27 June, 2022

Welcome to this week’s JMP Weekly Report

PNGX recorded 5 stocks trading on the local bourse last week with all stock prices remaining unchanged. BSP traded 500,119 shares at K12.40, KSL saw 146,223 shares trade at K3.00, STO trading 139 shares at K19.00, and KAM saw 2,002 shares at K1.00 while CCP had 1,080 shares trade at K1.85. Refer to details below.

WEEKLY MARKET REPORT | 21 June, 2022 – 24 June, 2022

| STOCK | QUANTITY | CLOSING PRICE | CHANGE | % CHANGE | 2021 FINAL DIV | 2021 INTERIM | YIELD % | EX-DATE | RECORD DATE | PAYMENT DATE | DRP | MARKET CAP |

| BSP | 500,119 | 12.40 | – | – | K1.3400 | – | 11.61 | THU 10 MAR | FRI 11 MAR | FRI 22 APR | NO | 5,270,833,466 |

| KSL | 146,223 | 3.00 | – | – | K0.1850 | – | 7.74 | THU 3 MAR | FRI 4 MAR | FRI 8 APR | NO | 67,057,337 |

| STO | 139 | 19.00 | – | – | K0.2993 | – | – | MON 21 FEB | TUE 22 FEB | THU 24 MAR | – | – |

| KAM | 2,002 | 1.00 | – | – | – | – | 10.00 | – | – | – | YES | 49,891,306 |

| NCM | 0 | 75.00 | – | – | USD$0.075 | – | – | FRI 25 FEB | MON 28 FEB | THU 31 MAR | – | 33,774,150 |

| NGP | 0 | 0.70 | – | – | – | – | – | – | – | – | – | 32,123,490 |

| CCP | 1,080 | 1.85 | – | – | K0.134 | – | 6.19 | THU 16 JUN | FRI 24 JUN | THU 28 JUL | YES | 569,672,964 |

| CPL | 0 | 0.95 | – | – | – | – |

– | – | – | – | – | 195,964,015 |

Dual listed stock PNGX/ASX

BFL – $4.76 +6c

KSL $0.82 steady

NCM – $23.04 down $1.75

STO $7.22 down $0.57

I have attached a copy of the CCP AGM Presentation

Download | CCP AGM Presentation

Our order book has us as nett buys of BSP, CCP and KSL

On the interest rate front, the TBill market was bid down .04bpts with this week’s average coming in at 2.46%. Approx. K199mill in bids were received and almost K150mill was accepted. The trend would indicate a levelling in the interest rate market with some of the liquidity having been flattened.

We did see a GIS Tender, wow, 62bpts between 5 and 10yr. The value along the curve is in the 5 yrs with the average yield coming in at 6.38%. I have attached the auction results for more detail.

Download | Govt. Bond Auction

I will forward the rates from last weeks auction when at hand.

Non-bank depos – FIFL

30 Days 0.60%, 60 Days 1.00%, 90 Days 1.10%, 180Days 1.00%, 365days 1.85%

And something a little different

Gold Standard $US59.02 ( Up $0.36 / 0.61%) $AU84.87 ( Down $0.08 / 0.10%)

Silver Standard $US0.68 ( Up $0.01 / 1.49%) $AU0.97 ( Up $0 / 0.00%)

Bitcoin $US21,145 ( Up $121 / 0.57%) $AU30,406 ( Down $45 / 0.14%)

Ethereum $US1209 ( Up $68 / 5.95%) $AU1738 ( Up $86 / 5.20%)

Litecoin $US57.78 ( Up $1.59 / 2.82%) $AU83.08 ( Up $1.7 / 2.08%)

Ripple $US0.36 ( Up $0.03 / 9.09%) $AU0.517 ( Up $0.04 / 8.38%)

Bitcoin Cash $US115 ( Down $3 / 2.54%) $AU165 ( Down $5 / 2.94%)

Theta $US1.35 ( Up $0.06 / 4.65%) $AU1.941 ( Up $0.073 / 3.90%)

Tron $US0.06 ( Up $0 / 0.00%) $AU0.086 ( Up $0 / 0.00%)

Cardano $US0.49 ( Up $0.02 / 4.25%) $AU0.704 ( Up $0.024 / 3.52%)

Stellar $US0.12 ( Up $0.01 / 9.09%) $AU0.172 ( Up $0.013 / 8.17%)

Chainlink $US6 ( Up $0 / 0.00%) $AU8 ( Up $0 / 0.00%)

Matic $US0.57 ( Up $0.02 / 3.63%) $AU0.81 ( Up $0.02 / 2.53%)

What we’ve been reading this week

The plunge in shares and the flow on to super – key things for investors to keep in mind during times of turmoil

Dr Shane Oliver

Key points

Share markets have fallen sharply in recent weeks continuing the plunge that started early this year due to worries about inflation, monetary tightening, recession & geopolitical issues including the invasion of Ukraine.

It’s still too early to say markets have bottomed.

This will weigh on super returns for this financial year.

Key things for investors to bear in mind are that: share pullbacks are healthy and normal; in the absence of a recession a deep and long bear market in shares may be avoided; selling shares after a fall locks in a loss; share pullbacks provide opportunities for investors to buy them more cheaply; shares still offer an attractive income flow; and to avoid getting thrown off a long-term investment strategy it’s best to turn down the noise.

Introduction

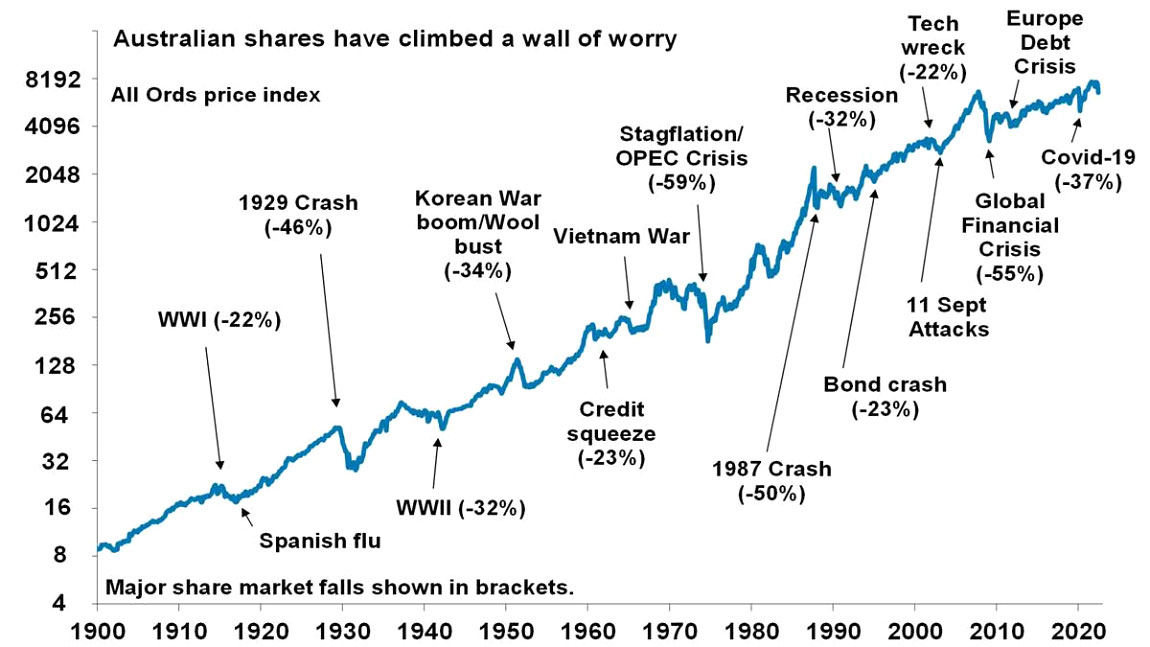

Usually share markets are relatively calm and so don’t generate a lot of attention. But periodically they tumble and generate headlines like “billions wiped off share market” & “biggest share plunge since…” Sometimes it ends quickly and the market heads back up again and is forgotten about. But once every so often share markets keep falling for a while. Sometimes the falls are foreseeable (usually after a run of strong gains), but rarely are they forecastable (which requires a call as to timing and magnitude)…despite many claiming otherwise. In my career, I have seen many periodic share market tumbles.

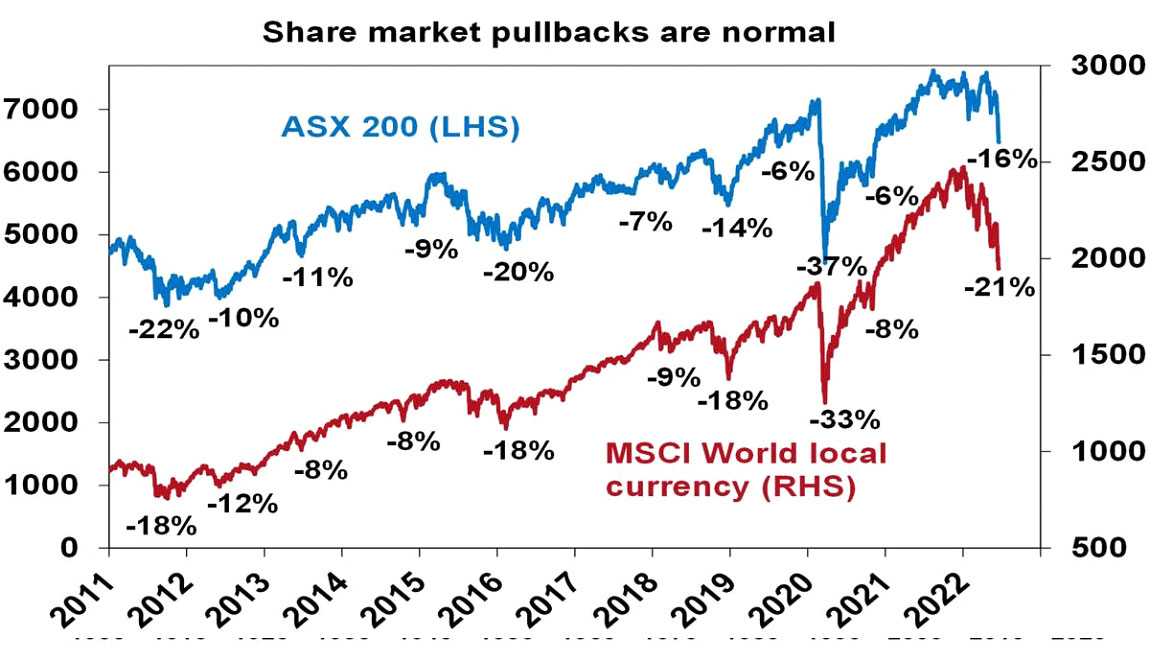

And so it is again – with share markets starting the year on a sour note and despite a few bounces along the way having several legs down with another sharp fall over the last two weeks. From their all-time highs to their lows in the past week US shares have now fallen 24%, global shares have fallen 21% and Australian shares have fallen 16%. Always the drivers are slightly different. But as Mark Twain is said to have said “history doesn’t repeat but it rhymes”, and so it is with share market falls. This means that from the point of basic investment principles, it’s hard to say anything new. Which is why this note may sound familiar with “key things for investors to keep in mind”, but at times like this they are worth reiterating.

What’s driving the plunge in share markets

The key drivers of the fall in shares remain:

- Shares had very strong gains from their March 2020 lows and speculative froth had become evident in tech stocks, meme stocks and crypto, and this left them vulnerable.

- High and still rising inflation flowing from pandemic distortions made worse by the war in Ukraine and Chinese lockdowns. US inflation rose further in May to 8.6%, its over 8% in Europe and looks to be on its way to 7% or so in Australia (not helped by our own electricity crisis & floods).

- The ongoing upside surprises on inflation have seen central banks become more aggressively focussed on pulling it back down and so stepping up the pace of rate hikes with: the US hiking by 0.75% last week; Canada, NZ & the UK all continuing to raise interest rates; the ECB moving towards rate hikes from July; and the RBA hiking rates by 0.5%.

- The increasing aggressiveness of central banks in the face of higher inflation is in turn raising the risk of triggering a recession, which could depress company profits.

- Rising bond yields in response to rising inflation and central bank tightening is adding to the pressure on share markets by making them look relatively less attractive which is driving lower price to earnings multiples.

- The ongoing war in Ukraine along with tensions with China are adding to the risks.

As always, the most speculative “assets” are getting hit the hardest including the pandemic winners of tech stocks (with Nasdaq having fallen 34%) and crypto currencies (with Bitcoin down 70% from its high last year). Crypto currencies surged with semi religious fervour around the claimed marvels of blockchain, decentralised finance, NFTs, freedom from government, an inflation hedge, etc, only to become a speculative bandwagon fuelled by easy money and low interest rates. Trying to disentangle its true fundamental value from the speculative mania became next to impossible. And now the easy money and low rates are reversing, pulling the rug out from under the mania and driving mishaps along the way (eg, Terra, Celsius Network and Babel Finance). Fortunately, the exposure of major banks and mainstream investors to crypto is still relatively low so this is unlikely to be another GFC moment.

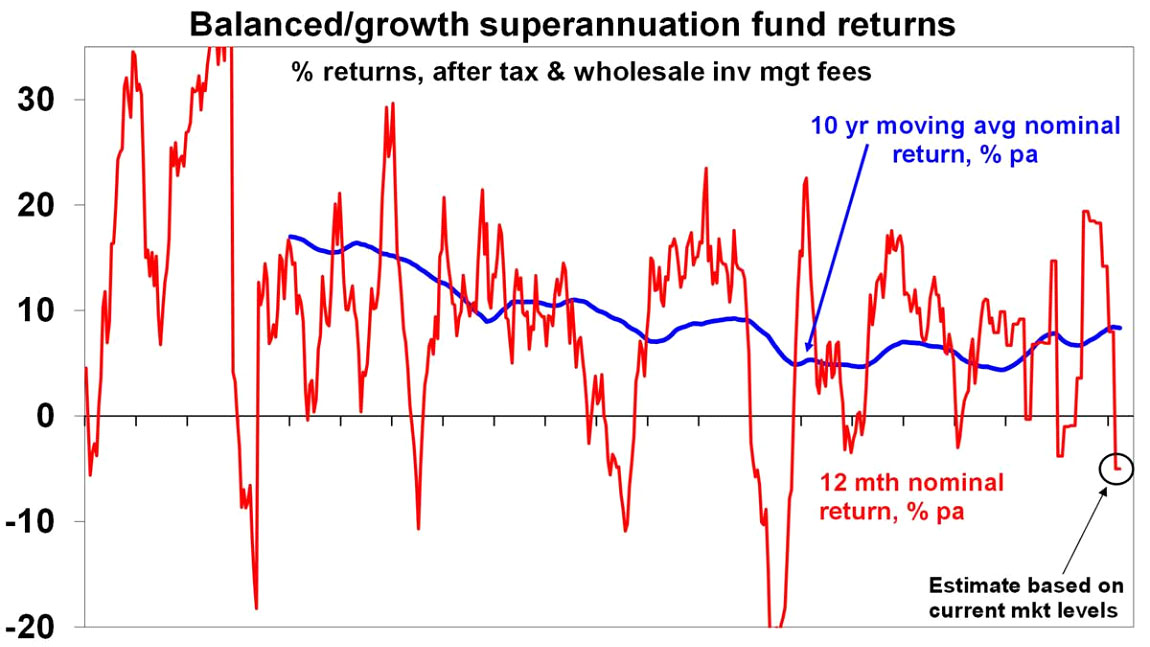

Reflecting the sharp falls in share markets and in fixed interest investments (which suffer a capital loss as bond yields rise) balanced growth superannuation funds are down by 5% or so for this financial year to date and are on track for their first financial year loss since 2019-20 (due to the pandemic) & their worst financial year loss since the GFC. See the next chart.

Source: Morningstar, AMP

Key things for investors to bear in mind

Sharp market falls are stressful for investors as no one likes to see their investments (including their super) fall in value. But there are some key things investors should keep in mind:

First, while they unfold differently, periodic share market corrections and occasional bear markets (which are usually defined as falls greater than 20%) are a normal part of investing in shares. For example, the last decade regularly saw major pullbacks. See the next chart.

Source: Bloomberg, AMP

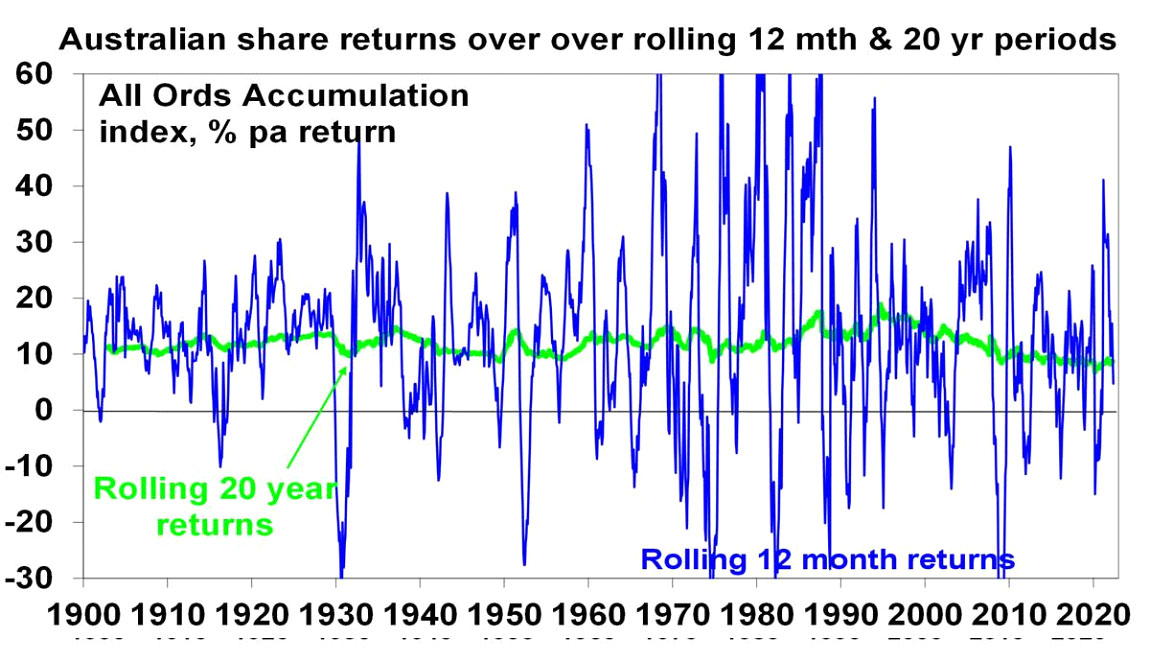

And, as can be seen in the next chart rolling 12 month returns from shares have regularly gone through negative periods.

Source: ASX, Bloomberg, AMP

But while the falls can be painful, they are healthy as they help limit excessive risk taking. Related to this, shares climb a wall of worry over many years with numerous events dragging them down periodically (next chart), but with the long-term trend ultimately up & providing higher returns than other more stable assets. As can be seen in the previous chart, the rolling 20-year return from Australian shares has been relatively stable and solid. Which is why super funds have a relatively high exposure to shares along with other growth assets. Bouts of volatility are the price we pay for the higher longer-term returns from shares. As can be seen in the first chart in this note while this financial year has been rough for super funds longer term returns have been solid & so recent weakness has to be seen in perspective.

Source: ASX, AMP

Second, historically, the main driver of whether we see a correction (a fall of say 5% to 15%) or even a mild bear market (with say a 20% or so decline that turns around relatively quickly like we saw in 2015-2016 in Australia – which may be called a “gummy bear market”) as opposed to a major (“grizzly”) bear market (like that seen in the mid-1970s or the global financial crisis when shares fell by around 55%) is whether we see a recession or not – notably in the US, as the US share market tends to lead most major global markets.

We remain of the view that a global recession can be avoided – if inflation starts to slow later this year or early next (as supply improves) taking pressure off central banks and in Australia as growth initially cools faster than expected (as the plunge in consumer confidence suggest that it will) putting a cap on how much the RBA needs to hike interest rates allowing it to avoid triggering a recession. But with inflation still surprising on the upside and central banks hiking rates aggressively the risks have increased to the point that its now a very close call. Either way it’s still too early to say that shares have bottomed.

Of course, short-term forecasting is fraught with difficulty and should not be the basis for a long-term investment strategy, so it’s better to stick to long term investment principles.

Third, selling shares or switching to a more conservative superannuation investment strategy whenever shares fall sharply just turns a paper loss into a real loss with no hope of recovering. Even if you get out and miss a further fall, the risk is that you won’t feel confident to get back in until long after the market has fully recovered. The best way to guard against deciding to sell on the basis of emotion after falls in markets is to adopt a well thought out, long-term strategy and stick to it.

Fourth, when shares fall, they’re cheaper and offer higher long-term return prospects. So, the key is to look for opportunities’ pullbacks provide. It’s impossible to time the bottom but one way to do it is to “average in” over time. Fortunately, the Australian superannuation system does just that by regularly putting money into shares for workers (via their super) effectively taking advantage of the fact they are cheaper.

Fifth, while share prices have fallen dividends have not and so the dividend yield has increased. Australian shares are offering a very attractive dividend yield compared to bank deposits despite rising deposit rates. Companies don’t like to cut their dividends, so the income flow you are receiving from a well-diversified portfolio of shares is likely to remain attractive.

Source: RBA, Bloomberg, AMP

Sixth, shares and other related assets often bottom at the point of maximum bearishness, ie, just when you and everyone else feel most negative towards them. So, the trick is to buck the crowd. “Be fearful when others are greedy. Be greedy when others are fearful,” as Warren Buffett has said.

Finally, turn down the noise. At times of uncertainty like now, the flow of negative news reaches fever pitch. Talk of billions wiped off share markets and of “crashes” help sell copy and generate clicks. But less newsy are the billions that market rebounds and the rising long-term trend in share prices add to the share market. Moreover, they provide no perspective and only add to the sense of panic. All of this makes it harder to stick to an appropriate long-term strategy – which is particularly important when it comes to super as it has to be seen as a long-term investment, except for many of those near to retirement. So best to turn down the noise and watch the new Elvis biopic!

Ghana will house first ever West African hydro-solar plant

By Nomvuyo Tena

The 1MW floating solar plant on the Bui Reservoir is a first for Ghana. Image: Bui Power Authority.

The first West African hydro-solar plant was deployed in Ghana at the beginning of 2022. Once its full capacity is brought online, the hydro-solar plant will reduce Ghana’s greenhouse gas emissions by 235,000 tons per year.

The United States Agency for International Development (USAID) and the US Department of Energy’s National Renewable Energy Laboratory (NREL) provided the technical know-how to help get the project off the ground.

As energy demand increases in Ghana, its government is seeking to diversify the country’s energy mix and find innovative ways to integrate variable renewable energy (VRE) into its national grid—particularly wind and solar—to reach its target emissions goals. This will allow a shift away from fossil fuels, supplement hydro resources during drought periods and lower energy costs.

To support this effort, the USAID-NREL Partnership in 2017 facilitated discussions with Ghana’s Bui Power Authority (BPA) at an NREL-hosted workshop focused on advanced photovoltaic (PV) plant capabilities, solar and wind grid integration, and best practices on integrating small-scale and utility-scale VRE into Ghana’s grid. Following the workshop, BPA invited the NREL team to provide additional technical assistance to support the power authority with adding power from solar PV to an existing 400-megawatt (MW) hydroelectric dam to cut greenhouse gases, augment the hydro power and provide energy diversity.

Building on those discussions, USAID’s Power Africa West Africa Energy Program (WAEP) and NREL collaborated with BPA to operationalise the first 50MW of PV within the existing Bui Generating Station hydroelectric dam site in 2021, with plans to grow the solar PV capacity to 250 MW. Scheduled for completion by late 2022, the plant will also contain a 20-MW-hour battery energy storage system and controls, which the NREL team suggested so the plant can meet existing grid codes for renewable energy resources, manage the variability of solar and increase the country’s power sector reliability.

This new capacity will provide enough energy to power an estimated 200,000 households and allow BPA to gain valuable experience in developing more solar energy projects.

“The global challenge of climate change, as well as the need to secure energy supply, makes the development of the hydro-solar plant very important for Ghana and West Africa,” said Peter Acheampong, deputy director of renewables at BPA who collaborated closely with the NREL-WAEP team.

Building the PV installation

Since 2017, the NREL-WAEP team has hosted workshops, provided technical analysis, reviewed grid impact and stability studies for the plant, modeled power flow for transient events and evaluated plant designs to ensure compliance with Ghana’s new grid codes for VRE. They also offered guidance on utility-scale PV and worked closely alongside stakeholder and industry groups in Ghana to review best practices with operationalising this large-scale VRE plant.

In addition to working with BPA and the Volta River Authority (VRA, another Ghana power authority), the NREL-WAEP team collaborated with sector agencies – including distribution utilities, transmission utilities and independent power producers – to conduct analytical studies and impact assessments beyond the Bui solar project.

The addition of PV to the hydro plant allows BPA to balance the variable output of solar by simultaneously increasing or decreasing hydro power output in real-time to maintain a steady power supply to meet demand, including the addition of new controls and capabilities to effectively manage output.

NREL worked closely with BPA’s renewable energy manager to provide in-depth analysis of the impacts of such hybrid hydro-PV operation and the institutional, operational and hardware changes required to ensure the proposed system can operate in a hybrid manner while maintaining system stability and reliability. In parallel, NREL worked with Ghana Grid Company Limited, the system operator and transmission asset owner, to better understand the potential operational impacts of interconnecting BPA’s hybrid system.

We will not be rushed into energy transition says Ghana Deputy Energy Minister

400kW hybrid waste-to-energy power plant a first for Ghana

“We are equipping them with all the tools and lessons we learned in the United States about VRE integration, and, in some cases, helping them to avoid some of the challenges we had with the latest technology and standards. Having this type of partnership is an effective way to streamline the process of integrating advanced technologies,” said David Corbus, the Wind Grid Integration Lead at NREL and a member of the NREL-WAEP team supporting the Ghana solar project.

This project represents a major advancement in West Africa’s efforts to integrate larger shares of renewables into its regional energy mix.

The first 50MW of the plant generates energy onto the national grid during the day, with 1MW of the installed system consisting of floating solar PV. Overall, the hydro-solar hybrid installation allows Ghana to harness its immense solar resources, combat low water levels during the dry season and provide grid operators more flexibility to run the hydropower plant at night.

Aerial view of 50-MW solar PV plant, with 200 additional MW under development. Photo courtesy of BPA.

Exploring rooftop solar

In parallel to the large-scale utility PV installation, the NREL-WAEP team is also supporting deployment of decentralised PV in Ghana, enabling consumers to tap into the savings of rooftop solar. The team is providing electric distribution companies with the tools needed to understand and plan for distributed PV, recognise the financial impact for utilities and consumers under different scenarios and rapidly assess the benefits and challenges of capacity-hosting analysis and new customer solar installations.

“We worked with the Electricity Company of Ghana and the Northern Electricity Distribution Company, where we transferred open-source software to them and gave them training, capacity building and workshops with utility engineers where we assessed plans and looked at studies for integrated distributed PV,” Corbus said about the team’s contributions to Ghana’s behind-the-meter PV planning.

Part of the training involved completing utility revenue impact analysis and tool development training, which assesses how PV affects build models, cash flow and revenue. The team also works with the Public Utility Regulatory Commission and the Energy Commission of Ghana to clarify results, respond to questions and challenges for distributed PV planning and translate analysis outcomes into policy.

Minigrid and solar PV net metering project to benefit citizens of Ghana

Double-digit growth for Ghana’s renewable energy capacity predicted

The road ahead for the hydro-solar plant

The Bui Hydro-Solar Hybrid project is a historic move toward a more sustainable future for Ghana and West Africa, paving the way for more renewable energy technologies across the continent, serving as a model for future hybrid plants and demonstrating how interagency collaboration can accelerate programme results and enable future partnerships.

“Through a societal push towards sustainable clean energy, it is my hope that a total of 60% or more power supplied to the national grid is from renewable energy sources. Although it may be on a higher side as Ghana is a developing country and we might be constrained to some uncontrollable factors, with the right mentality, we can push to make this dream or hope a reality,” said Acheampong.

ADB, AUSTRALIA, PNG PARTNER TO BOOST ACCESS TO CLEAN, RELIABLE, AND AFFORDABLE POWER

by PNG Business News -June 20, 2022

Photo credit: ADB

The Asian Development Bank (ADB) today announced a $305 million project which will support the strengthening and expansion of electricity in Papua New Guinea (PNG).

The Power Sector Development Project is supported by loans and grants from ADB and the governments of Australia and PNG and will target five subprojects within the main power grids of the country’s power utility, PNG Power Limited (PPL). ADB provided two loans amounting to $208.6 million, the Government of Australia contributed a $59.5 million loan and a $12.8 million grant, and the Government of PNG with PPL will yield $24.1 million.

“PNG has one of the lowest rates of electricity access in the Pacific, with only 13% of households having access,” said Director of ADB Pacific Department’s Energy Division Mukhtor Khamudkhanov. “The project will contribute to the government’s objective of connecting 70% of its population to electricity by 2030 and will help advance reforms in the power sector.”

The project will expand and upgrade transmission lines and substations in Gazelle, Ramu, and Port Moresby; build new low- and medium-voltage power distribution lines in Gazelle, Ramu, and Port Moresby, and mini grids in West New Britain; and strengthen the capacity of PPL through the introduction of procurement and implementation, utility operation, and financial management reforms.

The limited electricity access in PNG stifles economic growth and exacerbates poverty and inequality in both urban and rural areas. COVID-19 has also impacted the local economy, and quality infrastructure is a central component of the government’s post-pandemic economic recovery strategy. The stable power grids proposed under the project will help maintain urban health facilities’ basic operations and are critical to reducing COVID-19 risks.

ADB is committed to achieving a prosperous, inclusive, resilient, and sustainable Asia and the Pacific, while sustaining its efforts to eradicate extreme poverty. Established in 1966, it is owned by 68 members—49 from the region.

Artificial intelligence: No longer a future challenge

Governance Institute of Australia

Artificial Intelligence (AI) often reminds us of Hollywood with films such as The Terminator and The Matrix presenting dystopic futures where humans and robots face off in epic battles.

However, AI and automated decision-making (ADM) are increasingly being adopted in organisations across Australia.

It is estimated digital technologies, including AI, will be worth $A315b to the Australian economy by 2028.

The Federal Government recently completed consultations regarding potentially regulating AI and ADM, with Governance Institute of Australia lodging a submission in response to the issues paper.

This article discusses the technologies, the potential they offer and the challenges they pose.

Defining AI and ADM

AI is defined as a fast-evolving group of technologies that often use data to improve prediction, optimisation and service delivery for outcomes including economic, social, strategic, military or environmental benefits. ADM is closely connected to AI. Automated systems range from traditional rules-based systems (for example a system which calculates a rate of payment in accordance with a formula) through to more specialised systems which use automated tools to predict and deliberate.

The benefits

The growth of these technologies offers significant opportunities in productivity, economic growth and efficiency across a broad range of business sectors. It can also offer social and environmental benefits in sectors such as medicine, climate change and the environment, emergency response, logistics, finance, law, government services and defence. They are also likely to offer higher quality jobs, particularly for young people moving into the workforce, potentially with higher work satisfaction and less manual labour. However, the emergence of these new jobs could create challenges for industry around re-skilling the current workforce to adapt to the new technology.

The challenges for organisations and society

There are challenges connected to the emergence of AI and ADM for organisations, society and government.

Organisations: It is important that organisations use high quality data when developing these technologies as the use of inaccurate or poor-quality data can lead to bias and adverse outcomes for individuals. For example, academics in the United States found that AI models using data that reflected existing racial bias in healthcare delivery could create adverse outcomes for minority groups.

Society: A key issue for the development of AI and ADM is inclusion. It is important that the increasing use of AI and ADM does not exacerbate existing issues within Australian society such as the digital divide. The digital divide excludes Australian businesses and individuals who cannot access fast and reliable internet, for affordability, connectivity, speed and extent of access, bandwidth issues, digital literacy or any other reasons. The most recent Australian Digital Inclusion Index (ADII) report found that the number of Australians highly excluded from digital services is reducing but remains substantial. Technology organisations can help address this issue by involving diverse stakeholders in their risk assessment and design processes. Employing staff from diverse backgrounds would also be beneficial.

The challenges for government

There are many issues for governments to address in regulating these technologies including duplication, interoperability and stakeholder complexity.

Duplication: There is potential for duplication and overlap with interrelated policy areas such as privacy and data protection, cyber security and security of critical infrastructure. These areas of policy are important components of the governance and risk management frameworks of most, if not all, organisations in the modern Australian economy. In our submission we argued it is critical that any new legislation is harmonised in relation to these policy areas to ensure clarity and minimise regulatory burden. Reducing regulatory burden will allow organisations to innovate, develop new technologies and compete in global markets.

Interoperability: It is important that innovative technologies created in Australia can be developed, industrialised and exported to overseas markets. There are significant opportunities that will continue to arise with the development of these technologies, and it is critical that Australian organisations can compete internationally and become significant innovators in this field.

Stakeholder complexity: The development of AI and ADM can involve very complex relationships, which in turn create challenges for regulation. The research organisation the Lovelace Institute has found that “many AI products are not produced by a single organisation, but involve a complex web of procurement, outsourcing, re-use of data from a variety of sources, etc. This changes the question of who is in scope, and who should be accountable, for different parts of the AI lifecycle.”

A possible solution

In our submission we argued the current principles-based approach to regulating AI and ADM may be the best solution. This approach could be built on the existing Australia’s Ethics Principles. These principles outline the key outcomes organisations should consider in developing innovative AI including human centred AI, transparency, accountability, fairness, privacy, safety and contestability. These principles could be supported with further guidance and resources for organisations around conducting impact assessments prior, during and after AI and ADM development.

The continued rise of AI and ADM will create major opportunities globally. It is critical that Australia adopts an approach which facilitates technological advancement, but is also inclusive, human centric and focused not only on productivity, but also on providing benefits for society more broadly.

I hope you have enjoyed this week’s report. Have an awesome week

Regards,

Chris Hagan.

Head, Fixed Interest and Superannuation

JMP Securities

Level 1, Harbourside West, Stanley Esplanade

Port Moresby, Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814