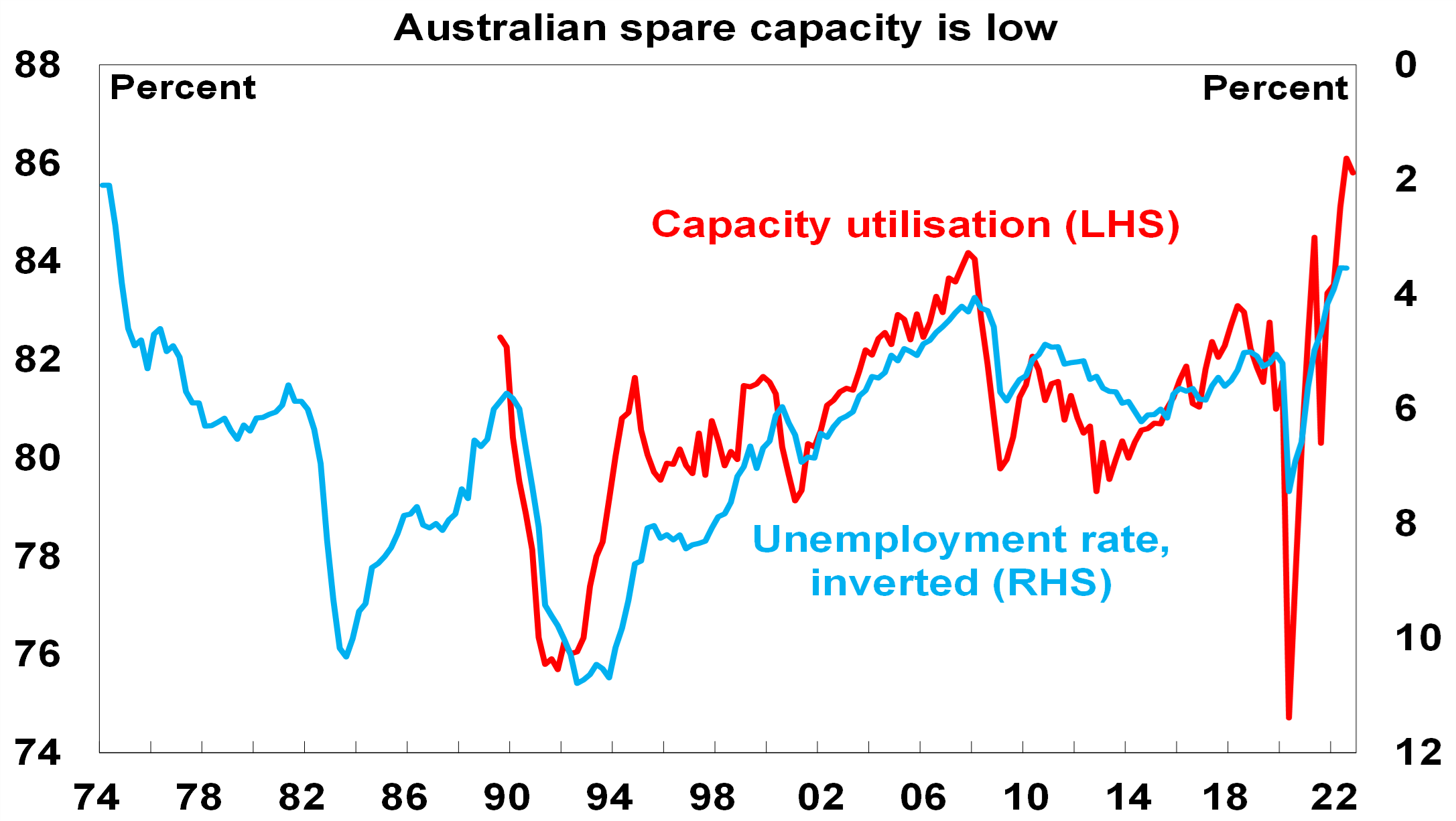

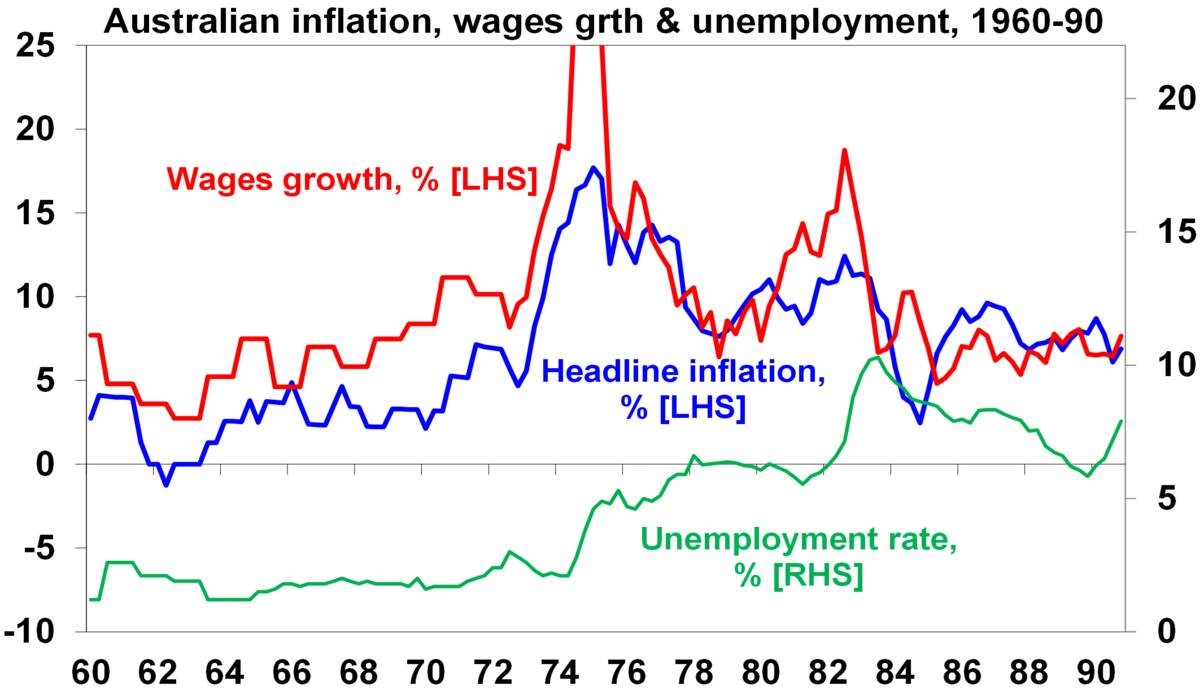

Returning inflation to the 2-3% target is of utmost importance as the 1970s experience highlights that failure to do so will lead to even worse economic conditions and a continuing rough time in investment markets. And the surge in inflation is more than just supply constraints flowing from the pandemic, the war in Ukraine and floods, as demand is running well above supply in the Australian economy. This is evident in very high capacity utilisation rates and very low unemployment (see the next chart).

Source: ABS, NAB, AMP

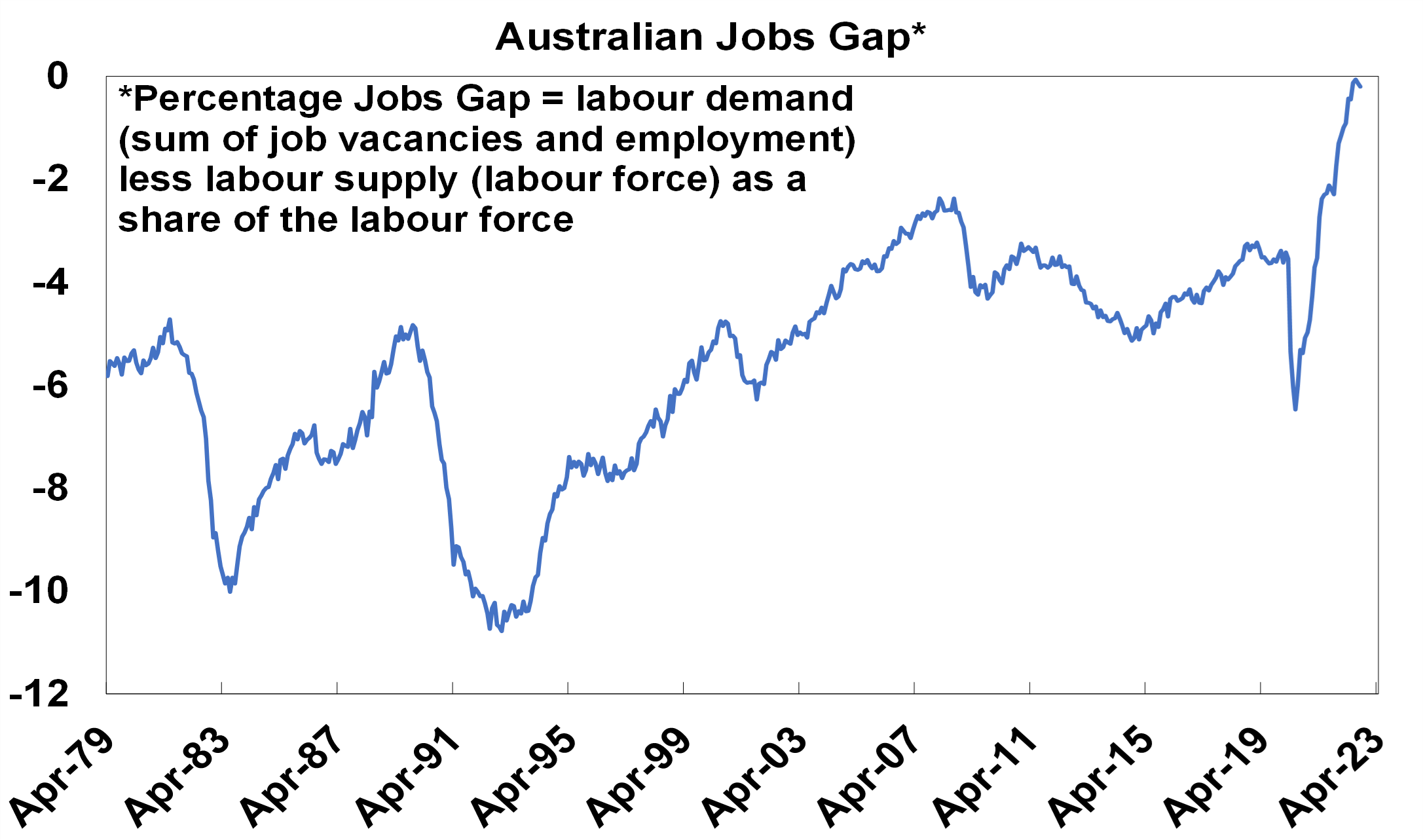

For the labour market its also evident in a high ratio of job vacancies to unemployment. This has meant that the “jobs gap” in Australia (defined as labour demand (as measured by job vacancies plus employment) less labour supply (or the labour force) as a share of the labour force) which has closed to around zero for the first time in over 40 years (see the next two chart). The longer the very tight labour market remains, the greater the chance that wages growth will surge will in excess of the three point something that is consistent with inflation in the 2-3% target range.

Source: ABS, AMP

To bring demand in the economy back into line with supply some economic slowdown is required to help get inflation back down. Hence the RBA has been raising interest rates.

With households most vulnerable to higher interest rates due to high levels of household debt and the double whammy from falling real wages, consumer spending is set to slow sharply. And RBA Governor Lowe has noted on several occasions that “we are travelling along a narrow path here” in terms of being able to return inflation to target and avoid a recession. However, it’s not inevitable that Australia will slide into recession. Assuming there is no further significant flare up in geopolitical problems (such as a war over Taiwan), this note looks at seven reasons why Australian should be able to avoid a recession.

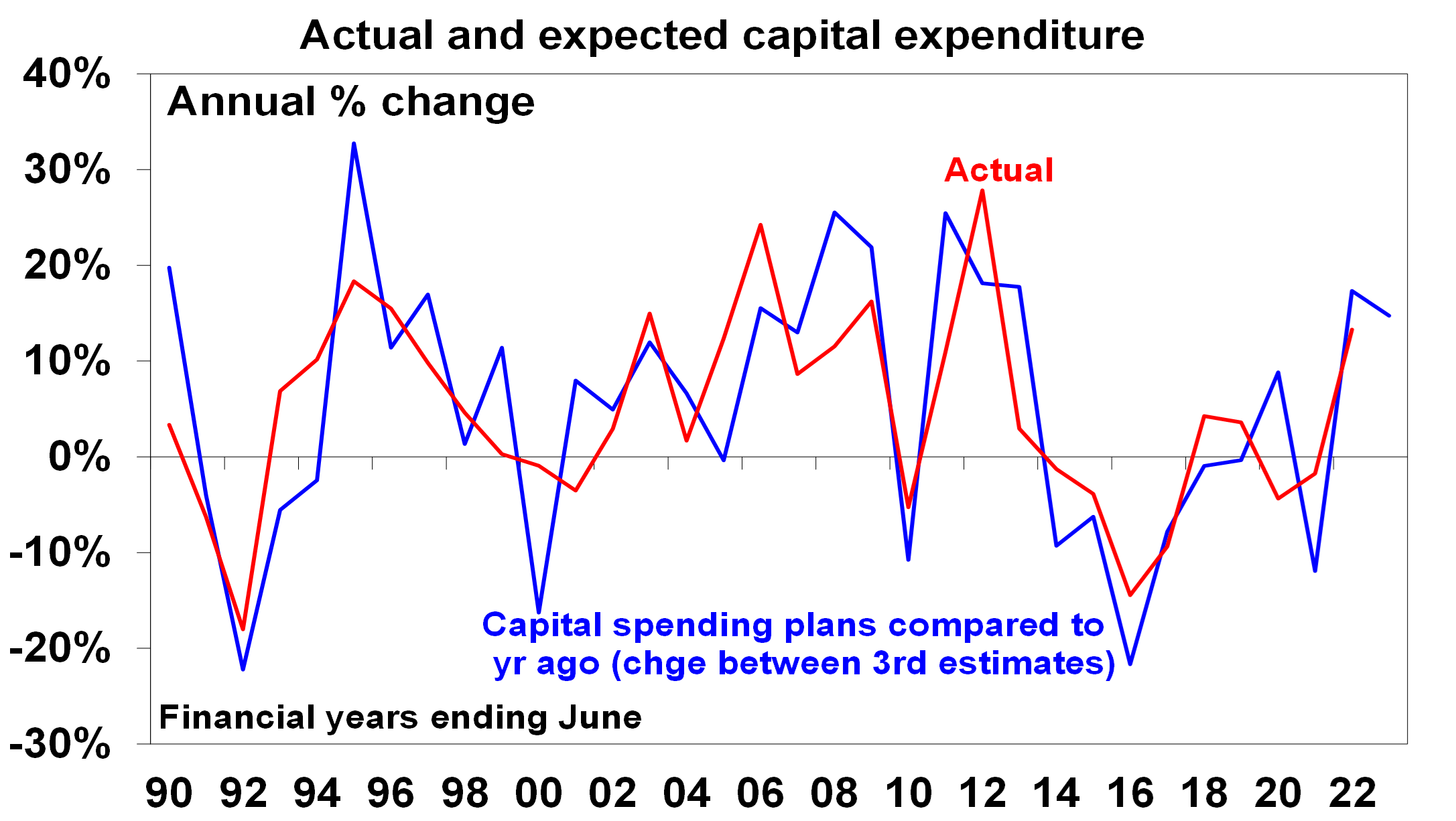

- The business investment outlook is reasonably solid

Business investment plans for the year ahead remain strong. The ABS capital spending intentions survey is up about 15% on a year ago. It’s likely this partly reflects the higher costs of investing, but it’s also consistent with high levels of capacity utilisation, reasonable business conditions and confidence, and some easing in supply chain pressures. Real business investment is expected to grow by around 5% over the year ahead.

Source: ABS, AMP

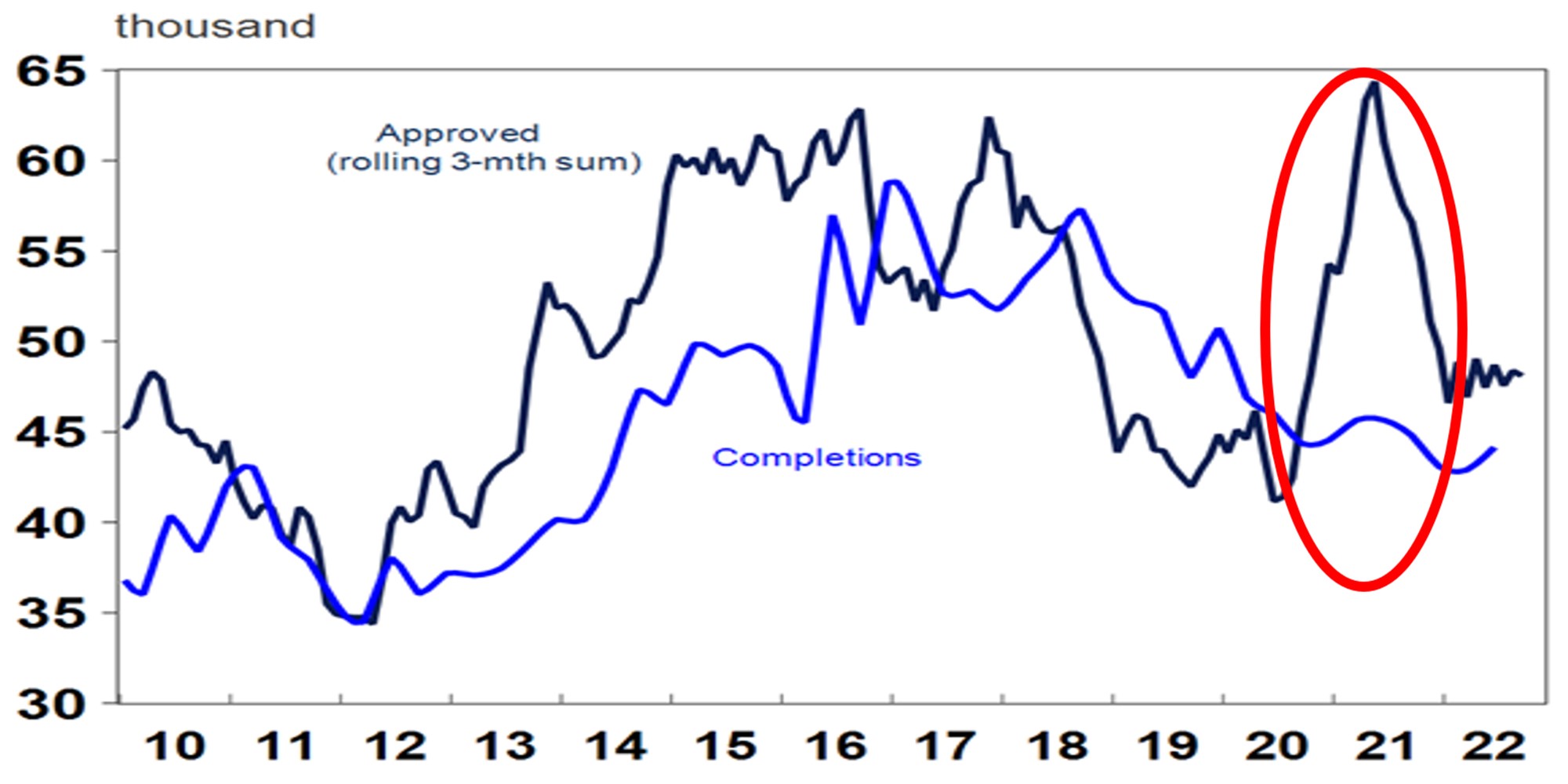

- There is a large pipeline of home building work

From their high last year, approvals to build new homes in Australia have fallen about 25% reflecting the end of the HomeBuilder grant and rising interest rates. While this points to a downturn in home building, its likely to be cushioned because there is a large pipeline of work yet to be completed with home completions yet to catch up to the surge in home building approvals through the pandemic (see red circled area in the next chart). This has been due to poor weather and shortages of labour and building materials. The large pipeline of work yet to be done will likely provide a floor for home building, preventing a plunge in dwelling investment that would normally flow from a 25% fall in approvals.

Residential approvals and completions

Source: Macrobond, AMP

- High energy prices are boosting national income

While the surge in energy prices is a huge hit to household budgets, its providing a big boost to national income via the earnings of energy companies. This is evident in strong trade surpluses and contributed to a $48bn improvement in the budget deficit last financial year and $42bn this financial year. This in turn is helping reduce the budget deficit and providing greater fiscal flexibility for the Australian Government.

- The $A will plunge if global recession leads to a sharp fall in commodity prices

So far this year the $A is down 11% against the $US but is unchanged on a trade weighted basis, ie against an average of currencies (as other currencies have fallen more against the $US than the $A has). But if global economic conditions collapse leading to a sharp fall in Australian commodity prices and hence our export earnings (which would push down inflation globally and in Australia) it’s likely that the $A will fall sharply. This in turn will help support the Australian economy by making our exports more competitive as it did in the Asian crisis, tech wreck and the GFC.

Alternatively, Chinese growth, after surprising on the downside this year could surprise on the upside next year. A key drag this year has been its zero Covid policy. But there are several signs that its heading towards an easing of it: with the People’s Daily running an article downplaying long Covid; a relaxation of PCR test requirements in some regions; Pfizer’s vaccine being made available to foreigners in China; and some regions building new makeshift hospitals. Its looking likely that the easing could come early next year. If so, this could result in a sharp rebound in Chinese growth as the stimulus measures of the last year would then be allowed to work. This in turn would boost global growth and benefit Australia.

- Immigration is rebounding rapidly

A surge in new visas for arrivals as the backlog is worked through and in monthly data for net permanent and long-term arrivals point to a rebound in immigration levels. Consistent with this the Budget is projecting net immigration of 235,00 from this financial year consistent with pre-pandemic levels. This follows negative net immigration in 2020-21. The surge in immigration will help ease the labour shortage and tight jobs market evident in the first two charts in this note. Which in turn will help head off a surge in wages growth to levels well beyond those consistent with the inflation target.

Source: ABS, AMP

- Inflation may be less of a problem in Australia

It’s all very well to say the economy is resilient, but that may just mean that the RBA will have to raise rates by more than otherwise to slow demand enough to get inflation down. In other words, the previous considerations are necessary to help avoid recession but are not sufficient. So this brings us to inflation and here there are reasons for optimism that the RBA won’t have to raise rates too much further (& not to the 4% plus that the money market is assuming but which would most likely tip us into recession):

- First, Australian wages growth is far lower than in other countries.

- Second, at least our energy prices have not been doubling or more, unlike in Europe.

- Third, longer-term inflation expectations are still consistent with the inflation target which should make inflation a lot easier to bring under control than it was in the 1980s when high inflation was entrenched.

- Fourth, while the Australian labour market is very tight, risking a wages blowout, this is in large part due to the absence of immigrants. Unlike in other countries labour force participation is above pre-pandemic levels and the return of immigrants will ease worker shortages.

- Fifth, the simultaneous monetary tightening by central banks risks a sharp slowing in global growth and inflationary pressures that Australia will benefit from, reducing the amount the RBA will need to tighten by.

- Finally, US upstream price pressure are slowing which should benefit Australia which is following US inflation with a six-month lag.

- The RBA has opted to move into the slow lane

Much will come down to how aggressive the RBA gets in raising rates. It has noted that it “will do what is necessary to” return inflation to target. But it’s also noted that its seeking to do this “while keeping the economy on an even keel.” After an initial run of rapid rate rises that returned the cash rate to more normal levels it has since slowed the pace down to better assess their lagged impact, allow for the global downturn, and hopefully strike “the right balance between doing too much and too little.” In motoring parlance “speeding kills” – the initial acceleration in rates was necessary to catch up to inflation but to continue at that pace would run the risk of a serious accident that tips us unnecessarily into recession.

Concluding comment

Some may wonder why I haven’t noted the strong jobs market as a reason why we should be able to avoid recession – the reason is because jobs are a lagging indicator. They were strong prior to the early 1990s recession too! Some may also argue that many households are protected by large mortgage and saving buffers – but many households aren’t, so I decided to not rely on that one too. But the key is that there are enough other reasons why, although economic growth is likely to slow sharply from 3% this year to around 1.5% next year, we should be able to avoid a recession.

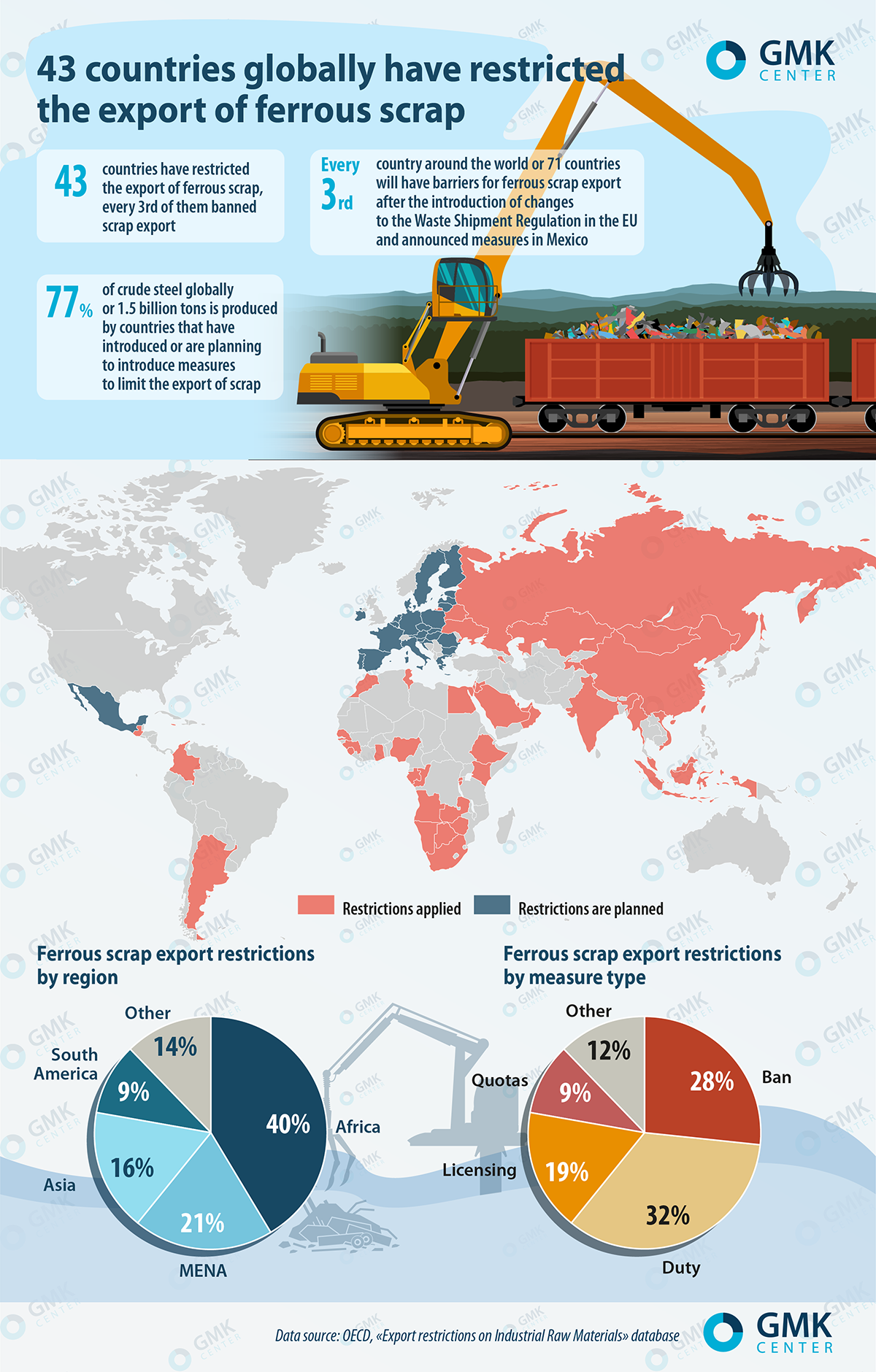

43 COUNTRIES GLOBALLY HAVE RESTRICTED THE EXPORT OF FERROUS SCRAP

Andrii Tarasenko

Restrictions will apply in 71 countries, or every third country in the world, after the adoption of appropriate measures in the EU and Mexico

The policies of restricting the export of ferrous scrap are very wide and currently are applied by 43 countries. With the expected adoption of changes to the Waste Shipment Regulation in the EU in January 2023, as well as relevant measures in Mexico, there will be 71 such countries, or every third country around the world.

Countries that applied scrap export barriers or are going to apply provide 77% of the global crude steel output. This is a very serious factor, since the absence of appropriate measures will put the steel industry in a losing position compared to competitors.

Export of scrap is most actively restricted in Africa, MENA and Asia. These are countries with historically low steel consumption and insufficient scrap resources. Export duty is the most common tool, because it provides more flexibility. But export bans are used almost as often as duties – about one in three measures.

The latest trend – is that developed countries, for example, the EU, are actively implement scrap export restrictions to achieve climate ambitions, since the production of steel, using scrap as the main raw material, involves up to 6 times less carbon intensity. It is also very important that similar instruments operate in the largest producers and exporters of steel – China, India, and the Russian Federation.

Restrictions on the export of scrap by the EU will lead to a strengthening of the trend and the introduction of relevant measures by a number of countries.

I hope you have enjoyed this week’s read, if you would like to discuss your investment options, opening a trading account or access to a Will Kit, please feel free to contact me.

Regards,

Chris Hagan.

Head, Fixed Interest and Superannuation

JMP Securities

Level 1, Harbourside West, Stanley Esplanade

Port Moresby, Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814