3 April, 2024

Hello and welcome to this week’s JMP Report,

On the equity front last week we saw 4 stocks trade on the local market. BSP traded 2,299 shares closing 2t higher at K16.12, KSL traded 788,793 shares closing 5t higherat K2.95, STO traded 5,386 shares, closing 6t higher at K19.36 and KAM traded 3,215 shares, closing 12t higher at K1.15.

WEEKLY MARKET REPORT | 25 March, 2024 – 29 March, 2024

| STOCK | QUANTITY | CLOSING PRICE | BID | OFFER | CHANGE | % CHANGE | 2023 INTERIM | 2023 FINAL DIV | YIELD % | EX-DATE | RECORD DATE | PAYMENT DATE | DRP |

| BSP | 2,299 | 16.12 | 16.13 | – | 0.02 | 0.12 | K0.370 | K1.060 | 8.87 | TUE 27 FEB 2024 | WED 28 FEB 2024 | FRI 22 MAR 2024 | NO |

| KSL | 788,793 | 2.95 | 2.95 | – | 0.05 | 1.69 | K0.097 | K0.159 | 8.82 | TUE 4 MAR 2024 | WED 6 MAR 2024 | MON 15 APR 2024 | PA |

| STO | 5,386 | 19.36 | 19.36 | – | 0.06 | 0.31 | K0.314 | K0.660 | 5.04 | MON 26 FEB 2024 | TUE 27 FEB 2024 | TUE 26 MAR 2024 | – |

| NEM | – | 145.00 | 145.00 | – | – | – | – | USD 0.250 | 0.63 | MON 4 MAR 2024 | TUE 5 MAR 2024 | WED 27 MAR 2024 | – |

| KAM | 3,215 | 1.15 | 1.15 | – | 0.13 | 11.30 | K0.12 | – | – | – | – | – | YES |

| NGP | – | 0.69 | – | – | – | 0.00 | K0.0.3 | – | – | – | – | – | – |

| CCP | – | 2.11 | 2.12 | – | – | 0.00 | K0.110 | K0.131 | 6.21 | FRI 22 MAR 2024 | WED 27 MAR 2024 | FRI 19 APR 2024 | NO |

| CPL | – | – | – | – | – | – | – |

– | – |

– | – | – | – |

| SST | – | 45.00 | 36.46 | 50.00 | – | 0.00 | K0.35 | K0.60* | 1.33 | – | – | – | NO |

Dual Listed PNGX/ASX Stock

BFL – 5.74 +19c

KSL – 89c +1c

NEM – 53.71 +88c

STO – 7.75 +25c

On the Interest Rate front

In the short end we saw the 7 day Central Bank Bill rate offered at 2% with the Bank taking 1.9bn out of the market. The 364 day TBill auction was a little softer with the rates averaging 3.29%

In the long end, the results of the GIS auction were a little soft with the overall auction undersubscribed by 144mil. The 10yr were well bid volume wise with the range of bids between 5.80% and 6.00% with the average at 5.87%. I have attached the results for your interest.

Download Auction Results

Other assets we like to monitor.

Gold – 2,241 – +72c

Silver – 24.97 – +25c

Palladium – 999 – +6c

Platinum – 900 – -$2

Bitcoin – 69,390 -1.84%

Ethereum – 3472 -4.42%

What we’ve been reading this week

Seven lasting impacts from the COVID pandemic

Dr Shane Oliver – Head of Investment Strategy and Economics and Chief Economist, AMP Investments

Key points

– Seven key lasting impacts from the Coronavirus pandemic are: “bigger” government; tighter labour markets; reduced globalisation and increased geopolitical tensions; higher inflation; worse housing affordability; working from home; and a faster embrace of technology.

– On balance these make for a more fragmented and volatile world for investment returns. But it’s not all negative.

Introduction

It’s four years since the COVID lockdowns started. The pandemic ended when it morphed into the less deadly Omicron variant in late 2021, but just as a sound can reverberate around a room the effects of the pandemic continue to reverberate in economies. Putting aside the long-term health impacts this note looks at 7 key lasting economic impacts.

#1 Bigger government and more public debt

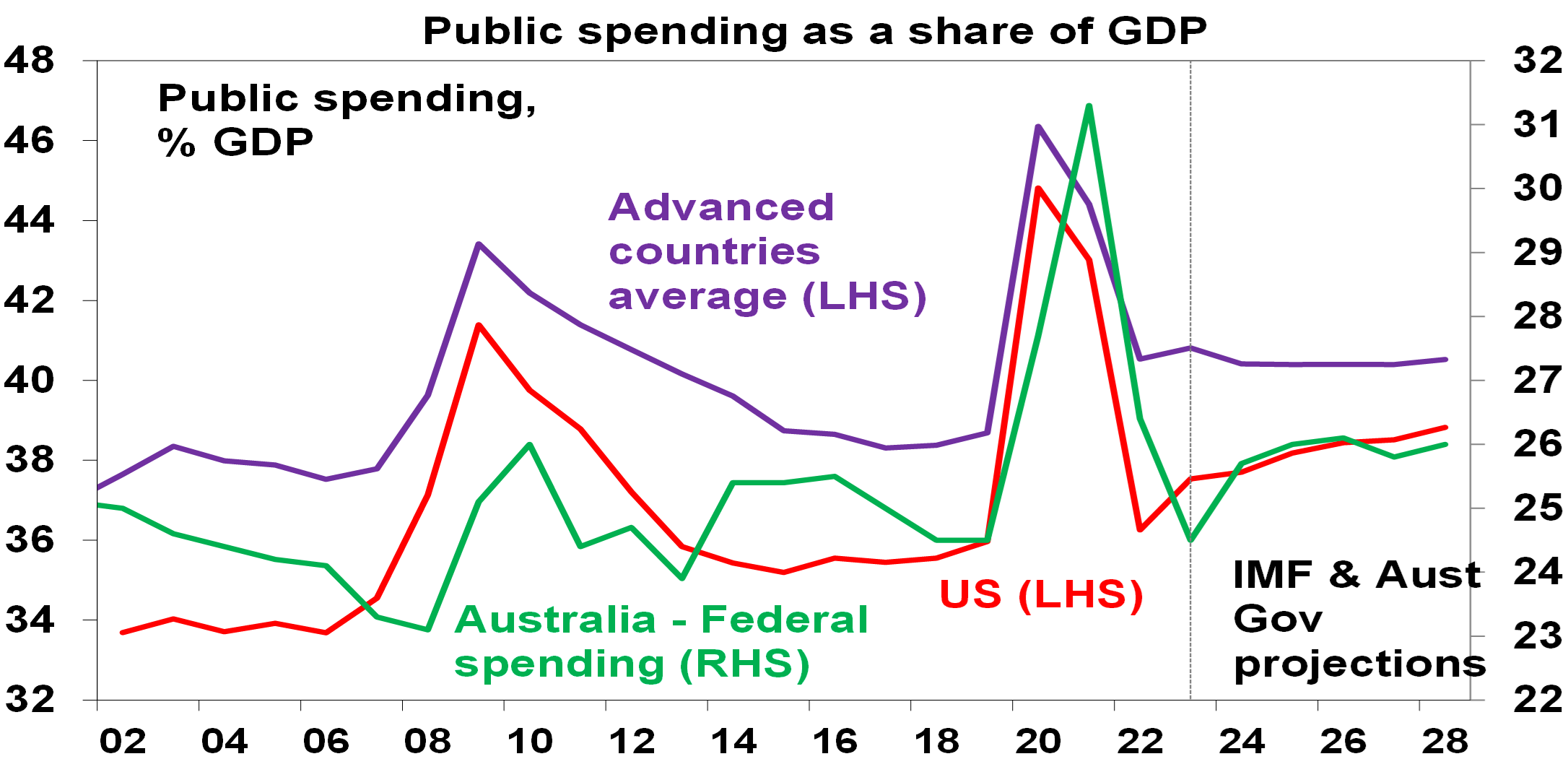

The malaise of the 1970s ushered in “smaller” government in the 1980s in the Thatcher, Reagan, Hawke and Keating era. But the political pendulum started to swing back to “bigger” government after the GFC & COVID has given it another push. Memories of the problems of high government intervention in the 1970s have faded and there is rising support for the view that government is the solution to most problems – via regulation, taxes, spending or education campaigns. The pandemic added to support for “bigger” government: by showcasing the power of government to protect households and businesses from shocks; enhancing perceptions of inequality; and adding support to the view that governments should ensure supply chains by bringing production back home. It’s combining with a desire for governments to pick & subsidise clean energy “winners”.

Source: IMF, Australian Government, AMP

Source: IMF, Australian Government, AMP

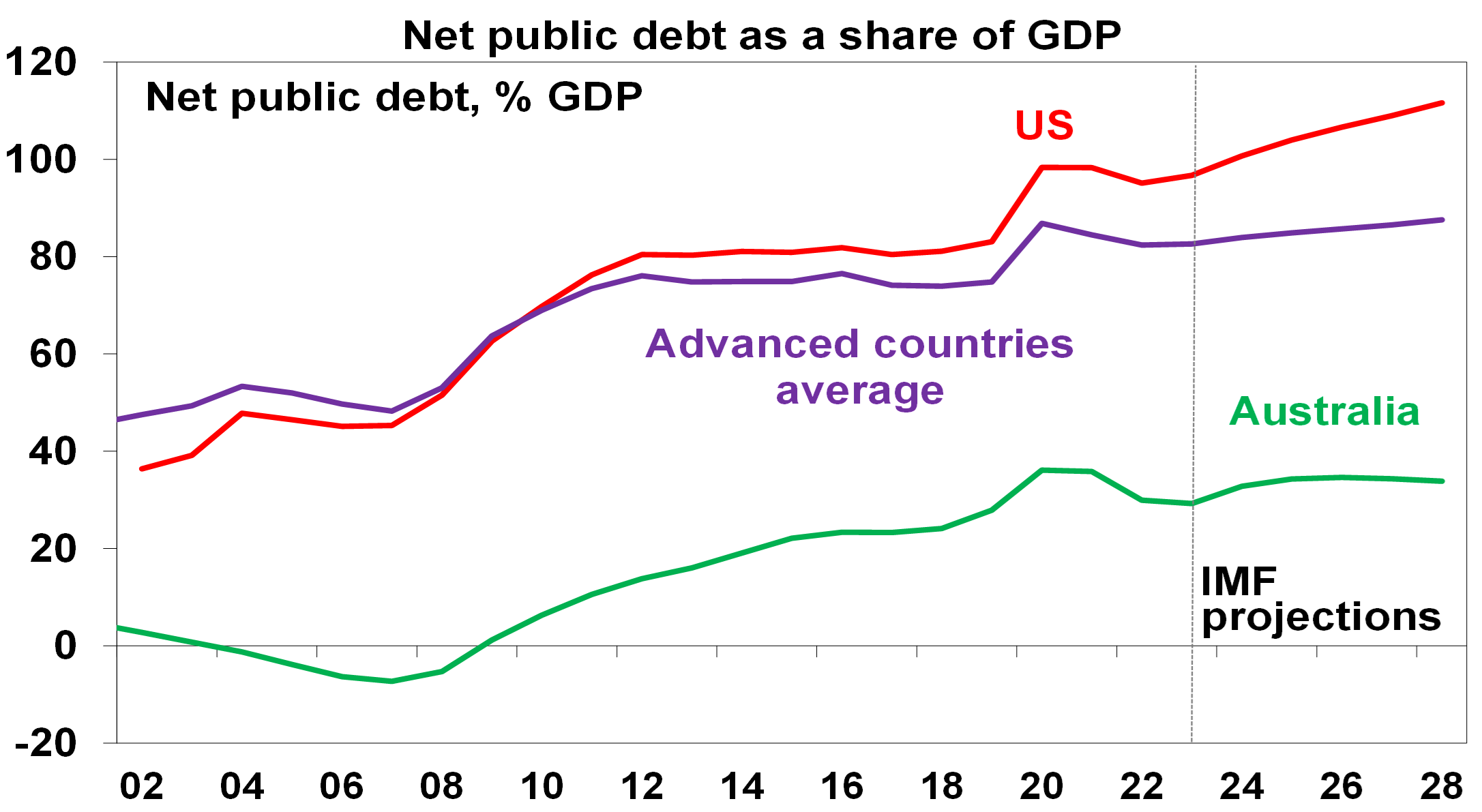

IMF projections for government spending in advanced countries show it settling nearly 2% of GDP higher than pre-COVID levels. The success of governments in protecting households from the worst of the pandemic has also reinforced expectations they would do the same in the next crisis. The pandemic ushered in even bigger public debt just as the GFC did. While high inflation helped lower debt to GDP ratios in 2022 it’s settling at higher levels than pre-pandemic.

Source: IMF, AMP

Source: IMF, AMP

Implications – While there may initially be a feel good factor, the long-term outcome of “bigger” government is likely to be less productive economies, lower than otherwise living standards and less personal freedom. It will take time before this becomes apparent though. Meanwhile, higher public debt means: less flexibility to respond with fiscal stimulus to a crisis; a greater incentive for politicians to inflate their way out; and interest payments being a high share of tax revenue.

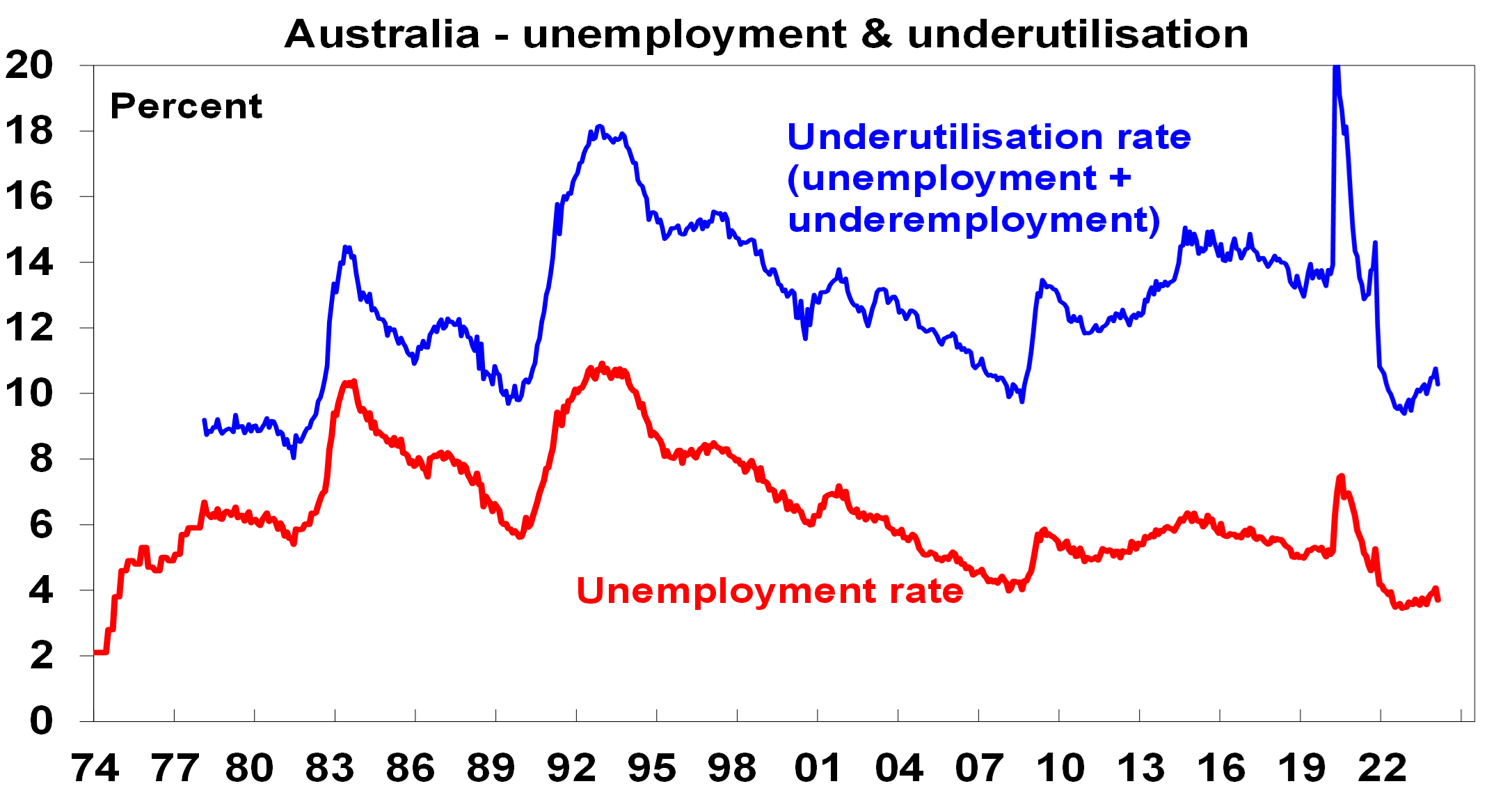

#2 Tighter labour markets and faster wages growth

In the pre-pandemic years, wages growth was relatively low, & a key driver was high levels of underemployment, particularly evident in Australia. After the pandemic, labour markets have tightened reflecting the rebound in demand post pandemic, lower participation rates in some countries and a degree of labour hoarding as labour shortages made companies reluctant to let workers go. As a result, wages growth increased, possibly breaking the pre-pandemic malaise of weak wages growth.

Source: ABS, AMP

Source: ABS, AMP

Implications – Tighter labour markets run the risk that wages growth exceeds levels consistent with 2 to 3% inflation.

#3 Reduced globalisation/more geopolitical tensions

A backlash against globalisation became evident last decade in the rise of Trump, Brexit and populist leaders pushing a nationalist gender when the benefits of free trade were being questioned. Also, geopolitical tensions were on the rise with the relative decline of the US and faith in liberal democracies waning resulting in a shift from a unipolar world dominated by the US, to a multipolar world as regional powers (Russia, Iran, Saudi Arabia and notably China) flexed their muscles. The pandemic inflamed both: with supply side disruptions adding to pressure for the onshoring of production; conflict over the source of and management of coronavirus; it heightened tensions between the west and China; and it appears to have added to nationalism and populism. So, the days of global free trade agreements and falling defence spending seem long gone for now. Rather we are seeing more protectionism (eg with subsidies and regulation favouring local production) and increased defence spending.

Implications – Reduced globalisation risks leading to reduced potential economic growth for the emerging world and reduced productivity if supply chains are managed on other than economic grounds. And combined with increased geopolitical tensions resulting in more defence spending it could result in a more inflation prone world than was the case.

#4 Higher prices, inflation and interest rates

A big downside of the pandemic support programs was the surge in inflation. The combination of massive money printing along with a big increase in government payments to households (eg, Job Keeper) resulted in a massive boost to spending once lockdowns were lifted which combined with supply chain disruptions, also flowing from the pandemic, to cause a surge in inflation. Inflation is now starting to come under control as the monetary easing and spending boost has been reversed and supply has improved again but the pandemic has likely ushered in a more inflation prone world by: boosting “bigger” government; adding to a reversal in globalisation; and adding to geopolitical tensions. All of which combine with aging populations to potentially result in more inflation.

Implications – Higher inflation than seen pre-pandemic means higher than otherwise interest rates over the medium term which reduces the upside potential for growth assets like shares and property.

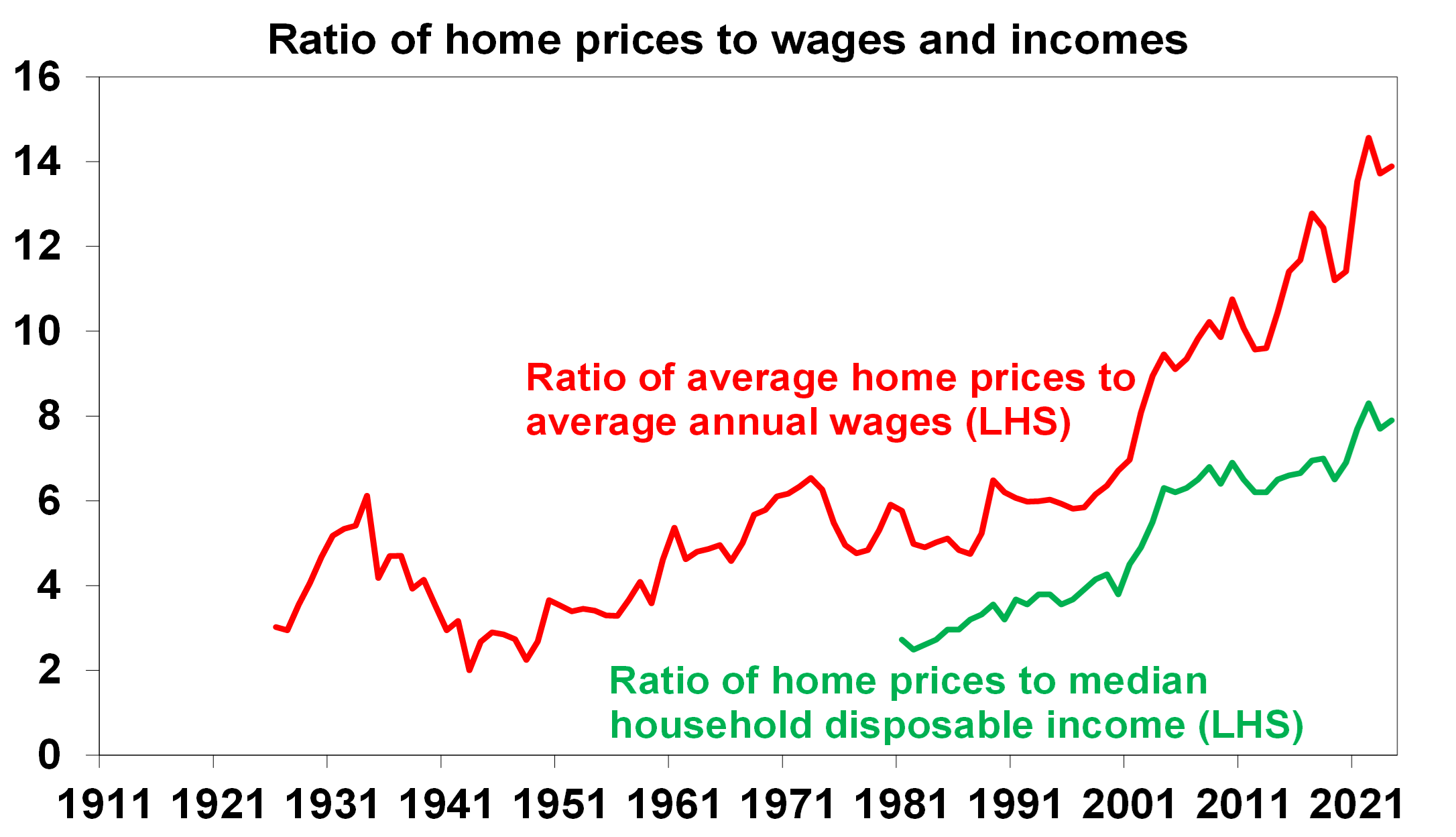

#5 Worse housing affordability

At the start of the pandemic, it was thought the economic downturn and higher unemployment and a freeze in immigration would cause a collapse in home prices and they did initially fall. But not by much as it was quickly turned around by policy measures to support household income, allow a pause in mortgage payments and slash interest rates and mortgage rates to record lows. What’s more the lockdowns and working from home drove increased demand for houses over units and interest in smaller cities and regional locations. As a result, Australian home prices surged to record levels. Meanwhile the impact of higher interest rates in the last two years on home prices was swamped by housing shortages as immigration surged in a catch up. The end result is now record low levels of housing affordability for buyers (who are hit by a double whammy of higher prices relative to incomes – see the next chart – and higher mortgages rates) and renters (who have seen surging rents).

Source: ABS, CoreLogic, AMP

Source: ABS, CoreLogic, AMP

Implications – Ever worse housing affordability means ongoing intergenerational inequality and even higher household debt.

#6 Working from home likely here to stay

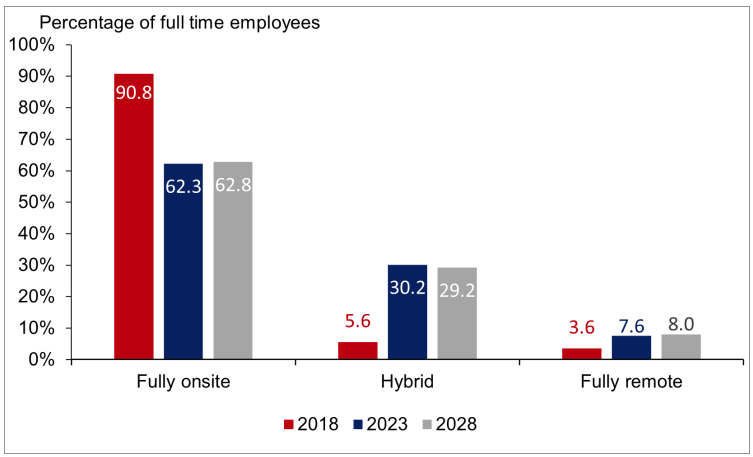

While there has been a return to the office, for many its only two or three days a week. Basically, the lockdowns resulted in a step jump towards working from home (WFH). A UK study of over 2000 firms is indicative. It showed that while around 90.8% of employees were fully onsite in 2018, last year this had fallen to 62.3%, with 30.2% with hybrid (working in the office and at home) arrangements. Similarly, the ABS found 37% of employed people in Australia regularly worked from home. Of course, this masks a huge range with industries with a high proportion of computer-based workers having more hours working at home. And firms expect this to remain the case. There are huge benefits to physically working together around culture, collaboration, idea generation and learning but there are also benefits to working from home with no commute time, greater focus, less damage to the environment, better life balance and for companies – lower costs, more diverse workforces and happier staff. So the ideal is probably a hybrid model. The proportion of workers in a hybrid model may even rise as new firms are quicker to embrace WFH.

Working arrangements for UK employees

Source: K Shah, and others, Managers say working from home here to stay, CEPR

Implications – Less office space demand as leases expire resulting in higher vacancy rates/lower rents, more people living in cities as vacated office space is converted and reinvigorated life in suburbs and regions.

#7 Faster embrace of technology

Lockdowns dramatically accelerated the move to a digital world. Everyone was forced to embrace new online ways of doing things. Many have now embraced online retail, working from home and virtual meetings. It may be argued that this fuller embrace of technology will enable the full productivity enhancing potential of technology to be unleased. The rapid adoption of AI will likely help.

Implications – This has meant a faster embrace of online retailing (up from 7% of retailing pre-pandemic to around 11%) at the expense of traditional retailing, virtual meeting attendance becoming the norm for many (even in the office) and business travel settling at a lower level.

Concluding comments

Perhaps the biggest impact is that the pandemic related stimulus broke the back of the ultra-low inflation seen pre-pandemic. Together with bigger government and reduced globalisation, this means a more inflation-prone world. So, a return to pre-pandemic ultra-low inflation and interest rates looks unlikely. It’s not all negative though – apart from the faster technology uptake, the global and Australian economies have come through the last four years in far better shape than might have been imagined at the start of the lockdowns!

Green Cement Startup Cemvision Raises €10 Million

Mark Segal March 25, 2024 | ENVIRONMENT/ PRIVATE EQUITY & VENTURE CAPITAL

Mark Segal March 25, 2024 | ENVIRONMENT/ PRIVATE EQUITY & VENTURE CAPITAL

Climate tech startup Cemvision announced that it has raised €10 million in a seed funding round, aimed at accelerating the company’s near-term efforts to provide high-performance, ultra-low CO2 footprint and resource-efficient, 100% circular cement.

Building materials are a key source of global greenhouse gas emissions. Cement production, an ingredient in concrete, accounts for approximately 8% of global carbon dioxide emissions, with over 900 kg of CO2 emissions generated for every 1000 kg of material produced.

Founded in 2020 by Paul Sandberg, Claes Kollberg and Marcus Olsson, Sweden-based Cemvision provides an alternative to traditional Portland cement, produced using raw materials recycled from industrial waste instead of virgin limestone, and utilizing kilns powered by green electricity at much lower temperatures, with a 95% lower carbon footprint. According to the company, its solution provides a series of additional benefits over traditional cement products, including early compressive strength, allowing for shorter construction times, as well as ultra-low heat and high chemical resistance.

The seed funding round follows the achievement by the company in July 2023 of its first largescale pilot production of fossil-free cement, and its first green cement supply agreement in December with Swedish state-owned miner LKAB AB.

Oscar Hållén, CEO of Cemvision, said:

“This investment will accelerate our near-future operations, right before we make the next jump, which is not too far away. Having met and retained interest from VCs worldwide, we concluded some of the very best ones were right around the corner, and we are delighted to have them doubling down on Cemvision.”

The seed round was led by Sweden-based VC investor BackingMinds and infrastructure-focused Polar Structure, with participation from California-based venture fund Zacua Ventures.

Susanne Najafi, founding partner of BackingMinds, said:

“Cemvision is addressing a $400 billion market, precisely meeting the increased environmental and regulatory needs of the industry. With the overwhelmingly positive market response, we’re thrilled to keep backing the Cemvision team as they pioneer global sustainable construction.”

Microsoft Signs 400 MW Renewable Energy Purchase Deals from New Texas Solar Projects

Susan Lahey March 28, 2024

COMPANIES/ ENERGY TRANSITION

Leeward Renewable Energy (LRE), announced two new Power Purchase Agreements (PPA) with Microsoft, for a total of 400 MW of renewable energy to be delivered from two solar facilities currently under development in Texas.

The two new solar projects, each 200 MW, include the Morrow Lake Solar in Frio County, Texas, expected to be completed by the fourth quarter of 2024, and Cradle Solar in Brazoria County, Texas, anticipate to be completed by the fourth quarter of 2025. According to LRE, the projects will utilize First Solar ultra-low carbon, thin-film photovoltaic solar modules, provide jobs and significant local economic benefits, and include initiatives to protect and enhance the environment, such as robust land stewardship activities that promote soil health, preserve native plant species, and enhance biodiversity.

Jason Allen, LRE’s Chief Executive Officer said:

“We are honored to collaborate with Microsoft in our joint commitment to accelerate the energy transition with the addition of these clean energy projects. We look forward to strengthening our relationships with Frio County and Brazoria County as we develop and operate the two facilities and deliver substantial and transformative benefits for local residents and communities for years to come, all while we support U.S. manufacturing.”

The new agreement marks the latest in a series of renewable energy deals for Microsoft, including a 408 MW Texas-based PPA announced earlier this month with solar and storage project developer and operator Primergy, and an “Environmental Justice PPA” with EDP Renewables North America (EDPR NA) and Volt Energy Utility in Illinois.

In 2021, Microsoft launched a “100/100/0 clean energy goal,” with the company targeting having 100% of its electricity consumption, 100% percent of the time, matched by purchases from zero carbon energy sources by 2030, adding to its prior commitment to use 100% renewable energy in its buildings and datacenters globally by 2025. Microsoft has also committed to become carbon negative by 2030, and to cover 100% of its electricity consumption in its buildings and datacenters globally with renewable energy by 2025.

I hope you have enjoyed this weeks report, please feel free to reach out if you require assistance with your investment journey.

Regards,

Head, Fixed Interest and Superannuation

JMP Securities

a. Level 3, ADF Haus, Musgrave St., Port Moresby NCD Papua New Guinea

p. PO Box 2064, Port Moresby NCD Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814