4 March, 2024

Welcome to this week’s JMP Report,

On the PNGX last week we had 3 stocks trade. BSP traded 9,305 shares, trading 8t higher to close at 16.12.KSL traded 464,918 shares, closing 15t higher at 2.90 and STO traded 1,671 shares, finishing the week flat at 19.31

WEEKLY MARKET REPORT | 26 February, 2024 – 1 March, 2024

| STOCK | QUANTITY | CLOSING PRICE | BID | OFFER | CHANGE | % CHANGE | 2023 INTERIM | 2023 FINAL DIV | YIELD % | EX-DATE | RECORD DATE | PAYMENT DATE | DRP |

| BSP | 0 | 16.12 | 16.11 | – | 0.08 | 0.50 | K0.370 | K1.060 | 8.92 | TUE 27 FEB 2024 | WED 28 FEB 2024 | FRI 22 MAR 2024 | NO |

| KSL | 0 | 2.90 | 2.73 | – | 0.15 | 5.17 | K0.097 | – | – | – | – | – | PA |

| STO | 0 | 19.31 | 19.30 | – | – | 0.00 | K0.314 | USD 0.175 | 4.91 | MON 26 FEB 2024 | TUE 27 FEB 2024 | TUE 26 MAR 2024 | – |

| NEM | – | 145.00 | 145.00 | – | – | 0.00 | – | USD 0.250 | 0.63 | MON 4 MAR 2024 | TUE 5 MAR 2024 | WED 27 MAR 2024 | – |

| KAM | – | 1.01 | 1.01 | – | – | 0.00 | K0.12 | – | – | – | – | – | YES |

| NGP | – | 0.69 | – | – | – | 0.00 | K0.0.3 | – | – | – | – | – | – |

| CCP | – | 2.01 | 2.05 | – | – | 0.00 | K0.110 | – | – | – | – | – | NO |

| CPL | – | – | – | – | – | 0.00 | – |

– | – |

– | – | – | – |

| SST | – | 35.46 | 36.46 | 40.00 | – | 0.00 | K0.35 | – | – | – | – | – | NO |

Dual listed PNGX/ASX

BFL – 6.34 – 65c

KSL – 91c +3.5c

NEM – 48.40 +1.78

STO – 7.20 -22c

Interest Rates

On the interest rate front, the short end saw less liquidity removed from the financial system than last week with 7day Central Bank Bills offered 1.939bn at 2.0% . Further along the curve we saw the 364 day bill auction average 3.11% which was relatively flat compared to the previous week. The Bank came to the market with 249mill on offer and the market taking up 158m.

The pullback in market demand could be attributed to some sectors of the investment community preferring to go longer in the GIS auction which was also held last week.

GIS Auction Results

The result is a little softer than I expected considering the auction is the first bond supply since September 2023. The auction results showed stronger interest in the 6,8 and 10yr maturities with the results coming in close to coupon rates. Auction details and rates are attached.

Other assets we like to monitor

Gold – 2083 +2.50%

Silver – 23.15 +2.72%

Platinum – 888.50 +0.96%

Natural Gas – 1.84 +11.4

Bitcoin – 63,158 +21%

Ethereum – 3,488 +12%

PAXGold – 2038 +1%

What we’ve been reading this week

What Leaders Are Saying About Costs and Growth in 2024

Boston Consulting Group Feb 2024

After spending last year on edge over inflation, market conditions, and the possibility of a recession, corporate leaders feel cautiously optimistic about 2024.

At the same time, C-suite executives are making cost managementa top priority to address lingering economic, financial, and geopolitical concerns.

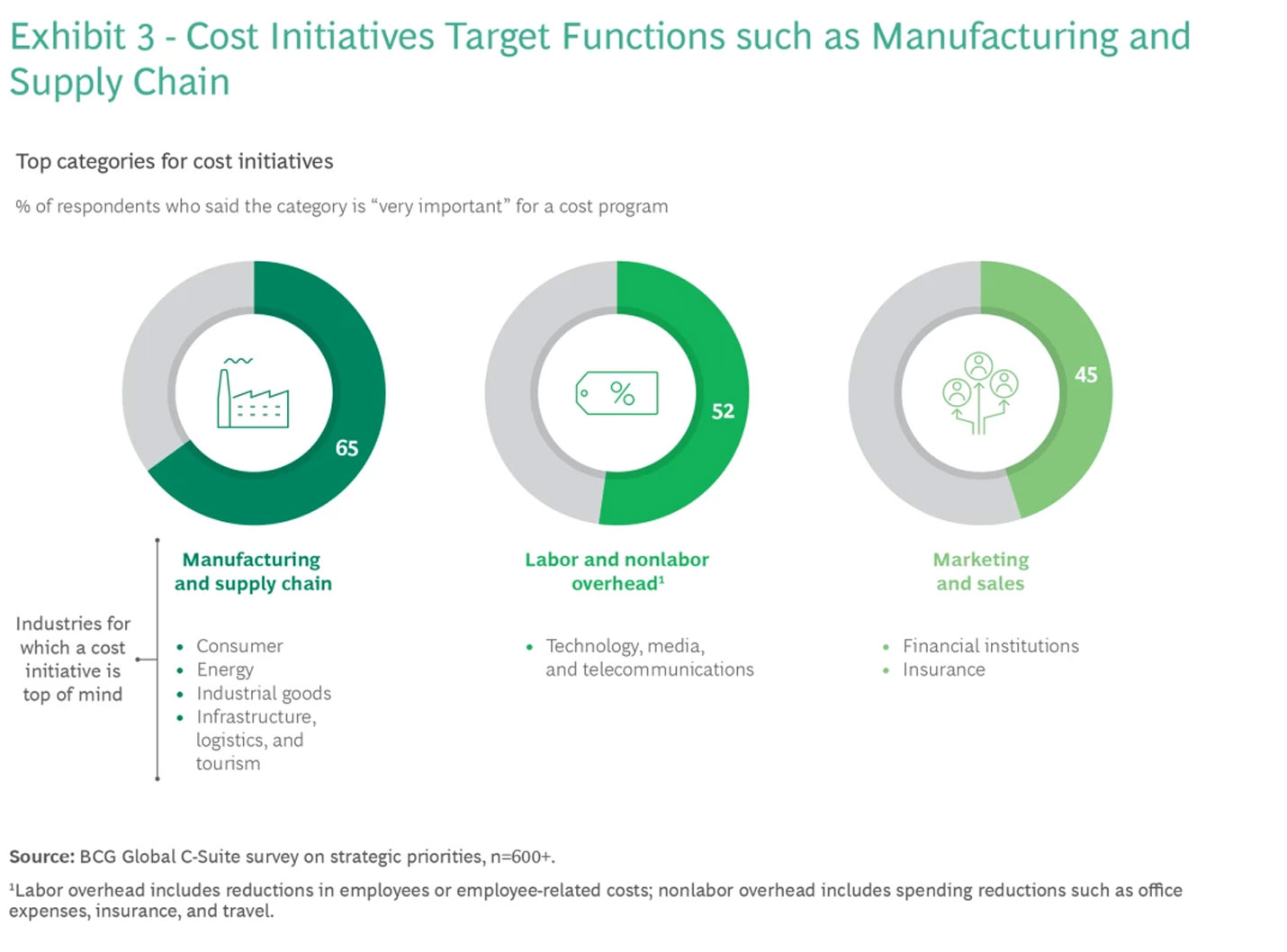

According to new BCG research, executives are initiating enterprise-wide cost campaigns, targeting such functions as manufacturing, supply chain, labor, and marketing and sales.

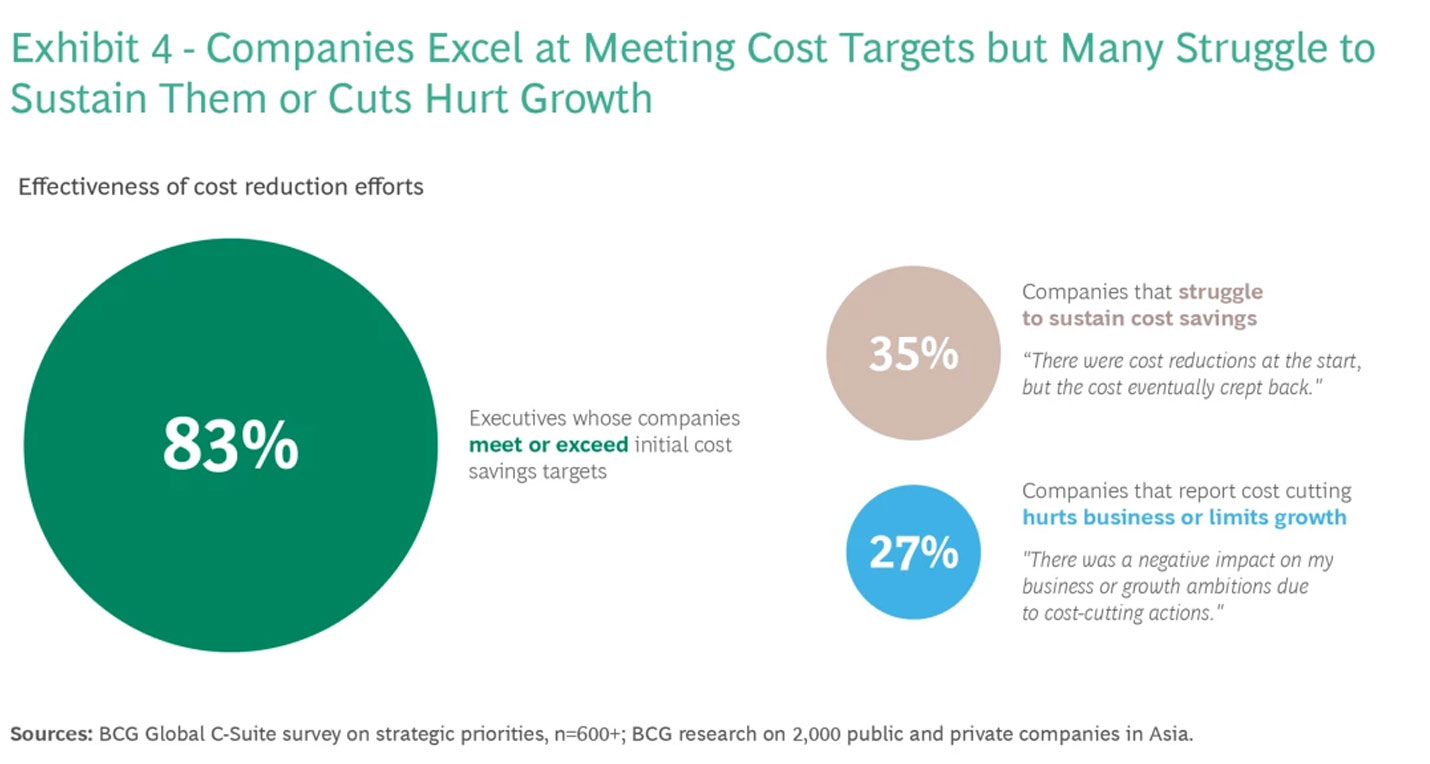

Cost initiatives may start strong but run into trouble. The vast majority of corporate leaders we surveyed said their cost programs meet or exceed initial savings targets. However, a substantial portion struggle to sustain reductions. Others report that cost cuts hurt business or limit growth.

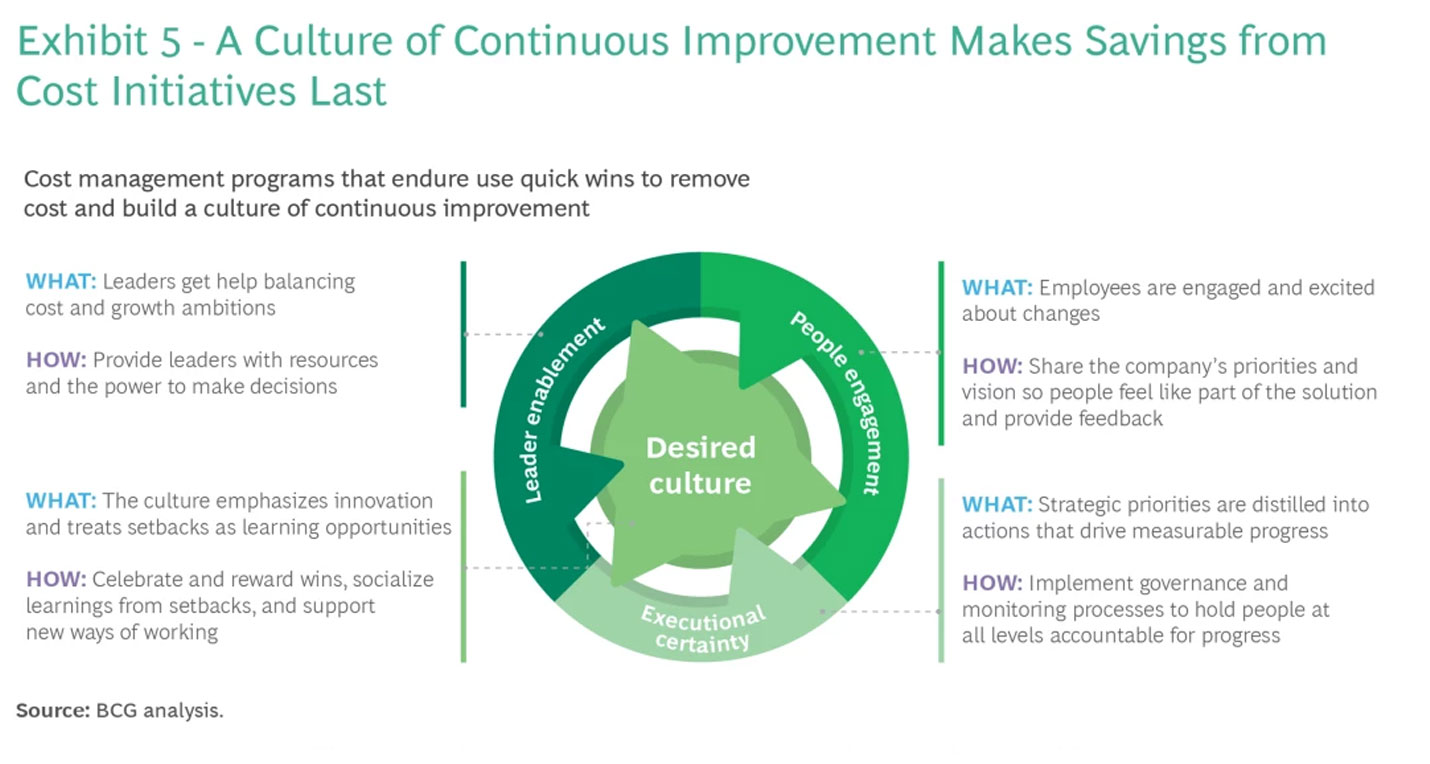

Companies can sustain savings and power growth if they take a holistic approach to cost management, apply resources unlocked from quick wins to fund innovation, and cultivate a culture of continuous improvement.

Cautious Optimism

Our survey of more than 600 C-suite executives around the world found that fewer are as pessimistic about macroeconomic shifts as they were in 2023.

Sixty-three percent believe their enterprises are prepared to weather additional global shocks. Even more (68%) believe they have enough visibility to make decisions about long-term capital investments. These positive sentiments—along with more abundant available capital, regulatory changes, and other trends—could cause mergers and acquisitions to pick up in coming months.

Corporate leaders aren’t entirely upbeat. They remain concerned about the possible business challenges posed by inflation, rising interest rates, and the potential for recession. They’re also tracking socioeconomic and geopolitical fallout from this year’s general elections in the US, India, and EU and from ongoing conflicts in Ukraine and the Middle East.

Making Cost Management a Priority

Lingering uncertainty, the need to reshape operations for the future, and disruptive technologies (such as generative AI) are motivating leaders to put cost management at the top of the to-do list. Corporate leaders’ goal of cutting costs stretched across all the regions we studied—North America, Europe, and Asia—and a variety of industries.

Cost Management

BCG’s cost advantage approach resets costs within a framework that is customized, precise, and thorough.

What Matters Most in a Cost Transformation

Successful initiatives depend on a holistic approach that considers every aspect of the organization and uses quick wins to fund long-term initiatives for future growth.

After managing costs, C-suite leaders’ top strategic priorities for 2024 are growth and expansion. How they accomplish both of those goals differs by region. Leaders in North America and Asia aim to grow by increasing product lines. In Europe, leaders are targeting growth by managing prices to counter inflation.

Leaders in the consumer goods and infrastructure and logistics sectors are particularly keen to grow by moving into new territories. Companies that are attracted to Southeast Asia’s status as a vibrant market and manufacturing hub are partially responsible for spurring geographic expansion. But interest in new regional markets is dampened in part by ongoing geopolitical tensions in other parts of the world.

Targeting Cost Efforts

Leaders are launching programs to manage costs in every aspect of their business. However, they said initiatives in manufacturing and supply chains, labor, and marketing and sales are “very important” for maintaining a competitive advantage. To lower manufacturing and supply chain costs, companies can optimize procurement, logistics networks, and distribution and warehousing, and invest in digital lean manufacturing and advanced planning processes.

A Strong Start Doesn’t Always Lead to Lasting Cost Savings

More than eight in ten leaders who launch cost programs reported meeting or surpassing their initial savings goals. But a strong start doesn’t guarantee lasting change. More than a third of the leaders we polled said costs eventually come back, and almost as many reported that cost cuts affect their business or growth.

C-suite executives told us that cost challenges are exacerbated by the difficulty of finding specialized talent in a tight labor market. Attracting and retaining people with the right skills is the biggest concern of leaders in health care and technology, media, and telecommunications. Cost initiatives are further stymied by disruptions caused by digital and AI.

A Holistic Approach to Cost Management

We know from years of client engagements that cost transformations are hard, and many don’t stick. Leaders improve the likelihood that their transformations will succeed by adopting a holistic approach that goes beyond one-and-done cost takeouts and by establishing a culture of continuous improvement.

Companies can unlock resources through quick wins and reinvest them in areas that drive growth, such as digital and AI, talent advancement, modernized supply chains, and operational excellence. To support change, top leaders must build a culture that supports it. They can do that by engaging people, translating strategies into measurable actions, treating setbacks as opportunities to learn, and provide other leaders in the organization with the support and resources they need to balance cost and growth goals.

Shifting economic trends, evolving geopolitics, and rapidly changing technologies are forcing organizations to evolve. Many are using the circumstances to improve costs. By taking a holistic approach, organizations can unlock funds to invest in strategic priorities that build competitive advantage for the future.

Canada Launches Second Green Bond Offering, Adds Nuclear Power to Eligible Investment Categories

ENERGY TRANSITION/ GOVERNMENT/ SUSTAINABLE FINANCE – Susan Lahey February 27, 2024

The Government of Canada announced that it will issue its second green bond this week, aimed at unlocking financing to accelerate green infrastructure and nature conservation projects, and supporting the achievement of the country’s climate goals. According to media reports, the new offering will aim to raise $4 billion through the issuance of 10-year notes.

The new offering follows Canada’s inaugural $5 billion green bond issuance in March 2022. According to the most recent green bond allocation report, issued in April 2023, more than a third of the proceeds were directed towards investments in “Clean Transportation,” including initiatives and projects supporting the adoption of zero-emission vehicles (ZEVs) and the deployment of ZEV infrastructure, such as charging stations. Other top allocation categories included “Living Natural Resources and Land Use,” with funding to support sustainable farming practices and to encourage the development of innovative technologies that will reduce GHG emissions in the agricultural sector, and “Renewable Energy.”

Prior to launching the new offering, Canada updated its Green Bond Framework, outlining the areas of eligible expenditure for the offering’s proceeds, as well as the process used for project evaluation and selection, and allocation and impact reporting obligations.

One of the most significant updates to the framework was the addition of some nuclear energy expenditures in the list of eligible investment areas, making Canada the first to do so. The inclusion of nuclear activities has been included in the sustainable finance taxonomies in jurisdictions including the EU and the proposed UK taxonomy, although it proved controversial in the former, with some member states, and the European Commission’s own sustainable finance advisory group opposed to its inclusion, noting problems including potentially adversely affecting other sustainability objectives and potential long-term problems from managing nuclear waste.

The framework lists the deployment of nuclear energy to generate electricity and/or heat under the eligibility category of Clean Energy. Additional eligible categories for allocation of green bond proceeds under the framework include Clean Transportation, Living Natural Resources and Land Use, Energy Efficiency, Terrestrial and Aquatic Biodiversity, Climate Change Adaptation, Sustainable Water and Wastewater Management, Circular Economy-Adapted Products, Production, Technologies, and Processes, and Pollution Prevention and Control.

Nikola’s $230M Raise in Q4 and the Hydrogen Revolution

By Jennifer L

As the world seeks to reduce carbon emissions and fight climate change, hydrogen emerges as a promising alternative in the global shift towards clean energy solutions. In this context, Nikola Corporation’s advancements in hydrogen represent a significant step in driving the transition within the transportation sector.

Nikola Corporation, a prominent player in zero-emissions transportation and energy supply and infrastructure solutions under the HYLA brand, has released its financial results and business updates for the fourth quarter and full year ending December 31, 2023.

Driving Toward a Hydrogen-Powered Future with $230M Raise in Q4

The reported achievement underscores Nikola’s market-leading position, highlighting the quality of its products and the success achieved by its fleet operations. In July last year, the company received a total of $58.2 million to bolster its hydrogen infrastructure.

Successfully delivered the first production hydrogen fuel cell electric truck available in North America.

Delivered 35 hydrogen fuel cell electric trucks in Q4, resulting in no finished goods inventory at the end of Q4.

Witnessed 225 additional voucher requests submitted in California for hydrogen fuel cell electric trucks from October 2023 through January 31, 2024, all attributed to Nikola.

Launched the first HYLA modular refueling station in Ontario, California, and announced a partnership with FirstElement Fuel in Oakland, California, providing fleets with fuelling solutions in both Northern and Southern California.

Raised $230.3 million during Q4, ending the year with $464.7 million of unrestricted cash, the highest since Q4 2021.

Looking forward to 2024, the company’s focus is on optimizing revenue and costs within its business. They commit to securing more modular refuelling sites and scaling up the production of their hydrogen fuel cell electric trucks.

Investing their resources in the direction of hydrogen appears to be a strategic move for the company.

Hydrogen Fueling the Green Revolution

Amidst the urgent need to reduce carbon emissions worldwide, there’s a surge in innovations focusing on alternative energy sources. Hydrogen stands out among these alternatives, particularly for providing a cleaner option in the transportation sector.

Unlike fossil fuels, which emit planet-warming gases, hydrogen fuel offers the potential to be 100% clean. In hydrogen fuel cell electric vehicles (FCEVs), hydrogen combines with pure oxygen in specialized cells, with the only resulting by-product being water.

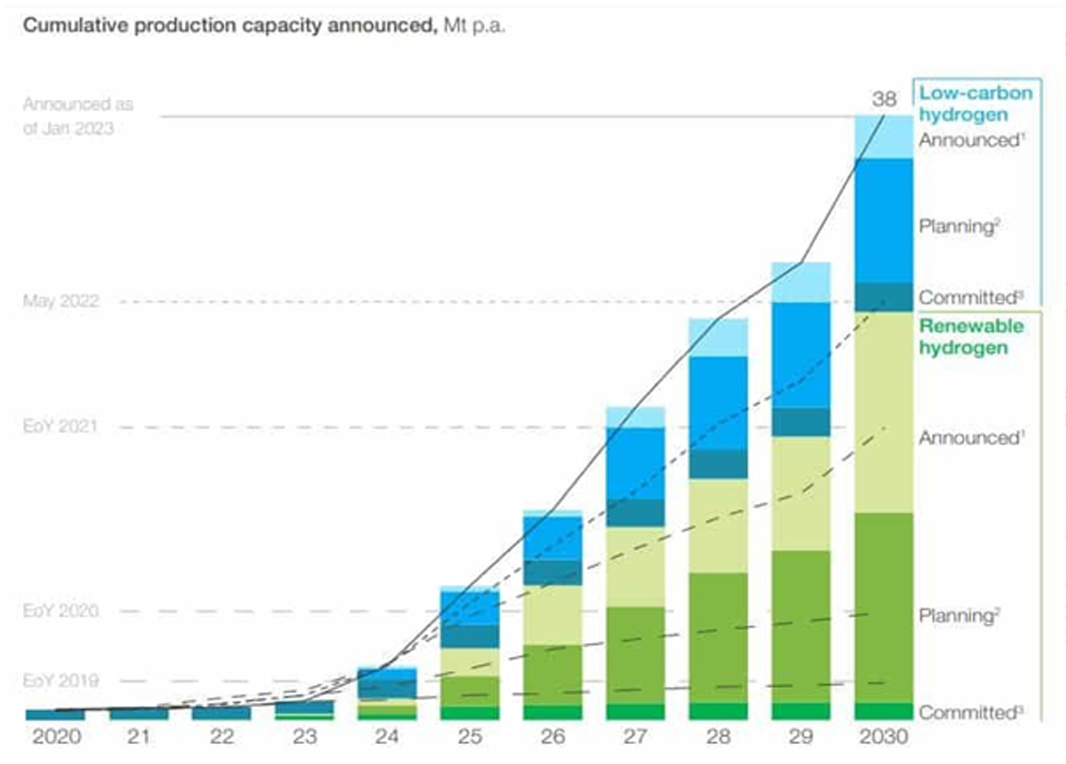

Projections also highlight the significant role that hydrogen fuel will play in the coming decades. Experts anticipate that the global hydrogen market will soar to about $231 billion by the year 2030. Low-carbon hydrogen production could significantly reach 38 million metric tons per annum by the same period.

McKinsey & Company estimated that the total hydrogen production capacity announced by companies by 2030 jumped by 40% as seen below.

Nikola believes that they have introduced the first production Class 8 hydrogen fuel cell truck to the North American market.

In California, Nikola holds an impressive 99% share of all hydrogen fuel cell electric tractor HVIP vouchers requested between 2023 and January 2024. The number of requests for their fuel cell truck surpasses those for all other truck OEMs combined. This includes both battery and hydrogen fuel cell electric trucks during the same period.

The promising future of hydrogen and its emission regulation compliance, particularly in California, motivated truckers to embrace this zero-emission technology. Many trucking companies believe that it brings advantages for long-haul trips and quick refueling. Plus, hydrogen-powered trucks can move heavier loads because they don’t need large batteries.

Powering up the Hydrogen Economy

What further ignites the growing demand for hydrogen is the implementation of the largest and most aggressive investment taken by the US government for climate, the $369 billion Inflation Reduction Act of 2022.

The IRA has caused a significant shift in hydrogen economics, particularly impacting green hydrogen. This type of hydrogen, produced through the process of electrolysis using renewable electricity and water, has now become cost-competitive with its natural gas-derived counterpart.

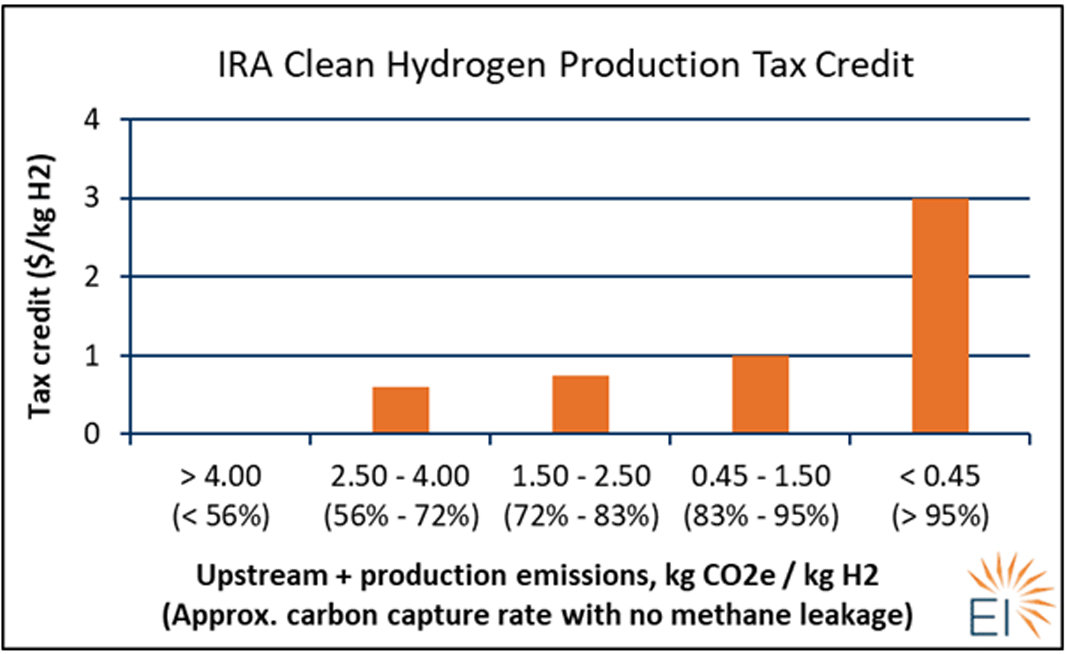

Under the Act’s provisions, production tax credits are offered for a duration of 10 years to “clean hydrogen” production facilities. These incentives are structured based on the carbon capture rates during the production process.

Initially, the incentives start at $0.60 per kilogram (kg) for hydrogen produced with a carbon capture rate that exceeds half of the emissions from the Steam Methane Reforming (SMR) process, subject to meeting workforce development and wage requirements. But as the carbon capture rates increase, the value of the production tax credit rises to $1.00/kg. Eventually, for hydrogen produced with minimal to no emissions, the production tax credit reaches $3.00/kg.

The carbon capture rate estimates assume an emissions rate of 9.00 kg CO2e / kg H2 from producing gray hydrogen. Source: Utility Drive

Alongside the IRA is the bipartisan Infrastructure Investment and Jobs Act that helps the U.S. unleash clean energy. The latter law provided a $7 billion grant to seven regional clean hydrogen hubs (H2Hubs) under the Department of Energy.

The program is part of a strategic move to accelerate the deployment of clean hydrogen across the country.

Collectively, the 7 chosen hydrogen hubs will cut about 25 million metric tons of carbon dioxide from end-users annually. They will share the cost of developing the network, located in carbon-producing centers, including Appalachia, the Gulf States, and the Midwest. Read more about them here.

In California, Nikola hydrogen infrastructure brand HYLA seeks to establish a comprehensive zero-emission transportation solution to help fleets achieve their climate goals. The company recently unveiled the opening of its inaugural HYLA modular refuelling station in Ontario, California.

The initiative enables fleets to use the refuelling station that facilitates freight transport between Southern and Northern California. The HYLA team plans to secure 9 additional fuelling sites across the state throughout 2024.

Carbon Credits vs. Carbon Offsets

At their core, both carbon credits and carbon offsets are accounting mechanisms. They provide a way to balance the scales of pollution. The big idea behind credits and offsets is that since CO2 is the same gas anywhere in the world, it doesn’t matter where emissions reduction happen.

For both consumers and companies, it makes financial sense to reduce emissions where it is cheapest and easiest to do so, even if that does not involve their own operations.

Offset and Credit Similarities

At the simplest level, a carbon credit or offset represents a reduction in or removal of greenhouse gas (GHG) emissions that compensates for CO2 emitted somewhere else. The instruments do have two major attributes in common:

- One carbon credit or offset equals one tonne of carbon emissions.

- Once a carbon credit or offset is purchased and the CO2 is emitted, that credit is “retired” and cannot be sold or used again.

Carbon Offsets and Carbon Credits Defined

While the terms “carbon credits” and “carbon offsets” are often used interchangeably, they refer to two distinct products that serve two different purposes. Before you begin purchasing either, it’s important to understand the difference between the two and which one will help you meet your goals. Here is a broad definition of the terms:

- Carbon offset: A removal of GHGs from the atmosphere.

- Carbon credit: A reduction in GHGs released into the atmosphere.

To help visualize the difference, imagine a water supply polluted by a nearby chemical plant. A “chemical offset” would mean pulling chemicals out of the water to help purify it. A “chemical credit” would mean paying another chemical company to release fewer chemicals into the water, so the overall level of pollution stays the same. Clear as mud? Great.

A Carbon Offset and Carbon Credit Primer*

Let’s dive a bit deeper into these products one at a time. Creating a carbon offset involves a fancy term we call “carbon sequestration.” Recall how a judge can order a jury to be sequestered—meaning they have to be sealed off from the outside world.

It works the same way with carbon: offsets involve CO2 emissions pulled out of the atmosphere and locked away for a period of time.

There is a growing list of ways to do this, including planting forests, blasting rock into tiny pieces, storing carbon in manufactured devices, capturing methane gas at a landfill, and the holy grail of carbon sequestration: using sophisticated technology to turn CO2 emissions into a usable product.

Carbon offsets are produced by independent companies that pull CO2 emissions from the atmosphere. The offsets are then sold to companies that emit (or have emitted) CO2. In a sense, offset-producing companies are directly funded by those companies that emit GHGs.

Carbon credits, on the other hand, are generally “created” by the government. Governments limit the amount of GHGs organizations can emit by placing acap on them—a specific number of tons of CO2 the company can emit. Each of those tons are referred to as a carbon credit.

Companies comply with that cap by reducing the emissions produced in their operations through improving energy efficiency or switching to renewable energy sources. An organization that brings its overall emissions below what is required by law can sell the excess credits to businesses that are unable or unwilling to cut their own emissions to become compliant.

There are a few other ways to produce carbon credits. For more detail, see our article on carbon credits.

The Two Carbon Markets

There’s one more important distinction between carbon credits and carbon offsets:

- Carbon credits are generally transacted in the carbon compliance market.

- Carbon offsets are generally transacted in the voluntary carbon market.

Mandatory schemes limiting the amount of GHG emissions grew in number. And with them, a fragmented carbon compliance market is developing. For example, the EU has an Emissions Trading System (ETS) that enables companies to buy carbon credits from other companies.

California runs its own cap-and-trade program. Nine other states on the eastern seaboard have formed their own cap-and-trade conglomerate, the Regional Greenhouse Gas Initiative.

The voluntary carbon market (think: offsets) is much smaller than the compliance market, but expected to grow much bigger in the coming years. It is open to individuals, companies, and other organizations that want to reduce or eliminate their carbon footprint, but are not necessarily required to by law.

Consumers can purchase offsets for emissions from a specific high-emission activity. An example would be a long flight. Or they can buy offsets on a regular basis to eliminate their ongoing carbon footprint.Do I Need Carbon Offsets or Carbon Credits?

Now that you know their differences and what they have in common, here’s how carbon credits and carbon offsets work in the grand, global scheme of emissions reduction.

The government is putting heavy caps on GHG emissions, meaning that companies will have to reconfigure operations to reduce emissions as much as possible. Those that cannot be eliminated will have to be accounted for through the purchase of carbon credits. Ambitious organizations, corporations, and people can purchase carbon offsets to nullify previous emissions or to reach net zero.

So which do you need? If you’re a corporation, the answer is likely “both”—but it all depends on your business goals. If you’re a consumer, carbon credits are likely unavailable to you. But you can do your part by purchasing carbon offsets.

Returning to the illustration from earlier, our vital, global goal is to both stop dumping chemicals into the metaphorical water supply, and to purify the existing water supply over time. In other words, we need to both drastically reduce CO2 emissions. And then we work to remove the CO2 currently in the atmosphere if we want to materially reduce pollution.

I hope you have enjoyed this week’s report, if you would like more information on your Superannuation, Personal Investment or how to open a trading account with JMP Securities, feel free to reach out.

Regards,

Head, Fixed Interest and Superannuation

JMP Securities

a. Level 3, ADF Haus, Musgrave St., Port Moresby NCD Papua New Guinea

p. PO Box 2064, Port Moresby NCD Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814