February 15, 2021

Welcome

Good morning and welcome to this week’s JMP Report.

The equity market was very quiet last week with very little turnover.

The trading was limited to BSP, KSL and OSH. BSP saw 2,057 shares trade unchanged at K12.00, KSL had 765 shares trade at K3.20 while OSH had 520 shares traded at K10.00. Refer details below. There has been no impact on the CCP share price since the announcement of the resignation of Peter Aitsi, the CEO earlier in the month.

|

WEEKLY MARKET REPORT 08.02.21 – 12.02.21 |

||||

|

STOCK |

QUANTITY |

CLOSING |

CHANGE |

% CHANGE |

|

BSP |

2,057 |

12.00 |

– |

|

|

KSL |

765 |

3.20 |

-0.05 |

|

|

OSH |

520 |

10.00 |

0.29 |

|

|

KAM |

– |

0.90 |

– |

|

|

NCM |

– |

81.50 |

– |

|

|

CCP |

– |

1.70 |

– |

|

|

CPL |

– |

0.50 |

– |

|

All the activity was in the interest rate market, with 364 day bills seeing good volume issued by BPNG at 7.20% average. But we did see good interest in the bonds trading in the secondary market. Clients are looking for good solid returns from assets other than shares. Why, a 9.34% coupon issued on 4yr or a 10.72% coupon issued on a 8yr bond by Bank PNG is guaranteed for the life of the bond whereas the dividend paid to shareholders on shares is not guaranteed.

Interest rates in the finance company area for 12 moths is around the 5%. In the bond market, 2yr – 7.54, 4yr – 9.34, 8yr – 10.72 and 10 yr. @ 11.92%

- Nine Common mistakes Investors make

Shane Oliver, AMP Capital

Key points

Many of the mistakes investors make are based on common sense rules of thumb that turn out to be wrong.

As a result, it’s often wise for investors to turn common sense logic on its head.

The easiest way to avoid many of these mistakes is to have a long-term investment plan that aligns your financial goals with your risk tolerance.

Introduction

In the confusing and often seemingly illogical world of investing, investors often make of bunch of mistakes that keeps them from reaching their financial goals. This note takes a look at the nine most common mistakes investors make.

Mistake #1 Crowd support indicates a sure thing

“I will tell you how to become rich…Be fearful when others are greedy. Be greedy when others are fearful.” Warren Buffett

It’s normal to feel safer investing in an asset when your neighbours and friends are doing the same and media commentary (whether traditional or social media) is reinforcing the message that it’s the place to be. But “safety in numbers” is often doomed to failure. The trouble is that when everyone is bullish and has bought into an asset with general euphoria about it, there is no one left to buy in the face of more positive supporting news but instead there are lots of people who can sell if the news turns sour. Of course, the opposite applies when everyone is pessimistic and bearish and has sold – it only takes a bit of good news to turn the value of the asset back up. So, it turns out that the point of maximum opportunity is when the crowd is pessimistic (or fearful) and the point of maximum risk is when the crowd is euphoric (and greedy).

Mistake #2 Current returns are a guide to the future

“Past performance is not a reliable indicator of future performance.” Standard disclaimer

To make it easier to process lots of information, investors often adopt simplifying assumptions, or heuristics. A common one of these is that “recent returns or the current state of the economy and investment markets are a guide to the future.” So tough economic conditions and recent poor returns are expected to continue and vice versa for good returns and good economic conditions. The problem with this is that when it’s combined with the “safety in numbers” mistake, it results in investors getting in at the wrong time (eg, after an asset has already had strong gains) or getting out at the wrong time (eg, when it is bottoming). In other words, buying high and selling low. This was most recently evident in March last year with investors getting out after share markets dropped 35% or so, only to find that that this was no guide at all as markets rebounded.

Mistake #3 “Experts” show the way

“There are two kinds of forecasters: those who don’t know, and those who don’t know they don’t know.” J.K. Galbraith

Galbraith’s comment may be a bit harsh for economists like me – but the reality is that no one has a perfect crystal ball. It’s well-known that forecasts as to where the share market, currencies, etc., will be at a particular time have a dismal track record so they need to be treated with care. Usually the grander the forecast – calls for “new eras of permanent prosperity” or for “great crashes ahead” – the greater the need for scepticism as either they get the timing wrong or it’s dead wrong.

Market prognosticators suffer from the same psychological biases as everyone else. The key value of investment experts – or at least the good ones – is to provide an understanding of the issues surrounding an investment and to put things in context. This can provide valuable information in terms of understanding the potential for an investment. But if forecasting was so easy then the forecasters would be rich and so would have retired!

Some combination of crowd support for an investment, good initial returns and some sort of expert support (which could come via “influencers” on social media) may lead some to think there is a “free lunch” to be had in investment markets. But as the recent experience with GameStop – which surged more than fivefold in late January as day traders piled in after reading comments on Reddit only to fall back to where it started a week or so later – showed, a lot of money can be lost as a result by those who come late to the party or don’t get out in time.

Mistake #4 Shares can’t go up in a recession…

“It’s so good it’s bad, it’s so bad it’s good.” Anon

A common lament around mid-last year and through much of the second half of 2020, after share markets rebounded from their late March pandemic low, was that, “the share market is crazy as the economy is in deep recession and earnings are collapsing!” Of course, shares have since risen even further, economies have started to recover, and earnings are rebounding. The reality is that share markets are forward looking, so when economic data and profits are really weak, the market has already factored it in – as we saw last year with the 35% or so share market plunge that occurred during the first lockdown – and has moved on to anticipating economic recovery. History indicates that the best gains in stocks are usually made when the economic news is still poor, as stocks rebound from being undervalued and unloved, helped by falling interest rates. In other words, things are so bad they are actually good for investors. Of course, the opposite applies at market tops after a sustained economic recovery has left the economy overheated with no spare capacity and rising inflation and so the share market frets about rising rates. Hence things are so good they become bad. This seemingly perverse logic often trips up many investors.

Mistake #5 Letting a strongly held view get in the way

“Pessimistic visions about anything usually strike the public as more erudite than optimistic ones.” Joseph Schumpeter

Many let their blind faith in a strongly held invariably bearish view – “there is too much debt”, “aging populations will destroy share returns”, “an Australian house price crash is imminent”, etc. – drive their investment decisions. This is easy to do as the human brain is wired to focus on the downside more than the upside and so is more easily attracted to doomsayers. They could turn out to be right one day but end up losing a lot of money in the interim. Giving too much attention to pessimists doesn’t pay for investors.

Mistake #6 Looking at your investments too much

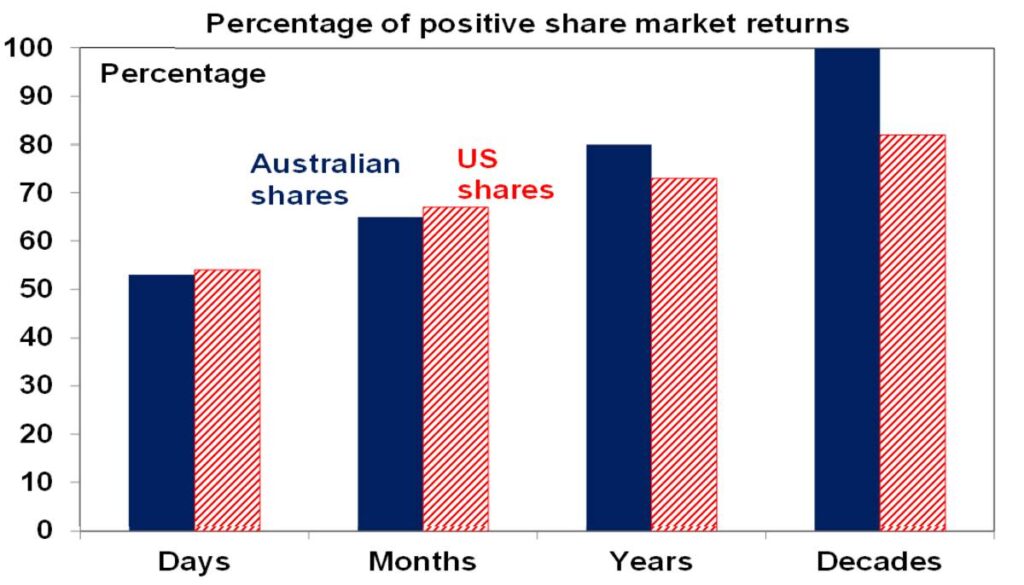

Surely checking up on how your investments are doing is a good thing? But the danger is that the more investors are exposed to news around their investments, the more they may see them going down. Whereas share markets have historically generated positive returns more than 60% of the time on a monthly basis and more than 70% of the time on a calendar year basis, on a day-to-day basis it’s close to 50/50 as to whether the share market will be up or down.

Daily and monthly data from 1995, data for years and decades from 1900. Source: Bloomberg, AMP Capital

Being exposed to this very short term “noise” and the chatter around it can cause investors to freeze up or worse can feed on our natural aversion to any reduction in the value of our investments and thus encourage a greater exposure to lower returning but safer investments. The trick is to turn down the noise and have patience. Evidence shows that patient people make better investors because they can look beyond short-term noise and are less inclined to jump from investment to investment after they have already had their run.

Mistake #7 Making investing too complex

“There seems to be a perverse human characteristic that makes easy things difficult.” Warren Buffett

With the increasing ease of access to investment options, ways to assemble them and information and processes to assess them, investing seems to be becoming more complex. The trouble is that when you overcomplicate your investments, it can mean that you can’t see the wood for the trees. That you spend so much time focussing on this stock or ETF versus that stock or ETF or this fund manager versus that fund manager that you ignore the key driver of your portfolio’s risk and return which is how much you have in shares, bonds, real assets, cash, onshore versus offshore, etc. Or that you end up in things you don’t understand. So avoid clutter, don’t fret the small stuff, keep it simple and don’t invest in things you don’t understand.

Mistake #8 Too conservative early in life

“Compound interest is the eighth wonder of the world. He who understands it, earns it..he who doesn’t, pays it.” Albert Einstein

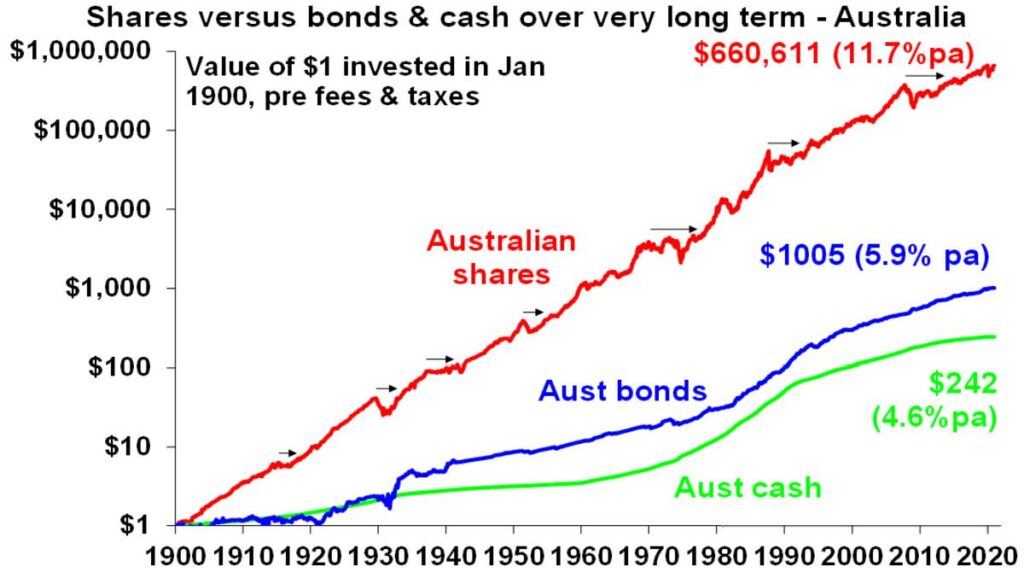

Cash and bank deposits are low risk and fine for near term spending requirements and emergency funds but they won’t build wealth over long periods of time. Particularly with ultra-low rates now. The chart below shows the value of $1 invested in various Australian assets since 1900 allowing for the reinvestment of interest and dividends along the way. That $1 would have grown to $660,611 if invested in shares but only to $242 if invested in cash. Despite periodic setbacks (WW1, the Great Depression, WW2, stagflation in the 1970s, 1987 share crash, GFC, etc.), shares and other growth assets provide much higher returns over the long term than cash and bonds.

Source: Global Financial Data, AMP Capital

Not having enough in growth assets can be a problem for investors early in their career as it can make it harder to adequately fund retirement later in life. Fortunately, compulsory superannuation in Australia helps manage this – although Early Super Withdrawal may have set this back a bit for some, albeit it may have been a godsend for them over the last year.

Mistake #9 Trying to time the market

“More money has been lost trying to anticipate and protect from corrections than actually in them.” Peter Lynch

In the absence of a tried and tested process, trying to time the market, ie, selling before falls and buying ahead of gains is very difficult. Many of the mistakes referred to above kick in and it can turn out to be a sure way to destroy wealth. Perhaps the best example of this is a comparison of returns if the investor is fully invested in shares versus missing out on the best days. Of course if you can avoid the worst days during a given period you will boost returns but this is very hard to do and many investors only get out after the bad returns have occurred, just in time to miss out on some of the best days and so hurt returns. If you were fully invested in Australian shares from January 1995 you would have returned 9.5% per annum (including dividends but not allowing for franking credits). But if by trying to time the market you miss the 10 best days the return falls to 7.4% p.a. If you miss the 40 best days, it drops to just 3.1% p.a. Hence, it’s time in that matters not timing.

Concluding comment

Perhaps the easiest way to overcome many of these mistakes is to have a long-term investment plan that allows for your goals and risk tolerance and then stick to it.Subscribe below to Oliver’s Insights to receive my latest articles

Shane Oliver, Head of Investment Strategy & Chief Economist AMP CAPITAL

- Shell Says It Has Reached Peak Oil Production

Shell says oil is on its way out.

In a Thursday statement, the fossil fuel giant said its “oil production peaked in 2019,” and that we can now expect it to decline gradually by 1 or 2% per year. Shell also said its total carbon emissions peaked in 2018 at 1.7 gigatonnes.

The statement doesn’t come as a total surprise. The oil market has been in decline for years, and since the covid-19 pandemic began last year, fuel prices went from bad to catastrophically bad. Last Fall, the International Energy Agency predicted a “treacherous” path ahead for the industry. And in September, fellow energy giant BP said the world may have already reached peak oil. Shell’s own CFO hinted at the announcement in May when she told investors the company has experienced “major demand destruction that we don’t even know will come back,” and soon after, Shell wrote down $22 billion on its balance sheets. But still, this is the first time it’s made an outright announcement of this kind.

With oil on the decline, Shell announced in September that it would achieve net-zero carbon pollution by 2050, but didn’t say much in the way of interim goals. The energy company now says it will build on that plan by launching an “accelerated strategy” to phase out of emissions.

But in typical Shell fashion, the actual plan to get there is weak as hell. It includes promises to rapidly ramp up investment in solar and hydrogen power, but also to pour money into biofuels—which research shows can be just as polluting as gas and diesel. It said it plans to make biofuels and hydrogen up to 10% of its portfolio by 2030. Even more insultingly, the company also plans to hugely up its output of liquefied natural gas, adding 7 million tons of new capacity for it by the middle of this decade. And though the company has said it will plow up to $3 billion into renewables “in the near term,” it still spends tens of billions on oil and gas exploration each year.

Upping dirty energy production will make it pretty difficult to reduce emissions, which is why Shell said last week that it will boost its use of “nature-based” forest offsets and carbon carbon capture and storage. The company already does that to produce “carbon neutral” natural gas. But carbon offsets are, simply put, not real climate solutions. Offsetting greenhouse gas pollution doesn’t actually stop emissions from occurring. In addition, offset projects have also been a source of horrific environmental justice since they have often resulted in displacing people from their homes in order to make room to plant trees.

Carbon capture technology would, in theory, suck up pollution, but it has not been proven to work at scale. Even if it did, it would do nothing to combat the other toxic impacts of at the source of extraction, so it’s no substitute for rapidly phasing out of fossil fuels.

There’s another reason not to celebrate the company’s announcement: Shell has also made it clear that as its oil production declines, workers will suffer. It has previously said its transition to low-carbon energy would include laying off 10% of its workforce. Yet it has not, of course, announced any pay cuts for its executives to make up for lost oil revenue.

Shell’s assertion that it has reached peak oil is yet more proof that the market is transitioning away from fossil fuels. But it also illustrates why we can’t leave the transition up to market forces. We need to cut fossil fuel production much faster than Shell’s plan allows, and to immediately put an end to all new oil and gas infrastructure. We also need to ensure laid-off fossil fuel workers have good jobs moving forward, and that renewable energy is not built with abusive labor practices or ones that disrupt fragile ecosystems. Judging by Shell’s track record on both fronts, we can’t rely on it to do the right thing. So while one of the world’s biggest oil companies acknowledging the end of oil is a good thing, it still points to the need for governments to take a much more active role to make sure we reach the end of that road in a fair and just manner.

- Plastic Trash can now be recycled into ultra-strong graphene

Plastic decomposition is sped up by the flash Joule heating method

Juliette Strasser, Materials Science, University of Texas

Packaging from the grocery store, lint from our clothing, plastic shopping bags – plastics and microplastics are everywhere, and they’re not going anywhere. In fact, it will take them hundreds of years to decompose in landfills . In order to speed up this decomposition process, scientists from Rice University are transforming these discarded plastics into non-toxic, naturally occurring materials. They’re doing this by using a newly developed technique called “flash Joule heating,” to rapidly heat plastic materials to very high temperatures .

Currently, there are a few plastic recycling techniques that are widely used, with differing results. For example, plastic bags are a huge contributor to the plastic waste stream – Waste Management, a trash collection company, estimates that over one billion plastic bags are used each year in the US alone. Even more shockingly, each plastic bag is used for, on average, less than one hour. Currently, the most common way to recycle plastic bags is by compressing them into composite lumber or small pellets, which can be used for building materials . While this is an excellent way to reuse single-use plastic, this plastic still is not biodegradable.

In contrast, the “flash Joule heating” method turns plastic into graphene, which is highly recyclable and very stable. Graphene itself is incredibly strong and stretchy – 200 times stronger than steel. Graphene is a single layer form of graphite, a naturally occurring carbon-based mineral that is commonly found as pencil lead. Typically, graphite is mined and then mechanically processed in order to separate its layers, forming graphene. However, obtaining graphite can be expensive. By directly generating graphene from plastic waste, it is possible to reduce its production cost. Importantly, a reduced production cost can lead to broad implementation of graphene use outside of academic research – with lower production costs, graphene can be added to concrete, rubber, or asphalt to improve strength and performance. Innovations like this will likely make graphene much more widely available for commercial use.

In addition to reducing graphene production costs, using plastic to generate graphene has significant environmental impacts as well. First, high levels of pollution are caused by graphite mining. Generating graphene directly from plastic could disrupt the graphite supply chain, thereby decreasing mining activity and reducing pollution caused by mining. Second, this graphene production technique has the capability to transform landfills by reducing plastic waste. While graphene biodegradability is still being studied, research suggests that graphene can be broken down within a few months, which is much faster than other common plastics. Ultimately, direct laboratory production of graphene has the potential to make a huge environmental impact.

Flash joule heating is actually a fairly simple process that involves running a large current through plastic materials. Joule heating is a commonly used heating technique. If you’ve used an iron, you’ve seen Joule heating in action. When a current is passed through a conductive material, like the metal of an iron, it quickly generates heat. Flash joule heating just means that, rather than building up heat over time, a large initial current is passed through the material, which causes an intense burst of heat. In the case of plastic waste, with the right conditions, this intense heat can actually cause chemical transformations

In order to transform plastic to graphene, there are some crucial intermediate steps. First, the plastic waste must be cut into small enough pieces to conduct electricity. Large sheets of plastic are typically resistive, meaning that they cannot conduct electricity. However, by cutting the plastic waste to an optimal size, it becomes conductive. After this initial processing, an extremely high current is applied to the plastic, heating it very quickly. This burst of heat chemically transforms the plastic, producing both a lower-quality graphene and some hydrogen and hydrocarbons. The low-quality graphene can then be flashed, or rapidly heated again, resulting in a high-quality graphene.

The first author on the paper, Wala Algozeeb, explains that it was initially a challenge to obtain high quality graphene from the plastic waste. She says, “It was challenging to get high quality graphene from plastic waste in the beginning of our journey because of the [quantity] of volatiles that evolve upon flashing. We are fortunate to have a great team that thought of using two types of current (AC + DC) to improve the quality.”

To produce high quality graphene, the current sent through the samples had to be optimized. The best graphene was made by using a combination of alternating and direct current. First, an alternating current, where the direction of electric current periodically switches, is applied to the plastics for eight seconds. Alternating current allows the plastic to reach high enough initial temperatures to form graphene and facilitates rapid cooling in between pulses. The rapid cooling step, which is unique to alternating current, prevents the newly-formed graphene from stacking into layers. However, this alternating current generates an initial, low-purity graphene.

At this point, a direct current can be applied for 500 milliseconds, a much shorter period of time. This direct current pulse reaches an even higher temperature than the alternating current step, which is necessary to form high-quality graphene. This study is the first example of using flash Joule heating on waste plastics. The authors had previously studied heating on different research-grade carbon materials, but applying their method to plastic required significant optimization of their system.

In addition to optimizing the currents, another challenge was determining what size to break the plastic into. In order to heat the sample, current needs to be able to run through the entire sample, not just one part of it. When the pieces of plastic were too large (larger than 2mm), the plastic powder was not conductive enough to flash. However, in contrast, when the pieces of plastic were smaller than 50 microns (1/20th of a millimeter), they just fell out of the flashing chamber. In order to solve this problem, the researchers tested a range of plastic grain sizes. After this testing, they found that plastic powders with a particle size between 1 and 2 mm was ideal for this process.

Universal Matter, a startup company from this research group, is working on developing flash joule heating for plastic waste recycling on an industrial scale. This technique has a few major advantages over common plastic recycling techniques. One perk is that flash joule heating does not require any chemical pretreatment of the plastic materials, meaning that plastics can simply be broken up into small pieces and heated without the use of any additional harsh chemicals. Additionally, directly applying a current to the sample produces very similar results to using a furnace, but is more energy-efficient because it does not require high heating to an outside environment. Scientists estimate that this technique would cost only $124 to convert a ton of plastic waste into graphene. Curbside recycling programs can cost up to $150 per ton, with huge amounts of plastic ending up in landfills anyway. In addition to having a comparable cost, the development of alternative recycling techniques like this could be huge in terms of diverting plastic waste from landfills.

The researchers suggest that their strategy for converting plastics into graphite will be able to be widely implemented in factories and recycling plants. Algozeeb says “We think the future of flash graphene is big, especially in [the] waste management area. Given how affordable our graphene is, we think it will be used as an additive in cement, polymers and asphalt roads.”

Market reports predict that the graphene market will increase by up to 40% in the next five years. Combined with the increased amount of trash generated in the US (approximately 35 million tons of plastic in 2018), developments like this one seem primed to move out of the lab into the real world. In the meantime, you can help fight plastic waste by making one small but significant change in your life: bring your own reusable fabric bag to the store with you.

I hope you have enjoyed this weeks read, if you would like more information on setting up a funds management account or trading and investing in shares and bonds, please give us a call.

Regards

Chris Hagan

Head, Fixed Interest and Superannuation

JMP Securities

Level 1, Harbourside West, Stanley Esplanade

Port Moresby, Papua New Guinea

Mobile (PNG): +675 72319913

Mobile (Int): +61 414529814