11 July, 2022

Hello and welcome to this week’s JMP Report

The Stocks doing the heavy lifting on the local bourse last week were BSP, KSL, CCP, and CPL. BSP traded 3,510 shares with an increase in the share price of 1 toea to K12.41, KSL had 130,000 shares trading lower by 1 toea to K2.90, CCP traded 10,000 shares and were unchanged at K1.85 per share while CPL traded 2,000 shares closing 15toea higher. Refer to details below.

WEEKLY MARKET REPORT | 4 July, 2022 – 8 July, 2022

| STOCK | QUANTITY | CLOSING PRICE | CHANGE | % CHANGE | 2021 FINAL DIV | 2021 INTERIM | YIELD % | EX-DATE | RECORD DATE | PAYMENT DATE | DRP | MARKET CAP |

| BSP | 3,510 | 12.41 | 0.01 | 0.08 | K1.3400 | – | 11.61 | THU 10 MAR | FRI 11 MAR | FRI 22 APR | NO | 5,270,833,466 |

| KSL | 130,000 | 2.90 | -0.1 | -3.45 | K0.1850 | – | 7.74 | THU 3 MAR | FRI 4 MAR | FRI 8 APR | NO | 67,057,337 |

| STO | 0 | 19.00 | – | – | K0.2993 | – | – | MON 21 FEB | TUE 22 FEB | THU 24 MAR | – | – |

| KAM | 0 | 1.00 | – | – | – | – | 10.00 | – | – | – | YES | 49,891,306 |

| NCM | 0 | 75.00 | – | – | USD$0.075 | – | – | FRI 25 FEB | MON 28 FEB | THU 31 MAR | – | 33,774,150 |

| NGP | 0 | 0.70 | – | – | – | – | – | – | – | – | – | 32,123,490 |

| CCP | 10,000 | 1.85 | – | – | K0.134 | – | 6.19 | THU 16 JUN | FRI 24 JUN | THU 28 JUL | YES | 569,672,964 |

| CPL | 2,000 | 1.10 | 0.15 | 13.64 | – | – |

– | – | – | – | – | 195,964,015 |

Dual listed stocks

BFL – $4.99 +11c

KSL – $0.845 +2c

NCM – $19.76 -51c

STO – $7.06 -15c

Our order book has us nett buyers of BSP, KSL, CCP and STO.

On the interest rate front we saw a very different result from this week’s TBill auction. The 364 results saw the average increase 30bpts to 2.75% and the market undersubscribed by 278million. Lets see what the coming weeks bring.

And for the alternatives;

Gold Standard $US55.94 ( Down $0.02 / 0.03%) $AU81.75 ( Down $0.70 / 0.86%)

Silver Standard $US0.61 ( Up $0.00 / 0.00%) $AU0.89 ( Up $0 / 0.00%)

Bitcoin $US21,592 ( Up $1114 / 5.43%) $AU31,558 ( Up $1382 / 4.57%)

Ethereum $US1228 ( Up $40 / 3.36%) $AU1794 ( Up $44 / 2.51%)

Litecoin $US51.45 ( Up $1.12 / 2.22%) $AU75.19 ( Up $1.03 / 1.38%)

Ripple $US0.34 ( Up $0.01 / 3.03%) $AU0.496 ( Up $0.01 / 2.05%)

Bitcoin Cash $US111 ( Up $5 / 4.71%) $AU162 ( Up $6 / 3.84%)

Theta $US1.27 ( Up $0.05 / 4.09%) $AU1.856 ( Up $0.059 / 3.28%)

Tron $US0.06 ( Up $0 / 0.00%) $AU0.087 ( Down $0.001 / 1.13%)

Cardano $US0.47 ( Up $0.01 / 2.17%) $AU0.686 ( Up $0.009 / 1.32%)

Stellar $US0.11 ( Up $0.01 / 10.00%) $AU0.160 ( Up $0.013 / 8.84%)

Chainlink $US6 ( Up $0 / 0.00%) $AU8 ( Up $0 / 0.00%)

Matic $US0.55 ( Up $0.04 / 7.84%) $AU0.80 ( Up $0.05 / 6.66%)

What we’ve been reading this week

Hydrogen-Powered “High-Speed Vessel of the Future” Will Hit 40 MPH With Zero Emissions

By Otilia Dragan

This isn’t just a symbolic description but the actual name of a major project that’s supported by local authorities in Norway. Several county municipalities are investing in what is supposed to become “the high-speed vessel of the future,” a hydrogen-powered passenger boat.

Norway is one of those countries that seem to always be one step ahead when it comes to clean energy and sustainability. So it’s not surprising that a few Norwegian municipalities (Finnmark, Nordland, Trondelag, and Vestland) want to support the development of next-generation technology for several areas, one of them being maritime transportation.

The consortium that was chosen to bring to life the world’s first high-speed hydrogen vessel is comprised of TECO 2030, Umoe Mandal, plus BLOM Maritime and has received 5 million NOK ($508,700) in funding. TECO 2030, a clean tech startup, will be the one to provide the fuel cell system for the future vessel. Umoe Mandal will bring its expertise in the use of SES (Surface Effect Ship) technology and energy-efficient hull design. According to Umoe Mandal, this would be the first hydrogen-powered version of its vessels.

Regarding the future ship itself, there’s not much information available at this point. The main characteristic of this currently-unnamed vessel will be the ability to hit an impressive speed of 35 knots (40 mph/64.8 kph) while carrying 200 to 300 passengers, powered only by hydrogen. The range is also a huge factor to be considered when it comes to hydrogen-powered vehicles of any kind. The exact range of this future boat wasn’t specified yet, but TECO 2030 mentioned that it will cruise “over long distances.”

Only last month, TECO 2030 announced its involvement in another major project. Together with Shell’s Maritime Division, it plans to launch a retrofitted hydrogen-powered tanker featuring the company’s fuel cell system.

Over the next two years, the consortium will develop the future high-speed vessel, which will be built during the next phase of the project. If things go according to plan, it should become operational by 2025.

What the inclusion of gas and nuclear in the EU taxonomy could mean for investors and asset managers

Author; Jennifer Laidlaw

Theme; ESG Global ESG Reporting Standards The Path to Net Zero

The European Commission’s decision to include natural gas and nuclear power in the taxonomy has ignited a fiery debate over whether they should be described as sustainable

Including the energy sources could lead to “taxonomy-aligned” funds with and without gas or nuclear exposure.

Including gas in the taxonomy may encourage governments to invest more in gas infrastructure.

The EU taxonomy is a key component of the EU’s sustainable finance agenda and has become something of a buzzword in the world of ESG investing as one of the leading attempts to define green investments consistently and comprehensively. The EU aims to mobilize some €1 trillion in public and private investment over 10 years as part of its “Green Deal” to help it achieve its ambitious climate targets. And there are an estimated €3.3 trillion in ESG assets under management in the EU – so changes to the framework could sway investment decisions for large fund managers and their customers.

How could having nuclear power and natural gas in the taxonomy affect asset managers?

In April 2021, the European Commission published the rules establishing which economic activities could be defined as green under the taxonomy, but it delayed deciding whether to include natural gas and nuclear power.

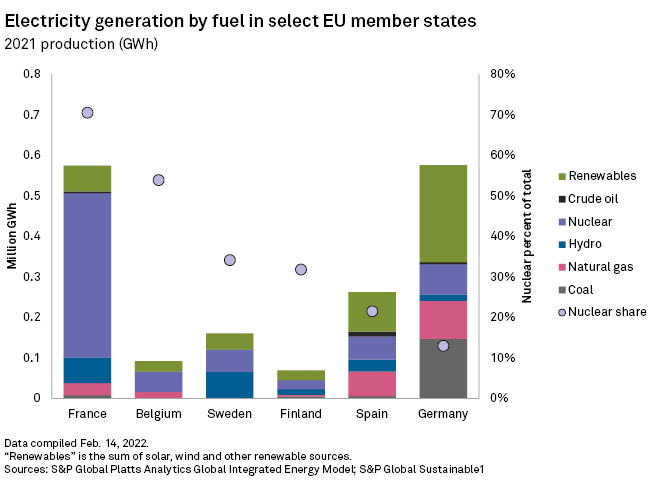

The bloc was under pressure not to make countries dependent on fossil fuels feel they were being left behind in the renewable energy transition. Some EU countries rely heavily on fossil fuels and want to use gas as a bridge fuel. France uses nuclear for most of its electricity needs, while Germany is closing its nuclear power plants. At the same time, sustainable investors, activists and the EU’s own expert advisory group argued the European Commission was drifting too far from a science-based approach to the taxonomy. Critics also feared the EU could tarnish its reputation as a global leader in sustainable finance regulation if it allowed a fossil fuel in the taxonomy. The taxonomy’s finalization is also taking place as Europe struggles with soaring power prices.

The taxonomy debate came to a head in early January after the European Commission began consultations on including natural gas and nuclear power in the taxonomy. Austria and Luxembourg threatened to sue the EU, while the Institutional Investors Group on Climate Change, or IIGCC, which represents investors with more than €50 trillion of assets under management, wrote to EU member states and the European Parliament to call for gas to be excluded from the taxonomy.

“To call gas green under the provisions of the taxonomy would be very misleading,” Rachel Ward, IIGCC’s policy programme director, told S&P Global Sustainable1 in an interview for the ESG Insider podcast. Other countries developing taxonomies may be tempted to include gas, keeping the fossil fuel in national energy plans for longer than is necessary, according to Ward. Under the current proposal, gas will be included in the taxonomy until 2030 and considered sustainable only if it replaces coal generation.

The inclusion of nuclear, meanwhile, complicates one of the key components of the taxonomy regulation. The framework has six environmental objectives, and progress on any objective cannot come at the expense of another. This is known in the taxonomy as the “do no significant harm” principle. So while nuclear can be claimed to be positive for two taxonomy objectives — climate change adaptation and mitigation due to its low greenhouse gas emissions — some argue that the unavoidable creation of nuclear waste hinders the taxonomy objective of pollution prevention. The European Commission has attempted to answer those concerns by only allowing permits for nuclear plants if countries can safely dispose of toxic waste. Despite this, the plan is facing stiff opposition.

“Nuclear waste is an unresolved issue. So for that reason, [for] the remainder of the taxonomy agenda, the classification of economic activities will be more complicated,” Alexander Lehmann, head of the Sustainable World Academy at the Frankfurt School of Finance and Management, told us in a podcast interview.

A simple majority vote in the European Parliament is needed to approve or reject the proposal to include nuclear and gas in the taxonomy. If it passes in the parliament, at least 20 of the 27 EU member states would have to vote against it to veto its adoption.

What triggered the debate over gas and nuclear in the taxonomy?

It all depends how much a particular asset manager, owner or fund manager focuses on ESG. If funds already exclude gas or nuclear, the EU’s decision may be unlikely to sway portfolio managers toward allowing exposure to those industries.

Many investors already exclude fossil fuels, and nuclear has been excluded from many portfolios, especially since the 2011 nuclear disaster in the Japanese city of Fukushima, Matthias Fawer, a senior analyst for ESG and impact assessment at Vontobel Asset Management, told S&P Global Sustainable1 in the podcast.

But the decision could also create “a kind of two-tier taxonomy,” in Fawer’s view. Asset managers can offer clients products that are aligned to the taxonomy and include nuclear and gas, but they could also propose taxonomy-aligned funds that exclude them. That could create confusion for investors, where funds both with and without nuclear and gas exposure are advertised as green or sustainable.

How might the EU’s taxonomy decision impact public funding and capital allocation?

The debate has shined a light on the challenges of managing the energy transition and the role of sustainable finance taxonomies in getting there.

“It opens this debate about the current difficult and delicate transitional period or bridge period … until the renewables can fully take over electricity power production in many countries of the world,” Vontobel’s Fawer said. Gas can act as a bridge fuel and provide storage capacity, especially in times of need, he told us in the podcast. But building new nuclear plants takes many years, meaning nuclear would be less effective as an energy source that helps transition the world to renewables, according to Fawer.

The taxonomy’s stamp of approval might encourage governments to put public funds into gas projects, which could influence where investors direct their capital in the future, IIGCC’s Ward said.

What impact will the decision have on other EU sustainable finance regulations?

Under the EU’s Sustainable Finance Disclosure Regulation, or SFDR, asset managers, pension funds and insurers must disclose how they consider ESG risks in their investment decisions. Investors managing ESG-related funds will have to explain how they use the taxonomy to determine the sustainability of their investments. SFDR disclosures vary depending on the objectives of a particular investment product, and those are defined in the regulation’s numbered articles.

An SFDR Article 9 product has the most demanding disclosure requirements and “has a reduction in carbon emissions as its objective,” according to the SFDR regulation. The product also needs to conform to the Paris Agreement on climate change, which set the goal of limiting global warming to 1.5 degrees Celsius above preindustrial levels. Article 9-conforming investments are often referred to as “dark green.” Lehmann believes the “quite demanding targets” of Article 9 funds would preclude gas and nuclear exposure.

Article 8 funds, referred to as “light green,” promote environmental and social characteristics but do not seek lower emissions as an objective, so gas exposure could be higher. According to a report by auditor and consultancy PwC, 92% of the €3.3 trillion assets under management among EU-domiciled ESG funds were classified as Article 8 as of June 30, 2021, while the remaining 8% were classified as Article 9.

But with the EU taxonomy’s inclusion of gas and nuclear, the kinds of investments that qualify for Article 8 and Article 9 could be subject to change.

In November, Eurosif, a European forum that promotes sustainable investment, warned that putting nuclear and gas in the taxonomy “would require rethinking the SFDR reporting.” Following the EU’s announcement, Eurosif said in February the decision will probably “adversely impact both the credibility and usefulness of the framework for sustainable investors.”

This piece was published by S&P Global Sustainable1 and not by S&P Global Ratings, which is a separately managed division of S&P Global

BILLIONS WORTH OF GOLD FOUND IN SHIPWRECK

Posted | 08/07/2022 Ainslie Bullion

New technology has shown billions of dollars worth of gold perfectly preserved on the floor of the Caribbean Sea. The legendary San Jose galleon shipwreck was first discovered in 2015, more than 300 years since sinking in 1708. Some experts believe there to be at least 200 tonnes of gold, silver and emeralds. The ship was sailing from modern Colombia to Panama with 14 merchant vessels and three Spanish Warships as a chaperone when they encountered a British squadron. Only 11 of the 600-strong crew survived the deadly battle. The ship was one of the jewels of the Spanish Navy, with historians long knowing of the riches held in its hull. The treasure belonged to King Philip V of Spain.

The shipwreck is located almost a kilometre down, and new images and videos taken this month show gold coins and ingots fully intact along with rusted cannons. The Colombian President is seeking to recover some of the valuables to have a “sustainable financing mechanism for future extractions”. In this sense the Colombian government plans to preserve the shipwreck and in that way “protect the treasure, that patrimony of the San Jose galleon”. There is likely to be some controversy about who will have the benefit of recovering the long-lost gold.

One reason why gold is a store of value is that it doesn’t corrode or rust when submerged. The gold in the San Jose galleon could stay there for another millennia and it will still have the same mass and properties that it was originally minted with.

It’s no accident that human civilisations from wildly different eras and geographical locales have independently landed on gold and silver as stores of value. Paper money is only as good as the governments which back them, shells can be easily broken, livestock can reproduce but can fall ill and all other metals are susceptible to extreme elements.

In contrast, the two precious metals have very high melt points, wouldn’t lose any of their mass in a fire and they will be preserved indefinitely when buried in the ground. On every measure of longevity and reliability, Gold absolutely dominates every other element of the periodic table.

Try as people might to destroy gold, whatever has been mined is still up here on the surface of the planet in a house, a vault, around someone’s neck, buried in the ground with an accompanying treasure map or at the bottom of the ocean. That gold has been here for thousands of years, and it will all still be here thousands of years after we mere mortals are gone.

I hope you have enjoyed this weeks report. Please feel free to contact me regarding any information regarding your investment journey.

Regards,

Chris Hagan.

Head, Fixed Interest and Superannuation

JMP Securities

Level 1, Harbourside West, Stanley Esplanade

Port Moresby, Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814