12 March, 2024

Welcome to this week’s JMP Report,

Last week saw 5 stocks trade on the local market. BSP traded 77,718 shares, trading 1t lower to close at K16.11. KSL traded 119,776 shares, closing steady at K2.90. STO traded 50 shares closing steady at K19.31. KAM traded 9,768 shares, closing 1t at K1.02 and SST traded 2,984shares closing K9.54 at K45.

WEEKLY MARKET REPORT | 4 March, 2024 – 8 March, 2024

| STOCK | QUANTITY | CLOSING PRICE | BID | OFFER | CHANGE | % CHANGE | 2023 INTERIM | 2023 FINAL DIV | YIELD % | EX-DATE | RECORD DATE | PAYMENT DATE | DRP |

| BSP | 77,718 | 16.12 | 16.11 | – | -0.01 | -0.06 | K0.370 | K1.060 | 8.92 | TUE 27 FEB 2024 | WED 28 FEB 2024 | FRI 22 MAR 2024 | NO |

| KSL | 119,776 | 2.90 | 2.90 | – | – | 0.00 | K0.097 | – | – | – | – | – | PA |

| STO | 50 | 19.31 | 19.31 | – | – | 0.00 | K0.314 | USD 0.175 | 4.91 | MON 26 FEB 2024 | TUE 27 FEB 2024 | TUE 26 MAR 2024 | – |

| NEM | – | 145.00 | 145.00 | – | – | 0.00 | – | USD 0.250 | 0.63 | MON 4 MAR 2024 | TUE 5 MAR 2024 | WED 27 MAR 2024 | – |

| KAM | 9,768 | 1.02 | 1.01 | – | – | 0.00 | K0.12 | – | – | – | – | – | YES |

| NGP | – | 0.69 | – | – | – | 0.00 | K0.0.3 | – | – | – | – | – | – |

| CCP | – | 2.11 | 2.10 | – | 0.10 | 4.74 | K0.110 | – | – | – | – | – | NO |

| CPL | 2,984 | – | – | – | – | 0.00 | – |

– | – |

– | – | – | – |

| SST | – | 35.46 | 36.46 | – | 9.54 | 26.90 | K0.35 | – | – | – | – | – | NO |

Dual Listed PNGX/ASX Stocks

BFL – 5.66 -68c

KSL – 0.845 -0.65c

NEM – 50.80 – 2.40

STO – 7.13 -7c

Interest Rates

On the interest rate front we saw a 60 mill offered in the 182 days with an average of 1.8%. The Bank also offered 30 mill in the 273 days averaging 2.45% and the 364 days remained flat at 3.13%. Interesting to note, the Bank offered 359 mill but received only 322mil in bids leaving the 364days undersubscribed by 39mill.

In the Finance Company market, Credit Corp and Fincorp offer the best 1yr depo rates at 2.35%.

Other assets we monitor

Gold – 2179 +$96

Silver – 24.30 +$1.15

Platinum – 915 +$27

Natural Gas – 1.81 -3c

Bitcoin – 68,600 + 8.25%

Ethereum – 3850 +11.4%

What we’ve been reading this week

Oliver’s insights – 21 great investment quotes

Dr Shane Oliver – Head of Investment Strategy and Economics and Chief Economist, AMP Investments

05 Mar 2024

Introduction

Investing can be scary and confusing at times. But the basic principles of successful investing are timeless and quotes from experts help illuminate these. This note revisits a series on insightful quotes on investing I first started a decade ago.

The aim of investing

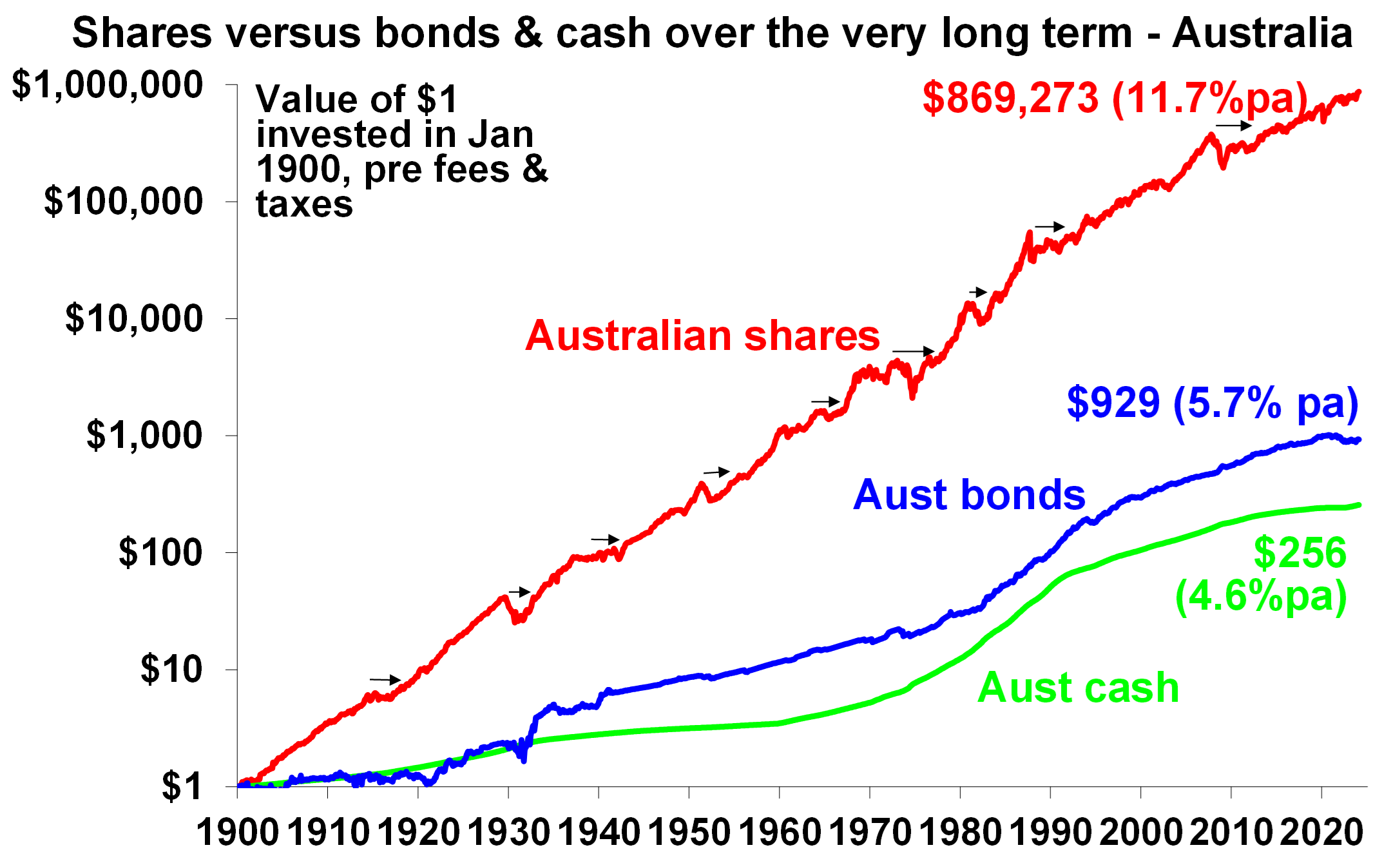

“How many millionaires do you know who have become wealthy by investing in savings accounts?” Robert G Allen, investment author

Cash and bank deposits are low risk and fine for near term spending requirements and emergency funds, but they won’t build wealth over long periods of time. The chart below shows the value of $1 invested in various assets since 1900. Despite periodic setbacks (see the arrows) shares and other growth assets like property (not shown) provide much higher returns over the long term than cash and bank deposits.

Source: ASX, RBA, AMP

“The aim is to make money, not to be right.” Ned Davis, investment analyst

There is a big difference between the two. But many let their blind faith in a strongly held view (e.g. “there is too much debt”, “aging populations will destroy share returns”, “global oil production will soon peak”, “the IT revolution means this time it’s different”) drive their decisions. They could be right at some point but end up losing a lot of money in the interim.

The investment process

“Much success can be attributed to inactivity. Most investors cannot resist the temptation to constantly buy and sell.” Warren Buffet, investor, chair & CEO of Berkshire Hathaway

Unless you really want to put a lot of time into trading, it’s advisable to only invest in assets you would be comfortable holding for the long term. This is less risky than constantly tinkering in response to predictions of short-term changes in value and all the noise around investment markets.

“Investing should be like watching paint dry or watching grass grow. If you want excitement…go to Las Vegas.” Paul Samuelson, economist

Investing is not the same as gambling and requires a much longer time frame to payoff.

“Successful investing professionals are disciplined and consistent and they think a great deal about what they do and how they do it.” Benjamin Graham, investment author, “father of value investing”

Having a disciplined investment process and consistently applying it is critical for investors if they wish to actively manage their investments successfully in the short term.

“Don’t look for the needle in the haystack, just buy the haystack!” John C Bogle, founder of Vanguard

The key insight here is that trying to beat the market by stock picking can be hard and so if you want to grow wealth over time the key is to get a broad exposure to the market and letting compound interest do its job.

The investment market

“Remember that the stock market is a manic depressive.” Warren Buffett

Rules of logic often don’t apply in investment markets. The well-known advocate of value investing, Benjamin Graham, coined the term “Mr Market” (in 1949) as a metaphor to explain the share market. Sometimes Mr Market sets sensible share prices based on economic and business developments. At other times he is emotionally unstable, swinging from euphoria to pessimism. But not only is Mr Market highly unstable, he is also highly seductive – sucking investors in during the good times with dreams of riches and spitting them out during the bad times when all hope seems lost. Investors need to recognise this.

“Markets can remain irrational longer than you can remain solvent.” John Maynard Keynes, economist

A key is to respect the market and recognise that it can be fickle rather than try and take big bets that can send you bust if you get the timing wrong. For example, by heavily selling shares short if you think a crash is about to happen or gearing in too heavily via margin debt when the market is strong. Such approaches can often undo investors and send them bust as they are too dependent on accurately timing the market.

Investment cycles and contrarian investing

“Bull markets are born on pessimism, grow on scepticism, mature on optimism and die of euphoria.” John Templeton, investor

This is one of the best characterisations of how the investment cycle unfolds. It follows that the point of maximum opportunity in terms of prospective return is around the time most investors are pessimistic and bearish and the point of maximum risk is when most investors are euphoric and bullish, but unfortunately many don’t realise this because it involves going against the crowd.

“The four most dangerous words in investing are: ‘this time it’s different’.” John Templeton

History tells us that that there are good times and bad and assuming that either will persist indefinitely is a big mistake. Whenever you hear talk of “new paradigms”, “new eras”, “new normals” or “new whatevers” it’s usually getting time for the cycle to go in the other direction.

“History doesn’t repeat but it rhymes.” Often attributed to Mark Twain (although it’s not sure he actually said it), author

No two cycles are the same, but they do have common elements which make them rhyme. In upswings investment markets are pushed to the point where the relevant asset has become overvalued, over loved (in that everyone is on board) and over bought and vice versa in downturns.

Recognising these common elements is necessary if you are to get a handle on cyclical swings in investment markets.

“If it’s obvious, it’s obviously wrong.” Joe Granville, investment author

This doesn’t apply to everything (e.g. if it is obviously sunny outside according to the usual definition, then it is!), but investing can be perverse. When everyone is saying “it’s obvious that the recession will continue” or “it’s impossible to see a recession as things are obviously good” then maybe the crowd is already on board and the cycle will soon turn.

“I will tell you how to become rich…Be fearful when others are greedy. Be greedy when others are fearful.” Warren Buffett

This is another great quote on contrarian investing that follows on from those above.

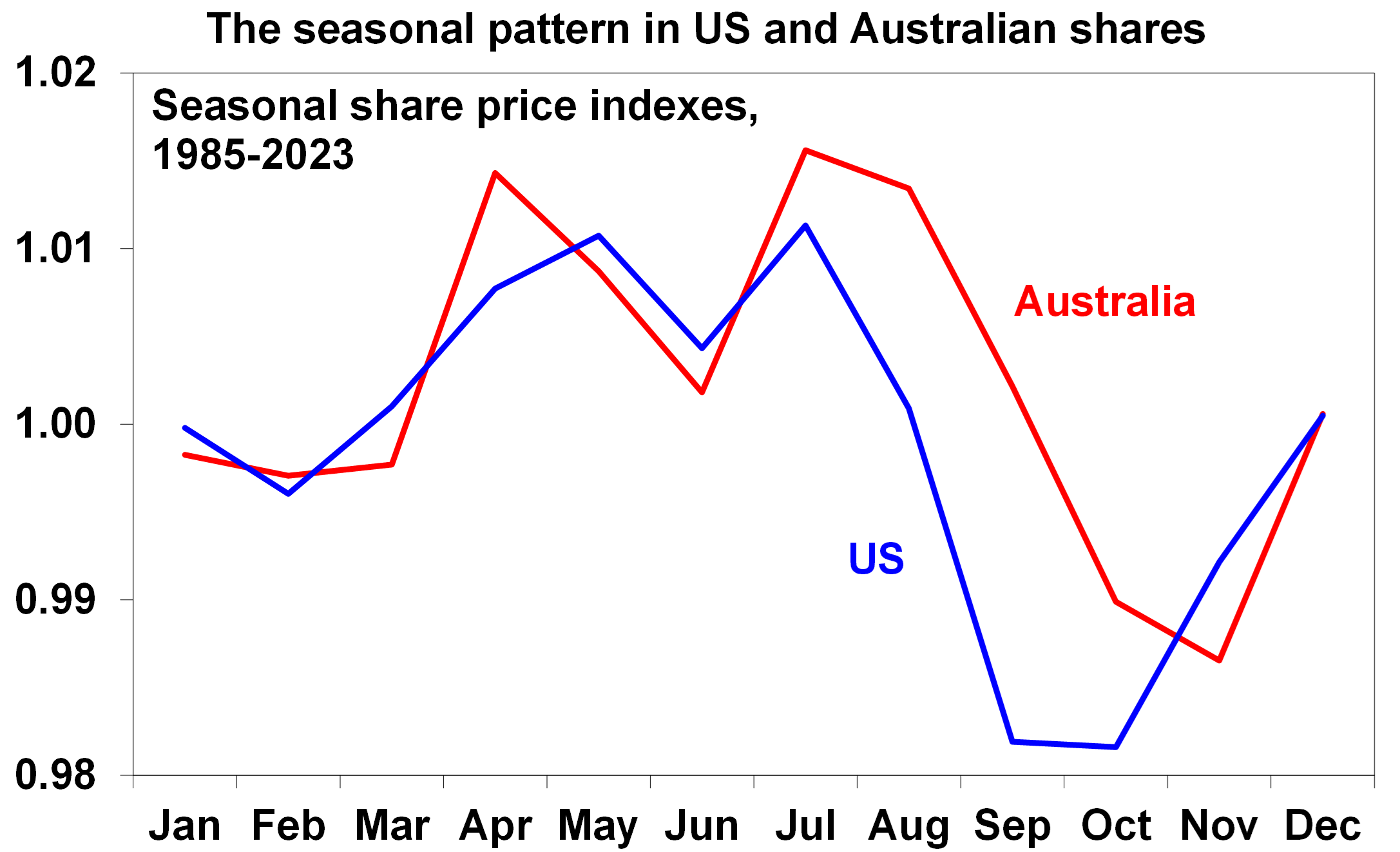

“Sell in May and go away, buy again on St Leger’s Day.” Anon

Shares have long been observed to have a seasonal pattern that sees strength from November through to May and then relative weakness through to around October. This can be seen in seasonal indexes for US and Australian shares in the next chart. (St Leger’s Day in terms of the UK horse race on the second Saturday in September may be a bit early, but not to worry!)

Source: Bloomberg, AMPl

Source: Bloomberg, AMPl

The reasons vary and relate to tax loss selling associated with a September tax year end for US mutual funds, a wind down in new equity raisings around December/January, New Year cheer and the investment of bonuses, but may have its origins in crop cycles. The point is that buying in May, might not be the best time, nor selling in September or October.

Investor pessimism

“To be an investor you must be a believer in a better tomorrow.” Benjamin Graham

This is a pre-requisite. If you don’t believe the bank will look after your term deposits, that most borrowers will pay back their debts, that most companies will see rising profits over time, that properties will earn rents etc then there is no point investing. This is flippant but true – to be a successful investor you need a favourable view of the future.

“More money has been lost trying to anticipate and protect from corrections than actually in them.” Peter Lynch, investor, fund manager

Preserving capital is important, but this can be taken too far and often is in the aftermath of bad times with the result that investors end up so focused on trying to avoid capital losses in share markets that they miss the returns they offer.

“I have observed that not the man who hopes when others despair, but the man who despairs when others hope, is admired by a large class of persons as a sage.” J.S. Mill, economist

It invariably seems that higher regard is had for pessimists predicting disaster than for optimists seeing better times. As the US economist JK Galbraith once observed “we all agree that pessimism is a mark of a superior intellect.” And we all know that bad news sells. There may be a neurological reason for this as the human brain evolved in the Pleistocene era when the key was to dodge woolly mammoths and sabre tooth tigers, so it has been hard wired to be always on guard and so naturally attracted to doom sayers. But for investors, giving too much attention to pessimists doesn’t pay over the long term.

Risk

“There is nothing riskier than the widespread perception that there is no risk.” Howard Marks (I think), investor, co-founder of Oaktree Capital

Many like to measure risk by looking at measures of volatility, but the riskiest time in markets is invariably when the common view is that there is no risk for it’s often around this point that everyone who wants to invest has already done so leaving the market vulnerable to bad news.

Debt

“It’s not what you own that will send you bust but what you owe.” Anon

Always make sure that you don’t take on so much debt that it may force you to sell all your investments and potentially send you bust, just at the time you should be buying.

The right mindset for an investor

“The investor’s chief problem and even his worst enemy is likely to be himself.” Benjamin Graham

This may sound perverse as surely it is events which drive investment markets down and destroy value. But the trouble is that events and bear markets are normal. Rather what causes the greatest damage is our reaction to events – selling after markets have already plunged and only buying back in after euphoria has returned. Smart investors have an awareness of their psychological weaknesses and their tolerance for risk and seem to manage them.

“You get recessions, you have stock market declines. If you don’t understand that’s going to happen then you’re not ready, you won’t do well in the markets.” Peter Lynch

If you can’t handle volatility associated with investment markets, then either they are not for you or you should just take a long term approach and leave it to someone else to manage and advise on the investment of your funds.

Managing ESG Data Flow a Growing Challenge for Investors as CSRD Reporting Begins: Bloomberg Survey

ESG REPORTING/ ESG TOOLS, SERVICES/ INVESTORS/ REPORTS, STUDIES

Mark Segal March 5, 2024

Investors are facing a series of ESG data challenges, including coping with coverage and quality issues of reported company sustainability data and managing the increasing volume of information resulting from new regulatory ESG reporting requirements, according to a new survey released by business and financial markets information service provider Bloomberg.

For the study, the European ESG Data Trends Survey 2024, Bloomberg surveyed over 200 financial market participants Europe, across countries including London, Stockholm, Geneva, Amsterdam, Frankfurt, Paris, and Milan, examining ESG data issues ranging from prioritization and challenges, to data management challenges and practices.

The primary ESG data challenge reported by the market participants in the survey was coverage and quality issues related to reported ESG data, with nearly two thirds (63%) citing this as their top concern, followed by “combining ESG with alternative data,” at a distant second place by 13% of respondents.

While investors view incomplete or low quality data as a concern, many of these issues will likely be addressed with the implementation of the EU’s Corporate Sustainable Reporting Directive (CSRD), although this will likely lead to a new challenge for market participants to manage the growing volume of reported ESG data. Accordingly, 41% of survey respondents reported that their top ESG data management challenge was the need to handle “constantly evolving and new ESG data content,” and another 25% cited linking ESG data content to existing data systems as the biggest challenge.

The survey indicated that many firms are still deciding on how to handle the new growing volume of ESG data. While 38% of respondents reported that ESG data is managed centrally with a proprietary solution, around a third (32%) of respondents said that they are currently managing ESG data using a more decentralized approach, with the data managed individually by business unit, and 20% said that they are still in the process of formulating and ESG data management strategies.

Nadia Humphreys, Head of Sustainable Finance Data Solutions at Bloomberg, said:

“While quality and comparability remain a global challenge, data management is coming into sharp focus for firms in Europe. If firms cannot organize their ESG data, they cannot effectively make decisions using that information.”

Econosights

An International Women’s Day special

Diana Mousina, Deputy Chief Economist, AMP

07 Mar 2024

Introduction

The 8th March marks International Women’s Day. Some might say that International Women’s Day has only gained popularity in recent years across the Western World but it actually has historical origins back to the early 1900’s, particularly in the former USSR, where I was born. It is still a day of celebration for girls and women in many ex-Soviet countries where girls and women are given flowers and gifts (and even a public holiday in some countries!). So I thought it was a good time to reflect on issues around gender inequality in Australia.

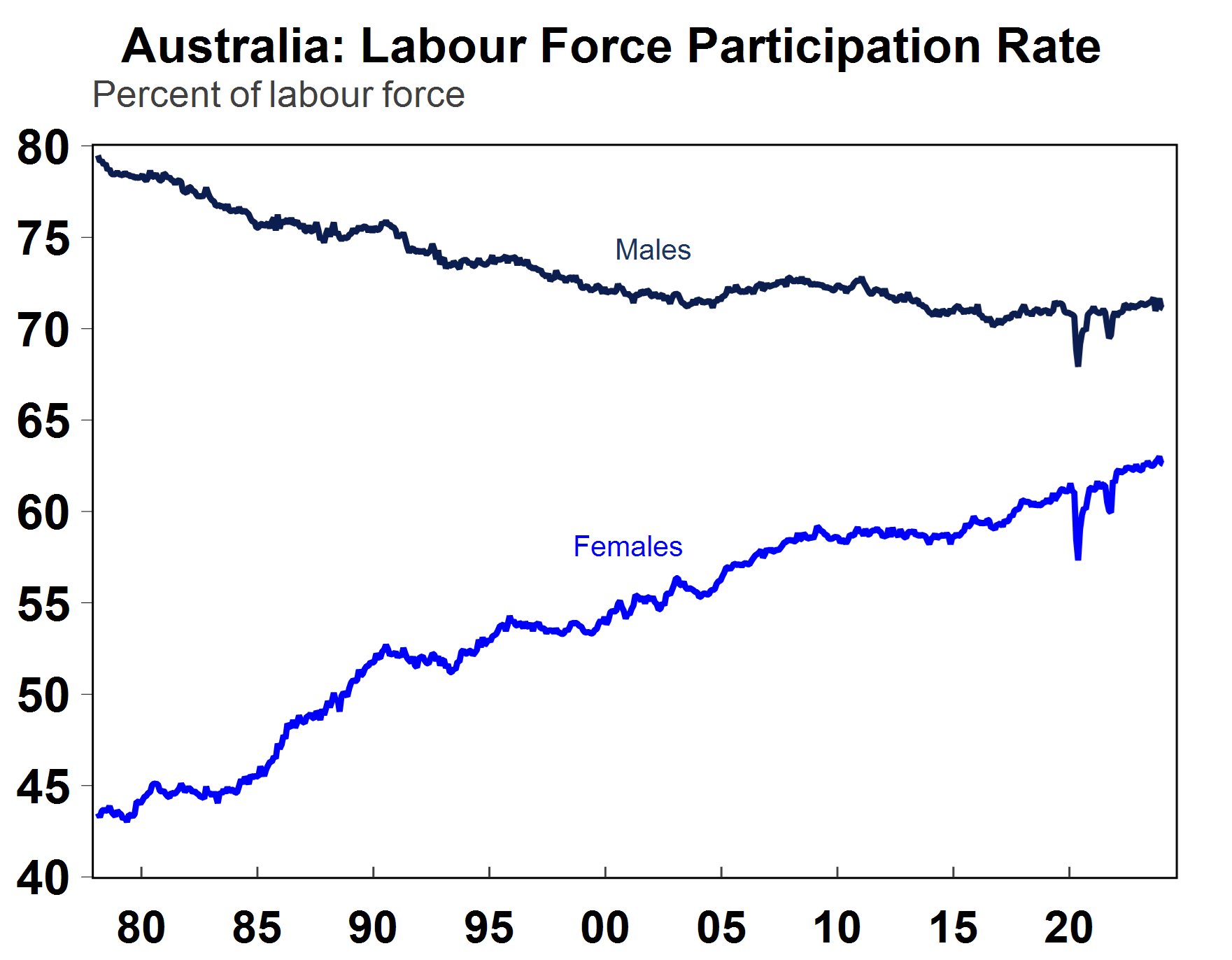

Women in the Australian labour market

The female participation rate (the number of women either employed or unemployed as a share of the labour market) is 62.6%, lower than the 71.1% for males (see the chart below) but is at around a record high and well above the ~43% that was recorded in 1978. So female participation in the labour force has gone up significantly over the past 50 years.

Source: Macrobond, AMP

Source: Macrobond, AMP

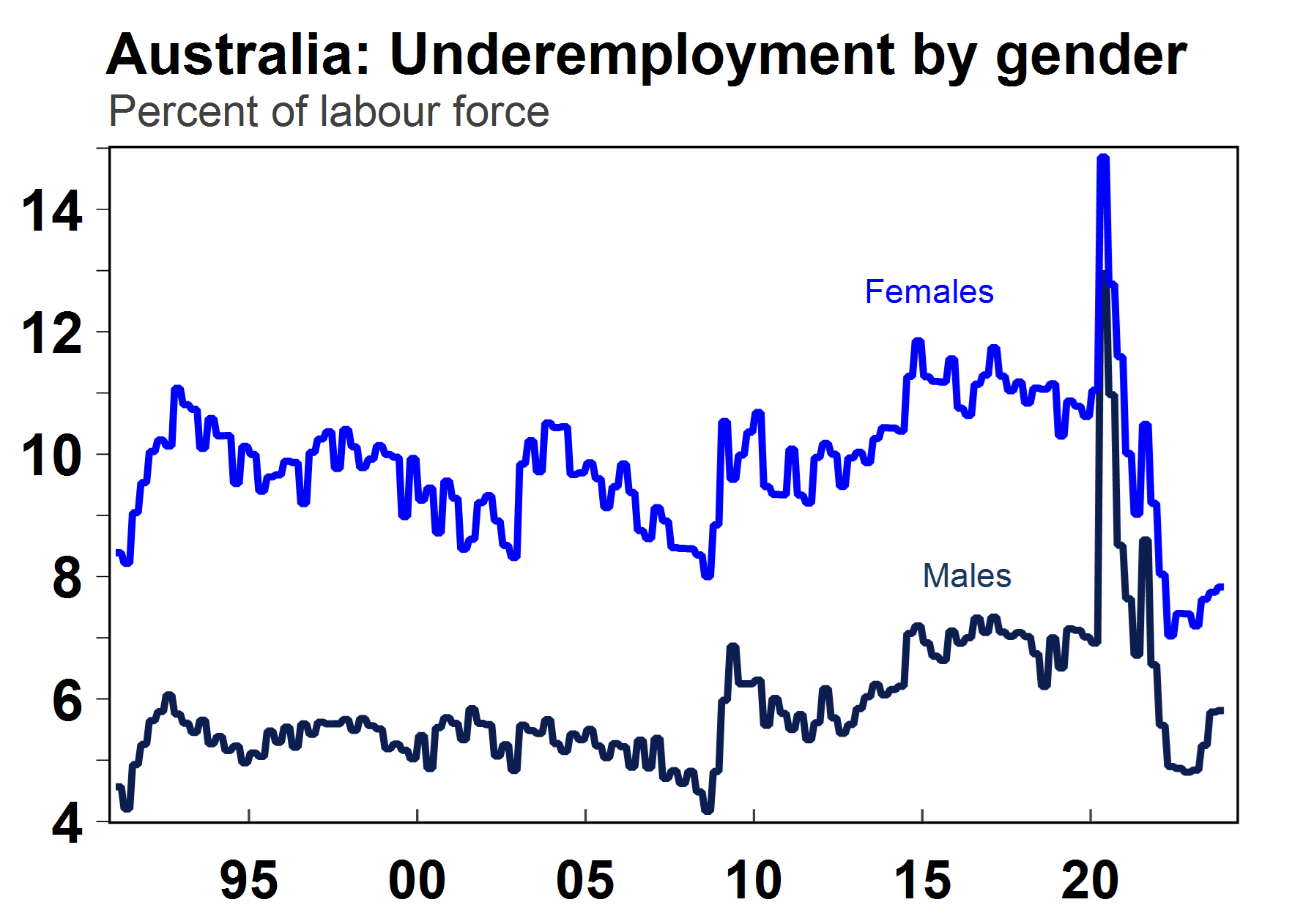

In Australia, 47% of women in the labour market work part-time, more than double the 20% of men who work part-time. The higher rate of part-time participation by females results in higher “underemployment” (i.e. females wanting to work more hours). Female underemployment is 7.8% and males is 5.8% (see the next chart).

Source: Macrobond, AMP

Source: Macrobond, AMP

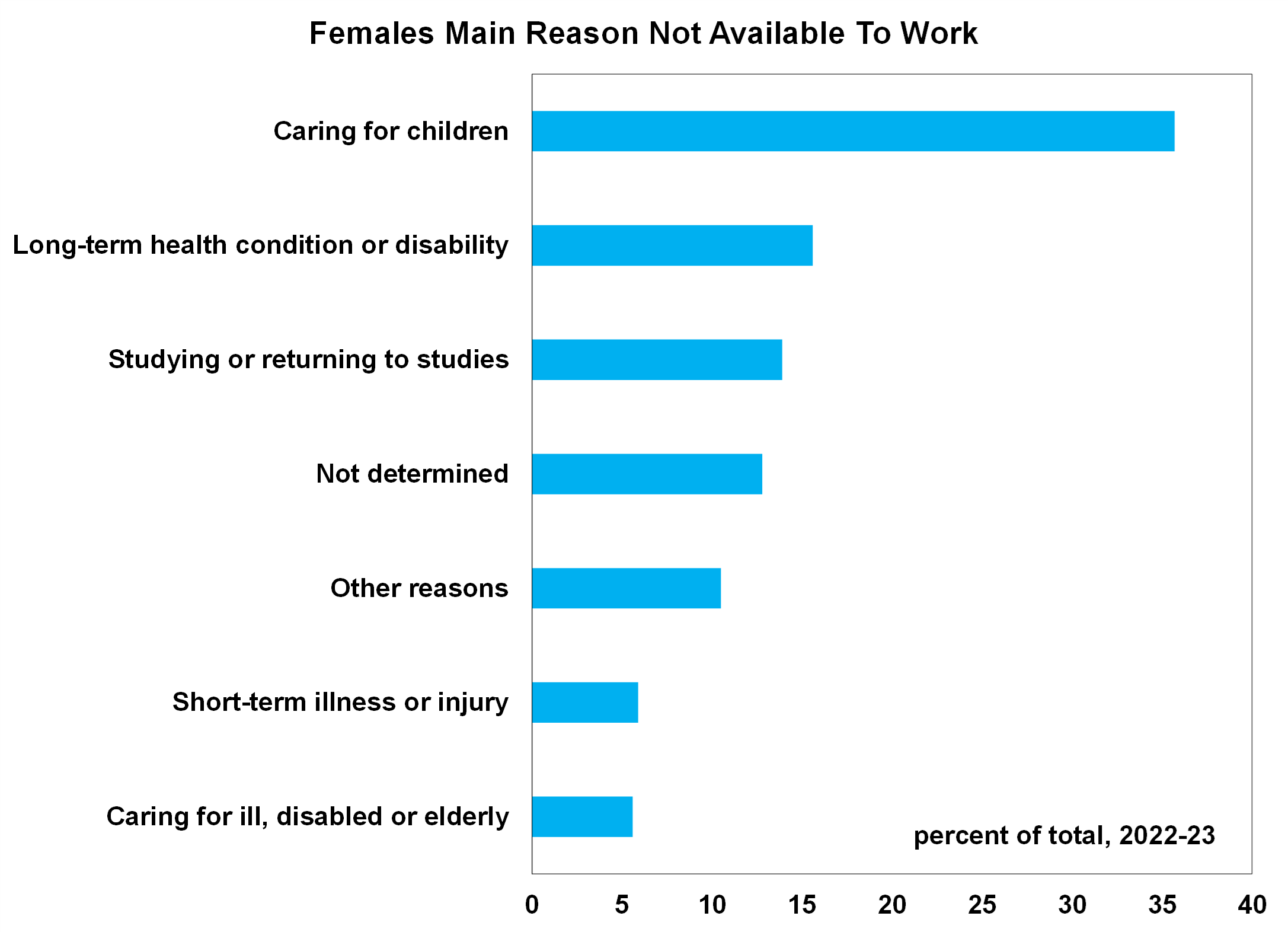

As expected, the main reason that females are not being available for more hours is because they are caring for children (see the chart below) with nearly 36% of women in 2022-23 citing that caring for children was the main reason they were unable to work. So, the gap in labour force participation between males and females is likely to narrow a bit further over time but is unlikely to ever completely close, because at the end of the day if women decide to have children then they are likely to take time out of work.

Source: ABS, AMP

Source: ABS, AMP

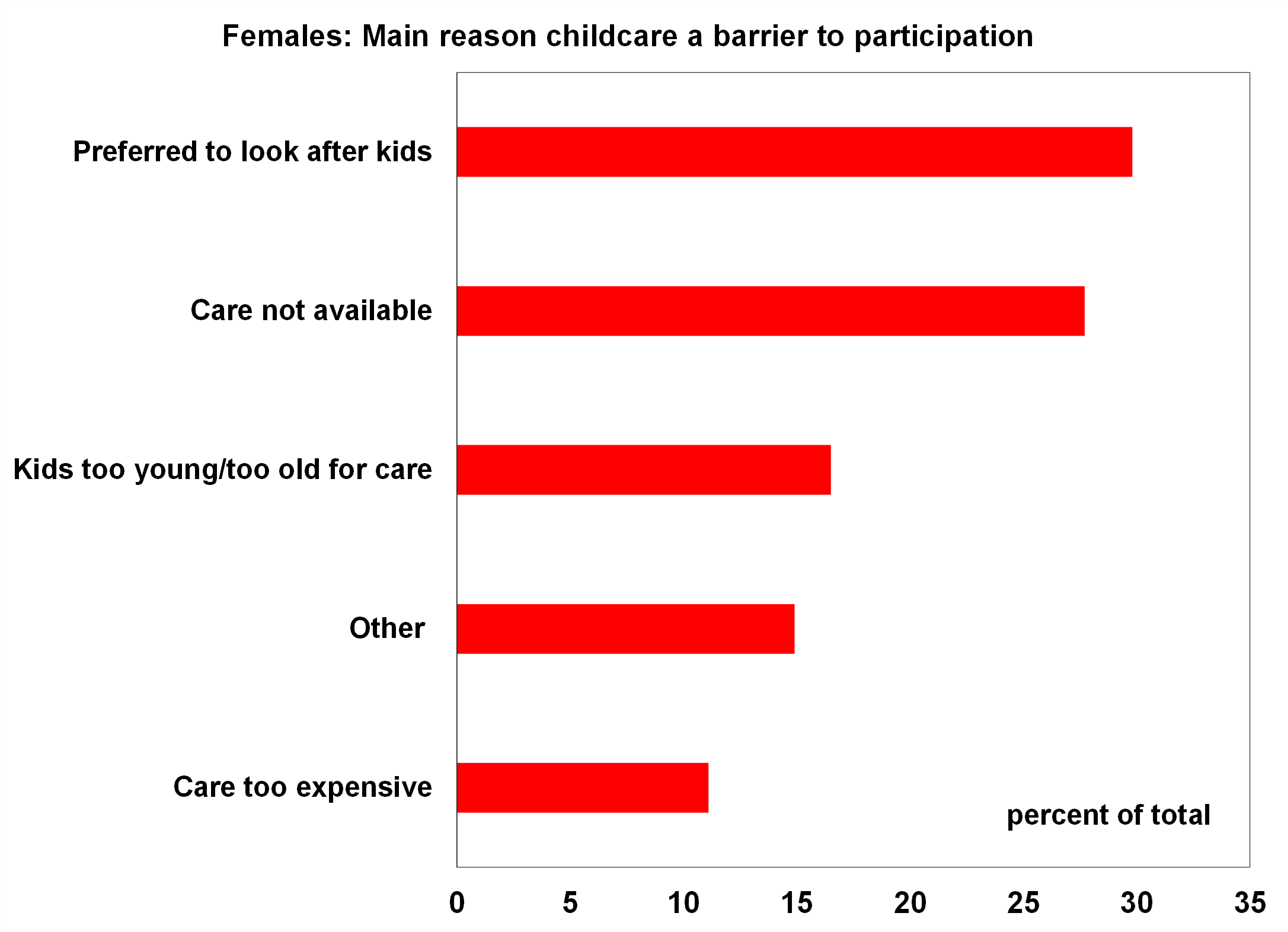

Interestingly, of the females that said that childcare was the main barrier to workforce participation, the main reason that it was an issue for them was because they preferred to look after their children, followed by childcare not being available (see the chart below) and childcare costs being the 5th reason that childcare was a barrier to particiaption (rather than the usual statistics indicating that it is the main reason for women not returning to work). This shows that there is some natural preference for many women to look after their children.

Source: ABS, AMP

Source: ABS, AMP

The gender pay gap

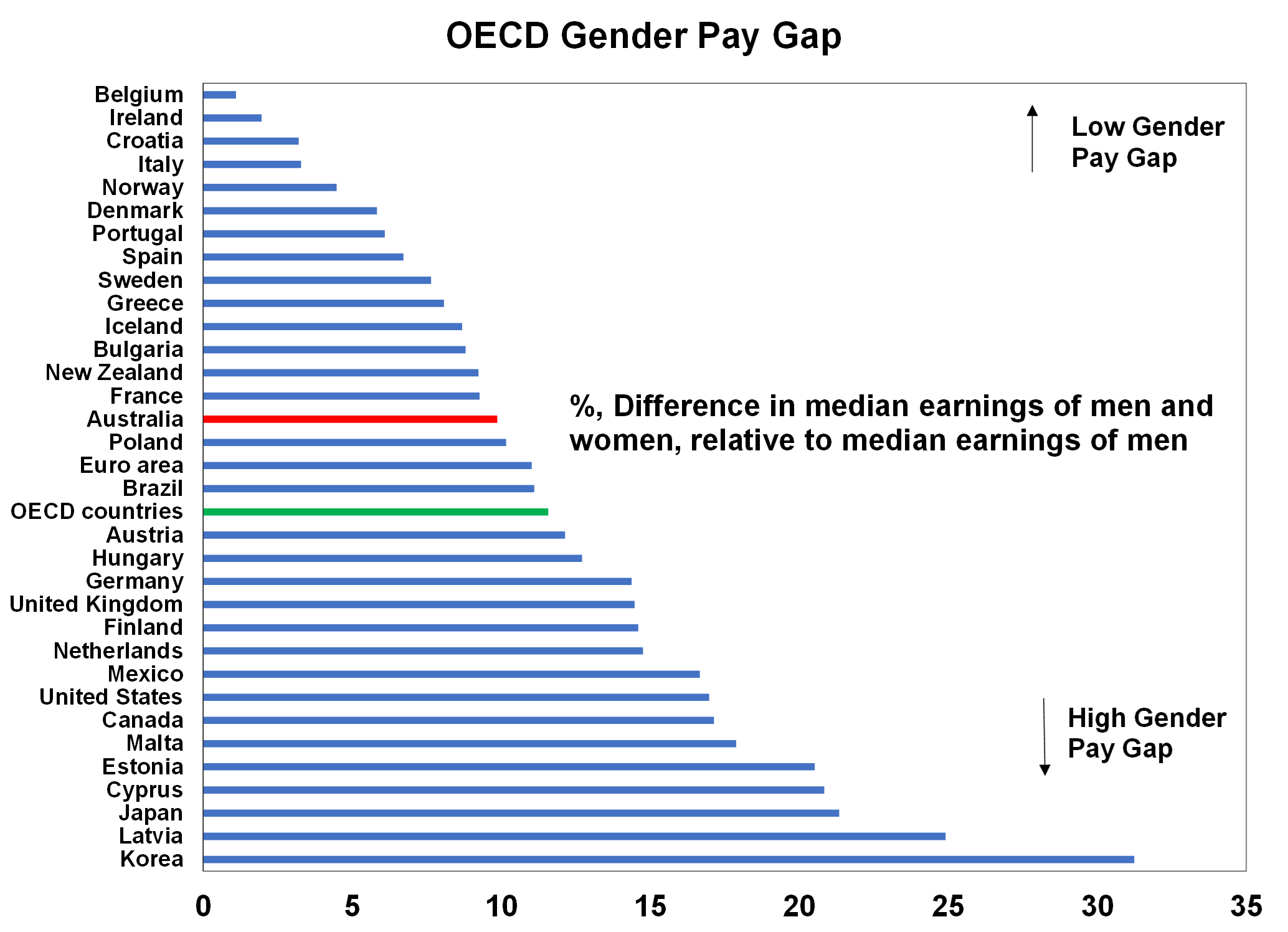

The gender pay gap refers to the difference in earnings from work for males and females for a full-time equivalent person. According to the OECD, there is an 11.6% difference in male and female pay across OECD countries (see the chart below) with Australia doing better than the average at 9.9%.

Source: ABS AMP

Source: ABS AMP

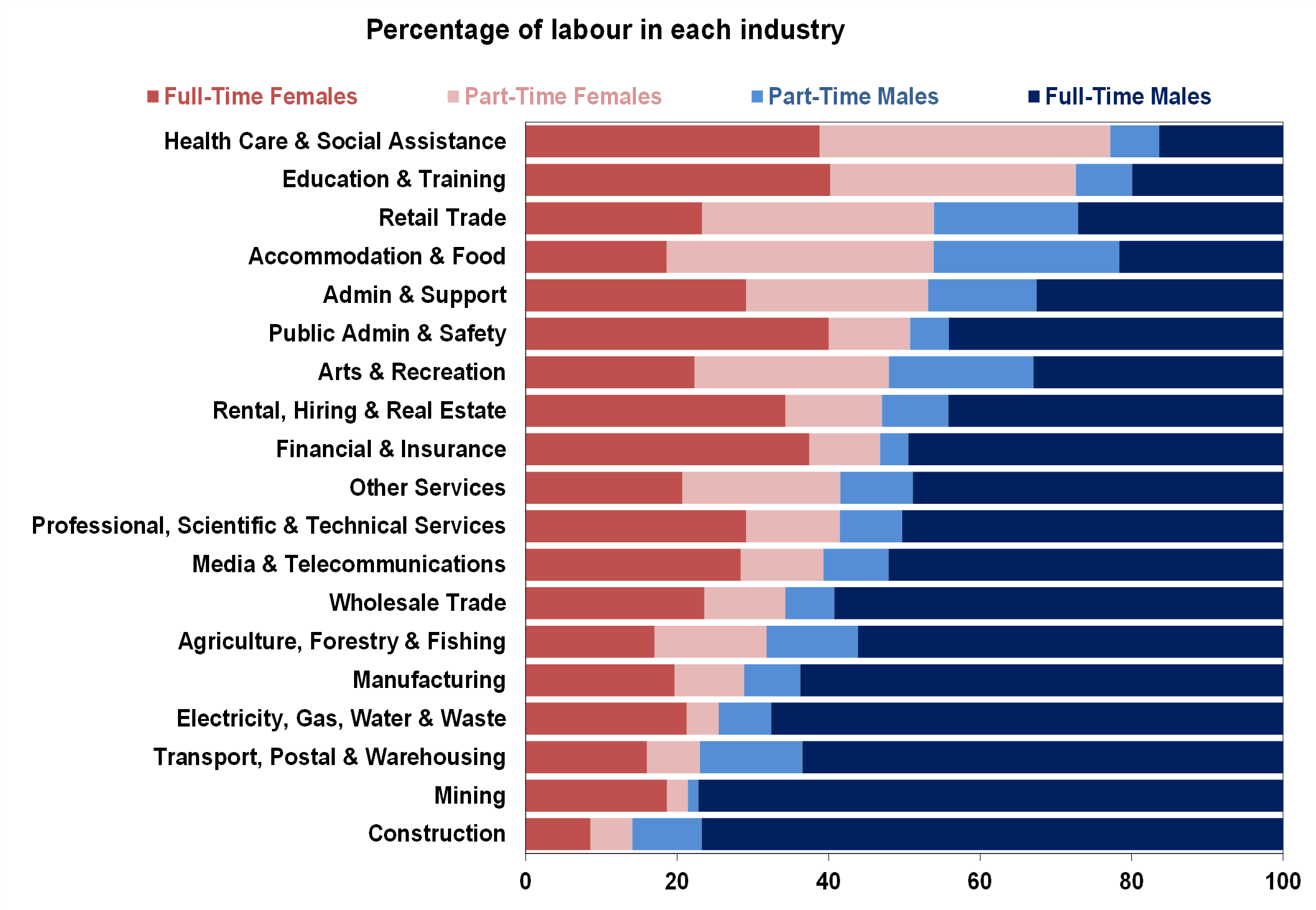

Unconscious gender biases in the workplace are still a big problem and need to be continually improved, but the other two main reasons for the difference in earnings between genders is the line of work undertaken and the decision to have children which takes time out of the workforce and can then result in a change of role or moving to part-time work. There is a significantly higher share of females in service-based industries (see the chart below) of health care and social assistance and education which are typically less lucrative, have higher flexibility around hours of work and require less travel requirements. While male dominance in manual industries like construction, mining, transport and postal, electricity, gas and water services and the manufacturing industries are typically paid higher rates because they are associated with less flexible hours and risky and manual work. There is probably also some societal bias that has typically placed less value on “softer” services skills.

Source: ABS AMP

Source: ABS AMP

The increasing importance of artifical intelligence means that both routine manual and routine cognitive jobs are at risk of being replaced which may impact male employment in these sectors which have a higher male full-time share. And an aging population means that the share of non-routine manual work will continue to rise which could help women. However, the larger share of males in the technology industry could mean that women are also left behind as technology increases in importance.

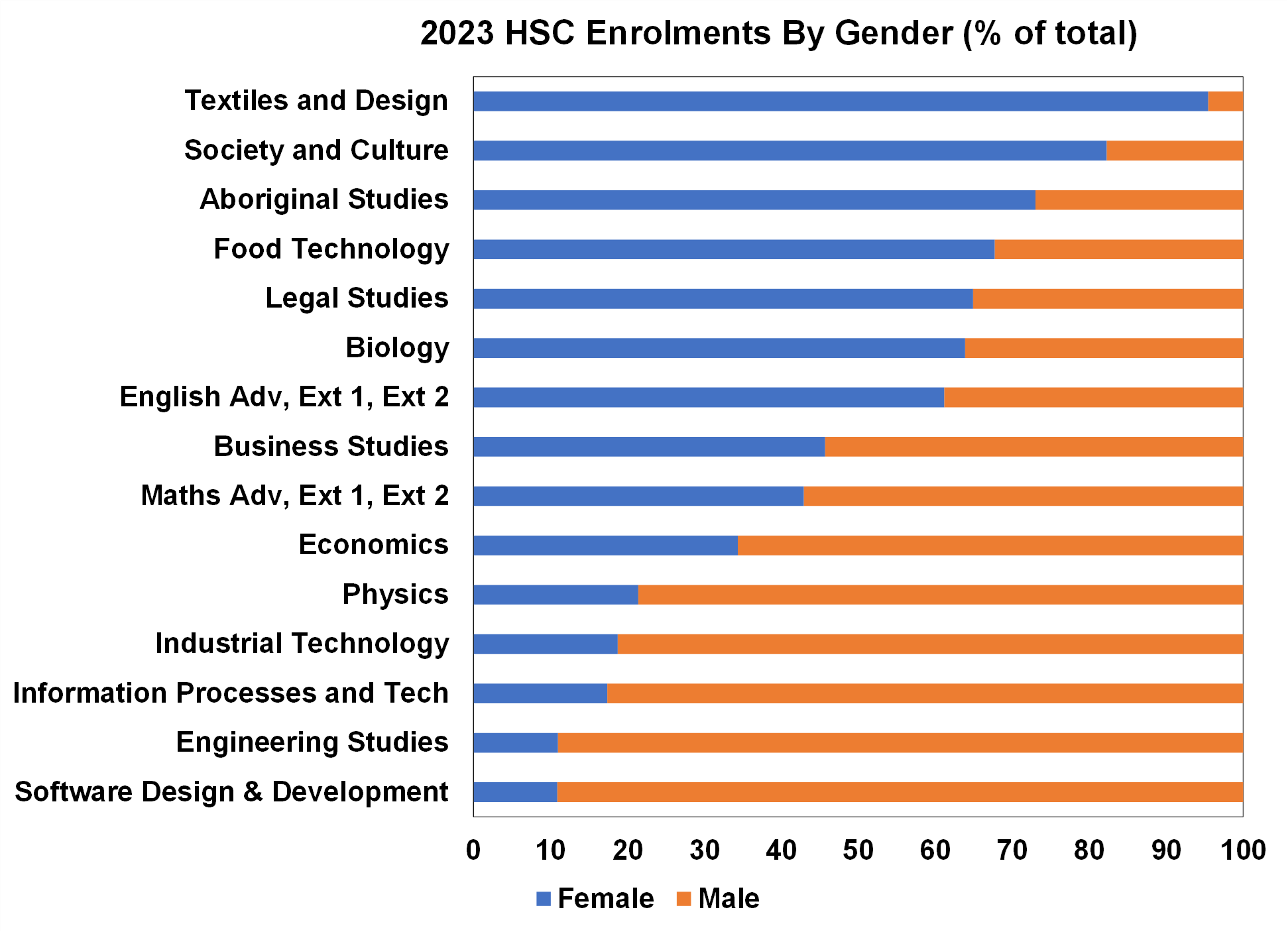

The difference in male and female job careers starts before the workplace. The chart below looks at HSC school enrollments in subjects with the biggest gender gaps. Females dominate in subjects like textiles and design, society and culture, Aboriginal studies and food technology while males significantly dominate in software design, engineerng studies and information processes and technology.

Source: NSW Government, AMP

Source: NSW Government, AMP

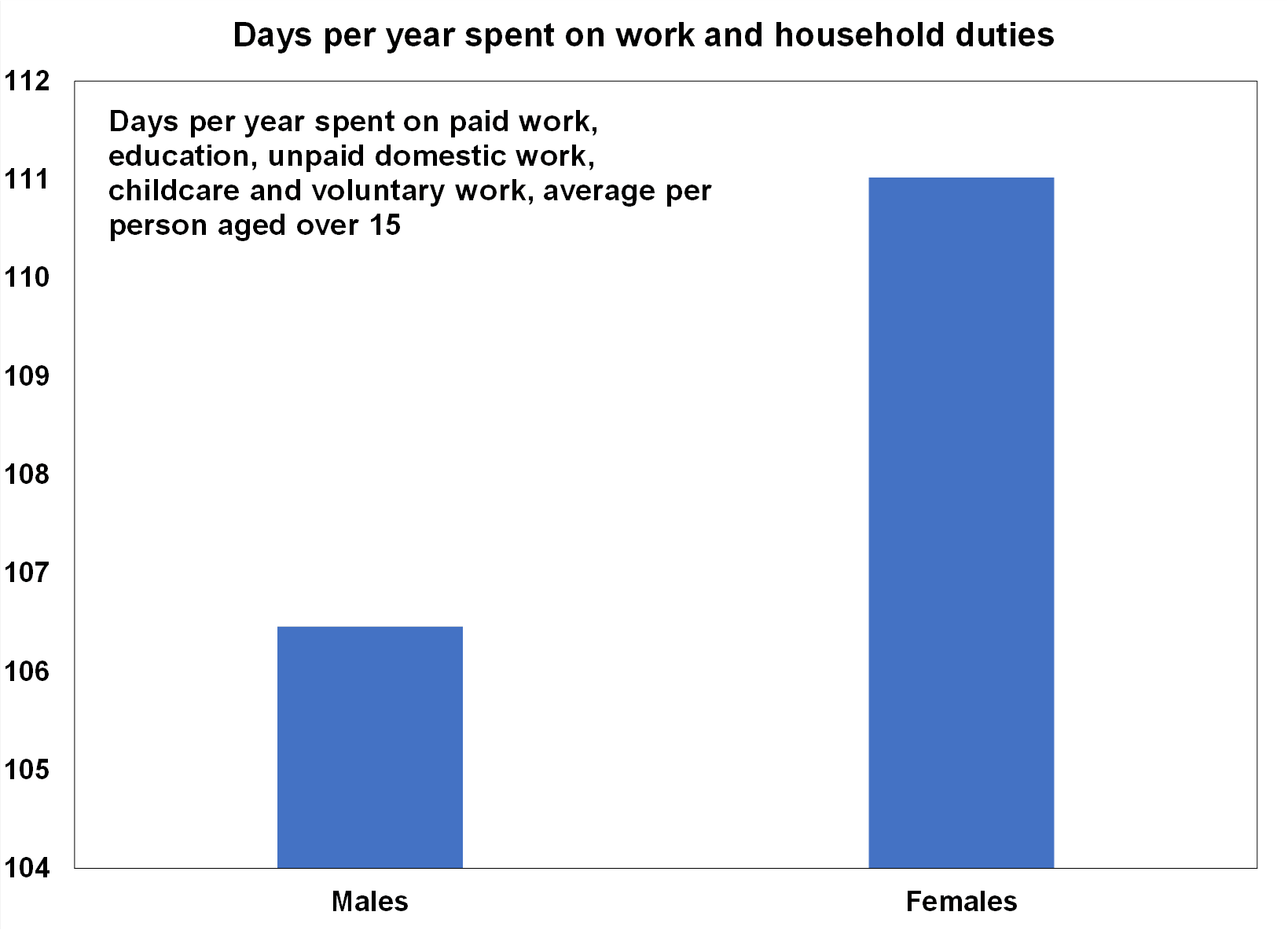

What policies can help these issues

From our point of view, there are three main areas that Australia needs to improve on to continue making progress on gender equaltiy. Firstly, there needs to be education around financial literacy starting at a primary school level, to lift financial literacy for women which is falling behind males as we have written about previously. Secondly, despite the recent postitive changes to childcare subsidies and the broadening of the paid parental leave scheme from the Labor government, there is still a need for more support for paid parental leave as Australian leave policies are not as generous compared to global peers that are having better results in reducing the gender pay gap. Early childcare funded by the private sector and government pre school funding is not sufficient. The countries that do the best on gender equality all have very generous parental leave schemes and universal access to early childcare. And lastly, there needs to be continued change in Australian society accepting men taking time off to look after the family and encouraging a more holistic perspective on the work-life balance as well as teaching girls the possible career pathways (and financial consequences) of the subjects that are taken at school. The countries that tend to do the best in terms of gender equality and life balance are those with very generous welfare systems (that allow long leave periods) where equality within the family is ingrained in the culture. Men also need to take more of a role in unpaid domestic work. While men (on average) work more hours per day than women which leaves less time for other home-based activities, once you include total “work” which includes paid work, education and all unpaid domestic work including childcare then females on average still “work” an additional 18 minutes a day comapred to men, which equates to 110 hours or 4.6 days per year which means less free time (and arguably more stress!).

Source: ABS, AMP

I hope you have enjoyed this week’s report. Please feel free to reach out for assistance with your investment journey.

Regards,

Head, Fixed Interest and Superannuation

JMP Securities

a. Level 3, ADF Haus, Musgrave St., Port Moresby NCD Papua New Guinea

p. PO Box 2064, Port Moresby NCD Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814