8 August, 2022

Welcome to this week’s JMP Report

On the equity front, we had a very quiet week which had two stocks trade on our local bourse. BSP saw 1,701,314 shares exchange hands closing lower by 0.01 toea to K12.41 while CCP traded 1,314 shares unchanged at K1.85 per share. Refer details below.

WEEKLY MARKET REPORT | 01 August, 2022 – 05 August, 2022

| STOCK | QUANTITY | CLOSING PRICE | CHANGE | % CHANGE | 2021 FINAL DIV | 2021 INTERIM | YIELD % | EX-DATE | RECORD DATE | PAYMENT DATE | DRP | MARKET CAP |

| BSP | 1,701,314 | 12.41 | – 0.01 | – 0.08 | K1.3400 | – | 11.61 | THU 10 MAR | FRI 11 MAR | FRI 22 APR | NO | 5,270,833,466 |

| KSL | 0 | 2.90 | – | – | K0.1850 | – | 7.74 | THU 3 MAR | FRI 4 MAR | FRI 8 APR | NO | 67,052,337 |

| STO | 0 | 19.10 | – | – | K0.2993 | – | – | MON 21 FEB | TUE 22 FEB | THU 24 MAR | – | – |

| KAM | 0 | 1.00 | – | – | – | – | 10.00 | – | – | – | YES | 49,891,306 |

| NCM | 0 | 75.00 | – | – | USD$0.075 | – | – | FRI 25 FEB | MON 28 FEB | THU 31 MAR | – | 33,774,150 |

| NGP | 0 | 0.70 | – | – | – | – | – | – | – | – | – | 32,123,490 |

| CCP | 1,314 | 1.85 | – | – | K0.134 | – | 6.19 | THU 16 JUN | FRI 24 JUN | THU 28 JUL | YES | 569,672,964 |

| CPL | 0 | 0.95 | – | – | – | – |

– | – | – | – | – | 195,964,015 |

Dual listed stock – ASX/PNGX

BFL – $4.90 -25c

KSL – $0.865 -2.5c

TO – $6.95 -43c

NCM – $19.15 -12c

The order book has me a nett buyer of CCP, BSP and KSL

In the interest rate market, we saw the 364 TBill auction remain steady at 4.40% with the market oversubscribed by 367mill (52%) .

The finance company money is reflecting very little need for cash with Fincorp 365day rates at 2.50%

In the long end, the TBill auction rates we are seeing today are a good reflection as to the poor returns from the last two GIS auctions.

And something a little different;

|

Gold Standard $US57.58 ( Up $0.87 / 1.53%) $AU82.68 ( Up $1.06 / 1.29%) Silver Standard $US0.65 ( Up $0.01 / 1.56%) $AU0.93 ( Up $0.01 / 1.08%) Bitcoin $US22,669 ( Down $288 / 1.25%) $AU32,551 ( Down $490 / 1.48%) Ethereum $US1599 ( Down $22 / 1.35%) $AU2296 ( Down $37 / 1.58%)

|

What we’ve been reading this week

SIGNS OF FISCAL RECOVERY IN PAPUA NEW GUINEA?

PNG Business News -August 01, 2022

by Kingtau Mambon and Stephen Howes

Papua New Guinea has been facing fiscal problems since the end of its economic boom almost a decade ago, with large deficits, increasing debt, falling revenue, and a rapidly growing salary bill. The COVID-19 pandemic has made things worse by depressing revenue. But the recently released 2021 Final Budget Outcome contains some promising signs.

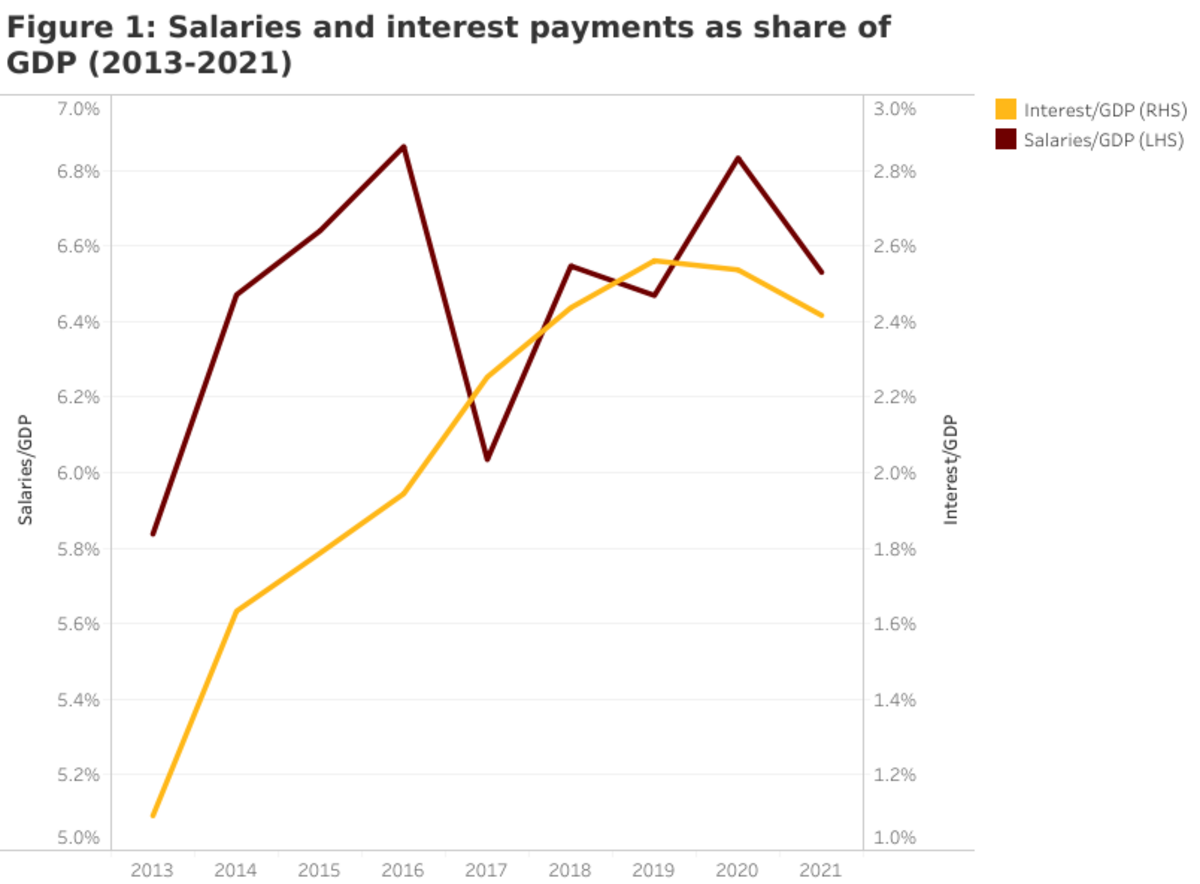

First, interest payments and the salary bill, both of which have increased rapidly since the boom ended in 2013, have been brought under control, at least for now. As the graph below shows, they have both started to fall relative to GDP.

Second, after two years of negative growth, revenue grew strongly, by 9.7% after inflation, or from 14.2% of GDP in 2020 to 14.9% in 2021. This is more than the target in the government’s ambitious plan to achieve a balanced budget in 2027, which requires 7% annual revenue growth.

The revenue increase in 2021 was largely driven by mining and petroleum taxes, reflecting higher commodity prices. Grants (foreign aid) also increased by 47%, indicating strong support from foreign governments and multilaterals during COVID-19, including the first budget support grant after two decades from Australia.

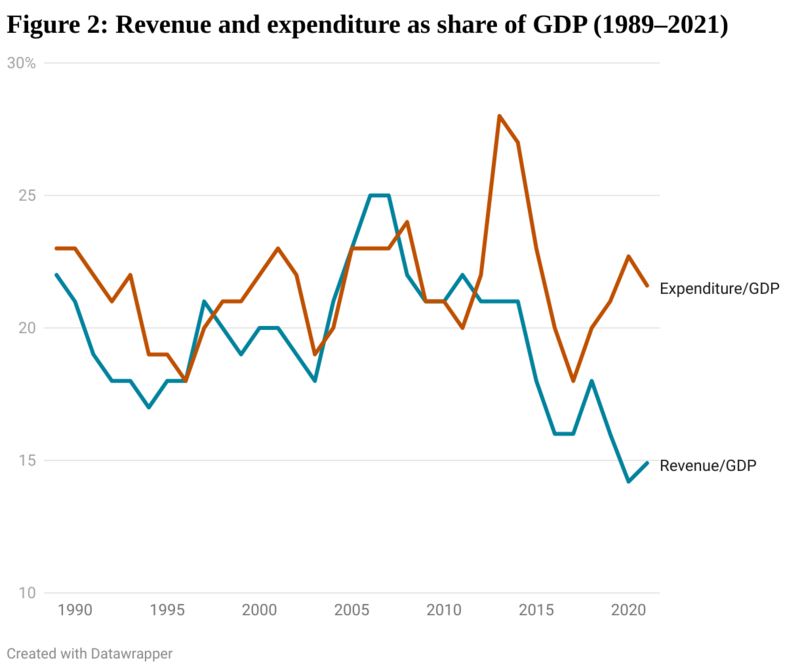

Third, the fiscal deficit fell from 8.6% of GDP in 2020 to 6.7% in 2021. This reflects the revenue growth noted above, as well as expenditure restraint. Expenditure grew in 2021 by slightly less than the rate of inflation. As a share of GDP, expenditure fell from 22.7% in 2020 to 21.6% in 2021.

However, despite these promising indications, PNG is far from achieving a fiscal recovery. The basic budget problem that PNG faces is a structural gap between expenditure and revenue. As the next graph shows, expenditure now hovers above 20% of GDP, and revenue around 15% of GDP.

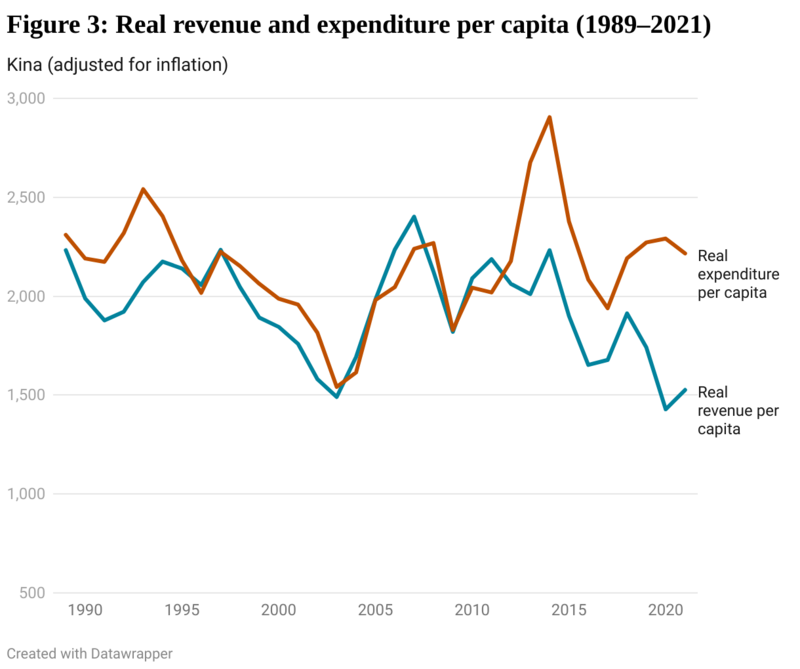

This is not only an issue for debt sustainability, but also for service delivery. PNG has a rapidly growing population. It is useful to divide revenue and expenditure by the population, as the next graph does. Adjusting for inflation, expenditure per capita in 2021 was around its long-term average of K2,200 (in 2021 prices). But revenue per capita was about K1,500, around its lowest level for three decades. With falling revenue per capita, it will not be possible to support expanded education, health and roads spending.

A lot more work needs to be done. Revenue is still below its pre-COVID level. Adjusting for inflation, revenue in 2019 was K14.9 billion (in 2021 prices); in 2021, it was only K13.9 billion.

While recovery from the COVID-19 downturn will take time, reforms are also needed. The worst revenue performer is dividends from state-owned enterprises (SOEs). Outside of mining and petroleum, the SOEs paid no dividends at all for the 2021 fiscal year. This is not a new issue. The 2019 and 2020 fiscal years also saw zero dividends coming from SOEs.

With their poor performance and estimated consolidated debt of 5.1 billion kina, it is perhaps unrealistic to expect much more from the non-resource SOEs. But Ok Tedi Mining Limited (OTML) only contributed K81 million to the budget, down from K370 million the previous year. A note in the budget indicates that most of OTML dividends went to Kumul Minerals Limited rather than the budget, another case of questionable diversion of funds.

The National Fishery Authority also paid nothing to the budget against a target of K146 million, despite being flush with funds from the auctioning of fishing licences.

On the expenditure side, while, as mentioned earlier, the salary bill was under control relative to earlier years, expenditure on salaries still went over budget by K180 million. The salary bill for MPs’ salaries increased by K8 million from K71 million to K79 million. There was a spike in the unclassified or ‘other’ portion of the salary bill, which increased from K16 million in 2020 to K73 million in 2021, raising questions of transparency and accountability.

In conclusion, the final budget outcome for the 2021 fiscal year shows strong growth performance in revenue collection and constraint over spending with lower deficits compared to 2020 outcomes. Despite these promising signs, it’s too early to say PNG has turned the fiscal corner. The large structural gap between revenue and expenditure existed before COVID-19, and closing it will not be easy.

The PNG Budget Database has been updated to reflect the 2021 Final Budget Outcome figures. (see devpolicy.org for hyperlinks to these).

Disclosure: This research was undertaken with the support of the ANU-UPNG Partnership, an initiative of the PNG-Australia Partnership, funded by the Department of Foreign Affairs and Trade. The views are those of the authors only. This article appeared first on Devpolicy Blog (devpolicy.org), from the Development Policy Centre at The Australian National University. Kingtau Mambon is an economics tutor at the University of Papua New Guinea School of Business and Public Policy (SBPP). Stephen Howes is the Director of the Development Policy Centre and a Professor of Economics at the Crawford School.

It’s Time to Invest in Climate Adaptation

Ravi Chidambaram & Parag Khanna

Art by Daniel Liévano

Summary

Currently, climate adaptation initiatives — that is, those that help people, animals, and plants to survive despite rising climate volatility rather than trying to reverse it — receive only 7% of climate-related investment. They deserve far greater business investment. Solutions that are low cost, proven to be effective, and have immediate impact include early warning systems for extreme weather events, coastal barriers, water desalination and wastewater treatment, vertical farming and hydroponic agriculture, improved cooling and insulation systems, 3D printed and modular housing, and many other measures.

Companies around the world are increasingly committing to climate change mitigation, pledging to reduce carbon emissions and water consumption across their operations and supply chains in an effort to slow the pace of global warming and better protect environmental ecosystems. However, while essential, these efforts merely prevent a worse future rather than addressing the inevitable consequences of the damage already baked in. Carbon offsets, for example, have yet to demonstrate meaningful impact on the atmosphere, and, at present, worldwide carbon sequestration efforts reportedly only remove 1% of annual global emissions.

We therefore believe that climate adaptation — helping people, animals, and plants to survive despite rising climate volatility — should be an equally urgent priority. According to a 2021 report from the Climate Policy Initiative, these types of initiatives receive only 7% of climate-related investment, allocated across a vast spectrum of needs such as flood and wildfire prevention, resilient agriculture, clean water supply, infrastructure modification, and population resettlement. They deserve far greater business investment, especially because they represent near-term opportunities at lower capital expenditures that offer faster paybacks. Indeed, according to this Bloomberg report, Bank of America analysts estimate that the climate adaptation market could be worth $2 trillion a year within the next five years.

Fundamentally, climate adaptation is about evolving organizational and institutional practices and infrastructures and technologies in places that most need them — which is everywhere that faces risks such as floods and rising sea levels, droughts, and heat waves. We advocate for solutions that are low cost, proven to be effective, and have immediate impact, such as early warning systems for extreme weather events, coastal barriers, water desalination and wastewater treatment, vertical farming and hydroponic agriculture, improved cooling and insulation systems, 3D printed and modular housing, and many other measures.

The insurance conglomerate SwissRe warns that a global temperature rise of 3.2°C by 2050 would wipe 18% from global GDP. But, as a pair of OECD studies point out, widespread climate adaptation measures can have a positive impact on growth, especially in G-20 economies.

When governments, capital market investors, commercial lenders, and businesses from multinational corporations to small enterprises work together toward climate resilience, as well as mitigation, the result will be a stronger world economy. Some are already stepping up to do so. For example, the Coalition for Climate Resilient Investment (CCRI), an umbrella organization of more than 120 companies and other stakeholders representing more than $20 trillion in assets, have launched pilot projects focused on reinforcing infrastructure to withstand anticipated climate effects. We see notable positive developments in other areas as well. Here, we’ll explore projects in water and agriculture and in construction and real estate.

Water and Agriculture

Water scarcity is already a short-term crisis and an even greater long-term challenge that even the most robust mitigation initiatives cannot immediately address. Water is the biggest and most important input for human life and global agriculture and is thus essential for our health, sustenance, and productivity, and yet many heavily populated geographies are already stricken by shortages.

Some of the most affordable water-related adaptation interventions involve rainwater harvesting and more efficient irrigation techniques. As countries invest in cloud seeding to spur rainfall, plant drought-resistant seeds, and deploy atmospheric water capture systems, conserving water for agriculture is an obvious complementary effort. London-based engineering consultancy Arup (which reports nearly $2 billion in annual revenue) has been ahead of the curve in carrying out flood control projects that increase natural water retention in Poland and flood alleviation schemes in England. Rainwater harvesting projects now represent a 5% and growing share of the portfolio of Kingspan, a leading Irish construction company whose low-energy insulation systems are featured in Bloomberg’s London headquarters and Singapore’s Changi airport. The city of Sydney, which has suffered consistent droughts with dams falling to record low capacity, has commissioned Kingspan to audit all 48 of the city’s rainwater management systems.

There are also signs of progress in developing countries. Israeli firm Netafim (a $1 billion revenue company) has installed irrigation systems across more than 100 villages in India, using soil and plant data to direct measured doses of water to optimize yield while bringing down water consumption and fertilizer usage by 40%. Olam, one of the world’s largest agri-business producers of rice, cotton, cocoa beans, and coffee that operates in 60 countries, is committing to reduce wastewater in the 30% of its upstream farms and plantations that are in water-stressed regions.

The economic benefits of water conservation include saving money on water purchases, storage, and maintenance, all of which accrue to corporations and villagers alike. Particularly in regions such as India, where only 10% of potential water-saving measures have been implemented, these kind of adaptation efforts deserve significantly greater investment and scaling.

Clean water generation is another essential and growing business opportunity. Existing desalination systems are often oil- or gas-powered and use a lot of energy. By contrast, Elemental Watermakers’ solar-powered reverse osmosis system uses the natural force of gravity to receive and clean pressurized seawater and is compact and mobile enough to be deployed in industrial sites and residential communities. One of its customers in Aruba has reduced water costs by 67% and carbon emissions by 180 tons per year. Another company, Terraformation, meanwhile operates what might be the largest full-scale, purely solar-powered water desalination plant on a 45-acre reforestation project site in Hawaii. However, similar ventures remain woefully underfunded despite their regenerative potential for ecosystems and local economies. Perhaps the most high-potential innovation would be nuclear-powered desalination, which would have enormous applications worldwide.

A steady and efficiently managed water supply would also support more environmentally friendly agriculture such as hydro- and aquaponic food production. China’s Sananbio, for example, operates large indoor farms in Beijing that can produce about six tons of leafy greens daily using only 5,000 square meters of space. Its plants absorb 60% of the water used, while the remaining 40% is recycled. Small and strategically vulnerable countries such as Israel, the United Arab Emirates, and Singapore have become leaders in this kind of food production, and it could greatly benefit many other water-stressed geographies.

Construction and Real Estate

Our built environment is a major driver of climate change and must also be a key front in adaptation. Because of their fixed location, real estate assets — valued at $200 trillion worldwide — are uniquely vulnerable to natural disasters and resource shortages. And many opportunities lie at the intersection of geography and technology. For example, from the Netherlands to Denmark and the Maldives to Singapore, developers and localities are planning or building floating cities that can rise with the tides and desalinate and recycle water for hydroponic agriculture.

Astro Teller, director of the Google X Lab, suggests that we might also one day need “movable cities” to cope with climate effects. As a first step, companies like ICON are creating 3D-printed houses. Its Vulcan construction system can deliver homes and structures up to 3,000 square ft that meet the requirements of the International Building Code (IBC) and are expected to last as long or longer than standard Concrete Masonry Unit (CMU), making them more resilient to extreme weather. They’re the first of their kind to be sold in the United States and the firm, currently valued at around $2 billion, is working with leading U.S. home-builder Lennar to construct a community of entirely 3D-printed homes in Austin. In both Mexico and the United States, ICON is also building entire communities of 3D-printed homes, barracks for those who serve, and a simulated Martian habitat for NASA.

Similarly, Boklok produces flat-pack homes designed and built by Skanska and sold at Ikea. The houses are primarily made of wood sustainably sourced from Scandinavia because of its relatively lower climate impact, and about 14,000 of them have been erected across Sweden, Finland, Norway, and the United Kingdom, generating $250 million in revenue for the adaptation-focused manufacturer.

According to UN Habitat, at least three billion people will require better housing by the end of this decade, which means that 96,000 new homes need to be built each day between now and then. Eventually, rather than building these habitats where people are, we will need to start moving certain populations to geographies less damaged by climate change, at lower risk of future effects, and with better resources and technology. Rising fire and flood insurance premiums, as well as chronic droughts and heatwaves, make this all but inevitable.

Our own Climate Alpha research suggests that investing early in climate-resilient geographies will generate more than 70% higher returns on real estate portfolios by 2030 alone. Property developers, asset managers, and insurers should take heed, accelerating the acquisition of land, construction of affordable housing, and adjustment of premiums to anticipate, encourage, and profit from climate-induced migrations. New technologies should help us to do this with speed. Consider the U.S.-based company Alquist, which can now print a three-bedroom home in just over 24 hours versus the typical four weeks that the volunteer-powered non-profit Habitat for Humanity takes to construct one.

Addressing climate change requires both mitigation and adaptation, and we believe the latter represents an even better business opportunity. As we learned from Charles Darwin, those who adapt are the most likely to survive and thrive. Small investments result in significant preparation for an unpredictable future.

Energy Studies and Models Show Advanced Nuclear as the Backbone of Our Carbon-Free Future

Thank you Nuclear Energy Institute (NEI)

Nuclear energy is poised to be the backbone of our affordable, reliable, clean energy system, and Nuclear Energy Institute (NEI) member utilities see a role for more than 90 gigawatts of nuclear power in support of their decarbonization goals, according to a recent NEI poll. That translates to about 300 new small modular reactors (SMRs), around 731.3 TWh of power, with the bulk coming online by 2050.

Just how much power are we talking?

Carbon-free nuclear power is essential to reaching our climate goals in time to protect our planet from the worst effects of global warming—proven by the fact that this level of planned nuclear energy output would avoid 471 million metric tons of carbon dioxide emissions, over 280,000 tons of sulfur dioxide, and over 235,000 tons of nitrogen dioxide each year.

The carbon emissions avoided by the power output of 300 new small modular reactors is equivalent to:

Taking 100 million cars off the road, which is 97% of all passenger vehicles on the road each year in the U.S.; and

Planting over 110 million trees each year.

The 731.3 TWh of electricity generated by these SMRs is equivalent to:

- Powering 68 million homes, or about half of the homes in the U.S.;

- Powering over 176 million electric vehicles each year, with a total of over 2 trillion vehicle miles traveled (VMT); and

- Powering over 367 billion smartphones for a year, which is 1,200 times the number of smartphones in the U.S. and the equivalent to 47 phones for every person in the world.

The utilities surveyed are prepared to invest in nuclear energy because it is a climate solution, and new small modular reactors are simpler and more versatile. Many utilities are evaluating siting new reactors at the site of retiring coal plants, which would provide the jobs and local economic stimulation needed to revitalize communities. This advanced technology will build on the strong foundation of nuclear energy today to help the U.S.—and the world—build a clean energy system of the future.

The electricity generated by these SMRs is more than the total 2020 generation in any one country except for China, U.S, India, Russia, and Japan. This is more power than Saudi Arabia and Mexico’s electricity generation combined.

Nuclear generates more electricity with less land than other renewable energy sources. To generate the same amount of carbon-free power as 300 SMRs, wind would require over 13 million acres, and solar would require over 2.3 million acres.

This type of production would double U.S. nuclear energy output today, but it is still a conservative estimate. The survey only includes utilities that already have nuclear as a part of their energy generation mix, and utilities with only non-nuclear generation such as Utah Associated Municipal Power Systems (UAMPS) and PacifiCorp have already announced plans to build new nuclear.

An INL analysis utilizing a Global Change Analysis Model predicted an even higher increase of nuclear generating capacity—more than 150%—in order to achieve economy-wide net-zero emissions by mid-century.

And this is only in the United States. Recent IPCC reports project that global nuclear energy capacity will need to double by 2050 to keep the climate temperature rise to 1.5 degrees Celsius.

And how much will a system like this cost?

Modeling by climate experts consistently demonstrates that the most reliable, affordable low-carbon energy system requires an increase in nuclear generation globally alongside increases in wind, solar and battery storage.

Vibrant Clean Energy (VCE) utilizes one of the most detailed models available to assure that low-carbon solutions align with the reliability that the electricity grid of the future will demand.

In a recent study, VCE found that pairing nuclear with wind and solar is the most cost-effective means to decarbonize electricity generation. This lowest cost scenario projects nuclear energy could provide nearly 43% of all generation in 2050 with wind and solar producing almost 50%. A significant portion of this 300 GW of advanced nuclear capacity that is needed could repurpose hundreds of fossil generation sites. A second scenario where solar and wind generate 77% of all generation in 2050 and the use of nuclear energy declines would result in over $400 billion in higher costs to consumers.

“It’s very, very clear when you add nuclear to the mix, the overall system cost is reduced,” said NEI President and CEO Maria Korsnick on the Grid Talk podcast.

So, what about widespread decarbonization?

IPCC reports clearly state that the world must decarbonize beyond the electricity sector. The transportation and manufacturing sectors alone make up 45% of our greenhouse gas emissions, and advanced reactors can provide the high-temperature heat and carbon-free hydrogen production needed to decarbonize these heavy industrial processes.

A recent study performed by engineering firm Sargent & Lundy found that opportunities for nuclear beyond the grid could dwarf the demand for grid generation with literally thousands of potential applications.

It is undeniable that we need to decarbonize, and nuclear energy is a clear investment in a future free of emissions and pollutants. Not only is it essential to reaching our climate goals, but it is also a part of every affordable clean energy solution—which is why utilities are interested in building more reliable, carbon-free nuclear energy.

I hope you have enjoyed this weeks report, have a great week and stay safe.

Regards,

Chris Hagan.

Head, Fixed Interest and Superannuation

JMP Securities

Level 1, Harbourside West, Stanley Esplanade

Port Moresby, Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814