13 November, 2023

Hello and welcome to this week’s JMP Report

On the equity front last week, we saw 3 stocks trade on the local market. BSP traded 6,196 shares closing 1t lower at K13.60, KSL traded 49,038 shares closing 7t lower at K2.43 and STO traded 104 shares, closing steady at K19.23.

WEEKLY MARKET REPORT | 6 November, 2023 – 10 November, 2023

| STOCK | QUANTITY | CLOSING PRICE | BID | OFFER | CHANGE | % CHANGE | 2022 FINAL DIV | 2023 INTERIM | YIELD % | EX-DATE | RECORD DATE | PAYMENT DATE | DRP |

| BSP | 6,196 | 13.60 | 13.60 | 15.00 | -0.01 | -0.07 | K1.4000 | K0.370 | 13.33 | FRI 22 SEPT 2023 | MON 25 SEPT 2023 | FRI 13 OCT 2023 | NO |

| KSL | 49,038 | 2.43 | 19.23 | 2.50 | -0.07 | -2.88 | K0.1610 | K0.097 | 10.75 | WED 6 SEPT 2023 | THU 7 SEPT 2023 | THU 5 OCT 2023 | NO |

| STO | 104 | 19.23 | 19.23 | – | – | 0.00 | K0.5310 | K0.314 | 4.42 | MON 28 AUG 2023 | TUE 29 AUG 2023 | THU 28 SEPT 2023 | – |

| NEM | 0 | – | 13.60 | – | – | 0.00 | – | K0.12 | 13.33 | TUE 19 SEP 2023 | WED 20 SEP 2023 | THU 19 SEP 2023 | YES |

| KAM | 0 | 0.90 | – | – | – | 0.00 | K0.5310 | K0.314 | 4.42 | MON 28 AUG 2023 | TUE 29 AUG 2023 | THU 28 SEPT 2023 | – |

| NGP | 0 | 0.69 | 0.69 | – | – | 0.00 | – | K0.0.3 | 5.80 | FRI 6 OCT 2023 | WED 11 OCT 2023 | WED 1 NOV 2023 | – |

| CCP | 0 | 2.10 | 2.11 | – | – | 0.95 | K0.123 | K0.110 | 11.51 | FRI 24 MAR 2023 | WED 29 MAR 2023 | FRI 5 MAY 2023 | YES |

| CPL | 0 | 0.70 | – | 0.79 | – | 0.00 | – | – |

– |

WED 22 MAR 2023 | THU 30 MAR 2023 | THU 30 JUL 2023 | – |

Dual Listed Stocks

BFL – 5.20 -11c

KSL – .775 +1.5c

NEM – 53.26

STO – 7.22 -20c

The JMP Order Book

The Order book starts the week as nett buyers of BSP, KSL, STO, NEM (NCM) and CCP

On the Interest Rate front

This week we saw the 7 day Central Bank Bill rate increase from 2% to 2.5%. The BPNG remains on track to tighten the liquidity in the system. In the longer end we saw the 364 day TBill creep out 9bpts to 3.50%, with 294mill on offer, the bank receiving 364mill in bids and issued 283mill of stock. Expect to see this week’s rate tick out further.

Other Assets we monitor

Natural Gas – 3.03 -35c

Silver – 22.31 steady

Platinum – 845 -96c

Bitcoin – 37,164 +6.64%

Ethereum – 2,056 +9.31%

PAX Gold – 1,948 -2.49%

What we’ve been reading this week

New Way To Get 700 C Degrees Heat And Electricity From Hydrogen – Without Burning It.

Ian Palmer

Hydrogen-gasoline refuelling station in Beijing.

New Mexico in the U.S. is a rich oil state, second only to Texas. So why does New Mexico want a radical new hydrogen-to-heat energy from Australia?

First, the state wants to make energy that’s clean, meaning energy with low carbon emissions (not oil or natural gas). Hydrogen is clean energy, and releases no emissions when it burns in car engines or when it’s converted to electricity.

But the hydrogen itself can be unclean if it’s made from methane (blue hydrogen which is cheap). Or the hydrogen can be clean if it’s made by electrolyzing water (green hydrogen which is expensive).

Second, New Mexico wants hydrogen-to-heat energy from Australia because the country has a new method to convert hydrogen into heat, without combustion. The system can be used directly in heavy industry or converted into electricity for just about any electrical application. Without combustion means avoiding a big mechanical step in power plants that have to burn coal to make heat (which release bad carbon emissions) and then make electricity.

The deal.

An Australian company called Star Scientific has announced it will start building a factory in Albuquerque, New Mexico in 2024. The investment is about $100 million, and the plant will eventually employ 200 employees to work at a 50-acre site that will contain up to 10 buildings – that will house all the way from R&D to management.

The deal was announced in Sydney late last month when the state governor, Michelle Lujan-Grisham met with Andrew Horvath, global group chairman of Star Scientific.

The new technology.

Curiously, the company made this discovery while studying nuclear fusion. They found a catalyst that encourages hydrogen gas to combine with oxygen gas to form water, and the reaction releases a large amount of heat. It’s really chemistry, not physics, but it does remind us of two hydrogen atoms fusing to helium and releasing enormous amounts of nuclear energy, which is the basis of the hydrogen bomb.

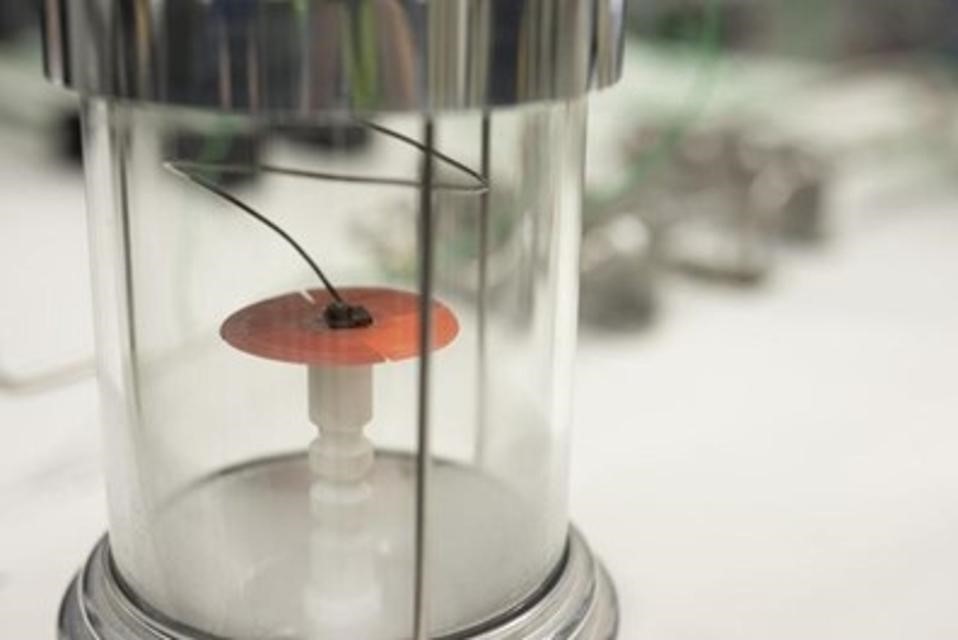

Figure 1. The HERO catalyst glows orange as the temperature soars to 700 C degrees.

In a laboratory demonstration, with inflow pipes for hydrogen and oxygen, within just a few minutes the catalyst became hot and orange in color as its temperature shot up to 713 C degrees. Such a temperature will be sufficient to provide heat for some industrial processes, without combustion, which would simplify the process.

The catalyst is a secret, and of course its patented. The process is called HERO which stands for Hydrogen Energy Release Optimiser.

Any desired temperature up to 700C degrees can be used to heat homes and offices. But it can also heat water into steam to drive turbines that produce electricity. The process is similar to what happens in a coal-fired power plant, except there the coal is combusted and releases heavy carbon emissions. In this case, swapping a coal-fired boiler within an existing power plant by a HERO process would cut emissions, according to Star Scientific.

If the inflow is green hydrogen, there will be no carbon emissions in the entire process. On the other hand, lots of energy will have been used to electrolyze water into hydrogen and oxygen, which is an inefficient process.

If the inflow is blue hydrogen, the full-life advantage of HERO is not clear, because blue hydrogen is produced along with a biproduct, CO2, that will have to be removed from the system by carbon capture and storage (CCS).

How does HERO compare with a hydrogen fuel cell?

A hydrogen fuel cell has an anode and a cathode and it looks a bit like battery action. The system uses a platinum catalyst which is an expensive part.

Fuel cells produce electricity and heat but the heat is rarely used. Also, the electrical power is generally too small for hard-to-abate sectors (about 9%), where HERO should have an advantage. The rest of industry (15%) called industry combustion, is addressable by electrification with batteries according to Rystad Energy. Fuel cells and HERO should have opportunities here.

But fuel cells have a relatively high efficiency, 65%, compared with a coal-fired power plant of 34%. The efficiency of HERO will be critical for its applications. Once HERO’s performance, cost and durability are demonstrated, it should be able to provide power or heat in many sectors such as transportation, heating commercial and residential buildings, and possibly in reversible grid systems.

Star Scientific are bullish on HERO. “Hydrogen can generate enough heat to be used to fire industrial processes, like a cement plant. It also has applications in other hard-to-decarbonize sectors, like long-haul shipping, or other heavy industrial processes that require immense heat or electricity that today generally come from fossil fuels.”

The political side.

Star Scientific is just the latest international company to be recruited successfully to New Mexico this year, joining companies from Singapore, Taiwan and Germany, according to the governor’s office.

Star Scientific, who were also considering whether to locate in Texas, were sold on the “governor’s bullish approach to hydrogen, and our [state’s] bullish approach on climate,” New Mexico Environment Secretary James Kenney said.

The Australian company were also impressed with how innovative people were in various industries in New Mexico. One example of such innovation is BayoTech a company that actually produces and markets hydrogen fuel in New Mexico.

The company makes hydrogen cheaper and with lower carbon footprint than large centralized plants that deliver hydrogen to chemical plants and refineries. Feedstocks can be clean natural gas or biomethane sources.

BayoTech Inc. announced on November 2, a newly completed hydrogen hub in Wentzville, Missouri. It can generate 350 tons of hydrogen per year for usage in fuel cells and industrial processes.

The company also demonstrated an electric semi-truck powered by a Nikola hydrogen fuel cell, and also a New Flyer fuel cell bus. BayoTech plans to buy 50 of these Nikola fuel cell trucks in a partnership with that company.

Before Star Scientific, there had been two other state initiatives to build out hydrogen generation. First was the Hydrogen Hub Act proposed to the legislature of New Mexico. It failed to pass as it was perceived by many as a tax credit subsidy to the oil and gas industry, when the goal of many stakeholders was to transition from fossil fuels to renewable energies.

Second was a joint enterprise with three neighbouring states called the Western Interstate Hydrogen Hub, or WISHH. This was to compete for several different hydrogen projects for various state-related applications, some green and some blue hydrogen. A proposal that aligned with the goals of the Infrastructure Act of 2021 was submitted to the U.S. Department of Energy (DOE) that would fund several hydrogen hubs across the country. The proposal passed the first elimination, but failed the second. Seven hubs were funded recently for about $1 billion each. It was reported that the governor said the DOE felt that the 4 -states combine had the interest and could find the funding to progress the joint project by themselves.

Takeaways.

New Mexico wants hydrogen-to-heat energy from Australia because the country has a new method to convert hydrogen into heat, without combustion.

The system can be used directly in heavy industry where intense heat is required, or converted into electricity for just about any electrical application.

An Australian company called Star Scientific has announced it will start building a factory in Albuquerque, New Mexico in 2024. The investment is about $100 million.

Swapping a coal-fired boiler within an existing power plant by a HERO process would cut emissions, according to Star Scientific, and probably cost less.

If the inflow to HERO is green hydrogen, there will be no carbon emissions in the entire process.

The efficiency of HERO will be critical for its applications. Once HERO’s performance, cost and durability are demonstrated, it should be able to provide power or heat in many sectors such as transportation, heating commercial and residential buildings, and possibly in reversible grid systems.

HERO also has potential applications in other hard-to-decarbonize sectors, like long-haul shipping, or heavy industrial processes that require intense heat or electricity that today come from fossil fuels

BayoTech Inc., based on New Mexico, announced on November 2, a newly completed hydrogen hub in Wentzville, Missouri. It can generate 350 tons of hydrogen per year for usage in fuel cells and industrial processes. The company also demonstrated an electric semi-truck powered by a Nikola hydrogen fuel cell, and also a New Flyer fuel cell bus. BayoTech plan to buy 50 of these Nikola fuel cell trucks in a partnership with that company.

Should you try to time the market?

Ele de Vere | Betashares

A buy-and-hold investment strategy might work better for some investors.

Key points

- Timing financial markets is difficult. Markets can be influenced by short-term fluctuations, noise, and random events that make it difficult to consistently predict short-term price movements.

- The biggest rallies historically have occurred during, or soon after market crashes. Missing out on these rallies can impact returns over the long term.

- Instead of trying to time the market, consider diversifying your portfolio, focussing on your investment goals, and staying invested for the long run.

Investors can go to a lot of effort trying to pick market (or individual share price) lows and highs, to time their entries and exits. It’s a strategy that often goes hand-in-hand with a willingness to take investment decisions based on relatively short-term market movements.

This approach is sometimes referred to as “market timing”, and it contrasts with a long-term “buy and hold” approach, where an investor is not so fixated on price, and typically buys with the intention of holding for several years.

Although simple in concept, in practice market timing is not so easy. As an old saying goes, no-one rings a bell at the top and the bottom [of markets].

While some investors achieve success with market timing on occasion, it’s important to remember that these successes are sometimes outweighed by failures.

Here are a few examples, both positive and negative, to illustrate the challenges of market timing.

Positive example:

Tech bubble (late 1990s): During the late 1990s, the technology sector experienced a significant bubble, with the stocks of many internet and tech companies soaring. Some investors recognised the bubble and successfully timed the market by selling their tech stocks before the crash in 2000-2002, avoiding substantial losses.

Negative examples:

Tech bubble (late 1990s): While some investors successfully timed the market during the tech bubble, many others did not. They continued to buy tech stocks at inflated prices, hoping for even more gains. When the bubble burst, many of these investors suffered substantial losses.

Global Financial crisis (2007-2008): Many investors failed to time the market during the GFC. After initially holding onto investments as stock markets plummeted, some investors subsequently panicked and sold off near the bottom, missing the subsequent rebound.

COVID-19 pandemic (2020): The rapid onset of the COVID-19 pandemic led to a sharp market downturn in early 2020. As in the global financial crisis, some investors sold their investments fearing further declines, only to miss out on the strong recovery that followed as central banks implemented stimulus measures and vaccine development progressed.

These examples highlight the difficulty of consistently timing the market. Even when investors make successful short-term predictions, they often involve a level of risk and uncertainty that can result in substantial losses or foregone gains if things don’t go as planned.

What is the lesson?

The key lesson is that it is almost impossible to consistently time the market over the long term.

Compounding the challenge is the fact that the biggest market rallies often happen in the middle of major market falls.

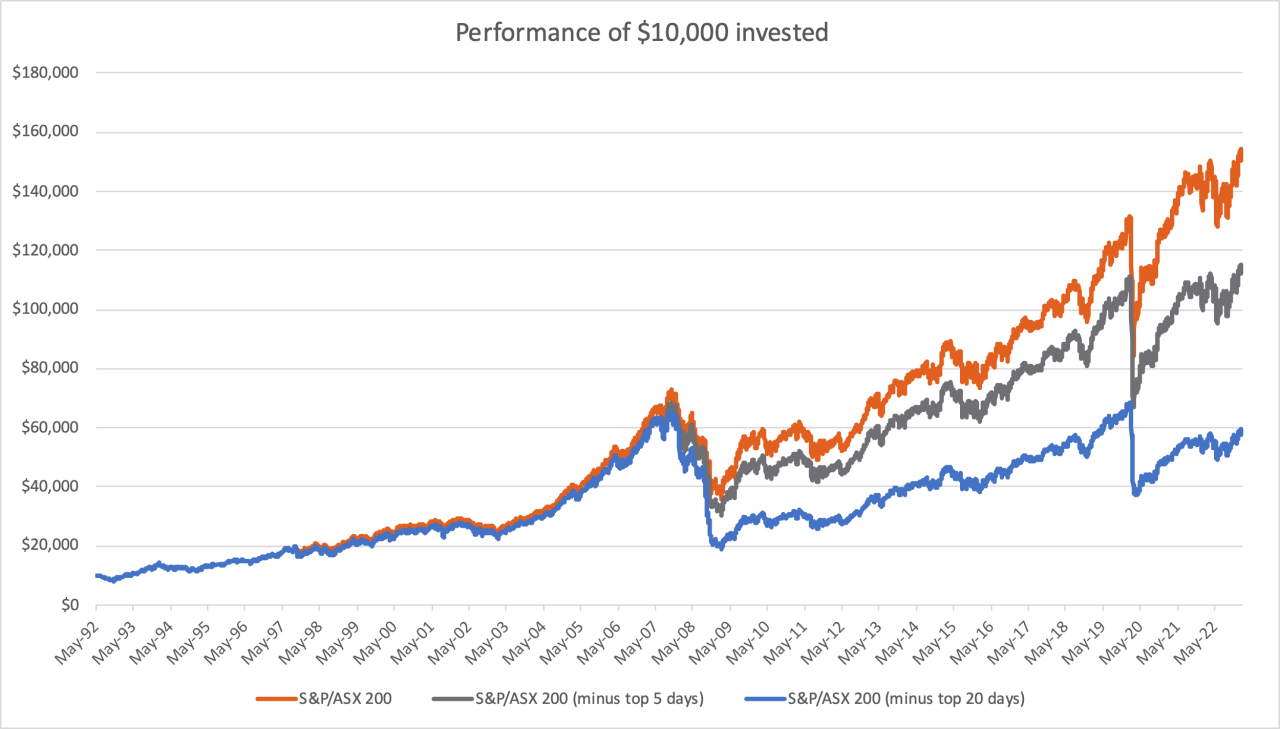

Earlier this year, Betashares crunched the numbers on returns from the Australian sharemarket over the 30 years to 31 January 2023, and the impact of missing out on the top 5 or top 20 days during that period.

The lesson is clear – by trying to time your sales to avoid the downturns, you run a risk of missing out on the big rallies, which ultimately reduces your gains over the long term, as the chart and table below shows.

Source: Betashares

|

S&P/ASX200 |

S&P/ASX200 |

S&P/ASX200 |

|

|

1 Year (%) |

12.21% |

12.21% |

12.21% |

|

3 Years (%, p.a.) |

5.96% |

1.66% |

-4.28% |

|

5 Years (%, p.a.) |

8.51% |

5.84% |

2.09% |

|

10 Years (%, p.a.) |

8.79% |

7.44% |

5.52% |

|

20 Years (%, p.a.) |

9.31% |

8.04% |

4.52% |

|

30 Years (%, p.a.) |

9.80% |

8.73% |

6.36% |

Source: Bloomberg, Betashares. As at 31 January 2023. Past performance is not an indicator of future performance. Top five and top 20 days over the last 30 years have been removed from the respective data sets. None of these days occurred in the year to 31 January 2023 so one-year returns are unaffected.

In contrast to the market timing approach, many financial experts advocate a long-term, buy-and-hold investment strategy that focuses on asset allocation, diversification, and staying invested through market fluctuations.

[Editor’s Note: Do not read the following analysis as a recommendation to invest in ETFs or use them in buy-and-hold investment strategies. ETFs that seek to replicate the return of an underlying index can deliver negative returns in falling markets].

Investment funds, such as Exchange Traded Funds (ETFs), are a consideration for a long-term, buy-and-hold investment approach, in Betashares’ opinion. ETFs provide a convenient, cost-effective way to get exposure to all the major asset classes, including Australian and global equities, fixed income, cash and commodities.

You can use ETFs to build the core of your portfolio – investments that will provide your portfolio foundation over the long term, through the market’s up and down cycles.

So, should I ever try to time the market?

By now it should be clear how difficult it is to time the market – and the risks you run if you get it wrong. However, that’s not to say that you should ignore market valuations, and adopt a “100% invested, 100% of the time” approach.

Just as some fund managers take an “overweight” or “underweight” approach according to their market view, you can also adjust your exposure.

Rather than selling everything when you think the market may be overvalued, you may consider banking some profits by selling a portion of an investment.

Similarly, when the market has suffered a significant pullback, if you think that a recovery is likely you can top up holdings, or take the opportunity to add a new investment to your portfolio.

This is very different from an “all in or all out” approach. If you get the timing right, you can potentially enhance portfolio returns – and if you don’t, at least taking an incremental approach means there is less risk of a catastrophic impact on your portfolio.

Of course, the approach you take should ultimately be informed by your personal objectives, financial situation and needs, and you should consider obtaining financial advice before making any investment decision and be aware of your own personal limitations, or biases. We explore these in depth here.

Ele de Vere, Betashares

Ele de Vere is Marketing Director of Betashares, a leading ETF issuer.

Thank you Australian Stock Exchange for this article

“Just Close The F*#kin Door” – Powell – Worst US Bond Auction

Posted 10/11/2023

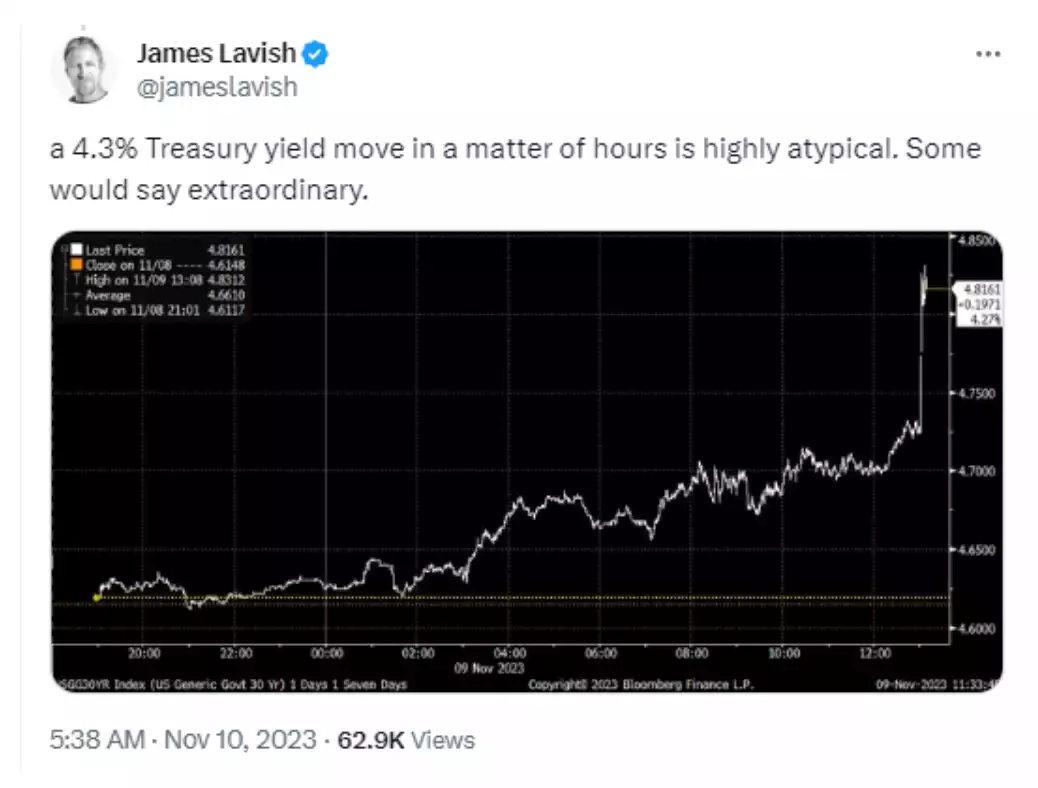

Public, foul language from the Chair of the Federal Reserve…Of course, he was just talking to climate protestors who shouted over his speech. But, Powell did also close the door on recent gains in the stock market and was clearly frazzled by what happened in the bond market. The extraordinary moves in the world’s biggest (and world reserve) sovereign bond market may have closed the door on the ‘soft landing’ goldilocks scenario markets are desperate for.

A selloff in equity indices was bolstered by Powells comments that central bank officials “are not confident” that interest rates are yet high enough to finish the battle with inflation. He also used more aggressive language in regard to timing, stating that “we will not hesitate” to tighten further if appropriate.

Since his speech earlier in the week headlines have been openly calling Powell “Dovish”. For those unfamiliar with economist jargon, this typically refers to a Fed chair that is not looking to raise rates and fight inflation, but rather cut and let easy money fix the problems (what has to be done later anyway, right?). The more recent comments by Powell re-establish him as a hawk and may have put an end to the tech-led surges in major indices.

But Wait, There’s More

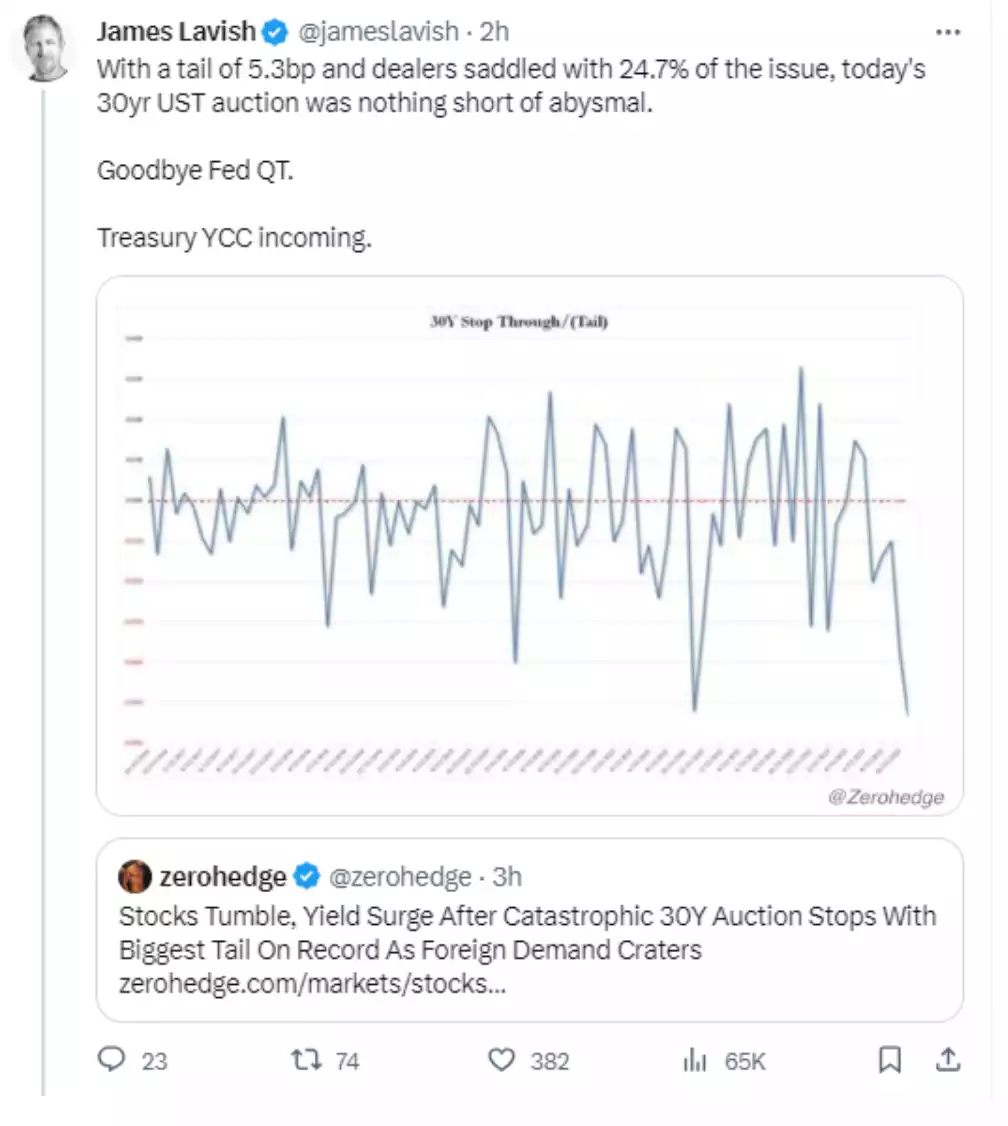

About an hour before Powell’s speech, the major indices moved sharply lower after Treasury yields jumped due to the auction of 30-year US bonds. That auction was one of the worst in history. As the Fed needs to issue more and more bonds to fund more and more deficits with fewer and fewer buyers… well, you can do the math. And the math was terrible. One of the biggest auction tails on record:

And a distinct feeling of something ‘breaking’…

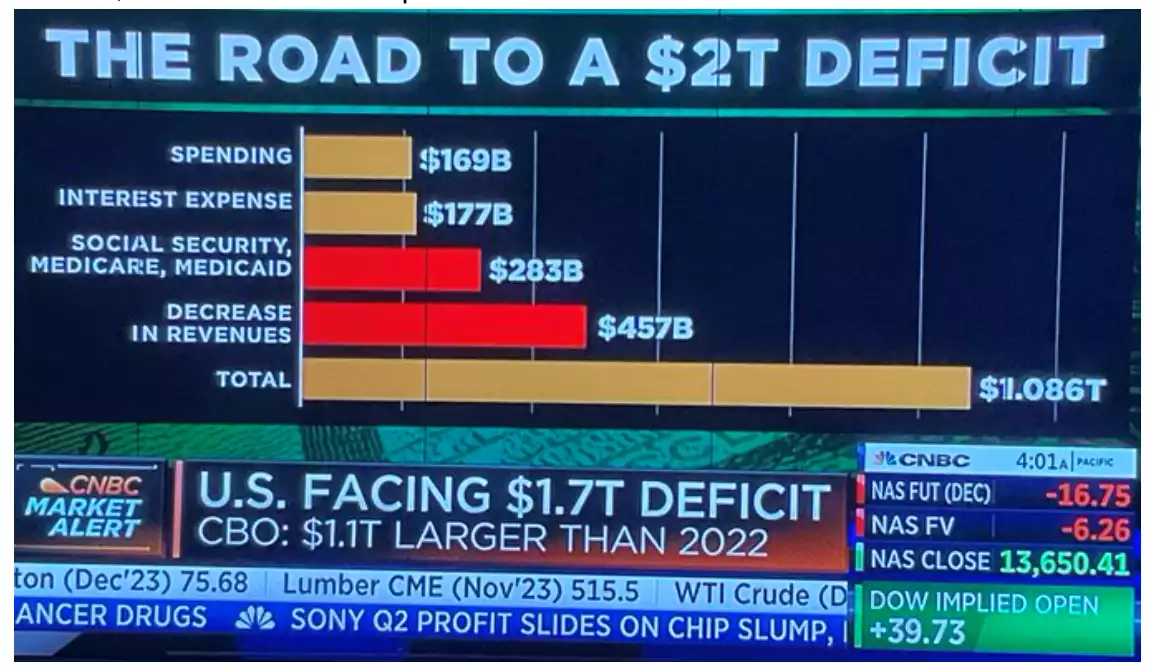

And when we talk about growing deficits, we aren’t talking incremental, just ‘mental’…an EXTRA $1.1 trillion in 2023 compared to 2033….

The 10-year Treasury yield US10Y has popped back up to 4.64%. Powell’s comments acted as a second blow to the indices but did not damage all markets.

The US Dollar, gold, and oil all benefitted from these events. Below we can see Gold, priced in Australian Dollars, which had an aggressive rise.

Gold has received a resurgence in safe-haven appeal due to the most recent war, but we have just seen another rise up in its price for purely economic worries – no extra kinetic bombs or bullets needed…just the financial bomb that is the world economic set up. It even rose in the face of a strong USD. This should not be a surprise as investors are always looking for a place to park their money to achieve the best returns, as well as safety. If the Fed is coming after the stock market with hawkish rhetoric, buoyed by surging US bond yields, this makes gold a potential option as one can see in the chart above.

I hope you have enjoyed this week’s read, please feel free to reach out if you have any questions relating to your investment journey.

Regards,

Head, Fixed Interest and Superannuation

JMP Securities

Level 1, Harbourside West, Stanley Esplanade

Port Moresby, Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814