16 May, 2022

Hello and welcome to this week’s JMP Weekly Report

We saw a busy week with a good deal of our stocks trading. NCM saw 206 of their shares trade, closing unchanged at K75, BSP saw 398,413 shares trade closing unchanged at K12.30, KSL had 160,266 shares trade closing unchanged at K3.00, STO traded 1,045 shares, up 0.5 toea to close at K19.00, KAM traded 599 shares at K1.00 remaining steady, CCP traded 7,463 shares closing up 0.03 toea to close at K1.85 while CPL had 5,541 shares trade closing unchanged at K0.95. Refer details below.

WEEKLY MARKET REPORT | 16 May, 2022 – 20 May, 2022

| STOCK | QUANTITY | CLOSING PRICE | CHANGE | % CHANGE | 2021 FINAL DIV | 2021 INTERIM | YIELD % | EX-DATE | RECORD DATE | PAYMENT DATE | DRP | MARKET CAP |

| BSP | 398,413 | 12.30 | – | – | K1.3400 | – | 11.61 | THU 10 MAR | FRI 11 MAR | FRI 22 APR | NO | 5,270,833,466 |

| KSL | 160,266 | 3.00 | – | – | K0.1850 | – | 7.74 | THU 3 MAR | FRI 4 MAR | FRI 8 APR | NO | 67,052,337 |

| STO | 1,045 | 19.00 | 0.5 | 2.63 | K0.2993 | – | – | MON 21 FEB | TUE 22 FEB | THU 24 MAR | – | – |

| KAM | 599 | 1.00 | – | – | – | – | 10.00 | – | – | – | YES | 49,891,306 |

| NCM | 206 | 75.00 | – | – | USD$0.075 | – | – | FRI 25 FEB | MON 28 FEB | THU 31 MAR | – | 33,774,150 |

| NGP | 0 | 0.70 | – | – | – | – | – | – | – | – | – | 32,123,490 |

| CCP | 7,463 | 1.85 | 0.03 | 1.62 | – | – | 6.19 | – | – | – | YES | 569,672,964 |

| CPL | 5,541 | 0.95 | – | – | – | – |

– | – | – | – | – | 195,964,015 |

Our order book has me a nett buyer of BSP, KSL and STO

Dual listed stock prices

BFL – $4.97 +1c

KSL – $0.86 +05c

NCM – $25.57 +$1.01

STO – $8.08 +3c

In the interest rate market,

The TBill market, the aggressive bidding continues with the 364 day averaging 3.7%, down from 4% the week before.

Keep an eye out for a GIS auction next week.

Non-bank term rates- FIFL

30 days 0.70%

60 Days 1.10%

90 Days 1.25%

180 Days 1.80%

365 Days 4.00%

Out of interest

Gold Standard $US59.23 ( Up $0.77 / 1.31%) $AU84.06 ( Up $0.25 / 0.29%)

Silver Standard $US0.70 ( Up $0.02 / 2.94%) $AU0.99 ( Up $0.02 / 2.06%)

Bitcoin $US30,160 ( Up $1215 / 4.19%) $AU42,804 ( Up $1306 / 3.14%)

Ethereum $US1996 ( Up $50 / 2.56%) $AU2832 ( Up $43 / 1.54%)

Litecoin $US71.16 ( Up $3.28 / 4.83%) $AU100.99 ( Up $3.68 / 3.78%)

Ripple $US0.41 ( Up $0 / 0.00%) $AU0.581 ( Down $0.006 / 1.02%)

Bitcoin Cash $US192 ( Up $0 / 0.00%) $AU272 ( Down $3 / 1.09%)

Theta $US1.26 ( Up $0.04 / 3.27%) $AU1.788 ( Up $0.039 / 2.22%)

Tron $US0.07 ( Up $0 / 0.00%) $AU0.099 ( Down $0.001 / 1.00%)

Cardano $US0.52 ( Up $0 / 0.00%) $AU0.738 ( Down $0.007 / 0.93%)

Stellar $US0.12 ( Down $0.01 / 7.69%) $AU0.170 ( Down $0.016 / 8.60%)

Chainlink $US7 ( Up $0 / 0.00%) $AU9 ( Down $1 / 10.00%)

Matic $US0.64 ( Up $0.00 / 0.00%) $AU0.90 ( Down $0.01 / 1.09%)

What we’ve been reading this week

The falls in the share market this year – the bad news and the good

Dr. Shane Oliver

Key points

Share markets remain under pressure from high inflation, rising interest rates and bond yields, the war in Ukraine and Chinese Covid lockdowns.

It’s still too early to say markets have bottomed.

However, it’s not all negative: we may have seen peak inflation in the US, share market earnings are still rising, Covid cases in China appear to be slowing and yield curves are still not pointing to recession.

Australian shares also remain vulnerable in the short-term but are likely to be medium term outperformers, reflecting high commodity prices and low tech exposure.

Introduction

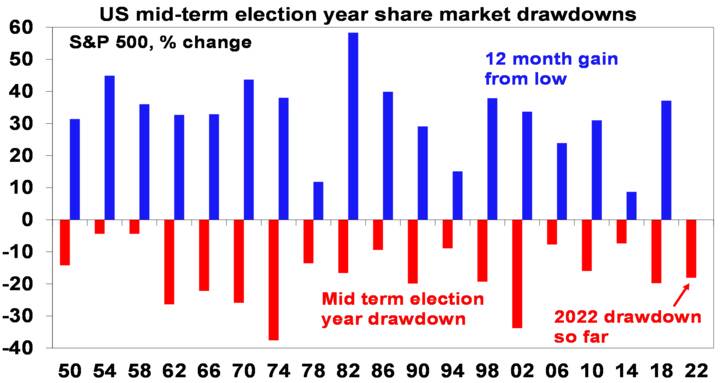

Last year saw very strong investment returns and was relatively calm in investment markets. While there was a lot to worry about, the biggest drawdown in US shares was 5% and in Australian shares it was 6%. This always seemed unlikely to be repeated and it certainly hasn’t been so far in 2022! While they have had a good bounce from last week’s lows, from their cyclical highs US shares have had a fall of 18% to their recent low, global shares have had a fall of 17% and Australian shares have had a fall of 9%. This has been led by tech stocks with Nasdaq having had a plunge of 29%. Mid-term election years in the US are known for below average returns and a rough ride with an average top to bottom drawdown of 17% and this has already been surpassed.

Source: Strategas, AMP

At the same time government bonds are having worse losses than in the bond crash of 1994 (don’t forget that when bond yields rise their capital value goes down) and crypto currencies have also been hit hard with 50% plus falls in prices.

So where are we?

What’s driving the volatility – the big negatives

The plunge in share markets reflects a combination of factors.

- Shares were vulnerable to a rougher ride this year. After strong gains from pandemic lows shares were no longer dirt cheap. Speculative froth was evident in tech stocks, meme stocks, SPACs and cryptos. Relatively calm years like 2021 are often followed by a rough year.

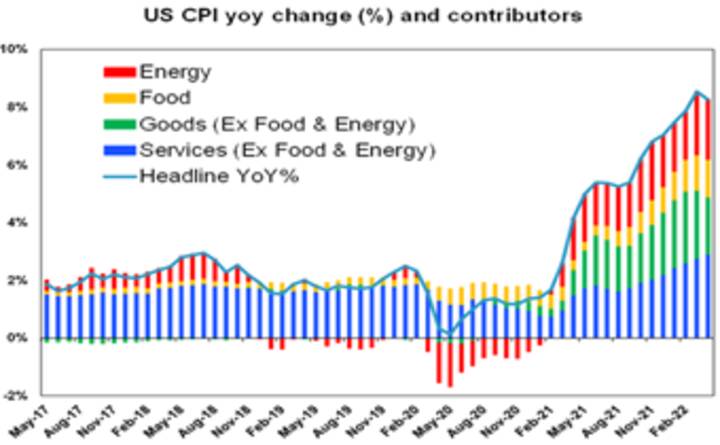

- Inflation continues to come in stronger than expected largely due to pandemic related supply disruptions and strong goods demand, but also labour shortages and “reopening” impacting wages and hence services prices. While US annual inflation fell slightly in April (from 8.5%yoy to 8.3%) as higher monthly inflation readings a year ago dropped out it was still higher than expected. Goods inflation (green bars in the next chart) looks to be slowing but services inflation (blue bars) is continuing to pick up partly reflecting the surge in wages growth seen recently in the US. So while inflation may have peaked it looks like staying too high for comfort for the Fed (and other central banks) for a while yet.

Source: Bloomberg, AMP

- Rising pressure for wage growth to compensate for inflation risks resulting in a wage/price spiral and a rise in inflation expectations that locks inflation in at high levels. Talk of 5% wage claims in Australia suggests this is also a risk locally.

- The war in Ukraine has added to supply constraints in relation to commodities. Fear of an escalation resulting in a cut to Russian gas to Europe &/or including NATO countries in direct fighting have added to market jitters with Finland & Sweden wanting to join NATO further annoying Russia.

- The war in Ukraine has further boosted geopolitical tensions which does not go down well with share markets.

- Lockdowns in China under its zero Covid policy in response to Omicron outbreaks have hit Chinese growth and further disrupted global supply chains. This has seen a sharp fall in Chinese economic data for April with industrial production down 2.9% on a year ago and retail sales down 11.1%.

- The surge in inflation has seen central banks step up monetary tightening. Even the ECB looks like it might start hiking rates in July. While the rise in inflation is mainly driven by supply, demand has been strong too and central banks have to act to stop high inflation boosting inflation expectations which will lock inflation in at high levels.

- The longer inflation stays high the more investment markets worry that central banks will not be able to tame it without bringing on recession. As Fed Chair Powell indicated, getting inflation to 2% will “include some pain”.

- And as bond yields rise in response to higher inflation this puts further pressure on share markets by making them look relatively less attractive to investors.

- Just as tech stocks and particularly crypto currencies were the biggest beneficiaries of easy money and low rates, they are the biggest losers of monetary tightening. With the end result that cryptos are moving like a high beta version of shares (and so are no portfolio diversifier) and have offered no hedge against the rise in inflation over the last year.

After plunging into last week, shares could have a further near-term bounce. But risks around inflation, monetary tightening, the war in Ukraine and Chinese growth remain high and still point to more downside in share markets. While investor pessimism is extreme (positive from a contrarian perspective), we have not yet seen levels for indicators like VIX or the ratio of Put options to Call options seen at major market bottoms.

It’s not all doom and gloom

However, there is some light at the end of the tunnel.

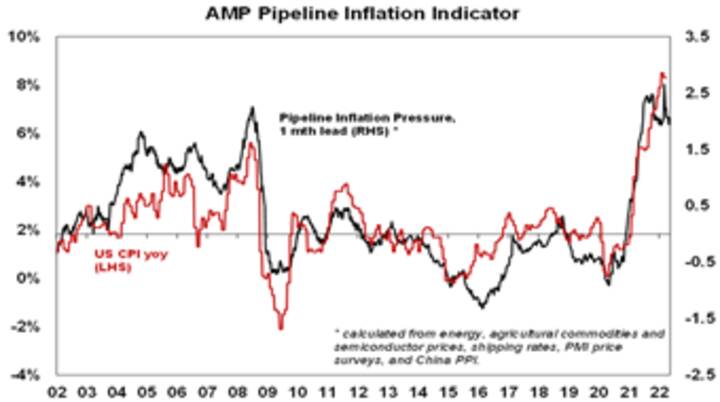

- While US inflation is still too high for comfort and may remain so for a while, signs of some peaking are evident in our Pipeline Inflation Indicator reflecting lower freight costs and a slowing in commodity prices. This could enable central banks to slow the pace of tightening later this year or early next in time to avoid recession.

The Inflation Pipeline Indicator is based on commodity prices, shipping rates and PMI price components. Source: Macrobond, AMP

- While services inflation could continue to rise for a while yet there are signs US wages growth may have peaked with eg monthly growth in average hourly earnings looking like it may have peaked late last year.

- Share market earnings are continuing to come in stronger than expected. US March quarter earnings reports continued to surprise on the upside and earnings look on track to rise around 12%yoy which is up from initial expectations for a 4.3%yoy gain. And earnings growth in Europe and Asia is averaging slightly faster.

- Some of the risks around a widening in the Ukraine conflict may be declining. Contrary to the fears of many, President Putin did not declare war on Ukraine and announce a general mobilisation signalling an escalation at his 9 May victory over Nazi Germany commemoration speech. It could become another frozen conflict which is horrible for Ukraine but not a further disruptor to global growth.

- Covid cases in China appear to be slowing which could enable an easing in restrictions and clear the way for policy stimulus to boost growth.

- Yield curves or the gap between long-term bond yields and short-term rates have yet to decisively invert (or warn of recession) and even if they do now the average lead to recession is 18 months – which takes us to late next year which would be too early for share markets to discount as they only look 6 months ahead.

- Just focussing on rate hikes ignores the tightening already underway from the ending of money printing, meaning that the Fed may have already tightened a lot and market expectations for a cash rate up to 3% in the US (and Australia) next year may be too hawkish.

So while shares could still see more falls in the short-term we remain of the view that a deep (or grizzly) bear market will be avoided as US and Australian recession should be avoided over the next 18 months, which should enable share markets to be up on a 12 month horizon.

Could a crypto currency meltdown de-rail things?

Now that easy money is being reversed crypto currencies are suffering along with tech stocks. The risks were highlighted in the past week with the collapse of TerraUSD, an algorithmic stablecoin meant to stay at $US1, with a flow on to demand for other cryptos, including Bitcoin. Notwithstanding short-term bounces, further downside is a risk if falls feed on themselves and the speculative mania in crypto unwinds, leading to yet another 80% top to bottom fall. And to the extent crypto currencies depend on bringing in more investors to keep moving forward, a collapse now could have a more lasting impact on interest in it than in the past when it was less “mainstream.” Particularly given that Bitcoin has so far offered little hedge against inflation over the last year. For the broader financial system and economy, a crypto crash poses a risk but it’s unlikely to be another sub-prime/2008 US housing crisis. Banking system exposure to crypto is limited and the exposure of the wider public is still small (unlike it was to US housing).

What about Australian shares?

Australian shares are vulnerable to further falls in the short-term along with global shares. However, as noted earlier they have been relative outperformers through the decline in share markets so far and this is also evident year to date where global shares are down 13% and Australian shares are down 4%. This reflects their exposure to strong commodity prices and low exposure to tech stocks. While Chinese Covid lockdowns may weigh in the short-term, Australian shares are likely to continue to outperform over the medium-term as the commodity super cycle continues – on the back of constrained supply reflecting low levels of resource investment, decarbonisation and geopolitical tensions – and as higher bond yields compared to the pre-covid era weigh on tech stocks.

Key things for investors to bear in mind

Sharp share market falls are stressful for investors as no one likes to see their investments fall in value. But at times like these key things for investors to bear in mind are that: share market pullbacks are healthy and normal; in the absence of a recession share market falls may be limited; it’s very hard to time market moves and selling shares after a fall locks in a loss; share pullbacks provide opportunities for investors to buy them more cheaply; Australian shares still offer an attractive income flow relative to bank deposits; and finally, to avoid getting thrown off a long-term investment strategy it’s best to turn down the noise around all the negative news flow.

What’s critical to know about critical infrastructure

Governance Institute of Australia

There have been major changes to the nation’s security of critical infrastructure laws in recent months with the Government passing amendments to the existing Security of Critical Infrastructure (SOCI) Act both in December last year and in March this year. The changes come following increasing concerns over rising cyber-attacks and foreign interference.

The laws have a number of key provisions affecting private and public sector organisations.

With the grace periods for these provisions due to expire in the coming months, we discuss the key provisions, grace periods and expiry dates.

Expanded sector coverage

In December 2021 the SOCI amendment laws increased the number of sectors classified as ‘critical infrastructure assets’.

Initially, critical infrastructure only referred to the electricity, gas, water and maritime/ports sectors.

However, following the amendments the laws applied to a broad range of sectors including:

- healthcare and medical sectors

- financial services and markets

- data storage or processing

- defence industry

- energy

- water and sewerage

- communications

- higher education and research

- space technology

- food and grocery provision

Under the SOCI amendments, critical infrastructure assets are defined according to their specific sector. For example, a ‘critical water asset’ is defined as ‘one or more water or sewerage systems or networks that are managed by a single water utility and deliver services to at least 100,000 connections.’

Organisations should consider which of their assets are defined as critical infrastructure and consult with government and/or consider legal advice where necessary.

Mandatory reporting of cyber incidents

The SOCI laws place obligations on entities responsible for critical infrastructure assets to report cyber security incidents to the Australian Signals Directorate (ASD).

The grace period for this provision is due to expire on 8 July 2022.

There are two levels of reporting:

- critical cyber security incidents – a responsible entity must report (orally or in writing) that a critical cyber incident has occurred within 12 hours of the entity becoming aware of the incident. A critical security incident is where an attack (direct or indirect) is having a significant effect on the availability of the asset. A written report must also be provided within 84 hours.

- other cyber security incidents – a responsible entity must also report any incident that has occurred, is occurring or is imminent that would have a “relevant impact on the asset”. This must occur (orally or in writing) within 72 hours. The entity must also provide a written report within 48 hours of the initial report being given.

Registration of critical assets

The SOCI laws place obligations on ‘reporting entities’ for critical infrastructure assets to provide information to the Federal Government to be recorded on its Register of Critical Infrastructure Assets. A reporting entity for an asset is either the ‘responsible entity’ for the asset or the ’direct interest holder’ for the asset. The responsible entities differ depending on each industry sector.

Organisations should consider whether they are a reporting entity for an asset and consult with government and/or consider legal advice where necessary.

The grace period for this provision is due to expire on 8 October 2022.

Positive security obligation

The positive security obligation passed Federal Parliament in late March this year.

This obligation requires entities responsible for critical infrastructure assets to adopt and maintain a risk management program. The purpose of the program is to enable entities to identify hazards and proactively maintain programs to minimise or eliminate the hazards from occurring. It requires the responsible entity to maintain and comply with a risk management program and provide an annual report to the relevant Commonwealth regulator regarding the program.

This obligation initially applies only to the following sectors:

- critical broadcasting assets

- critical domain systems

- critical data storage or processing assets

- critical hospitals

- critical energy market operator assets

- critical water and sewerage assets

- critical electricity assets

- critical gas assets

- critical liquid assets

- critical financial market infrastructure assets.

A six-month grace period will apply once the Minister for Home Affairs triggers this measure. This process involves the Minister ‘switching on’ the provision and informing asset holders. The grace period then commences from that date.

Enhanced cyber security obligation

This obligation allows the Minister for Home Affairs to privately declare a critical infrastructure asset to be a ‘system of national significance’. Before making the declaration, the minister is required to regard the asset’s interdependencies with other critical infrastructure assets and the consequences to Australia’s national interest if a hazard were to occur. A responsible entity can be required to comply with the following measures:

- a statutory incident response planning obligation – the entity must adopt, maintain and comply with an incident response plan with respect to its assets and provide a copy to the Secretary of Home Affairs

- a requirement to undertake cyber security exercises – these exercises are intended to test the relevant entity’s ability and preparedness to respond to cyber incidents

- a requirement to undertake vulnerability assessments – may require responsible entities to undertake a vulnerability assessment in respect of the relevant asset, the purpose of which is to test the vulnerability of the asset to cyber incidents, and

- provision of access by ASD to system information – a relevant entity for the system may be required to give the ASD periodic or event-based reports of system information, or install software that transmits system information to the ASD

The Federal Government is unlikely to provide a list of ‘systems of national significance’ for national security reasons. However, officials state that they will have one-on-one meetings with affected organisations.

Government intervention

This provision allows the government to intervene to respond to serious cyber incidents that impact the ability of Australia’s critical infrastructure assets to provide services.

This provision is in theory already operating, however the Federal Government states that it has not yet used the power.

Government intervention can occur where:

- a cyber incident has occurred, is occurring or is imminent

- the incident is having or is likely to have a relevant impact on a critical infrastructure asset, and

- the material risk that the incident has, or is likely to, seriously prejudice: a) the social or economic stability of Australia or its people, b) the defence of Australia or c) its national security

- no existing regulatory system could be used to provide a practical and effective response to the incident.

World Business Council for Sustainable Development WBCSD and WWF join forces to accelerate business action on nature, with focus on deforestation and overfishing

Author: Rodney Irwin, Chief Operating Officer, WBCSD and Jason Clay, Senior Vice President, Market Transformation, WWF

Last year marked a turning point for nature – protecting our forests, grasslands, and oceans has become a business-critical issue for companies around the world. As we saw at COP26, nature is now right up there with climate change on the business agenda.

In fact, a new consensus is emerging – across global and national policymakers, major investors, NGOs and consumers – that our global economy must not just become net zero but also nature positive.

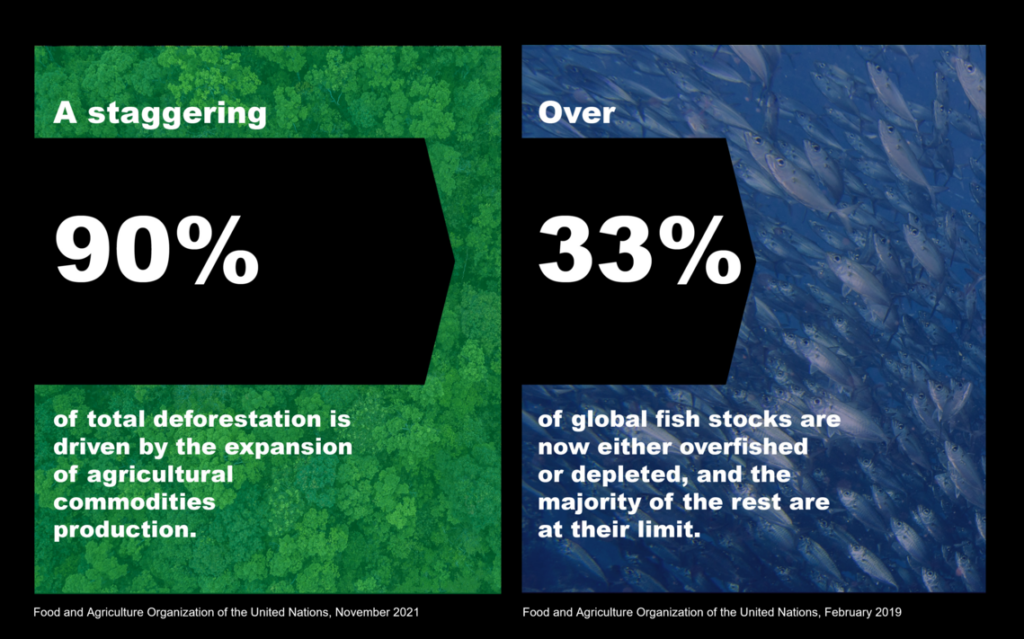

2022 is the year this expectation will be mainstreamed and that puts companies with land and ocean-based value chains at the forefront of action. A staggering 90% of total deforestation is driven by the expansion of agricultural commodities production. Over a third of global fish stocks are now either overfished or depleted, and the majority of the rest are at their limit. For business – especially food retailers and consumer goods companies – protecting and restoring nature is no longer an option; it is a necessity if they want to stay in business.

But becoming nature positive is also an opportunity. Leading food and retail companies have now realized that acting on nature is a chance to win trust with customers and civil society, while mitigating against significant risk exposure and lowering the cost of capital.

That’s because there are trillions of dollars of value at stake. Over half the world’s GDP is dependent on nature, which is why nature risk is fast becoming acknowledged as financial risk by major investors who have pledged to eliminate deforestation from their portfolios by 2025.

Companies in the food system will also miss their net zero targets unless they end deforestation in their supply chains immediately and stop overfishing. Agriculture accounts for nearly a quarter of global greenhouse gas emissions. Marine life absorbs up to 30% of global carbon today, and yet we are destroying this invaluable carbon sink: bottom trawling alone releases as much carbon dioxide as the entire aviation industry.

Equally important for retailers, nature loss has become a major consumer concern. Nine out of ten people in the EU now see biodiversity loss as a serious or very serious issue.

When we speak to CEOs and CFOs, they tell us it’s no longer a question of if they should act, but how.

They want their businesses to be part of the solution. But often, they are overwhelmed by competing demands, and they can’t yet see an effective roadmap for action. They are looking for practical, credible, deliverable approaches relevant to their business models and supply chains.

That’s why our organizations – World Wildlife Fund (WWF) and the World Business Council for Sustainable Development (WBCSD) – are strengthening our collaboration. We’ve both been working on these issues directly with some of the world’s largest companies for decades, and we’re at the forefront of global partner initiatives driving credible business action.

Together, our complementary expertise ranges from governance practices and environmental, social and governance (ESG) disclosures through to procurement processes and supply chain traceability tools. This range of support is what businesses need; because today their investors, customers, and employees all expect them to take comprehensive action to become nature positive.

Thankfully, the road to success is increasingly clear. Food and retail companies that are beginning to thrive through the transition are all doing three things at scale, and so our organizations are joining forces to help them make progress across each of these areas with the latest tools, technologies, and guidance.

First, they’re embedding nature into their business practices. Today, everybody knows that commitments are only worthwhile if they translate into changes on the ground that make credible progress, fast. WBCSD is therefore supporting companies to identify and measure their most material exposures and dependencies, before improving risk management and governance practices to embed nature into every decision.

Second, they’re driving progress within and beyond their supply chains. Unilateral action is no match for the complexities of today’s supply chains. That’s why teams across WWF are helping companies form meaningful partnerships to work together for change, while also outlining guidance for companies to take realistic and credible actions across their own supply chains.

Third, they’re using their influence to visibly advocate for ambitious policies and standards. COP26 demonstrated the importance of multilateral, multi-stakeholder action, and as we approach the UN Biodiversity COP 15, both WWF and WBCSD are working on campaigns with leading businesses to put their voice behind a clear goal for policymakers: protect and conserve a minimum of 30% of global land and 30% global oceans by 2030.

With a clear route to action, and now with access to integrated and comprehensive guidance and support, there is no time for food and retail companies to be complacent. Whatever the size or current level of maturity of your business, get in touch and our teams can offer you practical hands-on support with the tools needed to start halting and reversing deforestation, habitat conversion, and overfishing in your supply chain.

A system shift is underway, and the leading companies of the future will be those who are driving solutions on the ground today.

N.B. The global goal for nature, “nature-positive by 2030” provides a beacon to guide and transform action across all sectors of society, including business. WBCSD’s Nature Positive building blocks provide a framework of what Nature Positive means for business, based on existing frameworks. The steps outlined in the circular diagram demonstrate the areas of focus for WBCSD and WWF as we work to embed nature into business practices and across the supply chain to support companies in demonstrating meaningful progress towards managing performance against natural resource factors.

I hope you have enjoyed this weeks read. Have a great week.

Regards,

Chris Hagan.

Head, Fixed Interest and Superannuation

JMP Securities

Level 1, Harbourside West, Stanley Esplanade

Port Moresby, Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814