27 February, 2024

Welcome to this week’s JMP Report,

On the equity front last week we saw 5 stocks trade on the local market. BSP traded 9,123 closing 69t higher at K16.04, KSL traded 76,105 closing 1t higher at K2.75, STO traded 704 closing 1t higher K19.31, KAM traded 3,858, closing 1t higher at K1.01 and NGP traded steady at K0.69 per share.

WEEKLY MARKET REPORT | 19 February, 2024 – 23 February, 2024

| STOCK | QUANTITY | CLOSING PRICE | BID | OFFER | CHANGE | % CHANGE | 2023 INTERIM | 2023 FINAL DIV | YIELD % | EX-DATE | RECORD DATE | PAYMENT DATE | DRP |

| BSP | 9,123 | 16.04 | 16.03 | – | 0.69 | 4.30 | K0.370 | K1.060 | 8.92 | TUE 27 FEB 2024 | WED 28 FEB 2024 | FRI 22 MAR 2024 | NO |

| KSL | 76,105 | 2.75 | 2.73 | 2.90 | 0.01 | 0.36 | K0.097 | – | – | – | – | – | PA |

| STO | 704 | 19.31 | 19.30 | – | 0.01 | 0.05 | K0.314 | USD 0.175 | 4.91 | MON 26 FEB 2024 | TUE 27 FEB 2024 | TUE 26 MAR 2024 | – |

| NEM | – | 145.00 | 145.00 | – | – | 0.00 | – | USD 0.250 | 0.63 | MON 4 MAR 2024 | TUE 5 MAR 2024 | WED 27 MAR 2024 | – |

| KAM | 3,858 | 1.01 | 1.01 | – | 0.01 | 0.99 | K0.12 | – | – | – | – | – | YES |

| NGP | 8,500 | 0.69 | – | – | – | 0.00 | K0.0.3 | – | – | – | – | – | – |

| CCP | – | 2.01 | 2.05 | – | – | 0.00 | K0.110 | – | – | – | – | – | NO |

| CPL | – | – | – | – | – | – | – |

– | – |

– | – | – | – |

| SST | – | 35.46 | 36.46 | 40.00 | – | 0.00 | K0.35 | – | – | – | – | – | NO |

Please note, KSL are expected to release their 2023 Final Dividend Feb 27.

Dual listed PNGS/ASX Stocks

BFL – 7.25 +26c

KSL – 88c +1c

NEM – 47.50 -3.01

STO – 7.03 -34c

Interest Rates

In the short end we saw 2.04bn 7 day CBB paper issued at 2%. In the TBill market we saw 182 day paper average 1.80% with the bank issuing 60mill, 30m more than on offer. In the 364 day paper, the auction average was again lower at 3.13%, with the market pulling back from the amount on offer, leaving 36.8m undersubscribed.

The Bank of PNG did come to the market late on Friday and advised there will be a GIS auction this week. There are 6 stocks on offer ranging from 5yr to 10yr totalling 850m. This is the first auction for the 2024 Program.

In the Term Deposit Market, Credit Corp and Fincorp lead the 12 mth rate at 2.35%

Other Assets we monitor

Gold – 2031

Silver – 22.52

Platinum – 879.50

Natural Gas – 1.63

Bitcoin – 54,674 +5.06%

Ethereum 3181+6.87

PAX Gold – 2005 +.51%

What we’ve been reading this week

What we have been reading

The global economy in 2024 – Econosights

Diana Mousina, Deputy Chief Economist, AMP

Key points

– We expect global growth to be ~2.5% in 2024, below the long-run average of ~3% and lower than the IMF’s forecast.

– A global recession is unlikely. However, given that most major central banks have been raising interest rates, the risk of over-tightening is high, reflected in recent poor GDP growth in countries across Europe and Japan.

How is global growth tracking?

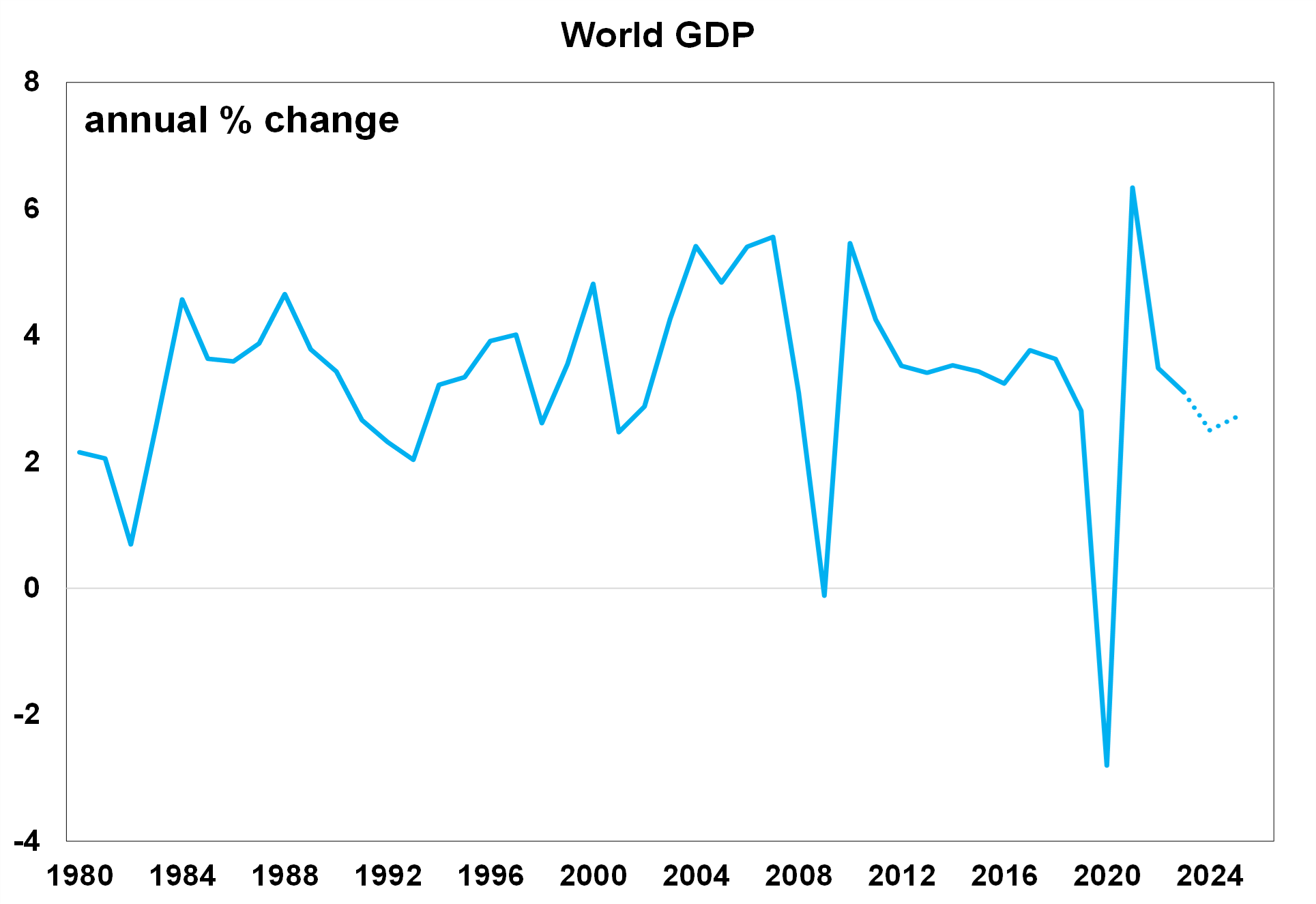

Global economic growth, as measured by GDP tends to average at 3% over the long run. This year we see global growth running at a sub-average 2.5% (see the chart below) after 3.1% in 2023. Institutions like the IMF are more optimistic, estimating 3.1% for 2024 and 3.2% for 2025.

Source: IMF, AMP

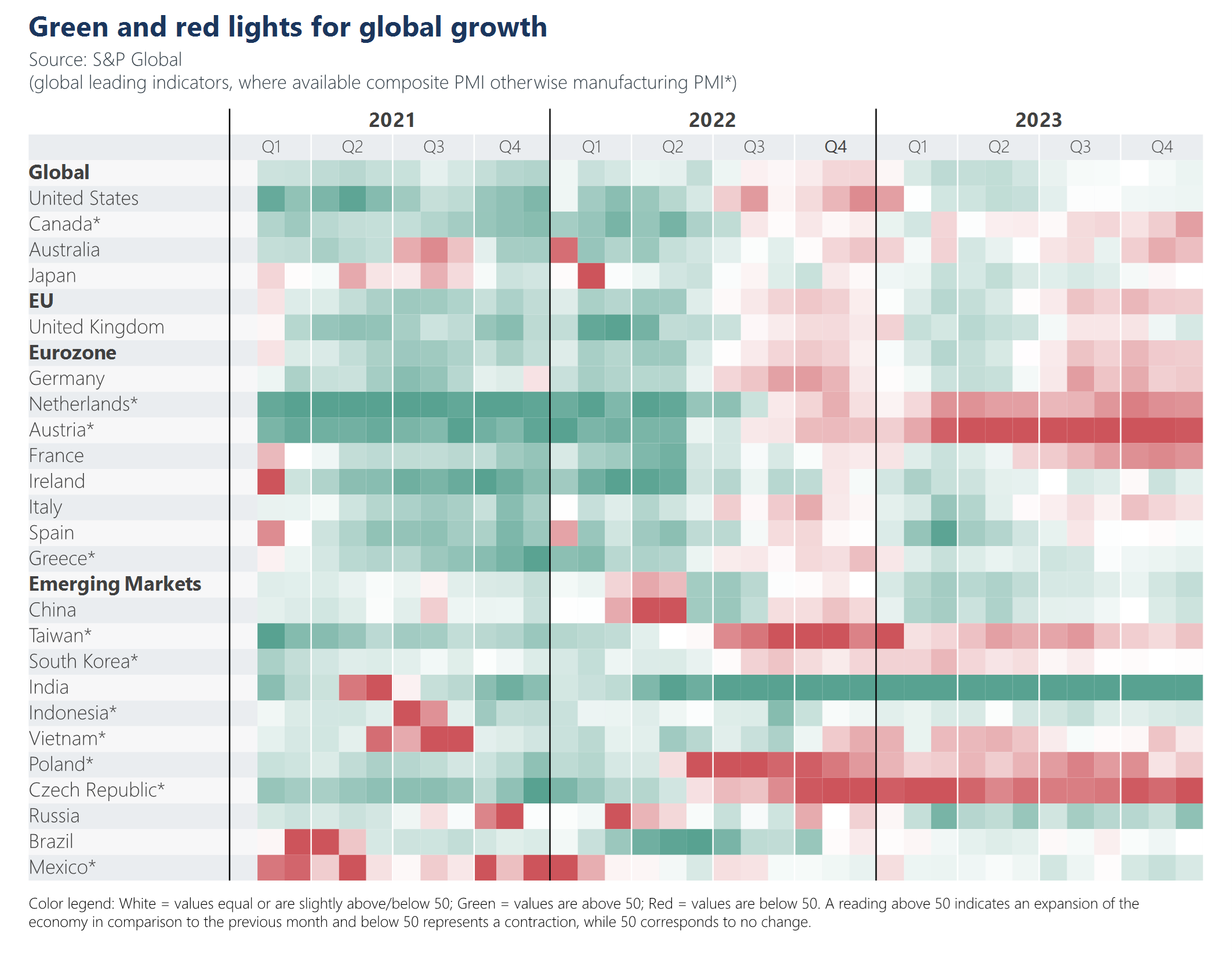

The “heatmap” below shows the evolution of economic growth across the largest economies in the world. GDP growth in 2023 was weaker compared to 2021, particularly in Europe and parts of the emerging world.

Source: Macrobond, AMP

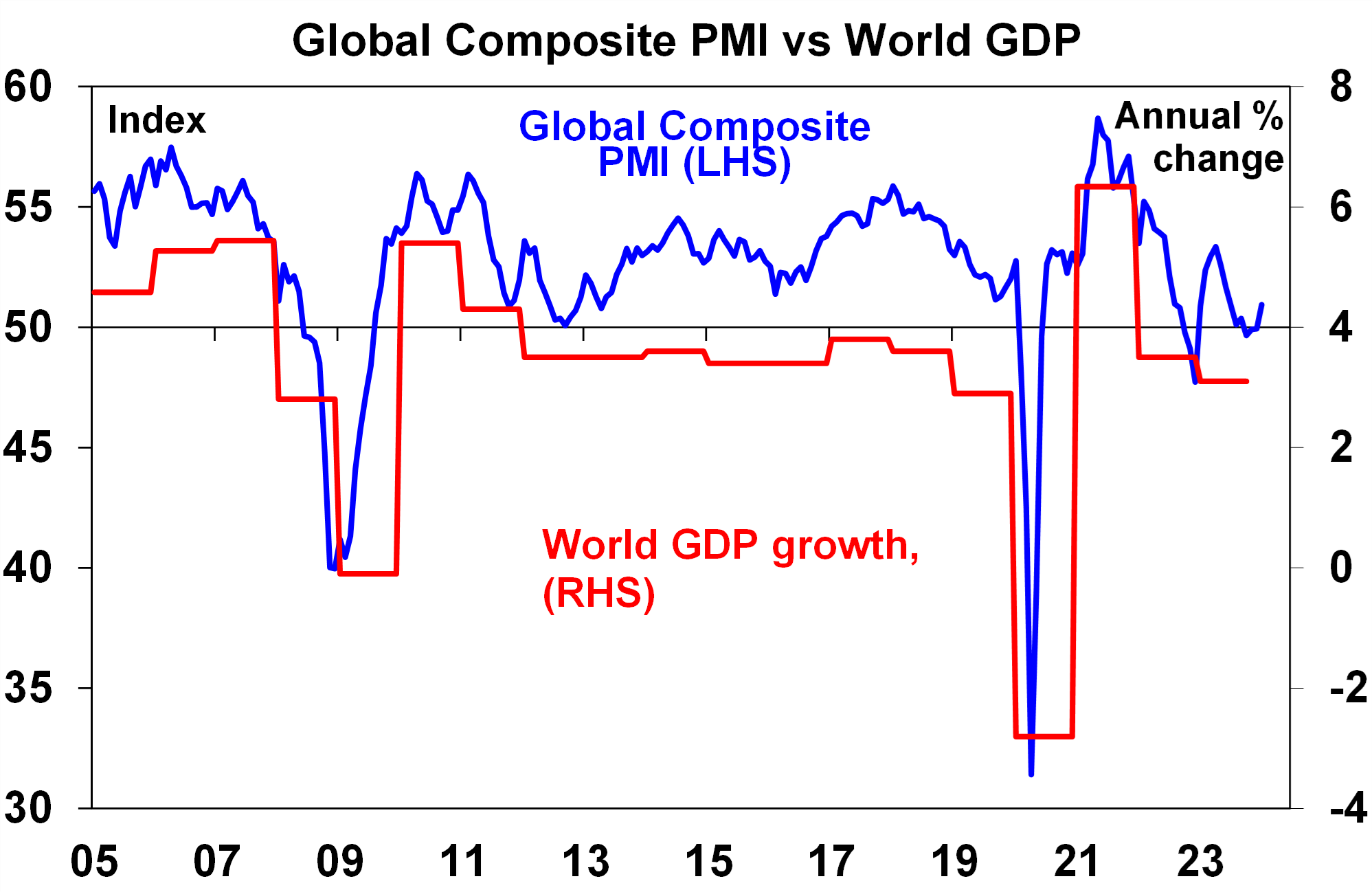

We often reference the Purchasing Managers Indices (or PMIs) as leading indicators of growth across manufacturing and services firms. The composite PMI (with is a weighted average of manufacturing and service conditions) has been trending up again since late 2023 (see the chart below), with better conditions for both manufacturing and service firms, a positive sign for global growth and not in line with a global growth downturn.

Source: Bloomberg, AMP

Will the US remain recession-proof?

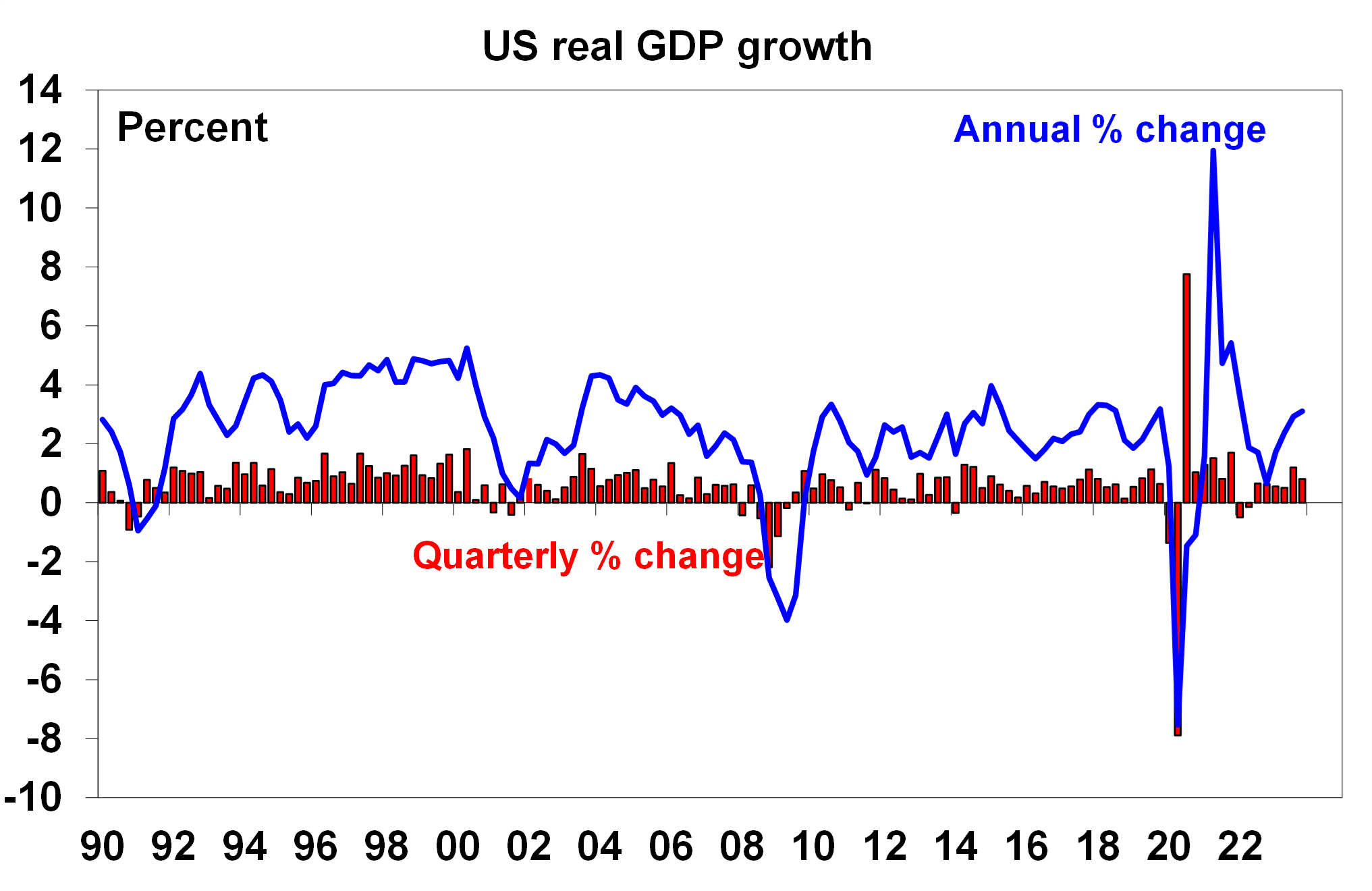

The strength in the US economy is often a barometer for the rest of the world through the demand channel, being the largest economy in the world, and the financial market channel, with many major equity, currency and fixed income markets taking their lead from US markets. The strength in the US economy in 2023 despite the tightening to interest rates since early 2022 was surprising. GDP growth in the December quarter of 2023 was at 3.3% annualised and current expectations for the March quarter this year is tracking at 3.4%. Consumer spending has been the strongest component of growth, with positive contributions from government spending and private business investment while net exports and inventories have detracted from growth.

Source: Bloomberg, AMP

Despite this strength, there is still a moderate chance of a US recession in 2024, according to some leading indicators like the inverted yield curve, ISM new orders, some measures of consumer confidence and lending standards. The labour market is weakening, with job advertisements falling and the unemployment rate ticking up (although it is still low compared to history). Inflation has dropped to 3.1% year on year, and we think it will be at 2.5% by December, as wages growth moderates and helps to reduce services inflation which should allow the US Federal Reserve to cut interest rates by mid-2024. We expect GDP growth to slow to 1.4% over the year to December, well below 2023 levels, but not quite consistent with a recession, which is positive for US earnings growth and the sharemarket.

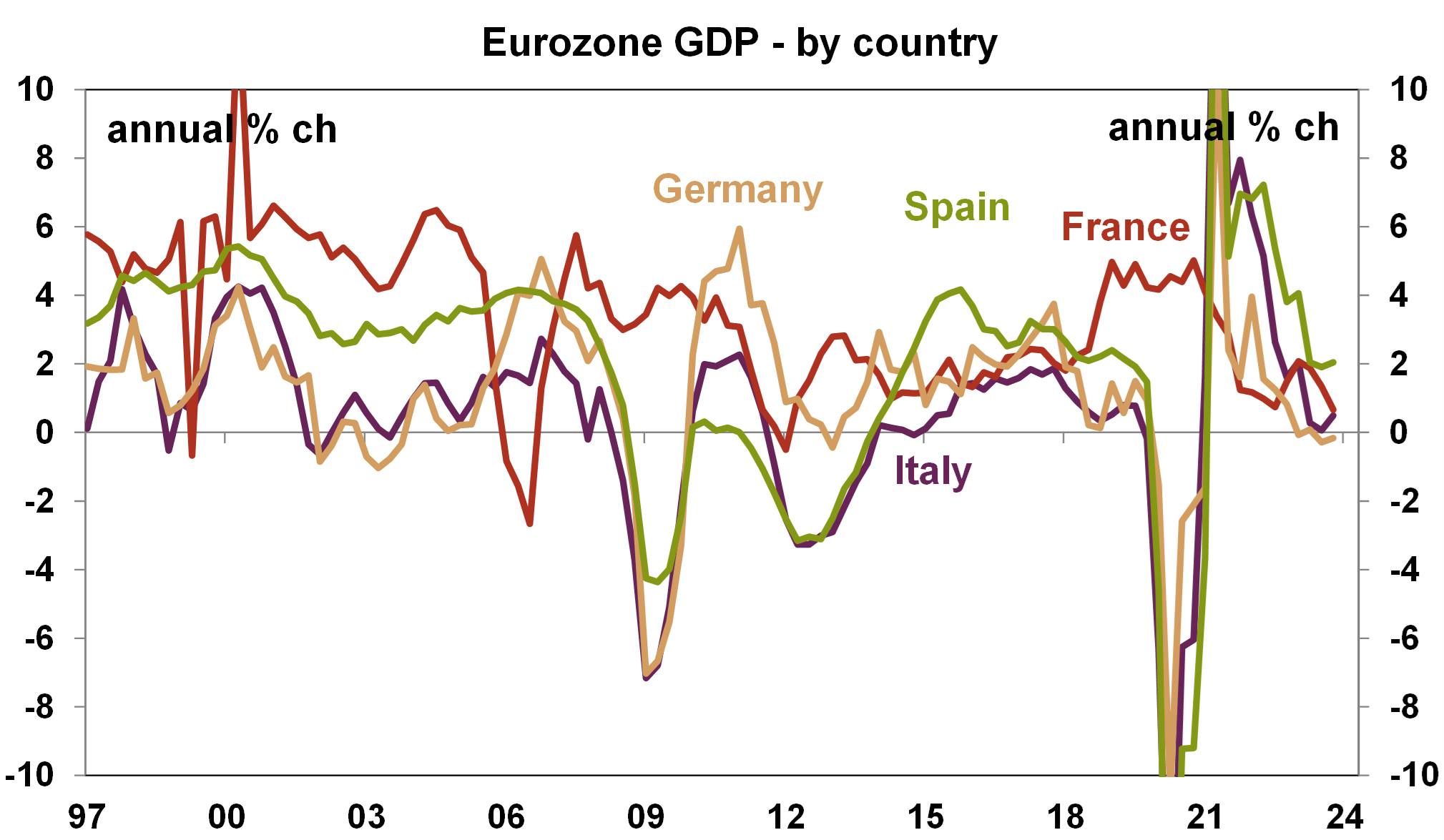

Eurozone economy to struggle without rate cuts

Eurozone GDP growth has barely increased over the past year, with GDP growth ending 2023 at just 0.1% over the year. Weakness is evident across Germany, France and Italy, while Spain is still holding up (see the chart below). Eurozone growth has suffered from the slowing in global manufacturing and lower Chinese imports which has weighed on Eurozone net exports. Inflation has dropped down to 2.8% over the year to January (according to the headline CPI), down from its cyclical high of 10.6% in October 2022. We think the poor growth environment and progress in inflation will see the European Central Bank start to cut interest rates around mid-year, or slightly earlier. An improvement in global manufacturing conditions in 2024 (according to the PMI) and rate cuts should see Eurozone growth at 0.9% in 2024, an improvement from last year.

Source: Reuters, AMP

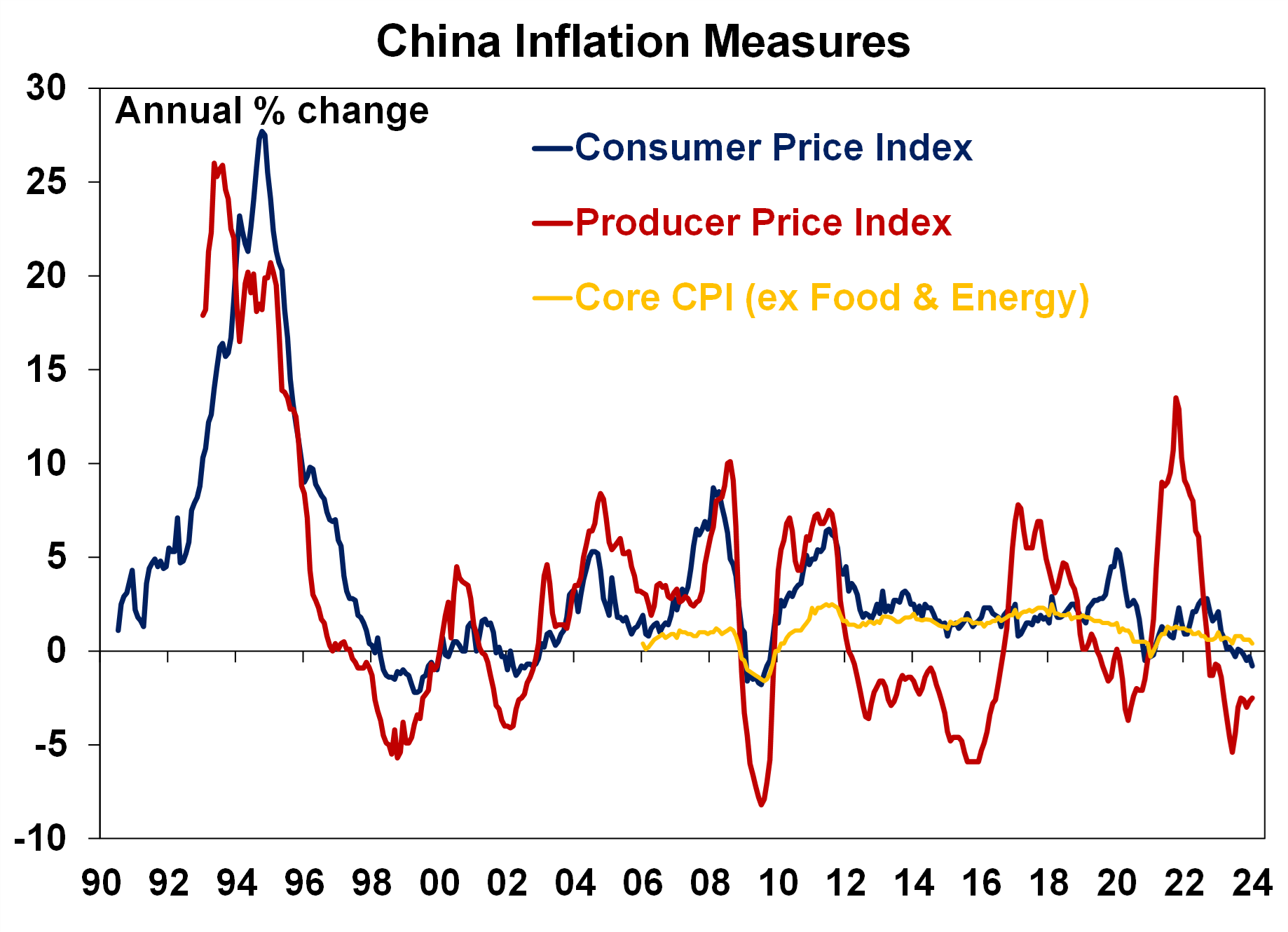

China needs more stimulus… but it may not get it

The Chinese economy is facing numerous concurrent growth headwinds. The lengthy COVID-19 lockdowns had a big negative impact on consumer spending (particularly for services) which is yet to fully recover, the property market is dealing with excess housing stock, overinvestment and problems with developers, an aging population has reduced workforce productivity and participation and Chinese shares are down more than 40% since their 2021 highs which is negative for consumer confidence as many Chinese people use the sharemarket as an investment (in the absence of a pension scheme). Reflecting soft growth conditions, China’s consumer prices are in deflation at -0.8% over the year to January (see the chart below) which weighs on corporate earnings, household wages and depresses sentiment.

Source: Bloomberg, AMP

Policymakers have focused stimulus measures on reducing borrowing costs, increasing corporate bond issuance and targeted infrastructure programs. But, without further monetary and fiscal easing (particularly for households to increase confidence and encourage spending rather than saving), Chinese growth will remain subdued. We expect GDP growth of around 4.6% in 2024 and 3% next decade. This is a much lower rate than the world has been used to given that China was growing at ~10% between 2006-10, although given the Chinese economy is now more than twice the size it was back then, there is still a positive and sizeable contribution to global growth and demand for commodities (which is important for Australia).

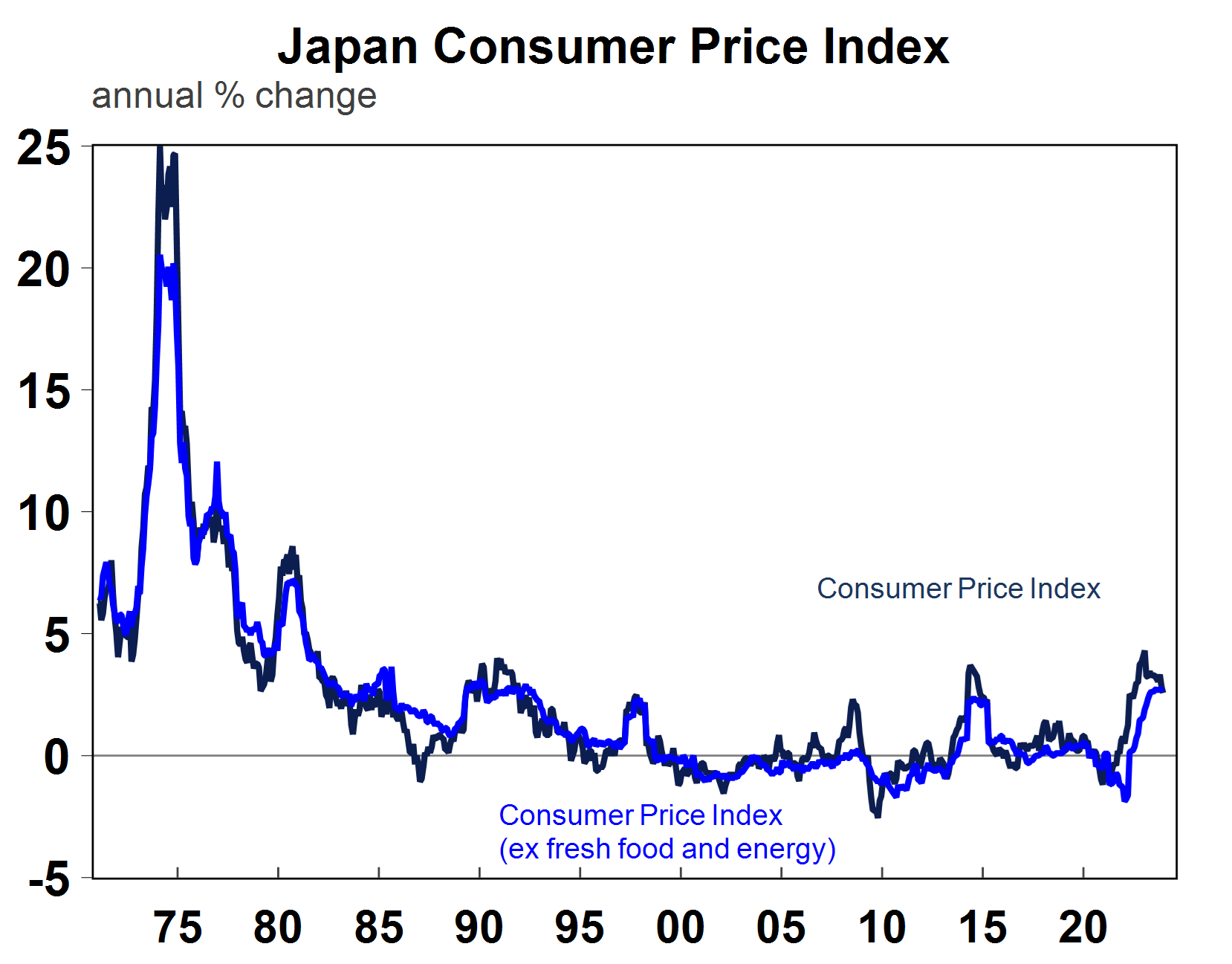

When will Japan start to tighten monetary policy?

The Bank of Japan is the last major central bank that has not tightened monetary policy in the post-COVID period. The current policy rate is at 0.1%, and interest rates have ranged between -0.1% to 0.5% since the late 1990s. Low interest rates relative to global peers has seen the Japanese yen depreciate by over 30% since 2022. However, the pressure is building on the Bank of Japan to start tightening monetary policy. The Bank of Japan already loosened its yield curve control target on bond yields and the next step will be to fully remove yield control before eventually increasing interest rates. Headline consumer price inflation is running at 2.6% over the year to December 2023 and 2.8% for core inflation (which excludes food and energy). However, Japan’s historical difficulty in lifting and sustaining inflation and inflation expectations and recent poor GDP growth outcomes (which have seen GDP growth fall over the September and December quarters in 2023 meaning a technical recession) means the Bank of Japan will tread carefully in hiking rates and only 10-20 basis points of rate hikes likely this year.

Source: Macrobond, AMP

Implications for investors

2024 is likely to be a year of slower GDP growth around the world, but a global recession is unlikely. This is good news for global earnings and sharemarkets, as a result and we expect global equities to have positive returns in 2024 around 7%. A further decline in global inflation will allow numerous global central banks to start cutting interest rates later this year, which will make way for stronger global growth in 2025.

Geopolitics always matter for investors, but in 2024 this could matter more as around 50% of the global population will have an election. Elections cause uncertainty and potentially change which is likely to see additional volatility in share markets. The US Presidential election in November is a major risk event for both the US and the world, especially because of the potential impacts of the election on US fiscal policy (and how that translates to bond yields) and US trade policy (especially as it relates to China). Geopolitical issues often also cause disruptions to commodity prices and global transport costs, which impact inflation. A second-round lift in inflation or persistent elevated inflation is also a risk for the developed economies in 2024 which would delay the start of central bank interest rate cuts.

JPMorgan AM Exits Climate Action 100+

Mark Segal February 15, 2024

- JPMorgan Asset Management (JPMAM) has withdrawn from Climate Action 100+, a climate-focused investor network focused on engaging with companies to reduce their greenhouse gas emissions and implement climate transition plans.

- According to a statement from a JPMAM spokesperson, the firm’s decision follows the development of its internal engagement capabilities, allowing the company to act on its own.

- The spokesperson said:

- “J.P. Morgan Asset Management (JPMAM) is not renewing its membership in Climate Action 100+in recognition of the significant investment it has made in its investment stewardship team and engagement capabilities, as well as the development of its own climate risk engagement framework over the past couple of years.”

- Launched in 2017, Climate Action 100+ is an investor initiative that has targeted the world’s largest corporate greenhouse gas (GHG) emitters to promote taking necessary action on climate change, and align their business strategies with net zero in order to help limit average global temperature rise to 1.5 degrees Celsius. The network has grown to include more than 700 investors representing more than $68 trillion in assets.

- The group, however, has also become a key target for anti-ESG politicians, and fueling claims that its members are “boycotting” energy companies. Last year, a group of U.S. Republican state attorneys general sent a letterto large asset managers warning that participation in groups such as CA100+ raised concerns about the investors’ adherence to fiduciary duties and compliance with anti-trust rules.

- Similarly, Texas cited participation in Climate Action 100+ as part of the criteria used by the state to compile a list of “Financial Companies that Boycott Energy Companies,” which it cited in its placement of a series of asset managers for divestment.

- JPMorgan Asset Management has listed Climate Change as one of its six main investment stewardship priorities, posing the most significant risks and opportunities for its investments, and the firm was involved in over 780 climate-focused engagements in 2022.

- In the statement, the spokesperson said:

- “The firm has built a team of 40 dedicated sustainable investing professionals, including investment stewardship specialists who also leverage one of the largest buy side research teams in the industry.

- “Given these strengths and the evolution of its own stewardship capabilities, JPMAM has determined that it will no longer participate in Climate Action 100+ engagements.”

Australian solar-to-methanol project secures €24m grant — with half coming from Germany

Vast’s Jemalong pilot CSP plant in New South Wales.

Photo: Vast

Plant would be co-located with planned concentrated solar thermal power installation with methanol marketed in Australia

By Rachel Parkes

The German government has granted millions of euros of funding to a 10MW Australian electrolyser project that aims to demonstrate that green hydrogen-derived methanol can be produced from solar power.

The proposed “SM1” green methanol plant in Port Augusta, South Australia has secured a €24.3m ($26.1m) grant, with over half coming from Berlin.

The 10MW project is being developed by Hamburg-based energy company Mabanaft and Australian renewables developer Vast, which specialises in concentrated solar thermal power (CSP) plants.

The duo want to produce 7,500 tonnes of green methanol per year at the demonstration plant, which is slated for operation in 2027 pending a final investment decision.

In total, the German government is providing €12.4m, via a public-private funding vehicle known as Projektträger Jülich, which is part of the Jülich research institute in Germany, while the Australian government is supplying €11.9m.

CSP plants use mirrors and lenses to maximise the energy harvested from the sun and convert it into heat and electricity.

SM1 will be co-located with Vast’s first utility-scale project, the proposed 30MW “VS1” CSP scheme in Port Augusta, which is itself backed by up to A$175m (US$ 114m) in federal Australian government funding.

Groundbreaking on the CSP plant is expected this year, according to Vast’s website.

Green methanol, or e-methanol, is typically made by making hydrogen from renewable power, then combining it with carbon dioxide — biogenic if it is to meet the EU’s standards for green methanol.

The methanol produced at SM1 would be marketed in Australia, Mabanaft told Hydrogen Insight.

“The green methanol…has the potential to be used as a replacement for existing methanol requirements in the chemical sector, as well as a fuel in industrial applications,” a spokesperson said. “There is also strong interest from the shipping industry, where methanol is currently a leading fuel to help that sector decarbonise. The shipping industry is the consortium’s preferred offtake partner given the strong growth expected in this sector.”

If the plant is successful the co-developers say they will consider setting up similar plants in Europe, even though there is not the same abundance of renewable energy in the bloc as there is in Australia.

“This is a significant milestone for Vast and for green fuel production globally,” said Craig Wood, CEO of Vast said. “Solar methanol produced at plants like SM1 has the potential to make a huge difference to the transport sector as it urgently looks at ways to decarbonise its fuels.”

The funding is being delivered as part of the HyGate German-Australian green hydrogen partnership, which has also granted A$14.9m ($9.7m) to Australian start-up Hysata to deploy its high-efficiency electrolysers.

UPDATED: to include further information on where the methanol will be marketed, including quote from Mabanaft

I hope you have enjoyed this week’s report. If you would like to discuss the steps involved in opening an account with JMP or need personal Financial Planning and Superannuation advice, please fee free to reach out.

Regards,

Head, Fixed Interest and Superannuation

JMP Securities

a. Level 3, ADF Haus, Musgrave St., Port Moresby NCD Papua New Guinea

p. PO Box 2064, Port Moresby NCD Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814