18 July, 2022

Hello and welcome to this week’s JMP Report

Last week we saw BSP, KSL, CPL and STO trading . KSL saw 158,301 shares exchange hands, closing at K3.00. STO traded 236 shares closing at K19.10. BSP traded 1,485 shares closing unchanged at K12.41 while CPL exchanged 20,458 shares closing down 15.79% to K0.95 per share on Friday. Please refer to details below.

WEEKLY MARKET REPORT | 11 July, 2022 – 15 July, 2022

| STOCK | QUANTITY | CLOSING PRICE | CHANGE | % CHANGE | 2021 FINAL DIV | 2021 INTERIM | YIELD % | EX-DATE | RECORD DATE | PAYMENT DATE | DRP |

| BSP | 1,485 | 12.41 | 0.0 | 0.00 | K1.3400 | – | 11.61 | THU 10 MAR | FRI 11 MAR | FRI 22 APR | NO |

| KSL | 158,301 | 3.00 | 0.1 | 3.33 | K0.1850 | – | 7.74 | THU 3 MAR | FRI 4 MAR | FRI 8 APR | NO |

| STO | 236 | 19.10 | 0.1 | 0.52 | K0.2993 | – | – | MON 21 FEB | TUE 22 FEB | THU 24 MAR | – |

| KAM | 0 | 1.00 | – | – | – | – | 10.00 | – | – | – | YES |

| NCM | 0 | 75.00 | – | – | USD$0.075 | – | – | FRI 25 FEB | MON 28 FEB | THU 31 MAR | – |

| NGP | 0 | 0.70 | – | – | – | – | – | – | – | – | – |

| CCP | 0, | 1.85 | – | – | K0.134 | – | 6.19 | THU 16 JUN | FRI 24 JUN | THU 28 JUL | YES |

| CPL | 20,458 | 0.95 | – 0.15 | -15.79 | – | – |

– | – | – | – | – |

Dual listed stock PNGX/ASX

BFL – $4.90 | -1

KSL – $0.86 | +3c

NCM – $18.67 | -55c

STO – $6.99 | –12c

In the TBill market we saw 364 days bill average increase by approximately 70bpts with an average of 3.30% with the market undersubscribed by 71.3million.

In the gentleman’s market, BPNG announced to the market they would be holding a GIS auction this week. The advice is that GIS maturities from 2yr to 10yr with a total of 500mil will be on offer. Not a lot of value along the curve when we look at the nett yield after inflation. You may find value in the 2yr and 4yr stocks.

And something a little different;

|

Gold Standard $US55.02 ( Up $0.00 / 0.01%) $AU80.85 ( Down $0.68 / 0.83%) |

What we’ve been reading this week

Inflation in the 70, baby boomers fantasy or nightmare? Why Central Banks must focus on getting inflation backdown.

Shane Oliver, Head of Investment Strategy & Chief Economist

Key points

- The high inflation of the 1970s was bad for economies and bad for investment returns

- the long-term downtrend in inflation and interest rates is likely over removing a tailwind for investment returns.

- But a return to sustained 1970’s levels of inflation appears unlikely.

Introduction

I grew up in the 1970s and it was fun – Abba, Elvis, Wings, JPY, flares, cool cars, etc. But economically it was a mess. Inflation surged and so did unemployment. And it was bad for investors too. After years of economic pain voters turned to economically rationalist political leaders – like Thatcher, Reagan and Hawke & Keating – to fix it up. Their policies to boost productivity ultimately culminating in independent inflation targeting central banks along with the help of globalisation, more competitive workforces and the IT revolution got inflation under control from the 1980s and 1990s. So much so that there was even talk of “the death of inflation”. The experience of the last year when inflation has surged tells us that unlike the parrot in Monty Python it really wasn’t dead but just resting. Initially its rise was seen as “transitory”. And many are still questioning why central banks need to do much – what will RBA rate hikes do to bring high lettuce prices back down? – and that central bank worries about wages growth picking up causing a wage price spiral are just a baby boomer fantasy. So just sit it out. The 1970s experience suggests otherwise.

So what happened in the 1970s?

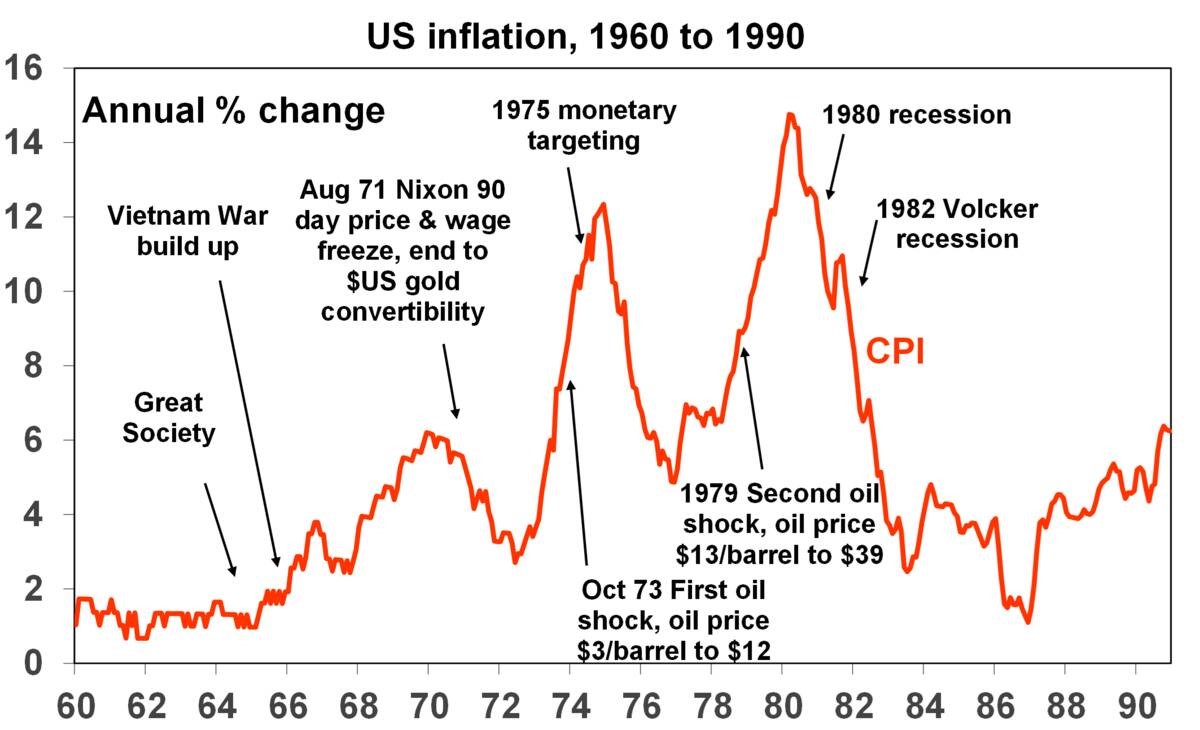

Many associated the inflation of the 1970s with the oil shocks of 1973 and 1979 but it actually got underway before that.

Source: Bloomberg, AMP

From around the mid-1960s inflation started moving up, notably in the US and then later in Australia reflecting a combination of:

- A big expansion in the size of government and welfare.

- Disruption associated with the Vietnam War.

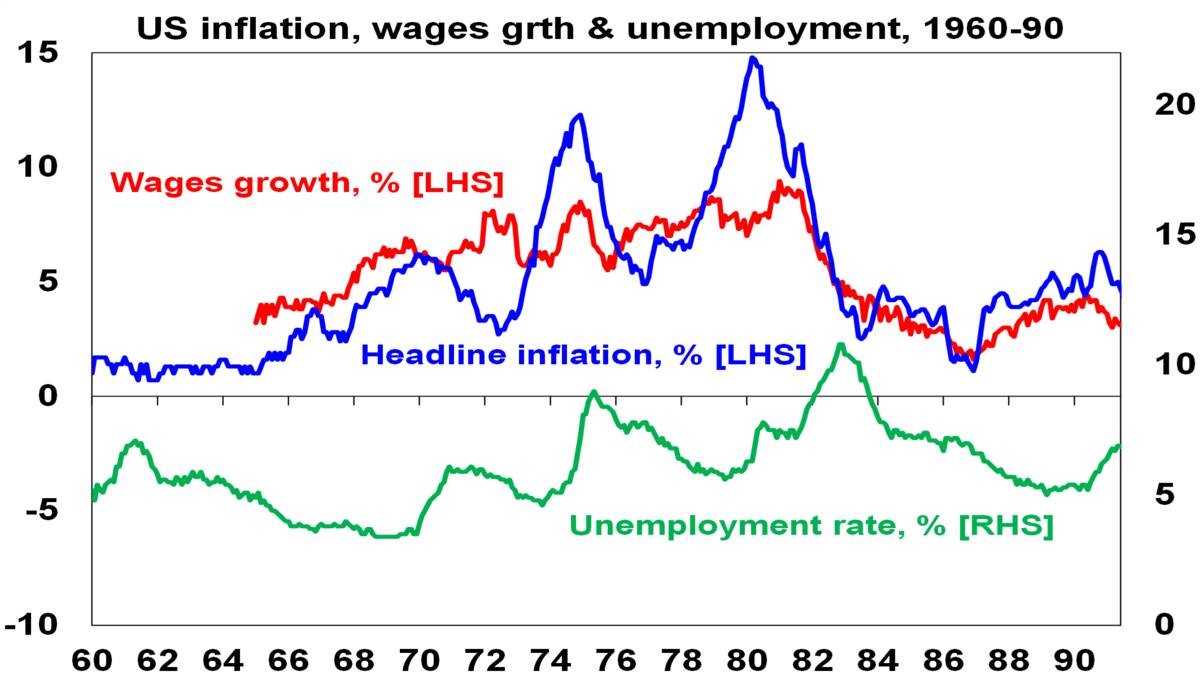

- Tight labour markets (with unemployment falling to 3.4% in 1969 in the US and spending most of the 1960s below 2% in Australia) led to more militant workers and surging wages.

- Easy monetary policies which supported high inflation.

- Social unrest & industry protection also played a role.

From 1965 to 1969 US inflation rose from below 2% to above 6%. US monetary policy was tightened driving a recession in 1969-70 which saw inflation dip. Monetary policy was then eased but before inflation came under control so it bottomed well above 1960’s lows and started up again forcing a return to monetary tightening. In 1973 inflation had already increased to 8% before the OPEC shock. The same whipsaw happened after another recession in 1974-75 which saw inflation bottom out above its previous high only to take off again. The process only ended with the deep recessions of the early 1980s.

Source: ABS, AMP

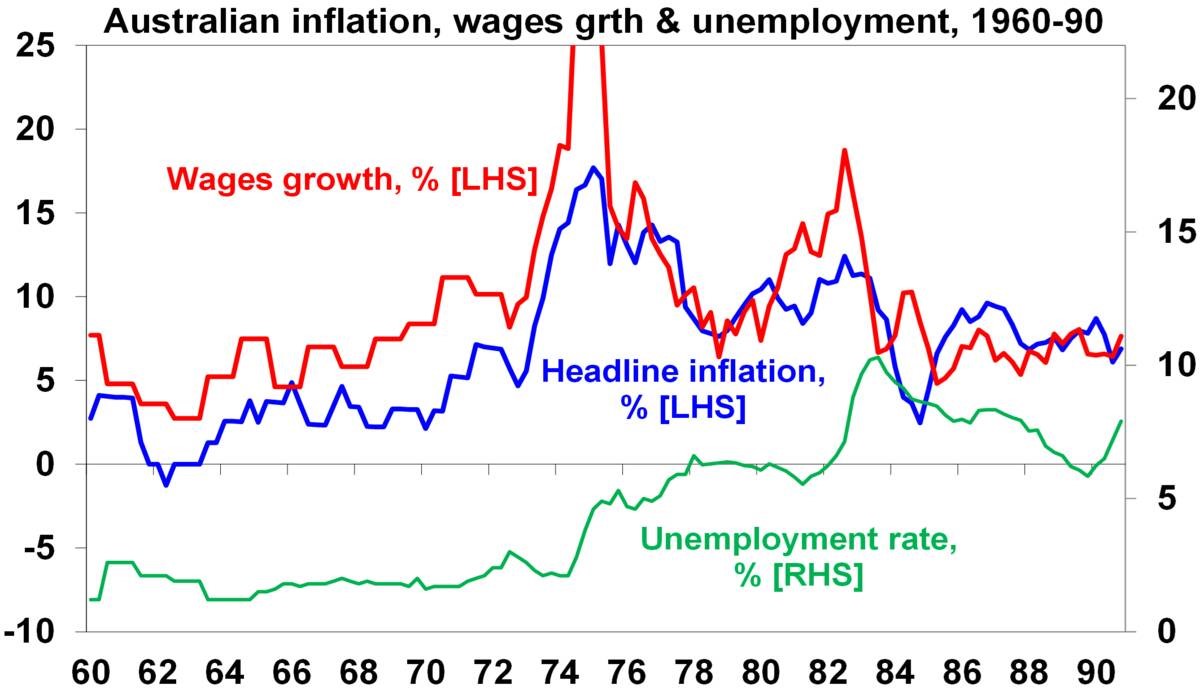

It was pretty much the same story in Australia, although here it started more in the early 1970s and was made worse by 20% plus wages growth and massive fiscal stimulus in 1974.

Source: ABS, AMP

And in Australia, the automatic indexation of wages to inflation from 1975 just helped lock in high inflation (as wages add to costs) with only the 1983 Accord breaking the nexus by trading off wage increases for tax cuts and social benefits.

The end result was a decade of high inflation and high unemployment. The problem was that policy makers were too slow to realise the extent of the inflation problem initially and then were too quick to ease which enabled inflation to quickly pick up again and move higher. The longer inflation persisted the more inflation expectations rose – with wage growth rising – making it harder to get inflation back down.

Why the concern today?

There are several reasons for concern about a return to the sustained high inflation of the 1970s today:

- Labour markets are very tight once again. Wages growth in the US has already increased to around 5%.

- Demand has been strong suggesting that the problem is not just due to supply disruptions.

- We are seeing a run of supply shocks – with notably the war in Ukraine, another energy crisis & repeated floods locally.

- Government policy has swung away from the economic rationalist approaches of the 1980s – with more tolerance for bigger more interventionist government – as median voters have swung back to the left.

- The globalisation that followed the end of the USSR and trade with China is under threat and appears to be reversing, not helped by a desire to onshore supply chains.

- This is being reinforced by geopolitical tensions which are boosting defence spending which adds to metal demand.

- Decarbonisation will boost near term costs & metal demand.

- The ratio of workers to consumers is falling and the entrance of millennials to the workforce replacing retiring baby boomers will depress productivity (just as the boomers did in the 1970s).

- Policy makers were caught focussing on the last war of disinflation coming out of the pandemic just as they were in the 1960s when the big fear was a return to 1930s deflation. This saw massive fiscal stimulus and money supply growth.

- Inflation is now very high at around 9% in the US, Europe and UK and an estimated 6% in Australia and as we saw in the 1970s the longer it remains high the more businesses and workers will expect it to remain high and they will plan accordingly. That is, inflation expectations will move up, which will make it harder to get inflation back down.

So while central banks can’t do much to boost the supply of lettuces and lower petrol prices they are right to have moved to a more aggressive strategy as it will slow demand and by stressing that they are committed to returning inflation to target will help keep inflation expectations down.

Why high inflation is bad news for investors?

The 1970s experience warns it’s in investors long term interest to get inflation under control even if it involves a bit of short-term pain. For investment markets high inflation is bad as it means:

- Higher interest rates – which makes cash more attractive and other assets relatively less attractive.

- Higher economic volatility and uncertainty – the period from 1969 to 1982 saw four recessions in the US and three recessions in Australia. This means that investors will demand a higher risk premium to invest.

- For shares, a reduced quality of earnings as firms tend to understate depreciation when inflation is high.

The first two mean rising bond yields which means capital losses for investors in bonds. This tends to unfold gradually.

All three mean shares tend to trade on lower price to earnings multiples when inflation is high, and real growth assets (like property) generally tend to trade on higher income yields. This was seen in the high inflation 1970s when shares struggled. It means that the boost to earnings (or say rents in the case of property or infrastructure) from inflation tends to be offset by a negative valuation effect as investors demand lower PEs/higher yields. See here for a deeper explanation.

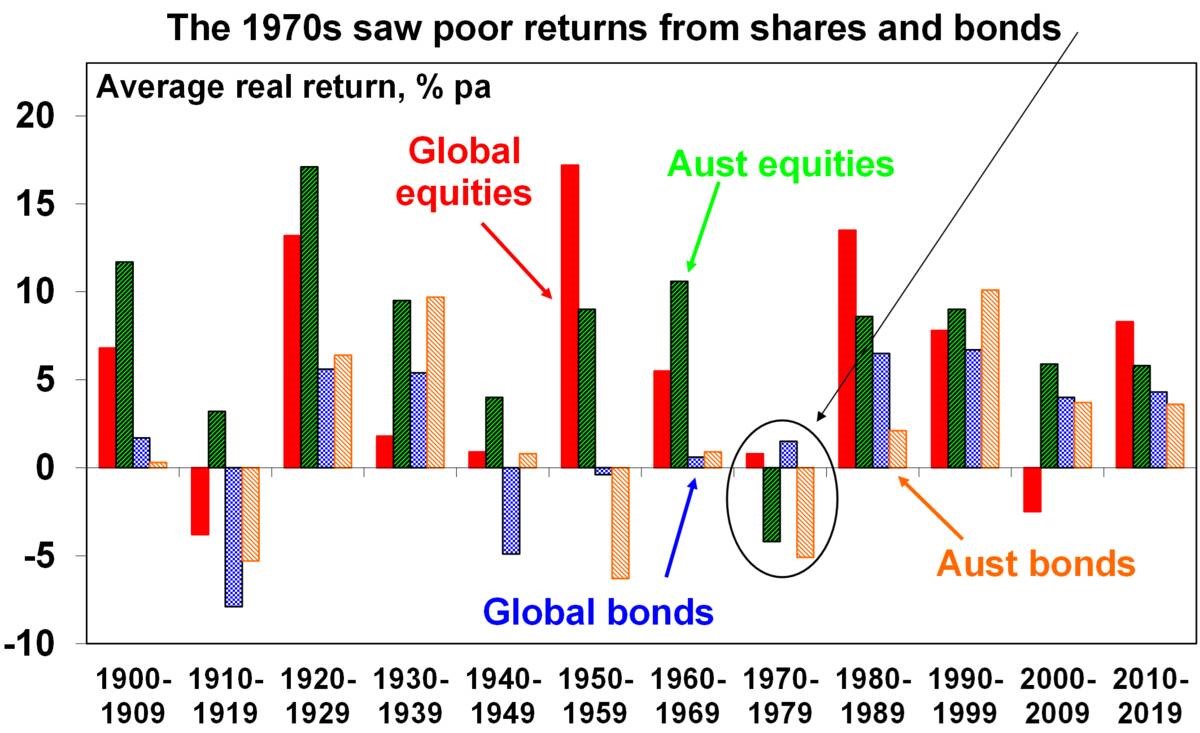

So the bottom line is that a sustained period of high and rising inflation can be a problem for bonds, shares and other growth assets. As can be seen in the next chart, the high inflation 1970s was one of the few decades to see poor real (ie after inflation) returns from bonds and shares.

Source: Global Investment Return Yearbook ABN/AMRO, Bloomberg, AMP

So, it’s in investors’ interest that inflation is kept low and stable.

Reason for optimism a return to the 1970s is unlikely

While many of the structural forces that drove the disinflation of the last few decades are reversing and suggest higher inflation over the decade ahead than seen pre-pandemic, sustained 1970s style high inflation appears unlikely:

- Central banks understand the problem and the need to keep inflation expectations down, and are now committed to bringing inflation back to target with Fed saying the commitment is “unconditional” (even if it means a recession) and the RBA saying it will do “what is necessary”.

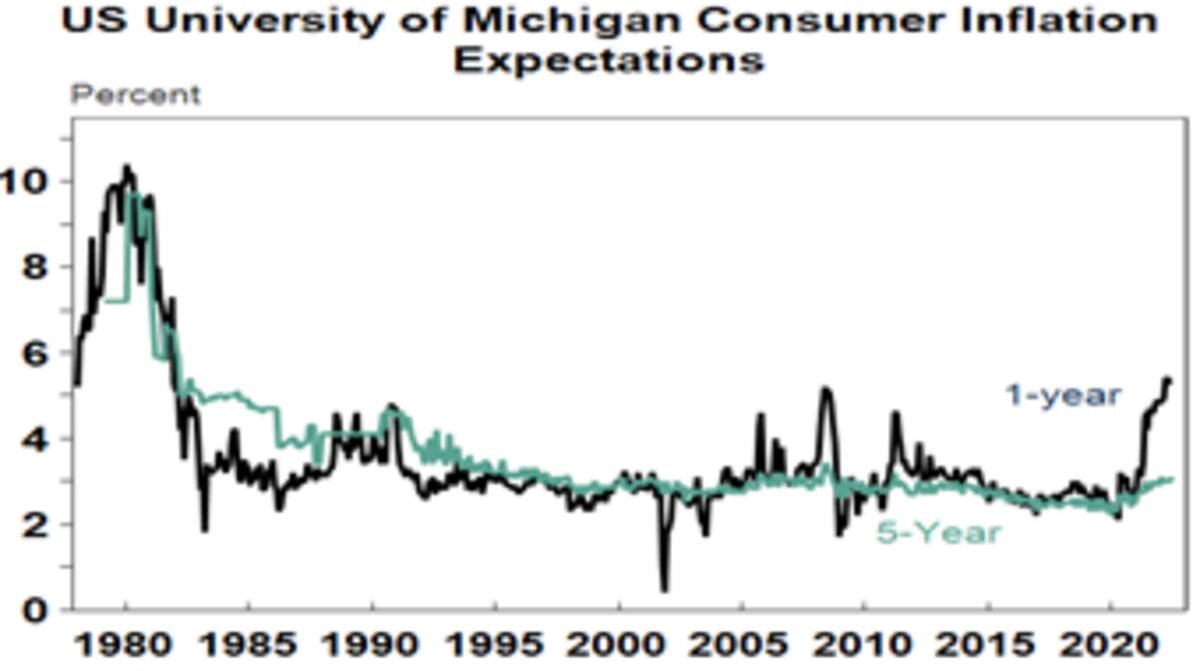

- While inflation is high, longer term inflation expectations remain low (at 3.1% in the US compared to nearly 10% in 1980) and wages growth is still relatively low suggesting it should be easier to bring inflation down than it was in 1980.

Source: Macrobond, AMP

- Related to this labour markets are far more competitive today with much lower levels of unionisation. In Australia, only 14.3% of employees (including me) are in a union whereas in 1976 it was at 51% of employees.

- Finally, as we noted here there are signs of easing cyclical inflation pressure in the US & its leading by about 6 months.

So, while inflation may not go back to pre-pandemic lows and the longer-term tailwind for investment markets from ever lower inflation and interest rates may be behind us, a full on return to the 1970’s malaise looks unlikely.

State Aid: Commission approves up to €5.4 billion of public support by fifteen Member States for an Important Project of Common European Interest in the hydrogen technology value chain

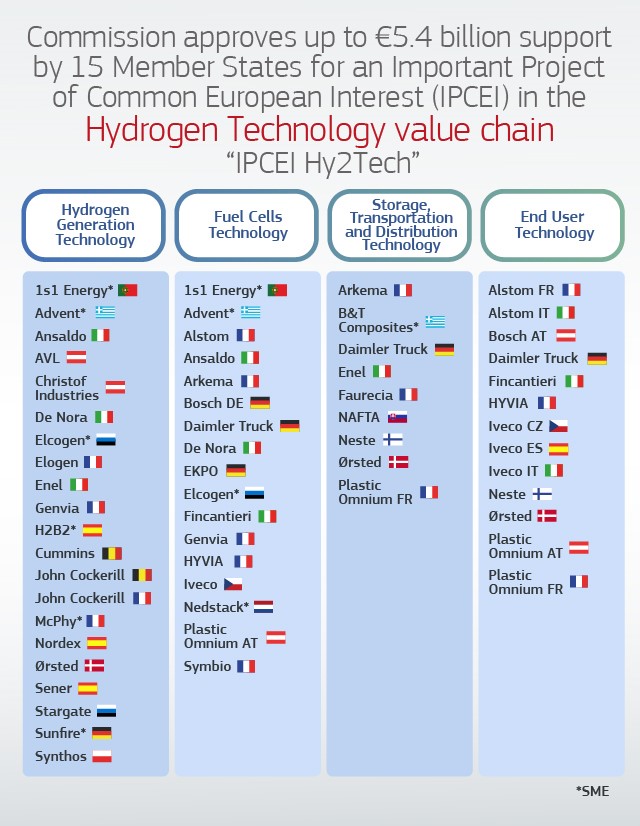

The Commission has approved, under EU State aid rules, an Important Project of Common European Interest (‘IPCEI’) to support research and innovation and first industrial deployment in the hydrogen technology value chain. The project, called “IPCEI Hy2Tech” was jointly prepared and notified by fifteen Member States: Austria, Belgium, Czechia, Denmark, Estonia, Finland, France, Germany, Greece, Italy, Netherlands, Poland, Portugal, Slovakia and Spain.

The Member States will provide up to €5.4 billion in public funding, which is expected to unlock additional €8.8 billion in private investments. As part of this IPCEI, 35 companies with activities in one or more Member States, including small and medium-sized enterprises (‘SMEs’) and start-ups, will participate in 41 projects.

Executive Vice-President Margrethe Vestager, in charge of competition policy, said: “Hydrogen has a huge potential going forward. It is an indispensable component for the diversification of energy sources and the green transition. Investing in such innovative technologies can however be risky for one Member State or one company alone. This is where State aid rules for IPCEI have a role to play. Today’s project is an example of truly ambitious European cooperation for a key common objective. It also shows how competition policy works hand in hand with breakthrough innovation.”

Commissioner for the internal market, Thierry Breton said: “Promoting hydrogen development and deployment will boost jobs and growth throughout Europe while contributing to our green and resilience agenda. It enables the clean transition of energy-intensive industries and increases our independence from fossil fuels. With this IPCEI, we see EU hydrogen production moving “from lab to fab”; and our industry turning technological mastery into commercial leadership. And of course, we are not only supporting hydrogen through funding. We have also made decisive progress on building partnerships through the Clean Hydrogen Alliance and are developing EU-wide rules for enabling the hydrogen market and creating dedicated infrastructure. Because we know what is at stake: Europe’s position as a leading region for the hydrogen industrial transformation.”

The IPCEI will cover a wide part of the hydrogen technology value chain, including (i) the generation of hydrogen, (ii) fuel cells, (iii) storage, transportation and distribution of hydrogen, and (iv) end-users applications, in particular in the mobility sector. It is expected to contribute to the development of important technological breakthroughs, including new highly efficient electrode materials, more performant fuel cells, innovative transport technologies, among which first time roll out hydrogen mobility ones. The IPCEI is expected to create approximately 20.000 direct jobs.

Commission assessment

The Commission assessed the proposed project under EU State aid rules, more specifically its Communication on Important Projects of Common European Interest.

Where private initiatives supporting breakthrough innovation fail to materialise because of the significant risks such projects entail, IPCEI enable Member States to jointly fill the gap to overcome these market failures. At the same time, they ensure that the EU economy at large benefits from the investments and limit potential distortions to competition.

The Commission has found that the IPCEI Hy2Tech fulfils the required conditions set out in its Communication. In particular, the Commission concluded that:

- The project contributes to a common objective by supporting a key strategic value chain for the future of Europe, as well as the objectives of key EU policy initiatives such as the Green Deal, the EU Hydrogen Strategy and REPowerEU.

- All 41 projects part on the IPCEI are highly ambitious, as they aim at developing technologies and processes that go beyond what the market currently offers and will allow major improvements in performance, safety, environmental impact as well as on cost efficiencies.

- The IPCEI also involves significant technological and financial risks, and public support is therefore necessary to provide incentives to companies to carry out the investment.

- Aid to individual companies is limited to what is necessary, proportionate and does not unduly distort competition. In particular, the Commission has verified that the total planned maximum aid amounts are in line with the eligible costs of the projects and their funding gaps. Furthermore, if large projects covered by the IPCEI turn out to be very successful, generating extra net revenues, the companies will return part of the aid received to the respective Member State (claw-back mechanism).

- The results of the project will be widely shared by participating companies benefitting from the public support with the European scientific community and industry beyond the companies and countries that are part of the ICPEI. As a result, positive spill-over effects will be generated throughout Europe.

On this basis, the Commission concluded that the project is in line with EU State aid rules.

Funding, beneficiaries and amounts

The IPCEI will involve 41 projects from 35 companies, including 8 small and medium-sized enterprises (‘SMEs’) and start-ups, with activities in one or more Member States. The direct participants will closely cooperate with each other through numerous planned collaborations, and with over 300 external partners, such as universities, research organisations and SMEs across Europe.

The timelines of this IPCEI vary in function of the individual projects and the companies involved.

The direct participants, the Member States supporting them and the different technology fields are as follows:

More information on the amount of aid to individual participants will be available in the public version of the Commission’s decision once the Commission has agreed with Member States and third parties on any confidential business secrets that need to be removed.

Background

The Commission’s approval of this IPCEI is part of the wider Commission efforts to support the development of an innovative and sustainable European hydrogen industry.

In 2018, the Commission established the Strategic Forum for IPCEI, a joint body of representatives from Member States and industry. In November 2019, the Strategic Forum published its report and identified, among others, Hydrogen Technologies and Systems as one of several key strategic value chains for Europe. In July 2020, the Commission published its EU Hydrogen Strategy, setting ambitious goals for clean hydrogen production and use, and launched the European Clean Hydrogen Alliance, bringing together the European hydrogen community (industry, civil society, public authorities).

Jointly with the policy priorities set out in the European Green Deal, notably in terms of environmental sustainability as well as the green transition of industry and transport sectors to climate neutrality, these initiatives played an important role for the objectives of the IPCEI Hy2Tech and facilitated the creation of industrial partnerships.

Today’s decision is the first IPCEI project approved on the basis of the 2021 State aid IPCEI Communication, setting out criteria under which several Member States can support transnational projects of strategic significance for the EU under Article 107(3)(b) of the Treaty on the Functioning of the European Union. The Communication aims at encouraging Member States to support highly innovative projects that make a clear contribution to economic growth, jobs and competitiveness.

The IPCEI Communication complements other State aid rules such as the Climate, Energy and Environment Aid Guidelines, the General Block Exemption Regulation and the Research, Development and Innovation (R&D&I) Framework, which allow supporting innovative projects whilst ensuring that potential competition distortions are limited.

The IPCEI Communication supports investments for R&D&I and first industrial deployment on condition that the projects receiving this funding are highly innovative and do not cover mass production or commercial activities. They also require extensive dissemination and spillover commitments of new knowledge throughout the EU, as well as a detailed competition assessment to minimise any undue distortions in the internal market.

The non-confidential version of the decision will be made available under the case numbers SA.64625 (Austria), SA.64651 (Greece), SA.64642 (Belgium), SA.64644 (Italy), SA.64640 (Czechia), SA.64649 (Netherlands), SA.64633 (Denmark), SA.64626 (Poland), SA.64646 (Estonia), SA.64753 (Portugal), SA.64632 (Finland), SA.64635 (Slovakia), SA.64671 (France), SA.64624 (Spain) and SA.64647 (Germany) in the State Aid Register on the competition website once any confidentiality issues have been resolved. New publications of state aid decisions on the internet and in the Official Journal are listed in the State Aid Weekly e-News

Creating safer workplaces: An update 13 July 2022

Thank you: Governance Institute of Australia

The role of leaders in creating safer workplaces was one of the issues put under the spotlight at a Respect@Work Council forum held in Sydney last week.

Facilitated by Sex Discrimination Commissioner Kate Jenkins, the Chair of the Council, the forum highlighted the work undertaken by the Respect@Work Council following the review by the Australian Human Rights Commission into Commonwealth parliamentary workplaces that outlined 55 recommendations designed to stamp out workplace sexual harassment.

Opening the forum, Commonwealth Attorney General The Hon Mark Dreyfus QC MP expressed his gratitude “to the individuals – particularly women – who have spoken up about the scourge of sexual harassment in the workplace.”

He announced he would work closely with Minister for Women, Senator Katy Gallagher and Minister for Employment and Workplace Relations, Tony Burke to deliver on the Government’s commitment to implement all the Respect@Work recommendations.

He announced the Sex Discrimination Act will be amended to include a positive duty on employers to prevent sexual harassment in the workplace. The Fair Work Act will also be amended to explicitly prohibit sexual harassment, to enable unions or other organisations to bring sex discrimination legal action on behalf of complainants and to establish costs protections for complainants.

Governance Institute expressed in-principle support for the positive duty in our submission on some of the legislative changes.

Given that approximately 92% of sexual harassment claims are work related, the importance of a well-designed workplace complaints system was discussed in detail at the forum.

When designing a workplace complaints system three things to do are:

- Take it seriously – make sure there is a nominated contact person

- Be transparent – about how the process works and give complainants agency

- Listen to what you hear back from complainants to try and improve your processes for the future.

The importance of it being safe for bystanders to raise issues in workplaces was also highlighted.

The crucial role of leadership in stopping and preventing workplace sexual harassment was also discussed. Steps that leaders can take include:

- Ensuring accountability at all levels of the organisation

- Ensuring transparency at all levels

- Active prevention – moving from a risk mitigation/ cost benefit approach to active prevention.

We also heard an update on the support services available to those who have experienced workplace sexual harassment as well as the importance of a trauma informed approach in these situations. There were also updates on guidance such as that developed by Safe Work Australia including guidance for small business, and the Fair Work Commission Sexual harassment benchbook.

How Governance Institute is taking action:

The landmark Respect@Work final report recommended that Governance Institute develop education and training for boards and company officers on good governance practice in relation to gender equality and sexual harassment.

In response we re-launched our Workplace Health and Safety Due Diligence short course to ensure directors, company secretaries and senior managers are up-to-speed their increased responsibilities, the management of psychological risks as well as physical, the impact of breaching WHS laws, and the steps organisations must take to be compliant.

And building on the success of our inaugural women-exclusive Effective Director Course, we are pleased to be continuing this course in 2022 with our next session commencing later this month.

Thank you to Ashurst for the attached newsletter, Ainslie Bullion, AMP and the Governance Institute of Australia for their articles.

Download | Low Carbon Pulse - Edition 42

I hope you have enjoyer our report and our shared articles. If you would like to discuss your investment journey, please feel free to reach out.

Regards,

Chris Hagan.

Head, Fixed Interest and Superannuation

JMP Securities

Level 1, Harbourside West, Stanley Esplanade

Port Moresby, Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814