9 October, 2023

Hello and welcome to this week’s JMP Report

Last week we saw 4 stocks trade on the local market. BSP traded 926,339 shares closing 16t lower at K13.25, KSL traded 231,435 shares closing 11t lower at K2.40, STO traded 705 shares, closing 1t higher K19.22 and CPL traded 2,910 shares, closing steady at K0.79.

WEEKLY MARKET REPORT | 2 October, 2023 – 6 October, 2023

| STOCK | QUANTITY | CLOSING PRICE | CHANGE | % CHANGE | 2022 FINAL DIV | 2023 INTERIM | YIELD % | EX-DATE | RECORD DATE | PAYMENT DATE | DRP | MARKET CAP |

| BSP | 926,339 | 13.41 | -0.16 | -1.19 | K1.4000 | K0.370 | 13.33 | FRI 22 SEPT 2023 | MON 25 SEPT 2023 | FRI 13 OCT 2023 | NO | 5,317,971,001 |

| KSL | 231,435 | 2.40 | 0.01 | 0.42 | K0.1610 | K0.097 | 10.75 | WED 6 SEPT 2023 | THU 7 SEPT 2023 | THU 5 OCT 2023 | NO | 64,817,259 |

| STO | 705 | 19.22 | 0.01 | 0.05 | K0.5310 | K0.314 | 4.42 | MON 28 AUG 2023 | TUE 29 AUG 2023 | THU 28 SEPT 2023 | – | – |

| KAM | 0 | 0.90 | – | 0.00 | – | K0.12 | 13.33 | TUE 19 SEP 2023 | WED 20 SEP 2023 | THU 19 SEP 2023 | YES | 49,891,306 |

| NCM | 0 | 75.00 | – | 0.00 | USD$1.23 | K0.719 | 2.60 | FRI 18 AUG 2023 | MON 21 AUG 2023 | MON 18 SEPT 2023 | – | 33,774,150 |

| NGP | 0 | 0.69 | – | 0.00 | – | – | – | – | – | – | – | 32,123,490 |

| CCP | 0 | 2.05 | – | 0.00 | K0.123 | K0.110 | 11.51 | FRI 24 MAR 2023 | WED 29 MAR 2023 | FRI 5 MAY 2023 | YES | 569,672,964 |

| CPL | 2,910 | 0.79 | – | 0.00 | K0.02 | – |

2.50 |

WED 22 MAR 2023 | THU 30 MAR 2023 | THU 30 JUL 2023 | – | 195,964,015 |

Dual Listed Stock PNGX/ASX

BFL – 5.21 +6c

KSL – 77c -1.5c

NCM – 24.27 -25c

STO – 7.35 -55c

Our Order Book has us starting the week as nett buyers of BSP, NCM, CCP and STO

Interest Rates

In the short end, the seven day Central Bank Bill was issued at 2% and a total of 1.743b of liquidity was taken out of the market. The number should continue to grow in line with current Monetary Policy.

In the longer end, rates drifted out a little further with 364day TBills averaging 3.15% up from 3.09%. The bank offered 358mill and left the market 30.65 mill oversubscribed.

Other Assets we watch

Natural Gas – 3.34 +41c

Silver – 21.99 -46c

Platinum 884.70 +2%

Bitcoin 27,840 -.41%

Ethereum – 1,628 -5.28%

PAX Gold – 1,867 flat

What we’ve been reading this week

What the Dickens is financial literacy?

ASX

Understanding investment basics can lead to good decisions and help avoid bad ones.

In Chapter XI of the Charles Dickens classic of 1850, David Copperfield boards at the home of the financially struggling Micawbers. Within no time, Mr Micawber is taken to debtor prison. David visits him and “cried very much”.

Micawber comforts the young orphan and gives him advice: “If a man had twenty pounds a-year for his income, and spent nineteen pounds nineteen shillings and sixpence, he would be happy, but that if he spent twenty pounds one he would be miserable.”

Thus is the origin of the ‘Micawber principle’ of managing personal finances. But this truism about controlling spending is not easy to follow. Too many people are like Micawber as they juggle rent or mortgage payments, child expenses, food costs, utility bills and everything else against their income.

Wilkins Micawber is a fictional character in Charles Dickens’s 1850 novel David Copperfield.

Harry Markowitz, however, probably had no trouble following the Micawber principle. The US economist, who died in June aged 95, was awarded the Nobel memorial prize for economic science in 1990 for forging modern portfolio theory.

Markowitz’s accomplishment was to analyse the relationship between risk and reward. He picked that a portfolio’s risk depended on how securities related to one another rather than on the riskiness of each stock or asset. Markowitz’s work led to the insight that asset allocation was the major determinant of a portfolio’s risk, not security selection.

Another of his contributions was to elevate the concept of ‘relative returns’. Before Markowitz, people used to judge performance on whether a portfolio made or lost money. Come Markowitz, the relative test became how securities performed against a benchmark such as the S&P/ASX 200 Index.

Nowadays, the Markowitz concepts of diversification, asset allocation and relative returns and the Micawber advice on income covering spending are everyday investment concepts. So too are terms such as defensive and growth assets, investment goals and risk appetite. Others are compound interest, price-earnings ratios, dividend yields, even capital-gains tax.

HOW TO BUILD A BALANCED PORTFOLIO

Diversification across asset classes is a foundation of long-term investing.

How to define?

What’s a novice investor to make of the terms that plague investing? The most constructive approach might be to attain a rudimentary level of financial literacy. The good news is that it won’t necessarily take that much effort and time to learn the basics. The government and the finance industry including the ASX are trying to make it as easy as possible.

What does it mean to be financially literate? The term can be defined as the ability to make informed decisions about money to help meet financial goals. In practice, this means people need to organise their finances to ensure they can pay for their daily needs. They then should seek to understand how to invest their super and other savings. It doesn’t mean that people need to become experts on company balance sheets, earnings reports, economic theory, trading strategies and valuation techniques, and so on.

ONLINE COURSES

Aimes at beginners, each course module takes 10 to 15 minutes to complete and includes downloadable course materials and self-test quizzes.

What then are the key steps to managing personal finances? The founding principle is actually the Micawber one. If people can’t live within their means, other financial advice would seem redundant.

While people who overspend these days won’t suffer Micawber’s fate, the principle shows that failing to manage day-to-day finances has consequences. A tool to help with managing personal finances is the federal government’s guide found at: moneysmart.gov.au/

The super quest

Most people seem to successfully manage daily household finances, even when mortgage rates jump as they have done over the past year. That’s no surprise because the Micawber principle is common sense.

Managing super and other savings, however, demands a higher level of financial literacy. To navigate the investment world, people might want to understand concepts such as economic growth, inflation and interest rates. It’s helpful to comprehend how the different asset classes are structured. An equity, for instance, in a tradeable share in the ownership of a company that gives the owner the right to share in the profits of a company. The price of this stake is theoretically based on the worth today of that company’s future profits. A bond can be considered a tradeable loan where the prevailing yield indicates the market value of the loan, which usually offers regular interest payments and is fully repayable.

INVESTING IN SHARES

Learn more about the features, risks and benefits of investing in shares.

Financial literacy extends to understanding the risk-and-return profile of each asset class. The fact that bond holders get their money back if they hold these securities to maturity means bonds are less risky than shares. Equities, of course, can even become worthless if a company’s fortunes slump. History shows, however, that share markets may offer better returns over the long term compared to the returns for bonds, although this is dependent on the relevant equity and prevailing economic conditions. Some equities have tended to recover from sudden declines, though, there is no guarantee of this result.

People might want to understand how the state of the economy influences the returns on asset classes. Inflation, for example, introduces the concept of real, or inflation-adjusted, returns, which affect the performance of the asset classes in different ways. Cash returns often fail to keep up with inflation. Inflation erodes bond prices (yields rise) because the real value of future bond payments declines.

INVESTING IN BONDS – TIPS AND TOOLS

Find out about risks and benefits, characteristics of the different types, and how to analyse market and pricing data.

It’s helpful too to understand the rudiments of portfolio theory. The Markowitz concept that diversifying across asset classes lowers portfolio risk is now a principle of investing – so too is holding a diverse portfolio of stocks rather than just, say, one name. Time has shown the major asset classes of bonds, cash and stocks perform differently across economic conditions. The right mix may steady returns.

Being financially literate can apply at a personal level too. People are advised to consider their investments as a whole – as one portfolio – to ensure proper diversification. They should be able to define their investment goals. Are they saving for a short-term goal such as buying a car? Or do they have a long-term goal because they are saving for retirement?

EXCHANGE TRADED FUNDS

Learn how to establish a diversified portfolio easily and cost-effectively with a single trade.

Compulsory super means that working Australians, especially the younger ones, have by default a long-term goal. After all, they can’t get hold of their money for decades.

Once a time frame is set, then people might want to judge their risk tolerance. One gauge of this is to what extent people might be anxious about their investments going wrong. People who are more risk-averse may be inclined to have a more conservative strategy.

Age can be a factor in risk appetite too. Workers who are closer to retirement often choose a more conservative strategy. They want to minimise the risk their investments will decrease in value just before they are eligible to access them.

Another form of financial literacy is understanding the psychology behind investing. Studies show that people are often hurt by losses more than they enjoy gains. The trap for investors here is that short-term ‘noise’ can prompt people to sell in falling markets, rather than take a long-term view. Some may hold the view that selling when prices are falling could result in missing out on a rebound in prices. Google: ‘Time in the market rather than timing the market’ to find examples of how some of the best-performing days on share markets occur after a big drop.

TUNE OUT OF MARKET NOISE

Learn how to avoid – or potentially profit from – investor sentiment.

A passing grade

When can people judge themselves to be financially literate? Competent investors can define investment goals based on their risk tolerance, recognise the importance of diversification, understand the differences of asset classes, shut out noise to focus on long-term performance and take the time to do proper research before making investment decisions. They are usually humble enough to seek advice, if only to ensure their strategies (including the tax implications) are aligned to their circumstances.

Savvy investors would may say that becoming financially literate can enhance investment returns and lead to financial independence. Since nearly everyone has finances to manage and super to invest, everyone should attain a basic level of financial literacy. As well as being financially worthwhile, people might even find it’s fun.

Becoming financially literate doesn’t guarantee investment decisions will end well. There are an unlimited number of risks that can hamper even sound strategies. Financial literacy is best seen as a prudent way to approach money, not a proven path to riches.

Dickens seems to have been financially literate as well as literate. The reason why might be that the Mr Micawber character was based on his father, a government clerk who was imprisoned for debt.

A financial literacy guide

ASX is a central player when it comes to financial education and offers a range of resources. Some of our clients have online resources to help investors. Here is a guide to some of the best sites:

ASX

asx.com.au/investors/investment-tools-and-resources

Federal government

moneysmart.gov.au/

Thank you ASX for this article

Scaling Australia’s carbon market

Marco Stella – CORE Markets – Presenter

ASX recently hosted the Carbon Market Institute’s Next Gen Carbon Credits and Projects Masterclass. Marco Stella, Co-Founder and Head of Carbon & Renewables Markets from CORE Markets was one of the presenters. In this article we share Marco’s insights on recent and future trends in Australian Carbon Credit Units (ACCU), as the market undergoes an important transition.

When it comes to the future of Australia’s carbon market, Marco Stella is not mincing his words. ‘We can’t scale this market on a voluntary model. The compliance market has a huge role to play in helping to build the foundation that the carbon industry needs to project forward.’ This sentiment is echoed by John Connor, CEO from the Carbon Market Institute, ‘It has been a tumultuous yet transformative 10 years, and the next decade promises to be even more intense. Minimising costs and maximising opportunities will require strengthened institutions, policies, collaboration and standards in order to target and turbo-boost public and private investment.’

Safeguard reforms to drive change

Recent Federal Government reforms of the Safeguard Mechanism have led to more stringent emission reduction targets for Australia’s biggest emitters. Entities captured under the Safeguard Mechanism are now required by law to keep annual emissions below a target level (baseline), with that target to reduce by 4.9% each year until 2030. Failure to meet annual targets will result in a penalty, designed to incentivise industrial emitters to invest in strategies and technology that will help reduce carbon emissions. Safeguard entities can also purchase Australian Carbon Credit Units (ACCUs) to offset emissions and remain below their baseline. Stella believes that these reforms will spark the evolution of Australia’s carbon market. He believes this next chapter will see the ACCU market transition to something far more significant, driven primarily by demand from compliance buyers captured under the Safeguard Mechanism.

Valuing co-benefits

Until recently, the majority of activity in the ACCU market has been from voluntary buyers looking to invest in carbon reduction projects or wanting to offset their carbon emissions. Stella believes voluntary buyers are more discerning when it comes to the type of ACCU they are buying. ‘Voluntary buyers are more sensitive as to the type of benefit or co-benefit that the ACCU is attached to resulting in a price differential between various ACCU methods’. Whilst each ACCU technically represents the same measure (one tonne of carbon avoided or removed from the atmosphere), buyers can perceive value differently. This has created a price spread among some methods.

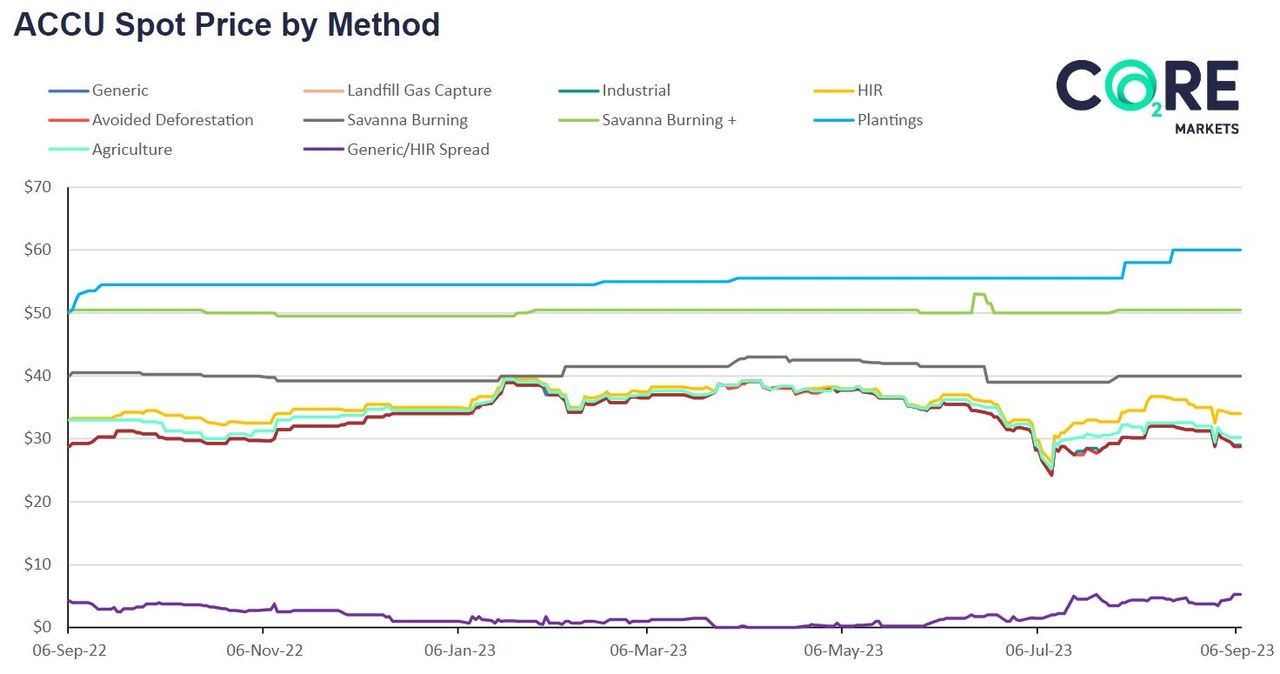

Stella explains, ‘While co-benefit valuation is completely subjective, we have seen distinct trends emerge among certain ACCU methods. Savannah burning with First Nations co-benefits is perhaps the best example of this, trading at a premium to standard savannah burning ACCUs with the spread moving as wide as A$10.00.’

The data in the graph below shows the ACCU spot price variation by method. Stella believes these price differentials will decline as more compliance buyers enter the market. ‘Compliance buyers tend to view ACCUs as a uniform commodity. For a compliance buyer, one ACCU means one tonne of CO2 avoided or removed from the atmosphere. It’s as simple as that.’

Data source: CORE Markets carbon and clean energy market data platform

Accelerating the transition

Compliance buyers are expected to become more active over the next 12-18 months as their emissions baseline under the reformed Safeguard Mechanism declines. Stella believes this will drive a permanent shift in the way the carbon market operates. ‘In order to scale the market to the extent necessary to meet our emission reduction targets, we need as much participation in the market as possible. We need a robust, deep and liquid secondary market for this to occur so investors and financiers can have confidence in the value of the projects they are investing in.’

To Stella, the path forward is clear. Voluntary and compliance markets can co-exist harmoniously and work together to strive for change. Stella says: ‘The inevitable growth of compliance markets will ultimately lead to more investment in carbon projects and greater co-benefits which can help to generate positive and real outcomes for local communities. The best is yet to come.

Marco Stella, CORE Markets – Presenter

Marco Stella is the Co-Founder and Head of Carbon and Renewables Markets at CORE Markets, an end-to-end markets, technology and climate partner for business. He is a specialist commodities broker in Environmental Markets with 20 years of experience in analysis and market commentary, and leads an award-winning transactions team. CORE Markets offers corporate net zero services, project optimisation services and corporate and institutional brokerage services, all backed by a powerful software-as-a-service platform.

Contact: hello@coremarkets.co

Learn more from CORE Markets about the ACCU market

Monique Bell, ASX- Author

Monique Bell is a Commodities Product Manager at ASX. She is working on the upcoming listing of a new Gas Futures contract as well as a suite of Carbon Futures products to support Australia and New Zealand’s energy transition. Monique is a CFA, holds a Masters’ Degree in Finance and recently completed certification with the Cambridge Institute for Sustainability Leadership.

For more information contact:

Email: commodities@asx.com.au

www.asx.com.au/energy-derivatives

Thank you ASX for this article

$24 Trillion Investor Group Launches Campaign Targeting 100 Companies to Address Biodiversity, Nature Loss

Mark Segal

Nature Action 100, an investor engagement initiative with 190 institutional investors representing nearly $24 trillion in assets announced its list of 100 companies to be targeted in a campaign aimed at driving corporate action to address nature loss and biodiversity decline.

Companies targeted by the campaign include Amazon, McDonald’s, Nestlé, Walmart and Glencore. According to Nature Action 100, companies were selected based on market capitalization within key sectors, and using of those with the highest impacts on nature. Key targeted sectors include biotechnology and pharmaceuticals, chemicals, household and personal goods, consumer goods retail, food, food and beverage retail, forestry and paper, and metals and mining.

Nature Action 100 was initially launched at the COP15 United Nations Convention on Biological Diversity in December 2022, coordinating investor engagement activity to increase corporate ambition and action to combat nature loss. According to the Nature Action 100 launch statement, the initiative was formed as financial risk from biodiversity and nature loss grow, with $44 trillion of economic value generation – more than half of global GDP – reliant on nature’s services, and tens of billions of dollars potentially at risk over the next 5 to 10 years from the continued production of deforestation-linked commodities.

Each of the 100 focus companies have been sent letters to kick off the engagement campaign, explaining the systemic risk to businesses arising from nature and biodiversity loss, with deteriorating ecosystems already impacting operations, supply chains, and financial returns.

The letters call on the companies to implement a set of expectations outlined by the initiative, including committing to minimize contributions to key drivers of nature loss and to conserve and restore ecosystems, assess and disclose nature-related dependencies, impacts, risks and opportunities across the value chain, set targets on nature-related dependencies, impacts, risks, and opportunities, and a plan to achieve the targets, establish board oversight on nature-related issues, and engage across the value chain to implement the nature-related plans and targets.

Click here for the list of focus companies, and the investors participating in Nature Action 100.

Adam Kanzer, Head of Stewardship, Americas, BNP Paribas Asset Management, said:

“As a member of the Nature Action 100 Launching Investor Group, we are gratified and energized by the strong response we’ve received from both asset managers and asset owners around the world. We believe this sends a very strong signal to the global markets – we must work together to reverse the systemic risk of nature loss. We have limited time, but working together with these 100 companies, we believe we can make a considerable difference. The real work begins now.”

I hope you have enjoyed this week’s read, please reach out if you would like more information regarding our investment services.

Regards,

Head, Fixed Interest and Superannuation

JMP Securities

Level 1, Harbourside West, Stanley Esplanade

Port Moresby, Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814