11 October 2021

Welcome to this week’s JMP Report.

I have attached for your interest the latest version of Ashurst’s publication, Low Carbon Pulse, thank you Ashurst and also attached is the Interim Dividend Announcement from Steamships.

On the equity front last week, CCP traded 367,0 00 shares closing down 0.02 toea or -1.18% to K1.68 followed by KSL with 6,241 shares traded closing unchanged at K3.25 per share. CPL saw 5,880 shares trade also closing unchanged at K1.00 whilst OSH traded 1,870 shares closing up 0.01 toea or 0.09% to K10.61 per share. BSP had a relatively quiet week closing the week at K12.30.

Low Carbon Pulse - Edition 28

Interim Dividend Announcement - Steamships

|

WEEKLY MARKET REPORT 27.09.21 – 01.10.21 |

|||||||||||

| STOCK |

QTY |

CLOSING |

CHANGE |

% CHANGE | 2020 Final Div | 2021 Interim | Yield % | Ex Date | Record Date | Payment Date | DRP |

|

BSP |

– |

12.30 |

-0.40 |

-3.15 | K1.0500 | K0.39000 | 11.61% | Fri 24 Sept | Mon 27 Sept | Mon 18 Sept | No |

|

KSL |

6,241 |

3.25 |

– | 0.00 | K0.1690 | K0.08250 | 7.74% | Wed 01 Sept | Thurs 02 Sept | Fri 01 Oct | No |

|

OSH |

1,870 |

10.61 |

0.01 | 0.09 | K0.0000 | – | 0.00% | Mon 30 Aug | Mon 20 Sept | Thur 20 Oct | |

|

KAM |

– |

1.00 |

– | 0.00 | K0.0400 | K0.06000 | 10.00% | Wed 15 Sept | Mon 20 Sept | Thurs 20 Oct | Yes |

|

NCM |

– |

75.00 |

– |

0.00 | K0.0000 | – | 0.00% | Thu 26 Aug | Fri 24 Sept | Mon 01 Nov | |

| NGP | – | 0.70 | – | 0.00 | K0.0000 | – | 0.00% | Fri 17 Sept | Fri 24 Sept | Mon 01 Nov | |

|

CCP |

367,000 |

1.68 |

-0.02 | -1.18 | K0.1800 | 0.04600 | 6.19% | Fri 1 Oct | Fri 8 Oct | Fri 26 Nov | Yes |

|

CPL |

5,880 |

1.00 |

– |

0.00 | K0.0000 | K0.0000 | 0.00% | ||||

BFL current pricing is $5.03/05 last trade $5.05

In the interest rate market, rates remain stable with the latest 364 TBills auction averaging 7.20%. The long end remains positive and well sort after with interest along the curve. No announcements at this point in regard to a Treasury Bond issue but for the smaller investor we can purchase Tap Bonds with varying maturities.

What we have been reading this week

What are we reading

Top 10 Business Risks and Opportunities for mining and metals in 2022

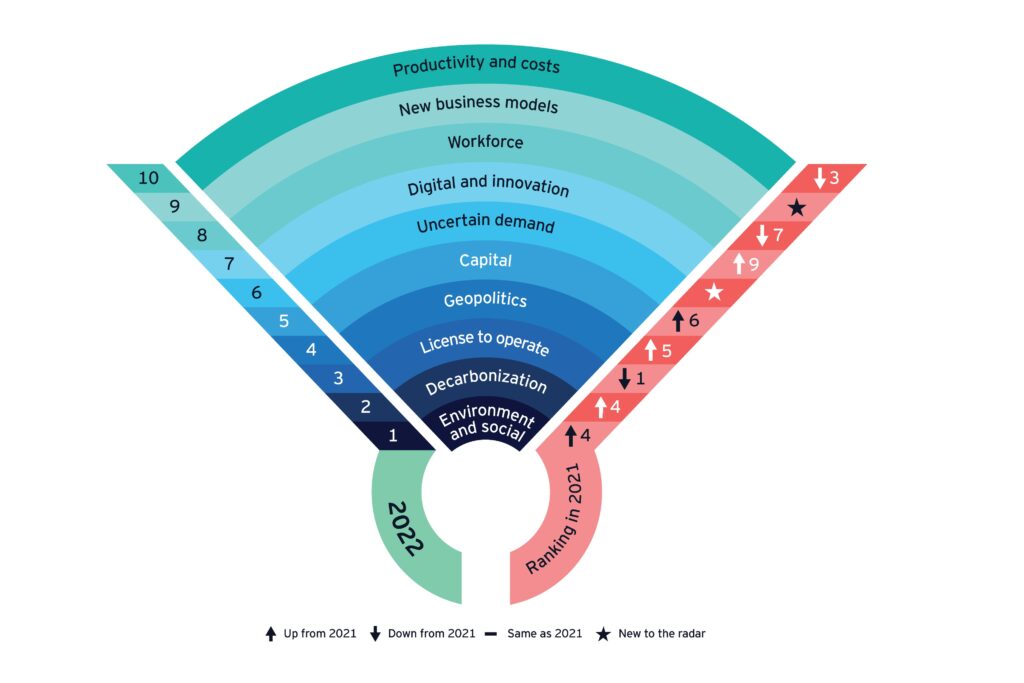

According to EY’s latest report on the mining sector, opportunities for mining and metals companies will continue to outweigh risks in 2022.

- For the first time in our annual report on the sector, mining and metals companies rank environment and social issues as their number one risk.

- Decarbonization is a major disrupter, dominating discussions and presenting both risks and opportunities.

- License to operate has lost the top spot it held for the past three years but is still seen as a top three risk.

Disruption is fast reshaping the mining and metals sector’s perception of where the biggest challenges – and paths to growth – may lie, according to our annual review of risks and opportunities in the global mining and metals sector (pdf). The climate crisis and rising stakeholder expectations are increasingly significant forces of change. Environment and social took the number one spot in our rankings for the first time, followed by decarbonization and then license to operate (LTO), which had held the top position over the past three years.

Two new entrants to the ranking – uncertain demand and new business models – highlight the ongoing volatility in a market still impacted by the COVID-19 pandemic. Still, we see more opportunities than risks for miners willing to make the transformational changes that can drive long-term value for organizations and the communities they serve.

Trend 1: Environment and social

Miners that can demonstrate their contribution to a sustainable future will have a competitive advantage.

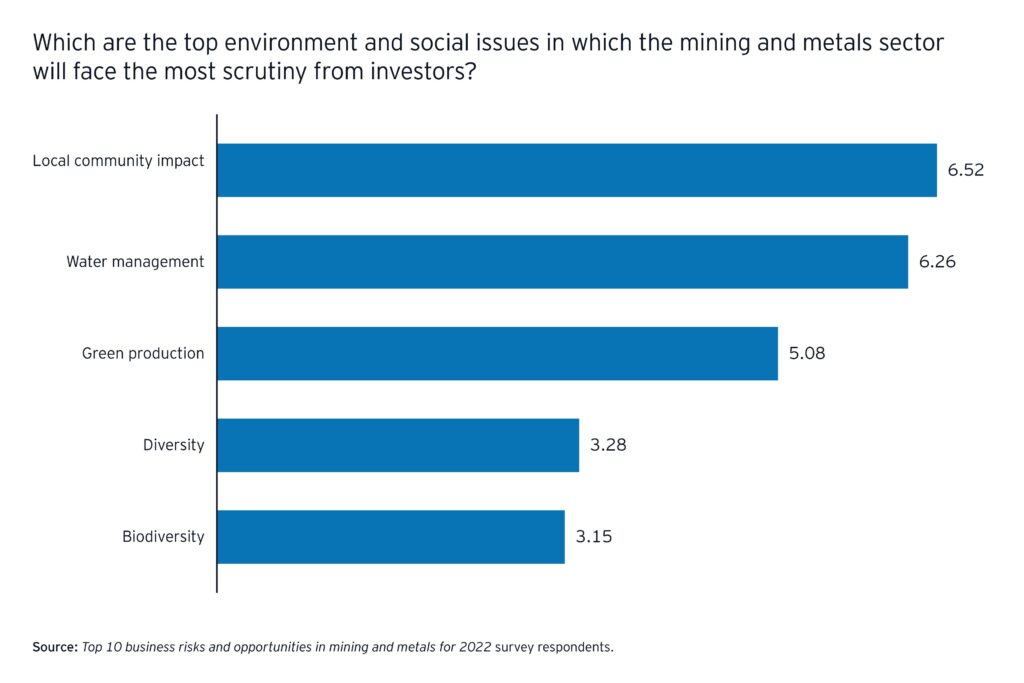

As environmental, social and governance (ESG) factors become a bigger priority for investors, shareholders and a broader group of stakeholders, miners are doing more to integrate ESG into corporate strategies, decision-making and stakeholder reporting. Stakeholder pressure over issues such as biodiversity and water management are likely to intensify, requiring miners to progressively plan for mine closures and better manage the water-energy nexus to satisfy expectations.

Companies are also under increasing pressure to take more responsibility for their impact on communities, and go beyond their regulatory obligations. Miners that help drive the long-term, sustainable economic and social growth of the regions in which they operate can leave a positive legacy beyond life of mine.

Trend 2: Decarbonization

Building a flexible decarbonization strategy can help achieve net zero and differentiation.

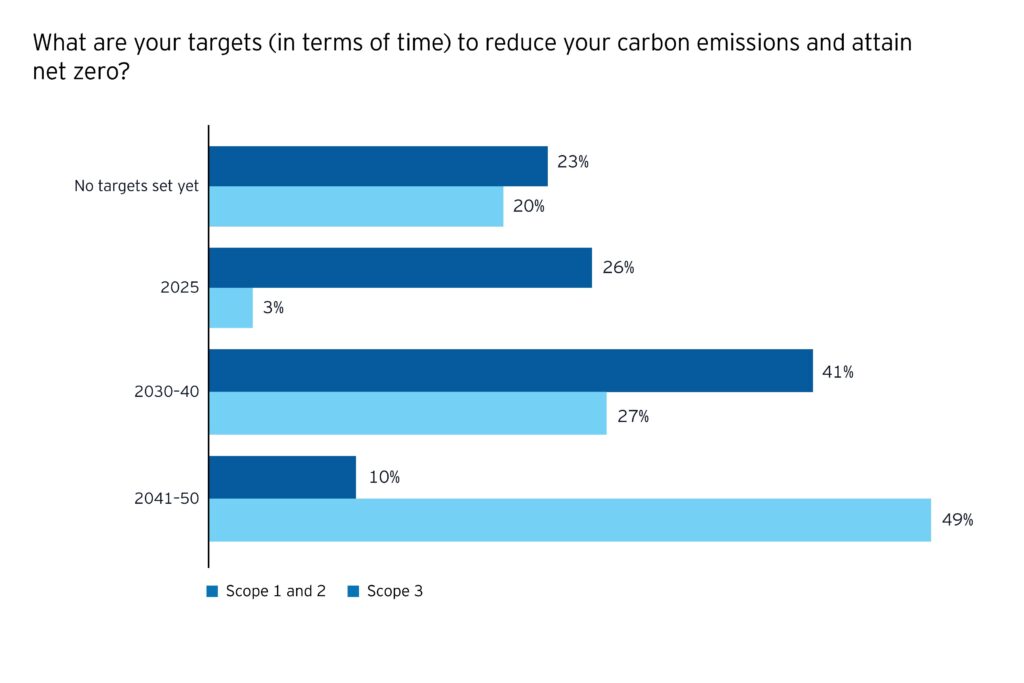

With investors and governments moving away from investment in thermal coal, and carbon pricing set to increase, miners must treat decarbonization like any other strategic risk.

Building a flexible path to decarbonization, which includes scenario modelling and reviewing funding, technology and assets, can help companies achieve net zero and differentiate. And while many companies have made progress in abating Scope 1 and 2 emissions, now is the time to focus on Scope 3. Those that can control these emissions can create genuine value and long-term sustainability.

Trend 3: License to operate

Creating long-term value for all stakeholders can secure mining’s future.

License to operate (LTO) is evolving fast as expectations change around mining’s contribution to communities, economies, protection of heritage sites and engagement with Indigenous and First Nations people.

Survey report

40%

of survey respondents say community engagement will be the focus of investor scrutiny in 2022.

With LTO increasingly linked to an organization’s ability to access resources, capital and debt, a proactive approach to these challenges is critical. Broader consultation with Traditional Owners, a sharper focus on strengthening brand, and a commitment to driving value for both shareholders and communities, can help companies build a stronger LTO. Over 40% of our survey respondents say that community engagement will be the focus of investor scrutiny of mining and metals in 2022.

Trend 4: Geopolitics

Miners will need to proactively navigate trade wars, new governments and resource nationalism.

The geopolitics of the COVID-19 pandemic — including export controls and industrial policies to increase “self-sufficiency” in critical products and a global minimum tax on the largest global companies — are creating headwinds for globalization and exacerbating strains in the global rules-based order.

Survey report

79%

of survey respondents expect royalties and taxes to increase.

2022 is likely to see more geopolitical challenges, including changing governments and resource nationalism. Seventy-nine percent of miners expect royalties and taxes to increase. Mitigating risks will require a diverse approach that includes engaging with governments and building supply chain resilience.

Trend 5: Capital

With capital availability increasingly linked to ESG ratings, miners need to demonstrate their achievements.

Access to capital remains challenging for mining and metals companies, with investors deterred by risks associated with ESG, LTO, community issues and volatility. Some companies with high-carbon assets are exploring alternative funding sources, such as private equity.

Competing for well-priced capital requires miners to better demonstrate their achievement of both financial and nonfinancial considerations. Higher ESG ratings can enable access to a larger pool of attractively priced capital. With capital tight, miners should also reshape portfolios and investments to align with their strategy and capitalize on changing demand, including for battery minerals.

Higher ESG ratings can enable access to a larger pool of attractively priced capital.

Trend 6: Uncertain demand

Building agility can help miners manage price volatility, substitution threats and changing demands.

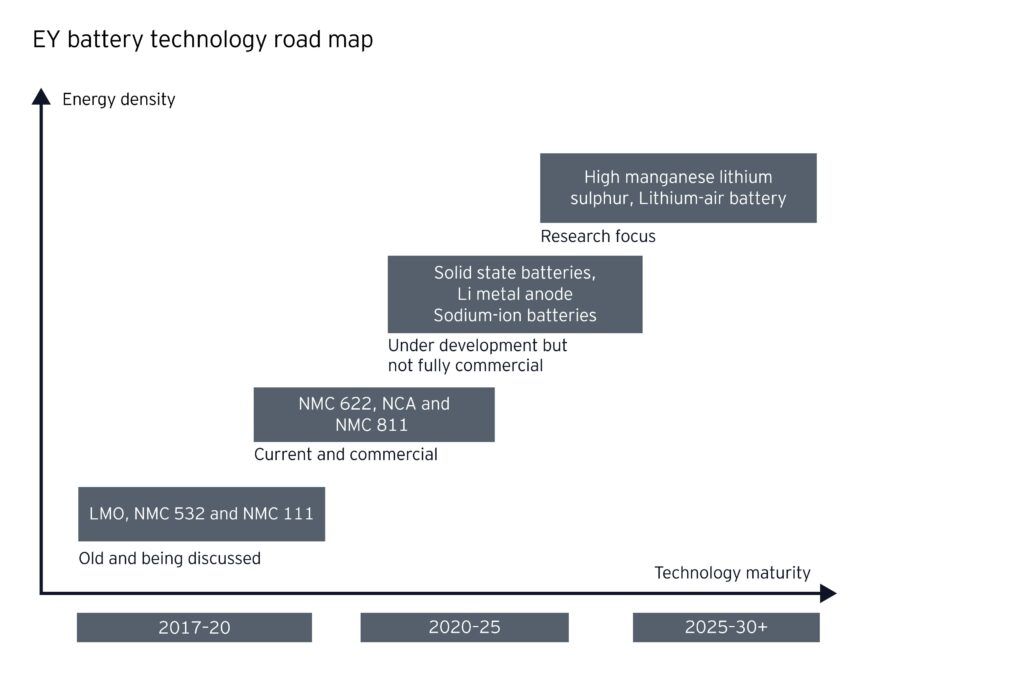

The energy transition is pushing up demand for the minerals integral to renewable energy, electric vehicles and energy storage systems. To meet this demand, miners will need to overcome big supply-side challenges, including accessing capital, securing LTO and the geopolitical risk that comes with minerals concentrated in just a few markets.

The threat of substitution is also real in a sector with long project lead times. Advances in technology and the evolution of the energy transition may see demand for different commodities change before miners can keep up. The timeline of battery manufacturing highlights this risk.

How EY can help

Our Digital Navigator takes an end-to-end approach to the development of a digital vision, strategy and actionable road map for mining and metals companies.

Scenario modelling can help miners predict the impact of changing demand, while offtake agreements may mitigate the risk of volatile prices. Some companies are becoming participants in integrated supply chains rather than commodity markets.

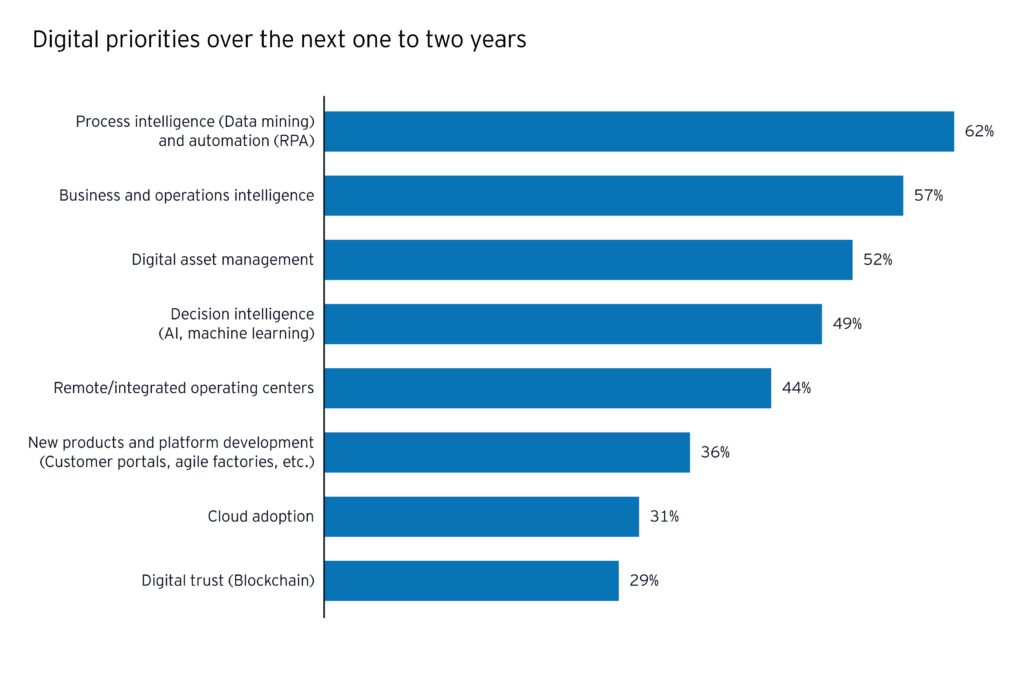

Trend 7: Digital and innovation

Miners are driving innovation to address productivity, safety and ESG priorities.

Digital and innovation have been key tools in helping miners improve productivity. We expect to see even greater use of data science, modelling and scenario planning to enable more agile decision-making around cost.

COVID-19 also highlighted the huge potential of digital to improve onsite health and safety. Miners that already used automation and remote operating centres (ROCs) fared better during the pandemic and, not surprisingly, our survey revealed that companies plan to increase investment in these areas.

Miners are also deploying technology as part of their ESG agenda. Digital innovation can allow diversification into greener products and improve transparency of reporting.

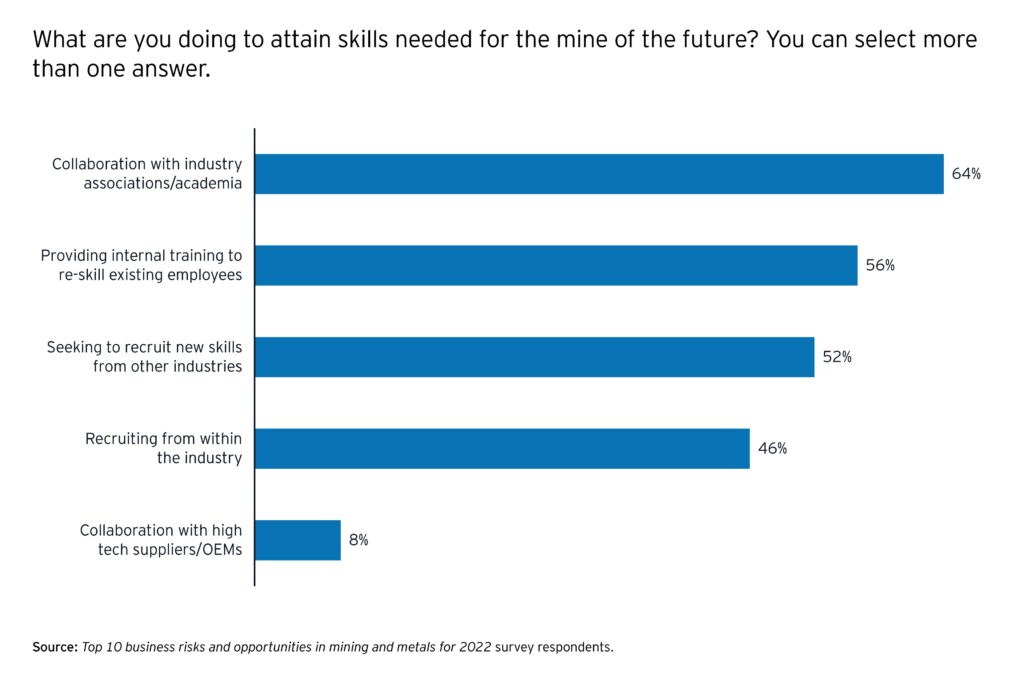

Trend 8: Workforce

Creating an inclusive, safe culture and career pathways can build a future-ready workforce.

Miners face a talent crisis as border closures and an unappealing brand make it difficult to find the right skills for a changing industry. Competing in a tight market requires miners to build a workplace that appeals to more diverse workers. Improving cultural safety on-site must be a priority, and miners should continue the mental health programs that began as a result of the COVID-19 pandemic. Diversity and inclusion are now firmly on investors’ agendas and must be a board-level directive in mining and metals companies.

Closing the sector’s big digital literacy gap will depend on greater investment in high-quality online learning, sometimes in collaboration with each other and third parties.

Trend 9: New business models

Six models can help mining and metals companies operate within a more volatile environment.

Amid ongoing uncertainty, miners have an opportunity to assess whether existing business models are fit for purpose. Six models may better help miners capture value amid volatility:

- Shared value model: Delivering greater returns directly to host communities and governments

- Circular business model: Minimizing waste and reducing emissions

- Vertical integration: Acquiring or integrating into downstream companies such as automakers

- Horizontal market integration: Moving into adjacent businesses, e.g., tech providers, to drive innovation

- Joint ventures: Potentially delivering more value to stakeholders and improving access to reserves and capabilities

- Offtake agreements: Providing low-risk access to capital

Determining which model fits best requires companies to first identify where value, risks and opportunities lie in the current model, then conduct in-depth scenario planning and future market assessments.

Trend 10: Productivity and costs

Balancing short term gains and long term value can drive sustainable cost reductions.

The COVID-19 pandemic means demand is up, but so are the costs of inputs, shipping, talent and decarbonization programs. Reducing costs and improving productivity is a balancing act for miners that must achieve short-term gains while creating long-term value.

Variability is a key impact on miners’ productivity. Managing this requires:

- Improved geological modelling to alleviate uncertainty

- Analytics around asset performance to enable predictive maintenance and improve reliability

- Operational discipline to deliver consistent results

- Integrated operating models that align with markets to enable rapid response to change

Productivity initiatives centred around people and enabled by technology can help miners achieve sustainable, end-to-end improvements without having a negative impact on LTO

10 Best Crops For Biofuel Production

Biofuel is a type of fuel that is produced from biomass (that is from plants and animal material). Unlike fossil fuels which take time to form because of the slow geological process, biofuels are readily available and can be produced from other sources apart from plants such as industrial waste with biological origin. Also, biofuel is a cleaner source of energy than fossil fuels and releases fewer pollutants and greenhouse gasses. There are two main categories of biofuel; biodiesel and bio-alcohol. Bio-alcohol is created by the bacterial breakdown of starch in plants while biodiesel is derived from the oil already available in such plants. Below are some of the main crops for biofuel production

Corn

Corn is considered as the main source of ethanol-based biofuel. Corn is rich in sugar which is the main source of ethanol. The sugar-rich corn is turned into ethanol through a brewing process which is similar to brewing beer. The kernels are first ground and then mixed with warm water and yeast. Kernels are used because it makes the fermentation process cheaper than when an entire corn plant is used. The yeast causes the mixture to ferment and produce ethanol. The resultant ethanol is then blended with gasoline for use in car engines. Ethanol produced from corn releases less nitrogen oxide, carbon monoxide, and sulfure thus reduces smog in cities.

Rapeseed/Canola

Rapeseed oil has been used in cooking food and illuminating homes for centuries and is still one of the main sources of biodiesel. The most popular rapeseed oil comes from canola since it contains low erucic acid compared to other rapeseeds. Apart from biofuel, canola is also a source of food for both humans and animals. Although most biodiesels derived from vegetables do not burn well, especially in cold weather because of the highly saturated fats, canola is an exception because it contains low saturated fats which makes it hard for the ice crystals to form. Canola also has higher oil content than other vegetable oils.

Sugarcane

Apart from corn, sugarcane is also an important source of ethanol which is considered generally cheaper than gasoline. In recent years, Brazil has made strides in reducing its dependence on fossil fuel and increase the use of biofuel. The government has been encouraging its farmers to plant sugarcane. Ethanol production from sugarcane is almost six times cheaper than producing ethanol from corn. However, despite the use of fewer chemicals in growing the crop, the harvesting of sugarcane which involves burning the field leads to the emission of large amounts of greenhouse gases into the atmosphere.

Palm Oil

Palm oil is an energy-efficient biofuel that is extracted from the palm tree. This type of biofuel is environmentally friendly as it releases less carbon dioxide gas into the atmosphere compared to gasoline. Interestingly, cars using diesel engines can run on palm oil without being converted. Palm trees are common along with the coastal areas and are also popular for their fruits. Palm oil has been one of the major contributors to the economies of Indonesia and Malaysia. However, the clearing of tracks of land to plant the crop is considered as an environmental concern.

Jatropha

Jatropha is popularly known as a poisonous weed that grows quickly and requires less water to produce its numerous seeds. However, its seeds are rich in oil content that can be used to supplement crude oil. India is the largest Jatropha producer in the world with its biodiesel industry centred on the crop. Jatropha bush can survive for up to 50 years in a drought-ravaged land. Approximately 0.83-2.2 tons of oil can be extracted from 1 hectare of jatropha.

Soybeans

Soybeans are not only used in the production of shampoos, tacos, and tofu but can also be used in the production of fuel. In the US, most of the biodiesels are produced from soybean oil. Heavy commercial vehicles can efficiently operate on pure soybean biodiesel or a blend of diesel and biodiesel. Soybean biodiesel produces more energy than corn ethanol and is also more environmentally sound. A bushel of soybeans can produce up to 6 litres of biodiesel. However, its oil content is lower than that of sunflower seeds and canola.

Switchgrass

Switchgrass has the greatest potential to solve the problem of over-reliance on fossil fuel than any other biofuel crop. Unlike corn or even sugarcane, this wonder plant has a form of cellulose that requires less energy to produce ethanol. The cellulose ethanol in switchgrass also contains more energy than corn ethanol and also emits fewer greenhouse gases. According to researchers, one acre of switchgrass plantation can produce up to 15 tons of biomass or 4,350 litres of ethanol daily. Despite being a potential source of biofuel, there are no great switchgrass farms or plantations.

Sunflower

Sunflower plants are quickly gaining popularity as feedstock crops for biodiesel as they share certain common characteristics with other crops such as canola and soy. The sunflower seeds have a high oil content of up to 40%, making the plant an excellent choice for biofuel crops. The seeds can be processed into biodiesel or the plant waste can be used as biomass to fuel factories and power plants. According to research by the National Sunflower Association, one acre of sunflower can produce up to 600 pounds of oil. However, the quantity of oil extracted from sunflower seeds varies depending on several factors including growing conditions and methods of oil extraction.

Wheat

Wheat is a source of biofuel used for renewable energy. Traditional biofuels such as ethanol have been derived from several sources including corn and wheat. One of the major benefits of wheat as a source biofuel is that the fuel is derived from wheat pellets which are made from the husk of the crop. Thus, it is possible to produce food and create energy from the same plant. In Europe, 4 million litters of wheat-based ethanol is produced every year. However, the increased use of wheat as a source of energy may divert the grains needed for food.

Cottonseed

Although cotton is mainly used as a source of fibre for clothes, cottonseed oil has been used for decades, especially in the US for cooking. Approximately 20% of the cotton plant is oil. It is estimated that an acre of cotton contains more oil than an acre of corn or soy. The main drawback of using cottonseed oil as a car fuel is that it solidifies in cold temperature and would render a vehicle unusable in winter.

Hyundai, Shell Hydrogen to develop 48 new hydrogen refuelling stations in California

California, US, is set to benefit from a new agreement between Hyundai and Shell Hydrogen which will see the development of 48 new and two upgraded Shell hydrogen refuelling stations.

Revealed today (Oct 8) as part of National Hydrogen and Fuel Cel Day, Hyundai Motor North America will join Shell hydrogen in developing the hydrogen infrastructure in California as a means to support the growth of the hydrogen sector the region.

The agreement, known as Project Neptune, will see the 48 new hydrogen refuelling stations and two upgraded shell stations developed across the Golden State in 2021.

Hydrogen refuelling infrastructure growth has been regarded as critical to rapidly increase consumer adoption of zero-emission fuel cell vehicles.

By joining Project Neptune, Hyundai reinforces its commitment to fuel cell technologies and their positive impact on the environment, a key pillar of its long-range strategic vision.

The new hydrogen stations will be partially funded by public funds from the California Energy Commission (CEC).

Two other fuel cell vehicle manufacturers have also joined the consortium with respective agreements for fuel cell vehicle sales to support infrastructure growth.

Olabisi Boyle, Vice-President of Product Planning and Mobility Strategy at Hyundai Motor North America, said, “We’re proud to join Shell Hydrogen’s ‘Project Neptune’, expanding California’s hydrogen infrastructure to meet increasing consumer demand for clean, zero-emission transportation solutions.

“Hyundai offers a superb fuel cell vehicle in its NEXO SUV, and this effort will help ensure that every eco-focused fuel cell driver has convenient refuelling options wherever they choose to go.”

I hope you have enjoyed this week’s read. If you would like to know more in regard to investing though JMP, whether that is to buy shares or bonds or more information on how you can maximise your superannuation, please feel free to call me

Regards,

Chris Hagan,

Head, Fixed Interest and Superannuation

JMP Securities

Level 1, Harbourside West, Stanley Esplanade

Port Moresby, Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814