5 February, 2024

Hi and welcome to an exciting 2024,

Last week saw 4 stocks traded on the local market. BSP traded 3,747, closing 90t higher at K15.00, KSL traded 344,082,cosing 3t higher at K2.60, STO traded 774 closing steady at K19.24 and CCP traded 1,316 closing 1t higher at K2.01.

WEEKLY MARKET REPORT | 29 January, 2024 – 2 February, 2024

| STOCK | QUANTITY | CLOSING PRICE | BID | OFFER | CHANGE | % CHANGE | 2022 FINAL DIV | 2023 INTERIM | YIELD % | EX-DATE | RECORD DATE | PAYMENT DATE | DRP |

| BSP | 3,747 | 15.00 | 15.30 | – | 0.90 | 6.00 | K1.4000 | K0.370 | 13.33 | FRI 22 SEPT 2023 | MON 25 SEPT 2023 | FRI 13 OCT 2023 | NO |

| KSL | 344,082 | 2.60 | 2.57 | – | 0.03 | 1.15 | K0.1610 | K0.097 | 10.75 | WED 6 SEPT 2023 | THU 7 SEPT 2023 | THU 5 OCT 2023 | NO |

| STO | 774 | 19.24 | 19.24 | – | – | 0.00 | K0.5310 | K0.314 | 4.42 | MON 28 AUG 2023 | TUE 29 AUG 2023 | THU 28 SEPT 2023 | – |

| NEM | – | 145.00 | 145.00 | – | – | 0.00 | – | K0.12 | 13.33 | TUE 19 SEP 2023 | WED 20 SEP 2023 | THU 19 SEP 2023 | YES |

| KAM | – | 0.90 | 0.90 | – | – | 0.00 | K0.5310 | K0.314 | 4.42 | MON 28 AUG 2023 | TUE 29 AUG 2023 | THU 28 SEPT 2023 | – |

| NGP | – | 0.69 | 0.69 | – | – | 0.00 | – | K0.0.3 | 5.80 | FRI 6 OCT 2023 | WED 11 OCT 2023 | WED 1 NOV 2023 | – |

| CCP | 1,316 | 2.01 | 2.01 | – | 0.01 | 0.50 | K0.123 | K0.110 | 11.51 | FRI 24 MAR 2023 | WED 29 MAR 2023 | FRI 5 MAY 2023 | YES |

| CPL | – | – | – | – | – | – | – | – |

– |

WED 22 MAR 2023 | THU 30 MAR 2023 | THU 30 JUL 2023 | – |

| SST | – | 35.46 | 36.46 | 40.00 | – | 0.00 | K0.70 | K0.35 | 2.96 | FRI 29 SEP 2023 | MON 2 OCT 2023 | TUE 31 OCT 2023 | NO |

NB CPL is still suspended until further notice from the market.

Dual Listed Stocks PNGX/ASX

BSP – 6.20 +33c

KSL – 86c +2c

NEM – 52.26 -1c

STO – 7.83 +16c

Other assets we watch

Gold – 2033

Silver – 22.58

Platinum – 896

Bitcoin – 42,740

Ethereum – 2295

GoldPax – 2014

What we’ve been reading this week

Moody’s Forecasts Resilient Sustainable Bond Market, with Cleantech Investment Offset by Soft Macro Environment

SUSTAINABLE FINANCE

Mark Segal January 29, 2024

Issuance volumes of green, social, sustainability and sustainability-linked (GSSS) bonds grew modestly in 2023 to $946 billion from $925 billion in 2022, maintaining a record 14% share of overall bond issuance, with continued growth in Europe and Asia Pacific markets offset by another year of sharp declines in North America, according to a new report from Moody’s Investors Service.

For 2024, Moody’s forecasts the GSSS market to hold steady at around $950 billion, as increased investment in and adoption of green technologies help the market maintain resilience in the face of an environment of higher-for-longer interest rates and moderating economic growth.

By region, Moody’s anticipates that Europe will maintain the largest share of GSSS volumes, after accounting for 45% of issuance in 2023, with sustainable bonds representing 20% of total bond issuances, and growing to $428 billion in 2023 from $411 in 2022, as sustainability issues remain top of mind for issuers. Similarly, GSSS issuance remains strong in Asia Pacific, hitting $234 billion in 2023 compared to $219 billion in 2022 and $194 billion in 2021, as countries including Japan and Singapore implement sustainable finance policies.

In North America, by contrast, sustainable bond volumes continued to decline in 2023, falling by more than 20% in the year to $110 billion from $139 billion the prior year, and representing only 4% of overall issuance volumes. Moody’s anticipates that volumes may bottom out in the region in 2024, with tailwinds from incentives from the Inflation Reduction Act driving increases in green technologies, although the report also notes uncertainty from the upcoming U.S. election on federal climate policy clouding the issuance outlook.

By bond type, Moody’s estimates green bond volumes will increase modestly to $580 billion in 2024, up 3% from $564 billion in 2023, as issuers from across sectors finance climate transition plans, and companies in hard-to-abate sectors invest in capital intensive projects to meet decarbonization commitments, with growing policy support improving the cost competitiveness of climate technologies such as green hydrogen, biofuels, battery storage and carbon capture, utilization and storage (CCUS).

Social bond volumes are expected to fall slightly in 2024, according to the report, declining to around $150 billion from $160 billion in 2023, as issuers integrate social features into broader sustainable financing frameworks, and turn to sustainability bonds – anticipated to grow to $160 billion from $150 billion in 2023 – to combine green and social use of proceeds.

Following years of sharp growth before dropping off significantly in 2022, sustainability-linked bond (SLB) issuance volumes levelled off in 2023, with Moody’s anticipating a modest decline in 2024 from $62 billion to $60 billion, as issuers continue to face challenges from investor scrutiny over issues such as the credibility and robustness of the bonds’ linked sustainability targets. While challenges for the still-developing SLB market persist, Moody’s notes that the quality of sustainability-linked bonds has been improving, and finds that new issuers continue to support the market, representing around two-thirds of issuers in 2023, compared to only around 31% of other GSSS bond types.

Additional factors highlighted by Moody’s that may support the GSSS market include the emergence of regulatory green bond standards, such as the new European Green Bonds (EuGB) label, addressing greenwashing concerns and growing investor scrutiny of labelled instruments, and the growing reliance by sovereign emerging markets issuers of sustainable finance markets to fund their climate mitigation and adaptation plans and address the climate finance gap for developing economies.

U.S. Treasurer Yellen makes $2 trillion bet on lower rates sooner

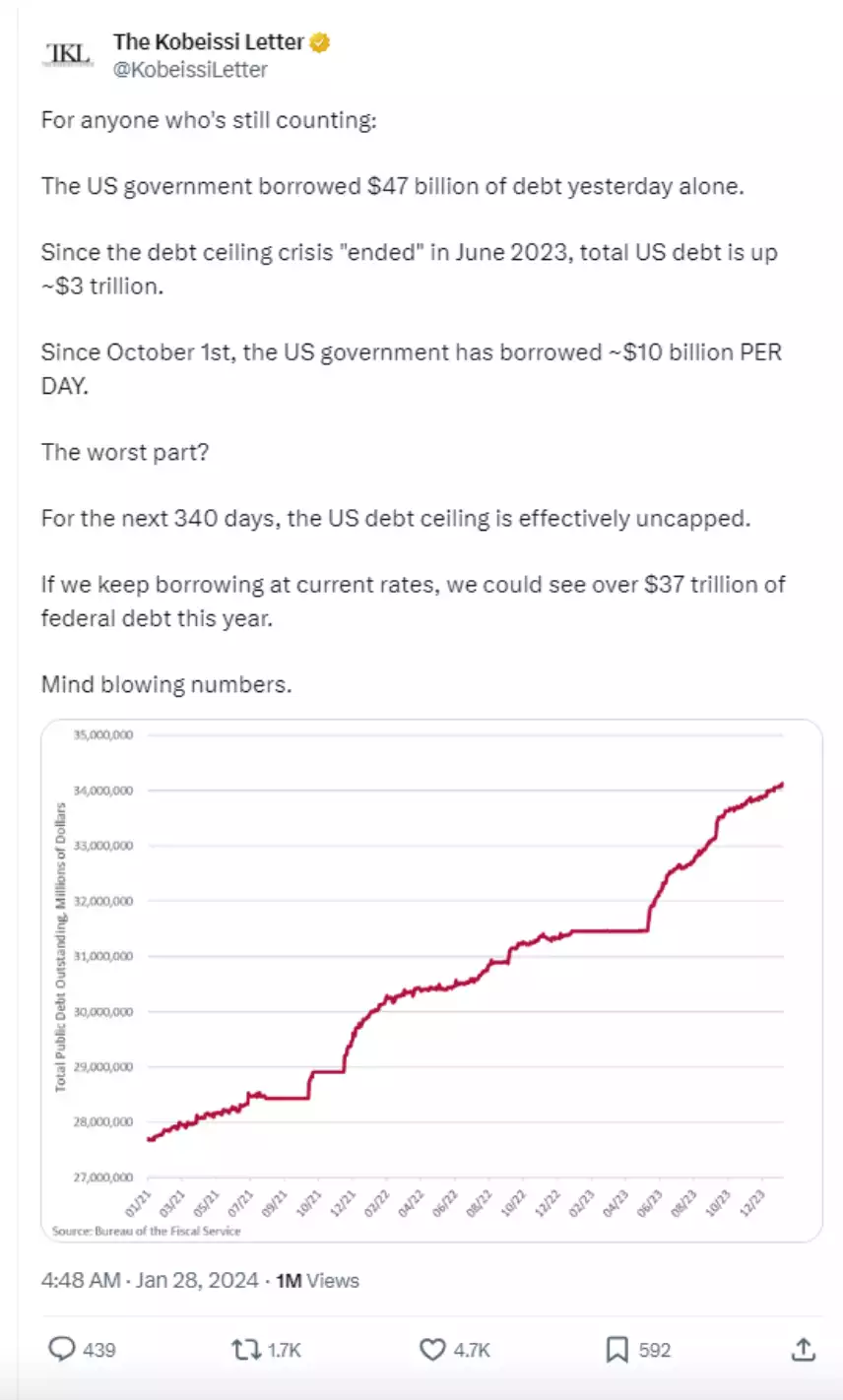

Last night saw gold and bitcoin bid as the U.S. dollar sold off on the latest U.S. Treasury report pushing a lowering of supply ‘narrative’ which saw yields fall back in line with expectations of Fed interest rates. The market is catching on to the sooner than later rate cuts reality. If you want more confirmation that it will be even quicker than even the Fed think, look no further than ex Fed Chair and current U.S. Treasurer Janet Yellen’s actions.

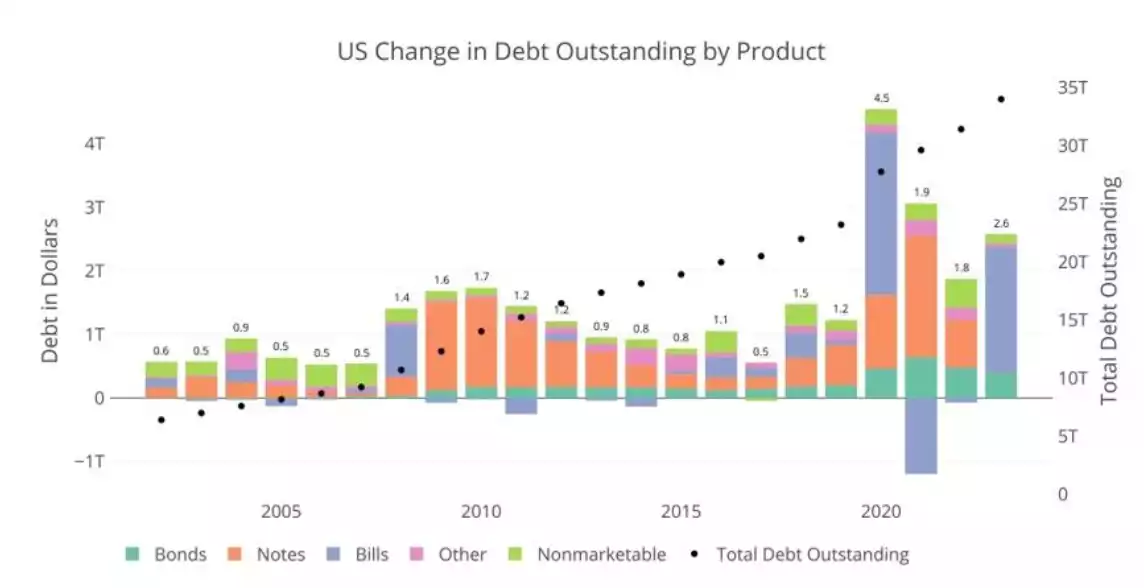

As a reminder, the U.S. Treasury funds the U.S. Government’s deficit spending given they spend more than they receive and have done so practically every year since 1969. They issue U.S. government backed Treasuries in the form of T-Bills (short term – 1m to 1yr), T-Notes (medium term – 2 – 10 yrs) and T-Bonds (long term – 20 – 30 years). Each pays interest and the higher the demand for them, the higher the price paid, the lower the yield.

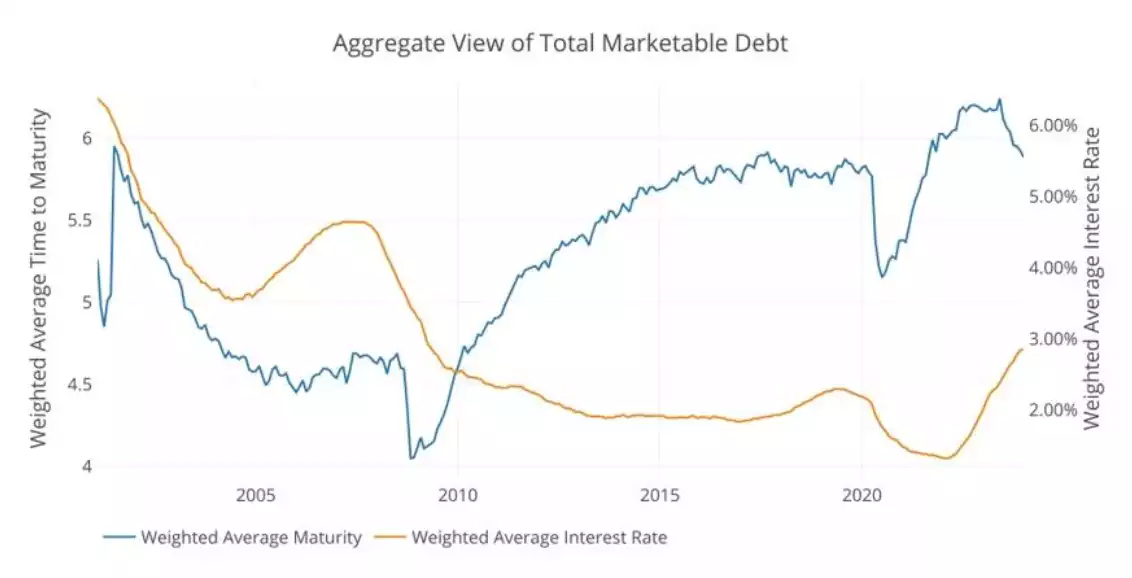

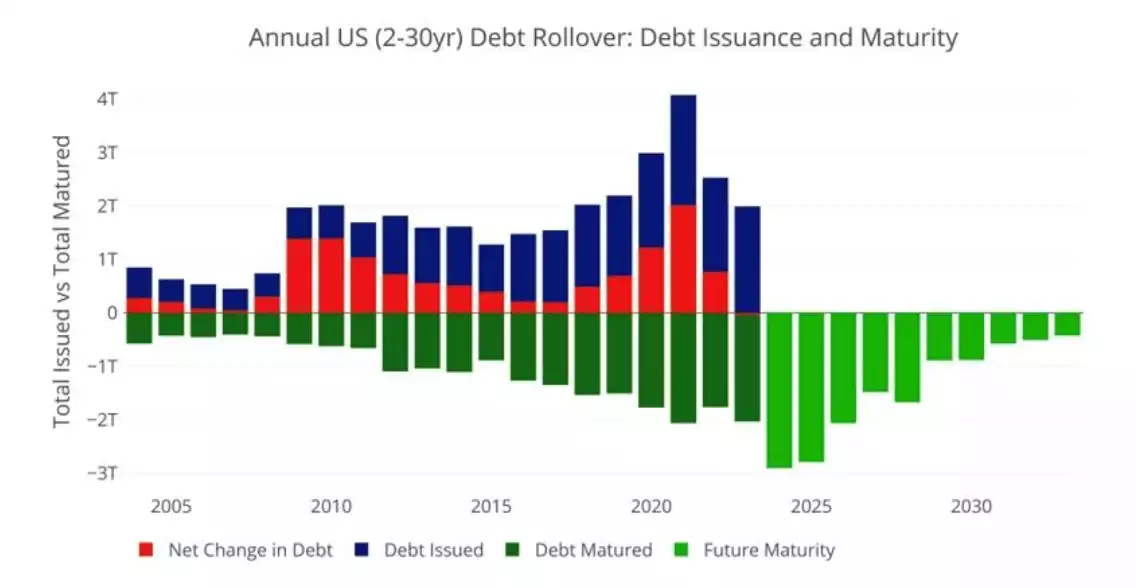

Since the GFC the Treasury has tried to extend the maturity of its debt to ease out the frequency of having to roll over the debt (note roll over, never repay…). So, after all those efforts, why now are they so heavily going short term? The chart below reminds us of the role interest rates play in the equation and the redux of GFC…

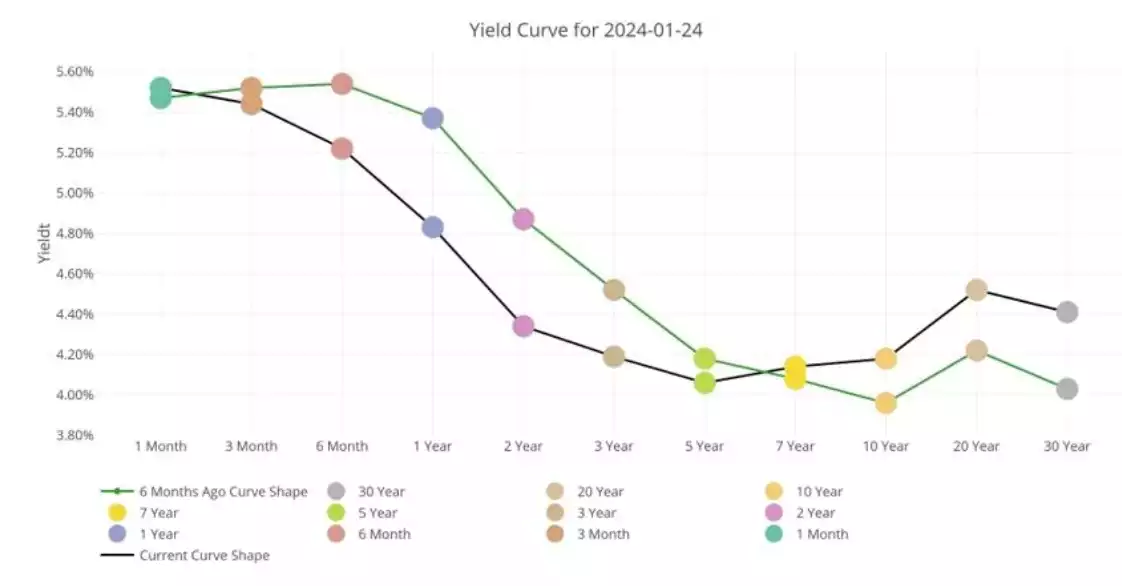

Regular readers will know we are currently in yield curve inversion territory where short term debt is paying more than long term debt, a phenomenon with a very high correlation with a recession ahead. So why, you may ask, would Ms Yellen choose to fund her Government’s largesse with a higher interest rate instrument? The chart below shows clearly that is around 1-1.5% higher than medium term Notes! So she is CHOOSING to pay an extra $30 billion in interest on her $2 trillion?

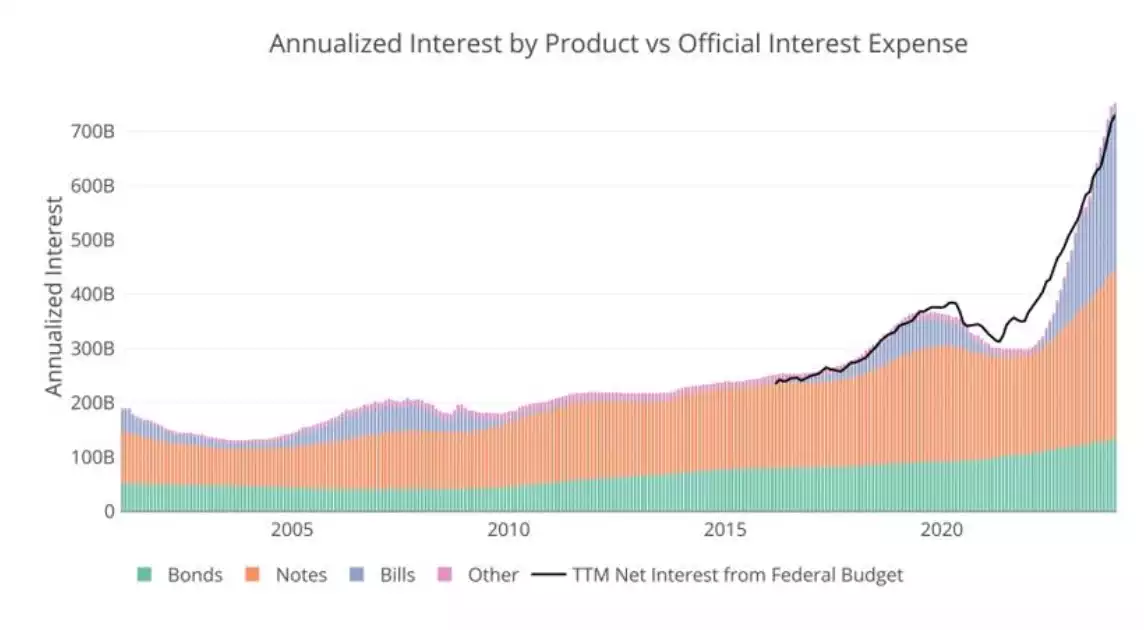

A more compelling reason is she knows longer term rates are set to fall and fall soon and fast. So why would she sell Notes and have to pay the 4%’s you see in the chart above when she know she can do that later (especially with that record $2.9 trillion this year) and pay much less? To put the sheer magnitude of this interest bill into perspective and the scale of the amount that is now short term Bills, check out the following chart…

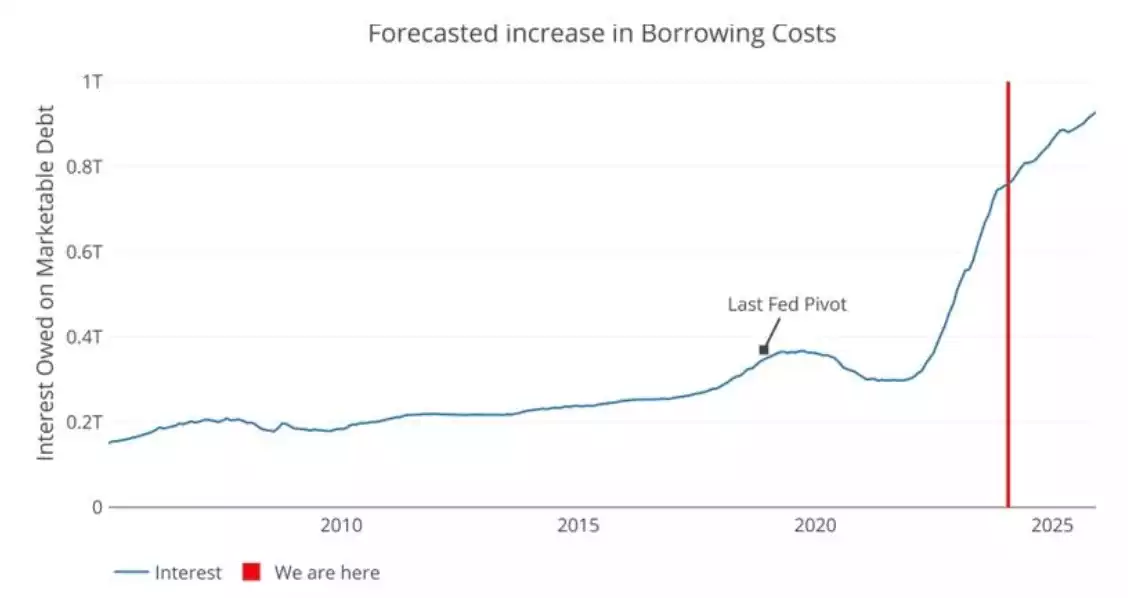

The Fed are forecasting 6 rate cuts reaching 3.5% by mid 2025 and in no particular hurry. The chart above and that below courtesy of the very same Fed forecasting a simply unfeasible debt interest bill of $900 billion by 2025 means that would be too little too late and it looks like Yellen is calling BS on it too. As a reminder, the Fed famously ‘pivoted’ in 2018 after its brief tightening foray saw the interest expense reach $400 billion… around half what’s dead ahead…

Love or loath her, Yellen has danced on both sides now, U.S. Fed Chair and U.S. Treasurer, and she effectively just made a $2 trillion bet that rates are coming down more and sooner than many predict. In isolation that may not convince you, but in combination with our own latest Global Liquidity Monthly it is confirmation of a very clear market trend and one that is hugely constructive for gold. Don’t do as they say, do as they do…

As he mentioned in the past, “World War 3 would be a catastrophe unlike any other. This would make WW1 and WW2 like very small battles”. Meanwhile, a US Senator wants to “hit Iran now”. Let’s look at his share portfolio.

“This attack would NEVER have happened if I was President, not even a chance – Just like the Iranian-backed Hamas attack on Israel would never have happened, the War in Ukraine would never have happened, and we would right now have Peace throughout the World. Instead, we are on the brink of World War 3.”

Maersk unveils world’s largest methanol-powered vessel — almost eight times bigger than its pioneering predecessor

The Ane Maersk under construction in HD Hyundai Heavy Industries’ shipyard in Ulsan, South Korea.

The Ane Maersk will soon begin its maiden voyage from South Korea to China, fuelled by green methanol

26 January 2024

By Leigh Collins

Maritime giant AP Moller-Maersk has officially unveiled its new methanol-powered shipping container, the Ane Maersk, which is the world’s largest vessel capable of running on the green hydrogen derivative.

It is able to carry almost eight times more containers than the Danish logistics company’s pioneering Laura Maersk, which became the planet’s first methanol dual-fuel container ship when it was launched in September last year.

Why shipping is opting for green hydrogen-based methanol over ammonia, despite much higher fuel costs

The new vessel is able to carry 16,000 20ft shipping containers (TEU), compared to only 2,100 for the Laura Maersk.

The Ane Maersk is set to begin its maiden voyage on 9 February from the Hyundai Heavy Industries shipyard in Ulsan, South Korea, where it was built, to Ningbo, China. It will then continue on to Malaysia, Sri Lanka, Saudi Arabia, Abu Dhabi, Morocco, the UK, France, Belgium and Germany.

Maersk has ordered 24 container vessels equipped with dual-fuel engines capable of burning methanol, biodiesel and conventional bunker fuel — another 11 of which will be the same size as the Ane Maersk. Six will be larger, with a capacity of 17,000 TEU, while six will be 9,000 TEU.

A further six of these vessels — the sizes of which are not clear — are due to be unveiled by the end of this year.

The company says it has “secured sufficient green methanol to cover the vessel’s maiden voyage and continues to work diligently on 2024-25 sourcing solutions for its methanol-enabled vessel fleet”. This includes methanol derived from both green hydrogen and biogas.

Maersk to buy half a million tonnes of hydrogen-based and biogenic methanol from Chinese wind farm

Last November, Maersk agreed to buy 500,000 tonnes of green and biomethanol a year from Chinese wind turbine manufacturer Goldwind, although the exact split between the two production methods is not known.

While methanol (CH3OH) does release CO2 when burned, it is said to be carbon-neutral when produced using captured CO2 derived from non-fossil sources.

“This series of vessels will have a transformative impact on our ambition to progress on our industry-leading climate ambitions,” said Maersk CEO Vincent Clerc. “It is a visual and operational proof of our commitment to a more sustainable industry. With Ane Mærsk and her sister vessels we are expanding our offer to the growing number of businesses aiming to reduce emissions from their supply chains.”

The Ane Maersk was named after Ane Mærsk Mc-Kinney Uggla, chairman of parent company AP Moller Holding.

I hope you have enjoyed this weeks read, if you would like further information regarding the set up of a trading account or more investment information, please reach out.

Regards,

Head, Fixed Interest and Superannuation

JMP Securities

a. Level 3, ADF Haus, Musgrave St., Port Moresby NCD Papua New Guinea

p. PO Box 2064, Port Moresby NCD Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814