19 March, 2024

Welcome to this week’s JMP Report,

Last week saw 4 stocks trade on the local market. BSP traded 11,364 shares, closing 1t lower at K16.10, KSL traded 113,758 shares, trading steady to close at K2.90, STO traded 466 , closing 1t lower at K19.30 and NGP traded 12,039 shares, closing steady at K0.69.

WEEKLY MARKET REPORT | 11 March, 2024 – 15 March, 2024

| STOCK | QUANTITY | CLOSING PRICE | BID | OFFER | CHANGE | % CHANGE | 2023 INTERIM | 2023 FINAL DIV | YIELD % | EX-DATE | RECORD DATE | PAYMENT DATE | DRP |

| BSP | 1,346 | 16.10 | 16.10 | – | -0.01 | -0.06 | K0.370 | K1.060 | 8.92 | TUE 27 FEB 2024 | WED 28 FEB 2024 | FRI 22 MAR 2024 | NO |

| KSL | 113,758 | 2.90 | 2.90 | – | – | 0.00 | K0.097 | – | – | – | – | – | PA |

| STO | 466 | 19.30 | 19.30 | – | -0.01 | -0.05 | K0.314 | USD 0.175 | 4.91 | MON 26 FEB 2024 | TUE 27 FEB 2024 | TUE 26 MAR 2024 | – |

| NEM | – | 145.00 | 145.00 | – | – | 0.00 | – | USD 0.250 | 0.63 | MON 4 MAR 2024 | TUE 5 MAR 2024 | WED 27 MAR 2024 | – |

| KAM | – | 1.02 | 1.10 | – | – | 0.00 | K0.12 | – | – | – | – | – | YES |

| NGP | 12,039 | 0.69 | – | – | – | 0.00 | K0.0.3 | – | – | – | – | – | – |

| CCP | – | 2.11 | 2.10 | – | – | 0.00 | K0.110 | – | – | – | – | – | NO |

| CPL | – | – | – | – | – | 0.00 | – |

– | – |

– | – | – | – |

| SST | – | 45.00 | 36.46 | – | – | 0.00 | K0.35 | – | – | – | – | – | NO |

Dual listed PNGX/ASX Stocks

BFL – 5.66 -9c

KSL – 0.87 +2.7c

NEW – 50.80 -9c

STO – 7.26 -8c

On the interest rate front we saw the bank take 2.057bn out of the 7day Central Bank Bill market, this is a significant increase from past weeks. It will be interesting to see the trend over the next 2-3 weeks.

In the 364 day TBill market we saw the Bank issue 256m at an average of 3.15%, a slight increase from 3.13% the previous week, which left the market 57m oversubscribed. We are likely to see a GIS auction announcement late this week.

Other assets we like to monitor

Gold – 2155 -$24

Platinum – $939 +24

Silver – $25.19 +89c

Natural Gas $1.67

Bitcoin – 68,168 –1.08% (7day)

Ethereum – 3,467 –5.67

PAXGold – 2,119 -0.8%

What we’ve been reading this week

What is the Best Carbon Credit to Buy? A Buyer’s Guide

By Jennifer L and thank you Carbon Credit

A lot of people and organizations nowadays consider offsetting their emissions by buying carbon credits.

Unfortunately, it’s quite hard to know which carbon credits are effective and which ones aren’t. Also, the quality and price of the carbon reduction or removal processes involved may vary a lot.

Hence, we’d like to address the confusion about this concern through this guide article. It will help potential carbon credit buyers and other people interested in the space.

Why Do We Need to Buy Carbon Credits?

There are approximately 2.5 trillion tons of carbon equivalents released into the atmosphere since humans started emitting CO2. And still, we continue to release 50 billion tons of CO2eq each year, making global warming a dire concern.

So, individual leaders and companies around the world agreed to limit warming to a critical 1.5°C.

Massive GHG emissions reductions are vital so as not to exceed such a limit. Hence, people and businesses are taking drastic decarbonization measures to reduce emissions.

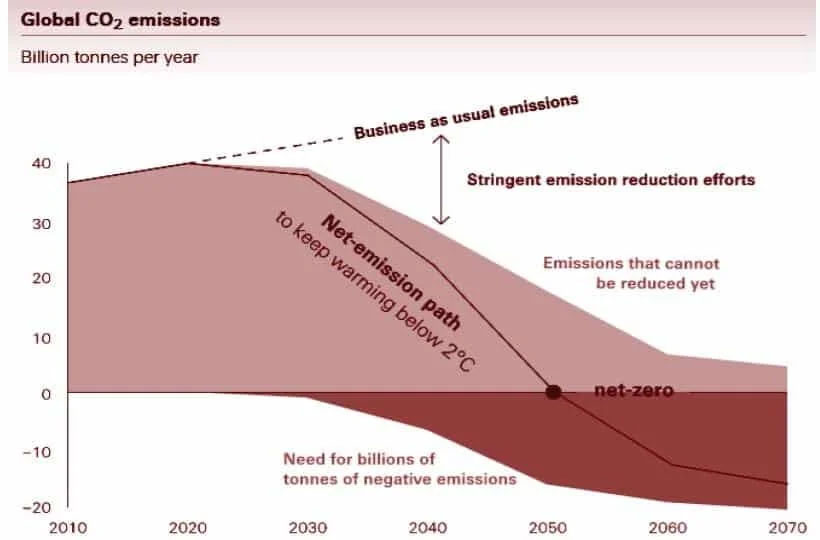

But reductions alone are not enough. We still need to remove a lot of carbon from the air to prevent catastrophic climate change. This entails stopping emissions and removing at least 6 billion tonnes of CO2eq per year by 2050.

The following chart shows how the world can reach net-zero by 2050.

Source: IPCC Climate Change Report

How to Buy Carbon Credits: Compliance vs. Voluntary Carbon Markets

It’s clear that for the world to continue doing business, offsetting emissions either by reduction or removal is a must.

How do you buy carbon offsets for your personal or organizational emissions?

There are two major means to do that. You can buy carbon credits through the compliance/regulated market or the voluntary carbon market (VCM).

Compliance or regulated carbon market

This carbon market is born out of the laws mandating reductions. It’s managed by emission trading systems (ETS) such as the EU ETS.

The compliance carbon market is also called the cap and trade system that dwarfs the size of the VCM. For 2021, the compliance market value hit $851 billion while the VCM reached its target value of $1 billion.

The cap and trade system is well regulated and seems to be more stable than the VCM.

Voluntary carbon market

The VCM has been operating for many years now but it grew so fast due to the Paris Agreement, calling on drastic corporate net-zero pledges.

In fact, governments and corporations had committed over USD 14 trillion in carbon credit sales.

Entities need to do various decarbonization actions to net their emissions to zero. The most common way is to buy carbon credits that correspond to the amount of CO2 emissions reduction allowed.

For the purposes of this guide, we focus on the VCM due to its rapid growth but lack of transparency and confusion in buying carbon offsets in this market.

Purchasing Carbon Credits in the VCM

Issuance of carbon offsets in the VCM is either through the carbon reduction or CO2 removal pathway. Here are the most common pathways for both options of buying carbon credits.

Carbon Reduction Pathway:

Carbon credits issued via this pathway mean the emitted CO2 is still hanging in the air. This is because the carbon offsets include an emission avoidance relative to an entity’s baseline emission. The amount of reduction needed is based on the current total emissions.

There are different types of carbon reduction credits available right now. But here are the three major ones worth considering.

- Community-based energy efficiency:bio-based energy sources like biogas and clean cooking solutions.

- Renewable energy:replacement for fossil fuel energy sources (hydro, solar, wind, and geothermal).

- Forestry-based avoidance(REDD+): management and conservation of forests to cut emissions.

Carbon Removal Pathway:

Unlike carbon credits that reduce emissions through green projects, carbon removal is different. It sucks in CO2 from the air using different processes and stores it underground for good. Hence, the net effect is zero or even negative.

The following are the three common carbon removal types and their corresponding technologies:

|

Types of Carbon Removal |

Available Technologies/Projects |

|

Nature-based removal and storage/use |

· Afforestation and reforestation · Soil carbon sequestration · Blue carbon habitat restoration · Seaweed and algae cultivation and burial |

|

Technological removal and storage/use |

· Direct air capture (DAC) and storage/use · Enhanced weathering · Concrete building materials · Hydro-carbon fuels · CO2-enhanced oil recovery (EOR) |

|

Hybrid removal and storage/use |

· Biochar · Bioenergy with carbon capture and storage (BECCS) · Building with biomass |

Now that the major carbon reduction and removal pathways have been identified, it’s time to learn how to assess them using a set of criteria.

Criteria for Evaluating Different Carbon Credits

There are four evaluation criteria that carbon credit buyers can use to guide their purchasing decision. These are additionality, permanence, measurability, and sustainability.

Let’s break down each criterion and discuss it in detail to guide you well.

Additionality: likelihood to sell the credits

A carbon reduction or removal is “additional” if it would not have happened without the carbon credit market.

This criterion is crucial when evaluating which carbon offsets to buy. It affects the quality of a particular carbon credit. This is because buying credits to offset an entity’s own emissions may only worsen the climate if the reductions are not additional.

An essential concept when considering the additionality of carbon credits is the “likelihood to sell the credits”. It plays a decisive role in implementing the reduction/removal.

There is a catch, however, when determining the additionality of carbon credits. It’s subjective and its determination uses educated predictions only, not solid facts.

As such, deciding on this criterion is uncertain but it’s possible by considering the risk.

How likely is a specific project to be additional?

A project has no additionality if it would have occurred even in the absence of carbon credit. Conversely, it has high additionality likelihood if it will not probably be realized without the carbon credit.

By definition, most carbon removals today have high additionality as they rely on carbon credits to work.

Permanence: duration and risk of leakage

This criterion considers the fact that most CO2 emitted today will not be 100% removed later. About 25% of it stays in the air for over a hundred years.

Thus, buying carbon credits to offset emissions has one major challenge – its effects are very lasting. And so, high-quality credits are the ones that go with reductions/removals that are permanent.

For example, a carbon project that uses a forest to cut down emissions may not be permanent but temporary. This is because when a fire burns down the protected trees, the CO2 will be emitted back into the atmosphere.

In this case, a reversal of the bought carbon credits occurs and no net reduction really happens.

Thus, duration and risk level of leakage are the key concepts when considering the permanence of the carbon reduction/removal pathway.

Projects that have no or low leakage risk and last for over a century are highly permanent. But the ones that have a high risk of leakage and effects that stay less than 100 years are temporary.

Measurability: data availability and verification

This third criterion is also important in knowing the quality of carbon credits to buy. The reported reductions must be accurate and verifiable.

In particular, overestimation of GHG reductions should not occur. Otherwise, the measurability of the data won’t be reliable.

When evaluating a project’s measurability, here are the red flags to watch out for:

- Overestimation of baseline emissions(reference against which reductions are measured)

- Underestimation of actual emissions(results in overestimation of reductions)

- Failure to account for projects’ indirect effectsor unintended increases (leakage) in emissions

- Forward crediting(credits issued for future reductions; may cause over-issuance of carbon credits)

To avoid those undesirable scenarios, it’s critical that project developers track and verify their data. This calls for scientific measurement and data collection verification through standardized processes.

Projects that have no data to verify have poor measurability while those with high-quality and verified data have good measurability.

Scalability: short term vs. long term

Lastly, a carbon reduction or removal project’s scalability depends on several factors. These include CO2 removal capacity, level of readiness for deployment, and cost-effectiveness.

Take for instance the case of direct air capture, a technological carbon removal.

DAC has the capacity to offer a more permanent CO2 storage than an afforestation project. Land availability is also not an issue with DAC but it’s energy-intensive and is not yet ready for scale-up.

On the contrary, afforestation is both ready to scale and capable of removing CO2 right now. But land availability might be a problem later on. So, evaluating a project’s scalability involves the aspects of short-run and long-run terms.

Projects have high scalability score if they are scalable both in the short-term and long-term. The ones that are scalable only in the short term have poor scalability.

The Price

One more crucial evaluation criterion when buying carbon credits is the price.

Unfortunately, there’s no single price per ton of CO2eq reduced or removed in the VCM like in the compliance market.

There are various factors that affect the price of credits in the VCM. The two major ones are project costs and the pathway’s value chain. The value chain aspect includes project developers, verification agencies, and the buyer.

Other key price influencers are the demand and supply dynamics. If demand exceeds supply, prices for high-quality carbon credits tend to be high.

Here is our live carbon pricing for the major compliance markets as well as for the big voluntary markets.

The Bottom Line

In summary, this guide focuses on the four quality criteria and the price of carbon credits for reduction and removal projects. These factors are very useful in evaluating which carbon credits to buy.

Yet, other considerations are to make when investing in carbon offsets. Here are some of them:

- Credit availability– demand for high-quality credits is more than supply in the VCM right now

- Own emission reduction goals– internal net-zero pathways

- Other social and environmental impacts– nature protection and community livelihood creation

So obviously, there’s no single way to build a carbon reduction/removal portfolio. There’s a multitude of considerations to think about how and where to buy carbon credits.

But one thing to remember is that the pathways identified are all relevant for the world to be at net-zero.

It’s up to the emitter which ones are the best to invest in and be carbon guilt-free.

Issues Facing US Lithium Projects and Battery Supply Chain Plans Amidst Price Decline

By Jennifer L and thank you Carbon Credits

Financing for lithium projects in the United States is facing challenges due to sustained low lithium prices, posing a threat to the development pipeline and potentially hindering President Joe Biden’s ambition to bolster the domestic battery supply chain.

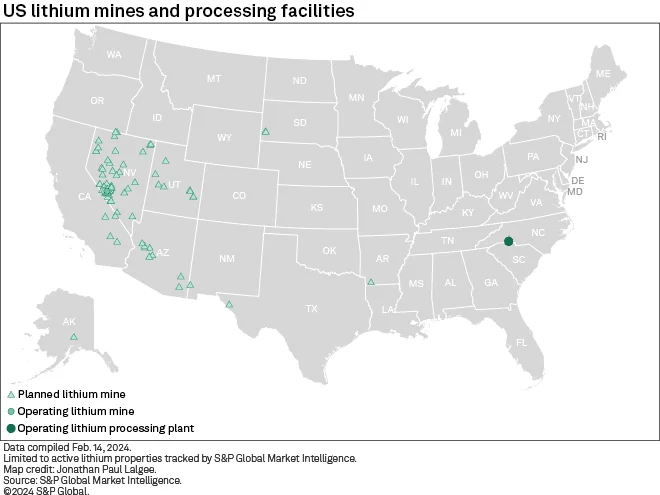

According to the S&P Global Market Intelligence report, there are about 100 lithium mine projects planned across the US. However, the allure of these projects is waning amidst a steep decline in lithium prices.

Navigating the Lithium Price Plunge

The sharp price decline has left many investors perplexed, particularly given the projected long-term demand for the mineral. Experts noted that it’s largely attributable to the slowdown in electric vehicle sales growth in China. This is also further compounded by the overall economic slowdown in the Chinese economy.

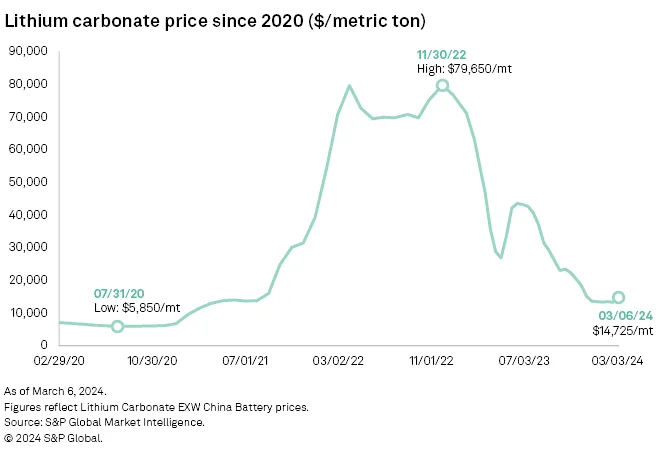

Market Intelligence data reveals an 81.7% drop in lithium prices from their 2022 peaks. This downturn made many projects less attractive to investors as the prolonged low prices persisted.

Existing US lithium producers, particularly those using brine extraction methods rather than hard rock resources, have managed to weather the price downturn to some extent.

Current producers have learned to adapt to the changing market conditions. Some employed cost-cutting measures, like what Albemarle did, while others are scaling back on their expansion plans.

However, the impact of the market downturn has been felt more keenly within the pipeline of future lithium output projects.

Additionally, junior companies seeking to develop lithium projects in the US and elsewhere have encountered difficulties securing funding amidst bearish market sentiment due to the price decline.

The financing hurdles confronting US lithium projects underscore the delicate balance between market dynamics and the imperative to strengthen domestic supply chains for critical battery materials.

Per Market Intelligence data, the price of lithium carbonate ex-works China battery stood at $14,750 per metric ton on March 6, down from its 2022 peak of $79,650/t on Nov. 30. Despite remaining 151.7% higher than the 2020 low of $5,850/t on July 31, current prices are not attractive for launching new projects.

Industry Insights and Uncertainties

The impact of low commodity prices on US lithium projects is significant in project development, particularly among smaller operators. These companies are finding it increasingly difficult to access funding due to concerns over returns.

Still, a junior Canadian lithium company, Li-FT Power (LIFT: LIFFF), remains committed to advancing the exploration and development of high-quality lithium assets in the country. It consolidates and advances hard rock lithium pegmatite projects in known lithium districts in Canada.

Keith Phillips, the CEO of Piedmont Lithium based in North Carolina, shared insights on lithium mining, describing it as a cyclical industry prone to fluctuations. In an interview, Phillips remarked on the significant downturn in lithium prices, saying:

“With lithium prices down by 90% from a peak 16 months ago, just about every new development project is slowing down, which will lead to another supply crunch.”

The uncertainty surrounding demand poses a significant challenge for the lithium industry. While increased demand for reliable lithium, spurred by the US Inflation Reduction Act, could provide some relief to the industry, there are concerns about the limited progress in the project development due to low prices.

This issue could potentially undermine the Biden administration’s objectives of reshoring critical supply chains. The IRA’s incentives should be able to adequately address this with proper incentives to promote domestic mining.

The Role of IRA and Investments

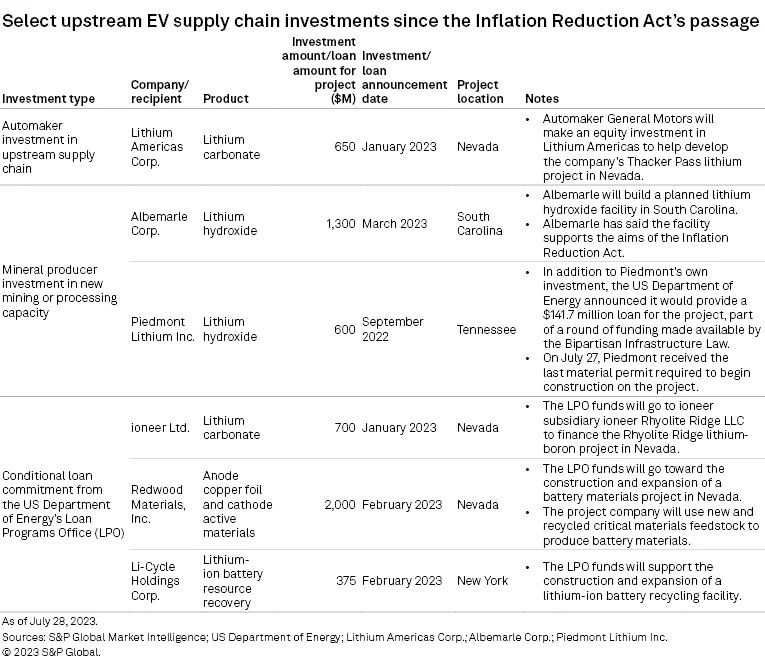

The law’s incentives have attracted massive investment into the US battery supply chain, which was largely underdeveloped before the bill’s passage. Electric vehicles (EVs) that meet specific requirements related to final assembly, critical mineral sourcing, and battery material processing may qualify for a $7,500 tax credit under the IRA.

The rule has led to a notable increase in investments in domestic critical mineral projects by both miners and automakers. For instance, Piedmont Lithium Inc., a US-based lithium producer, was motivated to establish a lithium processing plant in Tennessee. Moreover, its lithium project in North Carolina is also expected to start this year.

Ford Motor has planned to allocate $3.5 billion to construct a battery plant in Michigan, citing the IRA as a significant factor influencing this decision. Ford has also entered into supply agreements with several lithium companies in countries with free trade agreements with the US.

This strategic move enables the automaker to incorporate materials from these countries into its vehicle batteries while still qualifying for tax credits under the IRA. Similarly, Tesla Inc., the EV giant, has established supply agreements with multiple miners, including Piedmont and Albemarle.

Below is the investments to EV supply chain since the IRA has been enacted.

While there’s a strong demand for IRA-compliant material, the supply remains insufficient, according to Benchmark’s Williams. Albemarle CEO Kent Masters echoed this sentiment by expressing doubts about the effectiveness of the IRA in stimulating necessary investments.

Masters emphasized that the law has not yet succeeded in bridging the pricing gap between China and North America. It means that further measures may be necessary to incentivize investment in domestic lithium production.

BlackRock Highlights Forces Shaping Low-Carbon Transition Investment Mega Trend

ENERGY TRANSITION/ INVESTORS

Mark Segal March 13, 2024

Investment giant BlackRock outlined a series of key developments that it expects to impact low-carbon transition-related investment opportunities and risks in 2024, including falling battery prices, upcoming elections, and rising physical climate risks, in a new report released by its insights and market commentary unit, BlackRock Investment Institute.

The new report follows the identification of BlackRock of the low-carbon transitionlate last year as one of a few key “mega forces” that it expects to drive “major investment opportunities” over 2024, calling out specific infrastructure-related areas including clean energy and electrification, with a “massive reallocation of capital” expected to be driven by the need to rewire energy systems, as well as investment opportunities in climate resilience, or the preparation and adaptation to climate hazards and rebuilding after climate-related damage.

One of the key “potentially market-moving developments” highlighted by the new report includes the continued long-term reduction in battery prices, with drivers including an 80% drop in lithium prices, intense competition and technological advancements anticipated to lead to further sharp price cuts. BlackRock notes the potential for lower battery prices to feed through to final purchase prices for clean technologies such as power grid energy storage systems and electric vehicles.

The report also notes a series of elections in 2024, including in the U.S., EU and India, with results having significant implications on policy as governments balance often competing objectives such as decarbonization, energy security and energy affordability, which will likely impact areas including clean technology, as well as “the path of the low-carbon transition more broadly.”

Additionally, the new report highlights the potential for physical damage from extreme weather events – noting the World Meteorological Organization’s recording of 2023 as the hottest year on record – to drive an increase in interest in climate resilience as a new investment theme. Examples of opportunity areas noted in the report included “early monitoring systems for floods, air conditioning to cope with heatwaves or retrofitting buildings to better withstand extreme weather.”

In the report, BlackRock said:

“Bottom line: We think falling battery prices could boost the EV and energy storage industries this year. Much depends on the direction of global transition policy after key elections as we weigh transition-related investment opportunities and risks. As physical climate risks mount, we believe climate resilience could come to the fore as an investment theme.”

I hope you have enjoyed this week’s read, please feel free to reach out if you wish to discuss your investment journey.

Regards,

Head, Fixed Interest and Superannuation

JMP Securities

a. Level 3, ADF Haus, Musgrave St., Port Moresby NCD Papua New Guinea

p. PO Box 2064, Port Moresby NCD Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814