27 November, 2023

Hello and welcome to this week’s JMP Report

On the equity front, week, last week we saw 2 stocks trade on the local market. BSP traded 657 shares, closing 6t higher at K13.66 and KSL traded 15,387 shares, closing 4t higher at K2.45.

WEEKLY MARKET REPORT | 20 November, 2023 – 24 November, 2023

| STOCK | QUANTITY | CLOSING PRICE | BID | OFFER | CHANGE | % CHANGE | 2022 FINAL DIV | 2023 INTERIM | YIELD % | EX-DATE | RECORD DATE | PAYMENT DATE | DRP |

| BSP | 657 | 13.66 | 13.66 | 15.00 | 0.06 | 0.44 | K1.4000 | K0.370 | 13.33 | FRI 22 SEPT 2023 | MON 25 SEPT 2023 | FRI 13 OCT 2023 | NO |

| KSL | 15.387 | 2.45 | 2.45 | 2.50 | 0.04 | 1.63 | K0.1610 | K0.097 | 10.75 | WED 6 SEPT 2023 | THU 7 SEPT 2023 | THU 5 OCT 2023 | NO |

| STO | – | 19.23 | 19.23 | – | – | 0.00 | K0.5310 | K0.314 | 4.42 | MON 28 AUG 2023 | TUE 29 AUG 2023 | THU 28 SEPT 2023 | – |

| NEM | – | – | 145.00 | – | – | – | – | K0.12 | 13.33 | TUE 19 SEP 2023 | WED 20 SEP 2023 | THU 19 SEP 2023 | YES |

| KAM | – | 0.90 | – | – | – | 0.00 | K0.5310 | K0.314 | 4.42 | MON 28 AUG 2023 | TUE 29 AUG 2023 | THU 28 SEPT 2023 | – |

| NGP | – | 0.69 | 0.69 | – | – | 0.00 | – | K0.0.3 | 5.80 | FRI 6 OCT 2023 | WED 11 OCT 2023 | WED 1 NOV 2023 | – |

| CCP | – | 2.00 | 2.00 | – | – | 0.00 | K0.123 | K0.110 | 11.51 | FRI 24 MAR 2023 | WED 29 MAR 2023 | FRI 5 MAY 2023 | YES |

| CPL | – | 0.70 | – | 0.79 | – | 0.00 | – | – |

– |

WED 22 MAR 2023 | THU 30 MAR 2023 | THU 30 JUL 2023 | – |

| SST | – | 35.46 | 36.46 | 50.00 | – | – | K0.70 | K0.35 | 2.96 | FRI 29 SEP 2023 | MON 2 OCT 2023 | TUE 31 OCT 2023 | NO |

Dual Listed PNGX/ASX

BFL – 5.30 +5c

KSL .765 -1c

NEM – 57.10 +1.16

STO – 7.07 +5c

Order Book

Our Order Book has us as nett buyers of BSP, KSL, STO and CCP

Interest Rates

In the TBill auction this week we saw the Bank come to the market with three maturities, 182, 273 and 364 days. The Bank issued 30 mill in the shorter maturities at 2% and 2.44% while the 364days were well bid with 541mill in bids with the Bank issuing on 330mil at 3.56%, up 6bpts from the week before.

In the Term Deposit Market, the rates remain static with FIFL leading the 12mth money at 2.75%.

Other Assets we watch

Natural Gas – 3.00 +4c

Silver – 24.34 +56c

Platinum – 939 +34

Bitcoin – 37,774 +3.5%

Ethereum – 2,077 +6.5%

PAX Gold – 1,984 +1.27%

What we’ve been reading this week

Nine Key Things for Successful Investing

Dr Shane Oliver – Head of Investment Strategy and Economics and Chief Economist, AMP Investments

Key points

Successful investing is not always easy and can be stressful. Even in good times. For this reason, it’s useful for investors to keep a key set of things in mind.

The nine key things are: make the most of compound interest; don’t get thrown off by the cycle; invest for the long term; diversify; turn down the noise; buy low and sell high; beware of the crowd; focus on investments offering a sustainable cash flow; and seek advice.

These are very important in times like the present when uncertainty around inflation, interest rates, economic activity and geopolitics is high.

Introduction

There is an ever-present worry list surrounding investment markets – usually involving some combination of concerns about economic activity, inflation, profits, interest rates, politics, natural calamities, wars, etc. It makes it hard for investors to stay focused and avoid silly mistakes. Uncertainty is magnified by perennial predictions of a crash and then periodically by talk of the next best thing that’s going to make us rich.

It would be nice if the investment world was neat and predictable, but it’s well known for sucking investors in during good times and spitting them out during bad times. If anything, it’s getting harder reflecting a surge in the flow of information and opinion. This has been magnified by social media where everyone is vying for attention and the best way to get this is via headlines of impending crisis. This all adds to investor uncertainty and erratic investment decisions.

With this in mind, I have written regularly about nine key things for investors to bear in mind to be successful. This note provides a reminder.

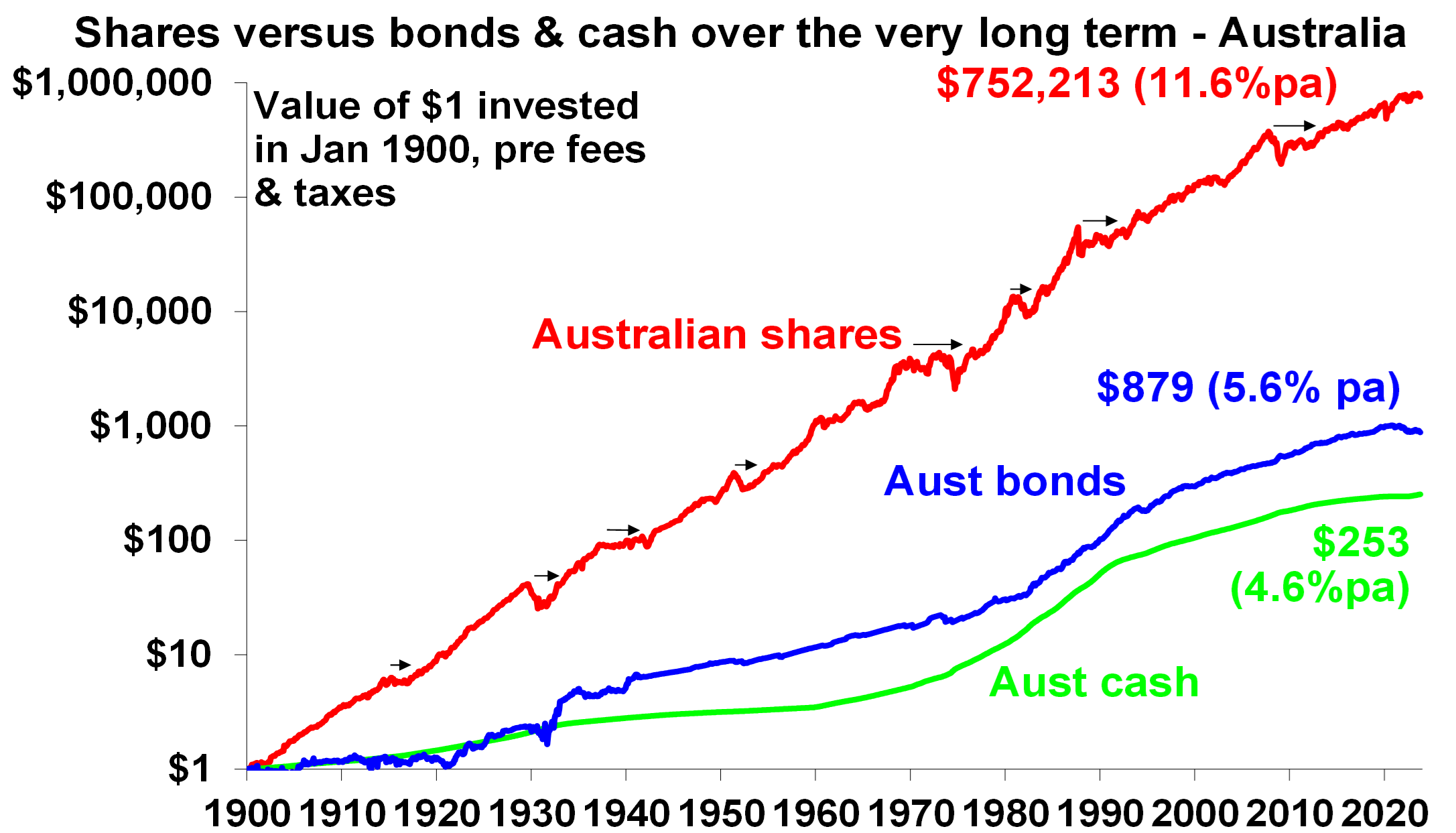

- Make the most of the power of compound interest

Making the most of compound interest – which refers to the way returns compound on past returns for an investor over long periods – is the most important thing an investor needs to do if they want to build wealth. It works best for growth assets. The next chart shows the value of one dollar invested in 1900 in Australian cash, bonds and equities with interest and dividends reinvested along the way, before fees and taxes. That one dollar would be worth $253 today if it had been invested in cash. But if it had been invested in bonds it would be worth $879 and if it was allocated to shares it would be worth $752,213. Although the average return on shares (11.6% pa) is just double that on bonds (5.9% pa), the magic of compounding higher returns leads to a substantially higher balance. The same applies to other growth assets like property. So, the best way to build wealth is to take advantage of the power of compound interest and have a decent exposure to growth assets. Of course, there is no free lunch and the price for higher returns is higher volatility but the impact of compounding returns from growth assets is huge over long periods.

Source: ASX, Bloomberg, RBA, AMP

The volatility set off by the pandemic and now flowing from high inflation and interest rate increases does nothing to change this, any more than previous setbacks (highlighted with arrows) like WW1, the Great Depression, the 1973-74 bear market, the 1987 crash or the GFC did. The likely end of the secular decline in inflation and interest rates over the last few decades which super charged investment returns means average returns over the next decade or so will be somewhat more constrained than we have become used to. But shares offering a dividend yield of 4% (5% or more with franking credits) should still provide superior medium-term returns and hence grow wealth better than bonds where the 10-year yield is 4.50% pa. Unfortunately making the most of the magic of compounding returns can be one of the hardest things to do.

- Don’t get thrown off by the cycle

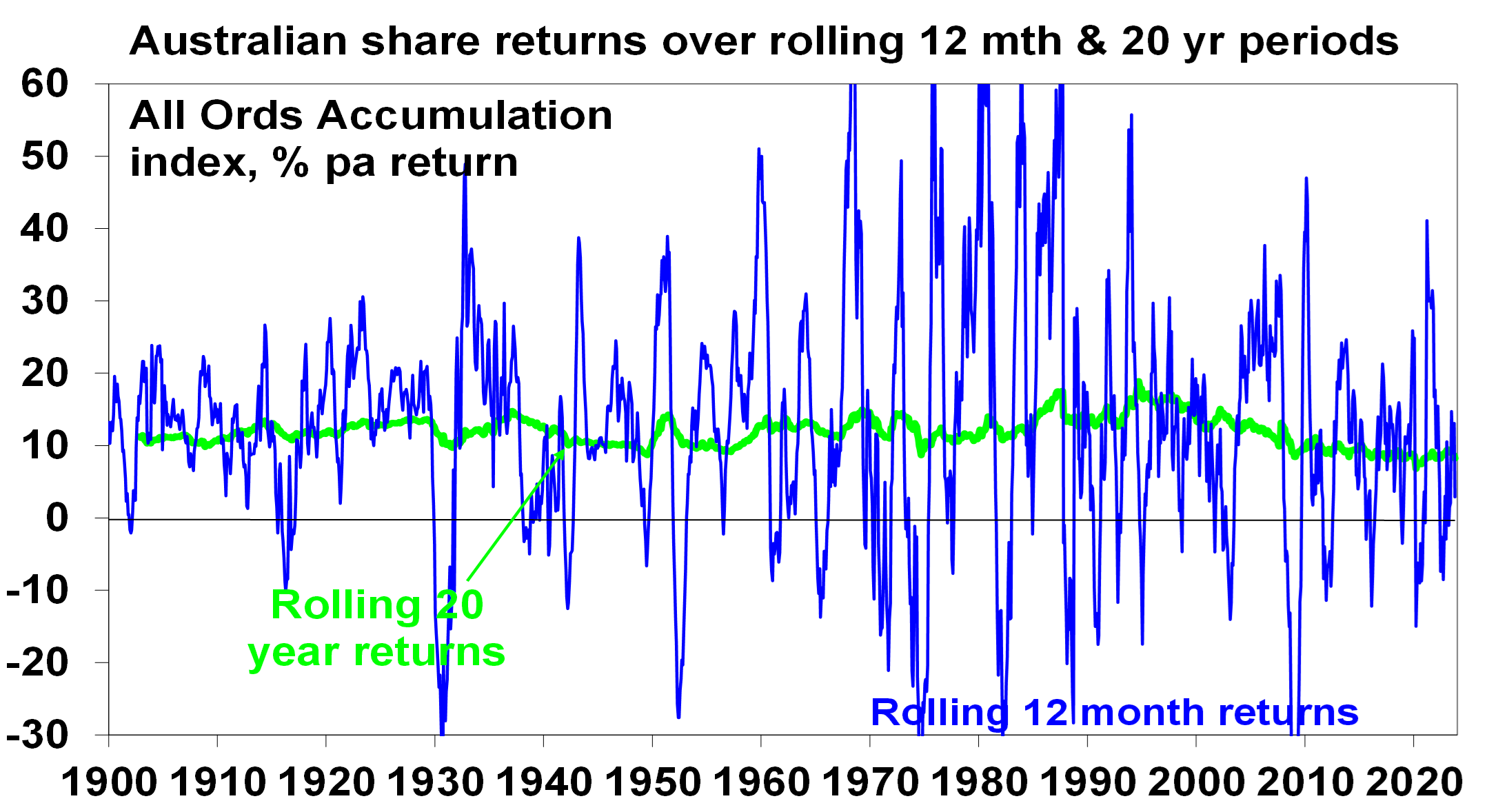

This is often because investment markets go through cyclical swings. All eventually set up their own reversal – eg, as falls make shares cheap and low interest rates help them rebound. But the outcome is extreme volatility in short term returns as evident in the next chart which shows the pattern of rolling 12 month ended returns in Australian shares (compared to rolling 20 year ended returns).

Source: ASX, Bloomberg, RBA, AMP

The trouble is that cycles can throw investors off a well thought out investment strategy that aims to take advantage of the power of compounding longer-term returns. But cycles also create opportunities. Looked at in a long term context, the 20% or so plunge in share seen into October last year was just another cyclical swing, after which markets rebounded. The key is not to get thrown off when markets plunge.

- Invest for the long term

Looking back, it always looks obvious as to why things happened and dips in investment markets look like great buying opportunities. But looking forward the future is shrouded in uncertainty. And no-one has a perfect crystal ball. As JK Galbraith observed “there are two kinds of forecasters: those who don’t know, and those who don’t know they don’t know.” Usually the grander the forecast the greater the need for scepticism as such calls invariably get the timing wrong or are dead wrong. If getting markets right were easy, then the prognosticators would be mega rich and would have stopped doing it. Related to this many get it wrong by letting blind faith – eg, “there is too much debt” – get in the way of good decisions. They may be right one day, but an investor can lose a lot in the interim. The problem is that it’s not getting easier as the world is getting noisier. This has all been evident through the pandemic and its high inflation aftermath with all sorts of forecasts as to where markets would go, most of which provided little help in actually getting the big swings right. Given the difficulty in getting market moves right in the short-term, for most it’s best to get a long-term plan that suits your level of wealth, age, tolerance of volatility, and stick to it. Focus on the green 20-year return line in the previous chart rather than short term swings.

- Diversify

Don’t put all your eggs in one basket. Having a well-diversified portfolio will provide a much smoother ride. For example, global and Australian shares provide similar returns over the very long term but go through long periods of relative out and underperformance (eg, Australian shares outperformed in the mining boom years but global shares have outperformed since). Similarly listed assets (like shares) and unlisted assets (like property) often perform differently through the cycle. The key is to have a mix of investments.

- Turn down the noise

After having worked out a strategy that’s right for you, it’s important to turn down the noise on the information flow and prognosticating babble and stay focussed. The trouble is that the digital world is driving an explosion in information and opinions about economies and investments. But much of this information and opinion is of poor quality. As “bad news sells” there has always been pressure to put the negative news on the front page of newspapers but there was hopefully some balance in the rest of the paper. In a digital world each story can be tracked via clicks so the pressure to run with sensationalised and often bad news headlines is magnified. This has gone into hyperdrive since the pandemic – with a massively stepped up flow of economic information. This may be of use in providing timely information on how the economy is travelling but it’s also added immensely to the flow of information and often it’s contradictory. The heightened uncertainty is leading to shorter investment horizons which in turn can add to the risk that you could be thrown off well thought out investment strategies. The key is to turn down the volume on all this noise. This also means keeping your investment strategy relatively simple. So don’t waste too much time on individual shares or funds as it’s your high-level asset allocation that will mainly drive the return and volatility you will get. Here are several tips to help turn down the noise:

- Put the worries in context – there have been plenty of worries over the last century and yet long-term investment returns have been fine.

- Recognise it’s normal for markets to swing around in the short term.

- Focus on only a few reliable news services and turn off all “notifications” on your smart device.

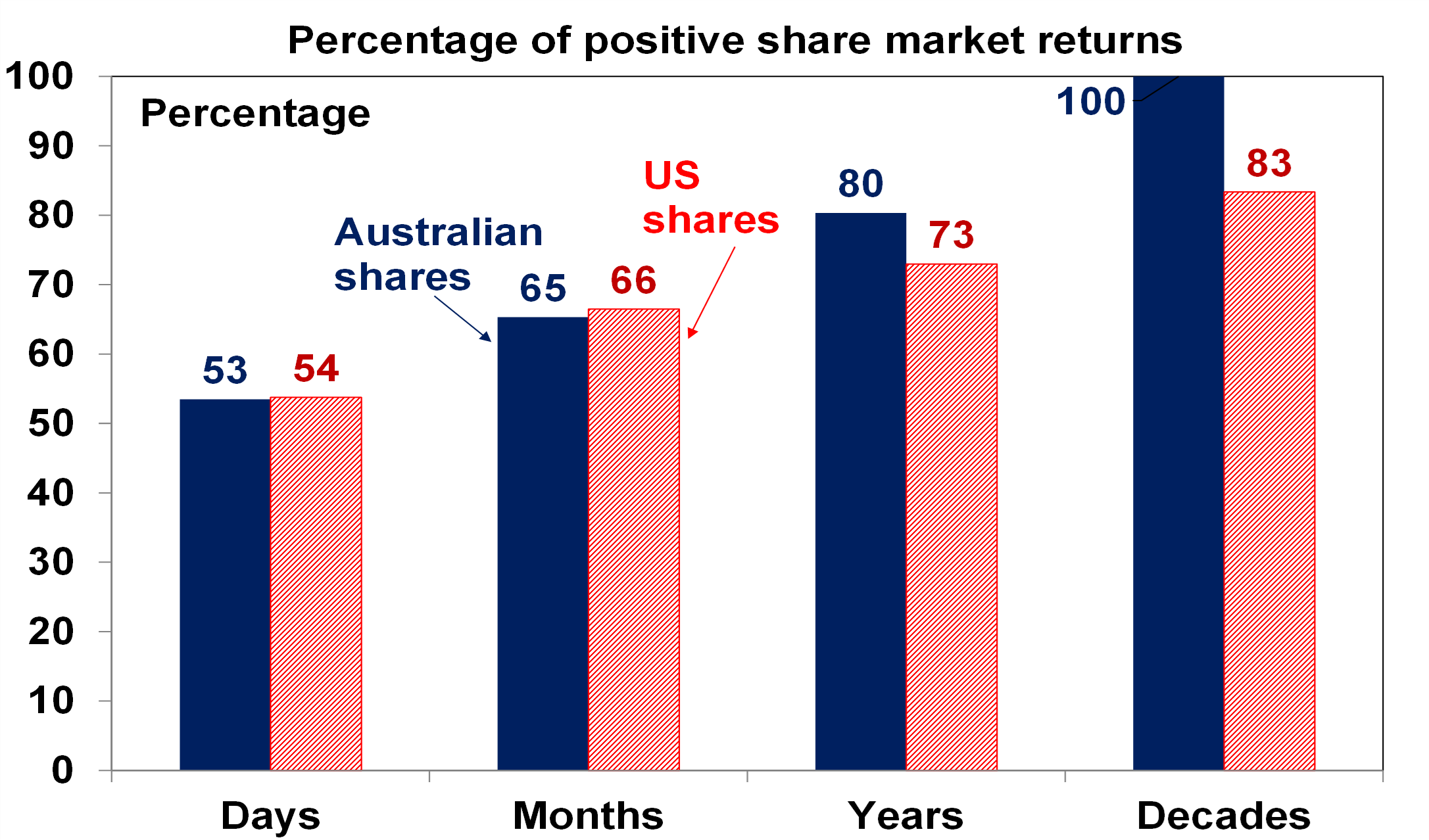

- Don’t check your investments so regularly – on a day-to-day basis it’s a coin toss as to whether the share market will rise or fall but the longer you stretch it out between looking at your investments the more likely you will get positive news. See the next chart.

Source: Bloomberg, AMP

- Buy low, sell high

The cheaper you buy an asset (or the higher its yield), the higher its prospective return will likely be and vice versa, all other things being equal. So as far as possible it makes sense to buy when markets are down and sell when they are up. Unfortunately, many do the opposite, ie, selling after a collapse and buying after a big rally…which just has the effect of destroying wealth even though it might feel good at the time in the midst of a panic (or euphoria). Again, turn down the noise!

- Beware the crowd at extremes

It often feels safe to be in a crowd and at times the investment crowd can be right. However, at extremes the crowd is invariably wrong – whether it’s at market highs like in the late 1990s tech boom or market lows like in March. The problem with crowds is that eventually everyone who wants to buy in a boom (or sell in a bust) will do so and then the only way is down (or up after crowd panics). As Warren Buffet has said the key is to “be fearful when others are greedy and greedy when others are fearful”.

- Focus on investments with sustainable cash flow

If it looks dodgy, hard to understand or has to be based on obscure valuation measures then it’s best to stay away. Most cryptocurrency “investments” are a classic example of this. If an investment looks too good to be true it probably is. By contrast, assets that generate sustainable cash flows (profits, rents, interest) and don’t rely on excessive gearing or financial engineering are more likely to deliver.

- Seek advice

We are all susceptible to psychological traps like the tendency to over-react to current investment market conditions, or to pay more attention to information and opinion that confirms our own views. And the increasing complexity of investing makes it anything but easy. However a good approach is to seek advice via an investment information and/or advisory service or a coach such as a financial adviser, in much the same way you might use a specialist to look after your plumbing or medical needs. As with plumbers and doctors it pays to shop around to find a service or adviser you are comfortable with and can trust.

Deloitte Canada Signs Deal to Capture and Store Carbon in Concrete

Susan Lahey November 23, 2023

Professional services firm Deloitte Canada announced today a multi-year agreement with carbon removal technology company CarbonCure Technologies to purchase high-quality carbon credits through supporting the deployment of CarbonCure’s technology, which captures CO2 in concrete.

Founded in 2012, Halifax, Nova Scotia-based CarbonCure provides solutions that let concrete producers use captured carbon dioxide to produce low carbon concrete mixes. CarbonCure’s technology injects captured and liquefied CO2 from industries and Direct Air Capture (DAC) into concrete ingredients. This transforms it into a substance that enhances the strength of concrete while reducing the reliance on its key, carbon-intensive ingredient, cement. Cement production, a key ingredient in concrete, accounts for approximately 8% of global carbon dioxide emissions, with over 900 kg of CO2 emissions generated for every 1000 kg of material produced.

Buildings are a key source of environmental and climate impact, generating nearly 40% of annual global greenhouse gas (GHG) emissions, and embodied carbon, or carbon emitted from the manufacturing of building materials and construction accounting for around half of carbon emissions from new construction.

Concrete is the world’s most utilized construction material with approximately 30 billion tons poured each year. CarbonCure said its technology for ready mix concrete reduces this environmental impact generally by about 5% per truckload.

Robert Niven, CEO of CarbonCure said:

“Entering this agreement with Deloitte Canada is pivotal in our mission to make a positive impact on the construction industry’s environmental footprint, accelerating the global deployment of our solution.”

According to Deloitte, the new agreement will directly support the deployment of CarbonCure’s carbon removal technologies around the globe, aligning with Deloitte’s carbon management strategy to support development and scale of meaningful market solutions.

Sheri Penner, Managing Partner of Purpose and Sustainability at Deloitte Canada said:

“Corporate buyers play a critical role as an early investor in climate solutions that enable decarbonization of high-emitting industries and permanent carbon removal. Supporting the development and verification of high-quality carbon removal credits is crucial to scale the gigaton market that is needed to meet net-zero.”

Maersk Signs its Largest-Ever Green Fuel Deal to Drive Fleet Decarbonization

Susan Lahey November 22, 2023

Integrated container logistics company A.P. Moller – Maersk announced today a major fuel purchase agreement with China-based clean energy company Goldwind, for the offtake of 500,000 tonnes per year of green methanol, beginning in 2026.

According to Maersk, the deal marks first large scale green methanol offtake agreement for the global shipping industry, and will enable low carbon operations for the company’s first 12 large methanol-enabled vessels.

The agreement is the latest in a series of moves by Maersk to enable the expansion of its low carbon fleet, with 25 methanol-enabled vessels on order, beginning with its order in 2021 for the world’s first carbon-neutral methanol fueled container ship. Earlier this year, the company announced plans for the industry’s first-ever retrofit to convert an existing fossil fuel-powered container vessel to dual-fuel methanol-powered vessel, with plans to retrofit future vessels. The company has announced a series of carbon reduction targets, including goals to achieve net zero gas emissions in 2040 across its entire businesses and all scopes, as well as a 50% reduction in emissions per transported container in its ocean fleet, and a 70% reduction in absolute emissions from fully controlled terminals by 2030.

Rabab Raafat Boulos, Chief Infrastructure Officer at Maersk, said:

“A.P. Moller – Maersk aims to reach net-zero greenhouse gas emissions by 2040 across its business. The deal significantly de-risks the initial stages of Maersk’s net-zero journey and supports expectations for a competitive green methanol market towards 2030. The record-high volumes can annually propel more than half the methanol-enabled capacity Maersk currently has on order.”

The fuel to be provided by Goldwind includes green bio-methanol and e-methanol, produced utilizing wind energy at a new production facility in Hinggan League in Northeast China. Production at the facility is anticipated to begin in 2026.

Goldwind Chairman Wu Gang said:

“The volumes combine a mix of green bio-methanol and e-methanol, all produced utilising wind energy at a new production facility in Hinggan League, Northeast China, around 1000km northeast of Beijing. Production is expected to begin in 2026. Following this signed offtake agreement, Goldwind expects to confirm a final investment decision for the facility by the end of the year.”

I hope you have enjoyed this week’s read, please do reach out to me if you would like to inquire more of the products and services, we offer at JMP.

Regards,

Head, Fixed Interest and Superannuation

JMP Securities

Level 1, Harbourside West, Stanley Esplanade

Port Moresby, Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814