9 April, 2024

Hello and welcome to this week’s JMP Report,

On the equity front we saw 3 stocks trade on the local market. KSL traded 23,432 shares, closing steady at K2.95, STO traded 314 shares, closing steady at K19.36 and CCP traded 160,827 shares, closing steady at K2.11.

WEEKLY MARKET REPORT | 31 March, 2024 – 4 April, 2024

| STOCK | QUANTITY | CLOSING PRICE | BID | OFFER | CHANGE | % CHANGE | 2023 INTERIM | 2023 FINAL DIV | YIELD % | EX-DATE | RECORD DATE | PAYMENT DATE | DRP |

| BSP | – | 16.12 | 16.15 | 17.50 | – | 0.00 | K0.370 | K1.060 | 8.87 | TUE 27 FEB 2024 | WED 28 FEB 2024 | FRI 22 MAR 2024 | NO |

| KSL | 23,432 | 2.95 | 2.95 | 3.00 | – | 0.00 | K0.097 | K0.159 | 8.82 | TUE 4 MAR 2024 | WED 6 MAR 2024 | MON 15 APR 2024 | PA |

| STO | 314 | 19.36 | 19.36 | – | – | 0.00 | K0.314 | K0.660 | 5.04 | MON 26 FEB 2024 | TUE 27 FEB 2024 | TUE 26 MAR 2024 | – |

| NEM | – | 145.00 | 145.00 | – | – | 0.00 | – | USD 0.250 | 0.63 | MON 4 MAR 2024 | TUE 5 MAR 2024 | WED 27 MAR 2024 | – |

| KAM | – | 1.15 | 1.11 | – | – | 0.00 | K0.12 | – | – | – | – | – | YES |

| NGP | – | 0.69 | – | – | – | 0.00 | K0.0.3 | – | – | – | – | – | – |

| CCP | 160,827 | 2.11 | 2.12 | – | – | 0.00 | K0.110 | K0.131 | 6.21 | FRI 22 MAR 2024 | WED 27 MAR 2024 | FRI 19 APR 2024 | NO |

| CPL | – | – | – | – | – | 0.00 | – |

– | – |

– | – | – | – |

| SST | – | 45.00 | 36.46 | 50.00 | – | 0.00 | K0.35 | K0.60* | 1.33 | – | – | – | NO |

Dual listed PNGX/ASX Stocks

BFL – 5.91 +11c

KSL – .895 -.05c

NEM – 59.74 +$6.04

STO – 7.83 +8c

Interest Rates

Results for the 7day auction were left at 2% with the Bank taking 1.9 bn out of the market.

In the 364day TBill auction the rates were a little softer by 10bpts averaging 3.39% and the market was undersubscribed by 40mill. We don’t expect a GIS auction until later in the month.

Other assets we like to monitor

Gold – 2,308

Silver 27.09

Palladium 994

Platinum – 924

Bitcoin – 69,657-2.2%

Ethereum 3,433 -5.1

What we’ve been reading this week

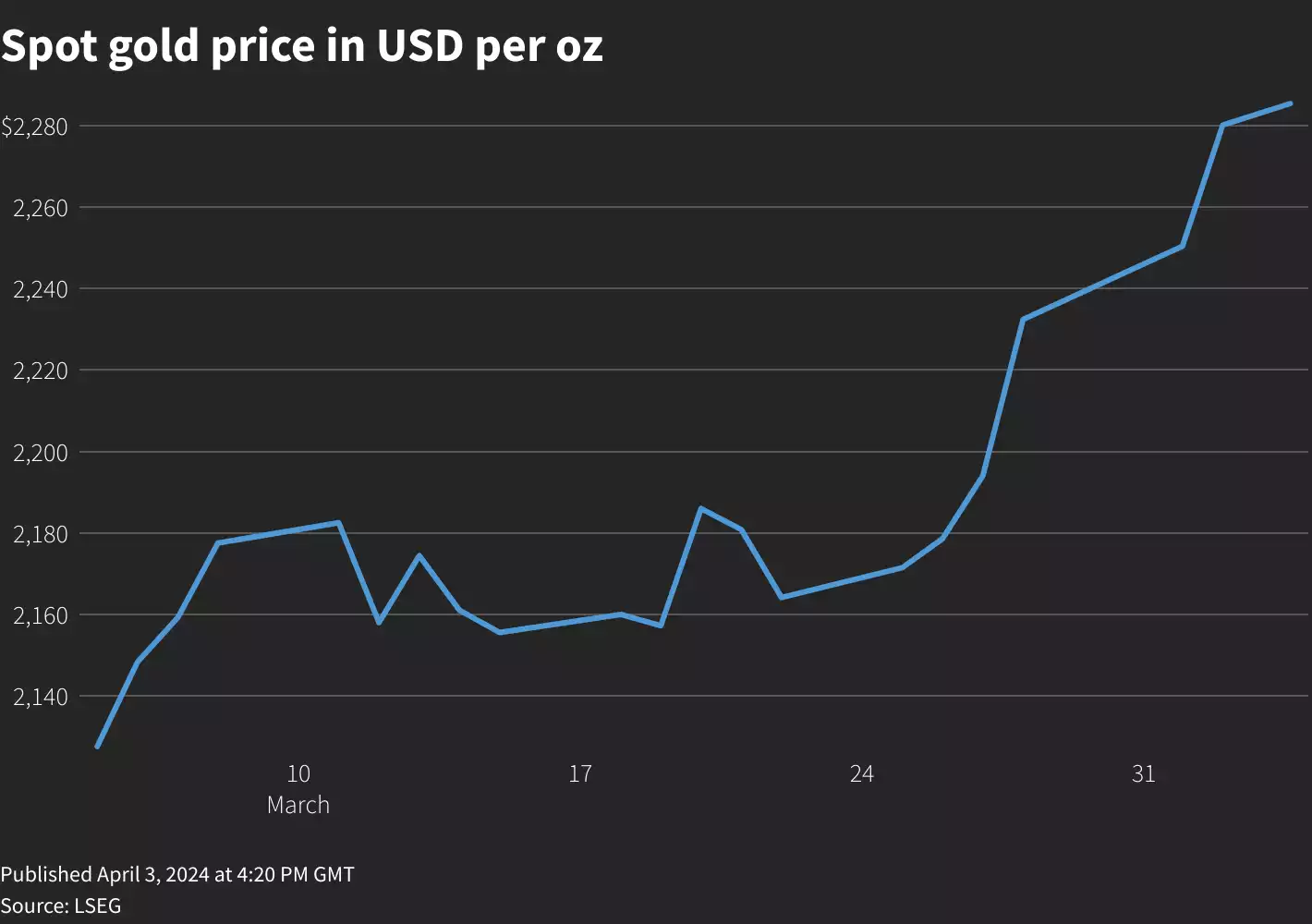

The Momentum Isn’t Stopping: Another Massive Day for Gold

Article thanks to Ainslie Bullion | 04/04/2024

Gold prices soared to new record highs again on Wednesday following comments from Federal Reserve Chair Jerome Powell, who maintained that recent economic indicators such as job gains and inflation spikes do not significantly alter the overall economic policy outlook for the year.

The price of spot gold increased by over 0.5% to reach an all-time high of US$2,294.99 (AU$3,510) this morning. Meanwhile, U.S. gold futures settled 1.5% higher at US$2,315, further displaying Wall Street’s general bullishness on the commodity.

In addition to gold, other precious metals also experienced gains, with silver rising 3.1% to US$26.92 per ounce (we discussed silver’s rise above $26 yesterday) and platinum up 1.7% at US$931.13.

Tai Wong, an independent metals trader based in New York, noted the surge in gold prices amid elevated trading volume following Powell’s remarks.

“Gold surged to yet another historic high on elevated trading volume after Powell stresses that ‘bumps’ in the road don’t change the overall rosy picture.”

“Powell’s customary cautious approach doesn’t worry gold bulls… I think bulls want to see $2,300 and I think more ‘tourists’ are getting involved in the trade.”

Powell’s statements regarding future policy interest rate adjustments based on economic developments have fuelled expectations of a rate cut at the Federal Reserve’s upcoming June 11-12 policy meeting. However, recent robust economic data has raised uncertainties among investors about the timing of such cuts.

This uncertainty about the timing of rate cuts has only seemed to benefit Gold, as its value has climbed over 11% since the beginning of the year which has been dominated by the FED rate storyline. Price has been further supported by significant central bank purchases and an increased demand for safe-haven assets during the continued turbulent political climate.

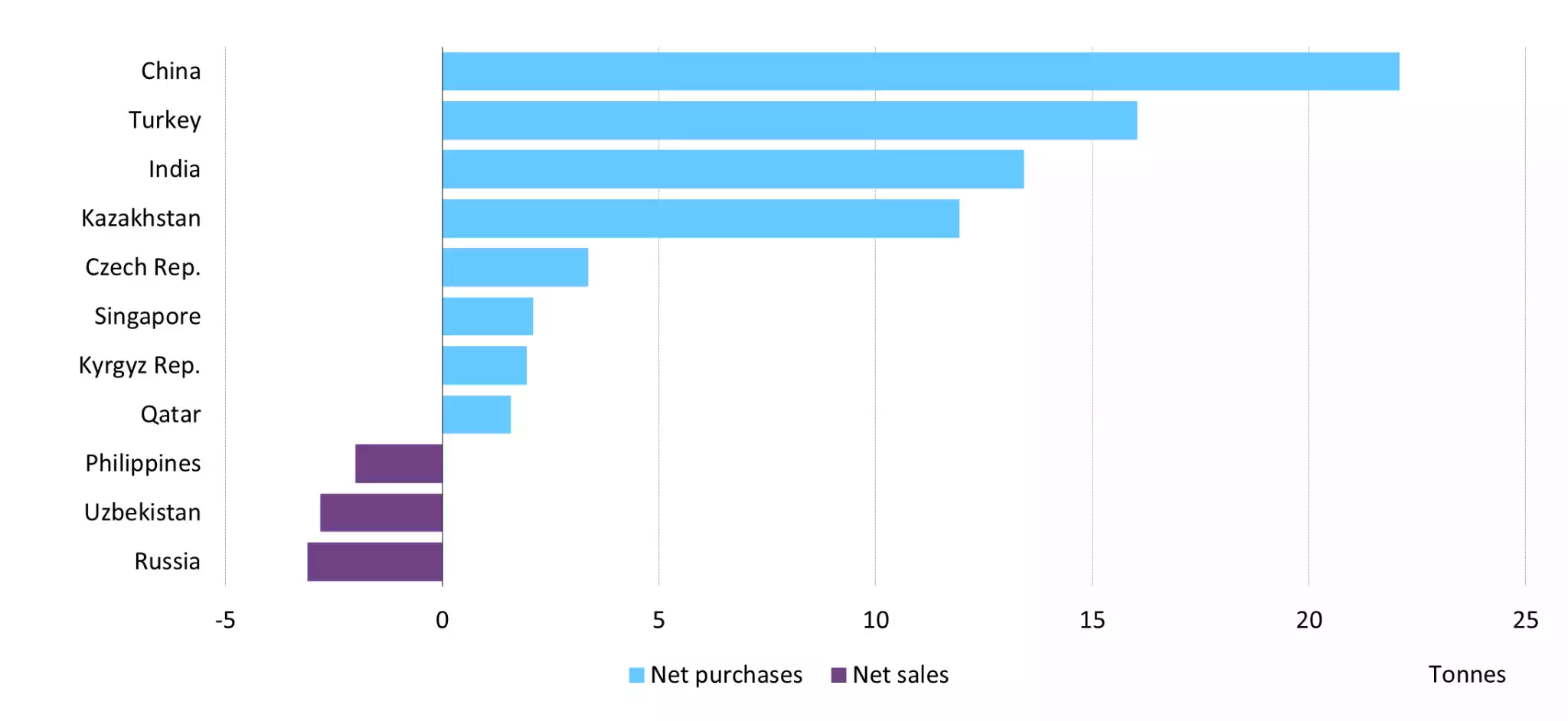

On the note of central bank purchases, the latest World Gold Council report showed that February saw a 19-tonne rise in global central bank gold reserves, marking the ninth consecutive month of growth.

This ongoing demand is primarily driven by emerging market banks, notably those in China and India. More specifically, the People’s Bank of China emerged as the largest buyer again this past month, increasing its gold reserves by 12 tonnes to reach a total of 2,257 tonnes. Despite this growth, gold constitutes about 4% of the PBoC’s total reserves, maintaining a relatively stable proportion over time.

Though there was a slower rate of gold accumulation in February, it hasn’t significantly altered the continuous trend of central banks increasing their gold holdings.

Overall, this consistent institutional buying pressure, combined with the current economic/political climate, means that there is a strong case for this gold momentum continuing to last given its strong fundamental base, the current sentiment, and the almost perfect technical setup.

How to Make Money Producing and Selling Carbon Offsets

Governments across the globe are working to reduce the amount of greenhouse gases (GHGs) released into the atmosphere by implementing stricter regulations and eco-friendly policies.

One of the ways this is taking place is through the creation of a “carbon offset” ecosystem.

Carbon offsets are valuable certificates that are issued when carbon dioxide is removed from the atmosphere—or prevented from being emitted in the first place. That can be accomplished through advanced extraction technology, through pumping it into rocks, or even just through planting trees.

The help of every farmer, rancher, and private landowner is necessary to produce enough carbon offsets to achieve the vision of global carbon neutrality—or at least come close. The good news is that anyone who owns or operates land can use the production and sale of carbon offsets to increase their profit margin while helping the environment.

Here are a few key takeaways from this article:

- Producing and selling carbon offsets is finally becoming a lucrative business in the United States, and first movers will have a huge advantage.

- Small farmers, ranchers, and landowners can earn additional revenue by optimizing their operations to produce carbon offsets.

- Carbon offsets are transacted on the rapidly-growing but still complex voluntary carbon market.

- How much a farmer, rancher, or landowner can earn per credit / per acre depends significantly on the location and the carbon offset project.

What Exactly Is a Carbon Offset?

Numerous programs will now measure and pay for every ton of carbon removed from the atmosphere through carbon offsets.

Carbon offsets are essentially a tradeable certificate that proves that one ton of CO2 or the equivalent amount of one ton of another GHG has been removed from (or not emitted into) the atmosphere.

- One carbon offset = one metric ton of carbon or other greenhouse gas (GHG).

If it’s difficult for you to gauge just how much a ton of carbon is, rest assured, you are not alone. After all, when most people think of a “ton,” they think of something physical, like a Volkswagen Beetle. But that is hard to do for a gas like CO2.

- Think of a good ol’ fashioned fire extinguisher, like the one hanging on the wall in your office building or apartment. Put 500 of those together, and you’ve got one tonne of CO2.

Since it’s difficult to understand just how much a ton of carbon is, the term “carbon offset” gives emissions a manageable metric.

The concept of using carbon credits to measure emissions started in the early twentieth century. The decision to market them, however, didn’t begin until the 1997 UN Kyoto Protocol, the first international agreement to cut CO2 emissions.

Since then, carbon credits and their cousins, carbon offsets, have become a popular revenue generation tool for farmers, ranchers, and landowners.

Carbon Offsets Are a Brand New Financial Market

Carbon offsets have proven to be a robust and financially lucrative market across Europe, Australia, and Canada. The EU, for instance, is aiming to reduce emissions by over 55% by 2030, with zero emissions by 2050—and that can only be achieved with the help of massive carbon offset purchases.

The EU price on carbon allowances is more than €80/ton. And yet, high-quality carbon offsets can be purchased for less than $10/ton. For corporations that need to decrease the impact of their emissions, buying verified carbon offsets is a no-brainer. And that means huge income potential in the EU for people who quickly understand the market and how to use their land to produce carbon offsets.

The good news for U.S.-based landowners is that the entire spectrum of participants in the carbon offset market is also finally starting to mature in the United States. The federal government and state governments are passing stricter regulations that raise the cost of carbon emissions, and individual citizens are searching for ways to reduce their own carbon footprint.

Right now, the most significant carbon market in the U.S. is located in California, which has stricter environmental protection regulations than any other state. Most carbon offsets are also sourced from California through various land-use-related sequestration projects.

You may have heard it said that “California is the United States in ten years.” It could not be truer than in the case of carbon offsets. Right on schedule, states have begun following in California’s footsteps, implementing additional ecological compliance standards, carbon emissions limits, and taxes on carbon.

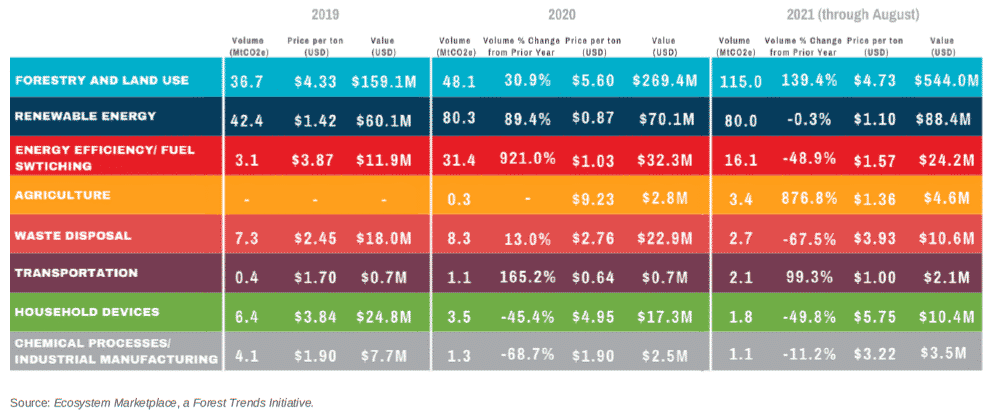

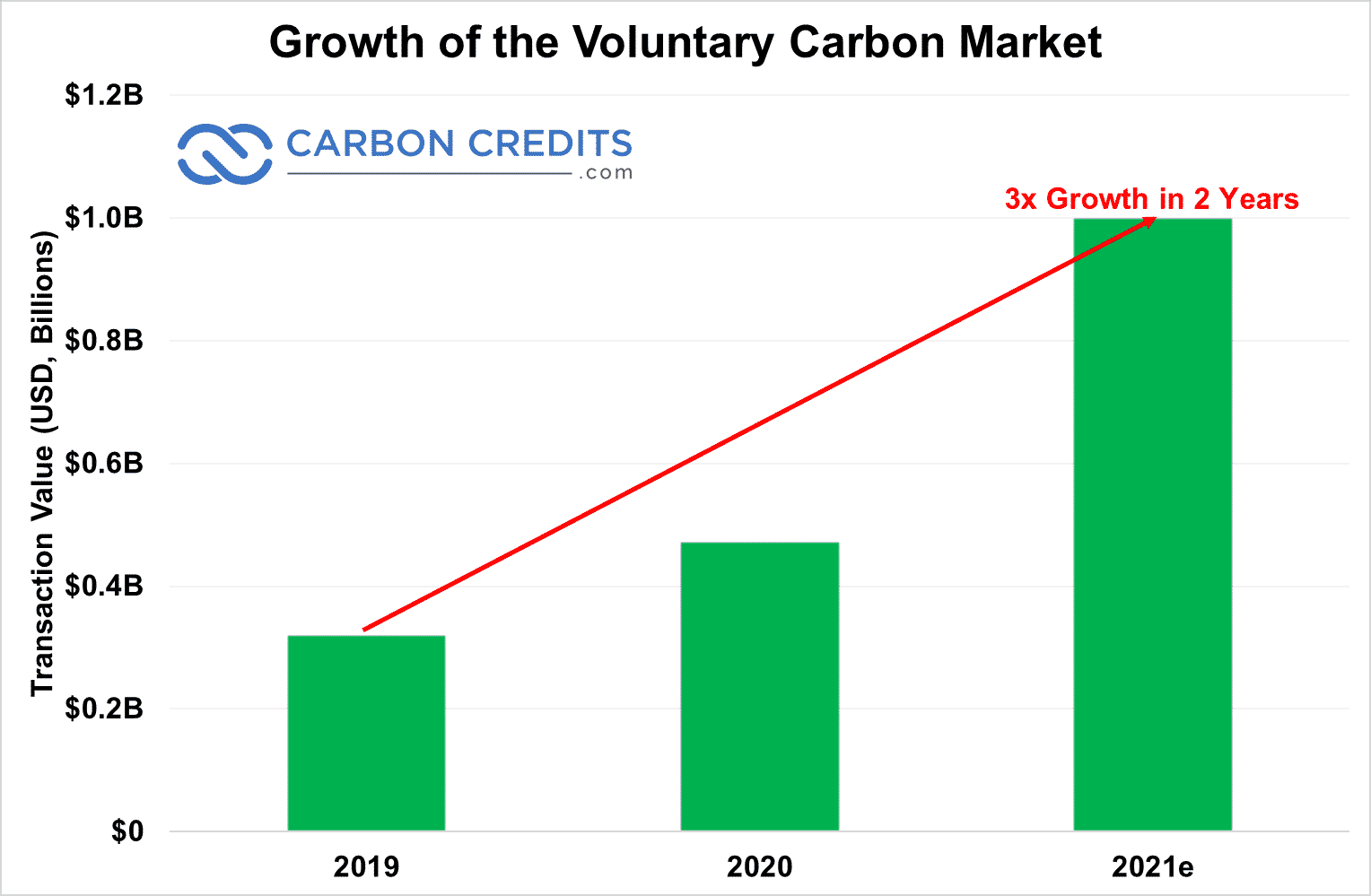

This new U.S. market comes with new financial incentives for landowners across the country to adopt more efficient agricultural operations and preserve their forested acreage. How much of an incentive? In 2016, $190 million in carbon offsets was transacted, representing 63 million tonnes of CO2. By 2019, offset transactions had almost doubled, accounting for 104 million metric tons of CO2—and worth $282 million. This market size would almost quadruple by 2021.

Take a look at the volume, prices, and value of the market through August 2021 yourself:

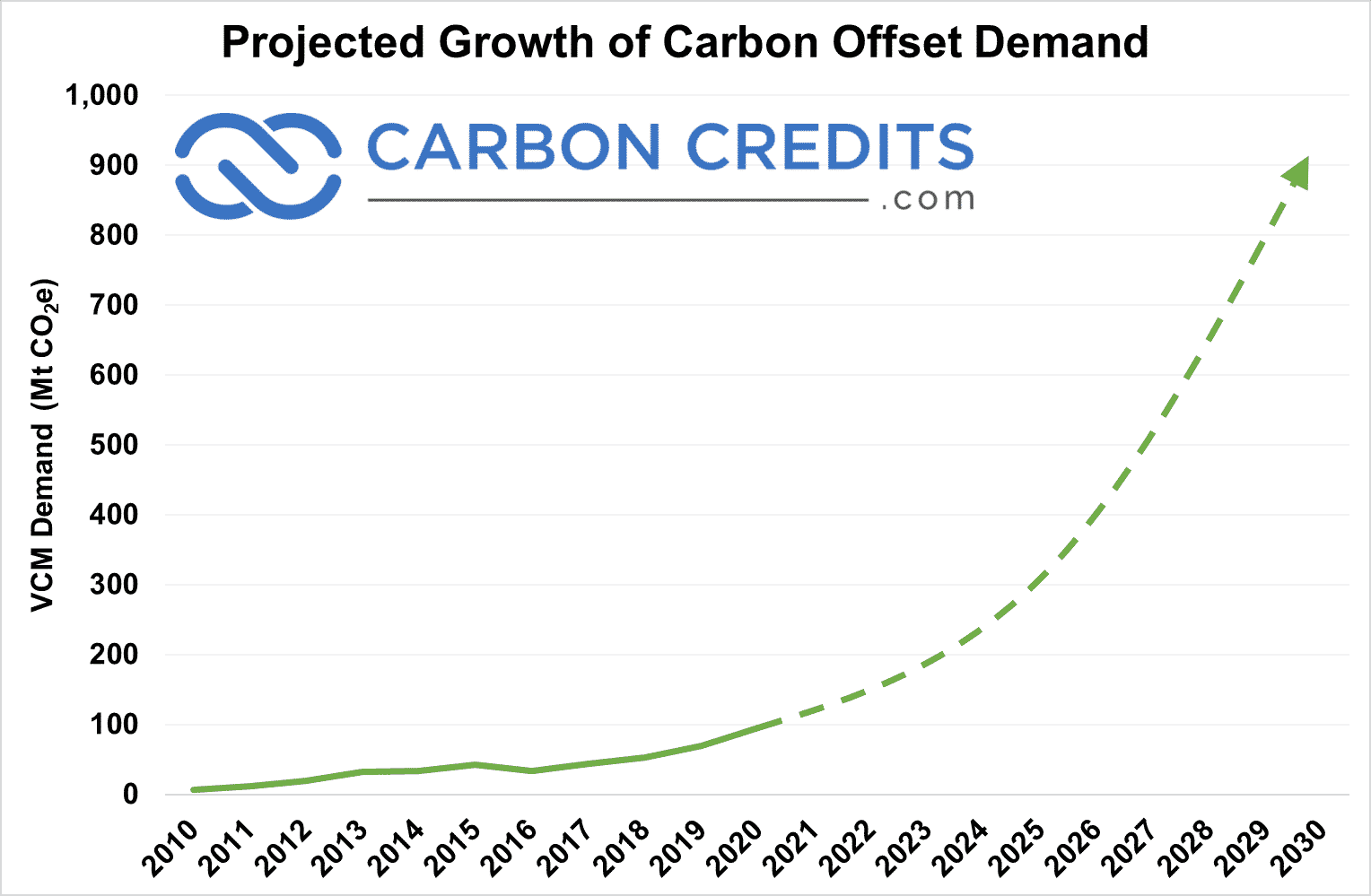

The “Forestry and Land Use” line is the one landowners should take note of. It’s an over half-billion-dollar opportunity that will have become even bigger by the time you read this. But what does the future look like for this market? According to experts surveyed by the Taskforce for Scaling Voluntary Carbon Markets (TSVCM):

“Based on stated demand for carbon credits, demand projections from experts… and the volume of negative emissions needed to reduce emissions in line with the 1.5-degree warming goal… the market size [for carbon offsets] in 2030 could be between $5 billion and $30 billion at the low end and more than $50 billion at the high end.”

That means something between 20x growth and 200x growth for the carbon offset market in under a decade. If you own any amount of acreage—even if not all of it qualifies—this is something you want to learn about before it’s too late.

A Tale of Two Carbon Marketplaces

Before you learn how to make money by using your land to produce carbon offsets, it’s important to understand why a market for carbon offsets even exists. And to get there, you have to start with carbon credits. Carbon credits are traded on the compliance carbon market. Here’s how it works…

Many countries and some states have passed “cap-and-trade” regulations, which limit the number of tons of CO2 a business can emit in a year. These tons are allotted as carbon credits.

Even companies that work as hard as possible to shrink their carbon footprint might find that the allocated emissions “cap” is not enough for their operations. They might be years away from substantial and compliant reductions in emissions, and they still have to keep operations going to make a profit in the interim. As such, they need to find a way to be able to emit more carbon than their cap without breaking the law.

- When companies hit their emissions cap, they look to the compliance market to “trade”—they’re trading money in exchange for another company’s credits.

Here’s a quick example. The Hoover Company is only allowed to emit 300 tons of carbon per year, but they know their operations will result in 400 tons of CO2 emissions. To avoid a financial penalty, the Hoover Company can make up for the extra 100 tons by purchasing credits from another company that will only emit 200 tons of carbon this year.

The voluntary carbon market works much differently. As suggested by the name, participation in the VCM is optional. It’s a place where companies and individuals can, at their choosing, buy carbon offsets to offset their carbon emissions.

This market is mostly made up of entities that are environmentally conscious and work to offset their carbon emissions because they want to. It could be a company that wants to demonstrate to its clients that it is doing its part to protect the environment. Or it could be a person who wants to offset the carbon emission from their flight travel.

Take the Hoover Company example. Suppose they announced their operations would be net zero by a certain date, but they’re still emitting 200 tons of CO2 on that date. They can easily purchase 200 tons worth of carbon offsets to meet their net zero guarantee.

Regardless of who is purchasing or the reason they’re purchasing offsets, they are looking for a way to reduce their emissions footprint—and by producing carbon offsets, landowners can provide an excellent way to do that. As a farmer, rancher, or landowner, you can sell offsets on the voluntary carbon market, creating an additional (and sometimes substantial) source of income.

How Landowners Can Produce Carbon Offsets

Farmers, ranchers, and landowners can produce and sell carbon offsets by capturing and storing emissions. They do this using carbon farming and carbon sequestration processes, which involve implementing practices that remove CO2 from the atmosphere by converting the gas into organic matter within the soil and eventually into plants. Once absorbed, the CO2 helps restore the soil’s natural qualities—simultaneously enhancing crop production and reducing pollution.

Farmers, ranchers, and landowners can offset carbon emissions in countless ways. Though not a comprehensive list, here are a few practices that typically qualify as offset-producing projects.

- Returning biomass to the soil as mulch after harvest instead of removing or burning. This practice reduces evaporation from the soil surface, which helps to preserve water. The biomass also helps feed soil microbes and earthworms, allowing nutrients to cycle and strengthen soil structure.

- Using conservation tillage or no-tillage practices that improve the quality of water and the air by increasing nutrients, soil structure, porosity, and tilth.

- Using nutrient management and precision farming to maintain plant and soil health instead of chemicals or pesticides.

- Planting cover crops during the off-season to ready the land for cash crops by improving the soil quality.

- Replacing surface irrigation systems with flood irrigation systems so that runoff water can be recycled to improve efficiency.

- Promoting forest regrowth to remove, store, and re-purpose carbon within trees and plants.

- Returning degraded soils to their natural state, converting acreage into grasslands, or planting trees or seeds to change open land into forest or woodlands.

- Rotating crops to ensure soil nutrients remain plentiful.

- Switching to alternate fuel types, such as lower-carbon biofuels like corn and biomass-derived ethanol and biodiesel.

- Altering manure management and changing feeding schedules.

After reading this list, you might be wondering how the volume and value of carbon offsets produced via each of these methods are determined. To be clear, it’s not an easy task. Monitoring and evaluating emissions and reductions can be a challenge for even the most experienced agricultural professional.

Fortunately, when it’s time to list offsets on the VCM, a third-party verification expert can collect, analyse, and verify data from your property, possible even conducting a site visit, to determine how many offsets you are eligible for. New technology being developed can also remotely track the amount of carbon sequestered by your land, eliminating the need for any guesswork.

What Are Carbon Credits Worth?

In 2019, more than $280 million in carbon offsets were traded on the VCM. Total carbon offset volume was 104 MtCO2e. Simple math says the average price paid for a tonne of carbon removed from the atmosphere in this manner was $4. There is a wide variance, however, in the price paid for carbon offsets, depending on project quality, issuance year, verifiability, additional benefits created by the carbon offset, and other factors. For live VCM pricing, please click here.

One major factor in pricing is the type of project. Different projects include forestry and conservation, waste-to-energy projects, and renewable energy projects. Some of these projects can be worth less than $1 per carbon ton offset, while others can be worth more than $50.

For example, imagine you planted a forest of shade trees. The chart below estimates that a typical urban shade tree will store approximately five tonnes of CO2 forty years, generating $12,500 in revenue at $10/tonne carbon. If the value of carbon rises to $50/tonne, that single tree could be worth more than $1,000 a year.

|

# of Trees Planted |

Average Annual Carbon Credits Generated |

Total Carbon Credits Generated Over 40 Years |

Total Value of 40-Year Contract @ $5/tonne |

Total Value of 40-Year Contract @ $50/tonne |

|

250 |

31.25 VERs |

1250 VERs |

$6,250 |

$62,500 |

|

500 |

62.5 VERs |

2,500 VERs |

$12,500 |

$125,000 |

|

1,000 |

125 VERs |

5,000 VERs |

$25,000 |

$250,000 |

Alternatively, imagine you are producing carbon offsets using your wheat farm, and you are paid $15 per tonne of carbon removed. Depending on how you sequester the carbon, you might earn anywhere from .25 to 2 offsets per acre. If your 1,000-acre wheat farm removes 1 tonne per acre, that is 1,000 carbon credits—and $15,000 profit annually.

Sounds pretty good when it’s theoretical, right? Here’s what that actually looks like in real life. Indigo Agriculture, a Boston-based for-profit carbon sequestration startup, guarantees farmers who signed up in 2019 $15 per tonne of CO2 that they sequester. Farmer Trey Hill received a payment of $115,000 for 8,000 tonnes of carbon—a little over $14/tonne—last year and has continued to receive payments since.

How to Sell and Get Paid for Carbon Offsets

There are numerous online carbon exchange programs located both within the United States and internationally that enable sellers to get cash for the carbon offsets they’ve produced. The exchanges work the same way as various stock and commodity exchanges.

The three largest voluntary carbon registries in the United States have created standards for producing carbon offsets. In addition, use strict protocols that both scientists and stakeholders have implemented.

To enrol, you need to have land maps available that document your ownership of the land, as well as the legal description of the land. You also need have to document your management practices and obtain a signed contract between yourself and those purchasing/paying for the carbon credits. All fees should be listed.

Before signing a contract, it’s important to thoroughly research the company, understand what’s required of you, and ensure the amount you’re paid is appropriate. If the contract you sign is overly optimistic on the amount of carbon sequestered, you could later be charged the shortfall amount. On the other hand, if the contract you sign lowballs the amount, you could miss out on income.

The Future of Carbon Markets

Former President Barack Obama said:

When Americans are called on to innovate, that’s what we do… once we have a clear target to meet, we typically meet it. And we find the best ways to do it.

The world is aware that much is at stake, with the climate change crisis at the forefront of everything we do. As nations, companies, and individuals work together to address GHG emissions, far more ambitious neutrality goals will be set.

Both the regulatory and voluntary carbon markets are set to expand dramatically in the next decade. Recall that according to the TSVCM, the demand for carbon credits could increase by 15x or more by 2030 and by a factor of up to 100x by 2050.

- The momentum behind those figures is that carbon marketplaces provide companies and individuals the power to experiment, innovate, and reach more people—strengthening environmental initiatives for generations to come.

When the United States and the world moves forward collectively to combat the climate crisis, change will happen, and a lot of money will be made. As a farmer, rancher, or landowner, now is the time to begin producing carbon offsets using your land.

Hopes logging giant will finally be held accountable in Papua New Guinea

Don Wiseman | RNZ Pacific Senior Journalist

Log piles in East New Britain. (file image) Photo: Global Witness Media Hub

Nearly 12 years ago the then Catholic archbishop of Rabaul in Papua New Guinea, Francesco Panfilo, led a campaign against giant Malaysian logging and palm oil developer, Rimbunan Hijau, hoping to win improved conditions for the beleaguered landowners of West Pomio in East New Britain.

RH, as the developer is mostly known in PNG, was accused along with its subsidiary Gilford Pty Ltd, of making unfair contracts with some landowners in the Sigite-Mukus district of West Pomio, ignoring other legitimate landowners, taking many trees illegally and planting oil palm where it shouldn’t.

The archbishop led the battle to try and have these contracts renegotiated, with mediation agreements made.

But this process was then stymied, both by the Covid-19 pandemic and what Panfilo sees as legal manipulations on RH’s part.

RH has been difficult to reach for comment but RNZ Pacific is continuing to reach out to it for comment.

Now retired and living in the Philippines, Panfilo, is still involved in the battle and said there are hopes the PNG Supreme Court will next month direct RH to renegotiate the land agreements with the landowners.

“What we want is to oblige RH to renegotiate because that is the agreement that we came upon that we had. We have to renegotiate the agreements.”

“Strictly speaking, if the landowners were to go to court on specific issues, they could have so many cases, for example, the environmental destruction,” Panfilo said.

An environmental impact audit conducted at the request of landowners and completed four years ago said the company had not complied with the requirements laid out in the original contract.

These include a need to protect water quality and to provide buffer zones around rivers and communities.

These zones are necessary to also protect sacred sites, graveyards and old villages, and they are an attempt to save wildlife and provide safe passage of fauna between areas that remain unlogged.

The audit goes on to say “Gilford Pty Ltd, unashamedly and incontrovertibly, wantonly destroyed all buffers within the Sigite-Mukus Oil Palm Development Area, to the detriment of the environment, landscape and the cultural heritage of people,”

Another report looked at the way the workers, mostly local, working for Gilford, were treated.

It found the environments in which they lived and worked were substandard, posing major risks to the health of the workers and their families.

I hope you have found this week’s read informative, if you would like to have a confidential discussion regarding your investment journey, please do reach out.

Regards,

Head, Fixed Interest and Superannuation

JMP Securities

a. Level 3, ADF Haus, Musgrave St., Port Moresby NCD Papua New Guinea

p. PO Box 2064, Port Moresby NCD Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814