19 February, 2024

Welcome to this week’s JMP Report,

Last week saw 4 stocks trade on the local market. BSP traded 1,879, closing 3t higher to close at K15.35, KSL traded 27,119, closing 4t higher to close at 2.74 and STO traded 543 shares closing 6t higher finish the week at 19.30 and NGP traded 15,461 closing steady at K0.69.

WEEKLY MARKET REPORT | 12 February, 2024 – 16 February, 2024

| STOCK | QUANTITY | CLOSING PRICE | BID | OFFER | CHANGE | % CHANGE | 2022 FINAL DIV | 2023 INTERIM | YIELD % | EX-DATE | RECORD DATE | PAYMENT DATE | DRP |

| BSP | 1,879 | 15.35 | 15.57 | – | 0.03 | 0.20 | K1.4000 | K0.370 | 13.33 | FRI 22 SEPT 2023 | MON 25 SEPT 2023 | FRI 13 OCT 2023 | NO |

| KSL | 27,119 | 2.74 | 2.74 | 2.87 | 0.04 | 1.46 | K0.1610 | K0.097 | 10.75 | WED 6 SEPT 2023 | THU 7 SEPT 2023 | THU 5 OCT 2023 | NO |

| STO | 534 | 19.30 | 19.30 | – | 0.06 | 0.31 | K0.5310 | K0.314 | 4.42 | MON 28 AUG 2023 | TUE 29 AUG 2023 | THU 28 SEPT 2023 | – |

| NEM | – | 145.00 | 145.00 | – | – | 0.00 | – | K0.12 | 13.33 | TUE 19 SEP 2023 | WED 20 SEP 2023 | THU 19 SEP 2023 | YES |

| KAM | – | 1.00 | 1.00 | – | – | 0.00 | K0.5310 | K0.314 | 4.42 | MON 28 AUG 2023 | TUE 29 AUG 2023 | THU 28 SEPT 2023 | – |

| NGP | – | 0.69 | – | 0.69 | – | 0.00 | – | K0.0.3 | 5.80 | FRI 6 OCT 2023 | WED 11 OCT 2023 | WED 1 NOV 2023 | – |

| CCP | – | 2.01 | 2.05 | – | – | 0.00 | K0.123 | K0.110 | 11.51 | FRI 24 MAR 2023 | WED 29 MAR 2023 | FRI 5 MAY 2023 | YES |

| CPL | – | – | – | – | – | – | – | – |

– |

WED 22 MAR 2023 | THU 30 MAR 2023 | THU 30 JUL 2023 | – |

| SST | – | 35.46 | – | 40.00 | – | 0.00 | K0.70 | K0.35 | 2.96 | FRI 29 SEP 2023 | MON 2 OCT 2023 | TUE 31 OCT 2023 | NO |

Dual Listed PNGX/ASX

BFL 7.01 – +30c

KSL – 87c -1c

NEM – 50.51 – 80c

STO – 7.37 +3c

Interest Rates

On the interest rate front, we saw the 7day Central Bank Bills offered at 2% which has been reduced from 2.5% over the last two weeks. We saw approximately 2.4bn in liquidity removed from the market which remains flat from the previous week. In the TBill market we saw a further drop in the rates with 364 day bills averaging 3.22% with the bank accepting 353mill after offering 313mill. The results left the market 293mill oversubscribed. No announcements regarding the commencement of the 2024 GIS program.

Other Assets we like to monitor

Gold – 2013

Silver – 23.41

Platinum – 909

Natural Gas – 1.60

Bitcoin – 52,321 +8.5%

Ethereum – 2,893 +15.45%

What we’ve been reading this week

What we have been reading

Recession risks, rates and inflation, valuations, geopolitics, the US election and Swiftonomics

Dr Shane Oliver – Head of Investment Strategy and Economics and Chief Economist, AMP Investments

Key points

– Rate hikes have worked in helping slow inflation and rate cuts are likely this year. Expect a bumpy ride though.

– The risk of recession remains high at around 40% in the US and Australia.

– Geopolitical risk including around the US election remains high but it’s often easy to get gloomy regarding geopolitics.

– Share valuations are a bit stretched pointing to the risk of more volatile and constrained returns, but shares should ultimately be okay as interest rates come down.

Introduction

Last year shares climbed a “wall of worry” as inflation fell leading to prospects for lower interest rates ahead. But can it continue? After participating in a webinar on the investment outlook this note takes a look at the main questions investors have in a simple Q&A format.

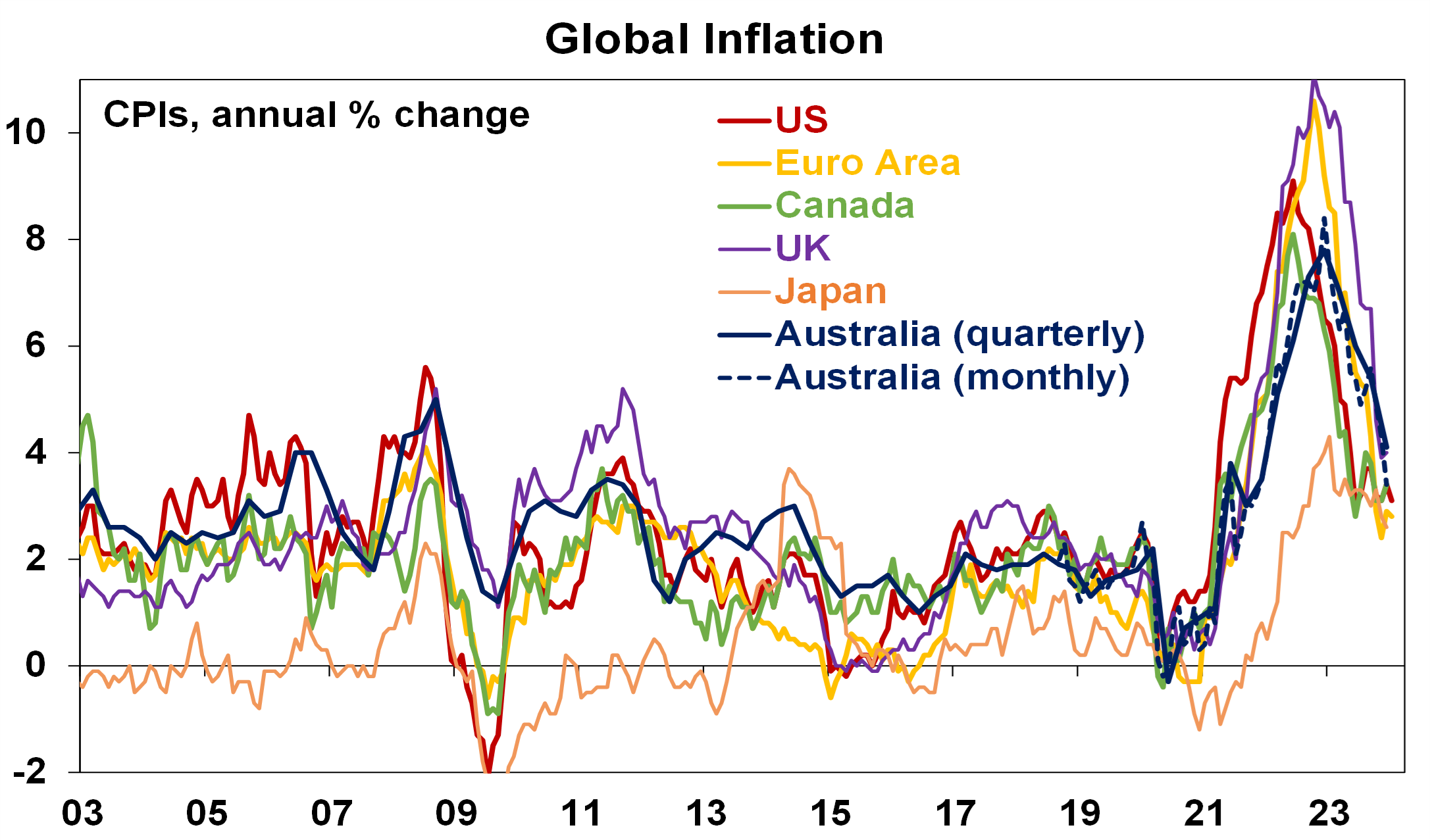

Are high interest rates working to cut inflation?

The evidence of this is overwhelming. Inflation has fallen from highs around 8 to 11% in major developed countries, including Australia, to now around 3-4%. This reflects a combination of the improved supply of goods and services as well as cooler demand (evident in cooling economic growth and slower labour markets) and higher interest rates have been a key driver. There has further to go and it will be bumpy as we saw with the January US CPI, but central banks are likely to start cutting interest rates in the June quarter with the Fed and ECB expected to cut 5 times this year (by 0.25% each time) and the RBA 3 times.

Source: Bloomberg, AMP

But aren’t high rates unfair? Isn’t there a better way?

Relying on higher interest rates is not the only or fairest way to slow inflation because it particularly hits 25 to 45 year olds with big mortgages. Ideally the medicine should also involve a mix of tighter fiscal policy (tax hikes and public spending cuts) and structural policies to boost productivity and hence the supply of goods and services. But it’s clear governments don’t want to tighten fiscal policy because it’s not politically popular (if anything they want to provide “cost of living relief”) and supply side policies take time to work and aren’t popular these days either. So after the experience of high inflation in the 1970s, it was concluded that central banks are best placed to control inflation and they really only have one main tool – i.e. higher interest rates.

What is the risk of recession?

Global and Australian growth has held up far better than expected a year ago helped by a combination of savings buffers built up through the pandemic, reopening boosts, resilient labour markets and in Australia far stronger than expected population growth (which has masked a per capita recession). Consequently, while global and Australian growth has slowed it has remained positive. Our base case is for a further softening in growth but for it to remain positive ahead of lower interest rates providing a boost from later this year.

However, the risk of recession remains high after what has been the biggest rate hiking cycle since the 1980s and this being reflected in inverted yield curves (short term rates above long term bond yields), falling leading economic indicators and tighter bank lending standards all of which warn of the high risk of recession particularly as some of last year’s supports like saving buffers, reopening demand and very strong population growth in Australia start to fade. So we put the risk of recession at 40% in Australia and the US. Europe is already close to recession having been stagnant GDP over the last year. China is also a risk – see below. Fortunately, if a recession does occur it’s likely to be mild as most countries have not seen a boom in consumer spending, business investment or housing investment that needs to be unwound.

Will Taylor Swift shake off Aussie consumer gloom?

For the next two and half weeks it will certainly help for the roughly 630,000 concert goers and the retailers, hotels, and food outlets that will get some extra spending. If each attendee spends a total of $900 on average (which sounds generous) it will mean spending of $570m which is a lot of money. But it won’t take us out of the woods because Taylor is an import and so maybe only $400m of that will stay in the country. And $400m is just 0.02% of our economy. And as Governor Bullock implied it will likely come at the expense of other things. So maybe a two-week blip and then back to where we were. In other words, if you are all excited about Swiftonomics you need to calm down. That said I am excited about finally getting a ticket…even if it is one of the partially obscured seats.

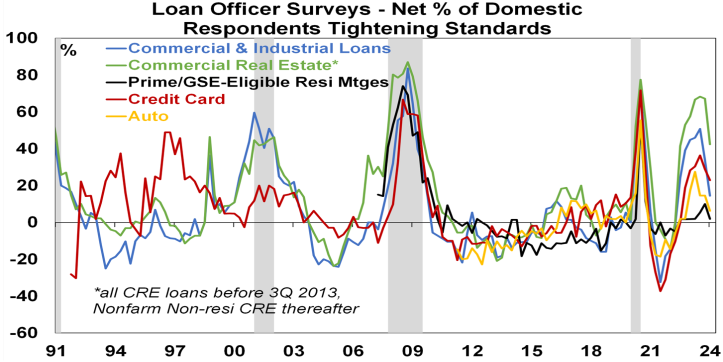

What happened to US bank problems?

Quick action by US and Swiss authorities settled the banking problems seen last year and the tightening in lending standards associated with it has eased. In the US, the Fed’s December quarter bank lending survey showed less tightening in lending standards and loan demand becoming less negative, which suggests an easing in regional banking problems. But with monetary policy still tight and ongoing falls in commercial property values the problems could return – as seen with New York Community Bank and Japan’s Aozora Bank recently. So, it’s worth watching.

Source: Bloomberg, AMP

What about China and Evergrande’s liquidation?

China faces three big challenges: a falling population; trying to get consumer spending to take over as a key growth driver from capital investment and the property sector; and political tensions with the West. Taken together they imply a slowdown in China’s long term growth rate.

In the near term the property slump continues. But a Hong Kong court ordering the liquidation of property developer Evergrande is not going to trigger a Lehman moment that will turn China’s property downturn into a global crisis. First, it’s not a big surprise. Second, it’s doubtful that PRC courts will allow liquidators to sell Evergrande assets in China in a fire sale given the Chinese Government’s focus on protecting home buyers and completing more homes. Finally, the Chinese Government will continue offset any impact from the property downturn and Evergrande’s woes on the economy with property and economy wide stimulus measures.

Overall, we see Chinese growth as being constrained with downside risks – but it’s likely to be around 4.7% this year with the Government providing just enough stimulus. It’s hard to have a strong view on Chinese shares but their bear market may be nearing an end. After having nearly halved since October 2021 they are now undervalued (with a forward PE below 10x), oversold & underloved and due at least a further bounce.

How big a threat are geopolitical risks?

Geopolitical risk is high this year: with half the world’s population seeing elections; the US looking like another divisive Biden v Trump election on the way; tensions with China remaining high; the war in Ukraine continuing; and an ongoing escalation in the Israel/Hamas war to include other countries in the region including Houthi rebels disrupting Red Sea shipping with a risk that further escalation could threaten global oil supplies. Trying to quantify what these mean for the global economy and investment markets is impossible – as we saw last year geopolitical risks turned out to be less threatening. But odds are that they will contribute to a more constrained and volatile ride in investment market this year.

What about the US election?

A Trump victory could lead to considerable global uncertainty given his style of governing and trade policies but this may not be immediately apparent because the US election has a long way to go yet and both Biden and Trump could drop out, US presidential election years historically see average share market returns and after the 2016 Trump victory shares rallied with 2017 being a strong year because of Trump’s pro-business policies (the trade war didn’t start till 2018).

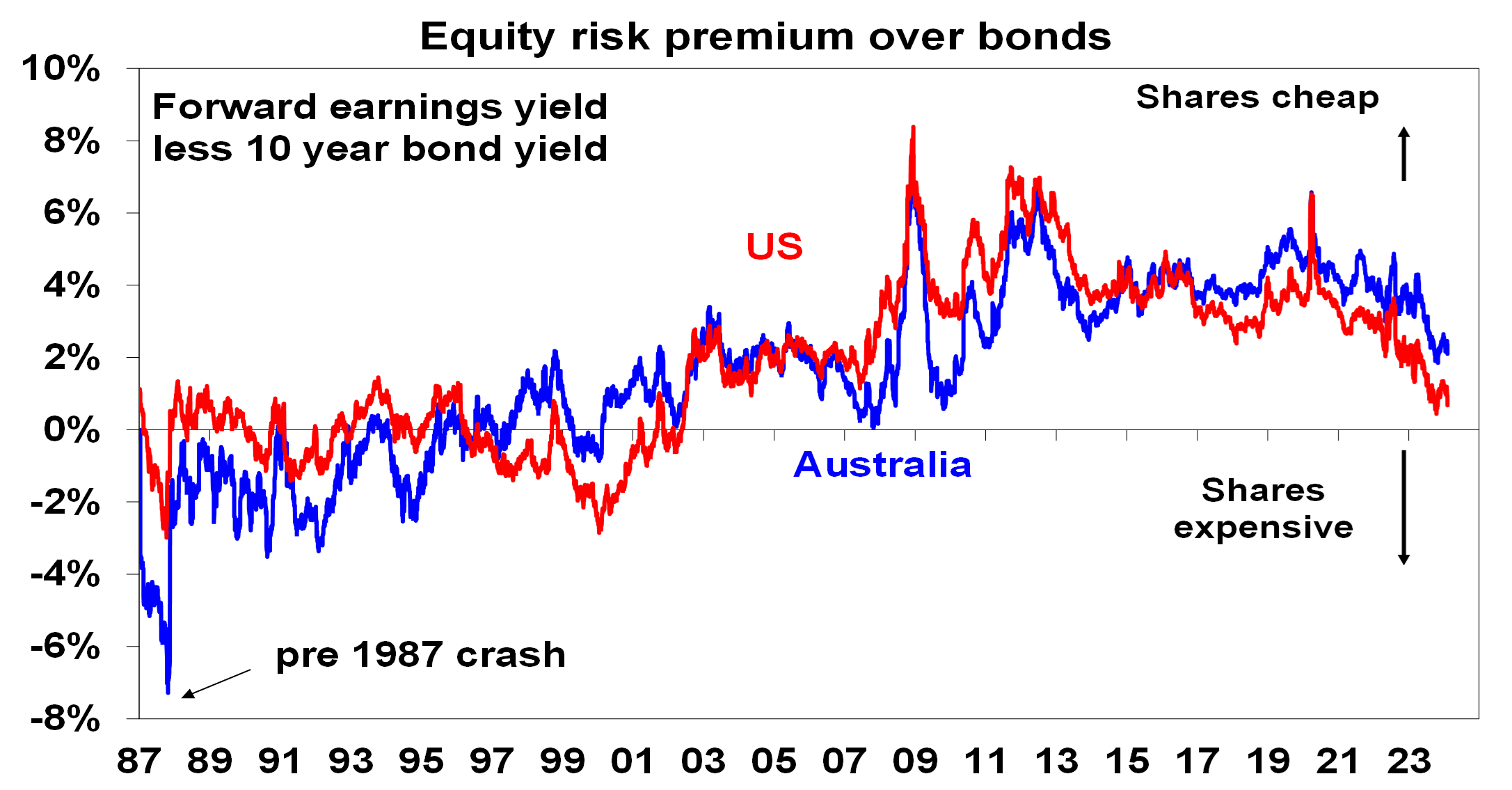

What about share valuations?

Shares are not cheap with above average forward PE’s and a lower risk premium on offer over bonds than seen over the last decade – which leaves shares a bit vulnerable given the high level of economic and geopolitical risks which will likely contribute to volatility. However, the risk premium is a bit higher than it was last October thanks to lower bond yields and shares should be okay providing central banks cut interest rates this year and the profit outlook improves.

Source: Bloomberg, AMP

What will happen to bond yields if interest rates fall?

If as we expect economic growth slows, inflation falls further and central banks cut interest rates then bond yields are likely to fall a bit this year. Of course if there is a recession, central banks are likely to cut interest rates more than we are allowing and bond yields will likely fall a lot pushing up bond values and see bonds be a good portfolio diversifier.

Will high levels of global debt de-rail things?

Global debt is now estimated to be around $US310trn or 340% of global GDP. This clearly poses a threat if bond yields resume rising which will be a big problem in emerging countries with $US debt but will also ramp up pressure for fiscal austerity in rich countries as debt interest payments rise. However, much of the rise in debt since the pandemic has been in the public sector where the risk of major problems is less (as governments can raise taxes), and most advanced country governments borrow in their own currency heading off foreign exchange crises.

How close is America to breaking?

It’s easy to look at the political polarisation, inequality and rising public debt in the US and get depressed. Then again people have long been looking at the US and getting depressed, but it seems to keep on keeping on. It has a very dynamic economy, its productivity growth is impressive, it continues to have world beating tech companies, its growth rate has been surprising on the upside, and it still has very low unemployment.

Why are rich countries running high immigration?

Part of this is a catch up after low immigration in the pandemic but it has been a bit out of control and does run the risk of a political backlash as it accentuates already expensive housing.

When will the $A get back to $US0.80-$US1?

We see upside in the $A to $US0.72 as the Fed cuts rates more than the RBA, commodity prices remain in a long-term upswing and the $US falls on hopefully reducing global uncertainty. However, a move much beyond that looks unlikely given slowing growth in China and geopolitical risks.

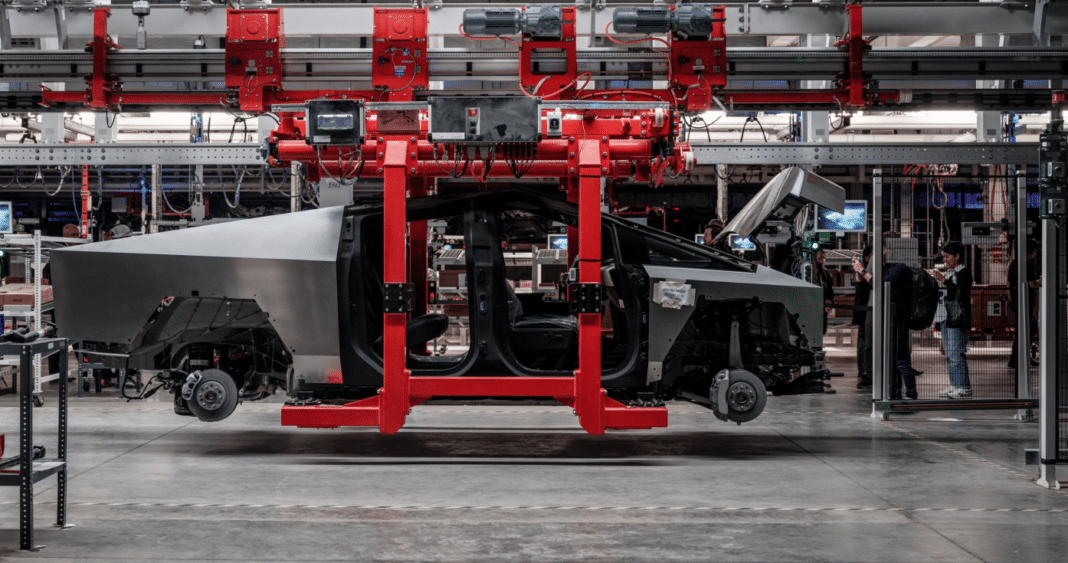

Tesla Hits Record High Sales from Carbon Credits at $1.79B

By Jennifer L

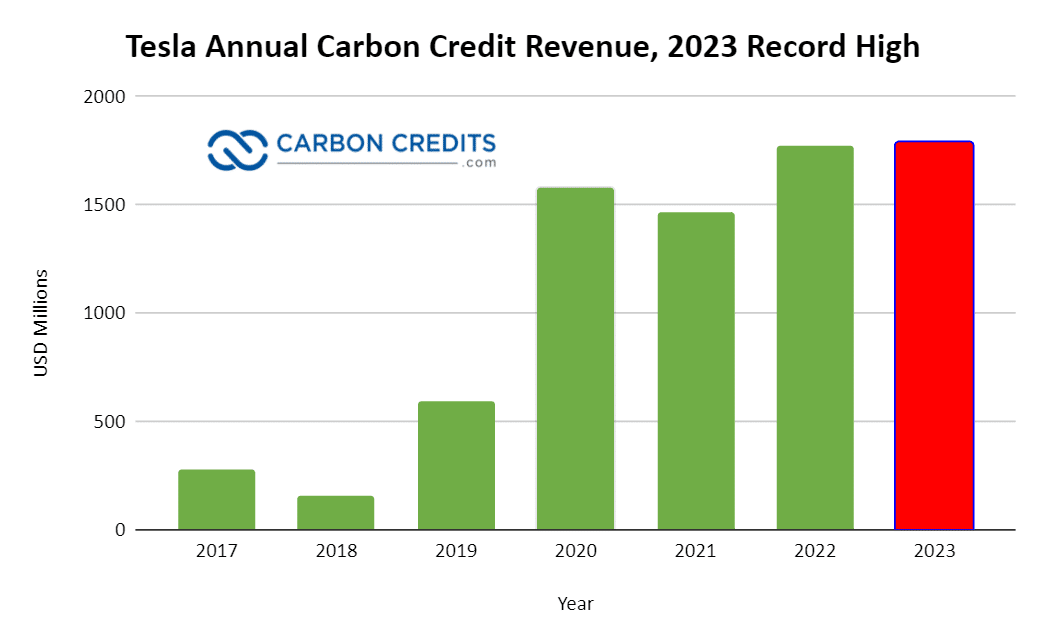

Elon Musk’s Tesla generated a substantial $1.79 billion from carbon credit sales last year, as revealed in their Q4 2023 and annual financial report, bringing its total earnings from such credits since 2009 to nearly $9 billion.

This revenue comes from trading regulatory credits to other automakers unable to meet emission regulations in the US, Europe, and China.

Carbon Credit Cashflow: Tesla’s Billion-Dollar Bonanza

Tesla continues to profit from the need of its rivals to meet emissions standards. It is a lucrative business that was initially expected to diminish. Since the EV giant incurs minimal additional costs to earn these credits, the sales represent almost pure profit.

This revenue stream has been crucial for Tesla, although the specific recipients of the credits remain undisclosed.

In its recent fourth quarter and annual 2023 filings, the EV maker reported a $433 million income from the sale of carbon credits. That figure represents a 7% decrease year over year (YoY) compared to $467 million earned in Q4 2023.

But the total annual revenue of Tesla from selling carbon credits in 2023 increased to $1.79 billion from $1.78 billion. Yet, that enabled the automaker to reach another record high in 2023.

This sustained revenue may have surprised Tesla, given previous expectations that regulatory credit income would fall as competitors increased EV production.

In 2020, the company’s former CFO Zachary Kirkhorn cautioned investors about relying too heavily on this revenue stream. He forecasted a decline in its significance over time.

However, contrary to expectations, Tesla’s earnings from regulatory carbon credits have not decreased significantly, as last year’s earnings slightly surpassed the previous year’s income.

- RELATED: Tesla Carbon Credit Sales Reach Record $1.78 Billion in 2022

Tesla is Driving the Carbon Market Forward

By providing its peers a mechanism to offset their carbon emissions, Tesla plays a significant role in the carbon credit market.

As the automotive sector seeks to comply with emissions standards set by regulatory bodies, they can purchase carbon credits from Tesla. They can also do the same from other companies that reduce greenhouse gas emissions through renewable energy and other carbon reduction or removal initiatives.

The revenue generated from the sale of carbon credits has become a substantial source of income for the company. In fact, the credits account for a staggering 11% of Tesla’s overall gross margin for the quarter, $4,065 million, down from 25.9% seen in Q4 2022.

Tesla’s total automotive revenues of $21,563 million were up 1% YoY but missed analysts’ estimate of $22,385 million.

Still, the growing carbon credit sales underscores the value of the EV maker’s clean energy initiatives. This is also evidenced by another growing business of the company, energy generation and storage. Its Q4 2023 revenues totaled more than $1.4 million, up from the year-ago earning of $1.3 million.

Given the global focus on reducing carbon emissions and addressing climate change, the demand for carbon credits is expected to increase in the future.

Tesla’s position as a leader in the electric vehicle market and its commitment to sustainable energy place it in a favorable position to continue profiting from the sale of carbon credits in the years to come.

- RELATED: Tesla’s Record Carbon Credit Sales Up 94% Year-Over-Year

Gearing Up Amid Shifting Automotive Landscape

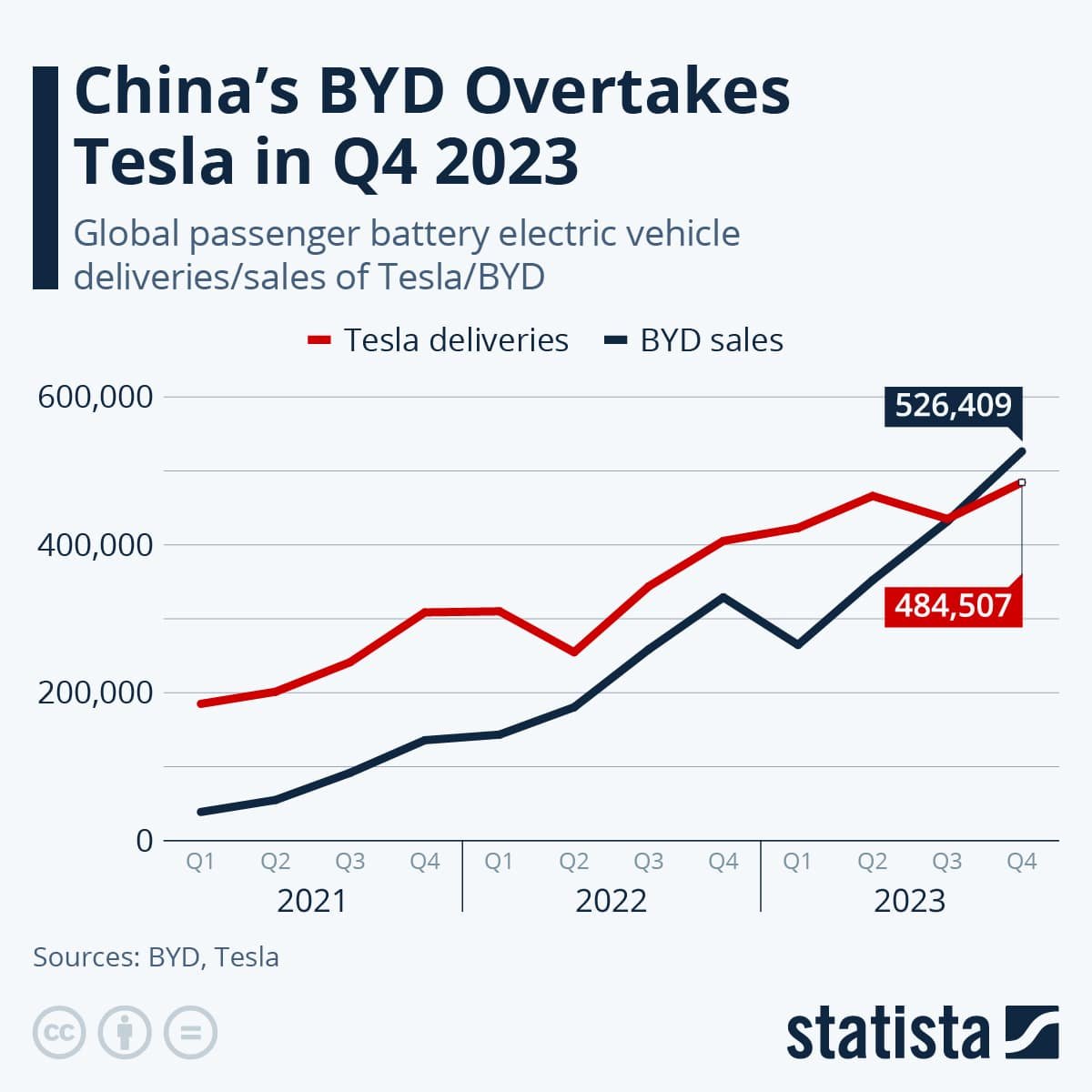

Despite its continued dominance in the U.S. EV market, Tesla faces growing competition, particularly from China’s BYD. The Chinese automaker recently surpassed Tesla as the world’s largest seller of EVs.

BYD’s vehicle production was up substantially last year, almost 2x as high as in 2022, at 3.02 million units. However, around 1.4 million of these vehicles were hybrids, while Tesla produced around 1.84 million all-electric vehicles.

Moreover, some of Tesla’s competitors are scaling back their EV investment plans, with Ford delaying $12 billion in investments. On the other hand, General Motors is reintroducing hybrids to its lineup.

As emissions regulations tighten, the regulatory landscape becomes increasingly challenging.

Europe is imposing stricter car emissions targets starting next year, with even more stringent standards set for 2030 and beyond. The EU sets a 100% emission reduction goal for both cars and vans from 2035 onwards.

Similarly, the United Kingdom has implemented a zero-emission vehicle mandate beginning this year.

At home in the U.S., the government committed $623 million in grants to propel the growth of EVs. The financing was made available through the 2021 Bipartisan Infrastructure Law. The funding aims to make EV chargers more reliable and accessible for American drivers.

Tesla’s lucrative carbon credit sales continue to defy expectations, bolstering its financial performance and solidifying its role in sustainable transportation. And despite growing competition and tightening emissions regulations, Tesla’s position in the EV sector remains robust, fuelled by its commitment to clean energy initiatives.

Thank you Carbon Credits

Thyssenkrupp Steel has launched its call for tenders to supply hydrogen to its first direct reduction plant in Duisburg

thyssenkrupp Steel has launched its call for tenders to supply hydrogen to its first direct reduction plant in Duisburg. In conjunction with two innovative melters, this is the centerpiece of the first transformation step in thyssenkrupp’s decarbonization process as part of the tkH2Steel project.

The procurement of hydrogen is being conducted through a transparent and extensive tendering process, with the objective of transitioning the direct reduction plant entirely to hydrogen by 2029. The call for tenders is being organized in close coordination with the German Federal Ministry for Economic Affairs and Climate Protection (BMWK), which, together with the state of North Rhine-Westphalia, is funding the innovative plant project and the associated hydrogen ramp-up to the tune of around €2 billion. This will make it possible to cease using natural gas at an early stage, while at the same time firing the starting pistol for the hydrogen ramp-up in Germany.

tkH2Steel decarbonization project

The direct reduction plant, in conjunction with the two downstream melters, will be integrated into Europe’s biggest iron and steel plant as a technologically new plant combination. It will be possible to retain all subsequent process steps from the steel mill onward. The 100% hydrogen-capable direct reduction plant has an annual production capacity of 2.5 million metric tons of directly reduced iron. The first use of hydrogen in the plant combination is planned for 2028, with the ramp-up to full hydrogen operation to be completed in 2029. The use of around 143,000 metric tons of hydrogen (equivalent to 5.6 TWh) will enable up to 3.5 million metric tons of CO₂ to be saved per year. As the largest German hydrogen consumer, thyssenkrupp Steel will thus function as the initiator of and driving force behind a hydrogen economy, paving the way for the decarbonization of the entire steel value chain.

Clear signal to customers, the market and policymakers

The call for tenders for the hydrogen volumes was already published in various German federal government and EU portals in mid-December. The tendering process will be divided into three phases and is aimed at all potential hydrogen suppliers which have production projects for renewable green or CO₂-reduced blue hydrogen with the ability to deliver to Duisburg. All interested suppliers will receive an information pack on the contract award process at the start of the first tendering phase, which begins in February 2024 and will culminate in a timely conclusion of binding supply contracts.

“We are delighted to be taking another significant step forward on our transformation path with this call for tenders,” said Dr Arnd Köfler, Chief Technology Officer at thyssenkrupp Steel. “With the call for tenders, we are sending a clear signal for scaling up the European hydrogen economy and the necessary infrastructure. This step will give our customers greater planning security when purchasing climate-friendly steel produced with hydrogen, and consequently enable them to significantly reduce the carbon footprint of their own production. In doing this, we are making an important contribution toward achieving the climate targets in Germany and Europe.”

I hope you have enjoyed this weeks read, please feel free to reach out if you would like further information.

Regards,

Head, Fixed Interest and Superannuation

JMP Securities

a. Level 3, ADF Haus, Musgrave St., Port Moresby NCD Papua New Guinea

p. PO Box 2064, Port Moresby NCD Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814