20 May, 2024

Hello and welcome to this week’s JMP Report,

On the equity front last week we saw 4 stocks trade on the local market. BSP traded 46,686, closing 1t higher at K16.81, KSL traded 175,324 shares, closing 1t higher at K2.92, STO traded 500 shares, closing 1t higher at K19.38 and KAM traded 2,446 shares, closing 5t at K1.25.

WEEKLY MARKET REPORT | 14 May, 2024 – 18 May, 2024

| STOCK | QUANTITY | CLOSING PRICE | BID | OFFER | CHANGE | % CHANGE | 2023 INTERIM | 2023 FINAL DIV | YIELD % | EX-DATE | RECORD DATE | PAYMENT DATE | DRP |

| BSP | 46,686 | 16.81 | 16.81 | – | 0.01 | 0.06 | K0.370 | K1.060 | 8.87 | TUE 27 FEB 2024 | WED 28 FEB 2024 | FRI 22 MAR 2024 | NO |

| KSL | 175,324 | 2.92 | 2.81 | 2.93 | 0.01 | 0.34 | K0.097 | K0.159 | 8.82 | TUE 4 MAR 2024 | WED 6 MAR 2024 | MON 15 APR 2024 | YES |

| STO | 500 | 19.38 | 19.37 | – | 0.01 | 0.05 | K0.314 | K0.660 | 5.04 | MON 26 FEB 2024 | TUE 27 FEB 2024 | TUE 26 MAR 2024 | – |

| NEM | – | 145.00 | 145.00 | – | – | 0.00 | – | USD 0.250 | 0.63 | MON 4 MAR 2024 | TUE 5 MAR 2024 | WED 27 MAR 2024 | – |

| KAM | 2,446 | 1.25 | 1.25 | – | 0.05 | 4.00 | K0.12 | – | – | – | – | – | YES |

| NGP | – | 0.70 | 0.69 | – | – | 0.00 | K0.03 | – | – | – | – | – | – |

| CCP | – | 2.16 | 2.15 | – | – | 0.00 | K0.110 | K0.131 | 6.21 | FRI 22 MAR 2024 | WED 27 MAR 2024 | FRI 19 APR 2024 | NO |

| CPL | – | 0.79 | – | 0.79 | – | 0.00 | – |

– | – |

– | – | – | – |

| SST | – | 45.00 | – | 50.00 | – | 0.00 | K0.35 | K0.60* | 1.33 | WED 24 APR 2024 | FRI 26 APR 2024 | FRI 26 JULY 2024 | NO |

Dual Listed PNGX/ASX

BFL – 6.40 +10c

KSL – 94.5c +1c

NEM – 63.82 -55c

STO – 7.55 -31c

Interest Rates

On the interest Rate front we understand the Bank soaked up and extra 0.6bn liquidity over the weeks maturities in the 7day CBB market by taking a total of 2.7bn out of the system. This is in line with the BPNG current Monetary Policy.

In the 364 day TBill market, the Bank came to the market with 230mill on offer, the Bank received 290mill in bids and issued 236mill at 3.84%, up 3bpts from the previous week. We are nearing 12month highs. You can expect the rates to drift out further, but I can see more interest will come into this area of the yield curve as investors look at the differential of 46bpts between 1yr and 2yr stock, and 86bpts between 1yr and 5yr stock.

The Bank of PNG conducted the May GIS auction through the week with yields in the 5 to 10yr maturities drifting out. The overall auction was undersubscribed by 87.5 mill taking the total shortfall for the year to 360mill. I would expect rates to drift out further and we will see the outcome in the June auction. I have attached the May GIS auction results for your interest.

Other assets we like to monitor

Gold – 2,415 +55c

Silver -31.43 28 +$3.43

Palladium – 1,010 +$31

Platinum – 1,085 +$87

Bitcoin – 66298 +8.22%

Ethereum – 3069 -1.52%

What we have been reading

Scaling Australia’s carbon market

Marco Stella CORE Markets – Presenter

ASX recently hosted the Carbon Market Institute’s Next Gen Carbon Credits and Projects Masterclass. Marco Stella, Co-Founder and Head of Carbon & Renewables Markets from CORE Markets was one of the presenters. In this article we share Marco’s insights on recent and future trends in Australian Carbon Credit Units (ACCU), as the market undergoes an important transition.

When it comes to the future of Australia’s carbon market, Marco Stella is not mincing his words. ‘We can’t scale this market on a voluntary model. The compliance market has a huge role to play in helping to build the foundation that the carbon industry needs to project forward.’ This sentiment is echoed by John Connor, CEO from the Carbon Market Institute, ‘It has been a tumultuous yet transformative 10 years, and the next decade promises to be even more intense. Minimising costs and maximising opportunities will require strengthened institutions, policies, collaboration and standards in order to target and turbo-boost public and private investment.’

Safeguard reforms to drive change

Recent Federal Government reforms of the Safeguard Mechanism have led to more stringent emission reduction targets for Australia’s biggest emitters. Entities captured under the Safeguard Mechanism are now required by law to keep annual emissions below a target level (baseline), with that target to reduce by 4.9% each year until 2030. Failure to meet annual targets will result in a penalty, designed to incentivise industrial emitters to invest in strategies and technology that will help reduce carbon emissions. Safeguard entities can also purchase Australian Carbon Credit Units (ACCUs) to offset emissions and remain below their baseline. Stella believes that these reforms will spark the evolution of Australia’s carbon market. He believes this next chapter will see the ACCU market transition to something far more significant, driven primarily by demand from compliance buyers captured under the Safeguard Mechanism.

Valuing co-benefits

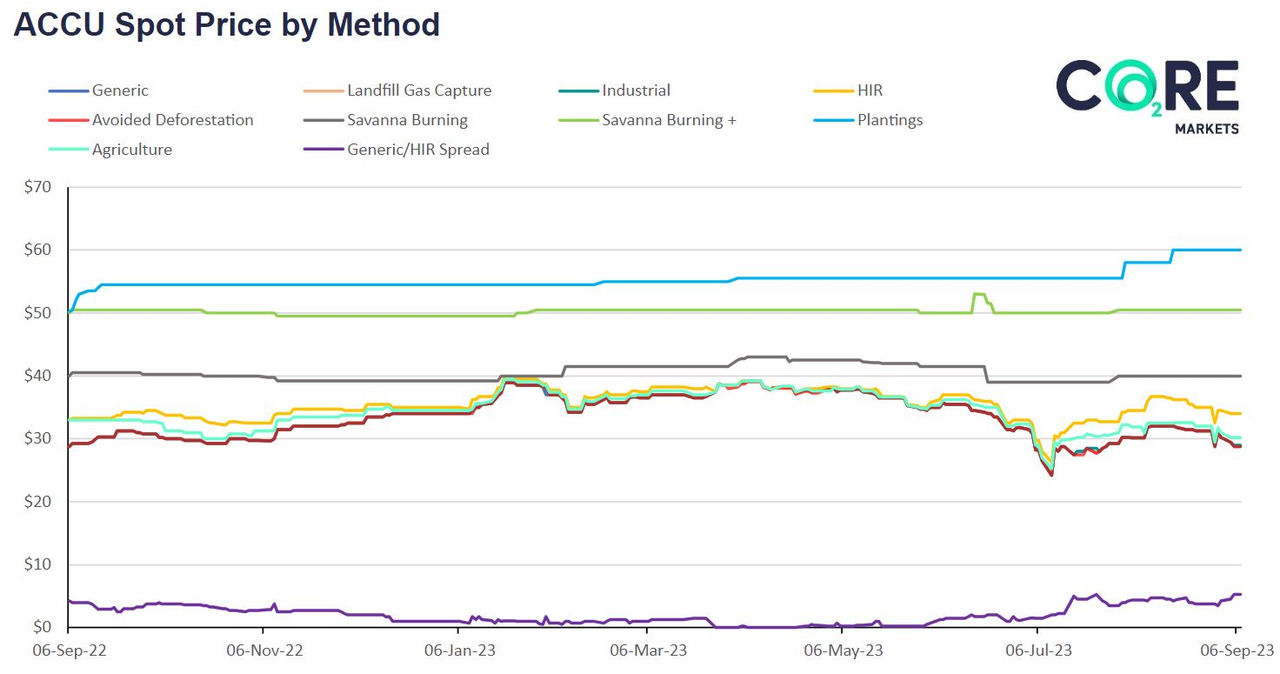

Until recently, the majority of activity in the ACCU market has been from voluntary buyers looking to invest in carbon reduction projects or wanting to offset their carbon emissions. Stella believes voluntary buyers are more discerning when it comes to the type of ACCU they are buying. ‘Voluntary buyers are more sensitive as to the type of benefit or co-benefit that the ACCU is attached to resulting in a price differential between various ACCU methods’. Whilst each ACCU technically represents the same measure (one tonne of carbon avoided or removed from the atmosphere), buyers can perceive value differently. This has created a price spread among some methods.

Stella explains, ‘While co-benefit valuation is completely subjective, we have seen distinct trends emerge among certain ACCU methods. Savannah burning with First Nations co-benefits is perhaps the best example of this, trading at a premium to standard savannah burning ACCUs with the spread moving as wide as A$10.00.’

The data in the graph below shows the ACCU spot price variation by method. Stella believes these price differentials will decline as more compliance buyers enter the market. ‘Compliance buyers tend to view ACCUs as a uniform commodity. For a compliance buyer, one ACCU means one tonne of CO2 avoided or removed from the atmosphere. It’s as simple as that.’

Data source: CORE Markets carbon and clean energy market data platform

Accelerating the transition

Compliance buyers are expected to become more active over the next 12-18 months as their emissions baseline under the reformed Safeguard Mechanism declines. Stella believes this will drive a permanent shift in the way the carbon market operates. ‘In order to scale the market to the extent necessary to meet our emission reduction targets, we need as much participation in the market as possible. We need a robust, deep and liquid secondary market for this to occur so investors and financiers can have confidence in the value of the projects they are investing in.’

To Stella, the path forward is clear. Voluntary and compliance markets can co-exist harmoniously and work together to strive for change. Stella says: ‘The inevitable growth of compliance markets will ultimately lead to more investment in carbon projects and greater co-benefits which can help to generate positive and real outcomes for local communities. The best is yet to come.’

Marco Stella, CORE Markets – Presenter

Marco Stella is the Co-Founder and Head of Carbon and Renewables Markets at CORE Markets, an end-to-end markets, technology and climate partner for business. He is a specialist commodities broker in Environmental Markets with 20 years of experience in analysis and market commentary, and leads an award-winning transactions team. CORE Markets offers corporate net zero services, project optimisation services and corporate and institutional brokerage services, all backed by a powerful software-as-a-service platform.

Contact: hello@coremarkets.co

Learn more from CORE Markets about the ACCU market

Monique Bell, ASX- Author

Monique Bell is a Commodities Product Manager at ASX. She is working on the upcoming listing of a new Gas Futures contract as well as a suite of Carbon Futures products to support Australia and New Zealand’s energy transition. Monique is a CFA, holds a Masters’ Degree in Finance and recently completed certification with the Cambridge Institute for Sustainability Leadership.

Mizuho Pledges to Provide $13 Billion Financing to Develop Hydrogen Supply Chain

ENERGY TRANSITION/ SUSTAINABLE FINANCE

Susan Lahey May 16, 2024

Tokyo-based banking and financial services company Mizuho Financial Group announced today a new goal to provide JPY 2 trillion (USD$13 billion) in financing for the production and supply of hydrogen and related technologies by 2030.

According to the company, the new goal reflects a growth in funding needs for the hydrogen sector, a key component for decarbonization in several emissions-intensive sectors, to address the growing urgency to set up supply chains for hydrogen and related technologies. Mizuho noted that hydrogen adoption to date has been hindered by issues including high costs and companies’ ability to secure funding, as well as the need to generate demand.

Hydrogen is viewed as one of the key building blocks of the transition to a cleaner energy future, particularly for sectors with difficult to abate emissions, in which renewable energy solutions such as wind or solar are less practical, such as metals manufacturing and heavy transport.

Around 90 million metric tons of hydrogen are produced annually, although the vast majority is extracted using fossil fuels, which create pollutants and GHG emissions. The development of clean hydrogen capacity, such as green hydrogen, which uses renewable energy to power the process to extract hydrogen from other materials, will require massive investments in areas including infrastructure, electrolysis, and transport.

Mihuzo outline key areas that it will focus on to achieve its new hydrogen finance goal, including developing business strategies focused on hydrogen and related technologies, establishing a group-wide framework dedicated to supporting hydrogen and related technologies, and expanding its pool of personnel specialized in related areas. The company added that it aims to further expand its initiatives to promote the construction of supply chains for hydrogen and related technologies going forward.

The announcement follows the launch of a goal by Mizuho last year to facilitate JPY 100 trillion ($USD 700 billion) in sustainable finance between 2019 and 2030, including JPY 50 trillion in environment and climate change-related finance.

Gold Technical Analysis – Potential Record Breakout

Posted 17/05/2024

Gold has formed a bullish pattern and is flirting with a potential breakout to another all-time high. The U.S. Dollar had a “gap” downward, which is rare to see. The latest CPI data has also rug-pulled the Fed’s plan of holding interest rates high.

See the gold chart below showing gold’s rapid recovery from its dip. The resistance line (in yellow) is the barrier holding gold from closing at a new all-time high. If the gold price breaks this barrier, that leaves open air for it to rise.

Gold/USD – daily chart

DXY gapped down – broke a huge support level

The U.S. Dollar Index has just gapped down – a move so aggressive that there is space between the candlesticks/price history. This shows that investors are pre-empting another large bout of money supply increase and are abandoning ship. Notice the gap down, pictured below, also fell through a major price floor. Those hoping for USD strength wanted to see the price make a strong bounce off this floor, but instead saw it leap downward:

DXY – hourly chart

Copper skyrockets – all-time high

Copper has just broken out to a new record high as well. We covered its aggressive rise last month, which could have been seen as a tell-tale sign that industry is preparing for another wave of money supply increase.

Much of these recent movements have been invigorated by the latest CPI reading out of the U.S. The reading showed inflation looking under control. Although this is not necessarily true, this eliminates the Feds excuse to hold interest rates high. If their stated goal is simply fighting inflation, and the reading they have convinced people to trust shows that inflation is no longer an issue, then they are out of ammo. They either must “turn the printer back on” or face the question of why they are needlessly punishing markets.

Thank you to Ainslie Gold for this article

I hope you have enjoyed this week’s read, please feel free to reach out if you would like to discuss your investment journey and financial objectives.

Regards,

Head, Fixed Interest and Superannuation

JMP Securities

a. Level 3, ADF Haus, Musgrave St., Port Moresby NCD Papua New Guinea

p. PO Box 2064, Port Moresby NCD Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814