April 06, 2021

Welcome to this week’s JMP Report.

Thank you for the great feedback we have been receiving on our Report. You can find us on www.jmpmarkets.com, LinkedIn or FB which will give you access to earlier editions of the Weekly Report, copies of our own Knowledge Lab and the latest news.

Last week was a short week on the POMX with the Easter Public Holiday. The few stocks that had trading activities were BSP, KAM, CPL and OSH. BSP saw 5,997 shares change hands at K12.00, KAM traded after quite some time with 101,585 shares trading unchanged at K0.90, CPL saw 4,000 shares trade also unchanged at K0.50 and OSH had a total of 1,816 shares traded unchanged at K10.02. Refer to details below.

.

|

WEEKLY MARKET REPORT 29.03.21 – 01.04.21 |

||||

|

STOCK |

QUANTITY |

CLOSING |

CHANGE |

% CHANGE |

|

BSP |

5,997 |

12.00 |

– |

|

|

KSL |

– |

3.20 |

– |

0.00% |

|

OSH |

1,317 |

10.02 |

– |

– |

|

KAM |

101,585 |

0.90 |

– |

|

|

NCM |

– |

81.50 |

– |

|

|

CCP |

– |

1.70 |

– |

|

|

CPL |

4,000 |

0.50 |

– |

|

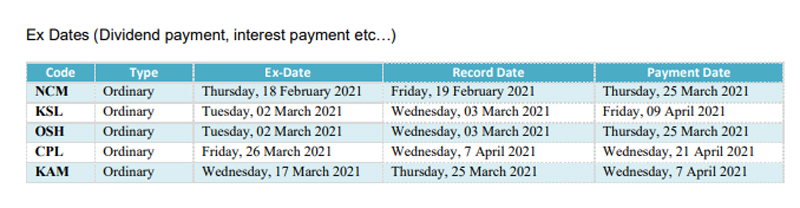

Please keep in the following table in your diary for easy reference.

In the interest rate market we saw the TBill auction unchanged with approx. K200mill 364 day bills issued by BPNG averaging 7.20%. On the Bonds, we are yet to see written confirmation on the 2021 GIS issuance program. We do understand the timing on the first tranche will be in the later part of April. Information is scant but confirmation will be sent through when at hand.

The interest rate yield curve in PNG is what we call a positive yield curve. If you have held Tap Bonds for over 12 months, please contact me for a market valuation and strategy on increasing your profitability on your bonds.

What we have been reading this week

The benefits of a carbon tax

Pricing the carbon content of domestic production and imports will help cut effluents

With China, the largest carbon dioxide emitter, announcing that it would balance out its carbon emissions with measures to offset them before 2060, the spotlight is now on the U.S. and India, countries that rank second and third in emissions. One way to cut effluents while earning revenues is to price the carbon content of domestic production and imports, be it energy or transport. With the International Monetary Fund endorsing the European Union’s plan to impose carbon levies on imports, India can be among the first movers in the developing world in taxing and switching from carbon-intensive fuels (like coal), the main sources of climate change.

Record heat waves in Delhi, floods in southwest China, and catastrophic forest fires in California this year are indicative of the existential danger from global warming. India ranks fifth in the Global Climate Risk Index 2020. Between 1998 and 2017, disaster-hit countries reported $2.9 trillion in direct economic losses, with 77% resulting from climate change, according to a United Nations report. The U.S. faced the highest losses, followed by China, Japan, and India.

A case for a differential global carbon tax

Air pollution has fallen worldwide after the COVID-19 outbreak, including in India. But with resumption of polluting activities, emissions in India are set to rise sharply unless strong action is taken. Carbon dioxide, the chief culprit in global warming, was 414 parts per million in August 2020 because of past accumulation. As one half comes from the three top carbon emitters, they need to drive de-carbonisation.

Stronger action

India has committed to 40% of electricity capacity being from non-fossil fuels by 2030, and lowering the ratio of emissions to GDP by one-third from 2005 levels. It is in the country’s interest to take stronger action before 2030, leading to no net carbon increase by 2050. A smart approach is pricing carbon, building on the small steps taken thus far, such as plans by some 40 large companies to price carbon, government incentives for electric vehicles, and an environmental tax in the 2020-21 budget.

One way to price carbon is through emission trading, i.e., setting a maximum amount of allowable effluents from industries, and permitting those with low emissions to sell their extra space. Pilot projects on carbon trading in China have shown success. There is valuable experience in the EU, and some American states — for example, the regional greenhouse gas initiative in the U.S. northeast. Another way is to put a carbon tax on economic activities — for example, on the use of fossil fuels like coal, as done in Canada and Sweden. Canada imposed a carbon tax at $20 per tonne of CO2 emissions in 2019, eventually rising to $50 per tonne. This is estimated to reduce greenhouse gas pollution by between 80 and 90 million tonnes by 2022. The fiscal gains from pricing carbon can be sizeable. A carbon tax at $35 per tonne of CO2 emissions in India is estimated to be capable of generating some 2% of GDP through 2030. An internally recommended carbon price of $40 per metric tonne in China could generate 14% additional revenues.

Putting a global price on carbon

Imposing a carbon tariff

Big economies like India should also use their global monopsony, or the power of a large buyer in international trade, to impose a carbon tariff as envisaged by the EU. Focusing on trade is vital because reducing the domestic carbon content of production alone would not avert the harm if imports remain carbon-intensive. Therefore, leading emitters should use their monopsony, diplomacy and financial capabilities to forge a climate coalition with partners.

India is among the nations that are hardest hit by climate impacts. There is growing public support for climate action, but we need solutions that are seen to be in India’s interest. A market-oriented approach to tax and trade carbon domestically and to induce similar action by others through international trade and diplomacy offers a way forward.

Ed Araral is Associate Professor and Director, and Vinod Thomas is Visiting Professor, at the Lee Kuan Yew School of Public Policy, National University of Singapore

An article you may find interesting from the latest ASX Update;

What SMSFs (small to medium superannuation funds) are buying

Gemma Dale

Higher portfolio allocation to the materials sector a feature in 2021

Self-managed superannuation funds (SMSFs) have been growing less quickly in recent years, but still represent more than 1.1 million Australians and a quarter of all superannuation assets.

As individuals managing their own retirement savings, SMSFs give an excellent insight into how Australians, particularly retirees and pre-retirees, choose to invest. At nabtrade, we get to see people’s retirement investment choices in real-time.

According to the Australian Tax Office’s SMSF statistical report, allocations to cash and term deposits in SMSF have remained stable over the last five years, now representing around 20% of total assets. This has been as high as 30% in the past, reflecting trustees turning away from secure assets to seek yield as interest rates hover near zero.

Total listed share investments have increased by 21% and listed trusts have increased by 90%, however direct shares still account for over 26% of total assets, while listed trusts are just 6%. The combination of listed assets has been as high as 40% in the last decade, but market falls due to COVID-19 have reduced this to just 32%.

At nabtrade, SMSFs represent less than 10% of our total accounts, but more than 30% of trading volumes, assets held, and cash. SMSF customers are generally older and much wealthier than the average nabtrade customer; many have personal accounts as well as their SMSF.

They’re also generally well informed about shares and place larger, higher-conviction trades when they invest.

How SMSF share portfolios have changed in 12 months

Firstly, cash balances have continued to grow over 2020, despite record low interest rates. But the growth of these balances has slowed. SMSF cash balances grew well above 10% per annum leading up to 2020; they only grew by 9% last year.

This growth in cash usually reflects a conservative mood among trustees; they will save rather than reinvest dividends and start taking profits if they believe the share market is due for a pullback, and switch from buying equities to holding or selling, keeping the proceeds in cash as they wait for a buying opportunity.

2020 provided the buying opportunity nabtrade SMSF trustees were waiting for – they switched aggressively from selling to buying shares, and poured hundreds of millions of dollars into the share market.

Despite this, they still managed to grow their cash balances, bringing in cash from other sources. Many SMSF are clearly keeping their powder dry, expecting a pullback after the market’s astonishing strength post-COVID-19.

The real shift is at the sector level. Financials have always comprised the bulk of the average SMSF portfolio, as retirees enjoyed the strong yields provided by the big four banks.

Despite the enthusiastic buying of the banks during the depths of the COVID-19 crisis, SMSF allocations to financials have dropped 4% over a single year (to the end of February 2021).

Almost all of this decline has been picked up in materials, which have climbed from less than 13% of the average portfolio to 17%.

Nabtrade investors, particularly SMSFs, are known to take profits from strong performers, but there has been no sign of this in the materials sector.

BHP Group (ASX: BHP) is a great example, with almost no selling during 2020; it has now risen from the 6th most popular stock among SMSFs, to the 3rd. Fortescue Metals Group (ASX: FMG) has risen from 16th to 10th.

One unique characteristic of SMSFs is their preference for traditional managed investments, albeit listed or quoted ones.

An ASX200 Exchange Traded Fund (ETF) – the Vanguard Australian Shares Index ETF (ASX: VAS) – Australian Foundation Investment Company (ASX: AFI) and Argo Investments (ASX: ARG) are all in the top 20 investments and have remained relatively constant.

Performance drags

What has hurt performance? The recent weakness in CSL (ASX: CSL) has seen it drop from 4th to 6th, despite huge buying from all nabtrade investors as the price has fallen back to its COVID-19 lows.

Also, the entire energy sector, of which AGL Energy (ASX: AGL), Woodside Petroleum (ASX: WPL) and Santos (ASX: STO) are in the top 20, has been a significant drag (although the sector allocation is still roughly the same, suggesting investors bought more during COVID-19).

SMSF positioning for 2021

Portfolios appear more balanced than previous years, with a higher allocation to materials (in which they were very underweight) and a lower allocation to financials, while healthcare has a greater allocation with buying in CSL and Cochlear (ASX: COH) joining the top 20 stocks.

The top 20 stocks comprise approximately half of all holdings, suggesting a fairly diverse average portfolio.

Eagle-eyed readers will note that some of the most popular stocks from 2020’s investor buying spree, including Afterpay (ASX: APT), Zip Co (ASX: Z1P), Qantas Airways (ASX: QAN) and Flight Centre Travel Group (ASX: FLT), don’t make the top 20. Zip Co is number 24, while the travel stocks are outside the top 49.

Clearly, the “reopening trade” (stocks that benefit from border reopening, such as travel companies) has not been as popular with this more mature SMSF audience.

The full top 20 stocks, and the proportion of nabtrade SMSF investors who hold them, is below.

|

Ranking February 2021 |

Proportion of SMSFs at nabtrade who hold the stock |

Ranking February 2020 |

|

# 1 NAB |

29.6% |

# 1 NAB |

|

# 2 CBA |

34.8% |

# 2 CBA |

|

# 3 BHP |

33.5% |

# 6 BHP |

|

# 4 WBC |

34.9% |

# 3 WBC |

|

# 5 ANZ |

38.1% |

# 5 ANZ |

|

# 6 CSL |

35.2% |

# 4 CSL |

|

# 7 TLS |

41.3% |

# 7 TLS |

|

# 8 MQG |

43.4% |

# 8 MQG |

|

# 9 WES |

35.9% |

# 9 WES |

|

# 10 FMG |

37.5% |

# 16 FMG |

|

# 11 RIO |

39.6% |

# 12 RIO |

|

# 12 WOW |

32.4% |

# 10 WOW |

|

# 13 WPL |

41.2% |

# 11 WPL |

|

# 14 VAS |

22.6% |

# 15 VAS |

|

# 15 AFI |

25.9% |

# 14 AFI |

|

# 16 COL |

34.5% |

# 17 COL |

|

# 17 TCL |

46.6% |

# 13 TCL |

|

# 18 STO |

38.6% |

# 20 STO |

|

# 19 COH |

41.6% |

# 18 SUN |

|

# 20 ARG |

26.3% |

# 19 ARG |

|

TOTAL |

32.8% |

|

|

Source: nabtrade |

||

Gemma Dale, nabtrade

Gemma Dale is Director, SMSF and Investor Behaviour at nabtrade. Gemma is presenting at ASX Investor Day.

Boosting women in the boardroom: Governance Institute launches women’s only version of flagship director course

Governance Institute of Australia has launched its flagship course for directors in a women’s exclusive format, saying targeted action is needed to boost equality in the upper echelons of business.

“With this launch, we are targeting the top tiers of an organisation, helping amplify senior leadership roles for women and encouraging a new generation of female directors,” Governance Institute CEO Megan Motto said.

“Equality and diversity are key tenets of good governance – and both also directly contribute to better business.

“We need more women in top roles and this new course has been specifically designed to help drive this change.”

The Effective Director Course has been running for four years for aspiring and newly appointed directors, executives transitioning into more senior roles, and those who need to be educated about the role of a director. The course examines the challenges faced by a director on a board, the dynamics of director effectiveness, and the key elements of a high performing board.

The new women exclusive Effective Director Course will also drill down on:

- strategies to address systemic and cultural challenges

- tackling unconscious bias

- enhancing visibility, influence and voice

- attributes and skills to enable a compelling and purposeful leadership pathway for female leaders.

Rather than the traditional three-day face-to-face intensive course structure, the women’s exclusive Effective Director Course will run virtually over seven weeks as short sessions, introducing a new level of flexibility.

While the pandemic continues to dominate many business discussions and decisions, now is not the time to take the focus off boardroom diversity, Ms Motto said.

“To thrive – especially in times of challenge and crisis – organisations need a diverse mix of views, problem-solving skills and knowledge at the boardroom table – and this comes best from having a diverse board.

“By launching our flagship director course exclusively for women, we aim to encourage a new level of diversity at the top by helping equip, empower and inspire the next generation of female leaders.”

The inaugural women’s exclusive Effective Director Course launches on 4 May. Media contact: Hannah Edwards 0403 024 149

We would like to thank Ashurst, ASX, Australian Governance Institute, Ed Araral and Vinod Thomas from the National University of Singapore for the use of their articles.

Have a great week, we do hope you enjoy this week’s read and please feel free to reach out if you would like further information on your fixed interest profit strategy. Enjoy the attached document courtesy of Ashurst titled a Shift to Hydrogen (S2H2) Elemental change.

Cheers,

Chris and the team

Head, Fixed Interest and Superannuation

JMP Securities

Level 1, Harbourside West, Stanley Esplanade

Port Moresby, Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814