5 September, 2022

Welcome to this week’s JMP Report

Three stocks traded on the local bourse last week, BSP, KSL, and STO. BSP traded 1,000,357 shares unchanged at K12.41, KSL saw 199,186 shares trading higher by 10 toea closing at K3.00 while STO traded 937 shares unchanged at K19.10. Refer details below;

WEEKLY MARKET REPORT | 29 August, 2022 – 2 September, 2022

| STOCK | QUANTITY | CLOSING PRICE | CHANGE | % CHANGE | 2021 FINAL DIV | 2021 INTERIM | YIELD % | EX-DATE | RECORD DATE | PAYMENT DATE | DRP | MARKET CAP |

| BSP | 1,000,357 | 12.41 | – | – | K1.3400 | K0.34 | 11.61 | FRI 23 SEPT | MON 26 SEPT | FRI 14 OCT | NO | 5,317,971,001 |

| KSL | 199,186 | 3.00 | 0.1 | 3.33 | K0.1850 | K0.0103 | 7.74 | MON 5 SEPT | TUE 6 SEPT | TUE 4 OCT | NO | 64,817,259 |

| STO | 937 | 19.10 | – | – | K0.2993 | K0.26760 | – | MON 22 AUG | TUE 23 AUG | THU 22 SEPT | – | – |

| KAM | 0 | 1.00 | – | – | – | – | 10.00 | – | – | – | YES | 49,891,306 |

| NCM | 0 | 75.00 | – | – | USD$0.075 | K0.70422535 | – | FRI 26 AUG | MON 29 AUG FEB | MON 29 AUG | – | 33,774,150 |

| NGP | 0 | 0.70 | – | – | – | – | – | – | – | – | – | 32,123,490 |

| CCP | 0 | 1.85 | – | – | K0.134 | – | 6.19 | THU 16 JUN | FRI 24 JUN | THU 28 JUL | YES | 569,672,964 |

| CPL | 0 | 0.95 | – | – | – | – |

– |

THU 5 APR | THU 14 APR | FRI 29 APR | – | 195,964,015 |

Please find below BSP Financial Group Limited (code: BSP) announcement: “Additional Company Tax – Court Application Re-filed”.

Download | BSP Announcement

Order Book

Our order book has us as nett buyers of BSP, KSL, CCP and STO.

Dual listed stock PNGX and ASX

BFL – $4.90 -1c

KSL – .92 steady

NCM – $17.03 – $2.31

STO – $7.73 -13c

On the interest rate front

This week’s TBill auction came in at an average of 4.18% and the volume was oversubscribed by 307mill. A little difficult to forecast how much further the rates are likely to fall whilst we have the liquidity that is in the market.

The results from the GIS auction are a little mixed with the professional market indicating they are not prepared to hold long dated stock, particularly the long end at these levels. The results from the auction were 4.84% in the 2yr out to 6.92% in the 10yr. A total of K288 mill was taken up which was 62mill less than what was on offer. I have attached the full results for your interest. I do expect pressure on GIS to rise to meet the spending requirements to kick start Porgera.

GIS Auction Results

And something a little different;

|

AUD/USD 0.69799 Gold Standard $US55.0 ( Up 0.48/0.88%) $AU80.90 ( Up 0.60/0.74%) Silver $US0.58 ( Up $0.01 / 1.75%) $AU0.85 ( Up $0.02 / 2.40%) Bitcoin $US19,861 ( Down $215/1.07%) $AU29,211 (Down $356 / 1.20%) Ethereum $US1569 (Down $18 / 1.13%) $AU2,307 (Down $30/1.28%)

|

What we’ve been reading this week

Forrest injects $150m into rare earths player

TOM PARKER

Australian Resources and Investment

Hastings’ Yangibana project.

Andrew Forrest’s private company Wyloo Metals has made a $150-million cornerstone investment into Hastings Technology Metals – owner of the advanced Yangibana rare earths project in Western Australia.

Hastings will use the Wyloo proceeds, paid in secured notes, to acquire a 22.1 per cent equity interest in TSX-listed Neo Performance Materials, a leading global rare earth processing and advanced permanent magnets producer.

This will cost Hastings $C15 per share, representing a 4.7 per cent premium to Neo’s closing share price of $C14.33 on August 24. The total consideration for the acquisition is $C135 million ($150.7 million).

The notes will have a term of three years and will be exchangeable, at any time after 60 days, into Hastings ordinary shares at an exchange price of $5.50 per share.

Wyloo will also have the right to appoint a nominee director to the board of Hastings and retain that nominee while Wyloo’s equity interest in Hastings is 12.5 per cent or more.

Wyloo chief executive officer Luca Giacovazzi said the investment fit well with the company’s long-term strategy.

“Rare earths and the permanent magnets they produce are essential enablers of the energy transition,” he said.

“There is already a shortage of these products, and the upcoming increase in magnet demand will require continued investment.

“This transaction with Hastings spans the value chain, from mining to magnet manufacturing. As the owner of the only commercial rare earth metals facility in Europe, Neo is strategically placed to help Europe meet its goal to become climate neutral by 2050.

Wyloo’s ambition is to “explore for, develop and invest in the next generation of mines that will produce the raw materials needed for a cleaner, more sustainable future”.

In 2021, Wyloo outpaced BHP in acquiring Canadian nickel explorer Noront Resources. This deal was completed in April.

Wyloo is also invested in nickel miner Mincor Resources, and has a strategic partnership with IGO that sees the two working together to advance downstream nickel-processing opportunities in Australia.

DIGITAL MARKETS FEELING THE PRESSURE OF FED LIQUIDITY HANDBRAKE

Ainslie Bullion

Near-term weakness continues to haunt numerous Bitcoin fundamentals, with prices faltering amidst minimal excess sell-side pressure. Investors who are spending appear to be taking advantage of exit liquidity.

It has been another tough week for asset markets, with Bitcoin, equities, forex, and bond markets experiencing volatility, and general price depreciation. The Euro has once again traded below USD parity as the European energy crisis worsens, and the DXY Dollar Index has punched up to a new twenty-year high above 109.30.

With the US Federal Reserve governors continuing to signal a hawkish stance on inflation at Jackson Hole, Bitcoin, as a developing index for global liquidity, reacted accordingly. Prices traded lower this week, coming off a high of $21,781, and hitting a multi-week low of $19,611.

The 2022 bear market carries on and has taken a toll on the aggregate Bitcoin investor base. Despite not seeing any widespread loss of conviction amongst the HODLers, as signalled by lifespan metrics in decline, the bulls still cannot establish a meaningful uptrend. That being said, they are supporting key levels.

The psychology of investor spending patterns remains firmly in the bear market territory, as rallies are sold, and exit liquidity is taken at or around cost basis levels. Given the current remarkably low active user base, it could be considered impressive that the $20k level has held up to date, signalling that long-term holder confidence remains.

It also remains plausible that Bitcoin is in a bottom formation range and would be historically similar to all past bear markets. We can see this in the on-chain data, which shows how BTC, and other crypto markets, are hanging on right now.

Starting with the lifespan metrics, which broadly describe the age of coins that are being spent on-chain. Generally speaking:

- Lower lifespan values signify younger coins dominate transactions. It is usually encountered as the bear market grinds lower, and speculators are purged from the market.

- Higher lifespan values signify older coins dominate transactions. It is usually experienced during bull markets as profits are taken, but also during bearish capitulation events, due to panic selling.

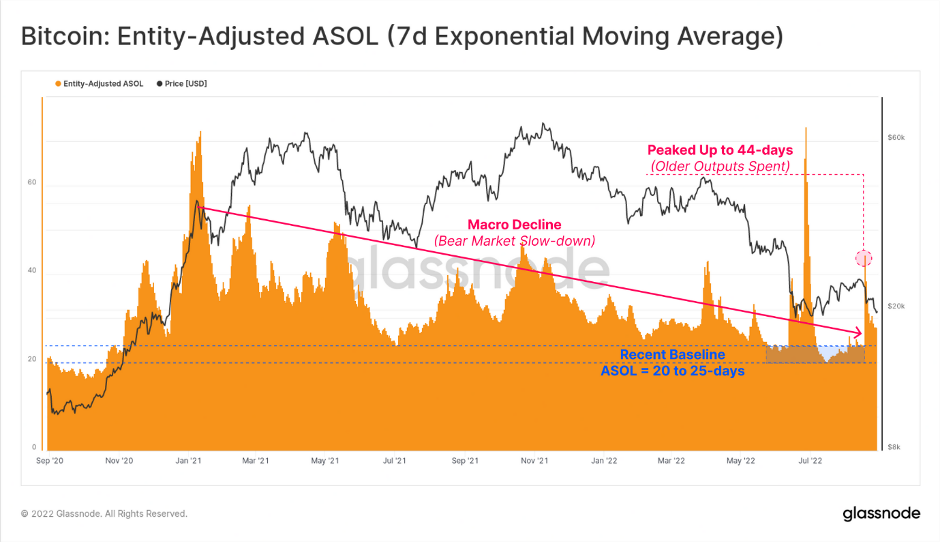

ASOL tracks the average age per spent output but ignores coin volume. It has been in a macro decline since Jan 2021, coincident with the prevailing bear. It spiked higher over recent weeks, as a group of older coins were spent, however, this was only for a fleeting moment.

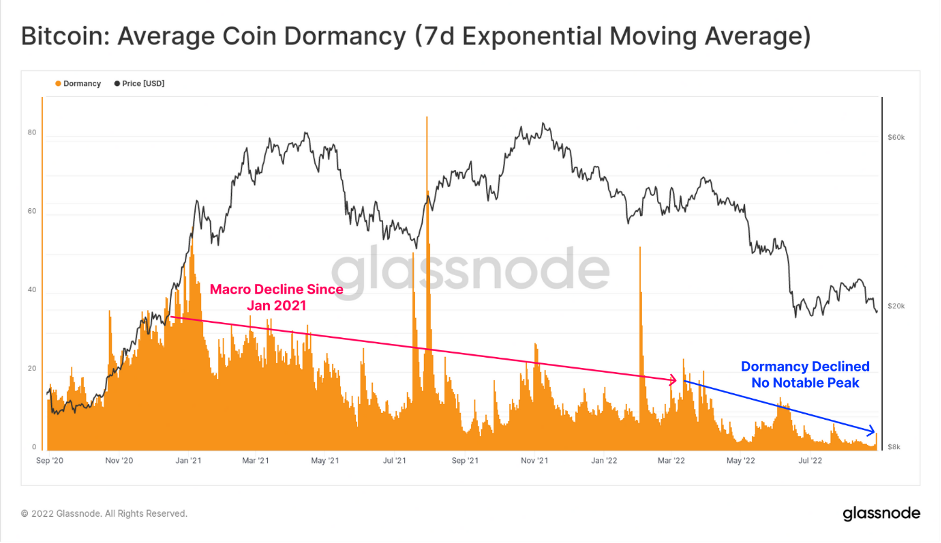

We can further inspect this by looking at Dormancy, which is the average age per unit coin moved. This metric does account for spent coin volume. Here we can see that the average age per coin is near multi-year lows, which means the ASOL spike was very light on BTC volume.

This could be a very constructive signal, as it shows older coins are staying dormant.

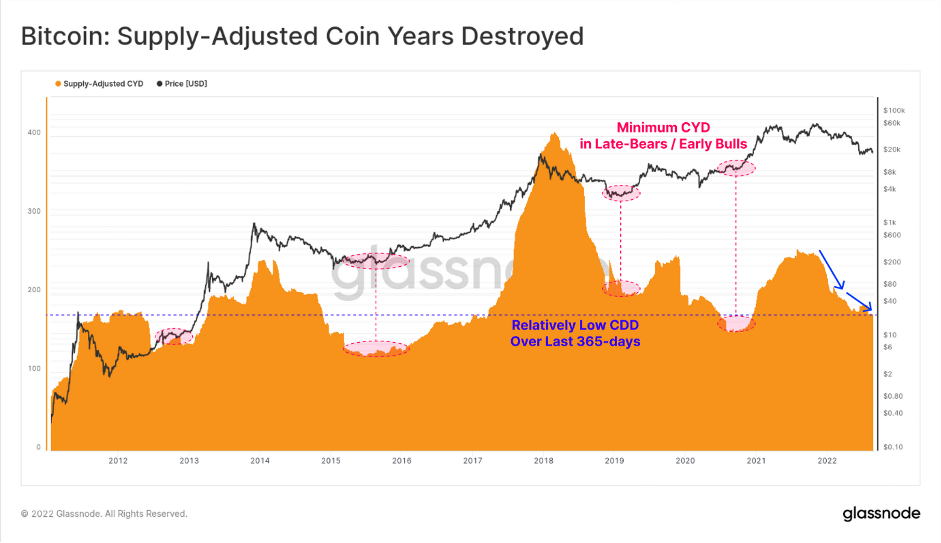

At a macro scale, the Coin-Years Destroyed metric continues to push lower, reaching a relatively significant low. This metric aggregates the total lifespan destroyed (in years) over the last 365-days, and similar to dormancy, low levels are usually constructive and typical of late-stage bear markets.

It remains plausible that the Bitcoin market is trading within what may become a longer-term bottom formation pattern.

it is quite clear that no widespread loss of HODLer conviction has taken place. The decline in lifespan metrics bodes well for the longer term, as it indicates old coins are stationary, and declining prices have a little psychological impact on this cohort’s conviction.

Whilst the resolve of the strong hands remains rock solid, it simply appears that their available demand inflows have not yet rebuffed the bears, who have driven the bulls back to the $20k line.

Asian LNG prices hit new records as Japan, South Korea start stocking for winter

LUKE PACHYMUTHU

Singapore is particularly vulnerable to the supply crunch that has sent natural gas prices in Asia to records highs. – ST

SINGAPORE (The Straits Times/Asia News Network): Liquefied natural gas (LNG) prices in Asia have hit fresh records as Japan and South Korea, two of the region’s largest buyers, start their procurement programme for the coming winter, industry sources said.

As Singapore imports most of its gas requirements, residents here can expect electricity prices to remain high.

The electricity tariff for the July to September quarter, exclusive of goods and service tax, is 30.17 cents per kilowatt-hour, up 8 per cent from the previous period.

The surge in LNG prices had been triggered by a strain on global supplies as Europe grapples with the significant loss of gas flows from Russia.

In Asia, the average LNG price for spot cargo being delivered in the month of October to north-east Asia is estimated at US$57 to US$60 per million British thermal units, according to industry sources, considerably higher than prices at the start of the third quarter.

Spot LNG prices in Asia were trading at around US$42 to US$43 at the tail end of July going into early August, up from around US$25 in May and about US$38 in June, according to industry data.

Alex Siow, lead Asia gas analyst at data intelligence company ICIS said Japan and South Korea combined are looking to secure around five million tonnes of spot cargo in August, September and October, compared with 5.5 million tonnes during the same period last year.

While the volume is slightly lower than in 2021, Siow said the market dynamics now is starkly different, pointing to the highly volatile situation in Europe.

Russian pipeline gas supplies to Europe have dropped off by around 75 per cent this year, impacted by a tug of war over European sanctions on Moscow over its invasion of Ukraine.

This week, Gazprom, the Kremlin-controlled company with a monopoly on Russian gas exports by pipeline, announced an unscheduled maintenance on Nord Stream 1, one of its largest pipelines supplying gas to Germany.

The disruption to piped gas supply has caused European buyers to compete aggressively for limited spot LNG supply in the global market, by outbidding buyers in Asia, said Mr Toby Copson, global head of trading and advisory at Trident LNG.

“It’s safe to assume that Europe will be active and try to corner whatever volume is available, but securing it isn’t guaranteed when you have government backing and initiatives like we have seen from South Korea and Japan. So, in effect, we will see a bidding war, and during this, prices will remain elevated due to the competition from Asia,” he said.

Siow said that based on ICIS price data, the total value of the 80 cargoes set to be bought from August through October is estimated to be about US$14.7 billion (S$20.4 billion), more than double the US$6.7 billion value of the 88 cargoes purchased during the same period in 2021.

While the imbalance between supply and demand has been reduced slightly from ICIS’ forecast of 14.4 million tonnes in July, Siow said the market still remains short of about 12.3 million tonnes.

Valery Chow, vice-president at consultancy Wood Mackenzie, said the high prices have resulted in buyers, particularly in South Asia, scrambling to reduce their power-generation costs by opting to use oil, which is cheaper than gas.

“For countries that can switch, oil reduces rapidly increasing power bills and staves off economic stress,” he said.

He added that oil demand has increased 67 per cent in Pakistan and 40 per cent in Bangladesh year on year. “These countries are rapidly increasing fuel oil imports to meet power demands.”

In August, Senoko Energy president Graeme York told The Straits Times that the company had used more diesel for power generation over the past six months due to the volatility of gas prices and supply.

The Energy Market Authority (EMA) had also noted at the time that while power-generation companies in Singapore continue to use natural gas for electricity production, the plants are designed to be able to operate on diesel as a back-up fuel.

While oil prices have fallen from a 2022 peak of around US$130 a barrel seen in March, strong demand for gas oil in the fourth quarter is pushing up prices over concerns about available supply, said Yaw Yanchong, director at Refinitiv, a unit of the London Stock Exchange Group.

He said: “We expect gas oil demand to peak in the winter, especially with the Dec 5 deadline of the European Union’s complete ban of seaborne Russian oil imports looming.”

Based on Refinitiv assessments, margins for gas oil are currently at around US$45 to US$50 a barrel, compared with pre-invasion levels when it was pegged at around US$10 a barrel.

“Winter demand is bullish and, as we have said before, the dip in oil prices is not a reflection of market fundamentals. There is a war in Europe where the stakes are now much higher than when it first started, and Europe is facing a severe energy crisis, as you can see from electricity costs in the region,” said Yaw.

Conserving energy is the simplest way for consumers in Singapore to keep their power bills in check, said industry executive Malavika Bambawale.

Bambawale, regional managing director of sustainability solutions at Engie Impact, told The Straits Times: “Energy efficiency is the lowest hanging fruit… (it) will be a win-win approach to reduce power consumption, save money and reduce carbon emissions.”

Bambawale noted that simple daily lifestyle adjustments can go a long way in keeping costs down.

“Energy efficiency is also about equipment change, and it starts from the simplest things,” she added.

“For example, replacing incandescent bulbs with fluorescent or LED bulbs can already make energy use 10 to 20 times more efficient. The challenge lies in the initial investment needed to adopt energy-efficient equipment.”

Her advice comes amid a growing global crisis in energy supplies triggered by sanctions on Russia, a major gas and oil producer.

Power prices have gone through the roof in recent months as competition intensifies among nations desperate to lock in new energy sources.

Singapore, which imports 95 per cent of its power generation requirements, is particularly vulnerable to the supply crunch that has sent natural gas prices in Asia to records highs.

Electricity tariffs here will increasingly reflect the new pricing levels in the months ahead.

SP Group’s electricity tariff for the period of July 1 to Sept 30 is at $30.17 cents per kilowatt-hour (kWh), excluding GST. This is up around 8 per cent from the previous rate of $27.94 cents per kWh.

Electricity tariffs have been rising since the first quarter of last year.

The Open Electricity Market’s price comparison website showed on Thursday (Aug 25) that prices are now ranging from $31.30 per kWh to as much as $48.15 per kWh.

Engie Impact is the sustainability consulting arm of French energy company Engie. Its South-east Asia unit was appointed by JTC Corporation last year to build, own and operate an underground district cooling system for the Punggol Digital District.

It involves Engie building the plant, which will have a cooling capacity of 30,000 refrigeration tonnes, equivalent to cooling 8,000 four-room Housing Board flats.

I hope you have enjoyed this week’s report, if you wish to discuss how to go about setting up an account to trade or have shares you would like to sell, please feel free to contact me.

Regards,

Chris Hagan.

Head, Fixed Interest and Superannuation

JMP Securities

Level 1, Harbourside West, Stanley Esplanade

Port Moresby, Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814