6 November, 2023

Hello and welcome to this week’s JMP Report

On the equity front last week, we saw 3 stocks trade on the local market. BSP traded 1,411 shares, closing 10t higher at K13.61, KSL traded 127,424 shares, closing 9t higher at K2.50 and CCP traded 1,074 shares, closing 2t higher at k2.10.

WEEKLY MARKET REPORT | 30 October, 2023 – 3 November, 2023

| STOCK | QUANTITY | CLOSING PRICE | CHANGE | % CHANGE | 2022 FINAL DIV | 2023 INTERIM | YIELD % | EX-DATE | RECORD DATE | PAYMENT DATE | DRP | MARKET CAP |

| BSP | 1,411 | 13.61 | 0.10 | 0.73 | K1.4000 | K0.370 | 13.33 | FRI 22 SEPT 2023 | MON 25 SEPT 2023 | FRI 13 OCT 2023 | NO | 5,317,971,001 |

| KSL | 127,424 | 2.50 | 0.09 | 3.60 | K0.1610 | K0.097 | 10.75 | WED 6 SEPT 2023 | THU 7 SEPT 2023 | THU 5 OCT 2023 | NO | 64,817,259 |

| STO | 0 | 19.23 | – | 0.00 | K0.5310 | K0.314 | 4.42 | MON 28 AUG 2023 | TUE 29 AUG 2023 | THU 28 SEPT 2023 | – | – |

| KAM | 0 | 0.90 | – | 0.00 | – | K0.12 | 13.33 | TUE 19 SEP 2023 | WED 20 SEP 2023 | THU 19 SEP 2023 | YES | 49,891,306 |

| NGP | 0 | 0.69 | – | 0.00 | – | K0.0.3 | 5.80 | FRI 6 OCT 2023 | WED 11 OCT 2023 | WED 1 NOV 2023 | – | 32,123,490 |

| CCP | 1,074 | 2.10 | 0.02 | 0.95 | K0.123 | K0.110 | 11.51 | FRI 24 MAR 2023 | WED 29 MAR 2023 | FRI 5 MAY 2023 | YES | 569,672,964 |

| CPL | 0 | 0.70 | – | 0.00 | – | – |

– |

WED 22 MAR 2023 | THU 30 MAR 2023 | THU 30 JUL 2023 | – | 195,964,015 |

Dual listed PNGX/ASX

BFL – 5.31 +24c

KSL – .765 +.05c

STO – 7.42 – 41c

The JMP Order Book

The JMP Order book starts as nett buyers of BSP, KSL, STO and CCP

Interest Rates

In the very short end, we saw the Bank offering 1.4645bn 7 day Central Bank Bills @ 2%, in the longer end, the 364 day TBills averaged 3.41% with the Bank issuing 271m, leaving the market almost 90mill oversubscribed. Interesting to note the rates drifted out 10bpts. I am hearing that the Bank has been intervening in the FX market which has taken some of the liquidity out of the system. In the depo market, Fincorp at 2.75% offers the best rates on paper, a direct call may result in better rates.

Other Assets we watch

Natural Gas – 3.38 -6c

Silver – 23.32 – +34c

Platinum – 941.30 +29c

Bitcoin – 35,208 +1.57%

Ethereum – 1899 +5.34%

PAX Gold – 1967 -.68%

What we’ve been reading this week

Carbon Removal Startups Are Finding More Places and Funds to Store CO2

By Jennifer L

The urgency to do something with the surplus of carbon in the atmosphere led to a surge in innovative approaches aimed at securing stable and contained storage solutions.

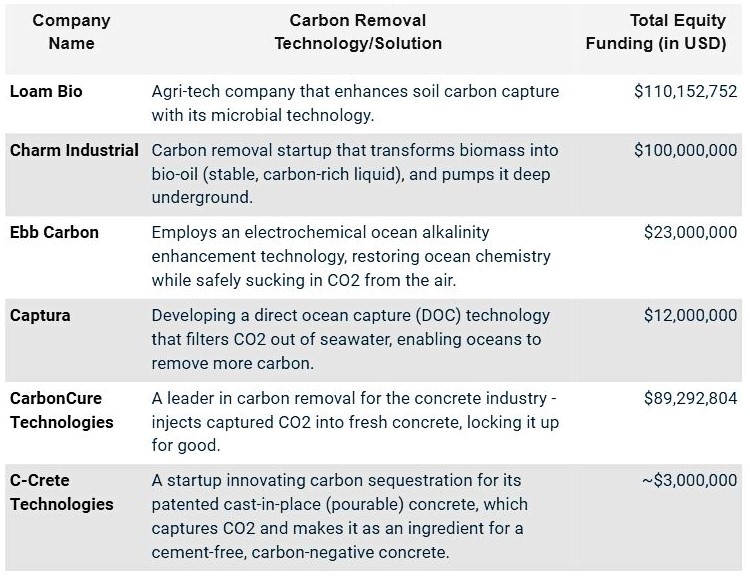

Notably, a number of startups in the carbon removal sector have drawn substantial investor interest, attracting hundreds of millions in funding over the course of this year, according to Crunchbase data. From underground storage to concrete mix and ocean sequestration, their strategies have gone beyond concepts to viable carbon removal solutions.

Recent funding trends reveal a notable increase in financing activities related to carbon removal initiatives. This surge in investment signifies a growing recognition to explore alternative solutions, considering the slow uptake of clean energy sources.

It further highlights the pressing need to fast-track the deployment of effective carbon reduction measures alongside existing clean energy efforts. Here are the startups with interesting carbon removal technologies, broken down by the places where they’re store the carbon.

Stowing Carbon in Soil

One common place to store carbon is in the soil. While capturing carbon through soil won’t be enough to remove what’s already in the air, it does help reduce emissions.

However, this would not be an easy task for most farmers, especially in cropping systems. This is where Loam Bio’s solution comes in to help farmers adopt farming practices that sequester more carbon.

The Australian startup aims to improve the quality and quantity of soil carbon capture via its unique microbial technology. Loam Bio, which closed a $73 million Series B round in February, said that its carbon sucking technology can turn croplands into giant carbon sinks.

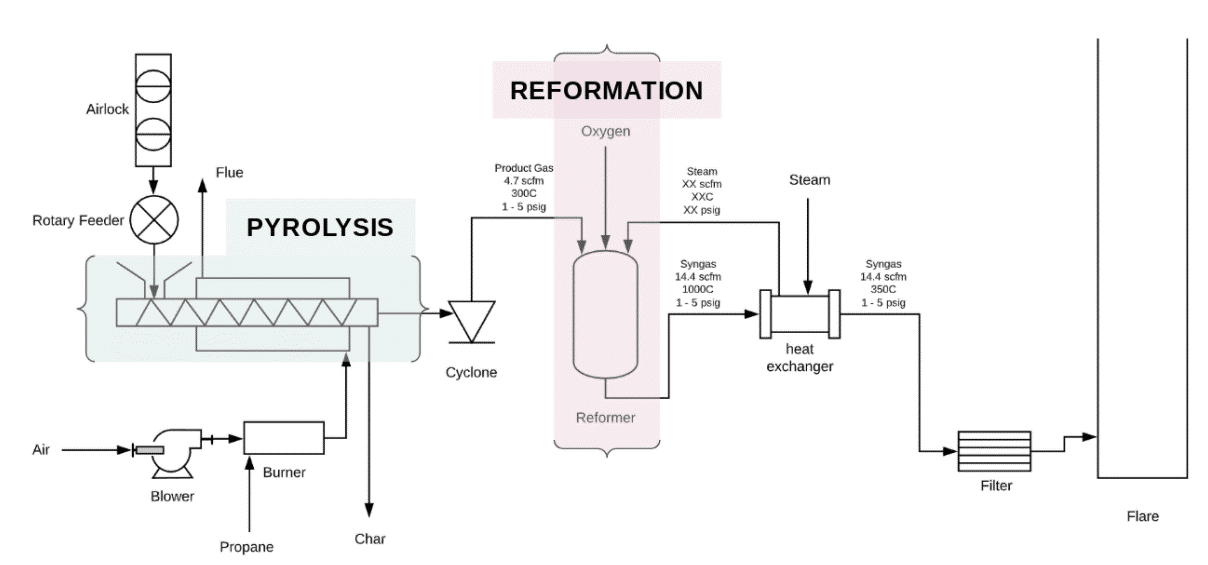

Plants or crops do absorb CO2, but a San Francisco-based carbon removal startup, Charm Industrial, offers a different solution. It takes waste biomass, transforms it into bio-oil (stable, carbon-rich liquid), and then pumps it deep underground for permanent storage.

The company bagged $100 million in Series B funding for the goal of putting oil back underground.

Here’s how its carbon removal technology works:

• RELATED: Frontier Fund Closes $53M Carbon Removal Deal With Charm

Sucking-in Carbon Through the Ocean

Recently, a trending way to store carbon is through the ocean. A couple of startups are developing technologies to capture and store carbon in this body of water.

On the list are two names that capture investors’ eyes – Ebb Carbon and Captura.

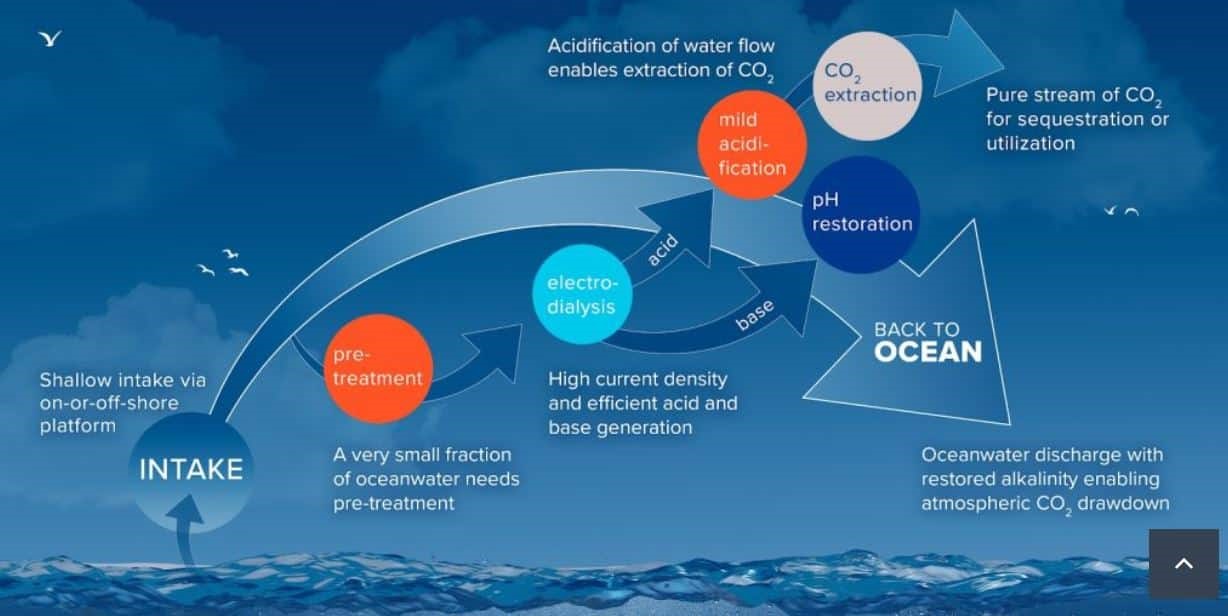

California-based Ebb Carbon, founded by former executives of Google X and Tesla, secured a $20 million Series A funding. The ocean-based carbon removal company claims to offer a solution to remove carbon at the gigaton scale.

Ebb is using an electrochemical ocean alkalinity enhancement technology, which speeds up the natural process of ocean alkalization that restores ocean chemistry while safely sucking in CO2 from the atmosphere.

Another startup that believes in the power of the ocean is Captura, also based in California. The carbon removal company is developing direct ocean capture (DOC) technology that filters CO2 out of seawater, enabling oceans to remove more carbon.

Captura’s process uses only renewable electricity and seawater to remove CO2 from the air, with no by-products and no absorbents. Their technology attracted $12 million from investors.

• RELATED: Revolutionary Ocean Capture Technology is Turning the Tide

Locking Away Carbon in Concrete

Buildings, particularly those made from concrete, are considered as one of the major contributors to greenhouse gas emissions. That’s mainly because traditional Portland cement is responsible for emitting huge amounts of CO2 (about 8% of global GHG emissions).

Thus, several startups are creating ways to make low-carbon concrete and even carbon-negative. CarbonCure Technologies, a Nova Scotia-based company that’s backed by Amazon and Microsoft, is a leader in carbon removal for the concrete industry and a provider of high-quality carbon credits. Each ton of removed CO2 generates a credit.

The startup injects captured carbon into fresh concrete, locking it up so it doesn’t return back to the atmosphere. Its innovative technology attracted $80 million in a new equity round led by Blue Earth Capital in July.

Another significant player in this field is C-Crete Technologies, a startup innovating carbon sequestration for its patented cast-in-place (pourable) concrete. Its technology captures CO2 and makes it as an ingredient for a cement-free, carbon-negative concrete.

Each ton of C-Crete’s cement-free binder can prevent 1 ton of carbon emissions. Its technology attracted two separate funding support from the U.S. Department of Energy – almost $1 million and $2 million.

While some of these startups have demonstrated that their technologies work in capturing and removing carbon from the atmosphere, scaling them up remains unproven and carries a major risk as climate experts noted.

Yet, the massive investments poured into their innovative models and technologies speak of confidence in technology deployment and scalability.

In summary, here are the carbon removal-focused funded startups rounded on the list.

The surge of innovative startups in the carbon removal sector reflects a growing commitment to combat climate change by deploying practical solutions to store carbon across diverse environments. While the scalability of these technologies remains a concern, the significant investments flowing into these ventures underscore a growing confidence in their pivotal role in mitigating the effects of too much carbon in the air.

Switzerland to Introduce Labelling and Disclosure Rules for Sustainable Investment Products

Mark Segal October 25, 2023

I hope you have enjoyed the read this week, please feel free to reach out if you would like to discuss your investment journey.

I hope you have enjoyed the read this week, please feel free to reach out if you would like to discuss your investment journey.

Switzerland’s Federal Department of Finance (FDF) announced today that it will proceed with plans to propose regulations to address greenwashing in the financial sector, including investment and disclosure rules for financial products using labels such as ‘sustainable,’ green,’ or ‘ESG.’

The announcement follows the release in December 2022 of a paper by the Swiss Federal Council outlining its position on the prevention of greenwashing, or the risk of having a financial product falsely or misleadingly portrayed as having sustainable characteristics.

Measures outlined in the Council’s greenwashing prevention position included requiring financial products that feature a sustainability label to pursue at least one investment objective, in addition to their financial goals, to align with one or more specific sustainability goals, or to contribute to the achievement of specific sustainability goals, and for product documentation to specify which of these characteristics, or combination of characteristics applied.

The Council noted that under this definition, products that are aimed at reducing ESG risk, without pursuing a specific sustainability goal, will not qualify for a sustainable label.

The Council’s proposals also included transparency rules, including requiring financial service providers offering sustainable investment products to describe their sustainability approach, and how the approach is achieved and measured, as well as regular reporting on the defined sustainability goals, along with verification by an independent third party.

The Federal Council also instructed the FDF at the time, along with other government agency representatives, regulators and industry and NGO organizations to assess how the proposals could be implemented. With today’s announcement, the FDF said that it would implement the Council’s position by proposing principles-based state regulation, with the regulation potentially supplemented by industry self-regulation.

The FDF added, however, that if the financial industry presents a self-regulation solution that meets the Council’s position, it will dispense with further regulatory efforts.

The FDF committed to submit a consultation draft for the proposed regulation by August 2024.

Troubled Waters Ahead for China

Katusa’s Investment Insights | By Marin Katusa – November 3, 2023

They had a chance…

Several months ago, I wrote that if China’s economy didn’t improve quickly, then the rest of the world would start feeling the pinch, not just China.

Well, here we are, two months later – and things have only gotten worse since we last visited the situation.

To recap – for the last 18-24 months, many indicators coming out of China have been negative.

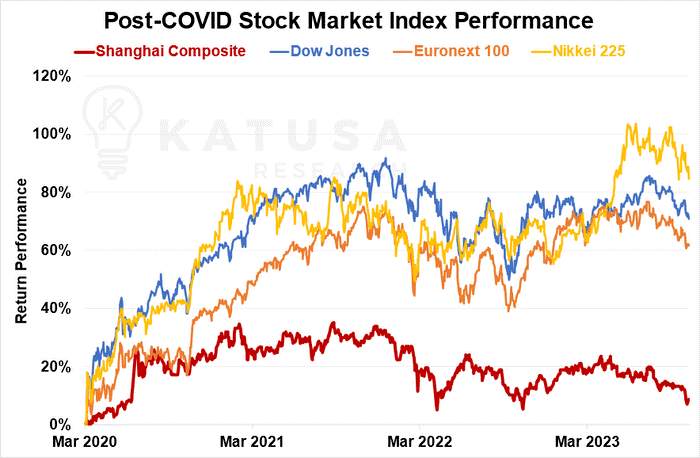

Ever since the post-COVID market lows, the Chinese markets have not experienced the same recovery that markets in other regions have, and continue to lag behind in performance:

Also of particular interest is China’s property sector, which accounts for a quarter of the mainland Chinese economy.

Chinese Real Estate Signals Don’t Look Good

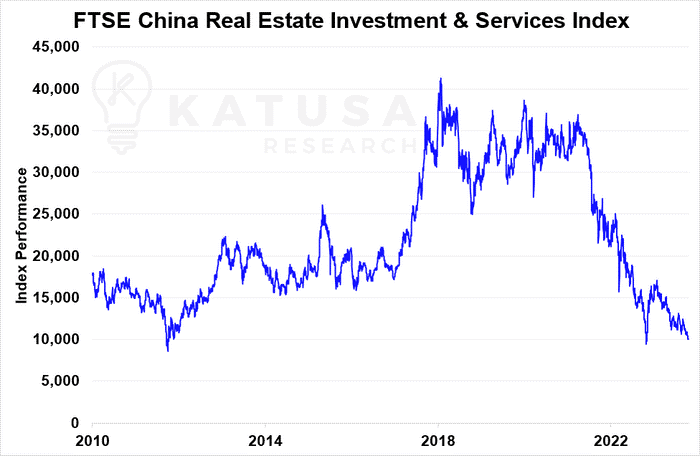

With several high-profile Chinese real estate developers in trouble, there are significant headwinds for the Chinese real estate market.

Last year’s biggest developer by sales, Country Garden, just defaulted on a US dollar bond for the first time last week.

China’s property sector isn’t just down over 70% in the last two and a half years…

It’s also lower than it has been at any point in the past decade and a half, except the very tail end of when China’s property market bubble burst in late 2011.

It’s important to remember that given how much of China’s GDP is made up of real estate, weakness in Real Estate drags down many other industries indirectly associated.

When people aren’t buying homes, nobody needs new furniture, appliances, or renovations. Demand for new utilities and services hookups decline, and related manufacturing and industrial segments suffer.

China Capital Flows

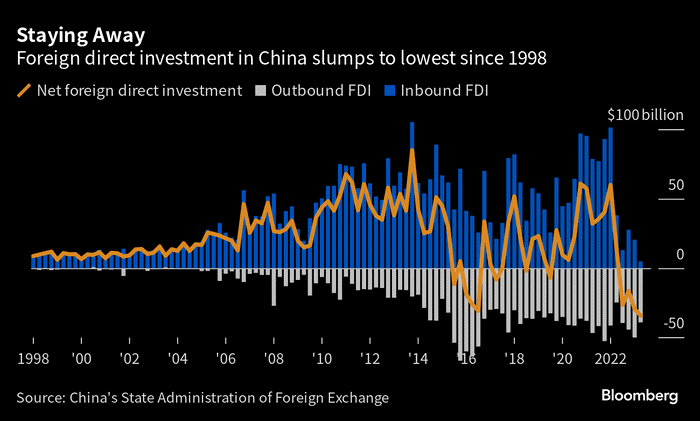

Another major sign of lack of confidence in the Chinese economy comes from looking at capital flows in and out of the country.

This past August experienced the highest capital outflow from China since early 2016, a period marked by a major anti-corruption drive and unexpected currency devaluation.

According to Goldman Sachs, China saw a $42 billion forex outflow in August 2023.

And this was immediately followed in September by another massive jump of $75 billion leaving the country, nearing the record previously set in 2016.

Record amounts of money are also leaving the Chinese financial markets…

• Roughly $26.2 billion in direct investments left Chinese shores this past September.

Outflows are bad, inflows are good. China is experiencing major outflows.

That’s bigger than the peak in 2016, and the largest outflow seen since this data began getting tracked in 1998 (orange line below).

The Yuan is down 5.7% against the USD this year, and preventing the Yuan from depreciating further is one of the CCP’s top priorities.

All these various problems compounded together has led to drastic action on the part of the CCP to keep things stable.

Xi’s Opening Chess Moves

In late October, President Xi visited the People’s Bank of China for the first time since he became president in 2013.

He also stopped by the State Administration of Foreign Exchange on the same trip – another first.

Though the reasons behind the visits were not publicly announced, Beijing announced a new $137 billion sovereign bond issuance…

While also raising its 2023 budget deficit by an additional 26.7% at the same time.

While local government debt in China is at an all-time highs of 76% of GDP, central government debt sits at 21%.

If those numbers are accurate…

Then there would be plenty of room for the government to work further stimulus into the economy.

That means even more bond issuances and debt into the system.

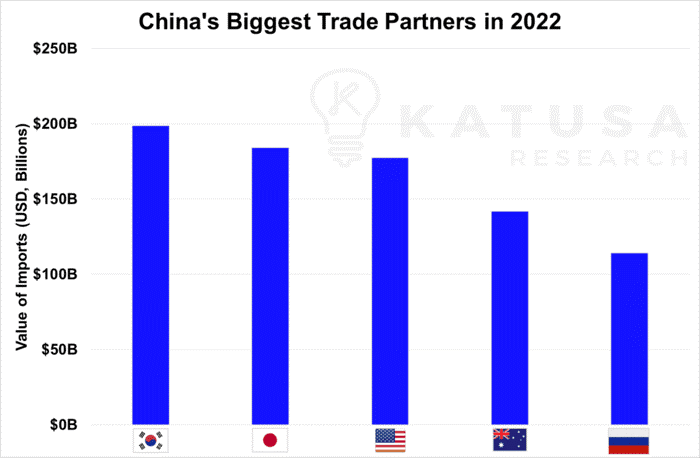

Eyes Wide Open: China’s Trading Partners

So why should you care about what goes on in China?

China is the world’s second-largest economy and largest importer of raw materials.

Any slowdown in China will have knock-on effects for the rest of the world.

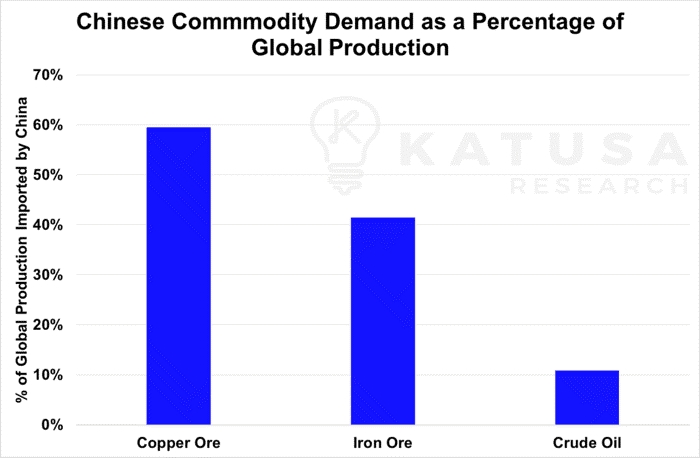

Not only is China the US’s third largest trade partner, but they’re also the world’s largest importer of copper ore, iron ore and crude oil, to name but a few commodities.

And demand for many of these commodities are tied to – you guessed it – the health of their real estate market.

Right now, it’s not yet clear whether things will be turning around soon in China.

Investor sentiment has taken a big hit in the last two months, and there’s a good chance we haven’t seen the bottom of the property market.

If things continue to go south for Chinese real estate, you should expect to see a corresponding drop in demand for iron ore and other raw materials like copper.

• This would negatively impact the resource markets meaning both commodity prices and the corresponding equity prices of producers and explorers will go lower.

As such, we’re keeping a close eye on the situation.

I hope you have enjoyed the read this week, please feel free to reach out if you would like to discuss your investment journey.

I hope you have enjoyed this week’s read, if you would like a confidential discussion around your investment journey, please do not hesitate to reach out.

Regards,

Head, Fixed Interest and Superannuation

JMP Securities

Level 1, Harbourside West, Stanley Esplanade

Port Moresby, Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814