10 July, 2023

Hello and welcome to this week’s JMP Report

Last week we saw 5 stocks trade in the local market. BSP traded 1,218,502 closing 5t lower at K12.80, KSL traded 3,379, finishing the week steady at K2.40, STO traded 721, also closing the week out steady at K19.11, CCP traded 5,722 closing steady at K2.00 and CPL traded 6,625 shares also finishing the week steady at K0.80.

WEEKLY MARKET REPORT | 3 July, 2023 – 7 July, 2023

| STOCK | QUANTITY | CLOSING PRICE | CHANGE | % CHANGE | 2021 FINAL DIV | 2021 INTERIM | YIELD % | EX-DATE | RECORD DATE | PAYMENT DATE | DRP | MARKET CAP |

| BSP | 2,176 | 12.85 | 0.05 | 0.39 | K1.4000 | – | 13.53 | THUR 9 MAR 2023 | FRI 10 MAR 2023 | FRI 21 APR 2023 | NO | 5,317,971,001 |

| KSL | 833 | 2.40 | – | 0.00 | K0.1610 | – | 9.93 | FRI 3 MAR 2023 | MON 6 MAR 2023 | TUE 11 APR 2023 | NO | 64,817,259 |

| STO | 405 | 19.11 | – | 0.00 | K0.5310 | – | 2.96 | MON 27 FEB 2023 | TUE 28 FEB 2023 | WED 29 MAR 2023 | YES | – |

| KAM | 0 | 0.85 | – | 0.00 | – | – | – | – | – | – | YES | 49,891,306 |

| NCM | 739 | 75.00 | – | 0.00 | USD$1.23 | – | – | FRI 24 FEB 2023 | MON 27 FEB 23 | THU 30 MAR 23 | YES | 33,774,150 |

| NGP | 0 | 0.69 | – | 0.00 | – | – | – | – | – | – | – | 32,123,490 |

| CCP | 16,917 | 2.00 | – | 0.00 | K0.225 | – | 6.19 | FRI 24 MAR 2023 | WED 29 MAR 2023 | FRI 5 MAY 2023 | YES | 569,672,964 |

| CPL | 0 | 0.80 | – | 0.00 | K0.05 | – |

4.20 |

WED 22 MAR 2023 | THUR 30 MAR 2023 | THU 30 JUL 2023 | – | 195,964,015 |

Dual Listed Stocks

BFL – 4.80 -6c

KSL – 74c steady

NCM – 26.19 -19c

STO – 7.46 -6c

Our Order Book

Our Order Book starts the week nett buyers of BSP, KSL, STO and nett sellers of CPL, CCP

Interest Rates

Evidence of Treasury’s Monetary Policy stance is clear with Central Bank Bills being offered across the short end but the majority of the volume was seen in the 7 day area. A total of 539mill was soaked up, leaving the market oversubscribed 231mill.

In the Treasury Bill market, the 364 day average remained static at 2.99%. The Bank offered 66.5mill and issued 142.9mill after receiving 179.5mill in bids.

The Finance Company money remains stable at around the 2-25%.

No announcements regarding GIS last week.

Other Asset Classes

Gold 1929 +9c

Silver – 23.26 +50c

WTI Crude 73.52+3.26

Bitcoin 30,142 -1.47%

Ethereum – 1,863 -3.85%

Gold Pax – 1903 -.32%

What we’ve been reading this week

Oliver’s insights – 2022-23 saw investment returns rebound – but is it sustainable?

Dr Shane Oliver – Head of Investment Strategy and Economics and Chief Economist, AMP Investments

Key points

– After the rough ride of 2021-22, 2022-23 turned out to be a good one for investors as shares rebounded thanks to falling inflation and hopes rates are near the top.

– Shares are at risk of a pull back as central banks remain hawkish and recession risks are high. However, returns over the next 12 months should still be reasonable as falling inflation takes pressure of central banks enabling rate cuts.

– The past financial year provides yet another reminder of just how hard it is to time investment markets – with shares rebounding just when everyone was most gloomy about inflation and interest rates. The key as always is to adopt a long-term investment strategy and turn down the noise.

Introduction

The past financial year saw a solid rebound in investment returns, after the negative returns of the 2021-22 financial year. This note reviews the past 12 months in investment markets and looks at the outlook.

Inflation worries start to recede

Just as worries about inflation, recession and geopolitics drove poor returns in 2021-22, a relaxation of worries about these things drove a strong rebound in returns over the last financial year:

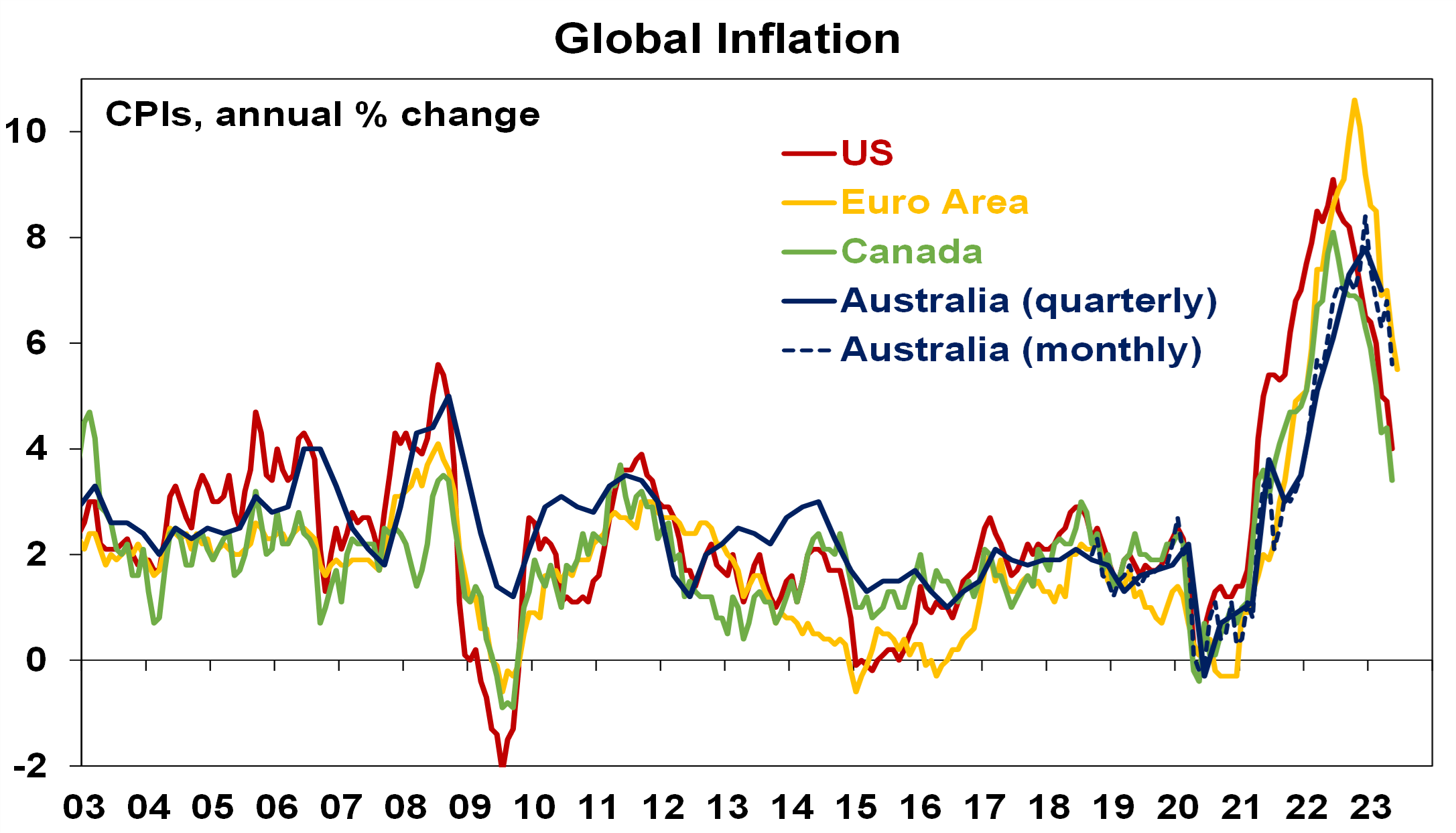

- While inflation rose to its highest in decades in 2022, it peaked in the US a year ago and has been trending down since with other countries following suit. Australia, which lagged on the way up, is doing the same on the way down. This reflects improved goods supply, lower commodity prices, lower transport costs and easing demand.

Source: Bloomberg, AMP

- While central banks still worry about sticky services inflation in the face of stronger wages growth, signs of cooling economic growth and slowing job openings have started to ease concerns on this front.

- This slowing in inflation has seen central banks slow the pace of rate hikes and provide confidence that they are near the top on rates.

- While the Eurozone entered a mild recession, global growth generally has held up better than feared with recession expectations getting pushed out. This in turn has supported profits.

- China reopened allowing its economy to bounce back – although so far, it’s been a bit weaker than expected in terms of manufacturing.

- Worst case fears regarding the war in Ukraine have not come to pass – with no escalation to NATO countries and Europe/Germany managing to move on from its reliance on Russian gas.

- Geopolitical tensions with China have got no worse with periodic talk of a thaw. This has occurred with China-Australian relations with the roll back by China of some restrictions on Australian exports.

- Enthusiasm for AI and its potential to boost productivity following the release of ChatGPT in late 2022 provided a boost for tech stocks.

Returns rebound

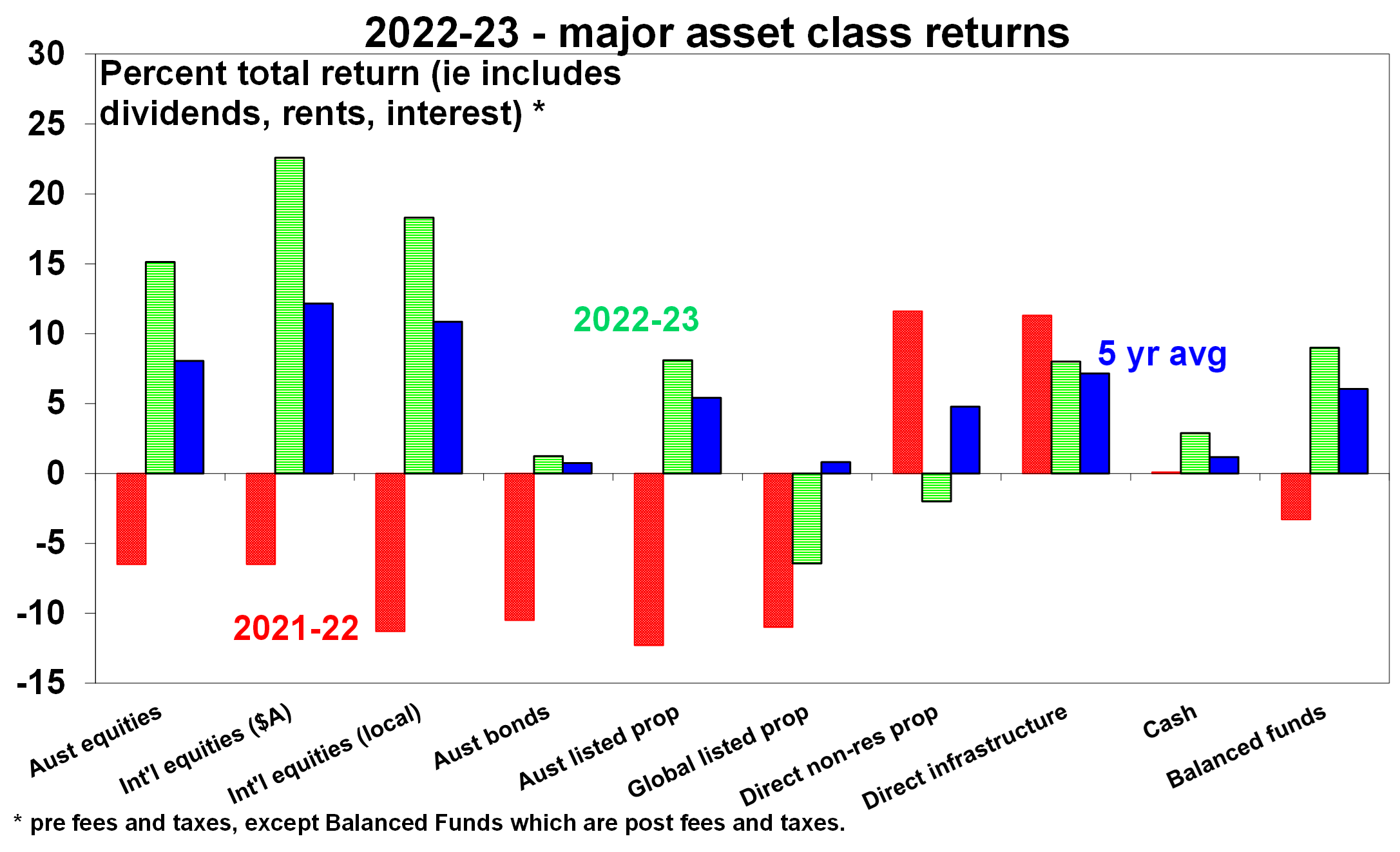

The net result has been a rebound in investment returns over the last financial year for most listed assets as can be seen in the next chart.

Source: Bloomberg, AMP

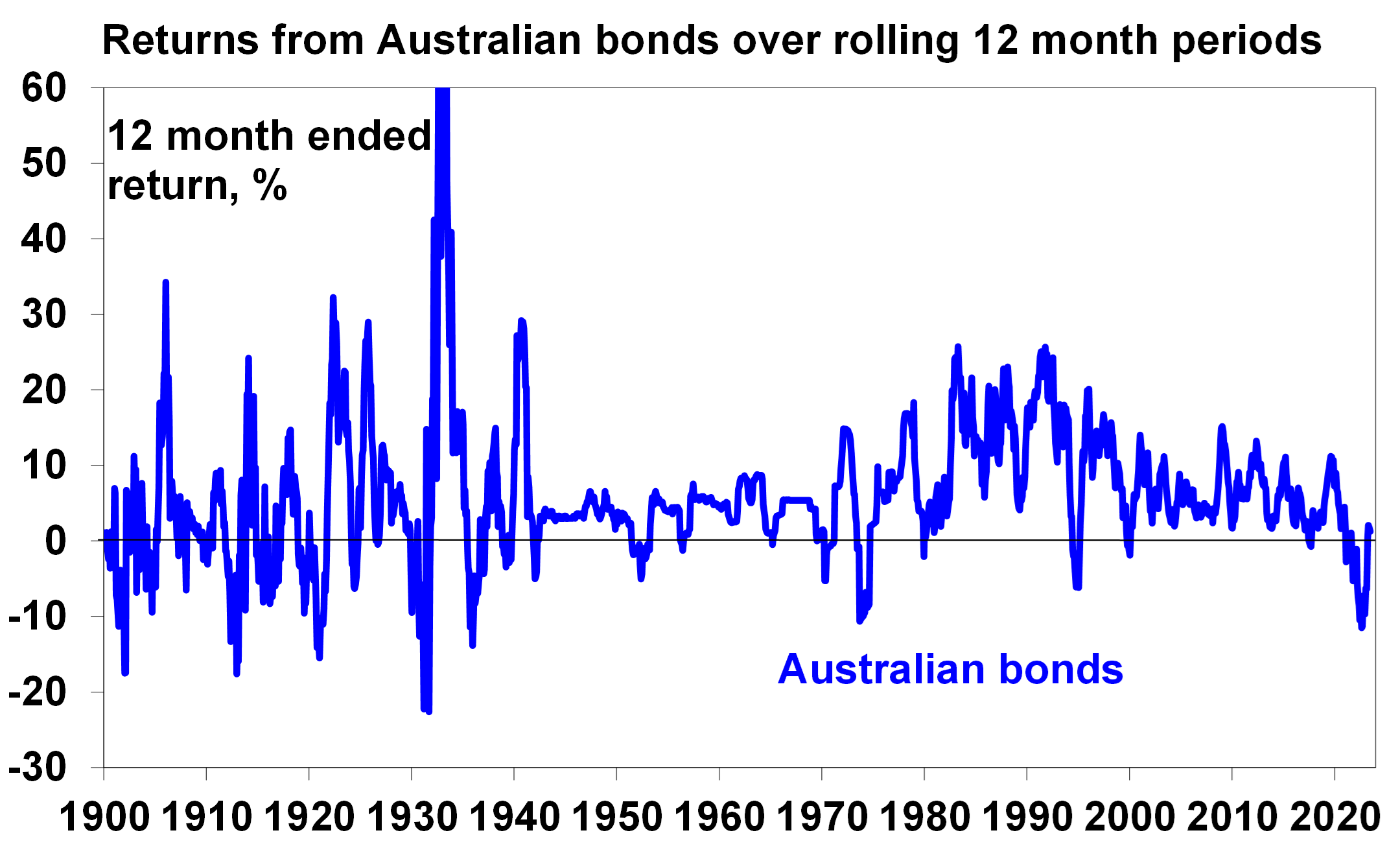

After seeing their worst loss in decades in 2021-22 as bond yields surged resulting in big capital losses, bond returns have stabilised over the last 12 months as bond yields stopped rising with higher yields helping.

Source: Bloomberg, RBA, AMP

Global shares returned 18% in local currency terms over 2022-23, with a fall in the $A (with lower commodity prices) boosting this to 23% in $A terms. Japanese & Eurozone shares outperformed, US shares benefitted from a rebound in tech stocks (helped by AI) & Chinese shares fell.

Australian shares returned 15%, benefitting from the positive global lead but were relative underperformers over the last six months as the RBA turned relatively more hawkish than had been expected driving worries about an Australian recession and with concerns about the strength of China’s recovery weighing on commodity prices and resources stocks.

Australian real estate investment trusts benefitted from better valuations & a stabilisation in bond yields but global REITs remained under pressure.

Unlisted commercial property returns look to have been negative as the lagged negative impact of higher bond yields and reduced space demand for office and retail property weighed on capital values.

Australian residential property prices fell 5.3%, reflecting a sharp fall in the second half of 2022 as higher mortgage rates hit but saw some recovery in the last 4 months as immigration rebounded and supply fell.

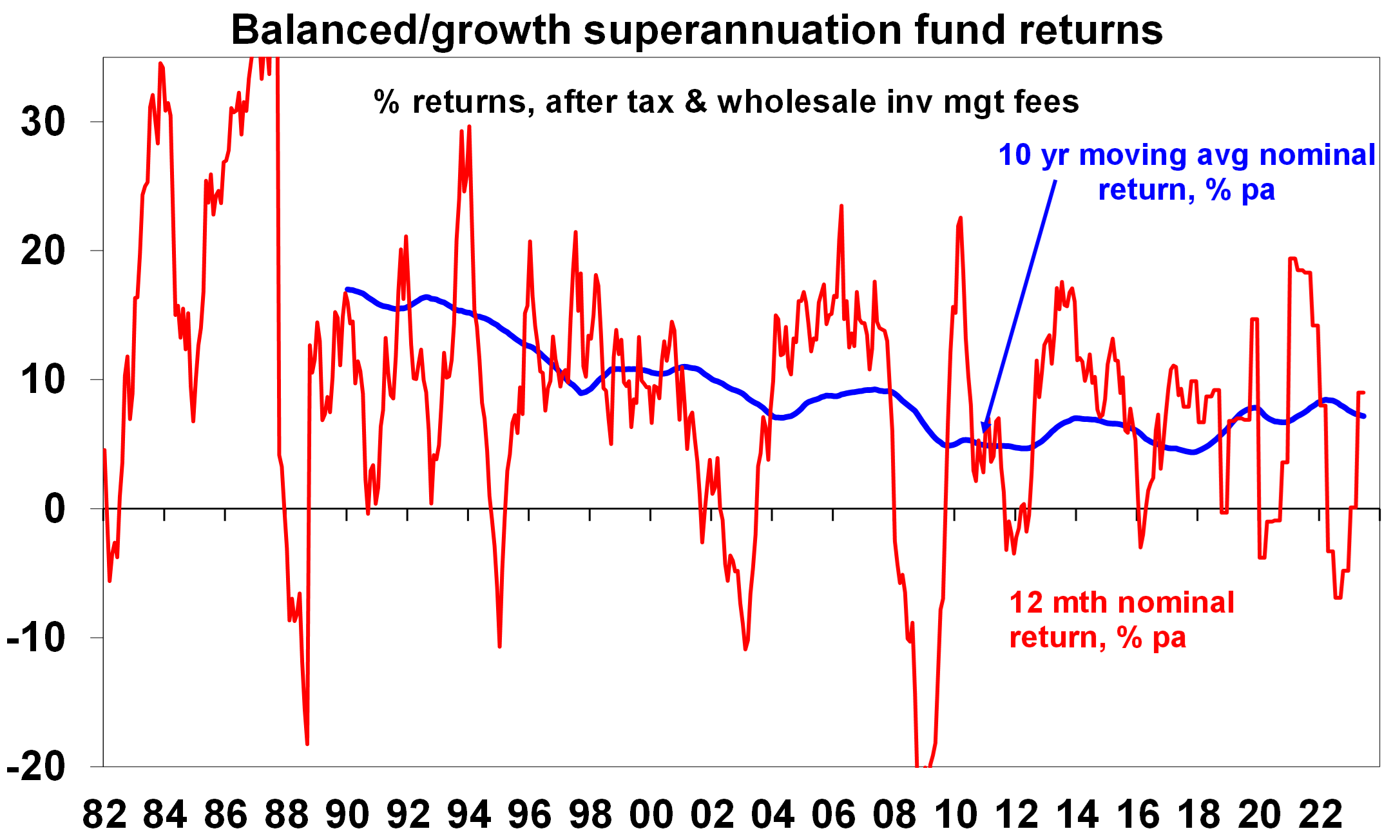

Combined, this drove an estimated 9% return in balanced growth superannuation funds. This is a big turnaround from the 3.5% or so loss from such funds in the previous financial year.

Source: AMP

The last few financial years has seen a bit of a zig-zag pattern in returns with average super funds seeing losses in 2019-20 (as the pandemic hit), very strong returns in 2020-21 (as markets rebounded), a loss in 2021-22 (as inflation and bond yields surged) and now a rebound. Given the volatility it’s best to focus on their longer-term average returns which have been 7.2% pa over the last decade or around 4.5% pa after inflation.

Some lessons from 2022-23

The big lesson of 2021-22 was that inflation was not dead, just resting, and can raise its head to cause mayhem when the circumstances are right. But there were two big lessons over the last year. The first was that just as easy money was a major contributor to inflation in 2021-22 the move to tight money looks to be working to bring inflation back under control again albeit there is a way to go yet. The second was yet another reminder of just how hard it is to time markets. Just when everyone was most gloomy about inflation and interest rates, share markets rebounded.

Shares at risk of a correction

The bad news is that the risk of a near correction in shares is high. Shares had strong gains in June and are now overbought technically. Leading economic indicators continue to point to a high risk of recession in the US and the risk of recession in Australia is now around 50%. China’s recovery is looking less robust than expected and policy stimulus there so far has been pretty modest. Central banks are probably close to the top, but they remain hawkish with a high risk of going too far. Risks also remain in relation to Ukraine – particularly with Putin looking to re-establish his authority after the Wagner mutiny in Russia. And while the month of July is often good for shares (particularly in Australian shares after June tax loss selling is reversed) the period to September-October is often rough.

Unlisted property returns are also likely to be negative over the year ahead as weak economic activity and the adjustment to working from home result in rising office property vacancy rates and more downwards pressure on property values.

The good news

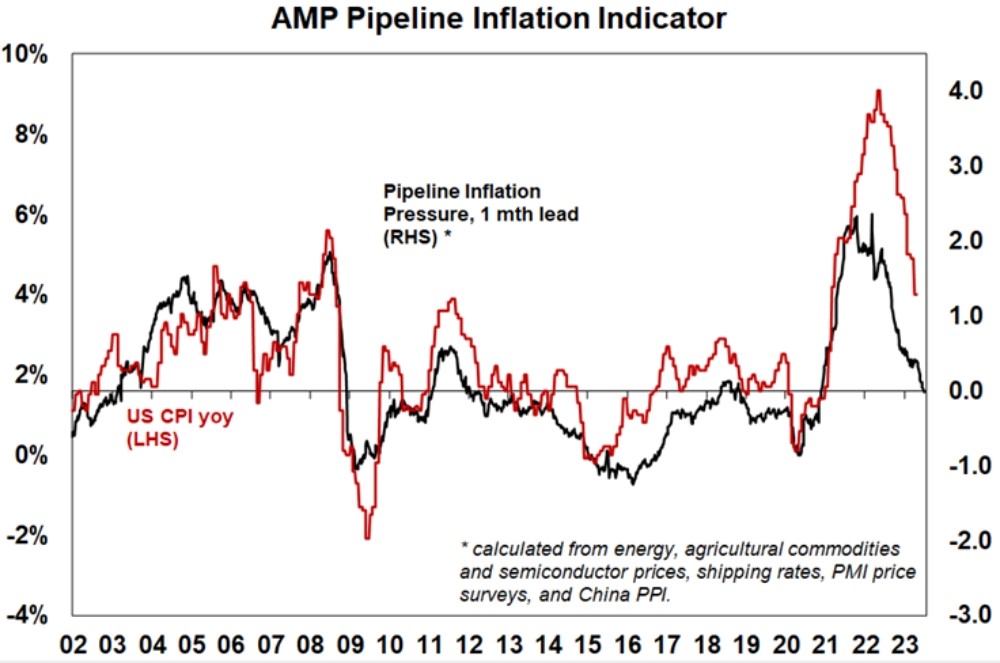

Fortunately, inflation rates are already falling without recession and our US Pipeline Inflation Indicator points to a further fall in inflation ahead.

The Inflation Pipeline Indicator is based on commodity prices, shipping rates and PMI price components. Source: Bloomberg, AMP

This should enable central banks to start easing monetary policy through next year in order to at least avoid a deep recession. In Australia, we expect the RBA’s cash rate to peak around 4.6% with four rate cuts through 2024. Moreover, global economic conditions have proven more resilient than investors feared, the rebound in US shares from their lows last year has broadened out to include more cyclical stocks (which is a positive sign) and investor positioning is still relatively cautious (which is arguably positive from a contrarian perspective).

So, while shares are vulnerable to a near term correction, returns over the next 12 months should still be reasonable albeit slower than they have been over the last 12 months. At the same time bond returns should be positive as bond yields settle down with falling inflation.

Overall balanced growth super returns are likely to be reasonable – but more like 6 to 7% than the 9% or so seen over the last financial year.

Things for investors to keep in mind

Of course, short term forecasting and market timing is fraught with difficulty and it’s best to stick to sound long term investment principles. Several things are always worth keeping in mind: periodic and often sharp setbacks in shares are normal; selling shares or switching to a more conservative superannuation strategy after falls just turns a paper loss into a real loss; when shares and other investments fall in value they are cheaper and offer higher long term return prospects; Australian shares still offer an attractive dividend yield versus bank deposits; shares and other assets invariably bottom when most investors are bearish; and during periods of uncertainty, when negative news reaches fever pitch, it makes sense to turn down the noise around investment markets in order to stick to an appropriate long term investment strategy.

The Biggest ESG Concern for Boards Isn’t What You Might Think

By: Amanda Carty, Managing Director of ESG & Data Intelligence at Diligent

The concept of ESG (environmental, social and corporate governance) has been in choppy waters this year with political resistance against ethical investing, as well as criticism of ESG as being virtue-signalling or supposedly distracting from financial returns. This begs the question, how are boards currently thinking about ESG?

The answer varies around the world, according to a survey of nearly 1,000 corporate directors globally conducted by Diligent Institute, the governance research arm of Diligent, and Spencer Stuart. In Europe, for example, where the Corporate Sustainability Reporting Directive (CSRD) has already begun its rollout, 56% of directors say they view ESG as an opportunity for their business, and 34% say ESG metrics have led to better performance of their stock. Meanwhile in the U.S., where there is still more uncertainty around local regulations and reporting frameworks, more directors are likely to view ESG as a risk (34%) than an opportunity (30%).

Regulations are a driving factor behind prioritizing disclosures

Whether ESG is viewed as a risk or opportunity, most boards recognize the value in collecting and measuring climate data, and organizations are mobilizing to prepare for regulatory reporting.

In the U.S., the SEC’s new climate disclosure rules are soon to come into play. Corporate directors are already preparing, with 55% saying they’ll take extra care to ensure their ESG strategies are adequately reflected in annual reports and filings. At the same time, 46% of directors plan to enhance their ESG disclosure methods. In Europe, where CSRD is already in play, directors not taking action on ESG are few and far between, with only 2% saying they aren’t prioritizing ESG strategies; as many as 14% of U.S. corporate directors say the same.

Yet, directors still struggle to link ESG to broader business strategy

Despite variances in how corporate boards are thinking about ESG, directors around the world have one thing in common — nearly half want more clarity on how sustainability goals link to their larger corporate strategy.

Even as ESG is on the upswing, many directors still struggle to grasp what ESG looks like in practice. Lack clarity around what ESG means for the company, as well as trying to balance ESG initiatives with competing business priorities or strategic interests, is where the greatest challenges lie for boards. In contrast, only 2% identified public backlash against ESG as being one of the greatest challenges.

The SEC’s new disclosure rules may provide some guidance. Boards and leadership roles will have to be re-focused to include ESG oversight. But to do that, boards need more visibility into progress on environmental goals, how environmental goals link to their broader business strategy and measure against competing risks and business objectives.

3 ways directors can overcome these challenges

- Technology

To achieve and measure the new sustainability benchmarks, many boards will need improved technology. Organizations should invest in software that can track their carbon emissions and collect and organize information from across their value chain in a single database.

Technology can also help organizations:

- Adopt GHG accounting best practices, including keeping digital records of scope 1 and 2 emissions.

- Start measuring scope 3 emissions.

- Check for overlap with relevant frameworks.

- Maintain dashboards of key GHG accounting and sustainability KPIs.

- Ensure reports are in an audit-ready format.

- Standardized and auditable reporting

In the past 20 years alone, supply chains have ballooned. Subsidiaries, suppliers, and third parties have created a complex network that can easily lead to gaps in oversight. The SEC’s new rules will only add to the complexity and volume of reporting requirements and board agendas. But that doesn’t mean directors’ workloads should increase, too.

Organizations need to prioritize credible and defensible reporting. This requires intuitive data, well-curated dashboards, and best-in-class ESG technology. With these functions in place, directors should not only be able to automatically create reports that both offer actionable insights and hold up to future audits, but create engaging presentations backed by the latest data that tells a compelling story to their boards.

- Skills and education

The proposed rules put ESG oversight squarely on the board and other leadership roles. To effectively champion ESG initiatives, directors need proactive education and skills training that equips them to intentionally and efficiently discuss climate and sustainability with management.

It’s likely that the SEC will hold boards accountable for overseeing sustainable growth strategies. New training and certifications must prioritize climate risk and ESG fundamentals, empowering directors to link business success to ongoing ESG efforts.

Start standardized and streamlined ESG reporting

ESG reporting isn’t going away. If anything, the SEC disclosure rules signal a continued focus on transparency and accountability with respect to organizations’ ESG impact.

But having a standardized and streamlined reporting system makes it possible to both answer to the continued emphasis on sustainability and prevent ESG fatigue. There will also likely need to be modifications and improvements to the SEC disclosure rules to break down barriers to adoption, but organizations can take action, too.

Prioritizing skill enhancements, offering certifications, and leveraging carbon accounting technology now will help your corporate directors work smarter, not harder, no matter how the conversation around ESG evolves.

About Diligent

Diligent is a leading GRC SaaS company that gives organizations the tools and solutions they need to bring clarity to complex risk, elevate impactful insights and get ahead of a world that is constantly changing. With solutions across governance, risk, compliance, audit and ESG, Diligent empowers more than 1 million users and 700,000 board members and leaders to make better decisions, faster. No matter the challenge. Learn more at diligent.com.

Up to $4 Trillion Investment Needed in Materials Supply Chains to Meet Decarbonization Goals: McKinsey

Mark Segal July 6, 2023

As much as $4 trillion in investments may be needed by 2030 to scale up the materials supply chain to address upcoming supply shortages of key metals and materials required to meet global decarbonization goals, according to a new report released by global management consulting firm McKinsey & Company.

The report, “The net-zero materials transition: Implications for global supply chains,” highlights the role of the materials supply chain as a key enabler of the global transition to net zero, with many of the technologies, from renewable energy and battery storage to electric vehicles, requiring more and different materials than the conventional technologies they are replacing.

On a per-GW basis, for example, solar PV’s material intensity is 1.4x that of conventional technology, according to the report, while onshore wind is 2.4x as material intensive, and offshore wind 6.3x. Similarly, battery electric vehicles (BEVs) can be 20% heavier, or more materials intensive, than comparable internal-combustion engine (ICE) vehicles.

As these technologies are increasingly deployed to help support initiatives to decarbonize industries, transportation, energy production and other sectors, the McKinsey report predicts that future growth rates for many materials are expected to outpace historical patterns, leading to shortages for many critical materials under a variety of scenarios examined by the study.

Forecast supply-demand imbalances include moderate shortages for battery materials including lithium, cobalt, nickel, manganese and graphite, with more severe shortages for magnet materials, which are used in electric motors and wind turbine drivetrains, including by as much as 70% for dysprosium. Significant shortages are also forecast for key materials for end markets including semiconductors, electrolyzers, and process material.

The McKinsey report also highlights high local materials concentrations, such as rare earth elements in China and nickel in Indonesia, as potentially having an impact on regional access to materials.

In order to scale up the required supplies of these key materials and minerals, the report predicts that investments in the materials supply chain, including in mining, refining and smelting, will need to increase by $3 trillion to $4 trillion by 2030, including capital expenditure for exploration, and new and ongoing projects.

In addition to these investments, the report estimates that labor capacity will need to be increased by as much as 600,000 specialized mining professionals, and an additional energy supply of 200 GW – 500 GW will need to come online as well.

In addition to the need to ramp investments in the material supply chain, workforce and energy, the report outlines a series of recommended actions to help bridge the materials gap, including recommendations to drive a shift in demand patterns towards proven technologies that are less material-intensive or rely on less constrained materials, increase investment in materials innovation and recycling practices, and policy recommendations such as streamlining permitting processes and driving demand to alternative technologies.

Michel Van Hoey, senior partner at McKinsey & Company said:

“Increasingly bold climate targets are changing global material value chains, to the extent that the transition to net-zero emissions has sparked a materials transition. Our report provides an integrated perspective on those changes and key actions that will be required to balance the equation and safeguard the industry.”

Click here to access the report.

I hope you have enjoyed the read, if you would like to discuss as to how to open an account, please feel free to reach out,

Regards,

Head, Fixed Interest and Superannuation

JMP Securities

Level 1, Harbourside West, Stanley Esplanade

Port Moresby, Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814