4 July, 2022

Hello and welcome to this week’s JMP Report

We saw 4 stocks trade on the local bourse last week. Prices for all the stocks remained unchanged with BSP trading 3,150 shares at K12.40, KSL saw 202,289 shares trade at K3.00, CPL trading 6,542 shares at K0.95 while CCP saw 2,437 shares trade at K1.85. Refer to details below.

WEEKLY MARKET REPORT | 27 June, 2022 – 1 July, 2022

| STOCK | QUANTITY | CLOSING PRICE | CHANGE | % CHANGE | 2021 FINAL DIV | 2021 INTERIM | YIELD % | EX-DATE | RECORD DATE | PAYMENT DATE | DRP | MARKET CAP |

| BSP | 3,150 | 12.40 | – | – | K1.3400 | – | 11.61 | THU 10 MAR | FRI 11 MAR | FRI 22 APR | NO | 5,270,833,466 |

| KSL | 202,289 | 3.00 | – | – | K0.1850 | – | 7.74 | THU 3 MAR | FRI 4 MAR | FRI 8 APR | NO | 67,057,337 |

| STO | 0 | 19.00 | – | – | K0.2993 | – | – | MON 21 FEB | TUE 22 FEB | THU 24 MAR | – | – |

| KAM | 0 | 1.00 | – | – | – | – | 10.00 | – | – | – | YES | 49,891,306 |

| NCM | 0 | 75.00 | – | – | USD$0.075 | – | – | FRI 25 FEB | MON 28 FEB | THU 31 MAR | – | 33,774,150 |

| NGP | 0 | 0.70 | – | – | – | – | – | – | – | – | – | 32,123,490 |

| CCP | 2,437 | 1.85 | – | – | K0.134 | – | 6.19 | THU 16 JUN | FRI 24 JUN | THU 28 JUL | YES | 569,672,964 |

| CPL | 6,542 | 0.95 | – | – | – | – |

– | – | – | – | – | 195,964,015 |

Dual Listed Stocks (PNGX/ASX)

BFL 4.88 + 4c

KSL $0.82 +1c

NCM – $20.27 -$2.38

STO – $7.21 – 31c

Our order book has us as nett buyers of BSP, CCP KSL and STO.

On the interest rate front the TBill market has continued its steady line with the 364 coming in 2.55%. What was interesting was the market was undersubscribed by 32mill.

In the non bank depo market, we have seen CCP and Fincorp rates offered at 4.60%

A look at the alternatives

Gold Standard $US58.09 ( Down $0.38 / 0.66%) $AU84.20 ( Down $0.75 / 0.88%)

Silver Standard $US0.65 ( Down $0.01 / 1.51%) $AU0.94 ( Down $0.01 / 1.05%)

Bitcoin $US18,899 ( Down $1308 / 6.47%) $AU27,393 ( Down $1960 / 6.67%)

Ethereum $US1027 ( Down $80 / 7.22%) $AU1488 ( Down $120 / 7.46%)

Litecoin $US51.69 ( Down $1.99 / 3.70%) $AU74.92 ( Down $3.05 / 3.91%)

Ripple $US0.32 ( Down $0.01 / 3.03%) $AU0.463 ( Down $0.016 / 3.34%)

Bitcoin Cash $US100 ( Down $8 / 7.40%) $AU144 ( Down $12 / 7.69%)

Theta $US1.16 ( Down $0.08 / 6.45%) $AU1.681 ( Down $0.12 / 6.66%)

Tron $US0.06 ( Up $0 / 0.00%) $AU0.086 ( Down $0.001 / 1.14%)

Cardano $US0.44 ( Down $0.02 / 4.34%) $AU0.637 ( Down $0.031 / 4.64%)

Stellar $US0.10 ( Down $0.01 / 9.09%) $AU0.144 ( Down $0.015 / 9.43%)

Chainlink $US6 ( Up $0 / 0.00%) $AU8 ( Up $0 / 0.00%)

Matic $US0.45 ( Down $0.05 / 10.00%) $AU0.65 ( Down $0.07 / 9.72%)

What we’ve been reading this week

BRICS NATIONS FORMING USD ALTERNATIVE

30/06/2022

China, India, Brazil and South Africa wondering if they will be next in line to suffer sanctions, the BRICS nations are forming a viable alternative to the US Dollar for international settlements. Speaking at the BRICS Business Forum on Wednesday, Putin stated.

“The matter of creating the international reserve currency based on the basket of currencies of our countries is under review.” This is the most formalised movement towards a global environment that functions largely without the US Dollar. Saudi Arabia has been in talks for most of the year to sell Oil denominated in Chinese Yuan, and Nigeria is already making those trades.

National leaders from each of the BRICS nations at the BRICS Business Forum June 2022.

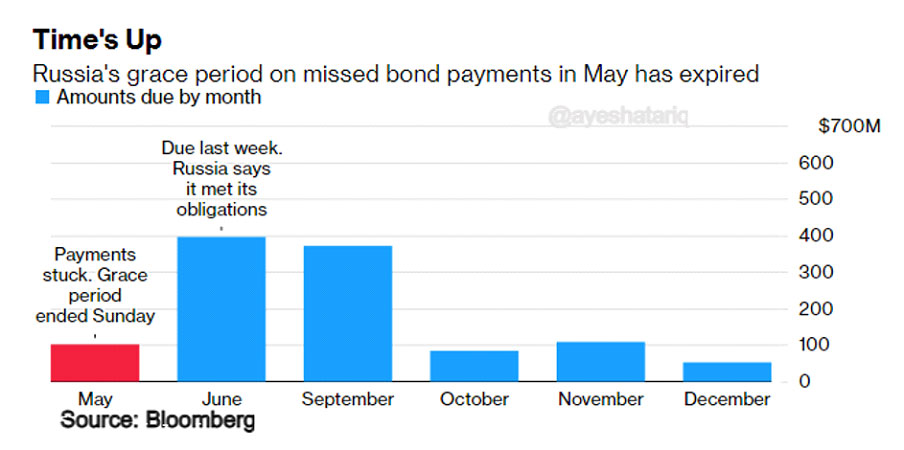

Russia has been shut out of the international financial system since the invasion of Ukraine. With a 30 day grace period expiring, they have been classified as in default according to the White House, Moodys and a number of other significant market participants and international regulatory bodies. As we covered in early February, Russia had approximately US$630 bn of reserves frozen in Western financial institutions.

Responding to claims of default, Kremlin spokesperson Dmitry Peskov described claims as ‘absolutely unjustified’ and that the sanctions had prevented their intermediaries from transferring payments.

The formal default may well be a technicality, as they are unable to interact with the SWIFT system to make the payments, but it may affect their borrowing capacity in the future as they are downgraded by credit agencies. With rocketing oil and gas exports and now actively trying to devalue a strengthening ruble to protect export competitiveness, the Russians are far from hard up when it comes to currency.

Other countries outside of the NATO block are looking at the Russian predicament and making alternative plans. Ironically, the US’s use of the dollar as a weapon is pushing other countries away from the dollar hegemony.

According to the International Monetary Fund, a number of central banks are seeking to “de-dollarise” but holding more non-traditional forex reserves such as the Chinese Yuan, Swedish Korona and the South Korean Won.

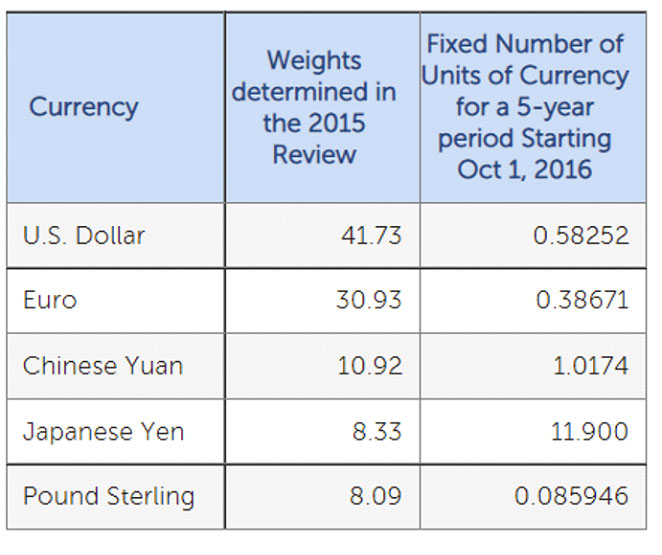

The statements coming from the IMF are significant because they have long been the distant second in terms of global payments with their own basket of currencies which include: the Dollar, Euro, Yuan, Yen and Pound Sterling. In 1970, the International Monetary Fund introduced a scheme for the creation and issue of Special Drawing Rights (SDRs). It was initially pegged to gold but was replaced with the weighted basket of currencies in the table below soon after.

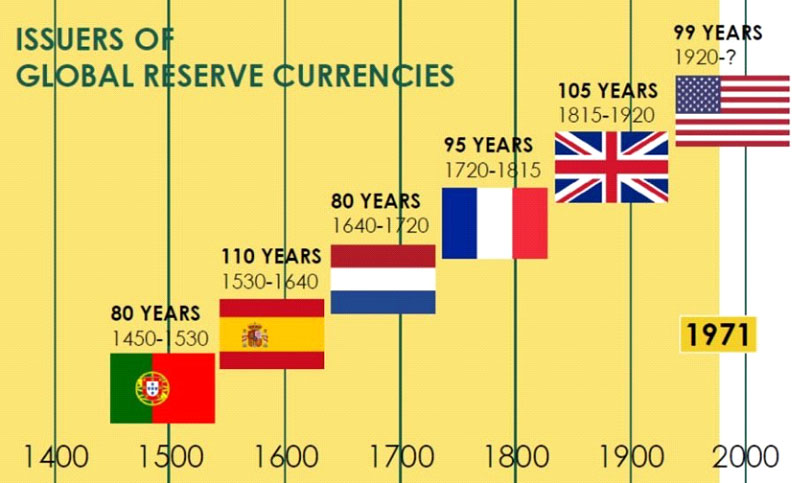

What does all of this mean for precious metals? With the rise of every major power, the global reserve status is both a blessing and a curse. In the early stages of empire, high education standards, efficient workers, manufacturing muscles and agricultural prowess all complemented a growing war machine.

As imports can be brought in purely by issuing additional fiat currency, manufacturing and agriculture move offshore and the skills and capacity of the world power slowly atrophy. This leads to trade imbalances and a weaker currency. This phenomenon is dubbed the “Triffin Dilemma” and effectively means reserve currencies have a life span.

Gold has maintained it’s purchasing power on every continent of the globe throughout all of these six previous periods of Portuguese, Spanish, Dutch, French, British and now American dominance. Currencies come and go, but gold and silver are money.

When transitioning from one era to another, having a strong allocation to precious metals becomes a hedge against major collapses in purchasing power and monetary dislocation. As the US hegemony is continuing to erode and cracks become more and more evident, gold and silver continue to be the store of value and safe haven of the world.

PNGX MARKETS AND XBOURSE AUSTRALIA SIGN MOU FOR USE OF BLOCKCHAIN TECHNOLOGY TO ACCELERATE PACIFIC ISLANDS’ CAPITAL MARKETS

by PNG Business News -June 22, 2022

Photo credit: PNGX

PNGX Markets – Papua New Guinea’s national stock exchange, XBourse Australia – a leading technology services company specialising in building innovative bespoke solutions for financial markets, and Pacific Capital Markets Development – an Australian company committed to the development of capital markets in the Pacific region, have recently signed a memorandum of understanding to explore the development of worldleading digital solutions for Pacific Islands’ capital markets, starting in Papua New Guinea.

The objectives of the cooperative arrangements are to enhance capital market efficiency, promote market liquidity, attract investment and reduce market risk in the Pacific Islands region.

Under the memorandum, PNGX, XBourse and PCMD will work together to explore the phased development of state-of-the-art digital market infrastructure and services:

- Multi-currency post-trade settlement and registration solutions for public and private markets; including equities, bonds and climate instruments.

- central securities depositories and registries;

- custodial services for international investors;

- integrated commercial and regulatory solutions for SMEs; and

- superannuation registry solutions.

“We are very excited to be working with XBourse” said PNGX Chairman and PCMD Director, Mr David Lawrence. “XBourse’s digital ledger technology (also known as blockchain) and smart contracts have the potential to turbo-charge the public and private capital markets in the Pacific region.

The concepts currently being developed would be world-leading, presenting real opportunities for Papua New Guinea.

“We have a vision to provide an integrated solution for Pacific companies of all sizes offering faster access to debt and equity capital, instantaneous and risk-free settlement of trades, a central securities depository to make trading easier for all market users, a custodial platform to meet the needs of international investors, and the potential for expansion into other services, such as superannuation technology services” Mr Lawrence said.

“XBourse is a market leader in the financial technology sector and has been working in recent years with globally recognised technology partners to develop a range of integrated and innovative market platforms and digital solutions that can be readily deployed into all types of markets, covering both existing and new assets, such as climate, that are rapidly being digitised. These platforms deliver greater functionality, efficiency and a new way of doing business in the 21st century at a lower cost than existing incumbent legacy systems and processes.

“Importantly they offer opportunities for new asset classes in the digital age. Some of the opportunities include issuance and registration of assets, trading, digital registries and other back-office systems with immutable records of ownership, transactions and provenance that provide much-needed integrity and security to support the market and regulatory confidence.

“XBourse is excited to be working with PNGX and Pacific Markets Capital Development to identify ways XBourse’s technology solutions can be implemented in the PNG market. Our experience has shown that better market infrastructure is vital to promote efficient use and allocation of capital and to attract the interest of investors large and small,” said XBourse CEO and Founder, Mr Tony Mackay.

“Digitisation and blockchain provide the opportunity for markets of all types and sizes to better and more efficiently access capital. Just as importantly, the new market infrastructure can reduce operational and regulatory risk for all participants and operators.

“XBourse is also working on early-stage projects to tokenise carbon abatement and carbon credits, and we see enormous potential in the Pacific for these instruments where digitisation and blockchain technology can validate, regulate and tokenise these instruments and initiatives and make markets in them,” Tony Mackay said.

“The input of key stakeholders in the market, such as listed companies, banks, superannuation funds and stockbrokers, is critical to the success of this project and ultimately of the PNG market” said PNGX General Manager, Ms Elizabeth Wamsa. “We will shortly be conducting industry forums to discuss user and regulator needs to enable the development of an optimal solution” she said.

Article courtesy of PNGX

HYPOCRISY BY THE WEST…

Charles-Henry Monchau, CFA, CMT, CAIA

Chief Investment Officer at Syz Group

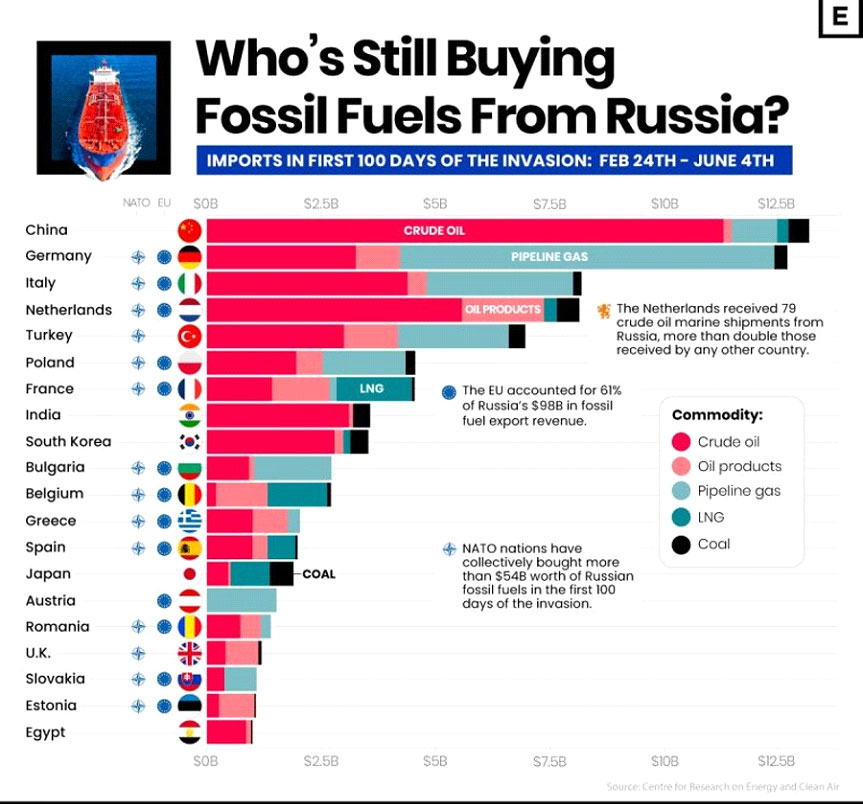

Despite looming sanctions and import bans, #Russia exported $97.7 billion worth of #fossilfuels in the first 100 days since its invasion of Ukraine. So, which fossil fuels are being exported by Russia, and who is importing these fuels?

The #EU bloc accounted for 61% of Russia’s fossil fuel export revenue during the 100-day period !!! Germany, Italy, and the Netherlands—members of both the EU and NATO—were among the largest importers, with only China surpassing them…

Still, it is worth noting that on a global scale, monthly fossil fuel import volumes from Russia were down 15% in May, an indication of the negative political sentiment surrounding the country. Moreover, several EU countries, including some of the largest importers over the 100-day period, have cut back on Russian fossil fuels. Besides the EU’s collective decision to reduce dependence on Russia, some countries have also refused the country’s ruble payment scheme, leading to a drop in imports.

And the import curtailment is likely to continue. The EU recently adopted a sixth sanction package against Russia, placing a complete ban on all Russian seaborne crude oil products. The ban, which covers 90% of the EU’s oil imports from Russia, will likely realize its full impact after a six-to-eight month period that permits the execution of existing contracts.

But someone will have to pay the price (through higher energy costs). , EU businesses and consumers will most likely be the ones…

Source: Visual Capitalist Elements, Mining.com

Defining ‘Destructive Fishing’

Hannah Richardson

Technical Specialist, Destructive Fishing at Fauna and Flora International

Photo Credit: JABRUSON

A scientific review of the term ‘Destructive fishing’ reveals vague and contrasting definitions across academic literature, media articles and policy documents, limiting effectiveness in global policy towards addressing destructive fishing practices, even as use of the term increases.

The term ‘destructive fishing’ appears in multiple international policy instruments intended to improve outcomes for marine biodiversity, coastal communities and sustainable fisheries. However, the meaning of “destructive fishing” is often vague, limiting effectiveness in global policy towards addressing destructive fishing practices.

Global fisheries catch almost 100 million tonnes of fish per year, highlighting a vast industry with huge direct and indirect consequences for people and the environment. Fish provide a vital source of protein to the global population, with particular significance in coastal and island states, and perform a key role in maintaining ocean health.

Sustainable fisheries management for people and the environment is key to ensuring these benefits persist, and is reflected in guidelines, best practice and policy frameworks, such as the United Nations Sustainable Development Goals (SDGs). The UN requires countries to “effectively regulate harvesting, and end overfishing, illegal, unreported and unregulated fishing (IUU) and destructive fishing practices.” While overfishing and IUU have associated indicators under the SDG framework, destructive fishing is not clearly defined and has no specific measurement of progress. Therefore, understanding how destructive fishing is defined is vital to ensure progress towards sustainable fisheries management can be assessed and promoted.

A study published in Fish and Fisheries (https://doi.org/10.1111/faf.12668) and led by a team of scientists and conservationists from Birdlife International, Brunel University, Cambridge University, Fauna and Flora International and the UN Environment Programme World Conservation Monitoring Centre, demonstrated a lack of consensus of what is considered ‘destructive fishing’ and sectoral differences in how the term is used. For example, media articles regularly focused on social impacts, while academic literature frequently reported economic harm and policy documents focused more on environmental impacts, highlighting a lack of consensus on what is included within the term.

The team analysed documents with reference to destructive fishing from a representative sample of academic literature, policy documents and media articles to understand historical use from 1976 to 2020. The term was described in detail in only 15% of documents, with habitat damage, blast and poison fishing the most commonly associated characteristics.

Bottom trawling and other unspecified net-based fishing methods were regularly linked to destructive fishing, relating to the term differently based on whether it was academic literature or a media article. Academic literature tends to specifically highlight the negative impacts, while media articles focus on the types of fishing method associated with destructive practices.

Furthermore, there are regional variations in the use of the term. For example in Oceania 22% of articles refer to purse seine gear while no other continent had more than 4% of articles mentioning this, while in North American Policy documents 38% mentioned set gillnets, which no other region had more than 4% of their policy documents mention this.

The study, therefore provides evidence of variable use of the term ‘destructive fishing’ across sectors and geographical regions. In order for the term to support sustainable fisheries management and have a positive impact for biodiversity, the study recommends addressing and understanding; what destructive fishing means in differing contexts, the impacts caused by specific fishing types across regions, clarifying and separating ‘destructive fishing’ as a term from other fishery-associated terms (e.g. overfishing), and recognising and mitigating persistent differences in opinion around what makes a fishing practice destructive.

Dr David Willer of Cambridge University and lead author of the study, said: “Both industrial and small-scale fishing are continuing to drive environmental damage to our ocean ecosystems and socioeconomic damage to the communities that rely upon them. The lack of a standard definition to quantify what ‘destructive fishing’ actually is, is exacerbating this problem and making it hard to implement effective policy. As a team we hope that by working towards a definition we can start to turn this problem around.”

The study provides an initial understanding of the use of ‘destructive fishing’ and highlights the need for collaborative cross-sector discussions to build consensus around a definition. Such an agreement would enable effective application in key policy frameworks and create the clarity needed for impactful action.

Reference

Willer, D. F., Brian, J. I., Derrick, C. J., Hicks, M., Pacay, A., McCarthy, A. H., Benbow, S., Brooks, H., Hazin, C., Mukherjee, N., McOwen, C. J., Walker, J., & Steadman, D. (2022). ‘Destructive fishing’—A ubiquitously used but vague term? Usage and impacts across academic research, media and policy. Fish and Fisheries, 00, 1– 16.

Funding

This project was funded by a grant from the Cambridge Conservation Initiative Collaborative Fund. D.F.W. was funded by the Department of Zoology, University of Cambridge and a Henslow Fellowship at Murray Edwards College. J.I.B. was supported by a Woolf Fisher Scholarship. D.S., J.W. and S.B. were funded by Arcadia – a charitable fund of Lisbet Rausing and Peter Baldwin

I hope you have enjoyed the read this week, if you would like a confidential chat about your investment journey, please don’t hesitate to contact me.

Regards,

Chris Hagan.

Head, Fixed Interest and Superannuation

JMP Securities

Level 1, Harbourside West, Stanley Esplanade

Port Moresby, Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814