16 October, 2023

Hello and welcome to this week’s JMP Report

Last week we saw 2 stocks trade on the local market, BSP and KSL. BSP traded 352,672 shares, closing 21t higher at K13.46 and KSL traded 245,804 shares, closing 1t higher at K2.41 per share.

WEEKLY MARKET REPORT | 9 October, 2023 – 13 October, 2023

| STOCK | QUANTITY | CLOSING PRICE | CHANGE | % CHANGE | 2022 FINAL DIV | 2023 INTERIM | YIELD % | EX-DATE | RECORD DATE | PAYMENT DATE | DRP | MARKET CAP |

| BSP | 352,672 | 13.46 | 0.21 | 1.56 | K1.4000 | K0.370 | 13.33 | FRI 22 SEPT 2023 | MON 25 SEPT 2023 | FRI 13 OCT 2023 | NO | 5,317,971,001 |

| KSL | 245,804 | 2.41 | 0.01 | 0.41 | K0.1610 | K0.097 | 10.75 | WED 6 SEPT 2023 | THU 7 SEPT 2023 | THU 5 OCT 2023 | NO | 64,817,259 |

| STO | 0 | 19.22 | – | 0.00 | K0.5310 | K0.314 | 4.42 | MON 28 AUG 2023 | TUE 29 AUG 2023 | THU 28 SEPT 2023 | – | – |

| KAM | 0 | 0.90 | – | 0.00 | – | K0.12 | 13.33 | TUE 19 SEP 2023 | WED 20 SEP 2023 | THU 19 SEP 2023 | YES | 49,891,306 |

| NCM | 0 | 75.00 | – | 0.00 | USD$1.23 | K0.719 | 2.60 | FRI 18 AUG 2023 | MON 21 AUG 2023 | MON 18 SEPT 2023 | – | 33,774,150 |

| NGP | 0 | 0.69 | – | 0.00 | – | – | – | – | – | – | – | 32,123,490 |

| CCP | 0 | 2.05 | – | 0.00 | K0.123 | K0.110 | 11.51 | FRI 24 MAR 2023 | WED 29 MAR 2023 | FRI 5 MAY 2023 | YES | 569,672,964 |

| CPL | 0 | 0.79 | – | 0.00 | K0.02 | – |

2.50 |

WED 22 MAR 2023 | THU 30 MAR 2023 | THU 30 JUL 2023 | – | 195,964,015 |

Dual Listed PNGX/ASX Stock

BFL – 5.25 +4c

KSL – 77c flat

NCM – 26.00 +1.73

STO – 7.64 +29c

Our Order Book has us nett buyers of BSP, CCP, KSL, STO

Other assets we watch

Natural Gas – 3.24 -10c

Silver 22.90 +91c

Platinum – 887.70 +$3

Bitcoin – 27,165 -2.87%

Ethereum – 1,559 -4.74%

PAX Gold – 1,923 +2.90%

Just out of Interest

Latest Carbon Prices

|

CarbonCredits.com Live Carbon Prices |

Last |

Change |

YTD |

|

Compliance Markets |

|||

|

European Union |

€87.45 |

– |

+9.31 % |

|

California |

$29.41 |

– |

+1.17 % |

|

Australia (AUD) |

$31.00 |

– |

−8.28 % |

|

New Zealand (NZD) |

$67.65 |

−0.51 % |

−11.48 % |

|

South Korea |

$8.83 |

– |

−25.31 % |

|

China |

$11.17 |

– |

+38.70 % |

|

Voluntary Markets |

|||

|

Aviation Industry Offset |

$0.75 |

– |

−80.47 % |

|

Nature Based Offset |

$1.60 |

– |

−65.22 % |

|

Tech Based Offset |

$0.77 |

– |

−32.46 % |

Interest Rates

On the interest rate front, BPNG was in the market easing liquidity by taking out almost 1.75bn 7day money at 2%. Access to FX continues to be an issue across the board and appears to be worsening.

In the TBill market we saw some easing with the 364 day TBills, averaging 3.20% with the bank issuing 306mill but left the market oversubscribed by 63mill.

I understand we may see another GIS tender announcement within the next few days.

Fincorp leads the Finance Companies term deposit market with 365 day money at 2.75%.

What we’ve been reading this week

Why is Gold Rocketing?

Ainslie Bullion

Gold has been marching higher, up over $100 in just a week, but what is the major cause? One of them might be scary signals from the treasury market.

The CPI inflation report has just been released from the US. Prices rose 3.7% y/y compared to 3.6% expected with shelter and energy being the biggest issues. As investors become fatigued at monitoring carefully sifted CPI data and balancing it with wishy-washy statements from Fed speakers, investors have been seeing major warning signs elsewhere.

In recent months, the rapid surge in US 10-year yields, climbing from 4.0% to 4.70% since early August, has sent shockwaves through the financial markets. This unexpected trend has occurred despite stable market-measured inflation and Federal Reserve expectations. Notably, there haven’t been any significant economic surprises to justify these movements. Let’s break down the factors contributing to this:

Lack of Foreign Investors and Sovereign Demand

One possible explanation for the rising yields is the reduction in foreign buyers, particularly China, in the treasury market. While China’s holdings aren’t rapidly decreasing, the lack of growth suggests a slowdown. If China and other countries reduce their purchases, the demand for US bonds decreases, leading to higher yields.

Higher Interest Rates Persisting

The resilience of US economic data (if believed), including robust jobs reports and spending figures, indicates that the US might withstand higher interest rates. This scenario could mark a shift to a new rate regime, possibly ranging from 3-6%, compared to the post-financial crisis range of 0-3%. However, this change could create challenges for other economies, which would make the USD keep getting stronger and pose a huge risk for US stocks.

Potential for Volatile Inflation

Market inflation pricing remains low, but the bond market might be signalling a future of higher (or more volatile) inflation. Wage resets and strikes hint at increased worker bargaining power, potentially contributing to inflation. The bond market’s concerns might also be linked to commodity-led inflation or inflation resulting from de-globalization.

The Challenge of Debt

The era of easy money, characterized by negligible sovereign rates, might be ending. Rising yields could complicate sovereign deficits, impacting financing. The US may not be ready to respond to this situation with aggressive tactics, such as austerity measures meanwhile workers are already striking.

QT and Central Bank Actions

The massive balance sheets of central banks, a result of extensive bond buying, might have masked the actual cost of government borrowing. If it turns out that winding down these portfolios is necessary, it could create further market uncertainty. Other central banks, including Japan, have engaged in significant quantitative easing, intensifying the concern.

Their Combined Force

When all these factors are considered collectively, there’s a fear that the global economy, built on deficits, quantitative easing, ultra-low rates, and speculative market activities, is facing a significant downturn. This scenario, akin to the bursting of a historic bubble, carries dire economic, market, fiscal, and political consequences, leaving investors with few safe havens.

Navigating the Turbulent Waters

Given these concerns, investors are left wondering where to seek safety for their capital. Traditional safe havens like bonds are less appealing due to rising yields (and actually being the debt instruments behind this Ponzi scheme). Cash could be one option, but what about those of us not using USD? Also, that leaves investors to call when monetary policy will pivot. Precious metals like gold and silver could be the winners, benefiting from reserve accumulation and market uncertainty. They have already been rising aggressively in the face of major economic announcements. Additionally, hard assets might prove resilient in a world experiencing currency devaluation, despite the bleak demand outlook.

Thank you to Ainslie Bullion for this article

Hydrogen Market Spotlight

Carbon Credits

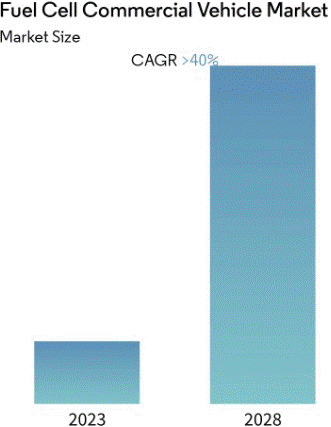

This Market is Growing at 40% Every Year…

Is This the Future of Highways and A.I.? Tap Into Hydrogen’s Unlimited Power Potential

First Hydrogen Corp.

FHYD: TSXV | FHYDF: OTC

5 Key Highlights of First Hydrogen (FHYD):

- Growing Market: Hydrogen is at the centre of a new market expanding 40% annually and First Hydrogen has first-mover advantage.

- Better than EVs: First Hydrogen’s vehicles have longer range than electric cars, carry more weight, and produce less emissions.

- Almost Launched: 16 of the largest fleet operators in the UK are trialing their vehicles over the next 18 months, with a full launch expected in 2026.

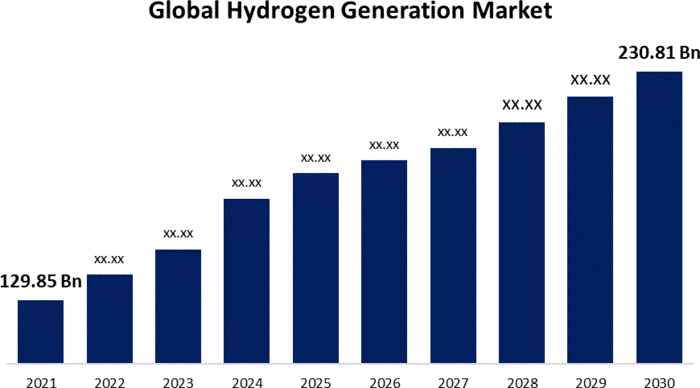

- 3 Income Streams: First Hydrogen doesn’t just produce Zero Emission Vehicles (ZEV), it also has two other businesses and one is a market set to reach $230 billion (more below…)

- Small Cap: First Hydrogen shares are worth just $189 million currently, roughly 4,014 times smaller than Tesla.i

When AI melded with human intellect in 2023, the world was utterly unprepared for the astonishing evolution that followed.

From crafting groundbreaking medicationsii to outpacing medical experts in disease detection,iii AI’s capabilities are staggering.

Consider this: An AI developed by a lone coder in merely 20 hours can beat a Chess Grandmaster. iv

And that’s not all – we even have AI composing symphonies across 10 instruments. v

This revolution is poised to unleash a surge of human potential, with projections indicating a staggering $15.7 trillion boost in global wealth by decade’s end—equivalent to the combined outputs of China and India. vi

Yet, beneath all this brilliance lies a crucial component: hydrogen.

The critical element making future AI breakthroughs possible.

Hydrogen is a Powerhouse Driving Future Technology

When hydrogen is burned in a fuel cell, it reacts with air to produce electricity, and the only emission it creates is water.

This offers significant advantages when paired with AI, because the need for data centres has rapidly increased ever since it went mainstream.

Global spending on AI is expected to grow 26.5% annually by 2026,vii and since AI applications burn more energy than conventional software, demand for data centres can’t keep up with supply.viii

- Equinix, which operates 245 data centres worldwide, cited power availability as one reason for a supply chain crunch. ix

Hydrogen can power more data centres in a much cleaner way, and without relying on foreign natural resources.

But data centres are just one part of the Hydrogen-AI boom…

Tech firms like Amazon, Google, and IBM are investing heavily to develop Quantum Computers.x

Regular computers solve problems step by step, while Quantum Computers process more information simultaneously, and look at many steps at once.

Stephen Hawking said Quantum Computing “Quantum computers will change everything, even human biology.”xi

In order to unlock their full potential, semiconductor particles are required which rely on hydrogen to control the quantum state of electrons. xii

In other words, these electrons have to be in a particular form for Quantum Computers to work the way they’re supposed to. And hydrogen is a critical element which helps them get into form.

Since it can be compressed into tanks at high pressures, liquefied at extremely low temperatures, or chemically stored in solid materials…

- It will bring electricity and other technology to off-grid locations that otherwise never could have xiii

- It will power homes and offices even in the most rural locations, while reducing the need for outside

Yet, there is one specific hydrogen application on the horizon, and it’s poised to unleash unparalleled shareholder value as it storms the mainstream.

The Market Growing an Astounding 40% Annually… xiv

Is the Hydrogen Commercial Vehicle Industry.

Hydrogen-powered vehicles are about to take over a share of the roads… Because compared to electric vehicles…

- They’re cleaner,

- Use power more efficiently,

- Charge faster and

- Have longer operating

While most people view electric vehicles as “green,” they still emit carbon dioxide if they’re charging at home, and there’s nothing “green” about that.

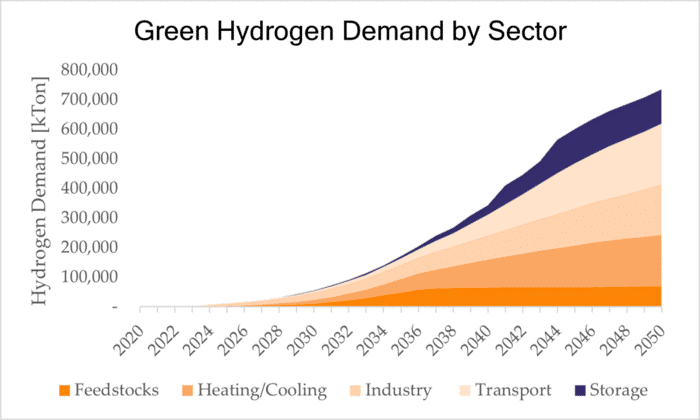

Hydrogen fuel cells are completely green. You’ll hear people refer to “green hydrogen,” meaning hydrogen that’s generated by renewable energy or from low-carbon power.

Green Hydrogen can cut annual global emissions by 20% on its own. xv

Electric battery production relies on precious and rare metals like lithium, cobalt, and nickel.

Putting an electric car in every driveway in America would require more lithium than the world produces,xvi but hydrogen fuel cells don’t require any of these materials.

They are similar to gas cars because they refuel in just a few minutes, significantly faster than even the quickest electric vehicle charging times.

For commercial vehicles, where downtime means lost revenue, hydrogen is a game-changer.

Hydrogen fuel cells have a higher energy density, and for the same weight, hydrogen can deliver more energy than a battery.

Beginning in 2025, stricter emission standards in some countries will put further pressure on businesses to convert to greener energy. xvii

Electric batteries can be heavy and don’t provide enough range for big trucks, especially when they’re carrying heavy loads.

That’s where hydrogen steps in.

It can power big vehicles without the issue of heavy batteries. And many argue it’s the future for commercial transport.

Hydrogen’s 2 Biggest Barriers Have Been Lifted

Hydrogen currently accounts for less than 2% of total global energy consumption, mostly for refining and industrial purposes. xviii

The International Energy Agency predicts hydrogen usage to grow sixfold by 2050 and will supply 10% of total energy consumption. xix

Hydrogen’s full potential is finally being tapped into in 2023 for two main reasons.

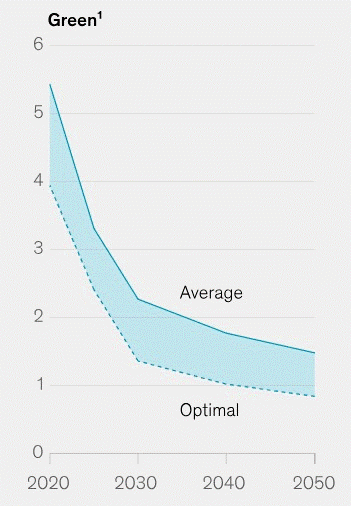

First, the expense of conducting electrolysis was prohibitively high for years.xxi Electrolysis is a method which generates low-emission hydrogen from renewable or nuclear energy.

But this situation is now changing.

McKinsey & Company says: “The production costs of clean hydrogen are expected to rapidly decline over the next decade.”xxii

The U.S. Department of Energy named hydrogen a “critical material,”xxiii and launched their “Hydrogen Shot” program to reduce the cost of green hydrogen by 80%.xxiv

The lower the cost, the faster hydrogen-powered vehicles will spread throughout the world, and companies in this industry could grow substantially.

The second barrier to Hydrogen was the public’s awareness of its benefits compared to gas and electric cars.

However, this is also beginning to change.

First Hydrogen

(FHYD:TSX | FHYDH:OTC)

Bringing Hydrogen Vehicles to North America, Europe, the UK, and Beyond

In July, the U.S. Department of Energy said:

“Hydrogen demand is expected to grow in… long-distance heavy- and medium-duty trucks.” xxv

As businesses wake up to the benefits of switching their vehicles from gas and electric to hydrogen, First Hydrogen (TSX: FHYD) is a first-mover ready to absorb this rise in demand.

First Hydrogen sells and leases next-generation hydrogen commercial vehicles, the exact type the Department of Energy is predicting a boom for.

- In the UK, spending on zero-emission vans increased 50% in 2021.xxvi

First Hydrogen’s demonstration vehicle became road legal in October 2022 with a range of 500 kilometers or more, while the average electric car has just a 348-kilometer range.xxvii

Then on August 8, 2023 First Hydrogen announced their van cleared 630km of range in a trial with SSE Plc.

And Rivus has 120,000 vehicles in their fleet!

The company’s light and medium-sized commercial vehicles can refuel in minutes, just like a gas-powered car.

An 18-month public trial started this year under real-world conditions to collect data while building up customer interest. xxviii

16 of the largest fleet operators in the UK have already signed up for the trial, from industries such as telecoms, utilities, infrastructure, delivery, grocery, and healthcare.xxix

Once the 18-month trial concludes, First Hydrogen plans to commence public sales of its “First Gen” vehicle in early 2026.

The “Next Gen Large Series” is slated to launch in 2028 and this vehicle will provide a range 1,000 kilometres or more,xxx nearly 3-times higher than the average EV. xxxi

Hydrogen Vehicles are Ramping Up in the USA…

Sales of new hydrogen vehicles just hit a record high in California,xxxii

And most industry executives believe this technology will breakthrough the industrial transportation market. xxxiii

Some of the most cutting-edge automakers are already transitioning to hydrogen…

- Toyota plans to sell more than 200,000 hydrogen vehicles by 2030.xxxiv

- Ford is developing its first hydrogen semi-truck, which will be tested in Europe.xxxv

- BMWhas rolled out a test fleet of 100 hydrogen-powered vehicles.xxxvi

Yet, as major automakers jostle for dominance in this arena, First Hydrogen is aligning to capture the rapidly expanding light and medium commercial vehicle market. xxxvii

Building Hydrogen Vehicles is Just One Income Stream for First Hydrogen…

First Hydrogen’s second business consists of providing powertrains for adjacent markets.

The company is in perfect position to provide these services because First Hydrogen has invested over $15 million into researching and developing hydrogen vehicles since 2021 alone.xxxviii

It’s leveraging its expertise in hydrogen powertrains and all the work accomplished to date to help other businesses while acquiring even more tech feedback for developing their own products.

By sharing its hydrogen technology with the markets below, First Hydrogen expects to boost short-term revenue:

- Recreational boat market = +$16 Billion xxxix

- Agriculture = ~$2.5 Billion fuel cell market by 2030

- Back-up power, portable power, EV charging = ~$1.4 Billion fuel cell market by 2030

- Commercial trucks = ~6 million medium-weight vehicles per year globally (units)

- Camper Vans = North American market valued at $56-billion (2022), anticipated to reach $108-billion by 2032

All of these markets are positioned to become early adopters of hydrogen vehicles and First Hydrogen has the technology and services to get them on the road.

Hydrogen as a Service

First Hydrogen will control part of the global hydrogen fuel supply by building its own production operation.

The plan is to build refuelling stations just like gas stations which are set to launch in 2026 however, the company’s “Hydrogen as a Service” provides even more benefits.

Hydrogen as a Service is for customers who prefer their hydrogen fuel to be delivered to them directly.

This not only simplifies entry into the hydrogen vehicle market for new customers but also ensures consistent fuel availability for current ones.

The long-term benefits are greater customer loyalty and retention for First Hydrogen, but also revenue diversification into a growing niche.

The global hydrogen generation market is expected to reach $230.81 billion by 2030.

Hydrogen’s French Revolution: Breaking Ground in Quebec

First Hydrogen (FHYD:TSX) purchased two plots of land in the City of Shawinigan, Quebec, which will produce 35 megawatts of green hydrogen using advanced electrolysis technology.

- 35 Megawatts has the potential to power roughly 87,797 vehicles.xl

The company will distribute this hydrogen within the Montreal-Quebec City corridor, but this new Quebec location won’t just produce hydrogen…

It will also assemble 25,000 First Hydrogen vehicles every year, which will then be sold throughout North America.

First Hydrogen is partnering with regional educators to help foster the high-demand skills needed for this booming industry.

Once hydrogen reaches full market penetration, it’s expected to create 675,000 new jobs in the United States alone. xli

Big Oil Pivots to Hydrogen

The most powerful global energy companies are now venturing into the rapidly expanding hydrogen market.

- Exxon Mobilis building a large-scale hydrogen plant in Texas,xlii in addition to exploring green hydrogen production in Norwayxliii

- Shellis building Europe’s largest renewable hydrogen plantxliv and will spend up to $1 billion annually on hydrogen over the coming two years.xlv

- BP has a 150-person team dedicated to hydrogen,xlviand has made several investments into large hydrogen projects, including in Australia, Europe and Britain.

- The Saudi Arabian Government is launching an $8.4 billion green hydrogen plant.xlvii

- Saudi Aramcorecently invested in a tech startup turning ammonia into hydrogen.xlviii

Big Oil’s investments are speeding up hydrogen’s path to the mainstream market.

First Hydrogen’s Unique Position

First Hydrogen has incredible potential and runway to capitalize on the hydrogen market.

- A company’s Quick Ratio is a financial metric that measures its ability to cover its short-term liabilities with its most liquid assets, anything at “1” or over indicates a company can pay its debts, and First Hydrogen passes.

The company is in this position because it has nearly 13 times more cash than it does debt at the time of this writing. xlix

- 67% of shares are owned by company insiders, which reinforces management’s dedication to enhancing shareholder value.l

However, just 1% of shares have been bought by institutional investors so far, as many large funds simply cannot buy a stock this small due to their Charter Agreements.li If First Hydrogen’s value rises, large investors will become eligible to buy it.

The Innovators Making It Happen

The company’s CEO is Balraj Mann, who has over 40 years of experience in corporate finance and acquisitions for public and private companies.

Rob Campell is the CEO of First Hydrogen’s Energy Business. He’s spent 40 years working in engineering, including as Chief Commercial Officer at Ballard Power Systems.

First Hydrogen’s CEO of Automotive is Steve Gill, who spent 20 years with Ford Motor Company, including as Director of Powertrain Engineering at Ford of Europe, and 11 years as Chief Engineer with Perkins Engines.

Francois Morin, VP of Corporate and Business Development – Quebec, brings 25+ years of business operations and development after leaving BMO Financial Group where he played a pivotal role in implementing a sustainable finance program for the Quebec business sector.

This team is on a path to bring First Hydrogen’s products to North America, Europe, the UK, and more.

They have a track record of delivering success in automotive engineering, manufacturing, and finance, and their combined skillsets have positioned the company to be a first mover in this fast-growing industry.

“Hydrogen Highways” are Inevitable

The hydrogen vehicle industry is growing 40% every year,lii while the hydrogen generation market is expected to reach $230 billion by the end of the decade. liii

$10 billion worth of hydrogen projects are being announced every month.liv

First Hydrogen’s three main revenue streams, which include producing zero-emission vehicles, providing hydrogen to customers, and powertrain supply, all position the company to grow with this new demand.

Because hydrogen is the cleanest form of energy and offers benefits that gas and electric vehicles do not, it’s poised to become the future of how businesses transport their goods.

First Hydrogen presents a unique opportunity to invest in a company with very little debt, yet huge potential to radically change transportation and provide shareholder value.

Thank you to Carbon Credits for this Article

Less Than 1 in 3 Boards Have a Strong Understanding of ESG Risks Affecting Their Companies: PwC Survey

Mark Segal – ESG

More than two thirds of corporate boards lack a strong understanding of the ESG risks affecting their companies, including only a quarter that report having a strong grasp of carbon emissions and even fewer on their companies’ climate risk or strategy, according to the new U.S.-focused Annual Corporate Directors Survey released by global professional services firm PwC.

For the study, PwC surveyed more than 600 directors of public companies in the U.S., across more than 12 industries. 73% of those surveyed represent companies with revenues greater than $1 billion, and 64% have served on their boards for more than 5 years.

The survey found that U.S. board members have seen a modest reduction in focus on ESG issues, in a year marked by continuing geopolitical turmoil, and with building political pressure pushing back on investors for their perceived “ESG agenda.” Even with these pressures, however, more than half of directors surveyed (52%) said that ESG issues are regularly a part of their boards’ agendas, down slightly from 55% last year, but remaining well above 34% reported by directors in 2019, and 54% continued to report that ESG issues are linked to their companies’ strategy, compared to 57% last year.

Female directors were found to more likely view ESG issues as tied to company strategy, with 67% reporting this link, compared to 51% of male directors. Similarly, 61% of female directors surveyed said that they believe that ESG issues have a financial impact on company performance, compared to only 35% of male directors who agreed with this statement.

While most boards continue to discuss and link ESG issues to corporate strategies, however, a large majority admit to lacking a strong understanding of key sustainability-related matters. Only 31% of survey respondents reported that their boards understand ESG risks “very well” as they relate to their companies, while 42% reported this level of understanding of their companies’ overall ESG strategy, and only 27% for ESG opportunities.

While directors appear to have a stronger grasp of ESG-related issues such as ‘talent and corporate culture’ and ‘data privacy/cybersecurity,’ with 52% and 45% reporting understanding these very well, respectively, only 26% claimed this level of understanding for carbon emissions, and 20% for climate risk and strategy.

The report examined the ESG-related issues that are currently receiving the most boardroom attention, with talent management and data security topping the list, with over 90% reporting that each of these topics have been discussed by their boards “somewhat” or “substantially” over the past year. Key sustainability-related topics are less frequently on the agenda, however, with only around half (49%) reporting having discussed climate change, 43% discussing environmental remediation, and only a third of boards discussing human rights.

One area in which directors signalled significant improvement was readiness for ESG-related reporting, with 51% of respondents reporting that their boards are sufficiently prepared to oversee mandatory ESG disclosures, compared to only 25% in last year’s survey.

The report also found strong support amongst board members for tying executive compensation to non-financial metrics, with only 7% saying that compensation should be linked only to financial performance. 44% of respondents said that executive compensation should be tied to diversity, equity and inclusion metrics, and 31% to environmental goals.

I hope you have enjoyed this week’s read, if you would like to discuss your investment requirements, please feel free to reach out.

Regards,

Head, Fixed Interest and Superannuation

JMP Securities

Level 1, Harbourside West, Stanley Esplanade

Port Moresby, Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814