25 October 2021

Welcome to this week’s JMP Report.

Last week on the local bourse, BSP had a big week with 570,761 shares exchanging hands closing unchanged at K12.30. BSP’s had quite a large range for the week, trading up to K13.50 on the back of small volume with most of the trades going through at K12.30. KAM saw 253,167 shares trade, closing unchanged at K1.00. KSL had 27,092 shares trade closing down -K0.05to K3.20 per share. NGP traded 19,000 shares closing unchanged at K0.70 along with CCP trading 17,375 shares also closing unchanged at K1.70 per share. There were NIL trades for CPL, OSH and NCM.

Refer below details;

|

WEEKLY MARKET REPORT 18.10.21 – 22.10.21 |

|||||||||||

| STOCK

|

QTY |

CLOSING |

CHANGE |

% CHANGE | 2020 Final Div | 2021 Interim | Yield % | Ex Date | Record Date | Payment Date | DRP |

|

BSP |

571,761 |

12.30 |

– |

0.00 | K1.0500 | K0.39000 | 11.61% | Fri 24 Sept | Mon 27 Sept | Mon 18 October | No |

|

KSL |

27,092 |

3.20 |

– 0.05 | -1.54 | K0.1690 | K0.08250 | 7.74% | Wed 01 Sept | Thurs 02 Sept | Fri 01 Oct | No |

|

OSH |

– |

10.60 |

– | 0.00 | K0.0000 | – | 0.00% | Mon 30 Aug | Mon 20 Sept | Thur 20 Oct | |

|

KAM |

253,167 |

1.00 |

– | 0.00 | K0.0400 | K0.06000 | 10.00% | Wed 15 Sept | Mon 20 Sept | Thurs 20 Oct | Yes |

|

NCM |

– |

75.00 |

– |

0.00 | K0.0000 | – | 0.00% | Thu 26 Aug | Fri 24 Sept | Mon 01 Nov | |

| NGP | 19,000 | 0.70 | – | 0.00 | K0.0000 | – | 0.00% | Fri 17 Sept | Fri 24 Sept | Mon 01 Nov | |

|

CCP |

17,375 |

1.70 |

– | 0.00 | K0.1800 | 0.04600 | 6.19% | Fri 1 Oct | Fri 8 Oct | Fri 26 Nov | Yes |

|

CPL |

– |

1.00 |

– |

0.00 | K0.0000 | – | 0.00% | ||||

On the interest rate front, we see Finance Company money steady with FIFL offering up 5.50% for 12 month money. From the Bank of PNG, 364 day bills remain steady at 7.20% on the back of strong liquidity in the financial system.

The Bank is offering Tap Bonds for the smaller investors with the following offers;

2 Year 8.00%

4 Year 8.85%

8 Year 9.40%

10 Year 9.40%

We have orders on both side for most POMX stocks and nett buyers of Government Inscribed Stock. Please feel free to give me a call for pricing and volume.

What we have been reading this week

What are we reading

Science and medicine appear to be getting the upper hand of coronavirus – implication for investors

Key Points

There are increasing signs that science and medicine are getting the upper hand against coronavirus: new global cases are in decline; vaccines are working; half the global population and 73% of Australians have had at least one vaccine dose; and there are more treatments for coronavirus.

Key to watch will be whether hospitalisations in response to any resurgence in cases remains subdued.

Coronavirus coming under better control means a continuation of the economic recovery and supply constraints starting to come under control both of which are positive for shares, although the latter will take time.

Introduction

Coronavirus continues to wreak havoc globally and in Australia, but there are increasing signs that its grip is loosening as humanity gets the upper hand thanks to science and modern medicine. This note looks at the current state of play regarding coronavirus, the risks and the implications for investors.

Coronavirus losing its grip? Five reasons for optimism

There are five key reasons for optimism regarding coronavirus.

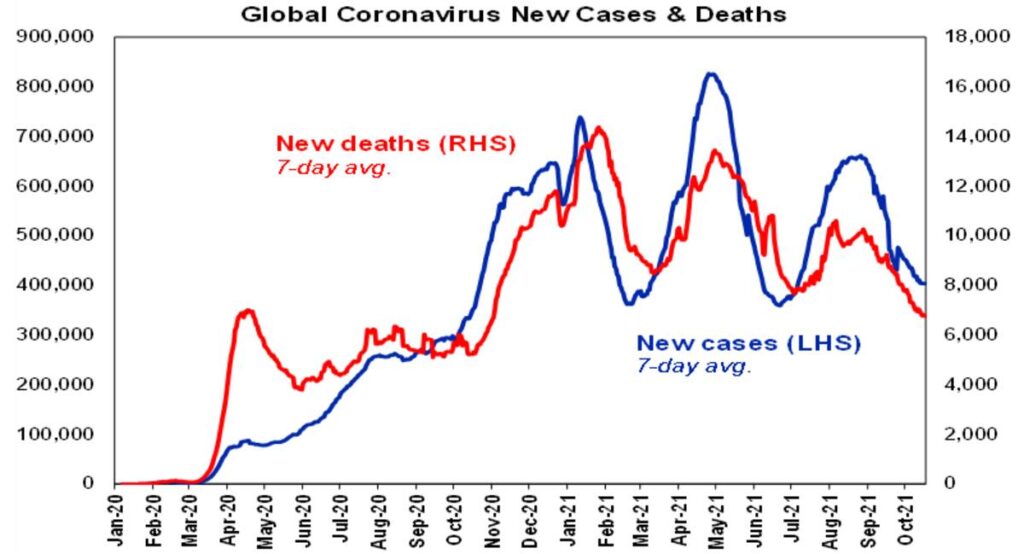

- First, new coronavirus cases globally are continuing to fall with most regions in a downtrend or flat.

Source: ourworldindata.org, AMP Capital

- Second, the Delta variant arguably turned out to be less transmissible globally than was feared in mid-year as even some poorer less vaccinated countries & regions have not seen a feared surge in cases (eg, Africa & South America).

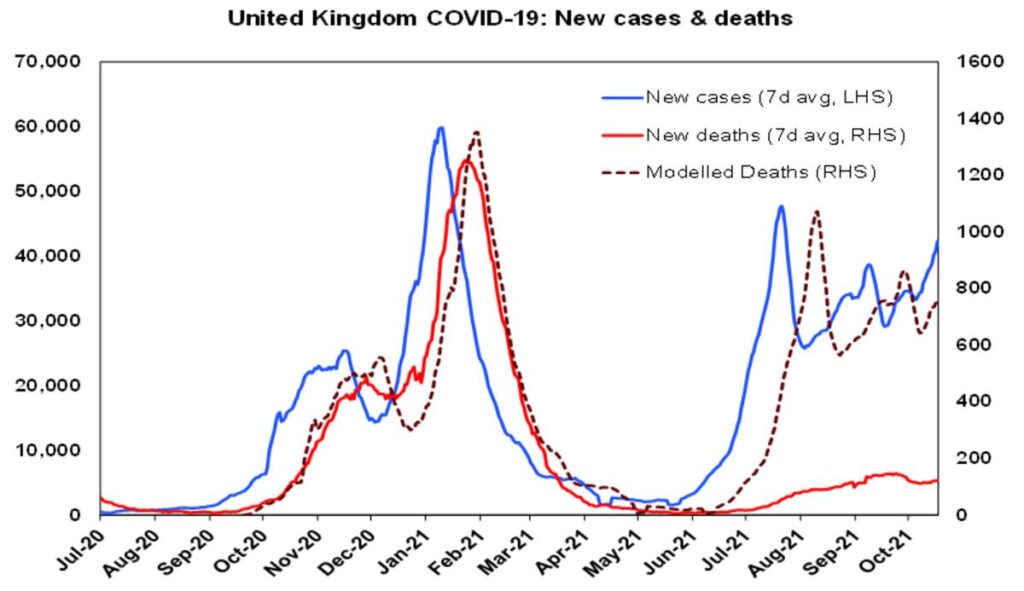

- Third, vaccines appear to be working. Of course, coronavirus has surged and subsided before so it could rebound again which is why vaccines are so important. While they may be only 60-80% effective in preventing infection – and this fades a bit after five months or so requiring booster shots – they are highly effective at around 85-95% in preventing serious illness. This is evident in new deaths remaining subdued relative to past waves – eg in the first chart new deaths globally have been in a downtrend this year relative to new cases. It’s particularly apparent in the more highly vaccinated developed countries where hospitalisations and deaths are far more subdued relative to new cases in comparison to the previous wave. For example, deaths in the UK (the red line in the next chart) are running less than 20% below the level suggested by the December/January wave (the dashed line). While Israel saw a Delta spike in new cases in August and September – likely not helped by waning efficacy for Pfizer vaccinations from earlier this year – the level of hospitalisations and deaths remained subdued compared to the previous wave and all are trending down, again helped by booster shots.

Source: ourworldindata.org, AMP Capital

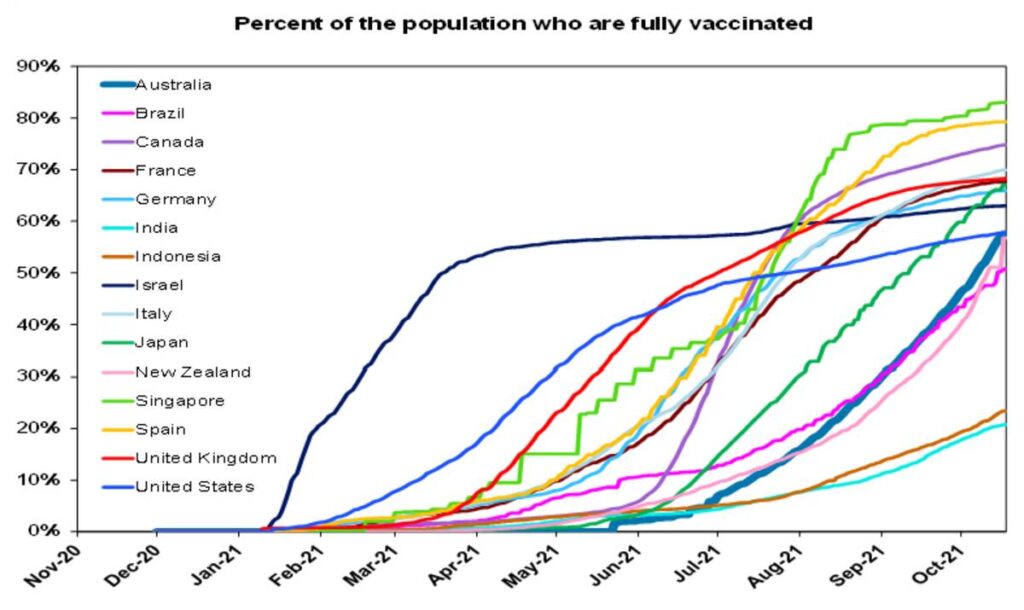

- Fourth, 50% of people globally have now had one dose and 37% have had two doses.

Source: ourworldindata.org, AMP Capital

- Finally, there are now several effective coronavirus treatments either approved or seeking approval. These include Ronapreve from Roche, a Merck COVID-19 treatment pill and AstraZeneca’s antibody cocktail – where clinical trials of all three showed the risk of severe illness to be at least halved – and a Pfizer anti-viral cocktail. So, there’s now more ways to treat patients. These are useful for high-risk groups for whom vaccines are less effective and the unvaccinated.

The good news also applies to Australia

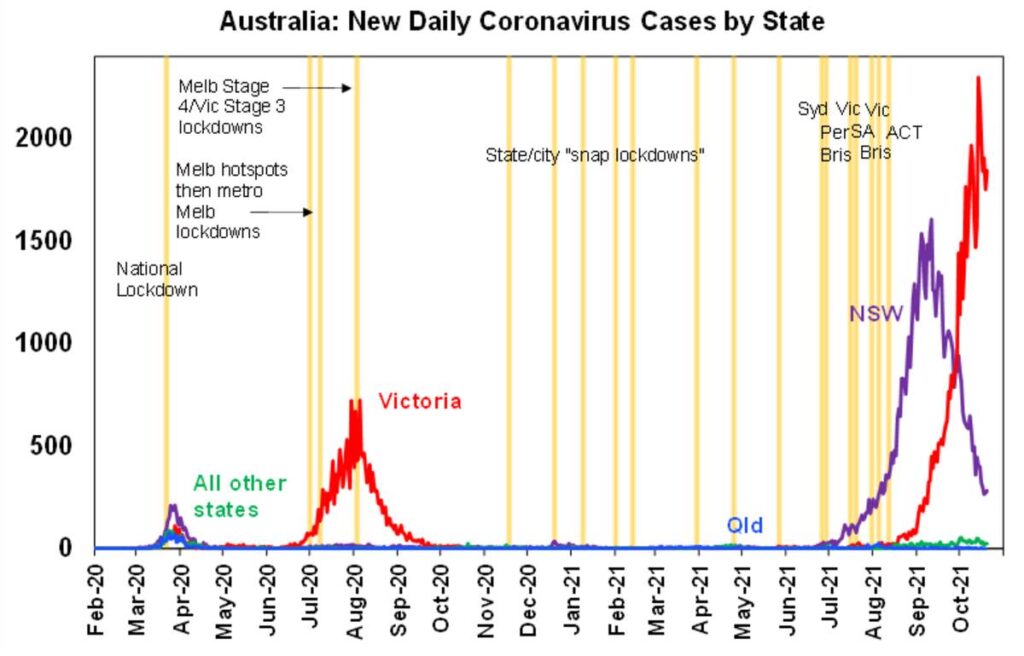

In Australia, new cases in Victoria are down from their recent high and if NSW, which led by a month, is any guide, Victoria should peak soon if it hasn’t already.

Source: covid19data.com.au, AMP Capital

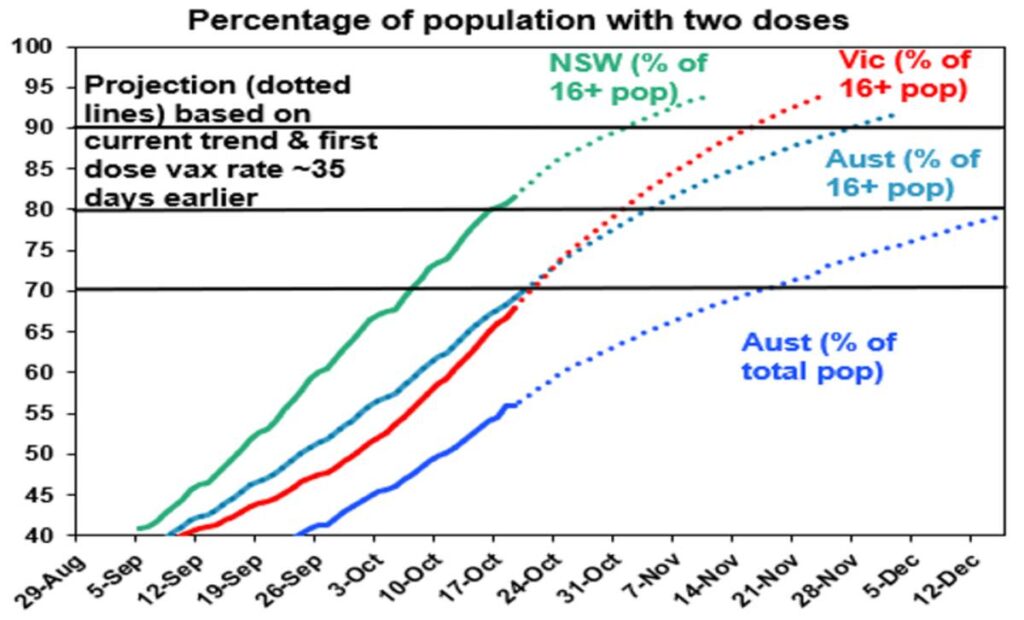

After a slow start Australia is vaccinating around 1.1% of the population a day. 58% of Australia’s whole population are fully vaccinated which is in line with the US and 73% have had one dose which is well above the US. For first doses for adults, the ACT is at 98%, NSW is at 92%, Victoria will reach 90% in a few days and Australia will reach 90% in early November. Allowing for current trends and the average gap between doses the next chart shows roughly when key vaccine targets will be met.

Source: covid19data.com.au, AMP Capital

NSW and the ACT have already reached the 80% of adults double vax target. Australia (on average), Victoria and Tasmania are either at 70% of adults or will be there in a day or so and will hit 80% late this month or early next month. Other states and territories will hit the 70% target in mid-November.

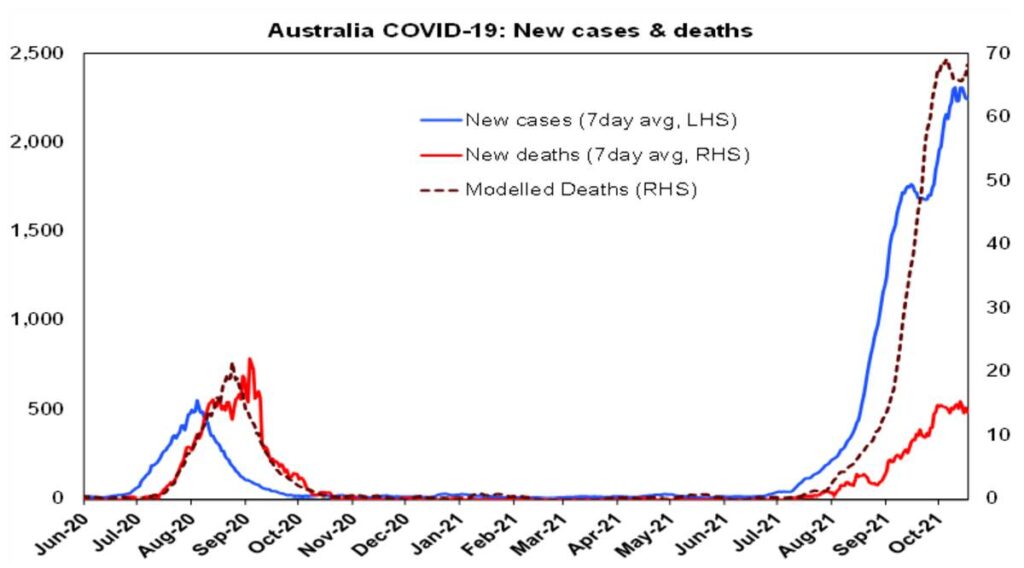

Meanwhile, vaccination is continuing to help keep serious illness down in Australia too and is the key factor supporting the reopening now underway. Coronavirus case data for NSW shows that the fully vaccinated make up a low proportion of cases (at around 5%), hospitalisations (5%) and deaths (11%) despite making up 67% of the NSW population as a whole and around 80% of the older most at risk of dying from coronavirus population. The level of deaths in Australia (the red line in the next chart) is running at around 20% of the level predicted on the basis of the previous wave (dashed line). On this basis the vaccines are helping save roughly 54 lives a day at present.

Source: ourworldindata.org, covid19data.com.au, AMP Capital

What are the risks?

Key risks to watch for globally are:

- a possible resurgence in cases in the northern winter particularly as vaccine efficacy starts to wear off in some countries in the absence of rapid booster programs. This may already be happening in the UK (where new cases are on the rise again) and parts of Europe. The key though is what happens to hospitalisations – if they remain subdued as has been the case since June and the hospital system is coping then it should be manageable;

- the possibility of more transmissible/deadly mutations; and

- the low level of vaccination in poor countries which is currently around 18% with a first dose – which contributes to an ongoing risk of mutations.

Some increase in new cases in NSW, the ACT and Victoria after reopening is highly likely. But the main risk in Australia is that too rapid a reopening in south eastern Australia leads to a resurgence in cases – like Singapore which after reopening saw new cases surge to around 3000 a day – which threatens to overwhelm the hospital system, necessitating new restrictions to slow new cases down. Which is what Singapore has done. Note that NSW is still only at 67% and Victoria at 55% of the whole population fully vaccinated compared to 83% in Singapore. This could particularly be a risk in the months ahead if vaccine efficacy for those vaccinated earlier this year starts to wear off. A less risky approach would have been to wait three weeks or so between each reopening stage in order to ensure that new cases and most importantly hospitalisations are not surging and overwhelming the hospital system. At this stage it’s all just a risk though, booster shots are now on the way from next month and even if it does happen it would probably not be enough to derail the economic recovery as a return to long hard lockdowns is most unlikely unless vaccines completely fail in preventing serious illness.

Implications for investors

While the risk of setbacks remains, our broad perspective is that coronavirus is gradually coming under control and this will permit a sustained reopening globally and in Australia in the months ahead. Although coronavirus will leave some lasting impacts, at a very high level sustained reopening will be positive for the investment outlook as reopening means:

- more demand – and in Australia a resumption of the economic recovery this quarter; and

- a return to work and a rotation in spending back towards services as opposed to goods.

The former is positive for corporate revenue (albeit profit growth will be slower than it has been) and the latter should ultimately relieve supply constraints and inflation pressures – although it may take 6-12 months. It will mean a continued winding down of ultra-easy monetary stimulus though.

By Shane Oliver, Head of Investment Strategy and Economics, AMP Capital

Global Economic Outlook Q3 2021: Picking Up Steam, Fueled By Vaccinations (S & P Global)

Global Chief Economist: Paul F Gruenwald

Key Takeaways

The effective end of the pandemic is approaching, particularly for the most advanced economies, as vaccinations become widely available, severe COVID-19 cases fall, and economies reopen. This is happening earlier and faster than previously assumed, driving both growth and inflation higher.

The macro outlook continues to improve. We have raised our global growth forecast by 40 basis points to 5.9% in 2021, reflecting stronger performance nearly across the board in the first quarter and the faster reopening. Our 2022-2024 outlook shows a stronger U.S. but lagging emerging markets.

Risks are shifting from those that are pandemic related to those that are rebound and exit related. In particular, rising inflation in the U.S. and some emerging markets points to a possible bumpy transition from ultralow rates and easy financing conditions to the post-COVID-19 steady state. And with economies on the mend, policy normalization and sustainability are coming into sharper focus.

The Macro Script Has Flipped

The script for the economic recovery from COVID-19 has flipped from damage control to driving toward the endgame. In the early stage of the pandemic, controlling the spread of the virus through lockdowns and track-and-trace led to superior economic outcomes. East Asian economies generally outperformed as reductions in mobility and restrictions on social distancing were lighter and shorter lived.

However, with the development of effective vaccines, the storyline has changed. The objective is now getting jabs in arms and dropping social distancing restrictions on a permanent basis, which unlocks key pandemic-affected sectors. Here, the U.S. and U.K. have been in the lead among major economies, which has led to an acceleration of growth and economic outperformance. In response to this changed dynamic, Europe has picked up its pace of vaccination, and, more recently, China has begun to quickly close the gap. Developments in emerging markets are very mixed, but generally lag those in developed markets.

The combination of vaccines (leading to opening up) and better management of the economic impact of the virus (where there are no vaccines yet) has led to stronger-than-expected performance so far this year. Growth was almost universally better than anticipated in the first quarter across both advanced and developing economies. The main reason was services–especially in the U.S., but more prevalent in advanced economies–while tech and commodity exports provided support elsewhere, primarily in emerging economies.

As vaccinations have accelerated and COVID-19 cases have dropped, the opening of key service sectors–food and beverage, hospitality, and travel and tourism–leading to higher confidence and spending is happening across many of the advanced economies, and some emerging markets. (The constraint to further progress in vaccinations appears to be on the demand side (hesitancy) in the more advanced economies and on the supply side (access to vaccines and logistics) in the emerging economies.) This dynamic has played out faster than we expected. Herd immunity seems less of a binding constraint as hospitalizations and fatalities from COVID-19 have begun to diverge from overall caseloads.

Surprisingly, the pickup in growth has led to much higher inflation across a number of metrics and put the fear of inflation on the macro radar for the first time in decades. Part of this fast rise relates to supply and demand mismatches as the latter outruns the former, at least for now, including energy, lumber, air travel, and used cars. The Consumer Price Index (CPI) weights of the items in this group are relatively small, but the percentage increases have grabbed headlines.

The rise in inflation has been particularly pronounced in the U.S. There, the quick rise in incomes, wealth effects, and generous government transfers are fuelling demand, while supply is constrained by labor shortages in some sectors and low supply responses as companies ran down capacity and inventories during the worst of the pandemic. Most inflation measures in the U.S., including the Fed’s preferred Personal Consumption Expenditures (PCE) index, have surged well past the 2% threshold and look likely to stay well above target for several quarters. We explore U.S. inflation further in the risk section below–for now, it suffices to say that base effects are not a convincing explanation given the large seasonally adjusted month-over-month prints for the last three periods.

Macro and prudential policies remain very accommodative and are now providing strong tailwinds to the recovery. Fiscal support in the form of direct transfers continues in the U.S. (sometimes overly generous), and most of Europe is seeing payments to businesses contingent on keeping workers on the payroll. Monetary support remains extraordinary, with most major central banks keeping policy rates near the effective lower bound, continuing to purchase government bonds to hold down yields, and, in some cases, intervening in corporate credit markets to ensure liquidity and manage spreads. Macroprudential policies include debt moratoriums, payment deferrals, and other forms of forbearance that either cancel or spread out payments of companies affected by pandemic restrictions. Very few of these have been unwound so far.

Our Updated Forecasts

Given the developments above, our 2021 GDP forecasts are generally higher than in our previous Credit Conditions Committee round. Specifically, we have marked up global GDP growth to 5.9% from 5.5% on the back of widespread higher growth, with the U.K. and Brazil leading the way among major economies. We have lowered our forecast for India because of its struggles in containing a recent wave of the virus, although we expect much of the lost output to simply be pushed to the next (fiscal) year.

This relatively benign baseline scenario rests on the assumption of orderly reflation (see “Orderly Global Reflation Will Support The Recovery From COVID-19,” March 22, 2021). On the real side, this means that economies recover smoothly in terms of closing output gaps and attaining full employment, and that policy stimulus is gradually withdrawn. On the market side, it means that the transition to the post-COVID-19 steady state is free of bouts of volatility and large shifts in risk appetite that would cause sharp price and spread adjustments and major disruptions in access to funding. It also assumes continued improvement on the pandemic front. Risks to this baseline are discussed below.

U.S.

As the U.S. heads into the summer, the economy is sizzling. A better vaccination outlook, a faster reopening schedule, and $2.8 trillion from two stimulus packages have turbo-charged the U.S. economic recovery this year and the next, with supply constraints (businesses unable to make products fast enough to meet surging demand) preventing the economy from swelling at an even faster pace. Our forecasts of real GDP growth for 2021 and 2022 are now 6.7% and 3.7%, respectively, up from 6.5% and 3.1% previously. Of note, our 2021 GDP growth forecast would be the highest reading since 1984.

Despite the improved outlook, the labor market still has a long way to go before it recovers the ground lost from COVID-19. The recovery in U.S. jobs growth remains soft, despite recent job gains, and the labor market is 7.6 million jobs short of the pre-pandemic peak. Inflation pressure is rising more than expected on the back of the strong rebound.

Federal Open Market Committee (FOMC) members sharply revised up their median PCE inflation forecasts (4Q/4Q) to 3.4% for this year and 2.1% for the next. Based on that more rosy assessment of the U.S. economic outlook, they also moved up the expected timetable for higher interest rates. FOMC members continued to emphasize that the price run-up so far has been “largely transitory,” with which we agree. We expect policy interest rate liftoff to be one hike in first-quarter 2023, with the second rate hike in the third quarter and two more hikes in 2024. Read the full U.S. macro update for more, “Economic Outlook U.S. Q3 2021: Sun, Sun, Sun, Here It Comes.”

Europe

The contours of the European economic recovery are changing, from one led by a rebound in industrial activity to a more services-based pickup. A lower incidence of COVID-19 and the broad rollout of vaccines across Europe is enabling governments to lift most restrictions to economic activity, paving the way for a strong restart this summer. We now expect GDP to increase 4.4% this year and 4.5% in 2022, from 4.2% and 4.4% previously. We also have a rosier long-term outlook now that there is more clarity about implementation of the Next Generation EU plan. In our view, the size of the plan will be enough to limit long-term scarring from this crisis as well as close the eurozone output gap by 2024.

The shift to a broad-based recovery is showing up in the labor market, with job postings rebounding even in the most affected sectors, like retail and hospitality. This confirms our view that the recovery will be rich in jobs. We now expect eurozone employment to recover to its pre-COVID-19 levels by the second half of 2022. This is half a year ahead of our previous forecasts. By comparison, it took the eurozone economy almost eight years after the global financial crisis to recover its precrisis level of employment.

In contrast to the situation in the U.S., European employers are likely to struggle less to fill vacancies because they have kept their employees in their jobs through short-time work schemes. This also means that companies will want to restore their profit margins first before raising salaries, to make up for the costs of furlough schemes during lockdowns. As a result, we don’t see core inflation reaching 1.6% before the end of 2024. Nonetheless, headline inflationary pressures will be higher this year, linked to the rebound in energy prices last year and one-off effects such as the normalization in German value-added tax (VAT). We do not see the European Central Bank hiking rates until late 2024. Read the full European macro update for more, “Economic Outlook Europe Q3 2021: The Grand Reopening.”

Asia-Pacific

Asia-Pacific’s recovery is mostly on track. Early stumbles during the vaccine rollout are giving way to redoubled efforts to vaccinate and open up. Exports are contributing to upward revisions to our growth forecasts for some economies in 2021, but as many trading partners reopen and consumers spend more on services, the impulse from exports will wane. Private consumption is exerting a drag, and while we expect an improvement in the next few quarters, much depends on the pace of the vaccine rollout. As result, we have revised our Asia-Pacific growth forecast slightly lower to 7.1% from 7.3% previously, with India and Southeast Asian economies (and Japan) pulling down the region’s growth. We nudged China’s growth up to 8.3% this year on accelerating vaccinations.

The rise of inflation across the region is, for the most part, transitory. Strong demand for durable goods globally should ease as economies reopen and people are able to spend on services, from hotels to restaurants. The base effect due to plunging commodity prices in early 2020 will also wash out of the annual data later this year.

Passthrough from inflation in producer prices to consumer prices has been weak in Asia-Pacific, and we expect it to remain so. The main reason is that with private consumption and services activities still soft, demand for labor is weak, and companies will not need to hike wages to attract or retain staff. With labor costs accounting for a large share of final consumer prices, this should keep a lid on inflation. There are exceptions where labor markets are tightening much more quickly, such as Australia. Read the full Asia-Pacific macro update for more, “Asia-Pacific’s Recovery Regains Its Footing.”

Emerging markets

Most emerging markets (EMs) continue to struggle with handling the pandemic. Unlike the advanced economies–the U.S. and U.K. in particular–the vaccination rollout remains slow. This reflects both the demand and the supply side: Vaccine hesitancy remains a challenge as does the supply of vaccines and the logistical difficulties in distributing them. The silver lining is that countries are learning to live with the virus. Specifically, the economic impact of mobility restrictions appears to have fallen appreciably.

We have raised our EM-14 2021 GDP growth forecast by 20 basis points to 4.6% in 2021 since our previous round. This mostly is the result of stronger-than-expected first-quarter performance, but with wide variations across subregions. We revised our growth forecast for Latin America up by more than a full percentage point to 5.7% and for EM EMEA by 0.4% to 4.1%, while we lowered it for EM Asia by 0.3% to 8%. Our forecasts for 2022 and beyond remain broadly unchanged.

While macro developments in EMs are looking up, they will lag the advanced economies in the rebound from COVID-19, which creates its own risks. The slower pace of vaccinations both reduces the speed of reopening (including an overhang of uncertainty holding down consumption and investment) and increases the risk of further waves of infection as variants of the virus continue to spread. EMs are also relatively more exposed to spillovers–both positive (demand for commodities) and negative (risk-sensitive financial flows and conditions). Faster vaccination therefore becomes the top priority. Read the full emerging market macro update for more, “Economic Outlook Emerging Markets Q3 2021: Despite Rising Resilience, Vaccinations Are The Key To Recovery.”

Shifting Risk Profile (Not A Bad Thing)

The faster and earlier recovery has shifted our risk profile. Inflation and orderly exit-related risks have risen while health- and premature austerity-related risks have declined. For the near term, the balance of risks to our forecast has moved to the upside.

U.S. inflation (rising). The largest shift in our risk profile since our last report has been the sharp rise in U.S. inflation and its potential impact on macro and credit outcomes, including beyond the U.S. Through May, the headline U.S. CPI has grown 5.0% year over year, the core index has risen 3.6%, and the PCE index–the Fed’s preferred measure–has grown 3.9%. Sequential measures of inflation are significantly higher (see chart 2). The Fed is targeting average inflation of 2%.

To be clear, the risk does not relate to the credibility of the U.S. Federal Reserve to achieve its inflation (and employment) objectives over the medium term. It has both the tools and the will to do so. The risk is that inflation will stay higher and last longer than the current forecast and could force the Fed to move earlier than planned, and earlier than what is currently priced by markets. The resulting repricing could cause market volatility, including widening spreads and diminished market access for higher-risk borrowers, and asset price volatility and downward adjustments, with knock-on effects on spending and, ultimately, employment and growth.

An uneven recovery across sectors and countries remains a key macro credit risk as we exit the pandemic.

- At the sector level, laggards will face the same market conditions as the faster-recovering sectors. This means that as conditions normalize and rates and prices rise, companies in these sectors may find it relatively more expensive–and perhaps slower–to rebuild than if the recovery had been more balanced, with knock-on effects on earnings and profitability. Lagging firms and sectors can also be disadvantaged on the policy front as forbearance and various transfer and subsidy programs expire.

- At the country level, a number of risks face (mainly) emerging markets from a slow recovery, especially relative to the U.S. These include a rising cost of U.S. dollar-denominated debt for borrowing or refinancing, less forthcoming capital flows to the extent that these flows chase relative yields and relative growth rates (and exchange rates), and a widening of spreads as markets reprice a large range of assets amid potential de-risking. A stronger U.S. dollar could lift import costs and raise inflation and result in higher policy rates in emerging markets.

Premature austerity (falling), non-credible exit strategy (rising). With the recovery arriving sooner than forecast, the policy focus is shifting from crisis control to the sustainability of the post-COVID-19 economy. This applies to both fiscal and monetary policy. On the fiscal side, extraordinary support (including record deficits) was the appropriate response to cushion the blow of the lockdowns and lay the foundations for the recovery. But as we exit the COVID-19 era, governments will need to put their fiscal accounts on credible, sustainable paths, including trend reductions in key debt ratios. On the monetary side, nurturing the recovery through extraordinarily low policy rates and quantitative easing/yield curve control (and their distortions, including on asset prices and risk taking) should be balanced against getting rates and the entire “credit surface” more back to normal.

Pandemic/health (falling). The pandemic is still with us, but COVID-19-related risks have declined, in our view. While the timeline for attaining herd immunity has not moved appreciably, hospitalizations and fatalities have fallen substantially–especially in the more advanced economies–so the total case numbers may not be the best metric. As countries have learned to manage the economic consequences of the virus better, opening has taken place earlier than previously thought. The main health risk now is that existing vaccines may be less effective against future COVID-19 variants. Thankfully, that has not been the case so far.

From Bad Problems To Better Problems

The faster-than-expected rebound from the depths of COVID-19, while welcome, has merely shifted the set of challenges. We prefer “rebound” to “recovery” since the economic slowdown was not a result of working off excesses in the previous cycle. Rather, it was generated by health restrictions. With the economy now being turned back on, we are close to resuming the pre-COVID-19 cyclical position as health restrictions are removed.

“Bad” problems related to identifying and measuring the effects of lockdowns are fading, while “better” problems relating to a fast opening are rising. Our surveillance focus continues to be on whether the reflation accompanying the rebound is orderly, which we have argued will generate better macro and credit outcomes. The policy challenge as we exit the COVID-19 crisis in the coming quarters will be to withdraw monetary and fiscal stimulus at a pace that provides enough support to maintain adequate velocity while balancing inflation pressures and moving to a post-COVID-19 steady state path. While the outlook is brightening, there is still much work to do.

The views expressed in this report are the independent opinions of S&P Global Ratings’ economics group, which is separate from but provides forecasts and other input to S&P Global Ratings’ analysts. S&P Global Ratings’ analysts use these views in determining and assigning credit ratings in ratings committees, which exercise analytical judgment in accordance with S&P Global Ratings’ publicly available methodologies.

This report does not constitute a rating action.

China May Have Found a Cheap Energy Storage Method: Compressed Air

Around 2008, a French engineer made the headlines with the idea of manufacturing a car that could run on compressed air. Guy Nègre had conceived the CAT (Compressed Air Technology) Air Car. We remembered his story after reading a CNEVPost article on China’s new solution for storing energy: compressed air.

CCTV went to China’s first compressed-air energy storage facility to show what it proposes to do. Instead of using increasingly precious and expensive lithium-ion batteries, the plant uses cheap energy to compress air in huge tanks. Its official name is quite long: National Energy Large-Scale Physical Energy Storage Technology Research and Development Center.

When there’s peak demand for electricity, and prices get higher, the unusual energy storage facility uses that air to propel turbines and generate power. According to CCTV, the facility can deliver up to 40 MWh of energy per day, enough to power 3,000 houses.

An Hai, the plant director, told the Chinese network that the secret to economically viable is to compress the air when energy prices are low and make this air generate electricity when energy rates are higher.

CCTV describes this strategy as if the plan was to use it with any means of producing electricity and eventually mentions that it can avoid wasting electricity produced by renewable energy sources. Ironically, this may be the main application of such a solution instead of the mega batteries used in Australia and California.

Solar and wind power are more potent in moments of the day when energy consumption is not that high. However, the electricity surplus that these methods generate is wasted if you do not have a way to store it. At first, the logical choice was to use batteries, but only because nobody came up with a better idea until now.

Currently, there is no better way to store energy than batteries in terms of energy efficiency. However, it takes time to charge them and energy release is not very fast. Moreover, CCTV did not mention how efficient it is to compress air and turn it into electric energy. Still, the speed factor may favor the method China is testing with this new energy storage facility.

The engineers that have developed it say that they allow solar and wind power plants not to be directly connected to the grid, which helps to stabilize them. According to them, it can be applied on a large scale, with low costs and a long lifespan. Batteries have a limited number of cycles and are in high demand by electric vehicles.

Guo Wenbin, an engineer at the Institute of Engineering Thermophysics, also stressed that they are a safe way to store energy. In his words, there is no risk of sudden explosion because the air pressure remains in the medium-range, with controllable risks. After the fire on the Victorian Big Battery, that may be a convincing argument.

If this energy station proves to work as expected, we may soon have more batteries for electric cars. The plan was always to have them for energy storage only when they are no longer suitable for automotive applications. In other words, they would only help to stabilize the power grid as used components that could still do some work before being recycled.

A welcome secondary effect would be to propel Nègre’s idea to use compressed air on vehicles as well. Tata Motors wanted to mass-produce the CAT Air Car, which was renamed Tata OneCAT. It was supposed to reach production by 2020, but it still did not happen.

Apart from its partnership with Tata, CAT became MDI (Motor Development International), a company that did not give up making compressed-air engines take off. It even developed the AIRPod, a vehicle we talked about back in 2012.

If the company ever manages to mass-produce its idea, that’s sadly something Nègre will not watch: he died on June 24, 2016. His son, Cyril Nègre, is currently MDI’s CEO, and he is still trying to make that work. May he make his father proud, wherever he is.

The 50 MW Kincardine floating offshore wind farm is now fully operational, Kincardine Offshore Windfarm Ltd. (KOWL) said.

Located 15 kilometres off the coast of Aberdeenshire, Scotland, in water depths ranging from 60 metres to 80 metres, Kincardine is the largest operating floating wind farm.

Source: Cobra Group

The project consists of five Vestas V164-9.5 MW and one V80-2 MW turbine, each installed on WindFloat® semi-submersible platforms designed by Principle Power.

”Kincardine is further showing the readiness and commercial potential of floating technology,” Aaron Smith, Chief Commercial Officer, Principle Power, said.

”With eighty percent of the world’s offshore wind resources in deep water areas, floating technologies like the WindFloat® open several new geographies to harness the boundless supply of clean energy contained therein. The UK has led the way in realising the potential of floating wind and is now recognised globally as a key market for floating wind developments. Kincardine demonstrates the readiness of floating wind to support the government’s net zero ambitions ahead of the forthcoming lease awards in ScotWind, floating wind leasing rounds managed by Crown Estate Scotland.”

The Kincardine project was started back in 2014 by Allan MacAskill and Lord Nicol Stephen, now both directors of Flotation Energy plc. In 2016 Cobra Group became the main investor in KOWL.

Cobra Wind, a subsidiary of Cobra Group, has been responsible for the delivery of the project, including engineering, construction, installation, and commissioning.

”The Kincardine project is not only the world’s largest. It has also been a fantastic foundation for other joint venture projects between Cobra and Flotation Energy. Our Round 4 success with the 480MW Morecambe project, our 7GW of bids into the Scotwind leasing round and our White Cross 100MW floating project in the South West are all signs of our confidence in Scotland and the UK Floating wind is set for massive growth in the future – and we want to do more,” Cobra’s Senior Manager, Jose Antonio Fernández, said.

In addition to being the largest floating wind farm in the world, the development also features another first, using the highest capacity wind turbines ever installed on floating platforms.

Nils de Baar, President, Vestas Central & Northern Europe, said: ”The Kincardine project shows how boundaries of offshore wind technology are constantly being pushed forward. We have once again demonstrated that the world’s most powerful turbines can be installed on floating substructures. We stand ready for the next phase of commercial scale floating offshore wind. With appropriate policy and regulations, floating technology offers the UK an opportunity to expand its global leadership position in offshore wind and build further opportunities for the domestic supply chain. We are proud to be part of the pioneering Kincardine project.”

Kincardine will generate over 200 GWh of green electricity a year, enough renewable electricity to power more than 50,000 Scottish households.

We hope you have enjoyed this week’s read

Please do give us a call if you would like further information regarding Funds Management, Investing and Trading.

Have an awesome week,

Chris Hagan,

Head, Fixed Interest and Superannuation

JMP Securities

Level 1, Harbourside West, Stanley Esplanade

Port Moresby, Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814